Global Hearing Aids Market Outlook to 2030

Region:Global

Author(s):Sanjeev

Product Code:KROD1858

November 2024

87

About the Report

Global Hearing Aids Market Overview

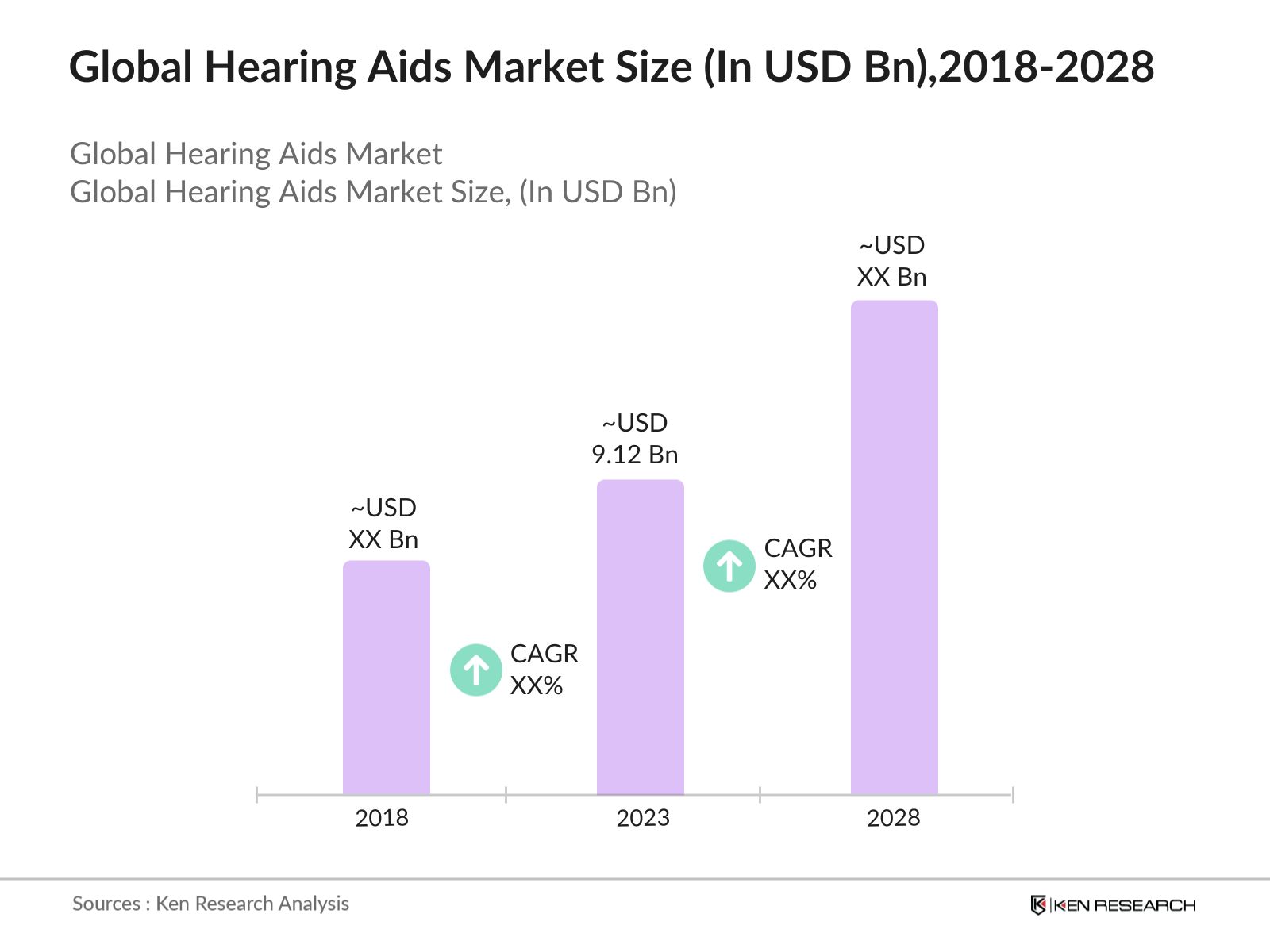

- In 2023, the Global Hearing Aids Market was valued at USD 9.12 billion, driven by the increasing prevalence of hearing loss, advancements in hearing aid technology, and rising awareness about hearing health. The market is segmented into behind-the-ear (BTE), in-the-ear (ITE), receiver-in-the-canal (RIC), and other hearing aids. BTE hearing aids remain the most dominant segment due to their adaptability, ease of use, and ability to cater to various levels of hearing impairment.

- Major players in the Global Hearing Aids Market include Sonova, Demant, GN Store Nord, Starkey Hearing Technologies, and WS Audiology. These companies are recognized for their innovative hearing solutions and emphasis on research and development to enhance hearing aid performance. Sonova leads the market with its popular Phonak brand, known for its cutting-edge technology and extensive product range.

- In North America, the United States is a prominent market, driven by high awareness about hearing health, strong healthcare infrastructure, and a growing aging population. The region is characterized by high consumer spending on advanced hearing solutions and strong adoption of digital hearing aids.

- In 2023, Demant introduced a new line of rechargeable hearing aids under its Oticon brand, aimed at health-conscious consumers looking for eco-friendly and convenient options. This innovation underscores the ongoing shift towards sustainable and user-friendly products in the hearing aids market, reflecting broader trends in consumer preferences towards sustainability and ease of use.

Global Hearing Aids Market Segmentation

The Global Hearing Aids Market can be segmented by product type, sales channel, and region:

- By Product Type: The Global Hearing Aids market is segmented into behind-the-ear (BTE), in-the-ear (ITE), and receiver-in-the-canal (RIC). In 2023, BTE hearing aids remain the most dominant product type due to their versatility and suitability for a wide range of hearing loss levels. However, RIC hearing aids are gaining popularity for their discreet design and natural sound quality. The demand for ITE hearing aids is also on the rise, driven by increasing consumer interest in customized and comfortable hearing solutions.

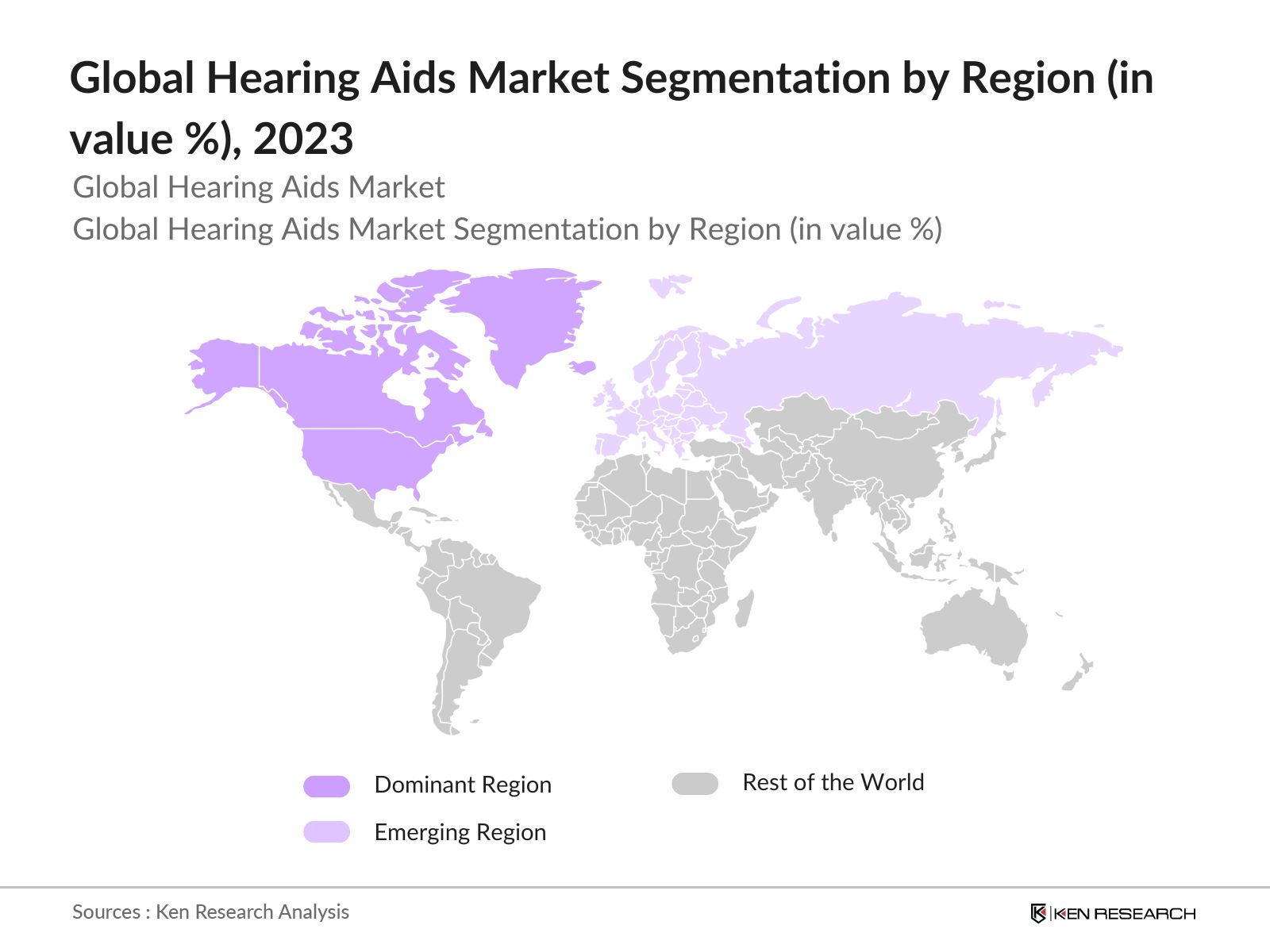

- By Region: The Global Hearing Aids global market is segmented regionally into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2023, North America leads the market due to high disposable incomes, a strong preference for advanced hearing solutions, and a large aging population. Europe is also a significant market, driven by high awareness about hearing health and the demand for digital and rechargeable hearing aids.

- By Sales Channel: The Global Hearing Aids market is segmented by sales channel into audiology clinics, hospital pharmacies, retail pharmacies, and online retailers. In 2023, audiology clinics dominate the market due to their comprehensive hearing services and expertise. However, online retailers are rapidly growing in market share, driven by the convenience of home delivery and access to a wide range of products. Hospital and retail pharmacies also hold significant shares, catering to the demand for accessible and convenient hearing aid solutions.

Global Hearing Aids Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Sonova |

1947 |

Stfa, Switzerland |

|

Demant |

1904 |

Smrum, Denmark |

|

GN Store Nord |

1869 |

Ballerup, Denmark |

|

Starkey Hearing Technologies |

1967 |

Eden Prairie, USA |

|

WS Audiology |

2019 |

Lynge, Denmark |

- Sonova: In 2023, Sonova launched a new range of digital hearing aids under its Phonak brand, featuring enhanced sound processing technology and Bluetooth connectivity. This launch aims to strengthen the company's position in the premium segment of the market, where there is increasing consumer interest in advanced, technology-driven hearing solutions. The new product line leverages Sonova's extensive research in hearing technology and aligns with the broader trend towards smart hearing aids.

- Demant: In 2024, Demant expanded its product line with the launch of a new range of rechargeable hearing aids, designed to meet the rising consumer demand for eco-friendly and convenient options. The new Oticon rechargeable range emphasizes environmentally friendly practices, including the use of sustainable materials and energy-efficient components. This expansion reflects Demant's commitment to sustainability and positions the brand to capture a significant share of the growing market for rechargeable hearing aids.

Global Hearing Aids Market Analysis

Market Growth Drivers:

- Increasing Prevalence of Hearing Loss: The growing number of individuals with hearing impairment is significantly driving the demand for hearing aids globally. According to the World Health Organization (WHO), over 1.57 billion people worldwide experience some degree of hearing loss, and this number is projected to rise to 2.5 billion by 2050. Factors contributing to this increase include the aging global population, with the proportion of people over 60 expected to double by 2050, reaching 2.45 billion. Additionally, rising noise pollution in urban areas and the use of personal audio devices at high volumes are contributing to the higher incidence of hearing loss.

- Aging Population and Increased Life Expectancy: The aging global population is a significant factor driving the demand for hearing aids. According to the United Nations, the global population of people aged 65 and older is projected to more than double, from 727 million in 2020 to over 1.5 billion in 2050. This demographic shift will increase the prevalence of age-related hearing loss, a condition that affects approximately one in three people over the age of 65 and nearly half of those over 75, as reported by the National Institute on Deafness and Other Communication Disorders (NIDCD).

- Rising Prevalence of Noise-Induced Hearing Loss: Noise-induced hearing loss (NIHL) is becoming increasingly common, particularly among younger individuals, due to prolonged exposure to loud music through personal audio devices and high-noise environments in workplaces and recreational settings. According to the World Health Organization (WHO), approximately 1.1 billion teenagers and young adults worldwide are at risk of hearing loss due to unsafe listening practices.

Market Challenges:

- Limited Access to Hearing Care in Low-Income Regions: In many low- and middle-income countries, access to hearing care and hearing aids remains limited due to inadequate healthcare infrastructure, a lack of trained audiologists, and high costs associated with hearing aids. The lack of access to affordable hearing care services and devices in these regions poses a significant challenge to market growth and limits the ability of many individuals to address their hearing loss effectively.

- High Product Cost and Limited Insurance Coverage: The high cost of hearing aids, which can range from $1,000 to $6,000 per device, remains a significant barrier for many potential users, especially in regions where hearing aids are not covered by public health insurance or subsidies. This lack of coverage and high upfront cost can deter individuals from purchasing hearing aids, especially in low- and middle-income households, limiting the market's growth potential.

- Social Stigma and Perception Issues: Despite advancements in technology and design, hearing aids are often still associated with aging or disability, leading to social stigma and reluctance among some individuals to use them.Younger individuals, in particular, may avoid using hearing aids due to concerns about their appearance or being perceived as older than they are. This stigma can delay the adoption of hearing aids and reduce market penetration, particularly among demographics that might otherwise benefit from early intervention.

Government Initiatives:

- Japans Subsidy Program for Hearing Aids: The Japanese government provides subsidies for hearing aids through its welfare program for the elderly and people with disabilities. Under this program, the government covers a significant portion of the cost of hearing aids for eligible individuals, especially those with severe hearing impairments. The new "Vibone nezu 3" bone conduction sound collector is being crowdfunded as an affordable hearing support option at 83,200 yen (including tax and shipping).This suggests the need for more affordable hearing solutions in Japan, making hearing aids more affordable and accessible for low-income and elderly individuals. This initiative has helped increase the penetration of hearing aids among Japan's aging population.

- Indias Accessible India Campaign (Sugamya Bharat Abhiyan): Launched in 2015, Indias Accessible India Campaign aims to make public infrastructure, transportation, and information accessible to people with disabilities, including those with hearing impairments. As part of this campaign, the Indian government has also focused on enhancing access to affordable hearing aids through public health programs and subsidies. In 2023, the Indian government allocated INR 2 billion (approximately USD 24 million) for programs under this initiative, which includes distribution of free hearing aids to low-income individuals and expanding access to audiological services in rural and underserved areas. The Accessible India Campaign also promotes awareness about hearing health and the importance of early intervention, helping to reduce stigma and encourage more people to seek hearing aids.

Global Hearing Aids Market Future Market Outlook

The Global Hearing Aids Market is expected to continue its steady growth, driven by the increasing prevalence of hearing loss, advancements in hearing aid technology, and rising awareness about hearing health.

Future Market Trends:

- Integration of Artificial Intelligence (AI): The integration of AI in hearing aids, which allows for personalized sound experiences and real-time adjustments, is expected to grow in popularity. This technology offers improved sound quality and user experience, enhancing the overall performance of hearing aids.

- Growth of Teleaudiology Services: Teleaudiology services, which provide remote hearing assessments and adjustments, are expected to grow in popularity due to their convenience and accessibility. This model offers an innovative approach to hearing care, particularly in regions with limited access to audiology services.

Scope of the Report

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

|

By Sales Channel |

Audiology Clinics Hospital Pharmacies Retail Pharmacies Online Retailers |

|

By Price Segment |

Economy Mid-range Premium |

|

By Product Type |

Behind-the-Ear (BTE) In-the-Ear (ITE) Receiver-in-the-Canal (RIC) |

|

By Technology |

Digital Analog |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Banks and Financial Institutions

Venture Capitalists

Government and Regulatory Bodies (FDA, EMA, TGA, PMDA)

Hearing Aid Manufacturers

Audiology Clinics and Hearing Care Providers

Retailers and Distributors

E-commerce Companies

Hearing Aid Product Development Firms

Hearing Aid Retail Chains

Hearing Health Organizations

Medical Device Regulatory Agencies

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Sonova

Demant

GN Store Nord

Starkey Hearing Technologies

WS Audiology

Cochlear Limited

MED-EL

Rion Co., Ltd.

SeboTek Hearing Systems, LLC

Zounds Hearing, Inc.

Audina Hearing Instruments, Inc.

Amplifon

Benson Hearing

Hearing Life

Widex A/S

Table of Contents

1. Global Hearing Aids Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Hearing Aids Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Hearing Aids Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Prevalence of Hearing Loss

3.1.2. Aging Population and Increased Life Expectancy

3.1.3. Rising Prevalence of Noise-Induced Hearing Loss

3.2. Restraints

3.2.1. Limited Access to Hearing Care in Low-Income Regions

3.2.2. High Product Cost and Limited Insurance Coverage

3.2.3. Social Stigma and Perception Issues

3.3. Opportunities

3.3.1. Technological Advancements in Hearing Aids

3.3.2. Expansion into Emerging Markets

3.3.3. Growth of Teleaudiology Services

3.4. Trends

3.4.1. Integration of Artificial Intelligence (AI)

3.4.2. Growth of Rechargeable and Sustainable Hearing Aids

3.4.3. Increased Focus on Personalized Hearing Solutions

3.5. Government Regulation

3.5.1. U.S. Over-the-Counter (OTC) Hearing Aid Act of 2017

3.5.2. Japans Subsidy Program for Hearing Aids

3.5.3. Indias Accessible India Campaign

3.5.4. European Unions Accessible Technologies for All Initiative

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competitive Ecosystem

4. Global Hearing Aids Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Behind-the-Ear (BTE)

4.1.2. In-the-Ear (ITE)

4.1.3. Receiver-in-the-Canal (RIC)

4.2. By Sales Channel (in Value %)

4.2.1. Audiology Clinics

4.2.2. Hospital Pharmacies

4.2.3. Retail Pharmacies

4.2.4. Online Retailers

4.3. By Region (in Value %)

4.3.1. North America

4.3.2. Europe

4.3.3. Asia Pacific

4.3.4. Latin America

4.3.5. Middle East & Africa

4.4. By Price Segment (in Value %)

4.4.1. Economy

4.4.2. Mid-range

4.4.3. Premium

4.5. By Technology (in Value %)

4.5.1. Digital

4.5.2. Analog

5. Global Hearing Aids Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. Sonova

5.1.2. Demant

5.1.3. GN Store Nord

5.1.4. Starkey Hearing Technologies

5.1.5. WS Audiology

5.1.6. Cochlear Limited

5.1.7. MED-EL

5.1.8. Rion Co., Ltd.

5.1.9. SeboTek Hearing Systems, LLC

5.1.10. Zounds Hearing, Inc.

5.1.11. Audina Hearing Instruments, Inc.

5.1.12. Amplifon

5.1.13. Benson Hearing

5.1.14. Hearing Life

5.1.15. Widex A/S

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global Hearing Aids Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global Hearing Aids Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Global Hearing Aids Market Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global Hearing Aids Market Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Sales Channel (in Value %)

9.3. By Region (in Value %)

9.4. By Price Segment (in Value %)

9.5. By Technology (in Value %)

10. Global Hearing Aids Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables

We begin by referencing multiple secondary and proprietary databases to conduct desk research. This includes gathering industry-level information on market drivers, challenges, key players, consumer behavior, and technological trends. We also assess regulatory impacts and market dynamics specific to the global market.

Step 2: Market Building

We collect historical data on market size, growth rates, product segmentation (BTE, ITE, RIC, others), and the distribution of sales channels (audiology clinics, hospital pharmacies, retail pharmacies, online retailers). We also analyze market share and revenue generated by leading brands, emerging trends in hearing technology, and consumer preferences to ensure accuracy and reliability in the data presented.

Step 3: Validating and Finalizing

We perform Computer-Assisted Telephone Interviews (CATIs) with industry experts, including representatives from leading hearing aid manufacturers, distributors, and audiologists. These interviews validate the statistics collected and provide insights into operational and financial aspects, such as pricing strategies, supply chain management, and consumer buying patterns.

Step 4: Research Output

Our team interacts with hearing aid manufacturers, audiologists, consumers, and market analysts to understand the dynamics of market segments, evolving consumer preferences, and sales trends. This process helps validate the derived statistics using a bottom-to-top approach, ensuring that the final data accurately reflects the actual market conditions.

Frequently Asked Questions

01. How large is the Global Hearing Aids Market?

In 2023, the Global Hearing Aids Market was valued at approximately USD 9.12 billion. The market's growth is driven by the increasing prevalence of hearing loss, advancements in hearing aid technology, and rising awareness about hearing health, which encourages spending on premium and advanced hearing solutions.

02. What are the challenges in the Global Hearing Aids Market?

Challenges in the Global Hearing Aids Market include high costs associated with advanced hearing aids, limited insurance coverage in some regions, and the stigma associated with hearing aid use. Additionally, regulatory constraints and the need for continuous innovation to meet consumer expectations pose significant challenges.

03. Who are the major players in the Global Hearing Aids Market?

Major players in the Global Hearing Aids Market include Sonova, Demant, GN Store Nord, Starkey Hearing Technologies, and WS Audiology. These companies lead the market with extensive product portfolios, strong brand recognition, and continuous innovation in hearing aid technology.

04. What are the growth drivers of the Global Hearing Aids Market?

Key growth drivers include the increasing prevalence of hearing loss, advancements in hearing aid technology, and rising awareness about hearing health. The integration of artificial intelligence in hearing aids and the growth of teleaudiology services also contribute to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.