Global Green Data Center Market Outlook to 2030

Region:Global

Author(s):Sanjna Verma

Product Code:KROD1575

December 2024

85

About the Report

Global Green Data Center Market Overview

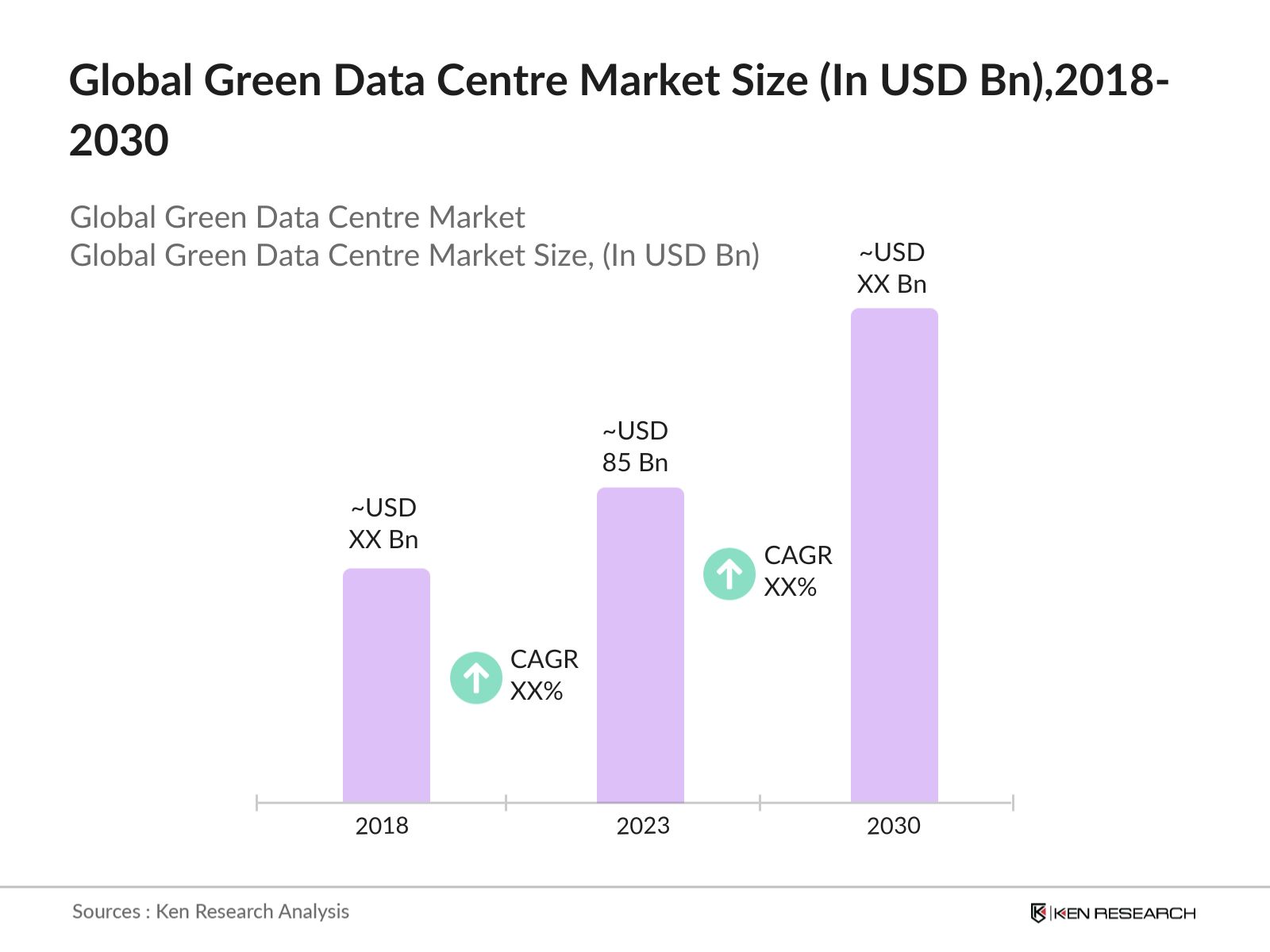

- Global Green Data Center Market was valued at USD 85 billion in 2023, driven by the escalating demand for energy-efficient and sustainable data storage solutions. Companies are increasingly focusing on reducing carbon footprints, leading to the widespread adoption of green data centers. The market is propelled by the integration of advanced technologies like AI, IoT, and edge computing.

- Key players dominating the Global Green Data Center market include Google LLC, Amazon Web Services, Equinix Inc., Microsoft Corporation, and Digital Realty Trust. These companies are leading the charge in developing and implementing green technologies such as renewable energy-powered data centers and advanced cooling systems.

- In 2021, Microsoft announced the launch of its first fully renewable energy-powered data center in Sweden, utilizing 100% carbon-free energy with presence in Gvle, Sandviken and Staffanstorp. It features rainwater harvesting to provide humidification and support onsite facilities, reducing water usage by 90% compared to other cooling systems.

- Cities like Dublin, Ireland, and Amsterdam, Netherlands, dominate the green data center market due to favorable government policies, access to renewable energy, and strategic locations as data hub centers. Dublin, for example, offers a robust technological infrastructure and access to clean energy, attracting major tech companies to set up green data centers in the region.

Global Green Data Center Market Segmentation

The Global Green Data Center Market can be segmented based on several factors:

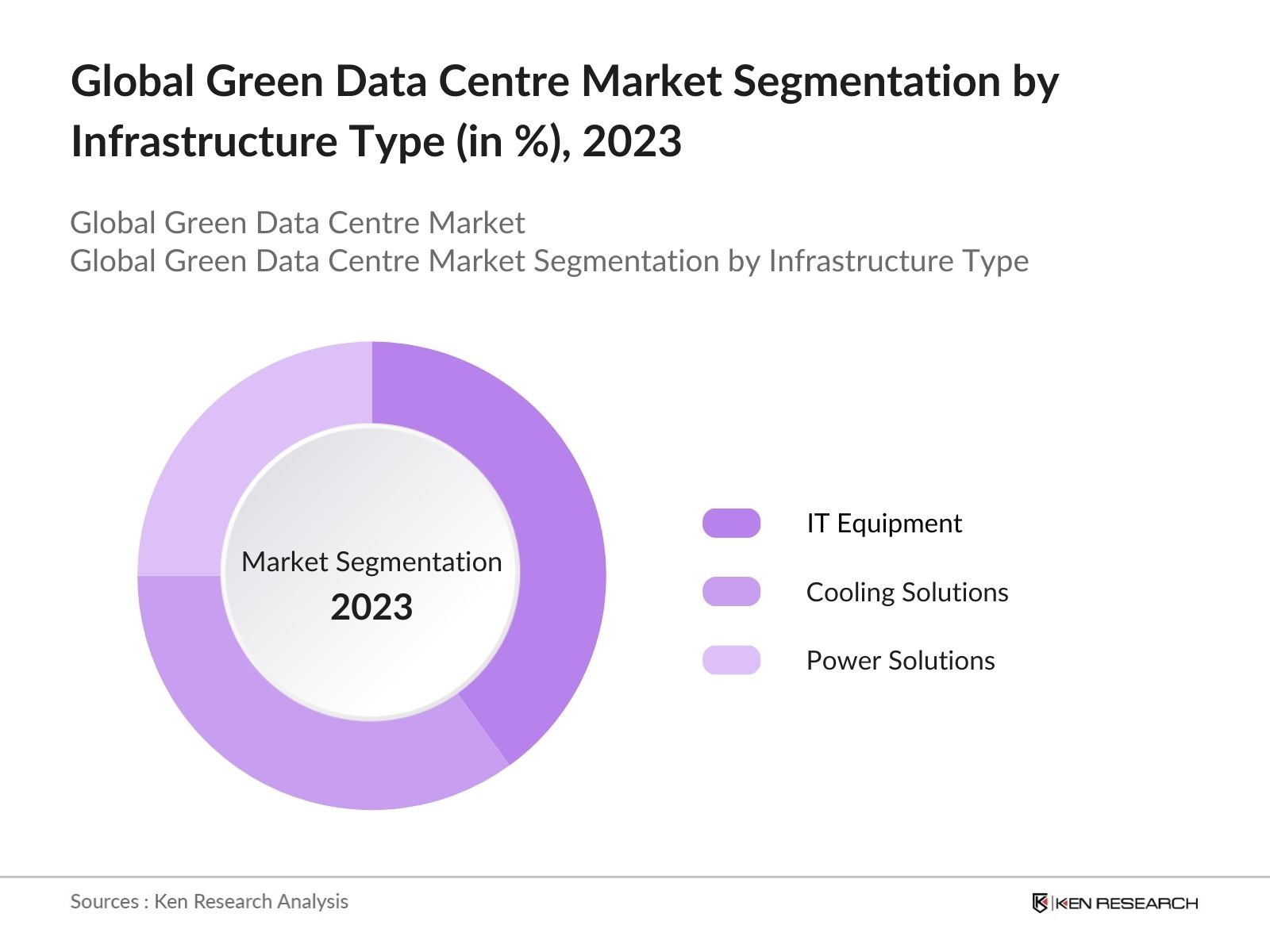

By Infrastructure Type: Global Green Data Center Market is segmented by infrastructure type into IT Equipment, Cooling Solutions & Power Solutions. In 2023, cooling solutions have a dominant market share in the green data center market, primarily due to the need for advanced cooling technologies that significantly reduce energy consumption. Innovative cooling methods, such as liquid cooling and free cooling, have gained popularity because they are more efficient and sustainable.

By Region: Global Green Data Center market is segmented by region into North America, Europe, and Asia-Pacific. In 2023, North America, particularly the USA, dominates the green data center market. This is due to the region's technological advancements, availability of renewable energy sources, and significant investments from tech giants in building energy-efficient data centers.

By End-User: Global Green Data Center Market is segmented by end-user into IT and telecom, BFSI, government and defense, and healthcare. In 2023, the IT and telecom sector holds the largest market share within the green data center market. This is attributed to the sector's massive data storage and processing needs, coupled with its focus on reducing operational costs through energy-efficient data centers.

Global Green Data Center Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Google LLC |

1998 |

Mountain View, USA |

|

Amazon Web Services (AWS) |

2006 |

Seattle, USA |

|

Equinix Inc. |

1998 |

Redwood City, USA |

|

Microsoft Corporation |

1975 |

Redmond, USA |

|

Digital Realty Trust |

2004 |

San Francisco, USA |

- Google LLC: In 2023, Google announced that it had achieved 100% renewable energy usage across all its data centers worldwide. The company has invested USD 3.5 billion in renewable energy projects and aims to transition all its operations to carbon-free energy by 2030. Googles strategy includes deploying cutting-edge cooling technologies and AI-based energy management systems to further reduce its carbon footprint.

- Equinix Inc.: In 2023, Equinix reduced Scope 1 and 2 operational emissions by 24% from its 2019 baseline and increased Scope 3 emissions coverage to 25% through supplier-set science-based targets. In the Asia-Pacific region, Equinix achieved 81% renewable energy coverage versus its electricity usage.

Global Green Data Center Industry Analysis

Growth Drivers

- Rising Demand for Sustainable Infrastructure in the IT Industry: Google has achieved 100% reliance on renewable energy for its data centers. The company aims to run all of its data centers on carbon-free energy by 2030, which includes not just renewable energy but also ensuring that the energy is available 24/7. This ambitious goal represents a significant step towards reducing the tech giant's overall carbon footprint and leading the way in sustainable business practices.

- Increased Government Regulations on Energy Efficiency: Several governments, including the U.S. and European Union, introduced stricter energy efficiency standards that have accelerated the shift towards green data centers. Data center operators aim to reduce their average Power Usage Effectiveness (PUE) ratio from 1.98 to 1.55 over five years, reflecting a significant focus on energy efficiency improvements. These policies, backed by fines for non-compliance, are creating a surge in the demand for energy-efficient, green data centers.

- Surge in Data Consumption and Cloud Computing: The rise of AI technologies necessitates greater computational resources, which cloud services provide. AI applications, including machine learning and deep learning, require substantial processing power to analyze large datasets and improve model accuracy. Data centers are now looking to invest in sustainable solutions to handle this demand, which is driving the growth of green data centers.

Global Green Data Center Market Challenges

- Limited Availability of Renewable Energy Sources: While green data centers rely heavily on renewable energy, there is a challenge in ensuring consistent energy availability. The reliability of renewable energy grids in some countries is still under development, making it challenging for companies to consistently run data centers using only green energy sources.

- High Initial Capital Investment: In 2023, the average cost to build a green data center includes the integration of renewable energy sources, advanced cooling technologies, and energy-efficient IT infrastructure, making it difficult for small and medium-sized enterprises (SMEs) to adopt these technologies.

Global Green Data Center Market Government Initiatives

- EU Green Digital Agenda: The EU "Green Digital Agenda" is an initiative aimed at integrating digital technologies with environmental sustainability to foster a greener economy. This agenda emphasizes the dual goals of promoting digital transformation while simultaneously addressing climate change challenges. The aim is to reduce the greenhouse gas emissions associated with digital operations by at least 30% by 2030.

- U.S. Energy Efficiency Program for Data Centers: Maryland was the first state to offer a targeted energy efficiency program for data centers. In 2018, Montgomery County Public Schools (MCPS) received a $127,000 DCEEG award to install more energy-efficient technology in their data center, including server virtualization, storage area network upgrades, and air flow optimization measures.

Global Green Data Center Future Market Outlook

By 2030, the market is expected to reach USD 422 bn, being driven by advancements in technology, increasing demand for immersive experiences, and supportive government initiatives. The continuous development of high-performance projection hardware and user-friendly software solutions will further enhance the capabilities and applications of projection mapping.

Future Market Trends

- AI-Driven Energy Management Systems: Green data centers will increasingly rely on AI-driven systems to optimize energy consumption. These systems will automatically adjust cooling and power usage based on real-time data, leading to substantial reductions in energy costs. AI will play a critical role in enabling data centers to operate more efficiently, ensuring minimal energy wastage while maintaining high performance.

- Increased Adoption of Liquid Cooling Solutions: Liquid cooling technology is set to become a dominant trend in green data centers due to its ability to significantly reduce energy consumption compared to traditional air-cooling methods. More data centers will adopt liquid cooling solutions to minimize the environmental impact and lower operational costs.

Scope of the Report

|

By Product Type |

IT Equipment Cooling Solutions Power Solutions |

|

By Data Center Type |

Colocation Data Centers Managed Service Data Centers Cloud Service Data Centers Enterprise Data Centers |

|

By End-User |

IT and Telecom BFSI Government and Defense Healthcare |

|

By Region |

North America Europe Asia-Pacific LAMEA |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

IT and Telecom Companies

Data Center Operators

Renewable Energy Providers

Cloud Service Providers

Energy Management Solution Providers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., European Commission, U.S. Environmental Protection Agency)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2030

Companies

Players Mentioned in the Report:

Google LLC

Amazon Web Services (AWS)

Equinix Inc.

Microsoft Corporation

Digital Realty Trust

IBM Corporation

Cisco Systems, Inc.

Hewlett Packard Enterprise (HPE)

Schneider Electric

Siemens AG

NTT Communications Corporation

Oracle Corporation

Fujitsu Limited

Dell Technologies Inc.

AT&T Inc.

Table of Contents

1. Global Green Data Center Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

2. Global Green Data Center Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Green Data Center Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Sustainable Infrastructure in the IT Industry

3.1.2. Increased Government Regulations on Energy Efficiency

3.1.3. Surge in Data Consumption and Cloud Computing

3.1.4. Adoption of Renewable Energy Sources

3.2. Restraints

3.2.1. Limited Availability of Renewable Energy Sources

3.2.2. High Initial Capital Investment

3.2.3. Availability of Resources

3.3. Opportunities

3.3.1. Innovation in Cooling Technologies

3.3.2. Expansion in Emerging Markets

3.3.3. Partnerships and Collaborations

3.4. Trends

3.4.1. Adoption of AI and Automation

3.4.2. Integration with Smart Grids

3.4.3. Increased Focus on Sustainable Design

3.5. Government Regulation

3.5.1. Data Center Energy Efficiency Standards

3.5.2. Renewable Energy Mandates

3.5.3. Green Building Certifications

3.5.4. Incentives for Sustainable Practices

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. Global Green Data Center Market Segmentation, 2023

4.1. By Component (in Value %)

4.1.1. IT Equipment

4.1.2. Power Systems

4.1.3. Cooling Systems

4.2. By Data Center Type (in Value %)

4.2.1. Colocation

4.2.2. Managed Service

4.2.3. Enterprise

4.2.4. Cloud Service

4.3. By Industry Vertical (in Value %)

4.3.1. BFSI

4.3.2. IT & Telecom

4.3.3. Healthcare

4.3.4. Government

4.3.5. Others

4.4. By Energy Source (in Value %)

4.4.1. Renewable Energy

4.4.2. Non-renewable Energy

4.5. By Region (in Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Green Data Center Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Schneider Electric SE

5.1.2. Vertiv Co.

5.1.3. IBM Corporation

5.1.4. Cisco Systems, Inc.

5.1.5. Hewlett Packard Enterprise (HPE)

5.1.6. Dell Technologies Inc.

5.1.7. Siemens AG

5.1.8. Equinix, Inc.

5.1.9. Digital Realty Trust, Inc.

5.1.10. Amazon Web Services, Inc.

5.1.11. Google LLC

5.1.12. Microsoft Corporation

5.1.13. Apple Inc.

5.1.14. Fujitsu Limited

5.1.15. Oracle Corporation

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global Green Data Center Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global Green Data Center Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Global Green Data Center Future Market Size (in USD Bn), 2023-2030

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global Green Data Center Future Market Segmentation, 2030

9.1. By Component (in Value %)

9.2. By Data Center Type (in Value %)

9.3. By Industry Vertical (in Value %)

9.4. By Energy Source (in Value %)

9.5. By Region (in Value %)

10. Global Green Data Center Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on green data center market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for green data center market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple green data center companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from green data center companies.

Frequently Asked Questions

01 How big is Global Green Data Center Market?

Global Green Data Center Market was valued at USD 85 billion in 2023, driven by the escalating demand for energy-efficient and sustainable data storage solutions. Companies are increasingly focusing on reducing carbon footprints, leading to the widespread adoption of green data centers.

02 What are the challenges in Global Green Data Center Market?

Challenges of Global Green Data Center Market include the high initial capital investment required for green technologies, limited availability of consistent renewable energy sources, and a shortage of skilled professionals trained in managing energy-efficient data centers. These factors can hinder the pace of adoption and expansion in the market.

03 Who are the major players in Global Green Data Center Market?

Key players dominating the Global Green Data Center market include Google LLC, Amazon Web Services, Equinix Inc., Microsoft Corporation, and Digital Realty Trust. These companies are leading the charge in developing and implementing green technologies such as renewable energy-powered data centers and advanced cooling systems

04 What are the growth drivers of the Global Green Data Center Market?

Global Green Data Center Market is driven by increased government regulations on energy efficiency, rising demand for sustainable IT infrastructure, and the surge in global data consumption and cloud computing services. The shift towards carbon-neutral operations by major corporations further accelerates market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.