Global Green Concrete Market Outlook to 2030

Region:Global

Author(s):Sanjna

Product Code:KROD10272

December 2024

93

About the Report

Global Green Concrete Market Overview

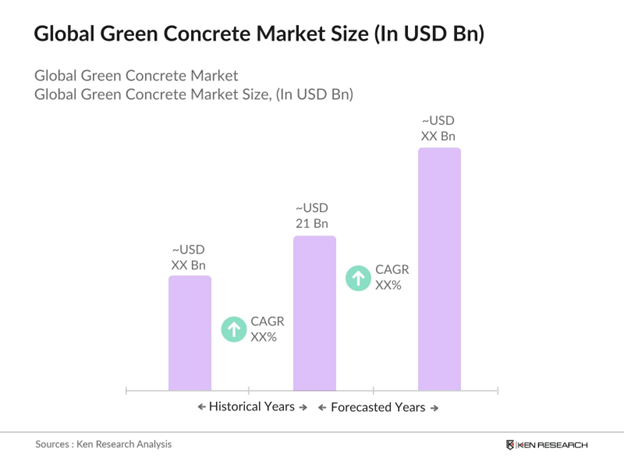

- The global green concrete market, valued at USD 21 billion in 2023, is primarily driven by increasing environmental concerns, government regulations on carbon emissions, and rising demand for sustainable construction materials. Green concretes ability to reduce carbon footprints, use recycled materials, and offer better performance in certain conditions has significantly boosted its adoption in the construction sector. The market's expansion is supported by growing infrastructure development projects worldwide, driven by sustainability goals.

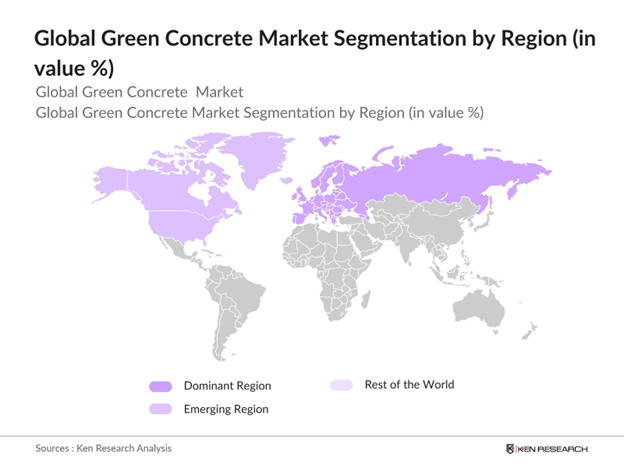

- The market is dominated by countries like the United States, China, and Germany. These nations are early adopters of green building regulations and have robust construction industries focusing on eco-friendly materials. The dominance of these regions is attributed to strong governmental support, stringent carbon emission laws, and a high demand for sustainable construction solutions. Additionally, these countries have abundant resources to invest in green technologies and innovative building materials, which solidify their leadership in the green concrete market.

- Governments around the world are implementing stringent regulations on carbon emissions in construction materials, which is driving the green concrete market. In 2023, the EU introduced new emission standards for construction materials, mandating a 30% reduction in carbon emissions. Similarly, Canadas federal government imposed strict limits on CO2 emissions for building materials used in public projects. These regulations align with global climate targets, such as the Paris Agreement, which aims to limit global warming to 1.5C .

Global Green Concrete Market Segmentation

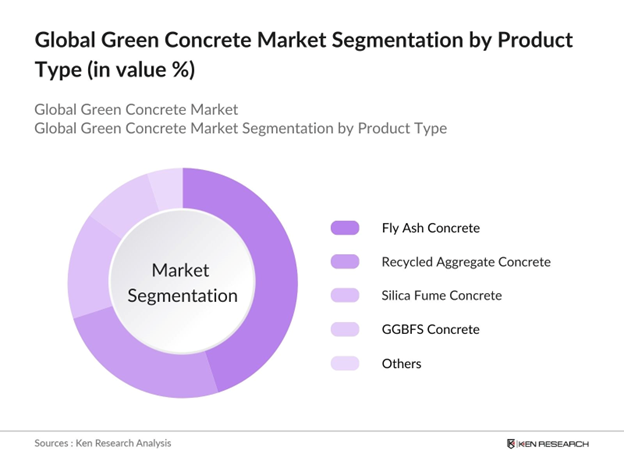

By Product Type: The global green concrete market is segmented by product type into fly ash concrete, recycled aggregate concrete, silica fume concrete, and ground granulated blast furnace slag (GGBFS) concrete. Among these, fly ash concrete holds a dominant share due to its widespread use in construction and its high durability compared to traditional concrete. The extensive availability of fly ash as a by-product of coal combustion and its use as a supplementary material in cement production further supports its dominance.

By Region: The global green concrete market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Europe leads the market in terms of regional dominance, primarily due to the strict environmental regulations and the widespread adoption of green building certifications like BREEAM and LEED. Countries such as Germany and the United Kingdom have set ambitious carbon reduction goals, which have encouraged the use of green concrete in both residential and infrastructure projects.

By Application: The market is also segmented by application into residential construction, commercial construction, infrastructure projects, and industrial construction. Infrastructure projects have the highest market share due to government investments in eco-friendly infrastructure development and the need to comply with environmental regulations. Green concrete is increasingly being used in highways, bridges, and airports, driven by its strength, durability, and sustainability credentials.

Global Green Concrete Market Competitive Landscape

The global green concrete market is dominated by several key players, who have a significant influence on market trends and innovations. These companies have strong brand recognition, vast distribution networks, and are at the forefront of sustainability initiatives. The green concrete market is highly competitive, with major global companies leading the development and commercialization of eco-friendly construction materials. Large-scale manufacturers, such as CEMEX, LafargeHolcim, and HeidelbergCement, have integrated green concrete solutions into their product portfolios, focusing on sustainability and compliance with global environmental regulations.

|

Company Name |

Establishment Year |

Headquarters |

Revenue |

Product Portfolio |

Sustainability Initiatives |

R&D Investment |

Production Capacity |

Mergers & Acquisitions |

Global Presence |

|

CEMEX |

1906 |

Mexico |

- |

- |

- |

- |

- |

- |

- |

|

LafargeHolcim |

1912 |

Switzerland |

- |

- |

- |

- |

- |

- |

- |

|

HeidelbergCement |

1874 |

Germany |

- |

- |

- |

- |

- |

- |

- |

|

CRH Plc |

1970 |

Ireland |

- |

- |

- |

- |

- |

- |

- |

|

China National Building |

1984 |

China |

- |

- |

- |

- |

- |

- |

- |

Global Green Concrete Market Analysis

Growth Drivers

- Carbon Footprint Reduction: The demand for green concrete is surging due to its ability to significantly reduce carbon emissions. Traditional cement production accounts for nearly 8% of global CO2 emissions, while green concrete using alternative binders and recycled aggregates cuts CO2 emissions by up to 40%. In 2023, global CO2 emissions reached 37.8 billion metric tons, making decarbonization in construction critical. The use of green concrete directly supports climate goals set by governments globally, as seen in the European Union's Green Deal, which aims to cut emissions by at least 55% by 2030 .

- Sustainable Construction Practices: Sustainable construction practices are being increasingly adopted in major economies, driving the green concrete market. For instance, the U.S. Green Building Council reported that nearly 6,000 LEED-certified projects were underway globally in 2023. These projects often mandate the use of eco-friendly materials like green concrete. In North America alone, sustainable building initiatives have led to the deployment of 30 million square feet of certified green buildings in 2023. The rise of government-backed sustainability programs fuels this growth, focusing on reducing the carbon footprint and promoting circular economies.

- Advancements in Recycled Aggregates and Alternative Binders: Recent technological advancements in the production of recycled aggregates and alternative binders, such as fly ash and blast furnace slag, are propelling the green concrete market forward. By 2023, the global use of recycled aggregates in construction projects grew by 20%, translating to over 1.6 billion tons of concrete waste reused annually. Countries like Japan and Germany have been at the forefront, where over 70% of demolished concrete is recycled and reintegrated into construction projects.

Challenges

- High Initial Costs of Sustainable Materials: Despite its environmental benefits, the adoption of green concrete faces hurdles due to the high initial costs of sustainable materials. For example, the cost of alternative binders like fly ash and ground granulated blast-furnace slag is approximately 20% higher than Portland cement in 2023, making it less attractive for smaller contractors. According to a report by the U.S. Environmental Protection Agency (EPA), using sustainable materials in construction projects can increase total project costs by 15% due to the need for specialized equipment and raw materials.

- Limited Availability of Raw Materials: The limited availability of key raw materials, such as recycled aggregates, hinders the widespread use of green concrete. In 2023, global concrete production reached 14.4 billion metric tons, but only 2 billion tons were produced using recycled materials. Countries like India and China, with high construction demand, often face shortages in sustainable materials, as only 20% of their construction and demolition waste is recycled, according to a report by the UN Environment Programme (UNEP) .

Global Green Concrete Market Future Outlook

Global green concrete market is expected to see significant growth, driven by rising investments in green building projects, increasing regulatory pressure on carbon emissions, and advancements in alternative materials for construction. As more governments around the world prioritize sustainable infrastructure and as companies continue to innovate, green concrete will likely play a central role in the global construction industrys transition toward a greener future.

Market Opportunities

- Expansion into Residential and Commercial Construction: Green concrete is poised for expanded use in both residential and commercial sectors. By 2023, nearly 10% of newly constructed residential buildings in the EU used sustainable building materials, including green concrete, due to regulatory mandates like the EUs Renovation Wave strategy. In China, the government invested over $500 billion into green buildings, highlighting the growing role of sustainable materials in urban planning. This shift opens substantial opportunities for green concrete manufacturers to cater to these expanding sectors.

- Development of Carbon-Negative Concrete: The development of carbon-negative concrete, which absorbs more CO2 than it emits, offers a groundbreaking opportunity for the market. In 2023, carbon-negative concrete was successfully piloted in the UK, absorbing 0.5 tons of CO2 per cubic meter of concrete. As governments push for more aggressive climate action, such innovations are expected to play a central role in reducing global CO2 levels, which stood at 37.8 billion metric tons in 2023. This trend positions green concrete as a critical component in meeting global carbon reduction targets.

Scope of the Report

|

Segments |

Sub-Segments |

|

Product Type |

Fly Ash Concrete Recycled Aggregate Concrete Silica Fume Concrete Ground Granulated Blast Furnace Slag (GGBFS) Concrete Others (Metakaolin, Geopolymers) |

|

Application |

Residential Construction Commercial Construction Infrastructure Projects Industrial Construction |

|

Technology |

Precast Concrete Ready-Mix Concrete Site-Mixed Concrete Pre-Stressed Concrete |

|

End-Use Sector |

Urban Infrastructure Transportation Projects Water Resource Projects Energy-Efficient Buildings |

|

Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Construction Companies

Building Material Manufacturers

Green Building Councils (LEED, BREEAM Certification Bodies)

Architects and Civil Engineers (Focused on eco-friendly construction designs)

Investors and Venture Capital Firms (Specialized in green infrastructure funding)

Real Estate Developers (Engaged in residential and commercial sustainable construction projects)

Government and Regulatory Bodies (Environmental Protection Agency, Department of Energy)

Companies

Players Mentioned in the Report

CEMEX S.A.B. de C.V.

LafargeHolcim

HeidelbergCement AG

CRH Plc

China National Building Material Group Corporation

Votorantim Cimentos

ACC Limited

UltraTech Cement Ltd.

Buzzi Unicem S.p.A.

Holcim Group

Table of Contents

1. Global Green Concrete Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Green Concrete Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Green Concrete Market Analysis

3.1. Growth Drivers

3.1.1. Carbon Footprint Reduction

3.1.2. Sustainable Construction Practices

3.1.3. Advancements in Recycled Aggregates and Alternative Binders

3.1.4. Growing Investment in Green Infrastructure Projects

3.2. Market Challenges

3.2.1. High Initial Costs of Sustainable Materials

3.2.2. Limited Availability of Raw Materials

3.2.3. Lack of Technical Expertise in Green Concrete Construction

3.2.4. Complexities in Achieving Standardized Quality

3.3. Opportunities

3.3.1. Expansion into Residential and Commercial Construction

3.3.2. Development of Carbon-Negative Concrete

3.3.3. Collaboration for Sustainable Development Goals (SDGs)

3.3.4. Integration with Smart Cities and Green Building Certifications

3.4. Trends

3.4.1. Innovation in Recycled Aggregates and Non-Portland Cement Alternatives

3.4.2. Use of Low-Emission Transport for Supply Chain

3.4.3. Adoption of Precast Green Concrete in Modular Construction

3.4.4. Digitalization in Concrete Manufacturing (AI and IoT)

3.5. Government Regulations

3.5.1. National Standards for Carbon Emissions in Construction Materials

3.5.2. Green Building Codes and Public Project Mandates

3.5.3. Tax Incentives for Sustainable Construction

3.5.4. Regional Green Building Certification Programs (LEED, BREEAM)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Suppliers, Contractors, End-Users)

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Global Green Concrete Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Fly Ash Concrete

4.1.2. Recycled Aggregate Concrete

4.1.3. Silica Fume Concrete

4.1.4. Ground Granulated Blast Furnace Slag (GGBFS) Concrete

4.1.5. Others (Metakaolin, Geopolymers)

4.2. By Application (In Value %)

4.2.1. Residential Construction

4.2.2. Commercial Construction

4.2.3. Infrastructure Projects

4.2.4. Industrial Construction

4.3. By Technology (In Value %)

4.3.1. Precast Concrete

4.3.2. Ready-Mix Concrete

4.3.3. Site-Mixed Concrete

4.3.4. Pre-Stressed Concrete

4.4. By End-Use Sector (In Value %)

4.4.1. Urban Infrastructure

4.4.2. Transportation Projects

4.4.3. Water Resource Projects

4.4.4. Energy-Efficient Buildings

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Green Concrete Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. CEMEX S.A.B. de C.V.

5.1.2. Holcim Ltd.

5.1.3. CRH Plc

5.1.4. China National Building Material Group Corporation

5.1.5. LafargeHolcim

5.1.6. HeidelbergCement AG

5.1.7. Votorantim Cimentos

5.1.8. ACC Limited

5.1.9. UltraTech Cement Ltd.

5.1.10. Buzzi Unicem S.p.A.

5.2. Cross Comparison Parameters (Product Portfolio, Revenue, R&D Investment, Production Capacity, Sustainability Initiatives, Mergers & Acquisitions, Global Footprint, Environmental Certifications)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Subsidies

5.9. Private Equity Investments

6. Global Green Concrete Market Regulatory Framework

6.1. Environmental Regulations (Carbon Emissions Caps, Water Usage)

6.2. Compliance Requirements (LEED, BREEAM Certifications)

6.3. Certification Processes

7. Global Green Concrete Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Green Concrete Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By End-Use Sector (In Value %)

8.5. By Region (In Value %)

9. Global Green Concrete Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This phase begins with extensive desk research to identify all significant stakeholders in the green concrete market. Using a combination of secondary sources, including industry reports, proprietary databases, and government documents, key variables like market drivers, challenges, and segment growth are identified to build a comprehensive market landscape.

Step 2: Market Analysis and Construction

During this stage, historical data on the adoption of green concrete across various regions is compiled. Market penetration, growth rate, and the use of eco-friendly materials are analyzed to develop a detailed picture of market trends. Factors such as pricing, raw material availability, and regulatory frameworks are also examined.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses around market dynamics are validated through interviews with industry experts, including green building material manufacturers, construction firms, and sustainability consultants. These insights help refine data accuracy and ensure a well-rounded understanding of the market.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing data from both primary and secondary research to create a validated report. This includes cross-referencing company-specific performance metrics, product trends, and consumer preferences. Final validation is conducted through expert consultations and feedback loops to ensure accuracy.

Frequently Asked Questions

01. How big is the Global Green Concrete Market?

The global green concrete market is valued at USD 21 billion in 2023, driven by growing concerns over carbon emissions and sustainability in construction.

02. What are the key growth drivers of the Global Green Concrete Market?

The global green concrete market is driven by government regulations aimed at reducing carbon footprints, advancements in the development of alternative construction materials, and increasing investments in green infrastructure.

03. What are the challenges in the Global Green Concrete Market?

Key challenges in global green concrete market include the high initial cost of green concrete compared to traditional materials, limited technical expertise, and the availability of sustainable raw materials in certain regions.

04. Who are the major players in the Global Green Concrete Market?

Major players in global green concrete market include CEMEX, LafargeHolcim, HeidelbergCement, CRH Plc, and China National Building Material Group Corporation, dominating through strong sustainability initiatives and extensive distribution networks.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.