Global Healthcare Analytics Market Outlook to 2030

Region:Global

Author(s):Tania Bansal

Product Code:KENGR034

September 2024

87

About the Report

Global Healthcare Analytics Market Overview

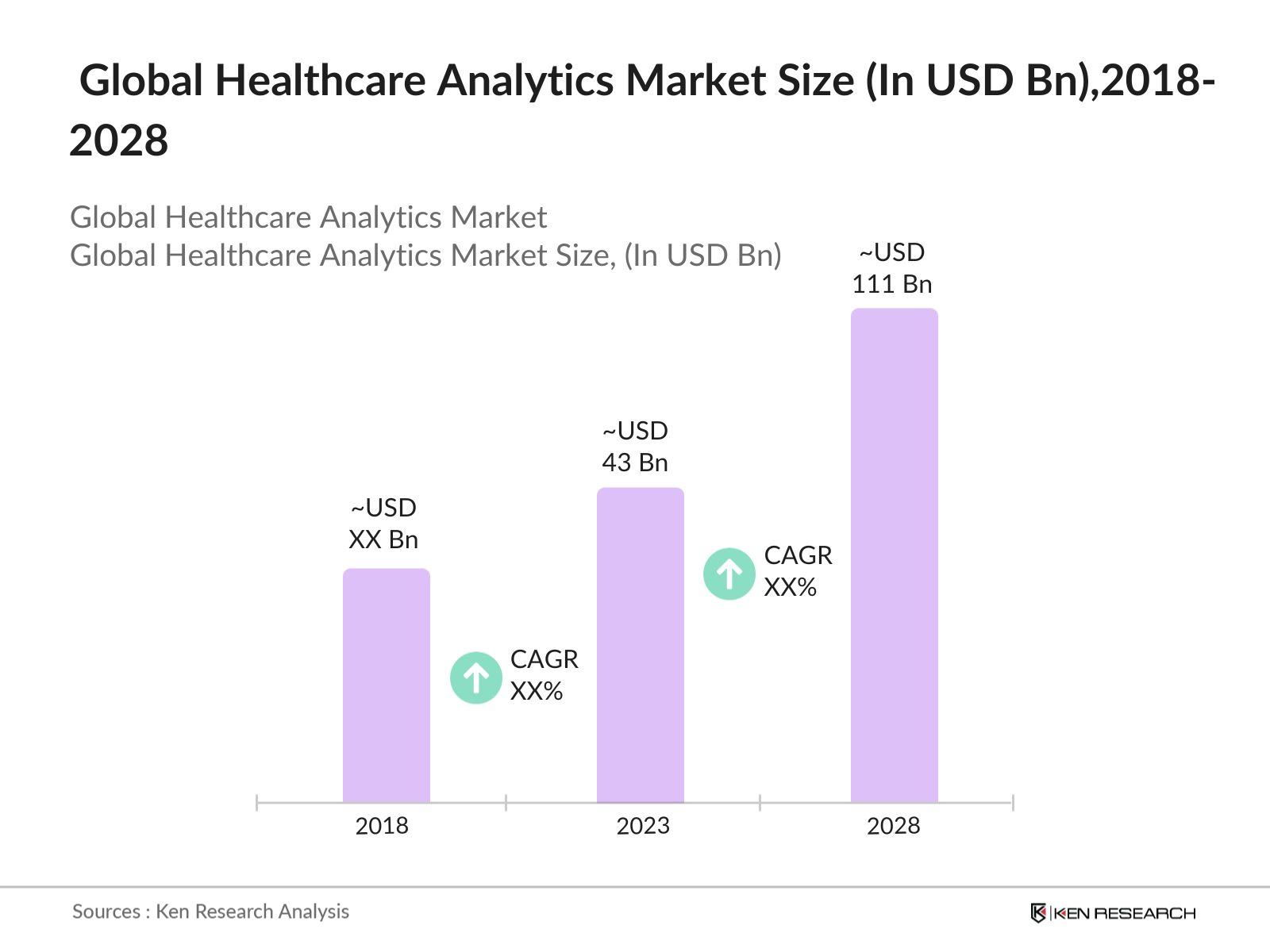

- Global Healthcare Analytics Market was valued at USD 45 billion in 2023, driven by the increasing adoption of electronic health records (EHRs) and the growing need for data-driven decision-making in healthcare. The demand for predictive and prescriptive analytics to improve patient outcomes and operational efficiency has significantly contributed to market growth.

- Key players in the market include McKessen Corporation, Health Catalyst, Koninklijke Philips N.V. to name a few. These companies have established strong footholds in the market by continuously innovating and providing comprehensive analytics solutions.

- In 2022, Health Catalyst, a prominent provider of data and analytics technology in healthcare acquired ARMUS Corporation. This strategic move aims to enhance Health Catalyst's Clinical Quality product offerings and its outsourced services, particularly in data abstraction and clinical registry management.

Global Healthcare Analytics Current Market Analysis

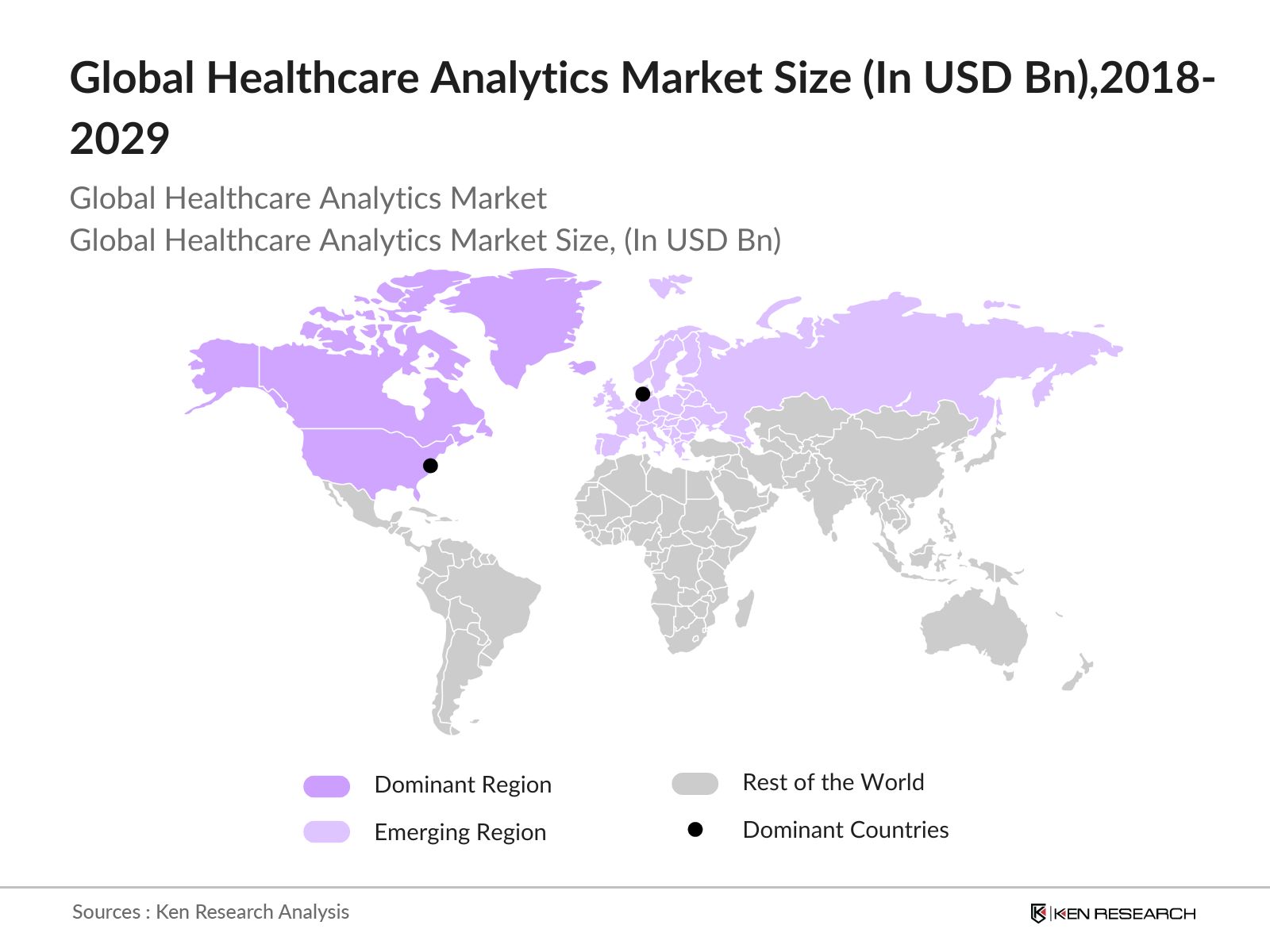

- North America as dominant region: North America excels in digital innovation due to its advanced IT infrastructure and early adoption of cloud computing, AI, and IoT. Epic Systems highlights this with its EHR solutions managing over 250 million patient records, improving U.S. hospital management. Amazon Web Services (AWS) has invested more than $108 Bn in U.S. cloud infrastructure from 2011 to 2022, enhancing regional tech capabilities. Silicon Valley boosts this ecosystem with AI leaders like Nvidia and Google, and startups such as Tempus driving precision medicine. Supporting policies like the Federal Data Strategy and National AI Initiative Act foster continued growth in finance and healthcare, contributing to the U.S.'s GDP of over USD 20 Tn.

- Europe as emerging region: Europe is rapidly emerging in the global healthcare analytics market, driven by advanced infrastructure, strong regulatory frameworks, and digital health technology adoption. Initiatives like the European Health Data Space (EHDS) and EU4Health promote data sharing and value-based care. Key countries like the UK, Germany, and France lead with innovative data initiatives. The healthcare sector significantly contributes to the economy, With Germanys healthcare sector alone contributing USD 883 billion. An aging population of 448.8 million in 2023 and high chronic disease prevalence further propel market growth.

- USA as dominant country: The United States leads the global healthcare analytics market, driven by advanced technology, substantial research investment, and a robust data science ecosystem. In 2022, U.S. healthcare spending reached $4.5 trillion, or $13,493 per person, representing 17.3% of GDP. Innovations in IoT and AI, such as Google's acquisition of DeepMind, enhance personalized care and diagnostics. Supported by a comprehensive regulatory framework like HIPAA, the U.S. excels in integrating data for precise and effective healthcare delivery.

Global Healthcare Analytics Market Segmentation

The Global Healthcare Analytics Market can be segmented based on several factors:

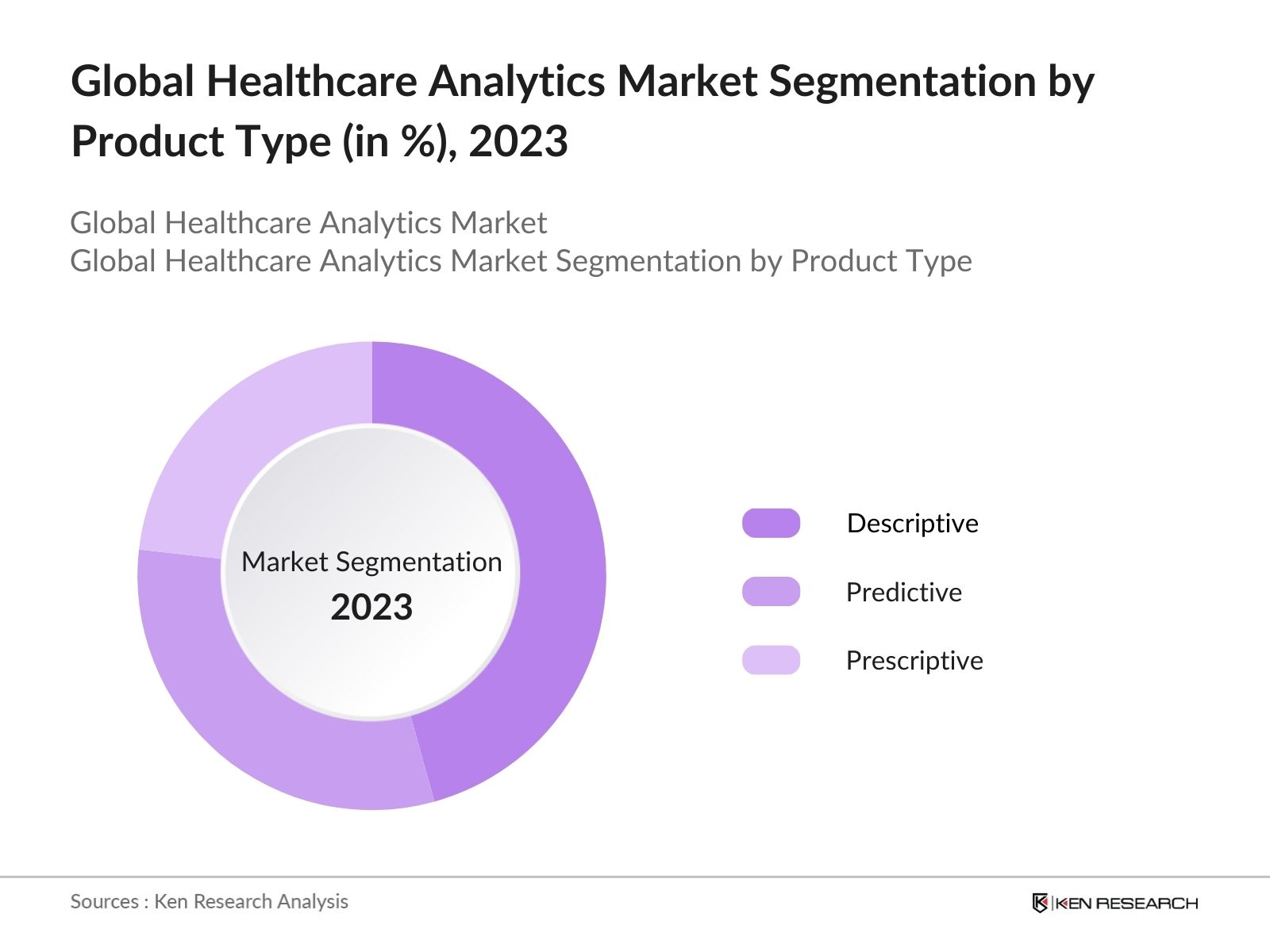

By Product Type: Global Healthcare Analytics Market is segmented by product type into descriptive, predictive & prescriptive. In 2023, descriptive sub-segment leads the market due to its foundational role in summarizing historical data and providing insights into past trends, which are critical for understanding current healthcare scenarios and making informed decisions.

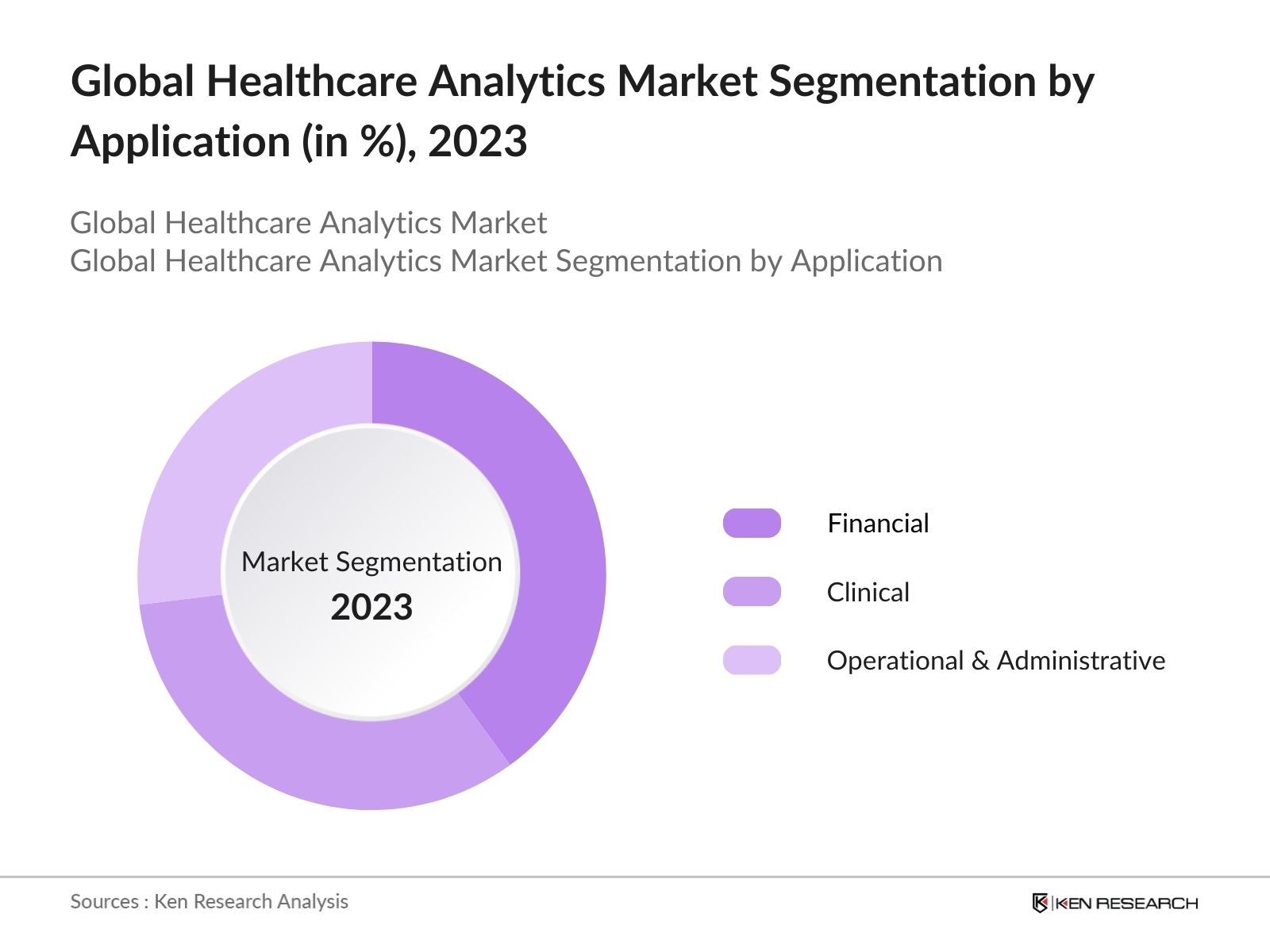

By Application: Global Healthcare Analytics Market is segmented by application into financial, clinical, operational & administrative. In 2023, financial dominates the market, driven by its significant role in optimizing revenue cycles, reducing costs, and enhancing overall financial performance within healthcare organizations.

By Deployment: Global Healthcare Analytics Market is segmented by deployment into On-Premise & On-Demand services. In 2023, on-demand dominate the market, driven by its cost advantages, scalability, ease of maintenance, accessibility, robust security, quick deployment, and the ability to integrate with other modern healthcare technologies.

Global Healthcare Analytics Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

Geographical Presence |

|

United Healthcare (Optum) |

1977 |

Minnetonka, Minnesota, United States |

130 |

|

McKesson Corporation |

1833 |

Irving, Texas, United States |

14 |

|

Health Catalyst |

2008 |

South Jordan, Utah, United States |

60 |

|

Koninklijke Philips N.V. |

1891 |

Amsterdam, Netherlands |

100 |

|

Veradigm (formerly Allscripts Healthcare Solutions, Inc.) |

1986 |

Chicago, Illinois, United States |

40 |

|

NextGen Healthcare, Inc. |

1974 |

Irvine, California, United States |

1 |

- McKesson Acquires RxBenefits: In 2023, McKesson Corporation acquired RxBenefits. The acquisition was to enhance $1.1 billion to enhance its data analytics capabilities within the pharmacy benefits management (PBM) sector. This strategic move is aimed at bolstering McKesson's position in the healthcare market, particularly in providing innovative solutions for managing pharmacy benefits more effectively.

- Koninklijke Philips N.V. and NYU Langone Health: In 2023, Philips and NYU Langone Health have announced an 8-year strategic partnership valued at up to $115 million. This collaboration aims to enhance patient care through the integration of advanced technologies, including digital pathology, clinical informatics, and AI-enabled diagnostics.

- Mercy Iowa City Adopts Allscripts Sunrise Platform: In 2021, Mercy Iowa City adopted the Allscripts Sunrise platform as its core electronic health record (EHR) system. This decision was made to enhance the hospital's ability to deliver integrated healthcare services to the community. The Sunrise platform is designed to provide a comprehensive, single patient record that integrates various aspects of patient care, including clinical data & revenue cycle management, to name a few.

Global Healthcare Analytics Industry Analysis

Global Healthcare Analytics Market Growth Drivers:

- Adoption of Electronic Health Records (EHRs) The increasing adoption of EHRs plays a crucial role in driving market growth by providing a wealth of data for analysis and decision-making in healthcare organizations. In developed nations, EHR adoption has reached substantial levels. For instance, as of 2021, nearly 96% of non-federal acute care hospitals and 78% of office-based physicians in the United States had adopted certified EHR systems. This widespread adoption facilitates advanced analytics, improving patient care and operational efficiencies.

- Utilization of Machine Learning & AI: The growing use of machine learning and artificial intelligence technologies in healthcare analytics is expected to drive market growth by enabling advanced data analysis and insights generation. Machine learning is applied in medical imaging to enhance the interpretation of scans, aiding radiologists in identifying conditions such as tumors or fractures more quickly and accurately.

- Growing Number of Startups: The growing number of startups is indicative of the increasing interest and investment in this sector. Healthcare analytics startups like Harbinger Health has raised significant funding round in 2023 securing over USD 190 million. This influx of investment supports innovation and the development of new healthcare analytics solutions, driving market growth.

Global Healthcare Analytics Market Challenges:

- IT Systems & Information: Security breaches and unauthorized use of IT systems and information pose significant risks, potentially exposing clients, data suppliers, or others to loss. For instance, healthcare data breaches have increased from 2020 to 2021, impacting many individuals. Ensuring robust cybersecurity measures is essential to protect sensitive healthcare data from malicious attacks and unauthorized access.

- Market Forces: Disruptions in credit and capital markets, along with unfavorable economic conditions, can adversely affect business operations and financial health. During economic downturns, healthcare organizations may face funding challenges, reducing their ability to invest in advanced analytics. The 2008 financial crisis led to a reduction in healthcare investments, illustrating the impact of market forces on operational stability.

Global Healthcare Analytics Market Government Initiatives:

- Global Initiative on AI for Health: Launched by the WHO in 2018, in collaboration with the International Telecommunication Union (ITU) and the World Intellectual Property Organization (WIPO), this initiative aims to integrate artificial intelligence into healthcare. It focuses on providing guidance and frameworks for the ethical use of AI in health, promoting evidence generation for AI-based medical devices, and developing a digital health strategy for 2020-2025.

- Global Initiative on Digital Health (GIDH): This WHO-managed network supports countries in digital health transformation. It aims to align resources for sustainable digital health initiatives and improve health systems through enhanced collaboration and knowledge sharing. The GIDH was formally launched in February 2024, focusing on the needs of countries for digital health advancements.

Global Healthcare Analytics Future Market Outlook

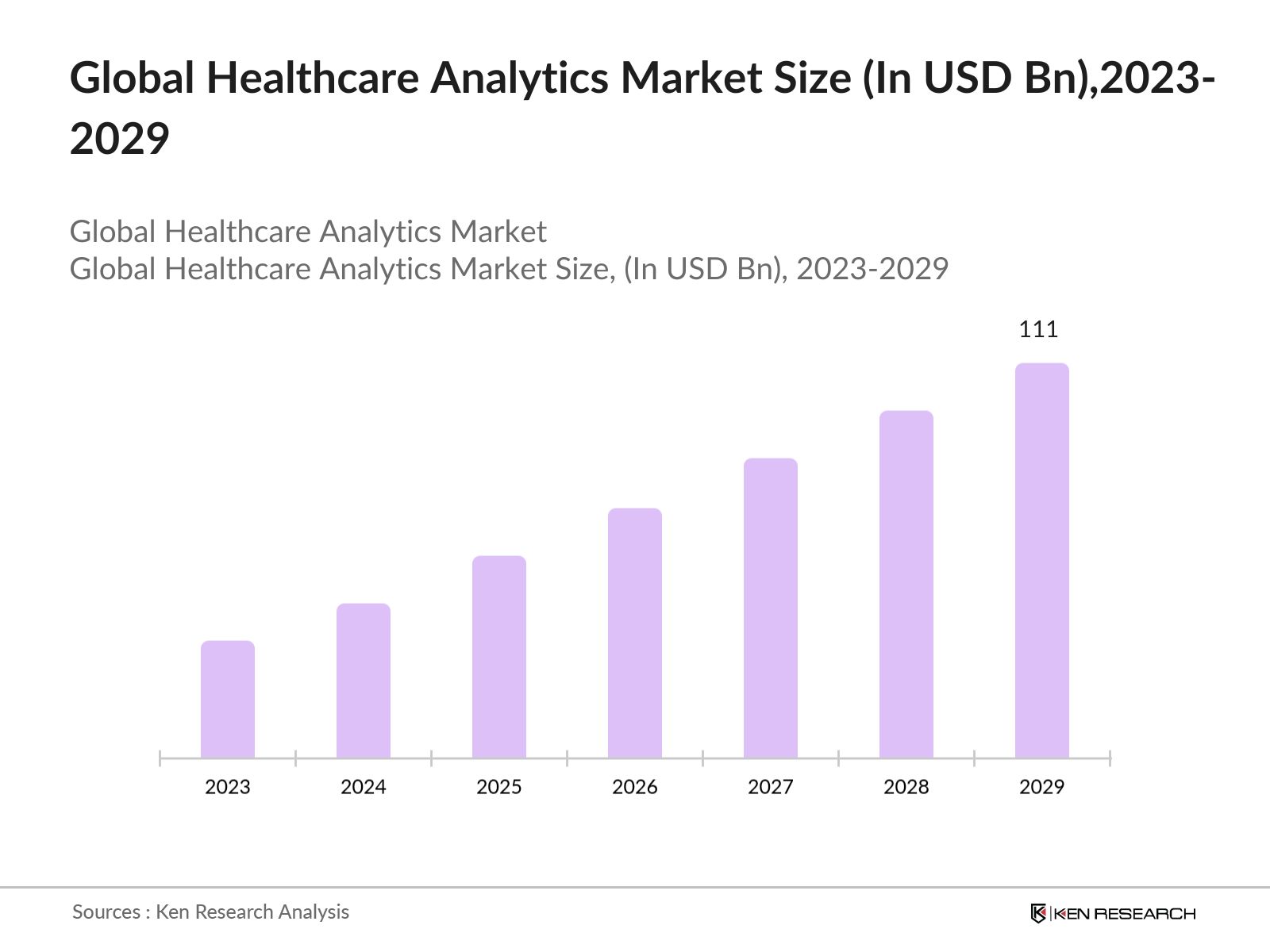

The Global Healthcare Analytics Market is expected to reach USD 111 billion till 2029, driven by advancements in data analytics technologies and increasing demand for data-driven decision-making in healthcare.

Future Market Trends

- Expansion of Predictive Analytics: Predictive analytics will become more prevalent in the healthcare sector, enabling providers to foresee potential health issues and intervene proactively. This trend will be driven by the growing availability of big data and advancements in AI and ML algorithms. Predictive analytics will help in reducing hospital readmissions, optimizing treatment plans, and improving patient outcomes by identifying risk factors and predicting disease progression.

- Increased Adoption of Cloud-Based Solutions: The shift towards cloud-based healthcare analytics solutions will accelerate, driven by the need for scalable, secure, and cost-effective data management. Cloud platforms will enable healthcare providers to access and analyze vast amounts of data in real-time, facilitating better decision-making. This trend will also support remote patient monitoring and telehealth services, further integrating analytics into everyday healthcare practices.

Scope of the Report

|

By Region |

North America Europe APAC Latin America MEA |

|

By Product Type |

Descriptive Predictive Descriptive |

|

By Application |

Financial Clinical Operational & Administrative |

|

By End-User |

Payer Provider |

|

By Component |

Software Services |

|

By Deployment Mode |

On-Premise On-Demand |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Pharmaceutical Companies

Health Insurance Companies

Health IT Companies

Data Warehousing Companies

Artificial Intelligence and Machine Learning Companies

Biotechnology Companies

Investment & Venture Capitalist Firms

Government & Regulatory Bodies (FDA, EMA)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2029

Companies

Players Mentioned in the Report:

United Healthcare (Optum)

McKesson Corporation

Health Catalyst

Koninklijke Philips N.V.

"Veradigm (formerly Allscripts Healthcare Solutions, Inc.)

NextGen Healthcare, Inc.

IQVIA

IBM Watson Health

Cerner Corporation

MEDITECH

MedeAnalytics

Table of Contents

1. Executive Summary

1.1 Global Healthcare IT Market

1.2 Global Healthcare Analytics Market

2. Global Overview

2.1 Overview of Global Economics

2.2 Overview of Global Healthcare IT Industry

2.3 Global Healthcare IT (EHRs, CDSS, HIE) Revenue

2.4 Global Healthcare Analytics Infrastructure

3. Global Healthcare Analytics Market Overview

3.1 Taxonomy

3.2 Ecosystem

3.3 Value Chain

4. Global Healthcare Analytics Market Size (in USD Bn), 2018-2023

5. Global Healthcare Analytics Market Segmentation (in value %), 2018-2023

5.1 By Region (North America, Europe, APAC, Latin America and MEA) in value %, 2018-2023

5.2 By Product Type (Descriptive, Predictive, Prescriptive) in value%, 2018-2023

5.3 By Application (Financial, Clinical, Operational & Administrative) in value %, 2018-2023

5.4 By End-Users (Payers and Providers) in value %, 2018-2023

5.5 By Component (Software and Services) in value %, 2018-2023

5.6 By Deployment Mode (On-Premises and On-Demand) in value %, 2018-2023

6. Global Healthcare Analytics Market Competition Landscape

6.1 Market Share Analysis

6.2 Market Heat Map Analysis

6.3 Market Cross Comparison

6.4 Comparison Matrix

6.5 Investment Landscape

7. Global Healthcare Analytics Market Dynamics

7.1 Growth Drivers

7.2 Challenges

7.3 Trends

7.4 Case Studies

8. Global Healthcare Analytics Future Market Size (in USD Bn), 2023-2029

9. Global Healthcare Analytics Future Market Segmentation (in value %), 2023-2029

9.1 By Region (North America, Europe, APAC, Latin America and MEA) in value %, 2023-2029

9.2 By Product Type (Descriptive, Predictive, Prescriptive) in value%, 2023-2029

9.3 By Application (Financial, Clinical, Operational & Administrative) in value %, 2023-2029

9.4 By End-Users (Payers and Providers) in value %, 2023-2029

9.5 By Component (Software and Services) in value %, 2023-2029

9.6 By Deployment Mode (On-Premises and On-Demand) in value %, 2023-2029

10. Analyst Recommendations

Research Methodology

Step 1: Literature Review

Conducted an extensive review of existing literature, industry reports, and academic publications to gain insights into the global healthcare analytics landscape. Gathered secondary data on market trends, challenges, and key players in the healthcare analytics sector.

Step 2: Market Segmentation

Employed segmentation criteria to categorize the healthcare analytics market based on Type, Application, Deployment, Region etc

Step 3: Regional Market Profiling and Comparative Analysis

Utilized the collected data to construct regional market profiles for each continent. Conducted a comparative analysis to discern regional variations in healthcare analytics adoption and market growth.

Step 4: Market Size Calculation

Calculated the overall market size for healthcare analytics in terms of value, integrating the segmented data from each region.

Step 5: Global Market Overview Compilation

Collated data from individual regional reports to build a comprehensive global overview of the healthcare analytics market. Emphasized the interplay between regional variations and global trends, providing a nuanced understanding of the market dynamics.

Step 6: Data Validation & Reliability Assessment

Conducted a rigorous validation process to ensure the accuracy and reliability of the obtained data. Employed statistical methods to assess the robustness of the findings and mitigate any potential biases in the research.

Frequently Asked Questions

01. How big is Global Healthcare Analytics Market?

Global Healthcare Analytics Market was valued at USD 45 billion in 2023, driven by the increasing adoption of electronic health records (EHRs) and the growing need for data-driven decision-making in healthcare

02. What are the challenges in Global Healthcare Analytics Market?

Challenges in the Global Healthcare Analytics market include IT systems & disinformation, market competition, price sensitivity & lack of infrastructure. Disruptions in credit and capital markets, along with unfavorable economic conditions, can adversely affect business operations and financial health

03. Who are the major players in Global Healthcare Analytics Market?

Key players in the Global Healthcare Analytics Market include McKessen Corporation, Health Catalyst, Koninklijke Philips N.V. to name a few. These companies have established strong footholds in the market by continuously innovating and providing comprehensive analytics solutions.

04 What are the growth drivers of the Global Healthcare Analytics Market?

Global Healthcare Analytics Market is propelled by the adoption of electronic health records, machine learning & AI along with growing startups. These factors enhance decision-making, connectivity, and operational efficiency across various industries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.