Global Hernia Repair Market Outlook to 2030

Region:Global

Author(s):Paribhasha Tiwari

Product Code:KROD6260

November 2024

80

About the Report

Global Hernia Repair Market Overview

- The global hernia repair market is valued at USD 4 billion, based on a five-year historical analysis. This market is driven by the rising number of hernia repair surgeries worldwide, largely attributed to increasing cases of abdominal and inguinal hernias, an aging population, and technological advancements in minimally invasive procedures. The demand for surgical mesh products, especially synthetic and biologic mesh, is propelling market growth, with major healthcare systems investing in improving surgical infrastructure globally.

- Countries such as the United States, Germany, and Japan dominate the global hernia repair market. This dominance is driven by their advanced healthcare infrastructure, high adoption of laparoscopic and robotic surgeries, and robust reimbursement policies. These regions have a strong presence of key industry players, as well as higher rates of hernia occurrences and surgeries, further solidifying their leadership in this space.

- In 2024, the U.S. government continues to reform its healthcare reimbursement policies, allocating more funds to cover the costs of hernia surgeries under Medicare and Medicaid. This has increased access to advanced hernia repair techniques, particularly for the elderly population. The introduction of value-based care models in surgical reimbursements has further incentivized hospitals to adopt minimally invasive techniques to reduce overall costs.

Global Hernia Repair Market Segmentation

- By Product Type: The global hernia repair market is segmented by product type into synthetic mesh, biologic mesh, fixation devices, and non-mesh hernia repair solutions. The synthetic mesh segment dominates this market due to its wide usage in various hernia repair surgeries. Synthetic mesh is preferred for its cost-effectiveness, proven performance, and availability, which makes it the go-to solution for most hernia surgeries globally.

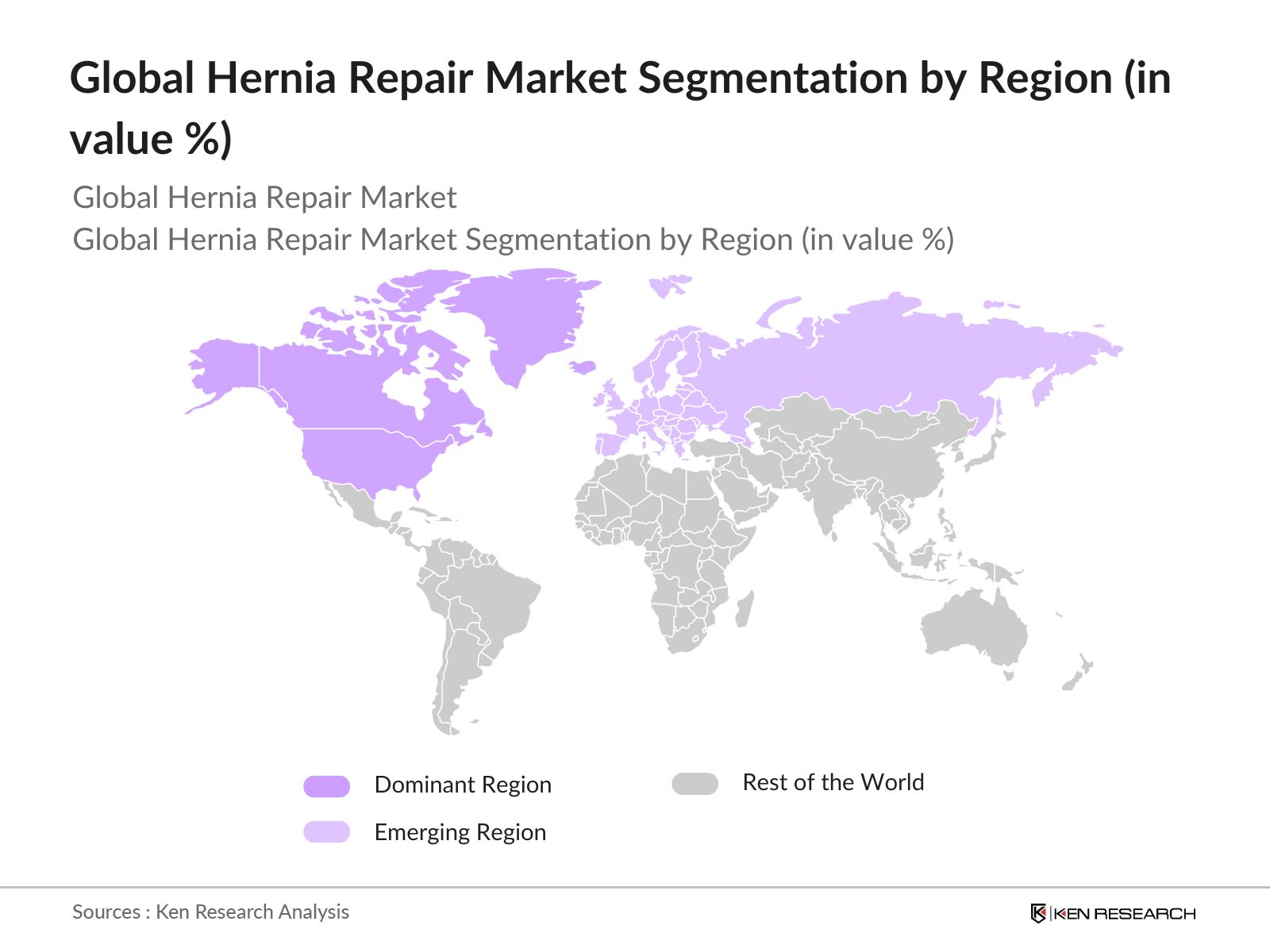

- By Region: Geographically, the market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominates the global hernia repair market, accounting for the largest market share due to its advanced healthcare systems, high prevalence of hernia cases, and strong adoption of robotic surgery technologies.

- By Procedure Type: Hernia repair is performed through either laparoscopic repair or open repair. Laparoscopic repair holds a dominant market share in 2023 due to its minimally invasive nature, shorter recovery times, and lower risk of complications. This procedure is especially popular in developed countries with access to advanced surgical equipment and well-trained professionals.

Global Hernia Repair Market Competitive Landscape

The global hernia repair market is characterized by the presence of both global and regional players. Key companies are investing in research and development to improve surgical outcomes and enhance the biocompatibility of hernia repair products. The market is also witnessing significant consolidation through mergers and acquisitions, highlighting the influence of key players in shaping market dynamics.

|

Company |

Establishment Year |

Headquarters |

R&D Spending |

Geographical Presence |

Key Products |

No. of Hernia Repair Surgeries Supported |

Patent Portfolio |

Collaborations |

FDA Approvals |

|

Medtronic Plc |

1949 |

Dublin, Ireland |

- | - | - | - | - | - | - |

|

Johnson & Johnson (Ethicon) |

1886 |

New Brunswick, USA |

- | - | - | - | - | - | - |

|

B. Braun Melsungen AG |

1839 |

Melsungen, Germany |

- | - | - | - | - | - | - |

|

Cook Medical |

1963 |

Bloomington, USA |

- | - | - | - | - | - | - |

|

W.L. Gore & Associates |

1958 |

Newark, USA |

- | - | - | - | - | - | - |

Global Hernia Repair Market Analysis

Makret Growth Drivers

- Rise in Hernia Procedures (Clinical Data on Hernia Prevalence, Aging Population): The growing number of hernia procedures globally is driven by an increasing aging population, a demographic more susceptible to hernia development. In 2024, it is projected that over 3 million hernia repair surgeries will be performed globally, as per healthcare databases. Countries like the USA, India, and Germany account for a substantial portion of these procedures due to the aging population and the prevalence of hernia cases. This rise is consistent with a higher incidence rate among individuals aged 60 and above, where hernias are commonly observed due to muscle weakening.

- Advancements in Surgical Techniques (Laparoscopic and Robotic Procedures): Technological advancements in minimally invasive hernia repair techniques, particularly laparoscopic and robotic procedures, are key growth drivers. In 2024, it is estimated that robotic-assisted hernia surgeries will account for approximately 700,000 surgeries worldwide, significantly reducing recovery time and post-surgery complications. These methods, especially popular in North America and Europe, reduce recovery periods from weeks to days, improving patient outcomes and increasing the adoption of advanced surgical techniques.

- Increased Adoption of Synthetic Mesh (FDA-Approved Mesh Products, Innovation in Biocompatibility): The use of synthetic mesh in hernia repairs has gained momentum, with over 90% of hernia repairs using mesh implants. By 2024, more than 2.7 million surgeries will involve synthetic mesh products, which are increasingly being designed for higher biocompatibility and lower rejection rates. The U.S. market alone sees substantial growth, driven by innovations in mesh materials approved by the FDA, which offer longer durability and fewer complications post-implantation.

Market Challenges

- High Cost of Hernia Repair Surgeries (Cost Constraints in Developing Economies): The average cost of hernia repair surgeries in developed countries like the U.S. is upwards of $10,000, limiting accessibility in developing economies. In 2024, the high costs continue to deter patients from opting for surgery in regions like Southeast Asia and Africa, where healthcare expenditures remain low. Limited insurance coverage in these areas exacerbates the challenge, particularly in low-income communities where advanced surgical techniques are not widely available.

- Post-Surgery Complications (Recurrence Rates, Mesh Rejection): Post-operative complications, including mesh rejection and recurrence rates, are significant challenges in the hernia repair market. In 2024, approximately 20-25% of hernia patients globally will experience some form of complication, with recurrence rates as high as 15% in certain regions. Countries with limited access to cutting-edge medical technologies, such as parts of Latin America, report higher recurrence rates due to inadequate surgical procedures and lower-quality mesh products.

Global Hernia Repair Market Future Outlook

Over the next five years, the global hernia repair market is expected to experience robust growth driven by continuous advancements in minimally invasive techniques, a rising geriatric population, and increasing cases of hernias worldwide. Technological innovations, particularly in biologic mesh and robotic-assisted surgeries, will play a significant role in enhancing patient outcomes and reducing recovery times. Moreover, expanding healthcare access in emerging markets and government efforts to improve healthcare infrastructure are expected to create substantial growth opportunities in the market.

Market Opportunities

- Growing Demand for Minimally Invasive Surgeries: Emerging markets, particularly in Asia and Latin America, are experiencing increased adoption of minimally invasive hernia repair techniques. In 2024, over 1 million laparoscopic hernia surgeries will be performed in countries such as India, Brazil, and China. The reduced recovery time and hospital stay associated with these surgeries make them increasingly popular, particularly in urban areas where advanced healthcare facilities are expanding.

- Rising Preference for Biologic Mesh Products: Biologic mesh products are gaining traction due to their superior biocompatibility and lower rejection rates compared to synthetic alternatives. In 2024, the use of biologic mesh in hernia repair surgeries is expected to surpass 600,000 procedures globally. This growth is fueled by increasing patient awareness and demand for safer surgical options, particularly in developed markets such as the U.S. and Western Europe, where healthcare systems are pushing for better patient outcomes.

Scope of the Report

|

By Product Type |

Synthetic Mesh Biologic Mesh Fixation Devices Non-Mesh Hernia Repair |

|

By Procedure Type |

Laparoscopic Repair Open Repair |

|

By Surgery Type |

Inguinal Hernia Repair Incisional Hernia Repair Umbilical Hernia Repair Femoral Hernia Repair |

|

By Hernia Type |

Reducible Hernia Irreducible Hernia Strangulated Hernia |

|

By End-Use |

Hospitals Ambulatory Surgical Centers Clinics |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, EMA)

Medical Device Manufacturers

Hospitals and Surgical Centers

Healthcare Practitioners (Surgeons, Physicians)

Medical Insurance Companies

Biocompatibility Testing Laboratories

Ambulatory Surgical Centers

Companies

Players Mentioned in the Report:

Medtronic Plc

Johnson & Johnson (Ethicon)

B. Braun Melsungen AG

Cook Medical

W.L. Gore & Associates

C.R. Bard (Becton Dickinson)

Stryker Corporation

Lifecell Corporation

Herniamesh Srl

TELA Bio, Inc.

Table of Contents

1. Global Hernia Repair Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Hernia Procedures, Regional Demand, Healthcare Accessibility)

1.4. Market Segmentation Overview (By Product Type, Procedure Type, Surgery Type, Hernia Type, End-Use)

2. Global Hernia Repair Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Surgical Innovations, FDA Approvals)

3. Global Hernia Repair Market Analysis

3.1. Growth Drivers

3.1.1. Rise in Hernia Procedures (Clinical Data on Hernia Prevalence, Aging Population)

3.1.2. Advancements in Surgical Techniques (Laparoscopic and Robotic Procedures)

3.1.3. Increased Adoption of Synthetic Mesh (FDA-Approved Mesh Products, Innovation in Biocompatibility)

3.1.4. Government Healthcare Reimbursement Policies (Policy Changes in Key Regions)

3.2. Market Challenges

3.2.1. High Cost of Hernia Repair Surgeries (Cost Constraints in Developing Economies)

3.2.2. Post-Surgery Complications (Recurrence Rates, Mesh Rejection)

3.2.3. Stringent Regulatory Approvals (FDA, EMA Compliance and Approvals)

3.2.4. Limited Access to Advanced Medical Facilities (Rural and Low-Income Areas)

3.3. Opportunities

3.3.1. Growing Demand for Minimally Invasive Surgeries (Technological Adoption in Emerging Markets)

3.3.2. Rising Preference for Biologic Mesh Products (Biocompatibility, Reduced Rejection Rates)

3.3.3. Medical Tourism Opportunities (Cost Advantages in Emerging Economies)

3.3.4. Expansion of Hernia Repair Techniques in Ambulatory Surgical Centers (Outpatient Care Adoption)

3.4. Trends

3.4.1. Robotic-Assisted Hernia Repair Surgeries (Market Penetration of Robotic Systems)

3.4.2. Increased Focus on Post-Surgical Care (Mesh Innovations to Reduce Recurrence)

3.4.3. Growth in Laparoscopic Hernia Repair (Adoption in Urban Hospitals)

3.4.4. Expansion of Single-Incision Hernia Repair (Key Market Adoption, Surgeon Training)

3.5. Government Regulation

3.5.1. Surgical Mesh Regulation (FDA Guidelines on Mesh Safety)

3.5.2. Surgical Device Registration and Compliance (Country-Specific Guidelines)

3.5.3. Reimbursement Policies and Government Support (Medicare, Medicaid Coverage)

3.5.4. Clinical Trials and Data Requirements (Pre-Market Approvals for New Devices)

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Hernia Repair Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Synthetic Mesh

4.1.2. Biologic Mesh

4.1.3. Fixation Devices

4.1.4. Non-Mesh Hernia Repair

4.2. By Procedure Type (In Value %)

4.2.1. Laparoscopic Repair

4.2.2. Open Repair

4.3. By Surgery Type (In Value %)

4.3.1. Inguinal Hernia Repair

4.3.2. Incisional Hernia Repair

4.3.3. Umbilical Hernia Repair

4.3.4. Femoral Hernia Repair

4.4. By Hernia Type (In Value %)

4.4.1. Reducible Hernia

4.4.2. Irreducible Hernia

4.4.3. Strangulated Hernia

4.5. By End-Use (In Value %)

4.5.1. Hospitals

4.5.2. Ambulatory Surgical Centers

4.5.3. Clinics

5. Global Hernia Repair Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Medtronic Plc

5.1.2. Johnson & Johnson (Ethicon)

5.1.3. B. Braun Melsungen AG

5.1.4. Cook Medical

5.1.5. C.R. Bard (Becton Dickinson)

5.1.6. W.L. Gore & Associates

5.1.7. Stryker Corporation

5.1.8. Herniamesh Srl

5.1.9. Integra Lifesciences

5.1.10. Cousin Biotech

5.1.11. Lifecell Corporation

5.1.12. TELA Bio, Inc.

5.1.13. Atrium Medical Corporation

5.1.14. Betatech Medical

5.1.15. Baxter International Inc.

5.2. Cross Comparison Parameters (R&D Spending, Product Portfolio, Patent Ownership, Geographical Presence, FDA Approvals, Revenue, Surgical Outcomes, Number of Collaborations)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Joint Ventures)

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Hernia Repair Market Regulatory Framework

6.1. Surgical Device Safety Standards

6.2. Mesh Product Approval Processes

6.3. Compliance Requirements for Hernia Repair Devices

6.4. Regional Guidelines and Certification Processes

7. Global Hernia Repair Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Hernia Repair Market Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Procedure Type (In Value %)

8.3. By Surgery Type (In Value %)

8.4. By Hernia Type (In Value %)

8.5. By End-Use (In Value %)

9. Global Hernia Repair Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the ecosystem of the global hernia repair market, identifying major stakeholders such as medical device manufacturers, surgeons, and healthcare institutions. Through extensive desk research, we analyze the historical data and establish key variables such as technological advancements and product innovation.

Step 2: Market Analysis and Construction

In this phase, we compile data on hernia repair procedures performed globally, assessing adoption rates of synthetic vs. biologic mesh and evaluating procedure-specific costs. Additionally, healthcare accessibility and the regulatory landscape are considered to assess market barriers.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated by consulting industry experts, including medical device manufacturers and surgeons specializing in hernia repair. Expert feedback provides critical insights into product efficacy, safety concerns, and market adoption trends.

Step 4: Research Synthesis and Final Output

The final phase integrates quantitative and qualitative data derived from primary and secondary sources, producing a comprehensive and validated report on the global hernia repair market. This ensures accuracy and reliability in all insights presented.

Frequently Asked Questions

01. How big is the Global Hernia Repair Market?

The global hernia repair market is valued at USD 4 billion, driven by a growing number of hernia procedures and advancements in surgical technologies.

02. What are the challenges in the Global Hernia Repair Market?

Challenges in the global hernia repair market include high costs associated with hernia repair surgeries, post-surgery complications like mesh rejection, and stringent regulatory hurdles for new products.

03. Who are the major players in the Global Hernia Repair Market?

Key players in the global hernia repair market include Medtronic Plc, Johnson & Johnson (Ethicon), B. Braun Melsungen AG, Cook Medical, and W.L. Gore & Associates. These companies lead due to their strong product portfolios and market presence.

04. What are the growth drivers of the Global Hernia Repair Market?

Key drivers in the global hernia repair market include a rise in hernia procedures worldwide, increased adoption of synthetic and biologic mesh products, and advancements in minimally invasive and robotic surgeries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.