Global Healthcare Consulting Services Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD7019

November 2024

80

About the Report

Global Healthcare Consulting Services Market Overview

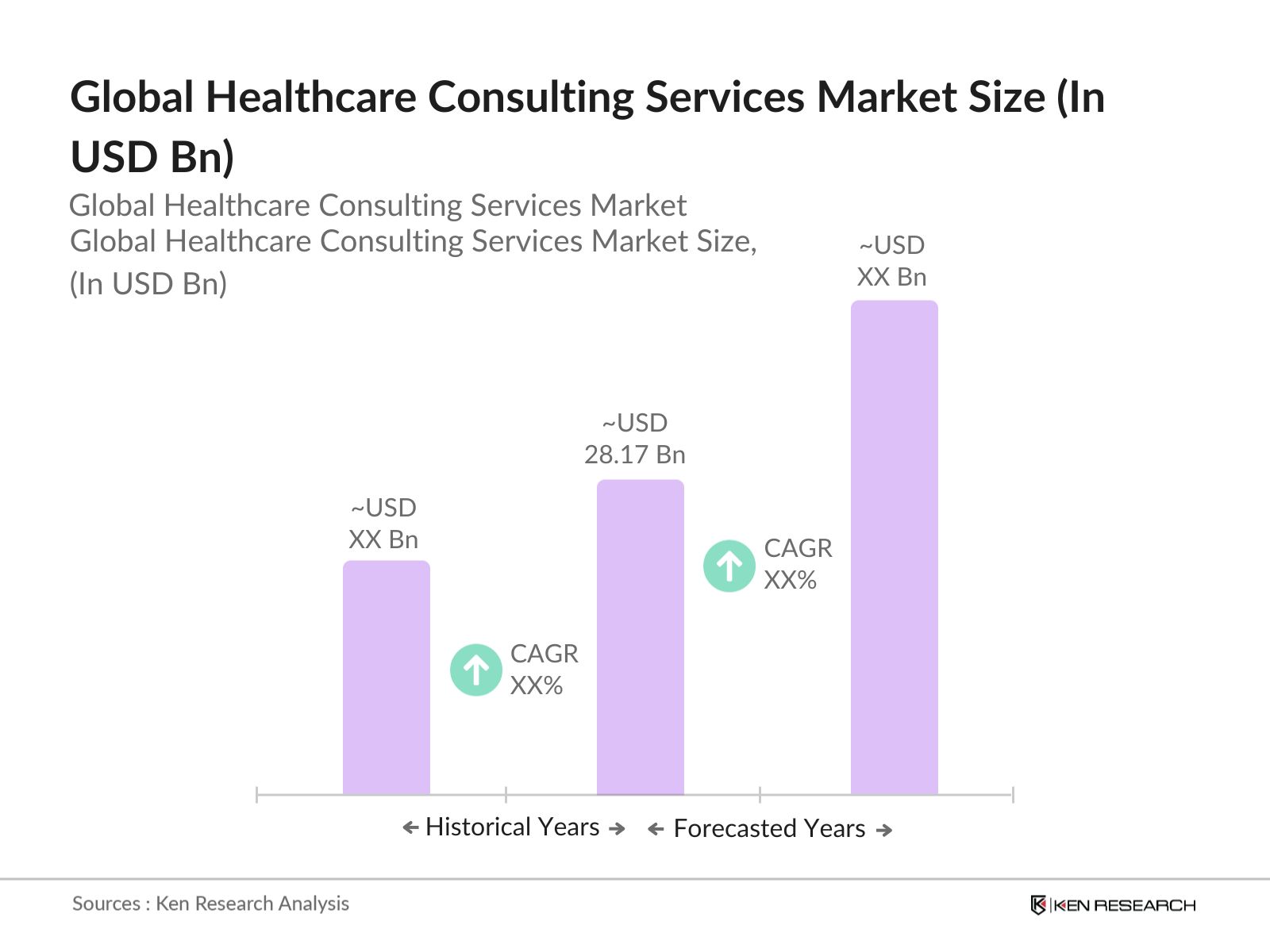

- The global healthcare consulting services market, valued at USD 28.17 billion based on a five-year historical analysis, is driven by the growing demand for digital transformation in healthcare organizations, increasing regulatory requirements, and the need to optimize operational efficiencies across healthcare systems. With healthcare providers constantly seeking strategies to improve patient care while cutting costs, consulting services have become integral to helping them navigate complex challenges like compliance, technological adoption, and evolving healthcare models.

- Countries like the United States and the United Kingdom dominate the healthcare consulting services market due to their mature healthcare systems, significant investment in healthcare technology, and established consulting infrastructure. The presence of leading consulting firms, strong demand for healthcare IT consulting, and ongoing healthcare reforms in these regions have made them leaders in the market. Moreover, the adoption of advanced technologies such as AI and cloud-based healthcare solutions further drives demand in these regions.

- Governments, especially in the U.S. and Europe, are offering incentives to healthcare consulting firms to help streamline healthcare operations and improve efficiency. These incentives are particularly focused on digitizing healthcare systems and achieving value-based care objectives.

Global Healthcare Consulting Services Market Segmentation

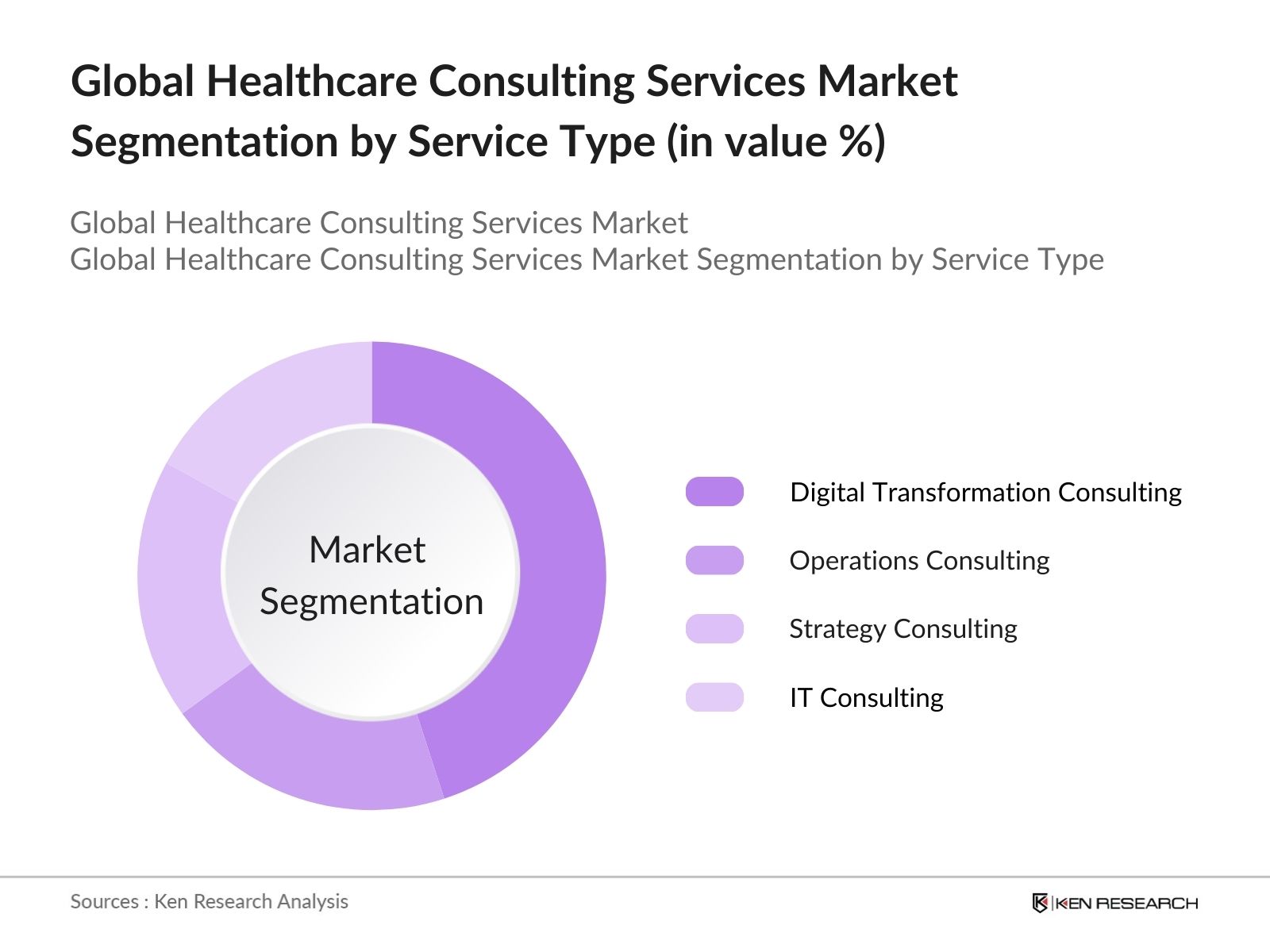

- By Service Type: The global healthcare consulting services market is segmented by service type into strategy consulting, digital transformation consulting, operations consulting, IT consulting, and HR and talent consulting. Recently, digital transformation consulting has taken the lead, driven by healthcare institutions' need to modernize their IT infrastructure and integrate digital solutions for enhanced patient care and data management. The rapid adoption of telemedicine, AI-driven diagnostics, and cloud-based health record systems have made digital transformation services essential in this segment.

- By Region: Regionally, the global healthcare consulting services market is divided into North America, Europe, Asia-Pacific, Middle East and Africa (MEA), and Latin America. North America leads the market, attributed to its advanced healthcare infrastructure, extensive government funding, and the early adoption of healthcare technologies. The region's dominance is also fueled by the presence of major consulting firms and the high demand for strategy and IT consulting services due to ongoing healthcare reforms.

- By Application: The market is segmented by application into hospitals and clinics, pharmaceuticals and biotechnology, government agencies, and insurance payers. Hospitals and clinics dominate the market share within this segment as they continuously invest in consulting services to manage their operational costs, improve patient care quality, and comply with increasing healthcare regulations. Additionally, the implementation of healthcare IT systems and EMR/EHR systems drives the demand for consulting services in this sub-segment.

Global Healthcare Consulting Services Market Competitive Landscape

The global healthcare consulting services market is dominated by a few key players, including McKinsey & Company, Deloitte, Accenture, PwC, and Boston Consulting Group (BCG). These firms hold a significant market share due to their vast experience in healthcare strategy, digital transformation, and regulatory consulting. Their established global presence, strong expertise in emerging technologies such as AI, and partnerships with healthcare organizations further consolidate their leadership position in the market.

|

Company |

Year of Establishment |

Headquarters |

Revenue (USD Bn) |

Employees |

Key Services |

Global Reach |

Clients |

Healthcare Consulting Specialty |

|

McKinsey & Company |

1926 |

New York, USA |

- |

- |

- |

- |

- |

- |

|

Deloitte |

1845 |

London, UK |

- |

- |

- |

- |

- |

- |

|

Accenture |

1989 |

Dublin, Ireland |

- |

- |

- |

- |

- |

- |

|

PwC |

1998 |

London, UK |

- |

- |

- |

- |

- |

- |

|

Boston Consulting Group (BCG) |

1963 |

Boston, USA |

- |

- |

- |

- |

- |

- |

Global Healthcare Consulting Services Industry Analysis

Growth Drivers

- Digital Transformation in Healthcare: The integration of digital technology in healthcare has accelerated in recent years, particularly in the aftermath of the COVID-19 pandemic. Global spending on health increased to $9 trillion, driven in part by investments in digital health, including telemedicine and AI-powered diagnostics. Digital health strategies are particularly effective in expanding access to care in low-income regions, where over 2 billion people face severe financial hardship when accessing healthcare.

- Increasing Healthcare Expenditure: Between 2022 and 2025, global healthcare expenditure continues to rise, underpinned by increased government funding following the pandemic. In 2022, healthcare accounted for 11% of global GDP, reflecting increased demand for healthcare services globally. Advanced economies, which are the most efficient in terms of healthcare spending, continue to see marginal improvements, while emerging markets are pushing for significant investments in universal healthcare.

- Government Regulations on Healthcare Systems: Governments worldwide are implementing stricter regulations to ensure healthcare quality and safety, with an emphasis on digital health and data security. For instance, the WHO's Global Strategy on Digital Health (2020-2025) has been key in guiding national healthcare systems toward integrated digital platforms. Governments in emerging markets are also focusing on meeting Sustainable Development Goals (SDG 3), which include universal health coverage by 2030.

Market Restraints

- High Consulting Fees: Consulting fees in the healthcare sector remain a significant challenge, especially for small and mid-sized healthcare providers. The IMF highlights the inefficiency in healthcare spending in some regions, which increases the cost burden on institutions trying to adopt new digital healthcare technologies. This inefficiency, coupled with the high cost of expert consultations, often makes it difficult for smaller healthcare systems to optimize their operations.

- Data Security and Privacy Concerns: As healthcare shifts towards digital platforms, concerns over data security have escalated. Compliance with regulations such as GDPR in Europe and similar frameworks in other regions is now mandatory for healthcare systems. A survey revealed that digital patient data breaches can cost hospitals and healthcare providers significant financial losses and damage to reputation. This regulatory pressure is particularly challenging for emerging markets where digital infrastructure is still developing.

Global Healthcare Consulting Services Market Future Outlook

Over the next five years, the global healthcare consulting services market is expected to witness significant growth. This expansion will be driven by the continued emphasis on healthcare reforms, the adoption of cutting-edge digital technologies, and a growing focus on patient-centered care. Government mandates for healthcare digitization and the integration of AI in healthcare processes will also play a crucial role in shaping the markets future. Furthermore, as emerging markets continue to expand their healthcare infrastructure, the demand for consulting services in regions like Asia-Pacific and the Middle East is expected to rise significantly.

Market Opportunities

- Adoption of AI and Automation in Healthcare Consulting: AI is revolutionizing healthcare consulting, offering precision in diagnosis and cost-saving benefits in healthcare delivery. Remote patient monitoring, powered by AI, has become increasingly widespread, enabling proactive care in chronic disease management. The WHO has highlighted AI as critical for improving healthcare outcomes, particularly in underserved regions.

- Mergers and Acquisitions in Healthcare Systems: Increased mergers and acquisitions (M&A) within the healthcare sector are opening opportunities for consulting firms to assist in integration efforts. In 2022, global healthcare M&A activity surged, driven by larger hospital systems looking to consolidate to manage rising operational costs. This trend is expected to continue, particularly in developed markets, offering consultants opportunities to streamline operations and ensure regulatory compliance.

Scope of the Report

|

By Service Type |

Strategy Consulting Digital Transformation Consulting Operations Consulting IT Consulting HR and Talent Consulting |

|

By Application |

Hospitals and Clinics Pharmaceuticals and Biotechnology Government Agencies, Insurance Payers |

|

By End-User |

Large Enterprises SMEs |

|

By Deployment Mode |

On-premise Cloud-based |

|

By Region |

North America Europe Asia-Pacific MEA Latin America |

Products

Key Target Audience

Hospitals and Healthcare Providers

Pharmaceuticals and Biotechnology Companies

Government and Regulatory Bodies (U.S. Department of Health & Human Services, NHS)

Health Insurance Providers

Medical Device Manufacturers

Healthcare IT Companies

Investor and Venture Capitalist Firms

Private Equity Firms

Companies

Players Mentioned in the Report:

McKinsey & Company

Deloitte

Accenture

PwC

Boston Consulting Group (BCG)

KPMG

Ernst & Young (EY)

Bain & Company

Tata Consultancy Services (TCS)

Cognizant

Huron Consulting Group

Oliver Wyman

Siemens Healthineers

GE Healthcare

Cerner Corporation

Table of Contents

1. Global Healthcare Consulting Services Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Key Market Developments

1.5. Market Segmentation Overview

2. Global Healthcare Consulting Services Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Healthcare Consulting Services Market Analysis

3.1. Growth Drivers

3.1.1. Digital Transformation in Healthcare

3.1.2. Increasing Healthcare Expenditure

3.1.3. Government Regulations on Healthcare Systems

3.1.4. Rising Demand for Specialized Healthcare Services

3.2. Market Challenges

3.2.1. High Consulting Fees

3.2.2. Data Security and Privacy Concerns

3.2.3. Shortage of Skilled Consultants

3.2.4. Regulatory Complexity Across Different Regions

3.3. Opportunities

3.3.1. Adoption of AI and Automation in Healthcare Consulting

3.3.2. Mergers and Acquisitions in Healthcare Systems

3.3.3. Expansion into Emerging Markets

3.3.4. Growing Demand for Telemedicine and Remote Monitoring Solutions

3.4. Trends

3.4.1. Implementation of Value-based Healthcare Models

3.4.2. Increased Focus on Patient Experience Management

3.4.3. Growing Use of Predictive Analytics in Healthcare Consulting

3.4.4. Rising Investment in Cloud-based Solutions

3.5. Government Regulations

3.5.1. Healthcare IT Regulation

3.5.2. Data Protection and GDPR Compliance

3.5.3. Healthcare Reform Initiatives

3.5.4. Federal Incentives for Healthcare Consulting Firms

3.6. SWOT Analysis

3.7. Healthcare Ecosystem Analysis

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Global Healthcare Consulting Services Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Strategy Consulting

4.1.2. Digital Transformation Consulting

4.1.3. Operations Consulting

4.1.4. IT Consulting

4.1.5. HR and Talent Consulting

4.2. By Application (In Value %)

4.2.1. Hospitals and Clinics

4.2.2. Pharmaceuticals and Biotechnology

4.2.3. Government Agencies

4.2.4. Insurance Payers

4.3. By End-User (In Value %)

4.3.1. Large Enterprises

4.3.2. Small and Medium Enterprises (SMEs)

4.4. By Deployment Mode (In Value %)

4.4.1. On-premise

4.4.2. Cloud-based

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Middle East and Africa (MEA)

4.5.5. Latin America

5. Global Healthcare Consulting Services Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. McKinsey & Company

5.1.2. Deloitte Touche Tohmatsu Limited

5.1.3. Boston Consulting Group (BCG)

5.1.4. Accenture

5.1.5. PwC

5.1.6. Cognizant Technology Solutions

5.1.7. Huron Consulting Group

5.1.8. KPMG

5.1.9. Ernst & Young (EY)

5.1.10. Siemens Healthineers

5.1.11. GE Healthcare

5.1.12. Cerner Corporation

5.1.13. Tata Consultancy Services (TCS)

5.1.14. Bain & Company

5.1.15. Oliver Wyman

5.2. Cross Comparison Parameters (Revenue, Headquarters, Employees, Global Reach, No. of Clients, Specialty Services, Digital Capabilities, M&A Activities)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers & Acquisitions

5.6. Investment Analysis

5.7. Private Equity and Venture Capital Funding

5.8. Government Funding and Grants

6. Global Healthcare Consulting Services Market Regulatory Framework

6.1. Global Healthcare Compliance Standards

6.2. Healthcare IT Regulations

6.3. Data Privacy Laws (HIPAA, GDPR, etc.)

6.4. Certification and Accreditation Processes

7. Global Healthcare Consulting Services Future Market Size (In USD Mn)

7.1. Market Projections and Key Growth Factors

7.2. Key Market Drivers for Future Growth

8. Global Healthcare Consulting Services Future Market Segmentation

8.1. By Service Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-User (In Value %)

8.4. By Deployment Mode (In Value %)

8.5. By Region (In Value %)

9. Global Healthcare Consulting Services Market Analysts Recommendations

9.1. Customer Acquisition Strategy

9.2. Market Entry and Expansion Strategies

9.3. Key White Space Opportunities

9.4. Technological Innovations to Watch

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying major stakeholders in the global healthcare consulting services market, including hospitals, consulting firms, and IT providers. This stage is grounded in thorough desk research to gather vital information on market dynamics and key trends.

Step 2: Market Analysis and Construction

In this phase, historical data on healthcare consulting services are compiled and analyzed, focusing on service adoption, regional demand, and revenue growth. The analysis incorporates quantitative data on market penetration and growth drivers to ensure a robust market outlook.

Step 3: Hypothesis Validation and Expert Consultation

After gathering data, market hypotheses are validated through consultations with industry experts and healthcare professionals. These insights are collected through interviews and focus groups to confirm the accuracy of the data.

Step 4: Research Synthesis and Final Output

Finally, the gathered data is synthesized into actionable insights, verified by real-world feedback from healthcare organizations. This ensures the final report provides an accurate and detailed analysis of the global healthcare consulting services market.

Frequently Asked Questions

1. How big is the Global Healthcare Consulting Services Market?

The global healthcare consulting services market was valued at USD 28.17 billion based on a five-year historical analysis, driven by digital transformation and regulatory requirements in healthcare organizations.

2. What are the challenges in the Global Healthcare Consulting Services Market?

Key challenges include data privacy and security concerns, high consulting fees, and the complexity of regulatory frameworks across various regions.

3. Who are the major players in the Global Healthcare Consulting Services Market?

The market is dominated by McKinsey & Company, Deloitte, Accenture, PwC, and Boston Consulting Group (BCG). These companies lead due to their expertise in healthcare strategy, digital transformation, and regulatory compliance.

5. What are the growth drivers of the Global Healthcare Consulting Services Market?

The market is driven by factors such as increasing healthcare expenditure, the need for healthcare organizations to comply with regulations, and the growing adoption of digital health technologies like telemedicine and AI-driven diagnostics.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.