Global Hip Implants Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD2084

November 2024

90

About the Report

Global Hip Implants Market Overview

- The Global Hip Implants Market is valued at approximately USD 9.83 billion, driven by the aging population and increasing demand for advanced orthopedic procedures. The market has witnessed significant advancements, including the use of materials like titanium and ceramic to enhance implant durability. Rising prevalence of osteoarthritis and other degenerative joint diseases has led to an increased adoption of hip replacement surgeries. Technological advancements in implant designs and materials are further fostering market growth.

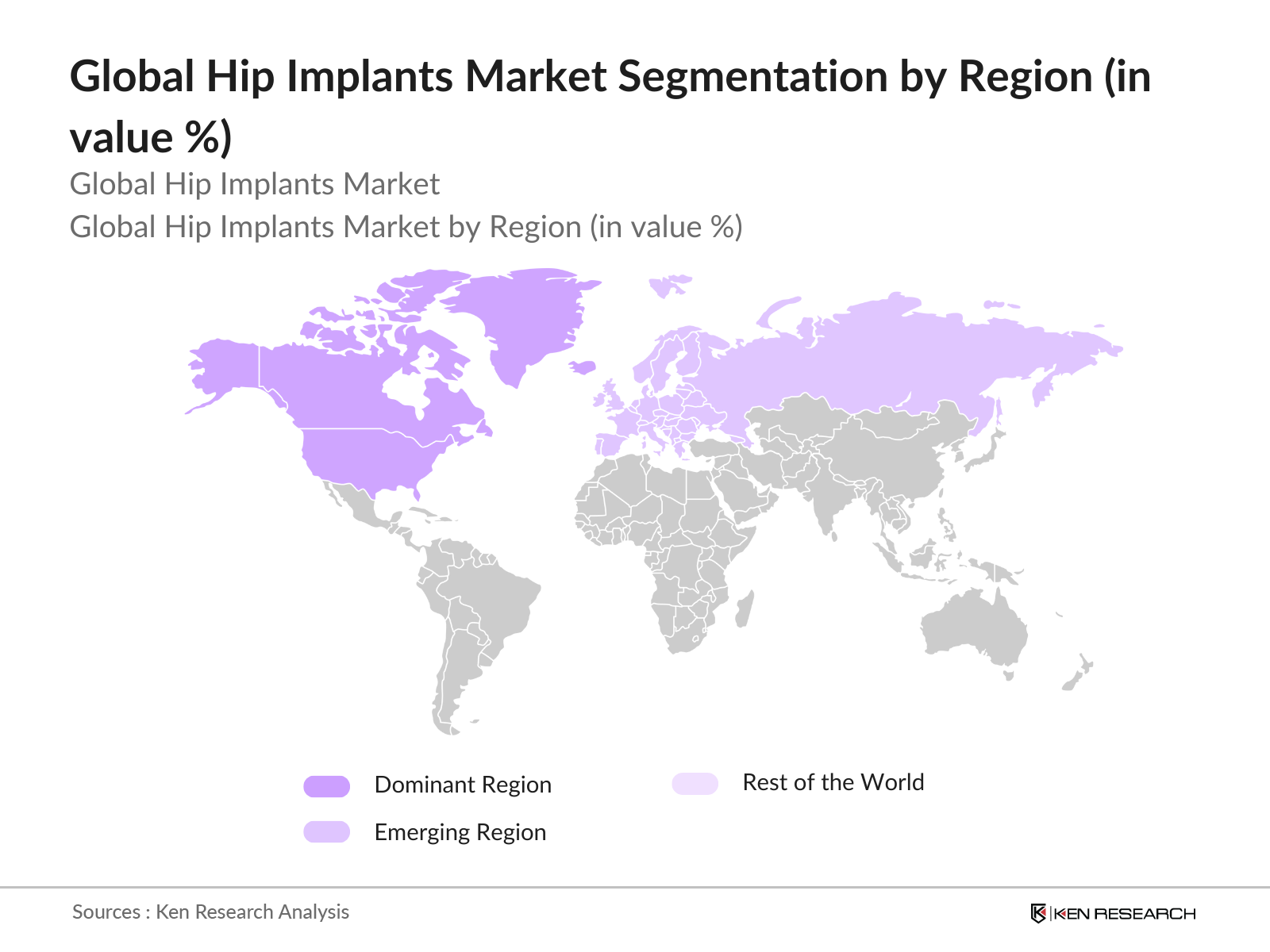

- The United States, Germany, and Japan are dominant players in the hip implants market. These countries have robust healthcare infrastructures, substantial investments in medical research, and high healthcare expenditure per capita. Additionally, favorable reimbursement policies in these regions and the availability of advanced surgical procedures contribute to their leadership in the global hip implants market.

- Governments worldwide are boosting investments in orthopedic research to advance implant technologies and improve patient outcomes. For instance, the U.S. National Institutes of Health allocated approximately USD 620 million in 2023 to orthopedic and musculoskeletal research, supporting innovation in implant materials and techniques. Such funding enables the development of safer, more durable implants and promotes collaborative research initiatives.

Global Hip Implants Market Segmentation

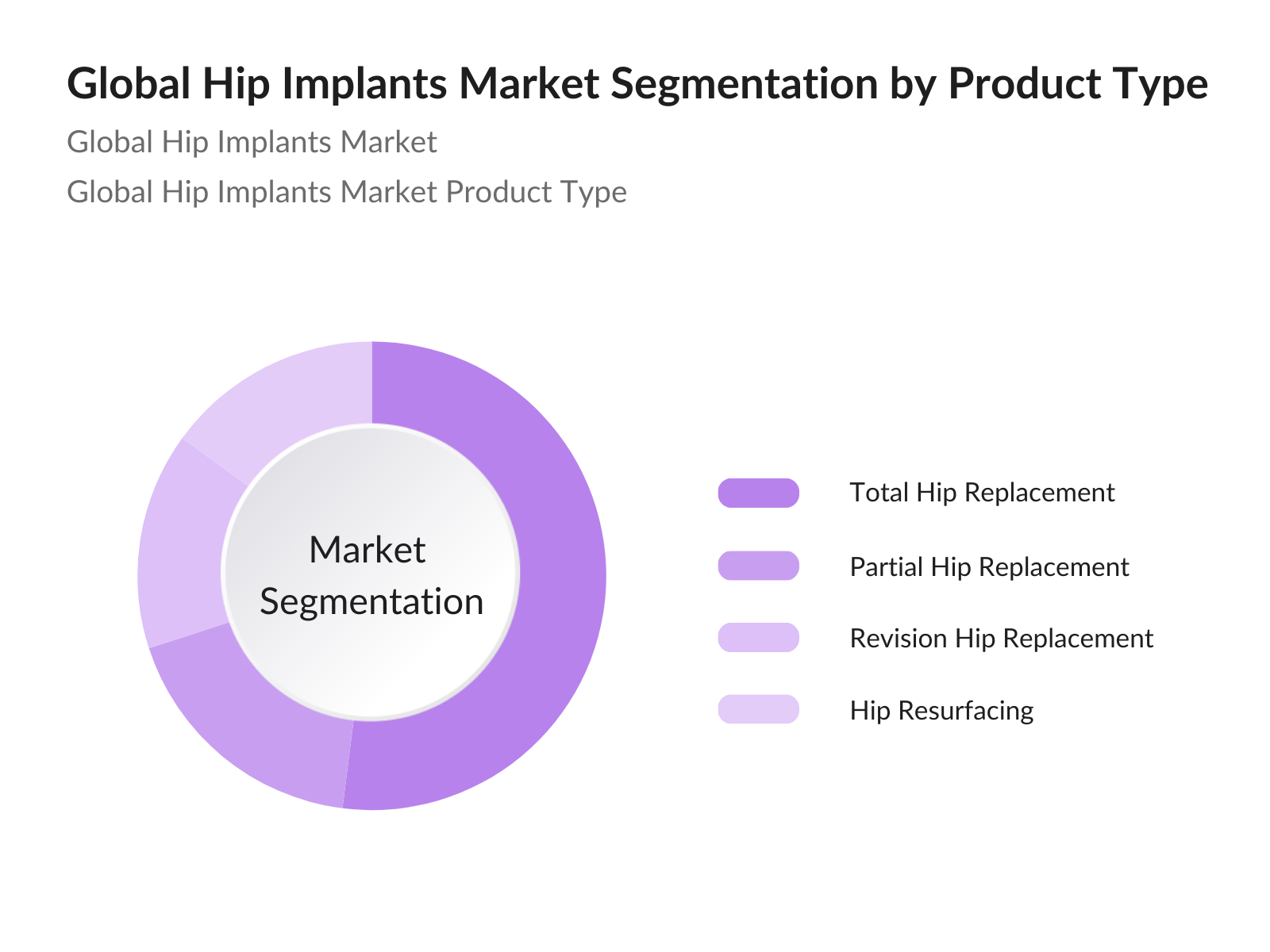

By Product Type: The Global Hip Implants Market is segmented by product type into total hip replacement implants, partial hip replacement implants, revision hip replacement implants, and hip resurfacing implants. Total hip replacement implants currently dominate this segment due to their widespread adoption in both developed and developing regions. These implants are increasingly preferred as they offer a long-term solution for patients with severe joint degeneration, reducing pain and improving mobility.

By Region: The hip implants market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America leads in market share due to the high number of joint replacement surgeries performed annually, advanced healthcare facilities, and well-established reimbursement policies. The region's aging population and high prevalence of lifestyle-related diseases also drive the demand for hip implants.

Global Hip Implants Market Competitive Landscape

The Global Hip Implants Market is characterized by the presence of major players who focus on innovation, partnerships, and acquisitions to strengthen their market position. Key companies continue to invest in research and development to bring advanced and durable implants to market, addressing rising patient demand.

Global Hip Implants Market Analysis

Market Growth Drivers

- Aging Population and Rising Demand for Orthopedic Procedures: The global population aged 65 and older is projected to grow significantly due to rising life expectancy. According to the United Nations, 2024 saw an estimated 820 million individuals aged 65 or older worldwide, leading to an increased demand for hip implants, as joint issues and hip fractures are prevalent in older adults. In the U.S. alone, around 310,000 hip replacement surgeries were performed annually as of 2023 (CDC), highlighting an ongoing demand for orthopedic procedures in aging populations.

- Technological Advancements in Implant Materials (Titanium, Ceramic, Polyethylene): Advanced materials such as titanium alloys, ceramics, and polyethylene have significantly enhanced the durability and biocompatibility of hip implants. Titanium implants offer superior corrosion resistance and lightweight strength, making them widely used globally, according to data from the World Health Organization (WHO) in 2023. The development of polyethylene materials has also led to a marked reduction in wear rates compared to earlier models, further increasing patient preference for these improved materials.

- Increased Prevalence of Osteoarthritis: As of 2024, osteoarthritis affects over 500 million individuals globally, according to the World Bank. A significant portion of these individuals require surgical intervention, including hip replacements. The aging global population has contributed directly to the increasing prevalence of osteoarthritis, which remains one of the primary conditions leading to hip replacement surgeries.

Market Challenges:

- High Cost of Hip Replacement Surgeries: Hip replacement surgeries can cost between USD 30,000 and USD 40,000 in the U.S. without insurance, which restricts access for patients in low-income demographics. According to the Kaiser Family Foundation, many patients in emerging economies are unable to undergo these necessary surgeries due to the high costs involved, limiting treatment accessibility and impacting patient outcomes.

- Limited Reimbursement Policies: Limited reimbursement frameworks in emerging economies constrain market growth, as insurance providers in these regions often cover only a portion of orthopedic procedures. According to 2024 data from the OECD, a significant number of hip surgeries in developing nations received only partial reimbursement, which impacts patient affordability and restricts access to implants.

Global Hip Implants Market Future Outlook

Over the next five years, the Global Hip Implants Market is expected to show steady growth, driven by advancements in biomaterials, an increase in minimally invasive surgeries, and a growing elderly population. Rising awareness of joint health, particularly in emerging markets, along with government support for healthcare infrastructure development, will further propel market expansion. The incorporation of 3D printing in implant manufacturing is anticipated to enhance customization, paving the way for new growth opportunities.

Market Opportunities:

- Adoption of Advanced Biomaterials: The use of advanced biomaterials, such as bioactive glass and hydroxyapatite coatings, is increasingly prevalent in hip implants, offering enhanced biocompatibility and integration with bone tissue. In 2023, healthcare data indicates that bioactive coatings have led to reduced infection rates and improved implant longevity, becoming a standard in high-quality implants. The incorporation of these materials has been instrumental in reducing post-surgery complications and enhancing recovery outcomes.

- Increased Use of 3D-Printed Implants: The adoption of 3D-printed implants for hip replacements is growing, allowing for precise customization according to each patients unique anatomical needs. In 2023, over 8,000 3D-printed hip implants have been utilized in surgeries worldwide, showcasing the shift toward personalized care. This technology significantly reduces rejection rates and allows for faster recovery, making it increasingly popular in advanced healthcare facilities.

Scope of the Report

|

By Product Type |

Total Hip Replacement Implants Revision Hip Replacement Implants |

|

By Material Type |

Metal-on-Metal Implants Metal-on-Polyethylene Implants Ceramic-on-Ceramic Implants Ceramic-on-Metal Implants |

|

By Fixation Type |

Cemented Cementless Hybrid |

|

By End-User |

Hospitals Ambulatory Surgical Centers Orthopedic Clinics |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Orthopedic Surgeons

Hospitals and Ambulatory Surgery Centers

Medical Device Distributors

Research and Development Institutes

Healthcare Procurement Managers

Government and Regulatory Bodies (e.g., FDA, EMA)

Investments and Venture Capitalist Firms

Health Insurance Providers

Companies

Players Mention in the Report

Stryker Corporation

Zimmer Biomet Holdings, Inc.

Johnson & Johnson (DePuy Synthes)

Smith & Nephew plc

B. Braun Melsungen AG

Medtronic plc

MicroPort Scientific Corporation

Exactech, Inc.

DJO Global, Inc.

Conformis, Inc.

Corin Group

Aesculap Implant Systems, LLC

Integra LifeSciences Corporation

Wright Medical Group N.V.

Biomet Inc.

Table of Contents

01. Global Hip Implants Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Key Market Dynamics (Market Drivers, Restraints, Challenges)

1.4. Market Segmentation Overview

1.5. Market Growth Rate

02. Global Hip Implants Market Size (USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Global Hip Implants Market Analysis

3.1. Growth Drivers

3.1.1. Aging Population and Rising Demand for Orthopedic Procedures

3.1.2. Technological Advancements in Implant Materials (Titanium, Ceramic, Polyethylene)

3.1.3. Increased Prevalence of Osteoarthritis

3.1.4. Growing Demand for Minimally Invasive Surgery

3.2. Market Challenges

3.2.1. High Cost of Hip Replacement Surgeries

3.2.2. Limited Reimbursement Policies

3.2.3. Risks of Implant Failure and Revision Surgeries

3.3. Opportunities

3.3.1. Increasing Investment in Healthcare Infrastructure in Emerging Markets

3.3.2. Rising Focus on Personalized and Custom Implants

3.3.3. Surge in Robot-Assisted Surgical Procedures

3.4. Trends

3.4.1. Adoption of Advanced Biomaterials

3.4.2. Increased Use of 3D-Printed Implants

3.4.3. Growth of Ambulatory Surgical Centers

3.5. Regulatory Landscape

3.5.1. FDA Approval Process for Hip Implants

3.5.2. European CE Marking Requirements

3.5.3. ISO Standards for Orthopedic Implants

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

04. Global Hip Implants Market Segmentation

4.1. By Product Type

4.1.1. Total Hip Replacement Implants

4.1.2. Partial Hip Replacement Implants

4.1.3. Revision Hip Replacement Implants

4.1.4. Hip Resurfacing Implants

4.2. By Material Type

4.2.1. Metal-on-Metal Implants

4.2.2. Metal-on-Polyethylene Implants

4.2.3. Ceramic-on-Ceramic Implants

4.2.4. Ceramic-on-Metal Implants

4.3. By Fixation Type

4.3.1. Cemented

4.3.2. Cementless

4.3.3. Hybrid

4.4. By End-User

4.4.1. Hospitals

4.4.2. Ambulatory Surgical Centers

4.4.3. Orthopedic Clinics

4.5. By Region

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

05. Global Hip Implants Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Stryker Corporation

5.1.2. Zimmer Biomet Holdings, Inc.

5.1.3. Johnson & Johnson (DePuy Synthes)

5.1.4. Smith & Nephew plc

5.1.5. B. Braun Melsungen AG

5.1.6. Medtronic plc

5.1.7. MicroPort Scientific Corporation

5.1.8. Exactech, Inc.

5.1.9. DJO Global, Inc.

5.1.10. Conformis, Inc.

5.1.11. Corin Group

5.1.12. Aesculap Implant Systems, LLC

5.1.13. Integra LifeSciences Corporation

5.1.14. Wright Medical Group N.V.

5.1.15. Biomet Inc.

5.2. Cross-Comparison Parameters (Market Share, Revenue, Production Capacity, Product Portfolio, Innovation Focus, Geographical Presence, Distribution Network, Mergers and Acquisitions)

5.3. Market Share Analysis

5.4. Strategic Initiatives and Partnerships

5.5. Mergers and Acquisitions

5.6. Investment Landscape

5.7. Venture Capital Funding

5.8. Government Grants and Initiatives

5.9. Private Equity Investments

06. Global Hip Implants Market Regulatory Framework

6.1. Compliance and Quality Standards

6.2. Certification Processes

6.3. Reimbursement Policies

07. Global Hip Implants Future Market Size (USD Mn)

7.1. Market Forecast Projections

7.2. Key Factors Influencing Future Market Growth

08. Global Hip Implants Market Future Segmentation

8.1. By Product Type

8.2. By Material Type

8.3. By Fixation Type

8.4. By End-User

8.5. By Region

09. Global Hip Implants Market Analysts Recommendations

9.1. Market Expansion Opportunities

9.2. Customer Segment Analysis

9.3. Strategic Partnerships and Alliances

9.4. Emerging Markets and White Space Opportunities

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

This step involves mapping major stakeholders across the Global Hip Implants Market. An extensive desk research was conducted to capture data on market drivers, restraints, and growth opportunities. Proprietary databases and secondary resources were used to validate key variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data on the Global Hip Implants Market was compiled to assess revenue generation, market penetration, and product uptake across various regions. Service quality and implant reliability were also evaluated to ensure accuracy in revenue estimation.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and tested through expert consultations via CATIs with industry specialists. These interviews provided insights into current trends, challenges, and operational dynamics in the hip implants industry.

Step 4: Research Synthesis and Final Output

The final stage involved interaction with multiple hip implant manufacturers to obtain in-depth information on product segments, sales performance, and consumer preferences. This bottom-up approach ensured comprehensive and validated insights into the Global Hip Implants Market.

Frequently Asked Questions

01. How big is the Global Hip Implants Market?

The Global Hip Implants Market is valued at approximately USD 9.83 billion, driven by the rising need for orthopedic solutions and advancements in implant technology.

02. What are the challenges in the Global Hip Implants Market?

Challenges include high costs of surgery, reimbursement issues, and potential risks associated with implant failure, which may lead to revision surgeries and impact market growth.

03. Who are the major players in the Global Hip Implants Market?

Key players include Stryker Corporation, Zimmer Biomet, Johnson & Johnson (DePuy Synthes), Smith & Nephew, and Medtronic plc, who dominate the market with their advanced product portfolios and global presence.

04. What are the growth drivers of the Global Hip Implants Market?

Growth is driven by the aging population, rising prevalence of osteoarthritis, and technological advancements in implant materials like titanium and ceramics for enhanced durability.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.