Global HMD Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD4234

November 2024

90

About the Report

Global HMD Market Overview

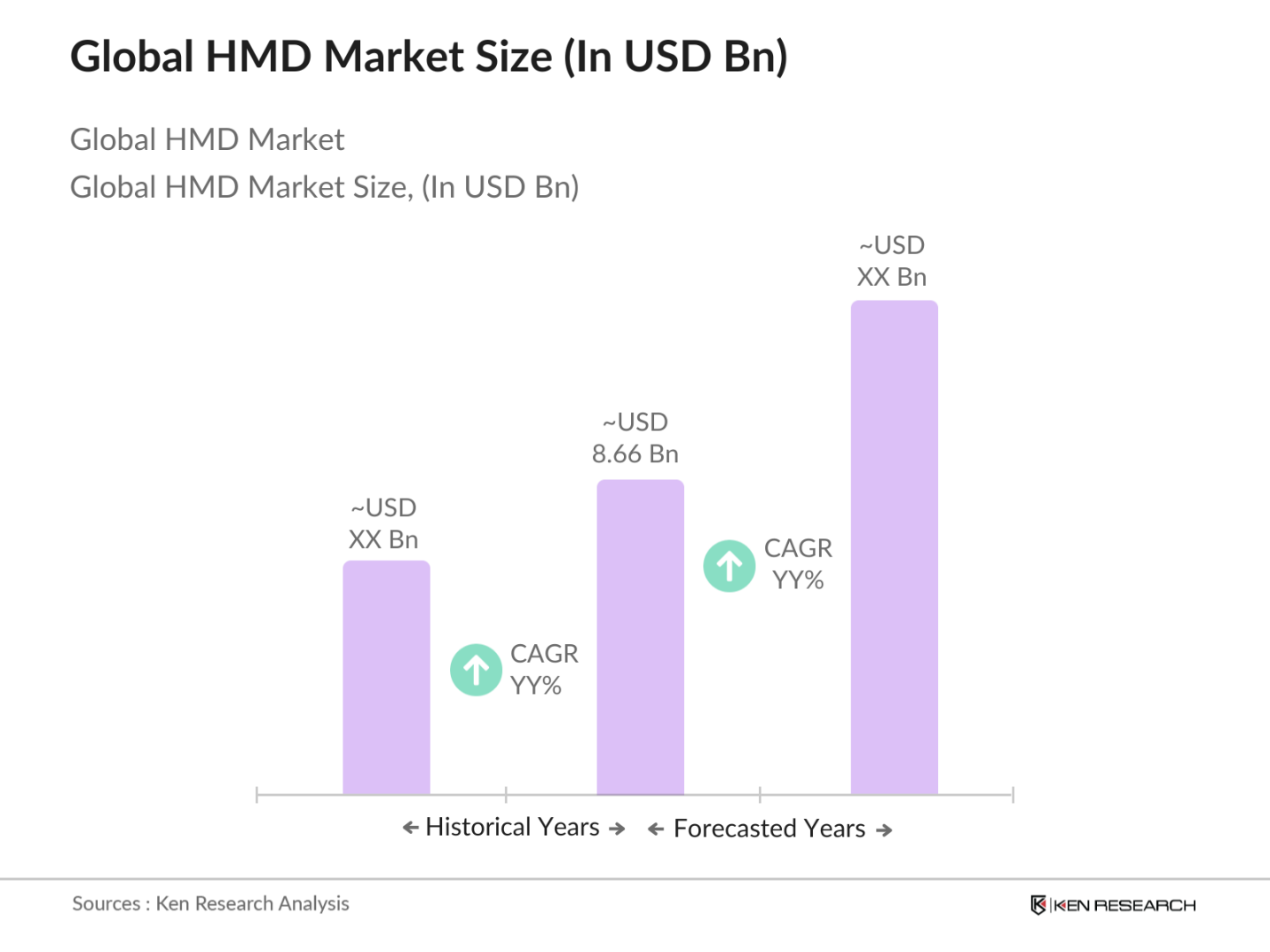

- The global Head-Mounted Display (HMD) market is valued at USD 8.66billion, driven by the rapid adoption of AR/VR technologies across various sectors such as gaming, healthcare, and defense. Technological advancements in display technologies, increased demand for immersive gaming experiences, and the growing application of HMDs in medical training and simulations are significant market drivers.

- Countries like the United States, China, and Japan dominate the HMD market, primarily due to their well-established technology infrastructure and high investments in research and development. The presence of major technology companies and the early adoption of advanced AR/VR technologies in sectors like entertainment and healthcare further strengthen their dominance. In particular, Silicon Valley in the U.S. remains a hub for innovation, while Chinas large manufacturing capabilities and rapid urbanization boost its market presence.

- Governments around the world have started implementing safety standards for HMD usage in various sectors. For example, the European Union has enforced regulations on the electromagnetic exposure of wearable devices, including HMDs, to ensure user safety. In 2023, over 25 countries updated their safety regulations concerning the prolonged use of HMDs, aiming to reduce potential health risks such as eye strain. These regulations are expected to become more stringent as the use of HMDs in professional environments grows.

Global HMD Market Segmentation

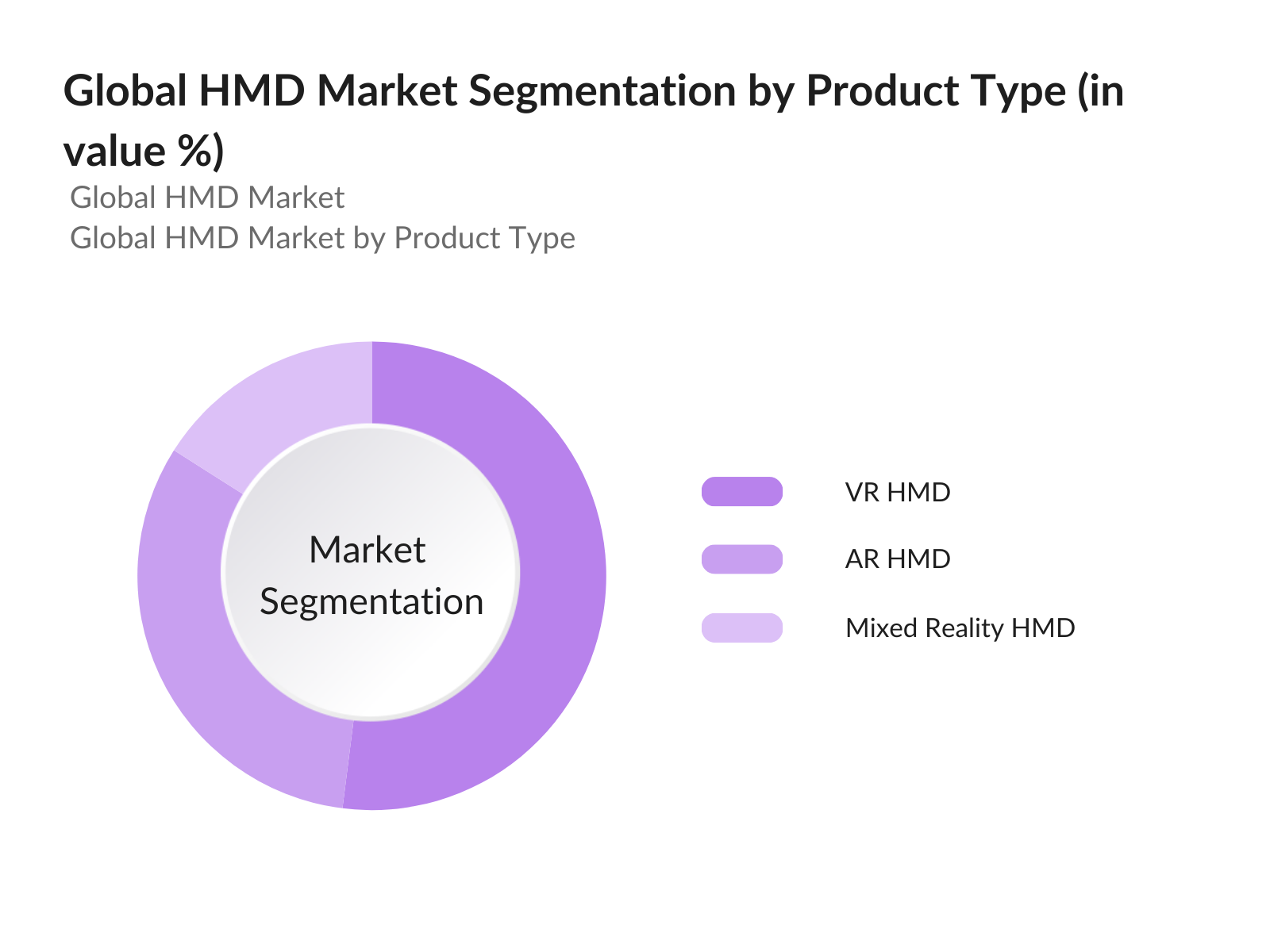

By Product Type: The HMD market is segmented by product type into VR HMD, AR HMD, and Mixed Reality HMD. Among these, VR HMD currently holds the dominant market share due to its widespread adoption in the gaming industry and entertainment sectors. The increasing demand for immersive gaming experiences and the availability of VR content in high-end gaming platforms contribute to the prominence of this segment. With gaming companies like Sony and Meta focusing on innovative VR products, VR HMD remains the leader under this segmentation.

By Region: The HMD market is divided into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads the market owing to the presence of major technology companies, robust infrastructure for AR/VR applications, and a large consumer base. The regions dominance is further supported by substantial investments in research and development by key players like Google, Microsoft, and Meta. Additionally, the high penetration of 5G technology in the region propels the growth of wireless HMDs, facilitating seamless experiences in various applications.

Global HMD Market Competitive Landscape

The global HMD market is dominated by several key players, ranging from technology giants to specialized HMD manufacturers. These companies focus on innovation, product launches, and strategic collaborations to maintain their market positions. The integration of advanced technologies such as AI and machine learning in HMDs has led to competitive differentiation, with companies vying for technological leadership. For instance, Meta and Microsoft continue to innovate in AR/VR space, while companies like Magic Leap focus on enterprise-specific applications.

|

Company |

Established |

Headquarters |

Revenue (USD Bn) |

Product Portfolio |

Technology Focus |

R&D Investments |

Strategic Partnerships |

Global Reach |

|

Sony Corporation |

1946 |

Tokyo, Japan |

76 |

|||||

|

Microsoft Corporation |

1975 |

Redmond, USA |

168 |

|||||

|

Meta Platforms, Inc. |

2004 |

Menlo Park, USA |

117 |

|||||

|

HTC Corporation |

1997 |

Taoyuan, Taiwan |

3.4 |

|||||

|

Google LLC (Alphabet) |

1998 |

Mountain View, USA |

282 |

Global HMD Market Analysis

Market Growth Drivers

- Adoption of AR/VR Technologies: The adoption of Augmented Reality (AR) and Virtual Reality (VR) technologies has rapidly accelerated, driving demand for Head-Mounted Displays (HMDs). According to the World Bank, over 1.6 billion individuals now have access to high-speed internet, enabling greater use of AR/VR in both personal and professional settings. The global increase in internet penetration, alongside significant advancements in AR/VR software development, is creating robust growth in demand for HMDs across industries. Moreover, countries like China and the US, which are pioneers in tech advancements, account for a substantial portion of this growth.

- Increasing Demand for Wearable Devices: Wearable devices, including HMDs, have seen a sharp rise in consumer adoption. Government reports from the US Department of Commerce highlight that nearly 430 million wearable devices were shipped globally in 2023, with a notable portion attributed to HMDs. This increase is primarily driven by technological innovations that integrate health monitoring and user-friendly applications, which enhance user experiences. The shift toward wearable technology in healthcare and fitness is further supported by global macroeconomic trends such as rising disposable income and increasing healthcare expenditures.

- Demand from Defense and Healthcare Sectors: HMDs are becoming critical tools in sectors such as defense and healthcare. The US Department of Defense allocated more than $7 billion in 2023 for the development of AR-based training programs for soldiers. Similarly, healthcare providers in countries like Germany and the UK have adopted HMDs for remote surgeries, patient monitoring, and medical training. These applications significantly reduce the cost of training and enhance efficiency, thereby driving the demand for HMDs in these sectors. The growing need for enhanced visualization tools in defense and healthcare is a key contributor to market growth.

Market Challenges:

- High Development and Manufacturing Costs: The high costs associated with the development and manufacturing of HMDs continue to challenge the industry. For example, the average cost to develop a VR headset ranges from $100 to $250, depending on the components used, according to a study by the World Trade Organization (WTO). These high costs hinder mass adoption, particularly in emerging markets where average purchasing power is lower. Manufacturers face challenges in reducing costs while maintaining the technological sophistication of these devices.

- Limited Battery Life and Power Constraints: HMDs face limitations due to short battery life, which restricts their usability for prolonged periods. A report from the International Energy Agency (IEA) in 2023 highlighted that current battery technologies for wearables, including HMDs, often last between two to four hours under heavy usage. This limitation poses a significant barrier in sectors like healthcare and gaming, where extended device usage is crucial. Furthermore, the demand for higher processing power in HMDs exacerbates these power constraints.

Global HMD Market Future Outlook

Over the next five years, the global HMD market is expected to show significant growth, driven by continuous innovations in AR/VR technologies, the increasing adoption of immersive learning and training in industries such as healthcare and defense, and the expansion of 5G networks. As the demand for more interactive and immersive user experiences grows, HMD technology will become a key enabler in various sectors, from education and healthcare to gaming and enterprise solutions. This growth will be underpinned by strong investments in R&D by key players, further pushing the market towards a more advanced, integrated future.

Market Opportunities:

- Technological Innovations in HMD Components: The HMD market is poised for growth, driven by technological advancements in components such as microdisplays and sensors. Government-backed research programs in countries like Japan and South Korea are pushing the boundaries of display technology, leading to thinner, lighter, and more power-efficient HMDs. For example, microLED technology, which is still in the development phase, is expected to replace OLEDs in next-generation HMDs. This shift in display technology opens significant opportunities for companies aiming to innovate within the HMD space.

- Growing Adoption in Enterprise Applications: Enterprise applications of HMDs are growing rapidly. In 2023, industrial sectors in Europe and North America spent over $1.8 billion on AR/VR technologies for applications such as training, design, and remote collaboration, as reported by the European Commission. The use of HMDs in industries such as automotive, aerospace, and logistics is rising, helping companies improve productivity and safety in the workplace. Enterprises are also leveraging HMDs for data visualization and simulation, making them an integral part of future industrial operations.

Scope of the Report

|

By Product Type |

VR HMD AR HMD Mixed Reality HMD |

|

By Application |

Gaming Entertainment Healthcare Military & Defense Enterprise |

|

By Component |

Display Panel Sensors Processor Optics Others (Head Strap, Cables) |

|

By Connectivity |

Wired HMD Wireless HMD |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Technology Manufacturers

Consumer Electronics Retailers

AR/VR Hardware and Software Providers

Healthcare Training and Simulation Providers

Defense Contractors

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., FCC, European Telecommunications Standards Institute)

Gaming and Entertainment Companies

Companies

Players Mention in the Report

Sony Corporation

Microsoft Corporation

Meta Platforms, Inc. (Oculus VR)

HTC Corporation

Google LLC (Alphabet)

Samsung Electronics Co., Ltd.

Vuzix Corporation

Magic Leap, Inc.

Lenovo Group Limited

Panasonic Corporation

Varjo Technologies

RealWear, Inc.

Pimax Technology

Apple Inc.

Avegant Corporation

Table of Contents

01. Global HMD Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Global HMD Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Global HMD Market Analysis

3.1. Growth Drivers

3.1.1. Adoption of AR/VR Technologies

3.1.2. Increasing Demand for Wearable Devices

3.1.3. Rise in Gaming and Entertainment Sectors

3.1.4. Demand from Defense and Healthcare Sectors

3.2. Market Challenges

3.2.1. High Development and Manufacturing Costs

3.2.2. Limited Battery Life and Power Constraints

3.2.3. Privacy and Data Security Concerns

3.3. Opportunities

3.3.1. Technological Innovations in HMD Components

3.3.2. Growing Adoption in Enterprise Applications

3.3.3. Expansion of 5G Networks and IoT Integration

3.4. Trends

3.4.1. Lightweight and Compact HMD Designs

3.4.2. Integration with AI and Machine Learning

3.4.3. Immersive Training and Simulation Applications

3.5. Government Regulations

3.5.1. Industry-Specific Safety Standards

3.5.2. Privacy Regulations and Data Compliance

3.5.3. International Trade Policies for Electronics

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

04. Global HMD Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. VR HMD

4.1.2. AR HMD

4.1.3. Mixed Reality HMD

4.2. By Application (In Value %)

4.2.1. Gaming

4.2.2. Entertainment

4.2.3. Healthcare

4.2.4. Military & Defense

4.2.5. Enterprise

4.3. By Component (In Value %)

4.3.1. Display Panel

4.3.2. Sensors (Gyroscopes, Accelerometers)

4.3.3. Processor

4.3.4. Optics

4.3.5. Others (Head Strap, Cables)

4.4. By Connectivity (In Value %)

4.4.1. Wired HMD

4.4.2. Wireless HMD

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

05. Global HMD Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Sony Corporation

5.1.2. Microsoft Corporation

5.1.3. Oculus (Meta Platforms, Inc.)

5.1.4. HTC Corporation

5.1.5. Samsung Electronics Co., Ltd.

5.1.6. Vuzix Corporation

5.1.7. Magic Leap, Inc.

5.1.8. Google LLC (Alphabet Inc.)

5.1.9. Panasonic Corporation

5.1.10. Lenovo Group Limited

5.1.11. Varjo Technologies

5.1.12. RealWear, Inc.

5.1.13. Pimax Technology

5.1.14. Apple Inc.

5.1.15. Avegant Corporation

5.2. Cross Comparison Parameters

(Revenue, Headquarters, Market Share, Product Portfolio, Technology Focus, R&D Investments, Strategic Partnerships, Global Reach)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers & Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

06. Global HMD Market Regulatory Framework

6.1. Industry Standards and Certifications

6.2. Compliance Requirements

6.3. Certification Processes

07. Global HMD Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08. Global HMD Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Component (In Value %)

8.4. By Connectivity (In Value %)

8.5. By Region (In Value %)

09. Global HMD Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves creating an ecosystem map, identifying all major stakeholders in the HMD market. This step leverages secondary research from industry reports, proprietary databases, and publicly available market data to define the variables influencing market growth, including technological innovations and regulatory factors.

Step 2: Market Analysis and Construction

In this step, we compile and analyze historical data from various secondary sources to assess trends in market penetration, consumer demand, and regional dynamics. This analysis also considers competitive strategies and the technological landscape shaping the market.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated based on the gathered data, which are then validated through interviews with key industry experts. These consultations provide deep insights into market trends, challenges, and emerging opportunities, ensuring data accuracy and industry relevance.

Step 4: Research Synthesis and Final Output

The final phase includes synthesizing the gathered data into a comprehensive market report. Primary insights from HMD manufacturers and technology providers are incorporated to validate market forecasts and projections, ensuring a complete understanding of market dynamics and future outlook.

Frequently Asked Questions

01. How big is the global HMD market?

The global HMD market is valued at USD 8.66billion, driven by the increasing adoption of AR/VR technologies across gaming, healthcare, and military sectors.

02. What are the challenges in the global HMD market?

Key challenges include high production costs, limited battery life, and privacy concerns. Ensuring data security and user privacy in AR/VR applications remains a pressing issue for HMD manufacturers.

03. Who are the major players in the global HMD market?

Major players include Sony Corporation, Meta Platforms (Oculus VR), Microsoft Corporation, HTC Corporation, and Google (Alphabet). These companies lead due to their strong innovation capabilities and significant R&D investments.

04. What are the growth drivers of the global HMD market?

Growth drivers include the increasing adoption of HMDs in gaming, healthcare, and defense sectors, as well as technological advancements in AR/VR. The expansion of 5G networks is also accelerating the development of more advanced HMDs.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.