Global Healthcare IT Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD3429

November 2024

87

About the Report

Global Healthcare IT Market Overview

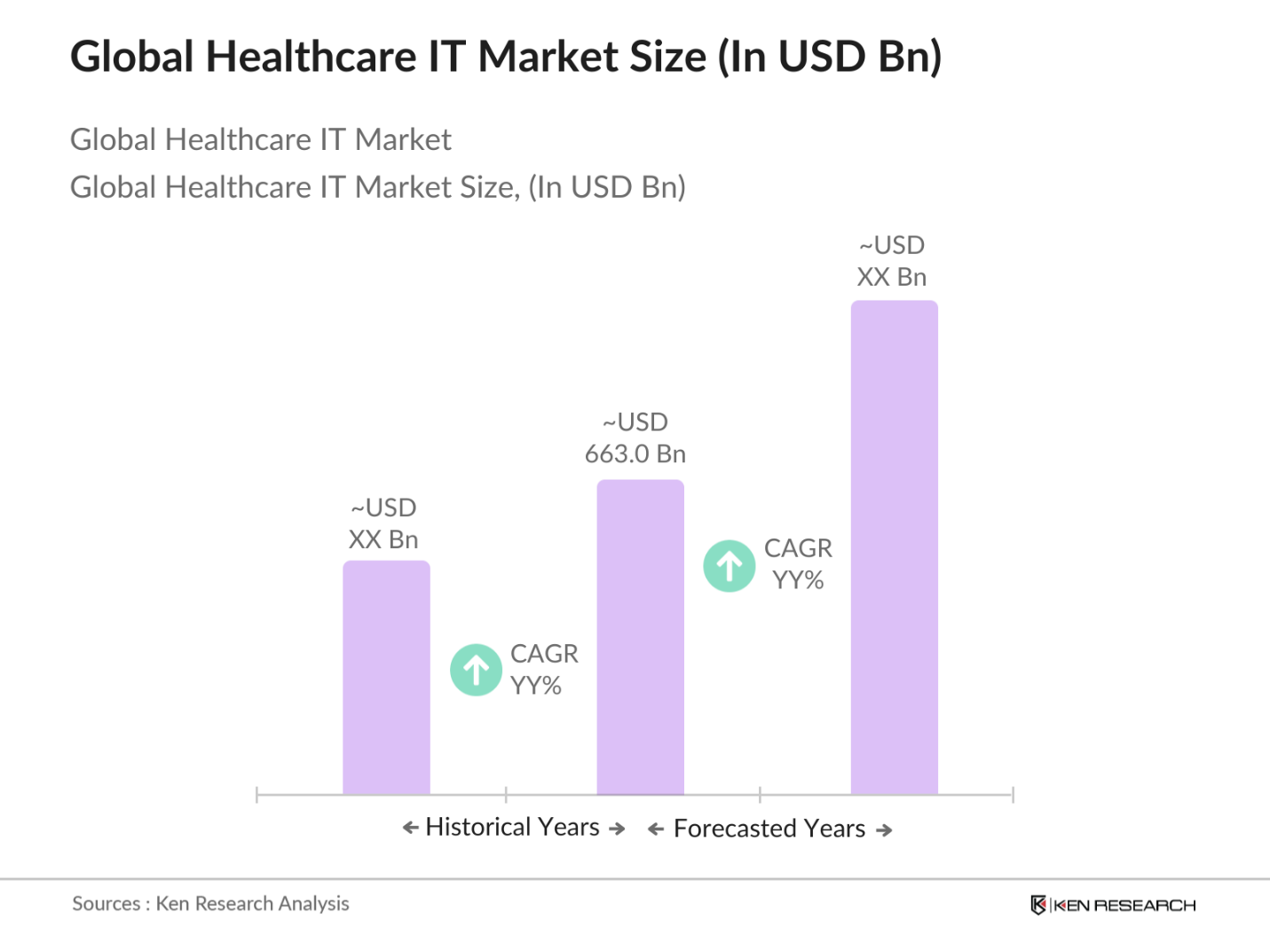

- The global healthcare IT market, valued at USD 663.0 billion, is being driven by the rising adoption of electronic health records (EHRs), telemedicine, and healthcare analytics across various healthcare institutions. This growth is fueled by the need for more efficient patient care, data management solutions, and compliance with government regulations concerning patient data security.

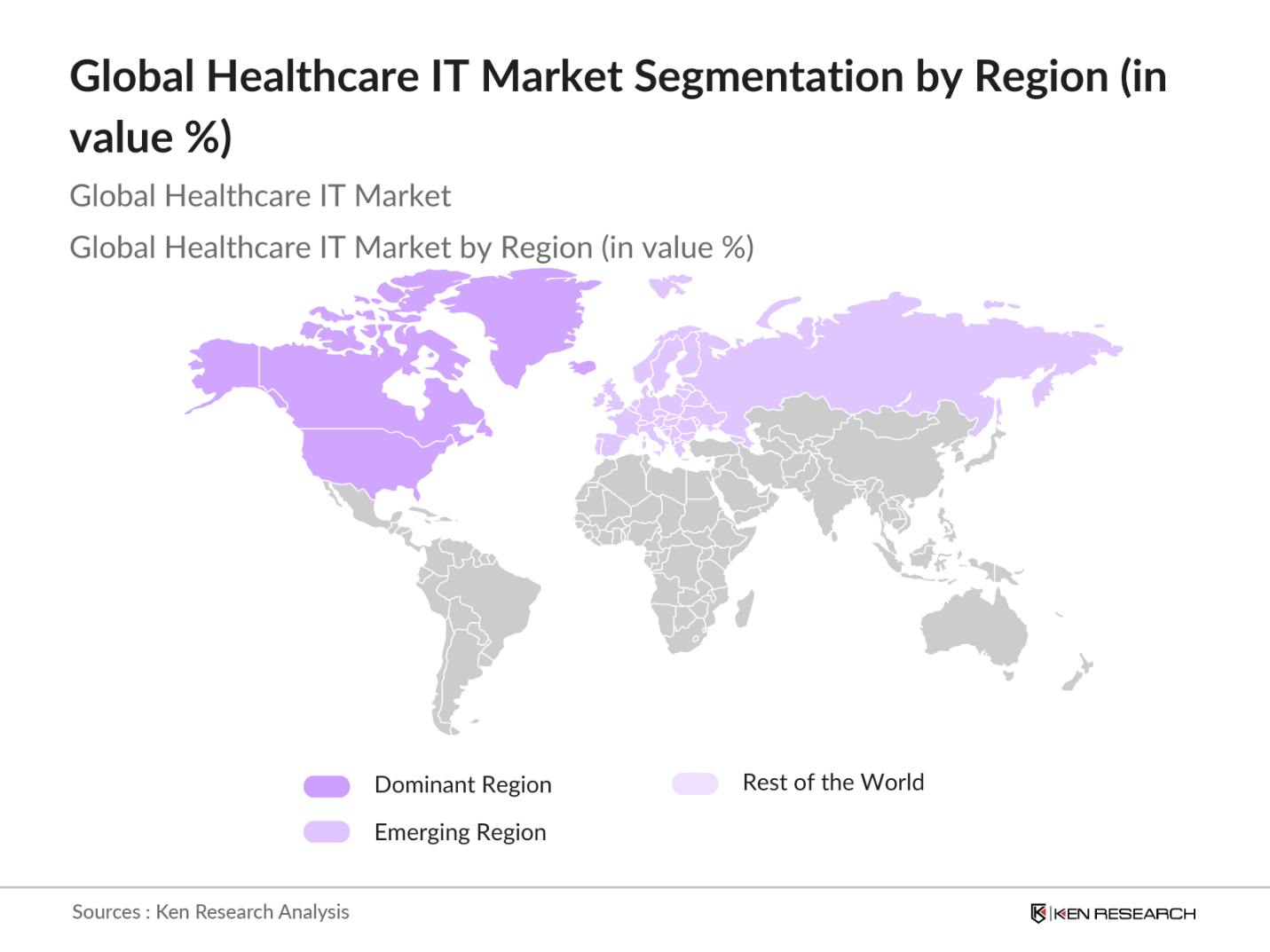

- The market is dominated by countries like the United States, Germany, and China, due to their strong healthcare infrastructures, significant investments in healthcare digitization, and advanced technological ecosystems. These countries also benefit from high healthcare IT spending and favorable government initiatives that encourage the adoption of IT solutions in healthcare. The United States leads the charge with the presence of key players and early adoption of innovative technologies, while Chinas fast-paced digital transformation makes it a major contender in the space.

- Data security regulations such as HIPAA in the U.S. and GDPR in Europe impose stringent requirements on healthcare organizations regarding the protection of patient data. In 2023, HIPAA enforcement led to over $55 million in penalties for non-compliance across U.S. healthcare providers. The GDPR, which impacts healthcare providers processing the data of EU citizens, has issued fines totaling 1.3 billion in 2023 for data breaches across various sectors, including healthcare. Compliance with these regulations is critical for healthcare IT systems, ensuring patient data remains secure and private across digital platforms.

Global Healthcare IT Market Segmentation

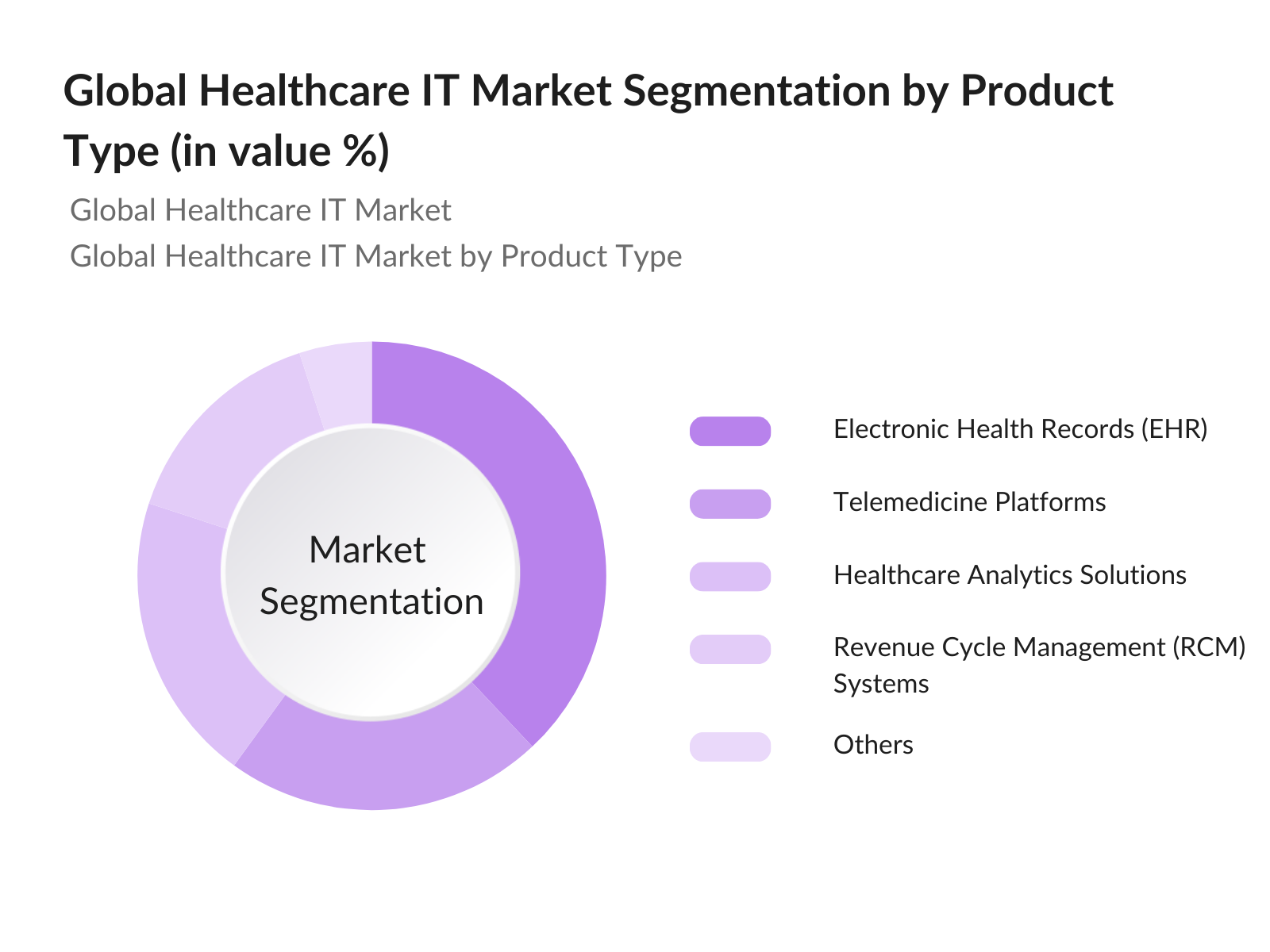

By Product Type: The global healthcare IT market is segmented by product type into electronic health records (EHRs), telemedicine platforms, healthcare analytics solutions, and revenue cycle management (RCM) systems. EHRs hold a dominant market share due to the increasing need for organized and easily accessible patient data, supported by government mandates for digitizing healthcare records. These systems have gained widespread adoption across hospitals and clinics, especially in the United States, which has stringent regulatory requirements regarding healthcare data management.

By Region: The global healthcare IT market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America commands the highest market share due to advanced healthcare infrastructure, higher investments in IT, and supportive government initiatives like the Health Information Technology for Economic and Clinical Health (HITECH) Act. Additionally, the region's mature market is characterized by early adoption of digital healthcare systems and the presence of major global healthcare IT companies.

Global Healthcare IT Market Competitive Landscape

The global healthcare IT market is dominated by a few major players who have significant market shares due to their strong portfolios of healthcare solutions and large customer bases. These companies are also pioneers in innovative technologies, including AI, cloud computing, and healthcare data analytics, which further solidifies their positions. The market is characterized by strategic collaborations, mergers and acquisitions, and heavy investment in research and development.

|

Company |

Established |

Headquarters |

No. of Employees |

Annual Revenue (USD Bn) |

Product Portfolio |

Market Focus |

R&D Investment |

Global Presence |

Recent Acquisitions |

|

Cerner Corporation |

1979 |

Missouri, USA |

26,000 |

||||||

|

McKesson Corporation |

1833 |

Texas, USA |

70,000 |

||||||

|

Epic Systems Corporation |

1979 |

Wisconsin, USA |

10,000 |

||||||

|

Philips Healthcare |

1891 |

Amsterdam, NL |

77,000 |

||||||

|

Allscripts Healthcare |

1986 |

Illinois, USA |

9,000 |

Global Healthcare IT Market Analysis

Market Growth Drivers

- Government Initiatives for Healthcare IT (Telehealth Reimbursement, Digital Health Policies):

Governments worldwide, including the United States and the European Union, have bolstered initiatives supporting healthcare IT development. In the U.S., the Centers for Medicare & Medicaid Services (CMS) allocated $34 billion in 2022 to healthcare IT reforms, notably telehealth reimbursement. These policies aim to integrate digital health services, promoting remote care and enhancing patient access to healthcare. Moreover, the European Unions Digital Health Europe initiative aims to improve digital health infrastructure, including eHealth interoperability. These government policies encourage rapid adoption of telehealth and digital health systems. - Growing Emphasis on Patient Data Security (Cybersecurity Measures, HIPAA Compliance):

With increased digitalization in healthcare, data breaches have become a critical concern. In 2022, the healthcare industry saw over 50 million patient records breached globally, prompting tighter cybersecurity regulations. The U.S. implemented more stringent HIPAA (Health Insurance Portability and Accountability Act) requirements in 2023, while the European Unions GDPR introduced hefty penalties for healthcare data violations, with fines reaching up to 20 million. This has led to healthcare providers investing in advanced cybersecurity solutions, ensuring compliance and safeguarding sensitive patient data. - Increasing Demand for Electronic Health Records (EHR): The adoption of EHRs continues to rise as healthcare institutions aim to improve care coordination and data accuracy. In 2023, a significant number of office-based physicians in the U.S. used EHR systems, supported by government incentives and regulatory frameworks. The European Union has also advanced its eHealth Strategy, mandating EHR interoperability across member states. EHR systems reduce errors, facilitate real-time data sharing, and contribute to operational efficiency. These systems align with regulatory efforts to standardize electronic medical records globally, improving patient safety, streamlining workflows, and enhancing the overall quality of care delivery.

Market Challenges:

- High Implementation Costs: Healthcare IT solutions come with significant capital expenditures. On average, the implementation of EHR systems costs between $15,000 and $70,000 per provider in the U.S., depending on system complexity. Smaller healthcare facilities face barriers in adopting such technology due to financial constraints. Government funding has eased some of these burdens, but high initial investment and ongoing maintenance costs remain a significant challenge, especially for rural and underfunded healthcare facilities. Despite these challenges, long-term operational savings are expected to offset these costs.

- Data Privacy and Regulatory Compliance Challenges: Ensuring compliance with complex data protection regulations such as HIPAA and GDPR is a significant challenge for healthcare providers. In 2023, non-compliance penalties totaled $1.5 billion globally, with healthcare organizations in the U.S. and Europe facing the brunt of these fines. The high cost of compliance, coupled with ongoing changes in regulatory requirements, presents a challenge for healthcare organizations. Moreover, emerging threats like ransomware attacks further complicate data privacy efforts, necessitating continuous updates to cybersecurity infrastructure.

Global Healthcare IT Market Future Outlook

Over the next five years, the global healthcare IT market is expected to witness significant growth, driven by the increasing digitalization of healthcare services, adoption of AI-based technologies, and government regulations aimed at improving healthcare quality and patient safety. As healthcare systems worldwide continue to evolve, the demand for more advanced, secure, and interoperable IT solutions will further propel market expansion. Additionally, emerging markets in Asia-Pacific and Latin America are expected to experience accelerated growth due to investments in healthcare infrastructure and IT adoption.

Market Opportunities:

- Rising Investments in Artificial Intelligence (AI) in Healthcare IT: AI is revolutionizing healthcare IT by improving diagnostics, personalized medicine, and predictive analytics. In 2023, over $10 billion was invested globally in AI applications for healthcare, driven by advancements in machine learning and big data analytics. The U.S. Department of Health and Human Services (HHS) has encouraged AI adoption, particularly in areas like radiology and drug discovery. Countries like China are also accelerating investments in AI, with the governments AI Innovation Strategy focusing on healthcare applications.

- Emerging Markets for Healthcare IT (Rural Health Initiatives, Developing Economies): Emerging markets present substantial opportunities for healthcare IT expansion. Countries like India and Brazil are increasingly investing in rural health IT infrastructure. In 2023, India allocated $5 billion to its Ayushman Bharat Digital Mission, which aims to bring digital health services to rural populations. Similarly, the Brazilian government launched a $2 billion Telehealth initiative to connect remote areas with healthcare services. These investments in underserved regions are expected to drive significant growth in the global healthcare IT market.

Scope of the Report

|

By Product Type |

Electronic Health Records (EHR) Telemedicine Platforms Revenue Cycle Management (RCM) Systems Healthcare Analytics Solutions |

|

By Application |

Hospitals |

|

By Technology |

Cloud-Based Solutions |

|

By End-User |

Healthcare Providers |

|

By Region |

North America |

Products

Key Target Audience

Healthcare Providers (Hospitals, Clinics, Diagnostic Centers)

Payers (Private Insurance Companies, Government Health Agencies)

Pharmaceutical Companies

Telehealth and Telemedicine Providers

Healthcare IT Vendors

Government and Regulatory Bodies (HIPAA, HHS, FDA)

Investment and Venture Capital Firms

Medical Device Manufacturers

Companies

Players Mention in the Report

Cerner Corporation

McKesson Corporation

Epic Systems Corporation

Philips Healthcare

Allscripts Healthcare Solutions

Siemens Healthineers

Athenahealth

Oracle Health

GE Healthcare

NextGen Healthcare

IBM Watson Health

Greenway Health

Meditech

eClinicalWorks

Intersystems Corporation

Table of Contents

1. Global Healthcare IT Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Key Performance Indicators (Adoption Rate, Healthcare IT Penetration)

1.4. Market Segmentation Overview

1.5. Evolution of Healthcare IT (Technological Innovations, Regulatory Push, Digital Health Adoption)

2. Global Healthcare IT Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (Healthcare Digitization, EHR Adoption)

2.3. Key Market Developments and Milestones (Government Initiatives, Investment Trends)

3. Global Healthcare IT Market Analysis

3.1. Market Drivers

3.1.1. Government Initiatives for Healthcare IT (Telehealth Reimbursement, Digital Health Policies)

3.1.2. Increasing Demand for Electronic Health Records (EHR)

3.1.3. Growing Emphasis on Patient Data Security (Cybersecurity Measures, HIPAA Compliance)

3.1.4. Expansion of Telemedicine and Virtual Care Solutions

3.2. Market Challenges

3.2.1. High Implementation Costs

3.2.2. Interoperability Issues Across Healthcare IT Systems

3.2.3. Data Privacy and Regulatory Compliance Challenges

3.3. Market Opportunities

3.3.1. Rising Investments in Artificial Intelligence (AI) in Healthcare IT

3.3.2. Growing Adoption of Cloud Computing in Healthcare

3.3.3. Emerging Markets for Healthcare IT (Rural Health Initiatives, Developing Economies)

3.4. Market Trends

3.4.1. Integration of AI and Machine Learning in Diagnostics

3.4.2. Growing Use of Wearable Devices and Remote Monitoring

3.4.3. Blockchain for Secure Healthcare Data Sharing

3.5. Government Regulations and Policies

3.5.1. Data Security Regulations (HIPAA, GDPR)

3.5.2. National Digital Health Initiatives

3.5.3. Public Health Information Exchanges

3.5.4. Public-Private Partnerships for Healthcare IT Expansion

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Healthcare Providers, IT Vendors, Governments)

3.8. Porters Five Forces (Competitive Intensity, Buyer and Supplier Power)

3.9. Competition Ecosystem (EMR Providers, Digital Health Startups)

4. Global Healthcare IT Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Electronic Health Records (EHR)

4.1.2. Telemedicine Platforms

4.1.3. Revenue Cycle Management (RCM) Systems

4.1.4. Healthcare Analytics Solutions

4.1.5. Population Health Management

4.2. By Application (In Value %)

4.2.1. Hospitals

4.2.2. Ambulatory Care Centers

4.2.3. Diagnostic Labs

4.2.4. Home Healthcare

4.2.5. Long-term Care Facilities

4.3. By Technology (In Value %)

4.3.1. Cloud-Based Solutions

4.3.2. On-Premise Systems

4.3.3. Software-as-a-Service (SaaS)

4.3.4. Artificial Intelligence (AI) Platforms

4.4. By End User (In Value %)

4.4.1. Healthcare Providers

4.4.2. Payers (Insurance Companies, Government)

4.4.3. Patients

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Healthcare IT Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Cerner Corporation

5.1.2. McKesson Corporation

5.1.3. Allscripts Healthcare Solutions

5.1.4. Epic Systems Corporation

5.1.5. GE Healthcare

5.1.6. Philips Healthcare

5.1.7. Siemens Healthineers

5.1.8. Athenahealth

5.1.9. Oracle Health

5.1.10. NextGen Healthcare

5.1.11. Meditech

5.1.12. Greenway Health

5.1.13. IBM Watson Health

5.1.14. eClinicalWorks

5.1.15. Intersystems Corporation

5.2. Cross Comparison Parameters (R&D Spend, Market Share, Product Portfolio, Revenue from Healthcare IT, No. of Active Installations, Global Presence, Partnerships, Recent Acquisitions)

5.3. Market Share Analysis

5.4. Strategic Initiatives (New Product Launches, Partnerships, Expansions)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Healthcare IT Market Regulatory Framework

6.1. Regulatory Landscape (FDA Regulations, European MDR)

6.2. Compliance Requirements (Interoperability Standards, Healthcare Data Exchange Protocols)

6.3. Certification Processes (HITRUST, EHNAC, ONC Certification)

7. Global Healthcare IT Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Aging Population, Increased Healthcare Spending)

8. Global Healthcare IT Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By End User (In Value %)

8.5. By Region (In Value %)

9. Global Healthcare IT Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis (Healthcare Providers, Insurers, Patients)

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

In this step, we developed a comprehensive ecosystem map encompassing all major stakeholders in the global healthcare IT market. This was accomplished through extensive desk research, drawing on both secondary and proprietary databases to collect critical industry-level data and define the key variables influencing the market.

Step 2: Market Analysis and Construction

This phase involved compiling and analyzing historical data on the healthcare IT market, focusing on key areas such as market penetration of IT systems, revenue generation from different segments, and regional market trends. A rigorous evaluation of the market structure was carried out to ensure accurate revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

We validated our market hypotheses through consultations with industry experts from various healthcare IT companies. These consultations provided deep insights into the operational and financial aspects of the market, helping to fine-tune our data and analysis.

Step 4: Research Synthesis and Final Output

In the final step, we engaged with multiple healthcare IT providers to gather insights into product segments, consumer preferences, and recent market trends. These insights were synthesized to produce a comprehensive, data-driven analysis of the global healthcare IT market.

Frequently Asked Questions

01. How big is the Global Healthcare IT Market?

The global healthcare IT market was valued at USD 663.0 billion, driven by increasing adoption of electronic health records, telemedicine, and healthcare analytics solutions.

02. What are the challenges in the Global Healthcare IT Market?

Key challenges include high costs of implementation, interoperability issues between different healthcare IT systems, and ensuring data privacy and regulatory compliance.

03. Who are the major players in the Global Healthcare IT Market?

Major players include Cerner Corporation, McKesson Corporation, Epic Systems Corporation, Philips Healthcare, and Allscripts Healthcare Solutions. These companies have established dominance through product innovation and strategic partnerships.

04. What are the growth drivers of the Global Healthcare IT Market?

Growth drivers include increased demand for EHR systems, advancements in AI and telemedicine, and government regulations pushing for better patient data security and healthcare quality.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.