Global Grid-Forming Inverter Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD4982

December 2024

86

About the Report

Global Grid-Forming Inverter Market Overview

- The APAC Grid-Forming Inverter market is valued at USD 680 million, based on a five-year historical analysis. This market is primarily driven by rapid industrialization, increasing energy demands, and the expanding renewable energy capacity in countries like China, India, and Japan. Government policies supporting clean energy and large-scale investments in solar and wind power projects are key factors behind the regions dominance. The strong push for energy storage systems, grid modernization, and technological innovations in grid-forming inverters further fuels the markets growth in this region.

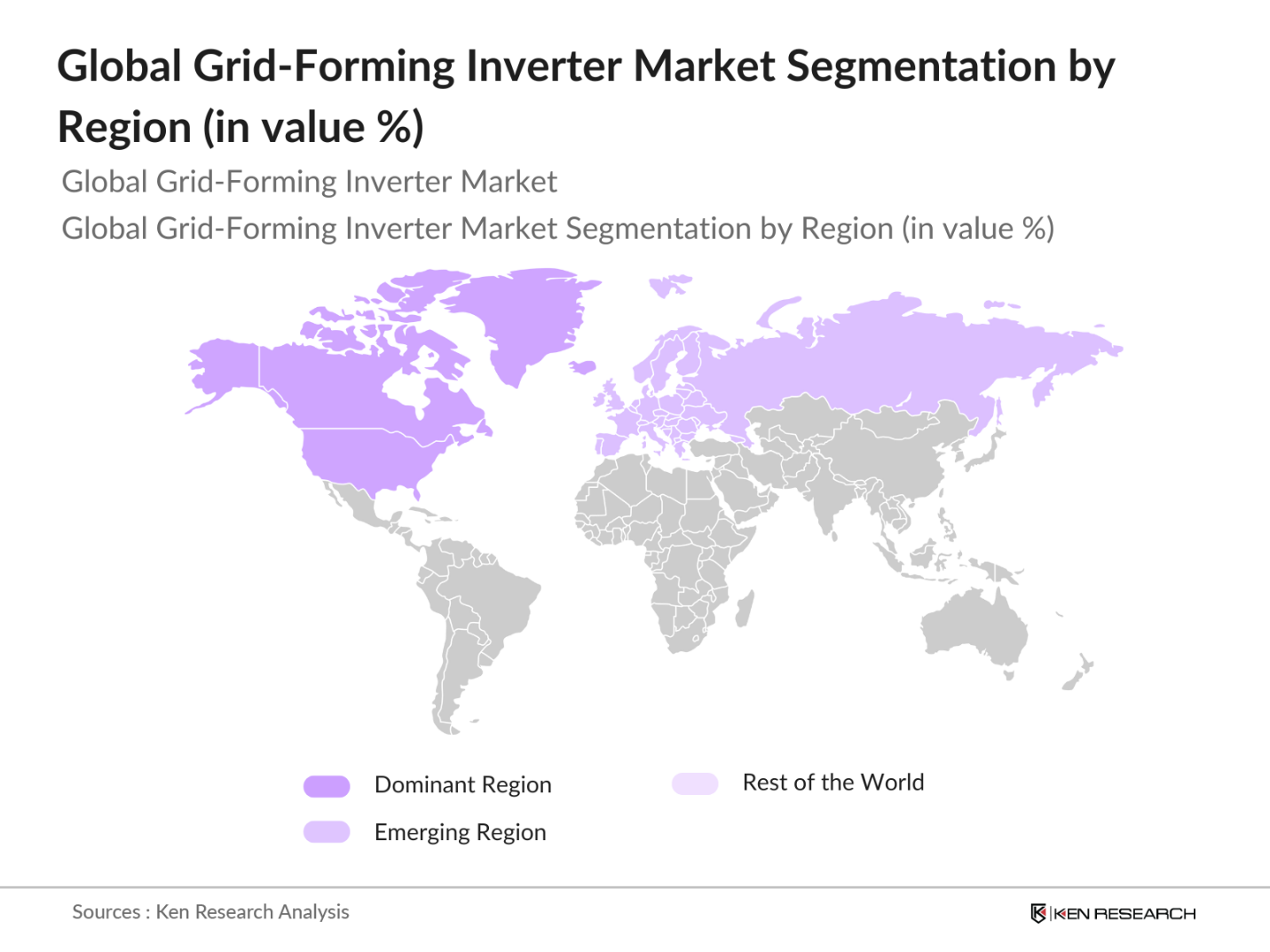

- Countries within regions such as North America, Europe, and Asia-Pacific (APAC) dominate the grid-forming inverter market. North America, particularly the United States, leads due to large-scale renewable energy installations and significant investments in grid modernization. APAC, driven by rapid industrialization in China and India, is witnessing robust growth due to high energy demands and strong government support for renewable projects.

- Governments are enacting strict mandates to ensure the integration of renewable energy sources into the grid. By 2023, over 50 countries had passed laws requiring that all new renewable energy installations include grid-forming inverters to enhance system resilience. These mandates are critical in ensuring that renewable energy sources like wind and solar can contribute reliably to national grids.

Global Grid-Forming Inverter Market Segmentation

By Product Type: The market is segmented into hybrid inverters, solar inverters, and wind inverters. Hybrid inverters dominate the market due to their flexibility in integrating both renewable energy sources and energy storage systems. Their ability to operate independently or in conjunction with grid-tied systems has made them popular, particularly in regions with unreliable grid infrastructure.

By Application: The market is categorized into commercial, residential, and utility-scale applications. Utility-scale applications hold the largest market share, driven by the increasing number of large renewable energy projects. The rising adoption of solar farms and wind power plants has accelerated the demand for grid-forming inverters that can manage large-scale energy production.

By Region: The market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America leads the market, driven by increasing investments in renewable energy infrastructure, favorable regulatory policies, and technological advancements. The United States, in particular, has been a strong player due to large-scale renewable energy projects and grid modernization efforts.

Global Grid-Forming Inverter Market Competitive Landscape

The global grid-forming inverter market is dominated by a few key players who have established a strong presence through technological innovation and strategic partnerships. These companies are focusing on research and development to improve inverter efficiency and to comply with evolving grid standards. Notably, companies like ABB, SMA Solar Technology, and Schneider Electric lead the market due to their advanced technologies and global distribution networks.

Global Grid-Forming Inverter Industry Analysis

Growth Drivers

- Integration of Renewable Energy Sources: Grid-forming inverters play a crucial role in integrating renewable energy into the grid. As of 2024, renewable energy generation accounts for 29% of the global electricity output, with solar power contributing 8,300 terawatt-hours (TWh). This surge in renewable energy sources has fueled demand for grid-forming inverters, which enable the smooth incorporation of variable renewable power into the grid.

- Increasing Energy Storage Systems Deployment: The growing adoption of energy storage systems (ESS) is another key driver for grid-forming inverters. Global installed energy storage capacity reached 34 gigawatt-hours (GWh) by 2023, reflecting a dramatic increase from the 24 GWh recorded in 2022. These systems require grid-forming inverters to manage energy flow, especially as utilities deploy more storage systems for balancing grid supply and demand.

- Grid Modernization Initiatives: Governments worldwide are investing in grid modernization to ensure their energy infrastructure is capable of handling decentralized renewable energy sources. By 2024, global investments in grid infrastructure had reached $370 billion, reflecting ongoing efforts to upgrade aging grids. In the U.S., for instance, $65 billion has been earmarked under the Infrastructure Investment and Jobs Act (IIJA) for power grid upgrades, including smart grid technology and integration of renewables, both of which depend on grid-forming inverters.

Market Challenges

- High Initial Costs of Grid-Forming Inverters: The initial investment required for grid-forming inverters remains a challenge, especially for developing economies. On average, the cost of installing a grid-forming inverter is $120,000 per megawatt (MW) for large-scale renewable energy projects. This high capital requirement limits the adoption of advanced inverter technologies, particularly in regions with less access to financing. Even with increasing demand, the high upfront cost deters small and medium-sized power producers from deploying this technology.

- Technological Complexities in Integration: Integrating grid-forming inverters with existing grid infrastructure poses technological challenges. For instance, older grids in regions like Eastern Europe, with an average age of 40 years, may struggle to support advanced inverter technologies. In addition, the decentralized nature of modern gridswhere energy generation is spread across various renewable energy sourcesadds complexity to the integration process, requiring advanced control systems and software to ensure grid stability.

Global Grid-Forming Inverter Market Future Outlook

Over the next five years, the grid-forming inverter market is expected to witness significant growth driven by increasing renewable energy penetration and advancements in grid technology. Government policies aiming at decarbonization and grid stability, combined with rising investments in energy storage solutions, will further fuel the market. In particular, hybrid inverters and utility-scale applications will continue to dominate as countries focus on modernizing their energy infrastructure to accommodate renewable energy sources and ensure grid stability.

Market Opportunities

- Expansion in Emerging Markets: Emerging markets are witnessing significant growth in renewable energy projects, presenting a vast opportunity for grid-forming inverter technology. In Africa, for example, renewable energy capacity reached 63 GW in 2023, driven by solar and wind energy projects. With countries like Egypt and South Africa ramping up renewable energy investments, grid-forming inverters are becoming critical for grid reliability. These markets represent untapped potential for inverter manufacturers, especially as governments prioritize grid modernization to meet growing energy demands.

- Advancement in Microgrid Technology: Microgrids, which operate independently of the central grid, are a growing trend in both urban and rural areas. By 2023, over 450 microgrid projects were in development globally, with a combined capacity of 4.6 GW. These systems rely on grid-forming inverters to regulate energy flow and ensure smooth integration of renewable energy sources. The advancement of microgrid technology presents an opportunity for the adoption of grid-forming inverters, particularly in areas where centralized grids are unreliable or underdeveloped.

Scope of the Report

|

By Product Type |

Centralized Grid-Forming Inverters Decentralized Grid-Forming Inverters Modular Grid-Forming Inverters |

|

By Application |

Utility-Scale Power Systems Microgrid Solutions Commercial and Industrial (C&I) Residential |

|

By Power Rating |

<100 kW 100 kW500 kW >500 kW |

|

By End User |

Utilities Independent Power Producers (IPPs) Industrial Users |

|

By Region |

North America Europe Asia Pacific Latin America Middle East and Africa |

Products

Key Target Audience

Grid Operators and Utility Companies

Renewable Energy Project Developers

Energy Storage Solution Providers

Government and Regulatory Bodies (Federal Energy Regulatory Commission, European Union Energy Agency)

Smart Grid Solution Providers

Energy Efficiency Consultants

Investments and Venture Capitalist Firms

Electric Vehicle Charging Infrastructure Providers

Companies

Players Mentioned in the Report

ABB Ltd.

SMA Solar Technology

Schneider Electric

Huawei Technologies

Siemens AG

GE Renewable Energy

Delta Electronics, Inc.

Eaton Corporation

Enphase Energy

SolarEdge Technologies

Table of Contents

1. Global Grid-Forming Inverter Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Grid-Forming Inverter Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Grid-Forming Inverter Market Analysis

3.1. Growth Drivers

3.1.1. Integration of Renewable Energy Sources

3.1.2. Increasing Energy Storage Systems Deployment

3.1.3. Grid Modernization Initiatives

3.1.4. Regulatory Mandates for Grid Stability

3.2. Market Challenges

3.2.1. High Initial Costs of Grid-Forming Inverters

3.2.2. Technological Complexities in Integration

3.2.3. Uncertain Regulatory Landscape

3.3. Opportunities

3.3.1. Expansion in Emerging Markets

3.3.2. Advancement in Microgrid Technology

3.3.3. Increasing Penetration of Smart Grids

3.4. Trends

3.4.1. Growing Adoption of Hybrid Inverter Solutions

3.4.2. Increased Demand for Self-Healing Grid Technologies

3.4.3. Rise in Government Investments in Energy Storage

3.5. Government Regulation

3.5.1. Renewable Energy Integration Mandates

3.5.2. Grid Resilience and Stability Standards

3.5.3. Energy Efficiency Regulations for Grid Inverters

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Landscape

4. Global Grid-Forming Inverter Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Centralized Grid-Forming Inverters

4.1.2. Decentralized Grid-Forming Inverters

4.1.3. Modular Grid-Forming Inverters

4.2. By Application (In Value %)

4.2.1. Utility-Scale Power Systems

4.2.2. Microgrid Solutions

4.2.3. Commercial and Industrial (C&I)

4.2.4. Residential

4.3. By Power Rating (In Value %)

4.3.1. <100 kW

4.3.2. 100 kW500 kW

4.3.3. >500 kW

4.4. By End User (In Value %)

4.4.1. Utilities

4.4.2. Independent Power Producers (IPPs)

4.4.3. Industrial Users

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East and Africa

5. Global Grid-Forming Inverter Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. ABB Ltd.

5.1.2. Siemens AG

5.1.3. General Electric

5.1.4. Schneider Electric

5.1.5. SMA Solar Technology AG

5.1.6. Hitachi Energy Ltd.

5.1.7. Eaton Corporation

5.1.8. Huawei Technologies Co., Ltd.

5.1.9. Mitsubishi Electric Corporation

5.1.10. Fronius International GmbH

5.1.11. Sungrow Power Supply Co., Ltd.

5.1.12. Enphase Energy, Inc.

5.1.13. Delta Electronics, Inc.

5.1.14. Power Electronics

5.1.15. Ingeteam S.A.

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Presence, R&D Investment, Strategic Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Grid-Forming Inverter Market Regulatory Framework

6.1. Energy Efficiency Standards

6.2. Grid Interconnection Guidelines

6.3. Certification and Compliance Processes

7. Global Grid-Forming Inverter Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Grid-Forming Inverter Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Power Rating (In Value %)

8.4. By End User (In Value %)

8.5. By Region (In Value %)

9. Global Grid-Forming Inverter Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In the initial stage, we developed a comprehensive ecosystem map highlighting the key stakeholders in the global grid-forming inverter market. Extensive desk research was conducted, utilizing a mix of secondary data and proprietary databases to identify the core market variables influencing the sectors growth.

Step 2: Market Analysis and Construction

At this phase, historical data related to the grid-forming inverter market was analyzed, including penetration rates, system integrations, and energy storage trends. A detailed assessment was performed on revenue generation patterns and the performance of different market segments.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses were formulated and validated through in-depth interviews with industry experts and company representatives. This process ensured the inclusion of both operational insights and financial projections, helping to verify the accuracy of our data.

Step 4: Research Synthesis and Final Output

The final research phase involved consultations with grid-forming inverter manufacturers to gather detailed market insights. This bottom-up approach was combined with the validation of collected data through engagement with grid operators, ensuring a holistic and accurate analysis of the market landscape.

Frequently Asked Questions

01. How big is the Global Grid-Forming Inverter Market?

The APAC Grid-Forming Inverter market is valued at USD 680 million, based on a five-year historical analysis. This market is primarily driven by rapid industrialization, increasing energy demands, and the expanding renewable energy capacity in countries like China, India, and Japan.

02. What are the challenges in the Global Grid-Forming Inverter Market?

Challenges include the high initial costs of grid-forming inverters, technological complexities in integrating them into existing grids, and a lack of uniform regulatory standards across regions, which may slow down market adoption.

03. Who are the major players in the Global Grid-Forming Inverter Market?

Key players include ABB Ltd., SMA Solar Technology, Schneider Electric, Huawei Technologies, and Siemens AG, among others, who dominate due to their technological innovations and established global presence.

04. What are the growth drivers of the Global Grid-Forming Inverter Market?

The growth is driven by the increasing penetration of renewable energy, grid modernization initiatives, and regulatory mandates to stabilize the grid. The rising demand for energy storage solutions further propels market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.