Global HighDensity Interconnect (HDI) Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD8154

November 2024

96

About the Report

Global High Density Interconnect Market Overview

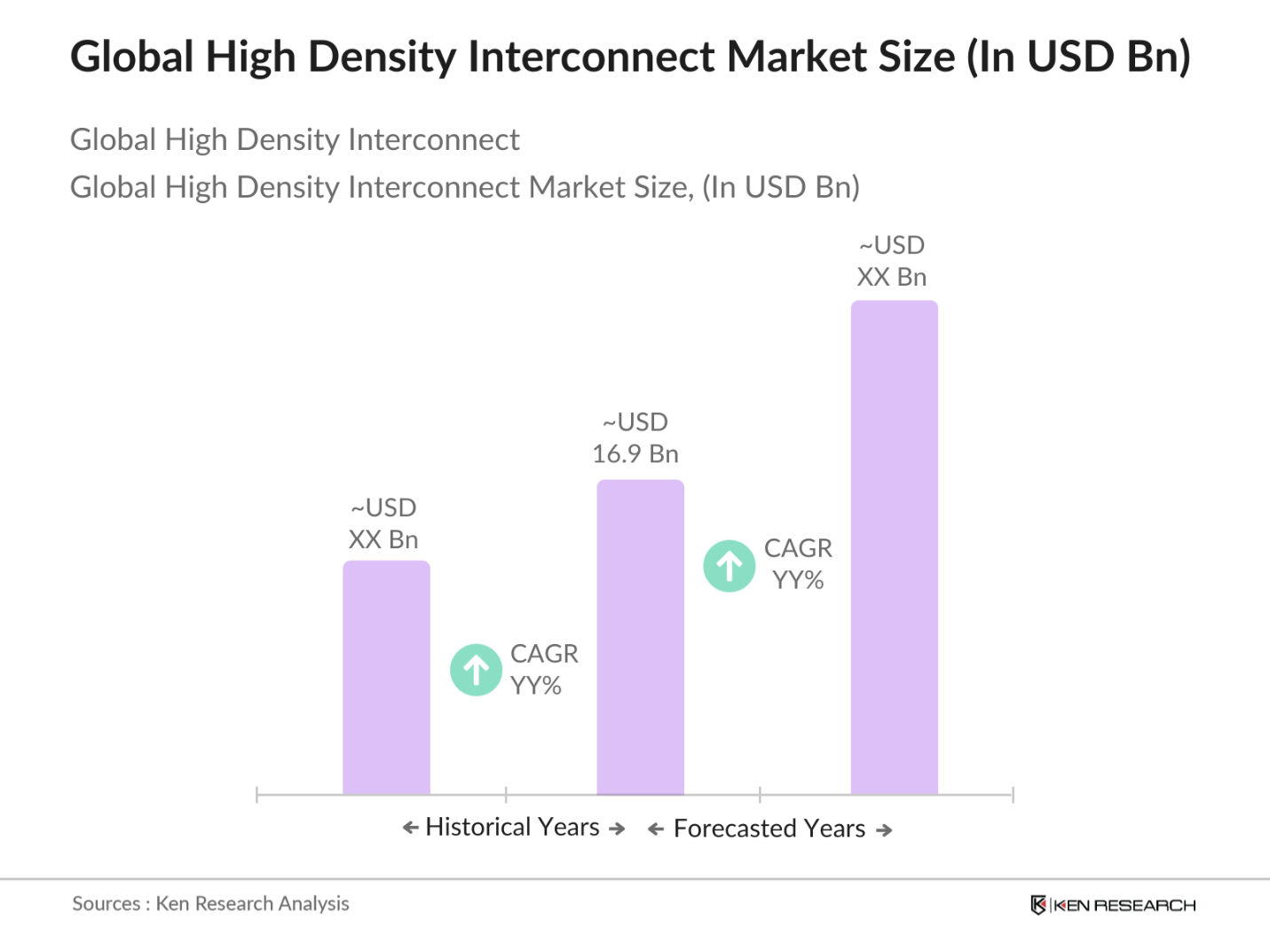

- The Global High Density Interconnect (HDI) market is valued at approximately USD 16.9 billion based on a five-year historical analysis. The market is driven by increasing demand for miniaturized electronic devices, especially in sectors such as consumer electronics, automotive, and telecommunications. The rise of 5G networks, IoT devices, and the continued advancement of autonomous vehicle technology are key contributors to market expansion, as HDI PCBs enable greater complexity and performance in these applications.

- Countries like China, the United States, and South Korea dominate the HDI market. China leads due to its large-scale electronics manufacturing ecosystem and cost-effective production capabilities. The U.S. maintains dominance due to its strong innovation in advanced technology sectors, while South Korea's leadership in consumer electronics and semiconductors significantly boosts its position in the global HDI market.

- Governments around the world are introducing stringent electronics manufacturing standards to boost the quality and reliability of electronic components, including HDI PCBs. In 2022, the U.S. Department of Commerce initiated the Advanced Electronics Manufacturing program to promote innovation and standardization in PCB manufacturing, including HDI technology. This program focuses on ensuring high precision and quality control in electronics production, encouraging manufacturers to adopt cutting-edge technologies like HDI to comply with government standards. Similarly, the European Unions Electronics Roadmap 2023 highlights the adoption of HDI technologies to meet future electronics design and performance needs.

Global High Density Interconnect Market Segmentation

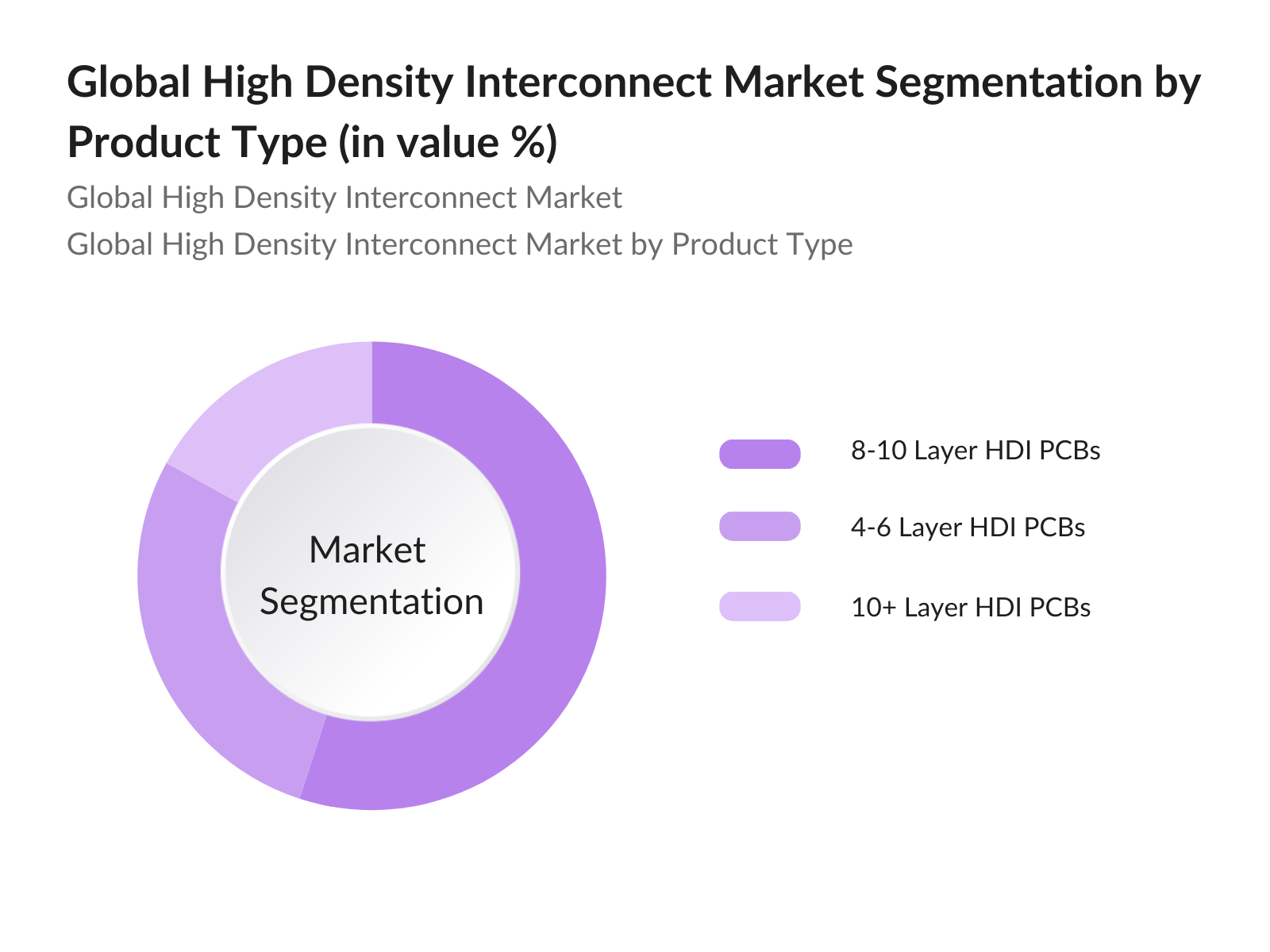

By Product Type: The HDI market is segmented by product type into 4-6 Layer HDI PCBs, 8-10 Layer HDI PCBs, and 10+ Layer HDI PCBs. Recently, 8-10 Layer HDI PCBs hold a dominant market share within this segmentation due to their widespread use in smartphones, tablets, and wearable devices. These PCBs offer the ideal balance of performance, miniaturization, and cost-effectiveness for consumer electronics. With the rapid expansion of 5G networks and IoT infrastructure, demand for 8-10 layer HDI PCBs continues to grow at a rapid pace.

By Region: The HDI market is geographically segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific, particularly China and South Korea, holds the largest market share. The region's dominance is driven by its strong electronics manufacturing base, low production costs, and high demand for consumer electronics. North America follows, driven by its focus on automotive electronics and advanced telecommunications technology.

Global High Density Interconnect Market Competitive Landscape

The global HDI market is dominated by both global and regional players who possess strong manufacturing capabilities, innovative product portfolios, and wide geographical reach. Companies like TTM Technologies and Unimicron Technology Corp. are key players due to their expertise in producing high-layer HDI PCBs for various industries. The consolidation in the industry is notable, with large companies holding significant influence in market dynamics.

Global High Density Interconnect Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

Market Specific Parameters |

|

TTM Technologies |

1978 |

USA |

Revenue, Number of HDI Plants, R&D Expenditure, Technological Advancements, Patents, Strategic Partnerships |

|

Unimicron Technology Corp |

1990 |

Taiwan |

Global Sales, Manufacturing Capacity, Innovation Pipeline, Market Expansion Strategies, Alliances, R&D Investments |

|

AT&S Austria Technologie |

1987 |

Austria |

Market Presence, Product Range, Technological Leadership, Geographical Reach, M&A Activities, Client Portfolio |

|

Fujikura Ltd. |

1910 |

Japan |

Product Innovation, PCB Design Capabilities, Production Capacity, Market Share, Environmental Initiatives, Customer Base |

|

Samsung Electro-Mechanics |

1973 |

South Korea |

Manufacturing Facilities, New Technology Development, Global Distribution, HDI Production Scale, Strategic Alliances, Quality Certifications |

Global High Density Interconnect Market Analysis

Market Growth Drivers

- Miniaturization of Electronic Devices: The trend of miniaturization is driving demand for high-density interconnect (HDI) technologies, particularly in smartphones, wearable devices, and medical equipment. The number of smartphone users globally crossed 6.6 billion in 2023, reflecting the rapid adoption of compact electronic devices. This has led to increased demand for smaller, yet more powerful components that require HDI for efficient space utilization. According to the World Bank, electronic device production is expected to expand in alignment with consumer demand for more compact and efficient technology solutions. This growth is particularly evident in regions such as North America and East Asia, where miniaturization is a key driver.

- Demand in Automotive: The global automotive industry is heavily investing in HDI technologies due to the rising complexity of automotive electronics, particularly for electric vehicles (EVs) and autonomous driving systems. According to the International Organization of Motor Vehicle Manufacturers (OICA), electric vehicle production increased by over 43% in 2023. HDI PCBs are crucial for integrating various sensors and electronic control units in limited spaces within vehicles. This shift toward more sophisticated electronics in the automotive sector is expected to boost HDI adoption, particularly as the number of EV units produced continues to increase annually.

- Wearable Technology Advancements: The wearable technology market is witnessing a sharp rise, driven by innovations in healthcare and fitness devices. As of 2023, approximately 500 million wearable devices were sold globally, driven by healthcare monitoring applications, fitness tracking, and consumer electronics. HDI technology enables the integration of complex electronic components into smaller, more efficient circuits, essential for wearable devices. Governmental support for healthcare and technology innovation, especially in North America and Europe, further underpins the rapid uptake of wearable technology, contributing to HDI demand.

Market Challenges:

- Complex Manufacturing Process: HDI manufacturing involves several intricate steps, including laser drilling, lamination, and precise copper plating, which make the process challenging. According to the U.S. Bureau of Labor Statistics, the global shortage of skilled labor has exacerbated these manufacturing complexities. Labor-intensive regions such as East Asia have reported a 10% decline in workforce availability within the electronics manufacturing sector in 2023, leading to production slowdowns. These complex procedures also necessitate advanced equipment, increasing operational lead times and affecting output efficiency.

- High Initial Setup Costs: Establishing HDI manufacturing lines requires significant capital investment in machinery, tooling, and skilled labor. Data from the World Bank shows that capital expenditures for advanced electronics manufacturing facilities have risen by 15% globally from 2022 to 2023. This high initial setup cost creates a barrier for new market entrants and limits production scalability. As HDI technology involves advanced fabrication methods, manufacturers must also continuously invest in research and development (R&D) to stay competitive, further driving up operational costs.

Global High Density Interconnect Market Future Outlook

Over the next five years, the Global High Density Interconnect (HDI) market is expected to show significant growth driven by continuous innovation in consumer electronics, advancements in telecommunications infrastructure, and the widespread adoption of 5G technology. Automotive electronics, in particular, will contribute to the expansion of HDI applications as autonomous vehicles and electric cars increasingly require sophisticated PCBs. Additionally, the demand for wearable technology and IoT devices will play a crucial role in shaping the market's future trajectory.

Market Opportunities:

- Growing Adoption in Medical Devices: The global healthcare sector is increasingly adopting HDI PCBs due to the demand for compact, high-performance medical devices. In 2023, the U.S. Food and Drug Administration (FDA) approved over 2,000 new medical devices, many of which incorporated HDI technology for improved functionality. From portable diagnostic tools to implantable devices, HDI enables enhanced data processing within compact designs, which are crucial for modern healthcare solutions. The rise in healthcare expenditures, which surpassed $8 trillion globally in 2023, supports the further adoption of HDI in the medical sector.

- Rising Use in Aerospace: HDI technology is gaining traction in the aerospace industry due to the demand for lighter, more compact electronics capable of withstanding extreme environments. In 2023, the global aerospace electronics market witnessed a rise in component miniaturization, with HDI technology enabling the production of lighter avionics systems. Government initiatives, such as NASAs investment in next-generation spacecraft, further underscore the importance of HDI in aerospace applications. As the aerospace industry continues to innovate, HDI will play a crucial role in meeting the technical demands of space exploration and aviation.

Scope of the Report

|

By Product Type |

4-6 Layer HDI PCBs 8-10 Layer HDI PCBs 10+ Layer HDI PCBs |

|

By Application |

Automotive Electronics Consumer Electronics Medical Devices Telecommunications Aerospace and Defense |

|

By Manufacturing Method |

Sequential Lamination Modified Semi-Additive Process (mSAP) Any-Layer HDI |

|

By End-User |

OEMs (Original Equipment Manufacturers) PCB Assembly Companies EMS (Electronics Manufacturing Services) Providers |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

HDI PCB Manufacturers

Automotive Electronics Companies

Consumer Electronics Manufacturers

Telecommunications Providers

Medical Device Manufacturers

Aerospace and Defense Contractors

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Federal Communications Commission, European Telecommunications Standards Institute)

Companies

Players Mention in the Report

TTM Technologies

Unimicron Technology Corp

AT&S Austria Technologie & Systemtechnik AG

Fujikura Ltd.

Samsung Electro-Mechanics

Zhen Ding Technology

Compeq Manufacturing Co., Ltd.

Tripod Technology Corporation

Ibiden Co., Ltd.

Daeduck Electronics Co., Ltd.

Meiko Electronics Co., Ltd.

Wus Printed Circuit Co., Ltd.

NCAB Group

Nan Ya PCB Corporation

Shennan Circuits Co., Ltd.

Table of Contents

01. Global High Density Interconnect Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Single Layer, Multi-Layer, High-Density Flexible PCBs)

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Global High Density Interconnect Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (5G Network Proliferation, IoT Expansion, Autonomous Vehicle Integration)

03. Global High Density Interconnect Market Analysis

3.1. Growth Drivers (Miniaturization of Electronic Devices, Demand in Automotive, Wearable Technology Advancements)

3.2. Market Challenges (Complex Manufacturing Process, High Initial Setup Costs, Lack of Skilled Workforce)

3.3. Opportunities (Growing Adoption in Medical Devices, Rising Use in Aerospace, 3D Printing Innovations in PCB Manufacturing)

3.4. Trends (Increasing Use of Laser Drilling, Adoption of Ultra-Thin Substrates, Integration with Advanced Packaging Technologies)

3.5. Government Regulations (Electronics Manufacturing Standards, Import/Export Controls on PCB Components, Environmental Compliance)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (PCB Manufacturers, Component Suppliers, End-User Industries)

3.8. Porters Five Forces (Threat of New Entrants, Bargaining Power of Suppliers, Industry Rivalry)

3.9. Competition Ecosystem

04. Global High Density Interconnect Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. 4-6 Layer HDI PCBs

4.1.2. 8-10 Layer HDI PCBs

4.1.3. 10+ Layer HDI PCBs

4.2. By Application (In Value %)

4.2.1. Automotive Electronics

4.2.2. Consumer Electronics

4.2.3. Medical Devices

4.2.4. Telecommunications

4.2.5. Aerospace and Defense

4.3. By Manufacturing Method (In Value %)

4.3.1. Sequential Lamination

4.3.2. Modified Semi-Additive Process (mSAP)

4.3.3. Any-Layer HDI

4.4. By End-User Industry (In Value %)

4.4.1. OEMs (Original Equipment Manufacturers)

4.4.2. PCB Assembly Companies

4.4.3. EMS (Electronics Manufacturing Services) Providers

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

05. Global High Density Interconnect Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. TTM Technologies

5.1.2. Unimicron Technology Corp

5.1.3. AT&S Austria Technologie & Systemtechnik AG

5.1.4. Compeq Manufacturing Co., Ltd.

5.1.5. Fujikura Ltd.

5.1.6. Samsung Electro-Mechanics

5.1.7. Zhen Ding Technology

5.1.8. Tripod Technology Corporation

5.1.9. Ibiden Co., Ltd.

5.1.10. Daeduck Electronics Co., Ltd.

5.1.11. Meiko Electronics Co., Ltd.

5.1.12. Wus Printed Circuit Co., Ltd.

5.1.13. NCAB Group

5.1.14. Nan Ya PCB Corporation

5.1.15. Shennan Circuits Co., Ltd.

5.2. Cross Comparison Parameters (Revenue, Number of HDI Manufacturing Plants, R&D Expenditure, Market Share, Headquarters, Manufacturing Capacity, Technological Advancements, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Collaborations, Technological Innovations)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Venture Capital Investments, Corporate Investments)

5.7. Private Equity Funding

5.8. Government Grants and Subsidies

06. Global High Density Interconnect Market Regulatory Framework

6.1. Compliance with Environmental Standards (RoHS, WEEE)

6.2. International Trade Regulations (Import/Export Duties, Tariffs on Electronics Components)

6.3. Certifications (ISO 9001, IPC-6012 HDI Standard)

07. Global High Density Interconnect Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Autonomous Vehicles, 5G Network Expansion, Smart Devices)

08. Global High Density Interconnect Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Manufacturing Method (In Value %)

8.4. By End-User Industry (In Value %)

8.5. By Region (In Value %)

09. Global High Density Interconnect Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The research process begins with identifying critical variables influencing the Global High Density Interconnect (HDI) Market. This involves mapping out stakeholders, product categories, and technology developments through comprehensive desk research using proprietary and secondary databases.

Step 2: Market Analysis and Construction

In this step, we analyze historical data and performance trends across the HDI market, covering areas like production scale, market demand, and supply chain dynamics. This helps in constructing an accurate market model.

Step 3: Hypothesis Validation and Expert Consultation

Key hypotheses are developed based on initial market findings and validated through interviews with industry experts from HDI manufacturing companies, ensuring data reliability.

Step 4: Research Synthesis and Final Output

Finally, we engage directly with leading HDI manufacturers to verify insights on market trends, customer preferences, and technical innovations, providing a comprehensive understanding of market dynamics.

Frequently Asked Questions

01. How big is the Global High Density Interconnect Market?

The global HDI market is valued at USD 16.9 billion based on recent industry analysis, driven by advancements in telecommunications, consumer electronics, and automotive technology.

02. What are the challenges in the Global High Density Interconnect Market?

Challenges in the HDI market include the complex manufacturing process, high costs of production, and the need for skilled workforce, particularly in high-layer HDI PCB manufacturing.

03. Who are the major players in the Global High Density Interconnect Market?

Key players include TTM Technologies, Unimicron Technology Corp, AT&S Austria Technologie, Fujikura Ltd., and Samsung Electro-Mechanics, among others. These companies dominate due to their technological advancements and extensive market presence.

04. What are the growth drivers of the Global High Density Interconnect Market?

Growth drivers include the increasing demand for miniaturized electronic devices, rising adoption of 5G technology, and the growing need for high-performance PCBs in the automotive and telecommunications sectors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.