Global Head Mount Display Market Outlook to 2030

Region:Global

Author(s):Sanjana

Product Code:KROD1113

October 2024

82

About the Report

Global Head Mounted Display Market Overview

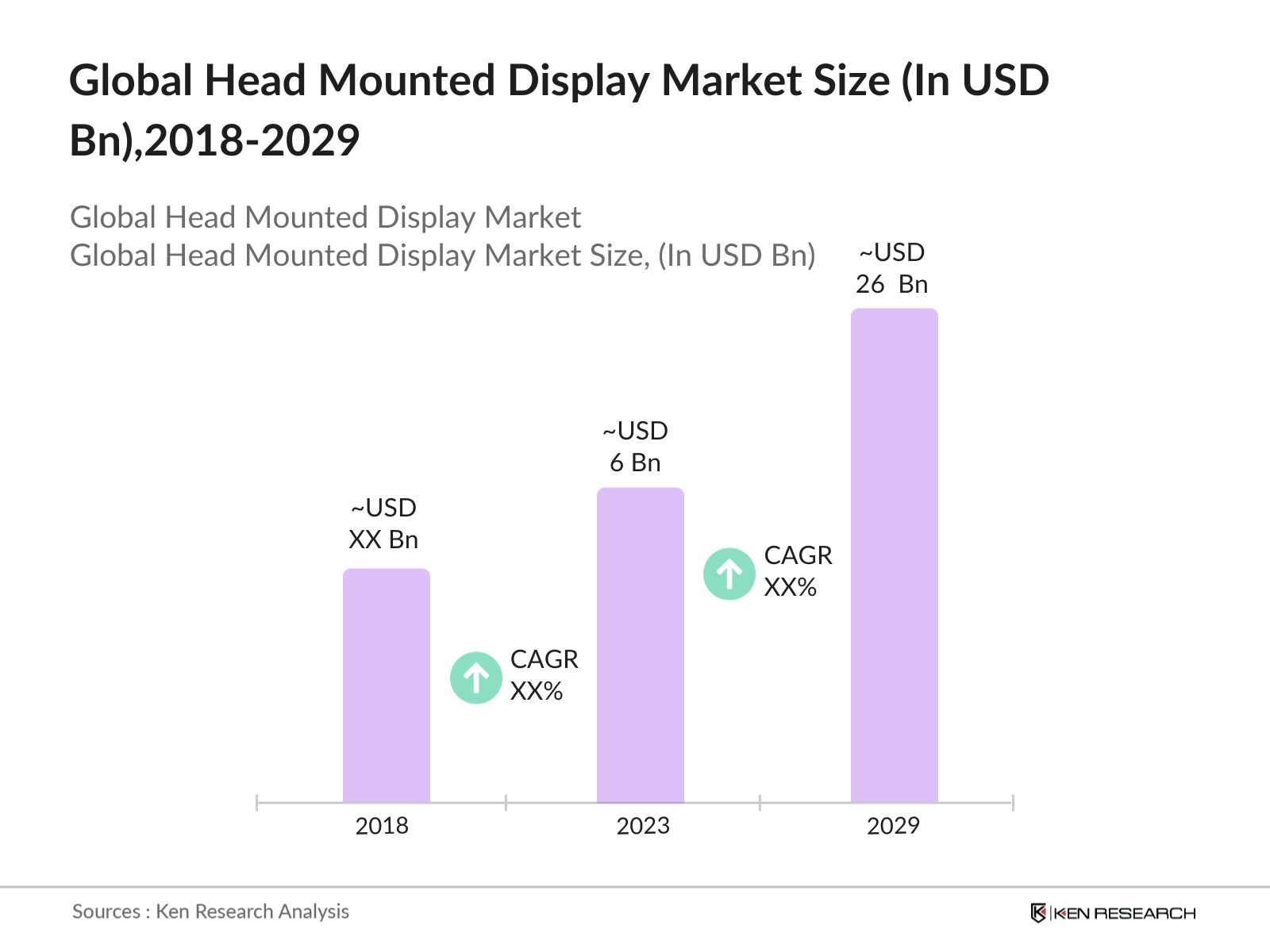

- Global Head Mounted Display (HMD) Market reached a valuation of USD 6 billion in 2023. This growth was primarily driven by the increased demand for augmented reality (AR) and virtual reality (VR) applications across various sectors, including gaming, healthcare, and military.

- The HMD market is dominated by leading tech companies including Sony Corporation, Microsoft Corporation, Samsung Electronics Co., Ltd., HTC Corporation, and Oculus (a division of Meta Platforms, Inc.). These companies have solidified their market positions through continuous innovation, strategic partnerships, and acquisitions.

- In 2023, Meta released Quest 3, which is an upgrade over its predecessor with improved mixed reality (MR) capabilities and better resolution. Quest 3 supports a vast library of over 500 games and applications, including all titles available for Quest 2, with many games optimized to take advantage of the new hardware capabilities.

- Major tech hubs such as San Francisco, Tokyo, and Seoul are at the forefront of the HMD market. San Francisco leads due to its concentration of tech giants like Meta and Apple, who are spearheading HMD innovation. Tokyo is a key player because of Sony's dominance and the city's strong gaming culture.

Global Head Mounted Display Market Segmentation

The Global Head Mounted Display Market can be segmented based on several factors:

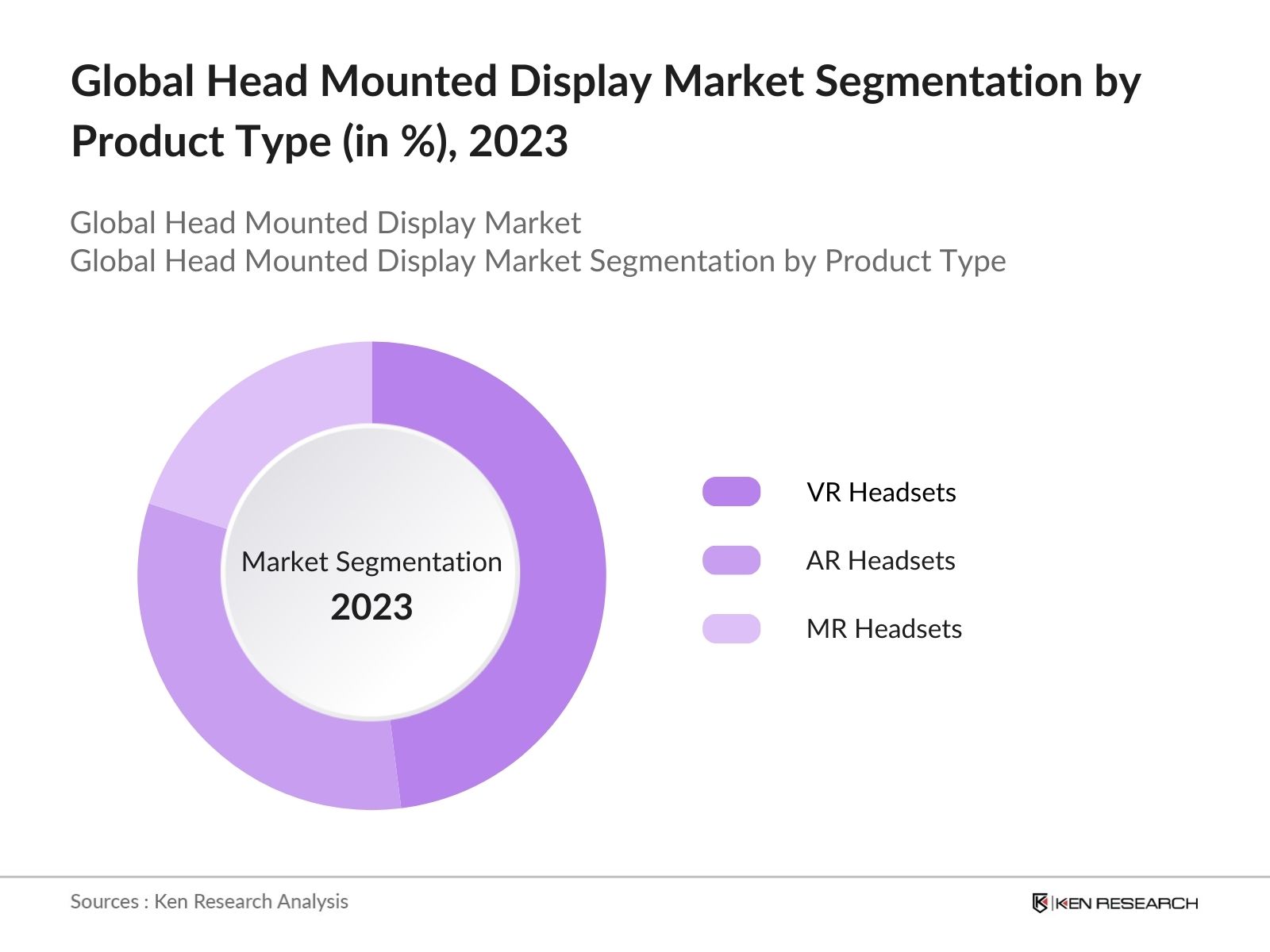

By Product Type: The HMD market is segmented by product type into VR headsets, AR headsets, and MR headsets. In 2023, VR headsets dominated the product type segment This dominance is driven by the strong consumer base in the gaming industry and the adoption of VR for training and simulation purposes in industries such as aviation and defense.

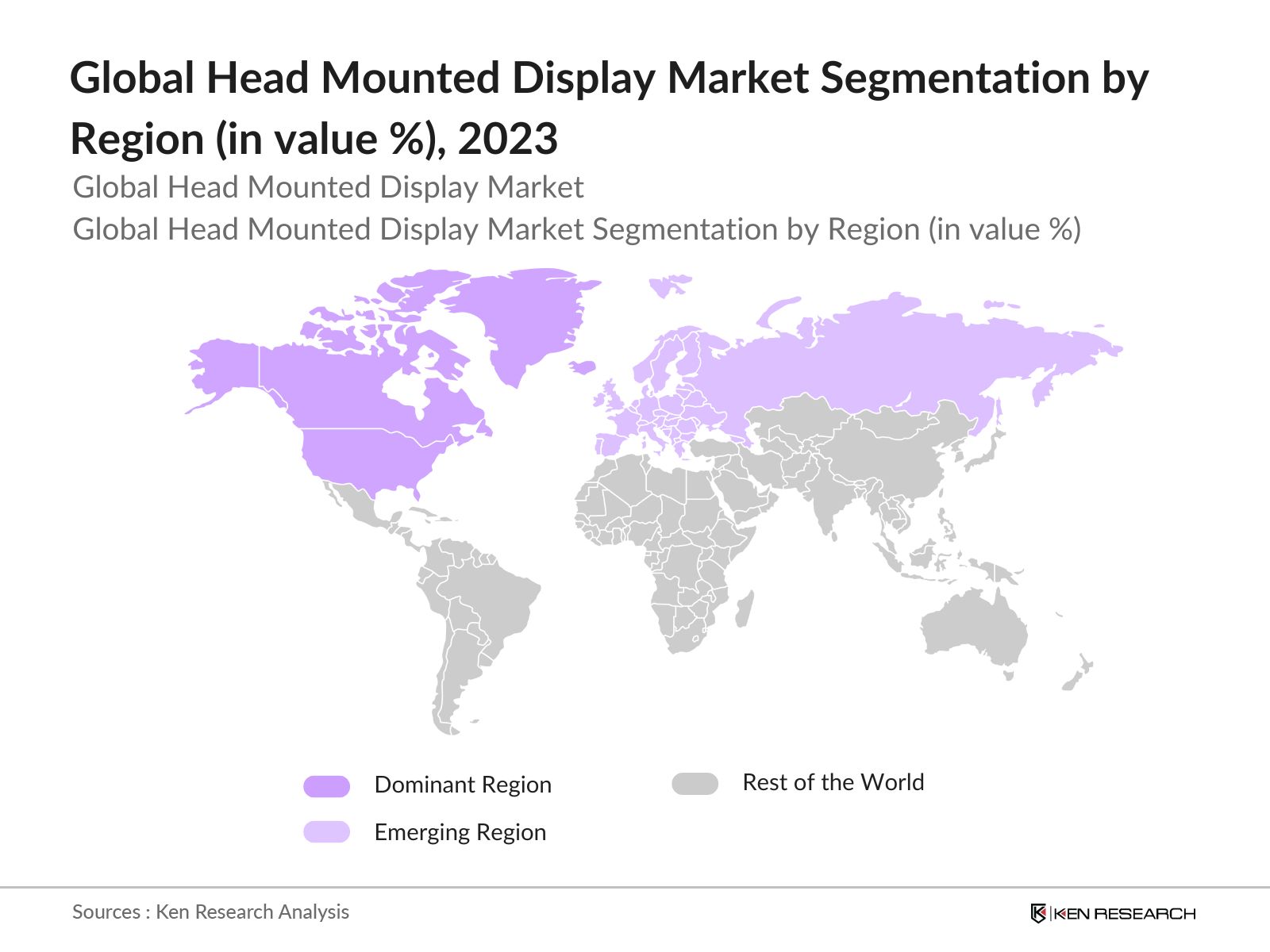

By Region: The market is segmented by region into North America, Europe, Asia-Pacific, LAMEA (Latin America, Middle East, and Africa), and MEA (Middle East and Africa). North America dominated the market in 2023. This leadership is due to the region's advanced technological infrastructure, high adoption rate of new technologies, and significant investment in AR and VR by tech giants.

By Application: The market is segmented by application into Gaming & Entertainment, Healthcare, Defense & Aerospace, and Education & Training. Gaming & Entertainment was the leading segment in 2023. The rapid advancements in VR gaming, with major franchises launching exclusive VR titles, has driven consumer demand. Additionally, the entertainment industrys push toward immersive experiences, such as VR concerts and movies, has solidified this segment's leading position.

Global Head Mounted Display Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Sony Corporation |

1946 |

Tokyo, Japan |

|

Microsoft Corporation |

1975 |

Redmond, Washington, USA |

|

Samsung Electronics |

1969 |

Suwon, South Korea |

|

HTC Corporation |

1997 |

New Taipei, Taiwan |

|

Oculus (Meta) |

2012 |

Menlo Park, California, USA |

- Sony Electronics Spatial Content Creation System: In 2024, Sony Electronics publicly showcased its Spatial Content Creation System for the first time in the U.S. at Augmented World Expo (AWE) USA 2024 in Long Beach, California. The advanced system offers visual clarity, performance and intuitive manipulation of virtual objects, setting a new standard for immersive spatial content creation.

- Meta Reality Labs Restructuring: In 2024, Meta announced a restructuring of Reality Labs into two distinct divisions: Metaverse and Wearables. This change aims to streamline operations and enhance focus on both augmented reality and the Metaverse. The Metaverse division will oversee the Quest headset line and related technologies, while the Wearables division will focus on hardware, including smart glasses.

Global Head Mounted Display Industry Analysis

Growth Drivers:

- Increased Adoption of AR/VR in Healthcare: The Head Mounted Display (HMD) market has seen substantial growth due to the rising adoption of AR/VR technologies in the healthcare sector. The immersive nature of VR is expected to improve patient engagement and satisfaction, as it allows for a better understanding of health conditions and treatments.

- Expansion in Military Applications: The defense sector has significantly driven the demand for HMDs, particularly in simulation, training, and situational awareness. In 2021, Indian Army is in the process of acquiring 556 Augmented Reality Head Mounted Display (ARHMD) systems. These systems are designed to enhance the capabilities of land-based air defense weapon systems, providing operators with radar and thermal imaging overlays. .

- Growth in the Gaming and Entertainment Industry: HMDs typically feature advanced display technologies, including OLED and LCD screens, which provide high-resolution visuals and a wide field of view (FOV). A greater FOV enhances the immersive experience, with human vision allowing for about 220 degrees of peripheral sight. The entertainment industry is also leveraging HMDs for immersive experiences such as virtual concerts and movies, further expanding the market.

Challenges:

- Technical Limitations and User Discomfort: Despite technological advancements, HMDs still face significant technical challenges, including limited field of view, motion sickness, and user discomfort during prolonged use. Additionally, the weight and fit of HMDs often lead to discomfort, particularly during extended sessions, which can deter users from adopting the technology.

- Privacy and Security Concerns: As HMDs increasingly integrate with internet-connected services and collect user data, privacy and security concerns have become more prominent. These security vulnerabilities pose a significant challenge to the widespread adoption of HMDs, especially in sensitive sectors such as healthcare and defense, where data security is paramount.

Government Initiatives:

- U.S. Department of Defense's AR/VR Training Program: The U.S. Department of Defense (DoD) has been significantly investing in augmented reality (AR) and virtual reality (XR) technologies to enhance its training capabilities for soldiers across all branches of the military. The U.S. Army's Program Executive Office Simulation, Training and Instrumentation (PEO STRI) conducted field tests in 2023 for a customizable AR/VR training system that can be deployed wirelessly using 5G networks.

- European Unions XR4All Initiative: XR4ALL is an initiative funded by the European Union's Horizon 2020 research and innovation programme to strengthen the European XR (eXtended Reality) technology industry and accelerate its growth. Till August 2024, XR4ALL has 1,184 members from 60 countries & over 50 projects have received funding through XR4ALL's open calls. By providing grants and technical support, XR4All is expected to boost the HMD market in Europe, driving advancements in both consumer and enterprise applications.

Global Head Mounted Display Future Market Outlook

The Global Head Mounted Display Market is projected to reach USD 26 billion by 2029, driven by technological advancements, increased adoption across various sectors, and strong government support.

Future Market Trends

- Integration of AI in HMDs: Over the next five years, the integration of artificial intelligence (AI) into HMDs will revolutionize user experiences by enabling personalized, context-aware interactions. AI will allow HMDs to adapt to the user's environment and activities, providing real-time assistance and predictive insights, particularly in enterprise and healthcare settings.

- Expansion of 5G-Enabled HMDs: The widespread rollout of 5G networks will significantly enhance the performance of HMDs, enabling low-latency, high-bandwidth applications. This will facilitate the development of more complex and immersive AR/VR experiences, particularly in areas such as remote collaboration, virtual events, and advanced simulations, making HMDs an integral part of the digital ecosystem.

Scope of the Report

|

By Region |

North America Europe Asia Pacific Latin America Middle East Africa |

|

By Product Type |

AR Headsets VR Headsets MR Headsets |

|

By Application |

Gaming & Entertainment Healthcare Defense & Aerospace Education & Training Enterprise Commercial Automotive Energy Others |

|

By Components |

Processor & Memories Displays Lenses Sensors Controllers Cameras Cases & Connectors |

|

By Connectivity |

Wired Wireless |

Products

Key Target Audience Organizations and Entities who can benefit by Subscribing This Report:

Consumer Electronics Manufacturers

Healthcare Providers and Institutions

Military and Defense Organizations

Gaming and Entertainment Companies

Telecommunications Companies

Educational Institutions with VR/AR Programs

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Department of Defense, European Commission)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2029

Companies

Players Mentioned in the Report:

Sony Corporation

Microsoft Corporation

Samsung Electronics Co., Ltd.

HTC Corporation

Oculus (Meta Platforms, Inc.)

Google LLC

Apple Inc.

Lenovo Group Limited

Vuzix Corporation

Magic Leap, Inc.

Table of Contents

1. Global Head-Mounted Display (HMD) Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Head-Mounted Display (HMD) Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Head-Mounted Display (HMD) Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Virtual and Augmented Reality

3.1.2. Advancements in Display Technology

3.1.3. Rising Adoption in Gaming and Entertainment

3.1.4. Military and Defense Applications

3.2. Restraints

3.2.1. High Costs of Advanced HMDs

3.2.2. User Experience and Health Concerns

3.2.3. Limited Content Availability

3.3. Opportunities

3.3.1. Integration with 5G Technology

3.3.2. Expanding Applications in Healthcare

3.3.3. Growing Use in Education and Training

3.4. Trends

3.4.1. Development of Lightweight and Compact HMDs

3.4.2. Increasing Use in Industrial Applications

3.4.3. Enhanced Immersive Experiences with AI and Machine Learning

3.5. Government Regulation

3.5.1. Safety Standards and Certifications

3.5.2. Data Privacy and Security Regulations

3.5.3. Environmental Impact Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. Global Head-Mounted Display (HMD) Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. VR Headsets

4.1.2. AR Headsets

4.1.3. Mixed Reality Headsets

4.2. By Component (in Value %)

4.2.1. Displays

4.2.2. Processors

4.2.3. Sensors

4.2.4. Display

4.2.5 Controllers

4.2.6 Cameras

4.2.7 Cases & Connectors

4.3. By Connectivity (in Value %)

4.3.1. Wired

4.3.2. Wireless

4.4. By End-User Industry (in Value %)

4.4.1. Gaming and Entertainment

4.4.2. Healthcare

4.4.3. Military and Defense

4.4.4. Education and Training

4.5. By Region (in Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Head-Mounted Display (HMD) Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Sony Corporation

5.1.2. Oculus VR (Facebook Technologies, LLC)

5.1.3. HTC Corporation

5.1.4. Microsoft Corporation

5.1.5. Samsung Electronics Co., Ltd.

5.1.6. Google LLC (Alphabet Inc.)

5.1.7. Lenovo Group Ltd.

5.1.8. Vuzix Corporation

5.1.9. Magic Leap, Inc.

5.1.10. Huawei Technologies Co., Ltd.

5.1.11. Epson America, Inc.

5.1.12. RealWear, Inc.

5.1.13. Nreal

5.1.14. Optinvent

5.1.15. Avegant Corporation

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global Head-Mounted Display (HMD) Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global Head-Mounted Display (HMD) Market Regulatory Framework

7.1. Industry Standards and Compliance

7.2. Data Protection and User Privacy

7.3. Certification and Safety Standards

8. Global Head-Mounted Display (HMD) Market Future Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global Head-Mounted Display (HMD) Market Future Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Component (in Value %)

9.3. By Connectivity (in Value %)

9.4. By End-User Industry (in Value %)

9.5. By Region (in Value %)

10. Global Head-Mounted Display (HMD) Market Analysts’ Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on Global Head Mounted Display Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Head Mount Display Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple head mount display suppliers and distributors companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from head mount display suppliers and distributors companies.

Frequently Asked Questions

01. How big is Global Head Mounted Display Market?

Global Head Mounted Display (HMD) Market reached a valuation of USD 6 billion in 2023. This growth was primarily driven by the increased demand for augmented reality (AR) and virtual reality (VR) applications across various sectors, including gaming, healthcare, and military.

02. What are challenges in Global Head Mounted Display Market?

Challenges in the Global Head Mounted Display Market include high device costs, technical limitations such as motion sickness, and significant privacy and security concerns, particularly regarding user data protection.

03. Who are the major players in Global Head Mounted Display Market?

The HMD market is dominated by leading tech companies including Sony Corporation, Microsoft Corporation, Samsung Electronics Co., Ltd., HTC Corporation, and Oculus (a division of Meta Platforms, Inc.). These companies have solidified their market positions through continuous innovation, strategic partnerships, and acquisitions.

04 What are the growth drivers of the Global Head Mounted Display Market?

The Global Head Mounted Display Market is driven by the increasing adoption of AR/VR technologies in healthcare for medical training, the expansion of military applications, and the growing demand for immersive gaming experiences.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.