Global High Bandwidth Memory Market Outlook to 2030

Region:Global

Author(s):Naman Rohilla

Product Code:KROD8960

December 2024

82

About the Report

Global High Bandwidth Memory Market Overview

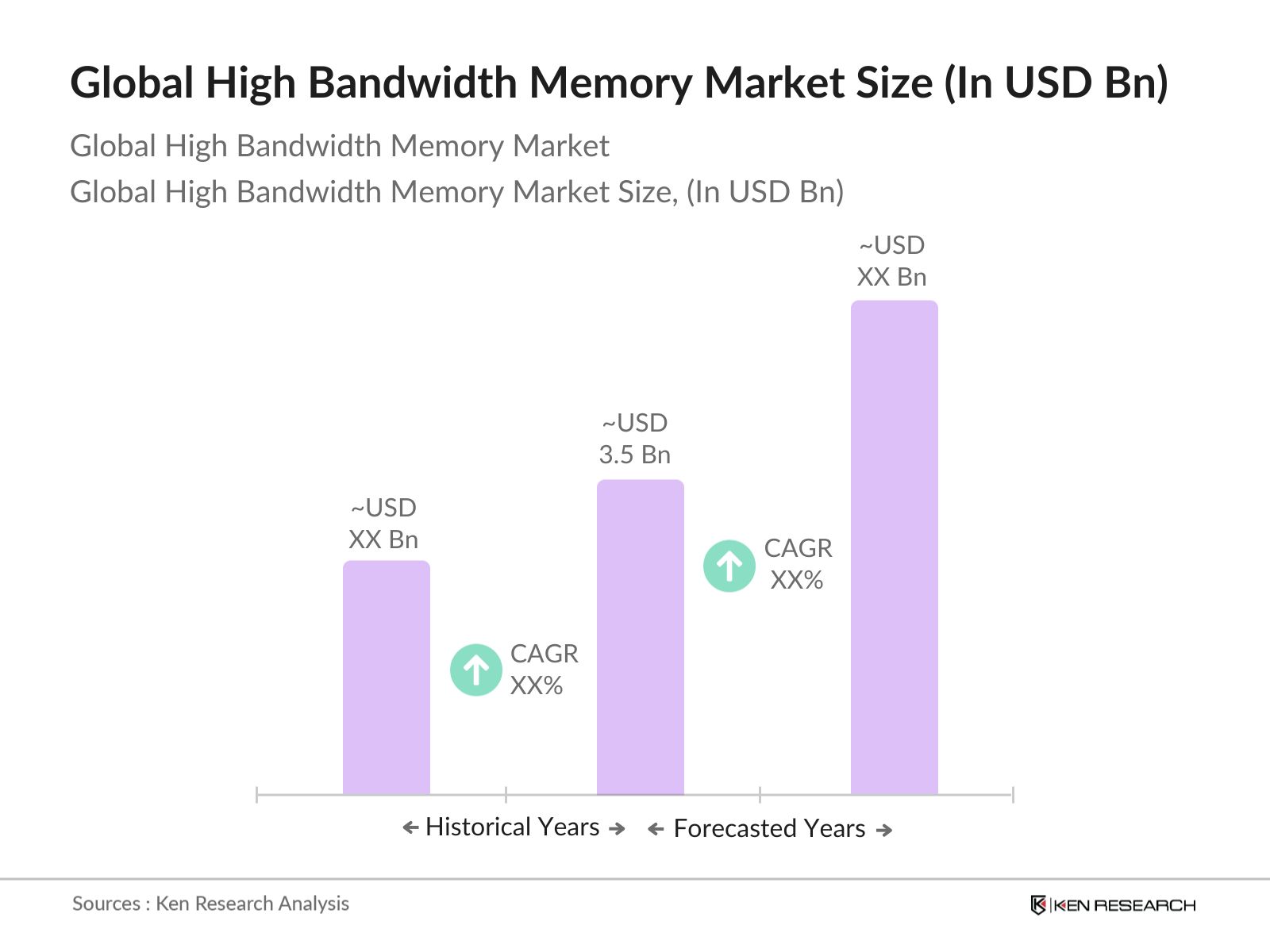

- The Global High Bandwidth Memory market is valued at USD 3.5 billion, backed by advancements in semiconductor and processor technologies. This valuation follows a five-year historical analysis showing steady expansion due to the escalating need for high-speed data processing in AI, machine learning, and graphics-intensive applications. The HBM sector has benefitted from its ability to meet demands for high-performance computing with energy-efficient memory solutions, driving its adoption in data centers and 5G infrastructure. Increased investments in advanced DRAM technologies have bolstered market growth, solidifying HBM as a critical component in next-gen processing.

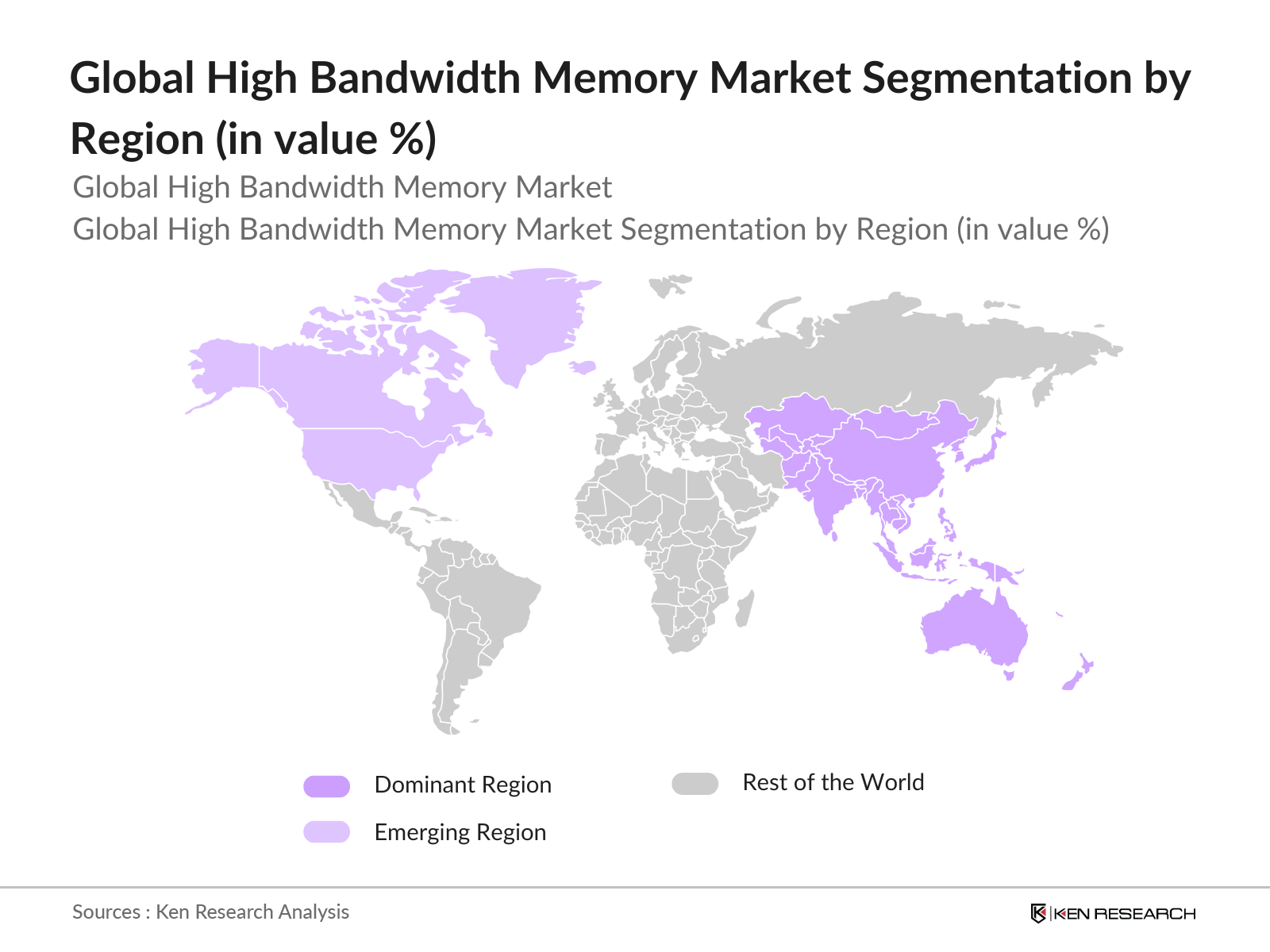

- Regions such as North America and Asia Pacific, especially countries like the United States, South Korea, and Taiwan, dominate the HBM market due to their established semiconductor industries and substantial investments in technology R&D. The dominance of these regions is influenced by strong local semiconductor manufacturers and a supportive regulatory environment that encourages innovation and technological advancement. In particular, the United States has a thriving tech ecosystem and strong demand for advanced computing applications, while Asia Pacific remains a global leader in memory manufacturing and innovation.

- Environmental standards in semiconductor production have become increasingly stringent, with regulatory bodies mandating lower carbon emissions. According to the U.S. Environmental Protection Agency (EPA), 2024 regulations require a 20% reduction in emissions for semiconductor manufacturing, impacting HBM production practices. This regulatory push aligns with the industrys transition towards eco-friendly memory solutions, encouraging HBM providers to adopt sustainable production technologies.

Global High Bandwidth Memory Market Segmentation

- By Product Type: The High Bandwidth Memory market is segmented into HBM1, HBM2, HBM2E, and HBM3. Currently, HBM2E is the dominant segment, given its enhanced data bandwidth capabilities and compatibility with high-performance applications. The adoption of HBM2E in AI processors and advanced GPUs, due to its high-speed data transfer capabilities, has positioned it as the preferred choice in high-end computing, appealing to industries seeking speed and efficiency.

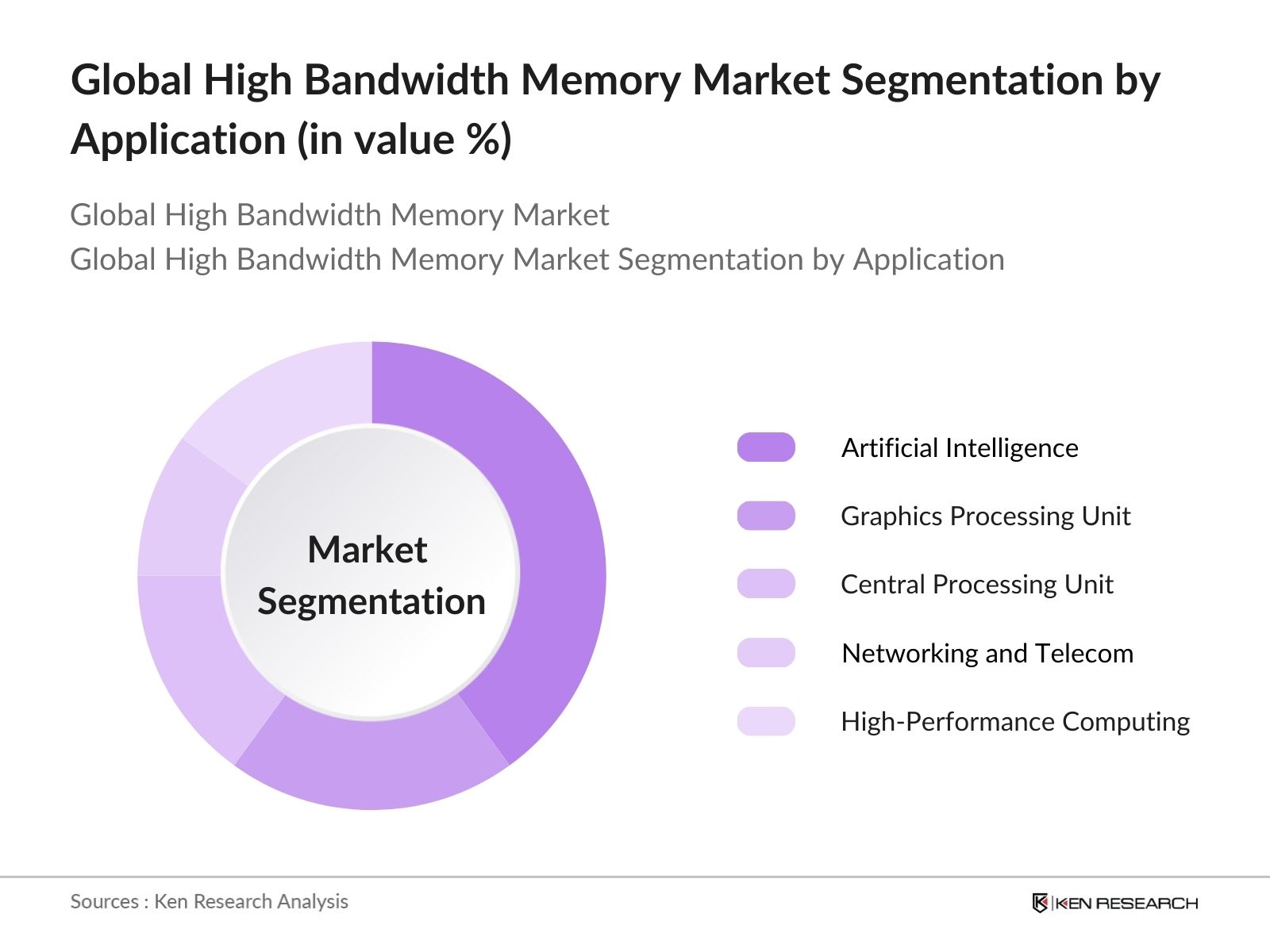

- By Application: The High Bandwidth Memory market application segment includes Artificial Intelligence, Graphics Processing Units, Central Processing Units, Networking and Telecommunications, and High-Performance Computing. Artificial Intelligence applications hold the highest market share within this segmentation, driven by the demand for rapid data processing and energy efficiency, essential for AI operations. AI applications require HBM for tasks like real-time data analysis and machine learning, where speed and efficiency are paramount, making it the largest consumer of HBM solutions.

- By Region: The High Bandwidth Memory market is segmented regionally into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominates the market, propelled by its well-established semiconductor manufacturing base and favorable government policies supporting technological innovation. The region benefits from leading memory manufacturers and advanced infrastructure, positioning it as a hub for HBM production and technological advancements.

Global High Bandwidth Memory Market Competitive Landscape

The competitive landscape of the HBM market is characterized by major players with extensive expertise in semiconductor technology, high R&D budgets, and global footprints. Key players like Samsung Electronics and SK Hynix lead the market due to their innovation in DRAM technology and established global distribution networks.

Global High Bandwidth Memory Market Analysis

Market Growth Drivers

- Advancements in Processor Technologies: Technological advances in processor capabilities have bolstered demand for high-bandwidth memory (HBM) due to its role in accelerating data access and enhancing processing speed. According to the U.S. Bureau of Labor Statistics (BLS), the computer hardware and software industry recorded a 6% increase in productivity from 2022 to 2024, spurred by advanced processing needs. Global data shows that the proliferation of processors in high-performance computing (HPC) systems has been pivotal in advancing AI and machine learning, supporting HBM demand growth through applications in automotive and healthcare.

- Surge in AI and Data-Intensive Applications: AI and data-intensive applications require memory solutions with high speed and capacity, directly supporting the adoption of HBM. In 2023, the Organization for Economic Cooperation and Development (OECD) reported that data usage in AI applications grew by 8.3 zettabytes due to machine learning applications in banking, defense, and healthcare. HBM provides essential support for real-time analytics in AI and deep learning, crucial for data-reliant sectors that process millions of data points per second, making HBM indispensable in modern AI architecture.

- Expanding High-Performance Computing Needs: The U.S. National Institute of Standards and Technology (NIST) stated that demand for HPC in sectors such as pharmaceuticals and aerospace surged by 17% from 2022 to 2024 due to increased computational needs. The energy and materials sectors have also shown a reliance on HPC for extensive simulations, creating consistent demand for HBM. This memory technology is valued for its ability to manage workloads effectively and process extensive datasets essential for industries focused on performance and accuracy.

Market Challenges

- High Production Costs: The high costs associated with HBM manufacturing remain a major barrier. The World Semiconductor Trade Statistics (WSTS) report of 2023 revealed that HBM production costs were 30% higher than traditional memory due to sophisticated processing requirements. The raw materials and production complexities involved in producing these advanced memory modules pose financial challenges for companies. This restricts broad adoption, as firms must allocate capital to cover production expenses, impacting overall market affordability.

- Scalability Issues: The European Commissions report on semiconductor scalability in 2023 emphasized that scalability remains limited for HBM due to design intricacies, making it challenging to integrate with diverse systems. As high-density devices increasingly require modular solutions, the inability of HBM to scale smoothly has limited its potential applications. This challenge affects manufacturers who aim to meet growing demand for adaptive and compatible memory solutions across different hardware systems.

Global High Bandwidth Memory Market Future Outlook

The HBM market is projected to experience growth, with factors such as the increasing integration of AI applications, expansion in 5G networks, and rising demand for high-performance computing acting as primary growth drivers. The deployment of HBM technology in upcoming 5G infrastructure projects and its integration into high-demand applications like gaming and VR will likely sustain its growth trajectory.

Market Opportunities

- Integration in Next-Gen Data Centers: Next-generation data centers have accelerated the need for faster data transfer rates, with HBM serving as a pivotal component. In 2023, the U.S. Department of Energy (DOE) reported that over 60% of data centers implemented high-speed memory technologies to meet processing demands for big data applications. HBM offers the requisite speed for seamless data handling, positioning it as essential in optimizing data center operations and enabling real-time analytics in financial and industrial applications.

- Expansion in 5G Infrastructure: The deployment of 5G infrastructure requires robust memory solutions to handle high-speed data exchange, creating an opportunity for HBM. In 2024, Japans Ministry of Internal Affairs and Communications reported a 15% expansion in 5G infrastructure, which necessitates HBM's bandwidth capabilities to support IoT and mobile applications. With HBMs capacity to meet these demands, it is well-positioned to play a crucial role in the backbone of modern communication networks.

Scope of the Report

|

Product Type |

HBM1 HBM2 HBM2E HBM3 |

|

Application |

Artificial Intelligence (AI) Graphics Processing Unit (GPU) Central Processing Unit (CPU) Networking and Telecommunications High-Performance Computing (HPC) |

|

Technology Type |

3D Stacked DRAM Through-Silicon Via (TSV) Hybrid Memory Cube (HMC) |

|

End-User Industry |

IT and Telecommunication Healthcare and Life Sciences Defense and Aerospace BFSI (Banking, Financial Services) |

|

Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

High-performance Computing Firms

Semiconductor Manufacturers

Artificial Intelligence Solution Providers

Graphics Processor Developers

Banks and Financial Institutions

Network Infrastructure Companies

Government and Regulatory Bodies (e.g., U.S. Federal Communications Commission, Japan Ministry of Economy)

Investor and Venture Capitalist Firms

Telecommunications Companies

Companies

Players Mentioned in the Report

Samsung Electronics Co., Ltd.

SK Hynix Inc.

Micron Technology, Inc.

Intel Corporation

Nvidia Corporation

Rambus Inc.

Fujitsu Limited

IBM Corporation

Xilinx, Inc.

Marvell Technology Group

Table of Contents

1. Global High Bandwidth Memory Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics Overview

1.4. Industry Value Chain and Ecosystem Analysis

2. Global High Bandwidth Memory Market Size (in USD)

2.1. Historical Market Size Analysis

2.2. Growth Rate Analysis (Annual % Change)

2.3. Key Developments and Industry Milestones

3. Global High Bandwidth Memory Market Analysis

3.1. Growth Drivers

3.1.1. Advancements in Processor Technologies

3.1.2. Surge in AI and Data-Intensive Applications

3.1.3. Expanding High-Performance Computing Needs

3.1.4. Innovations in DRAM Technology

3.2. Market Challenges

3.2.1. High Production Costs

3.2.2. Scalability Issues

3.2.3. Dependency on Semiconductor Manufacturing

3.3. Opportunities

3.3.1. Integration in Next-Gen Data Centers

3.3.2. Expansion in 5G Infrastructure

3.3.3. Collaboration with AI Hardware Providers

3.4. Trends

3.4.1. Adoption of TSV (Through-Silicon Via) Technology

3.4.2. Growth in Cloud Computing Applications

3.4.3. Increasing Preference for Energy-Efficient Memory Solutions

3.5. Regulatory Environment

3.5.1. Environmental Compliance Standards

3.5.2. Semiconductor Quality Control Regulations

3.6. Competitive Landscape (15 Competitors)

3.6.1. Samsung Electronics Co. Ltd.

3.6.2. SK Hynix Inc.

3.6.3. Micron Technology, Inc.

3.6.4. Intel Corporation

3.6.5. Advanced Micro Devices, Inc.

3.6.6. Nvidia Corporation

3.6.7. Rambus Inc.

3.6.8. Fujitsu Limited

3.6.9. IBM Corporation

3.6.10. Xilinx, Inc.

3.6.11. Marvell Technology Group

3.6.12. Broadcom Inc.

3.6.13. Open-Silicon, Inc.

3.6.14. Applied Materials, Inc.

3.6.15. TSMC (Taiwan Semiconductor Manufacturing Company)

3.7. Cross Comparison Parameters (Revenue, Manufacturing Capabilities, Global Presence, Product Portfolio, R&D Investments, Strategic Partnerships, Customer Segmentation, Regional Dominance)

4. Global High Bandwidth Memory Market Segmentation

4.1. By Product Type (in Market Share %)

4.1.1. HBM1

4.1.2. HBM2

4.1.3. HBM2E

4.1.4. HBM3

4.2. By Application (in Market Share %)

4.2.1. Artificial Intelligence (AI)

4.2.2. Graphics Processing Unit (GPU)

4.2.3. Central Processing Unit (CPU)

4.2.4. Networking and Telecommunications

4.2.5. High-Performance Computing (HPC)

4.3. By Technology Type (in Market Share %)

4.3.1. 3D Stacked DRAM

4.3.2. Through-Silicon Via (TSV)

4.3.3. Hybrid Memory Cube (HMC)

4.4. By End-User Industry (in Market Share %)

4.4.1. IT and Telecommunication

4.4.2. Healthcare and Life Sciences

4.4.3. Defense and Aerospace

4.4.4. BFSI (Banking, Financial Services, and Insurance)

4.5. By Region (in Market Share %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global High Bandwidth Memory Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.2. Cross Comparison of Competitors (in Revenue, Product Innovations, Market Strategy, Geographical Reach, Partnerships, Manufacturing Facilities, Financial Stability, Workforce)

5.3. Strategic Initiatives

5.4. Market Share Analysis by Competitor

5.5. Investment Landscape (Venture Capital, M&A, Private Equity)

5.6. Industry Partnerships and Collaborations

6. Global High Bandwidth Memory Market Regulatory Framework

6.1. Quality and Compliance Standards for Memory Technology

6.2. Export Control Regulations for Semiconductor Components

6.3. Environmental and Safety Regulations

7. Future Market Size for Global High Bandwidth Memory (in USD)

7.1. Growth Opportunities for HBM Adoption in Emerging Markets

7.2. Key Market Drivers for Future Growth

8. Future Market Segmentation for Global High Bandwidth Memory

8.1. By Product Type (in Market Share %)

8.2. By Application (in Market Share %)

8.3. By Technology Type (in Market Share %)

8.4. By End-User Industry (in Market Share %)

8.5. By Region (in Market Share %)

9. Market Analyst Recommendations for the Global High Bandwidth Memory Market

9.1. Target Market Identification and TAM Analysis

9.2. Customer Cohort Identification

9.3. Marketing Strategy Recommendations

9.4. White Space Analysis for Product Development

Research Methodology

Step 1: Identification of Key Variables

The initial step involves mapping the ecosystem of stakeholders in the Global High Bandwidth Memory Market. A comprehensive desk research approach using verified databases will be used to determine critical variables affecting market dynamics.

Step 2: Market Analysis and Construction

This step includes compiling historical data on HBM technology, examining adoption rates, and analyzing application-specific growth. The collected data will allow for reliable and detailed revenue assessments based on specific usage segments.

Step 3: Hypothesis Validation and Expert Consultation

The research team will develop hypotheses on market performance, validated by industry experts via structured interviews. These insights will provide an accurate operational perspective, helping refine data accuracy.

Step 4: Research Synthesis and Final Output

The final phase will involve engaging with multiple HBM manufacturers to gather insights on market trends, consumer demand, and performance indicators. This data will be validated through cross-references with secondary research sources, ensuring a comprehensive and accurate market analysis.

Frequently Asked Questions

01. How big is the Global High Bandwidth Memory Market?

The Global High Bandwidth Memory Market is valued at USD 3.5 billion, driven by the need for faster data processing in applications like AI, VR, and high-performance computing.

02. What are the main growth drivers of the High Bandwidth Memory Market?

The market's growth is fueled by advancements in processor technology, increased AI usage, and the rapid expansion of 5G infrastructure demanding high-speed memory solutions.

03. Which regions dominate the High Bandwidth Memory Market?

Asia Pacific, particularly South Korea and Taiwan, lead the market due to their advanced semiconductor manufacturing sectors and supportive technological innovation policies.

04. What challenges does the High Bandwidth Memory Market face?

Challenges include high production costs and scalability issues, which are growth barriers to widespread adoption, especially in smaller and mid-sized applications.

05. Who are the key players in the High Bandwidth Memory Market?

Key players include Samsung Electronics, SK Hynix, Micron Technology, Intel, and Nvidia, all contributing to the market with their cutting-edge technologies and innovations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.