Global Home Appliances Market Outlook to 2030

Region:Global

Author(s):Sanjeev kumar

Product Code:KROD11034

December 2024

92

About the Report

Global Home Appliances Market Overview

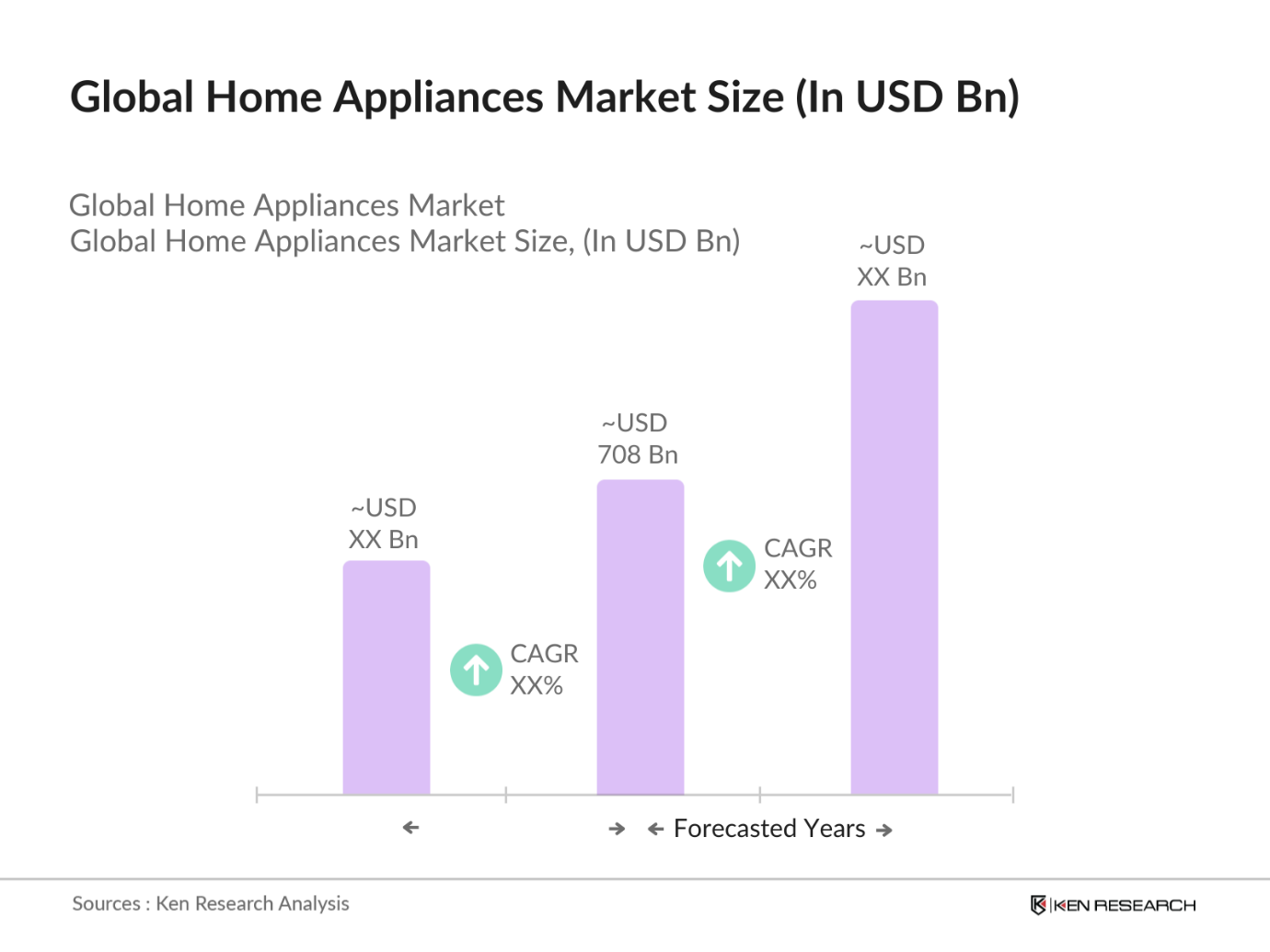

- The global home appliances market is valued at USD 708 billion, driven by rapid urbanization, increasing disposable incomes, and growing consumer demand for technologically advanced and energy-efficient products. The market has shown consistent growth over the past five years, as rising consumer awareness around energy conservation and government incentives for sustainable products drive demand for smart home appliances. The increased integration of IoT and AI in appliances, such as smart refrigerators and washing machines, has also contributed to this growth, with consumers willing to invest in premium products that offer greater convenience and connectivity.

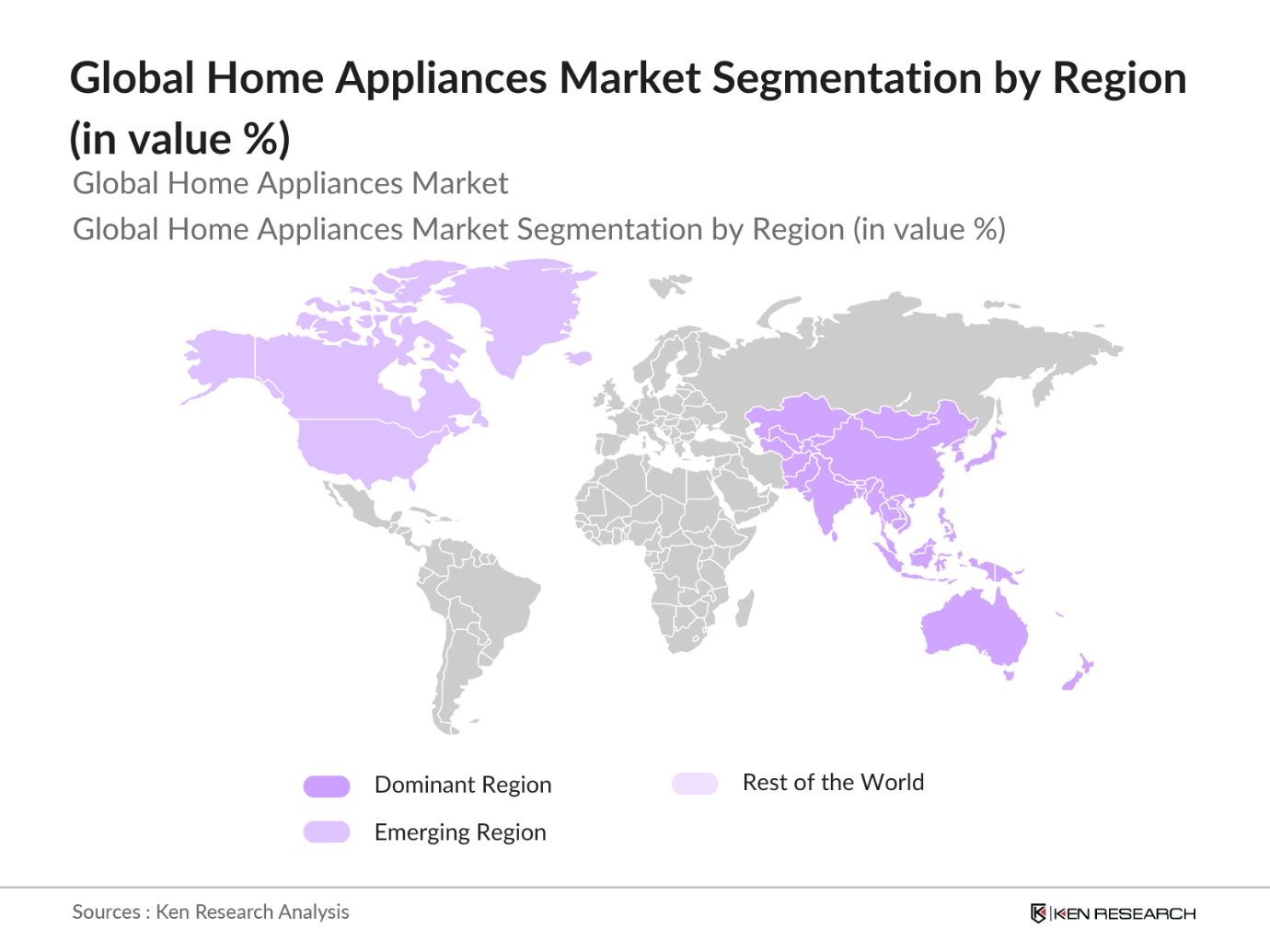

- The dominant regions in the global home appliances market include North America, Europe, and Asia-Pacific. In particular, countries like the U.S., China, and Japan lead the market due to their high levels of technological advancement, robust consumer bases, and strong manufacturing sectors. China, in particular, holds a significant portion of the market, fueled by its massive domestic demand and status as a global manufacturing hub. The presence of key players, extensive distribution networks, and high consumer spending on smart and innovative home products have solidified these regions dominance in the market.

- Government mandates on energy efficiency continue to evolve, with the U.S. Department of Energy updating its appliance standards in 2023 to require a 30% reduction in energy consumption for all new refrigerators sold from 2024 onwards. Similar standards have been adopted in the EU, where energy-efficient ratings are now mandatory for all household appliances. This shift is expected to lead to significant reductions in household energy usage, aligning with global sustainability goals.

Global Home Appliances Market Segmentation

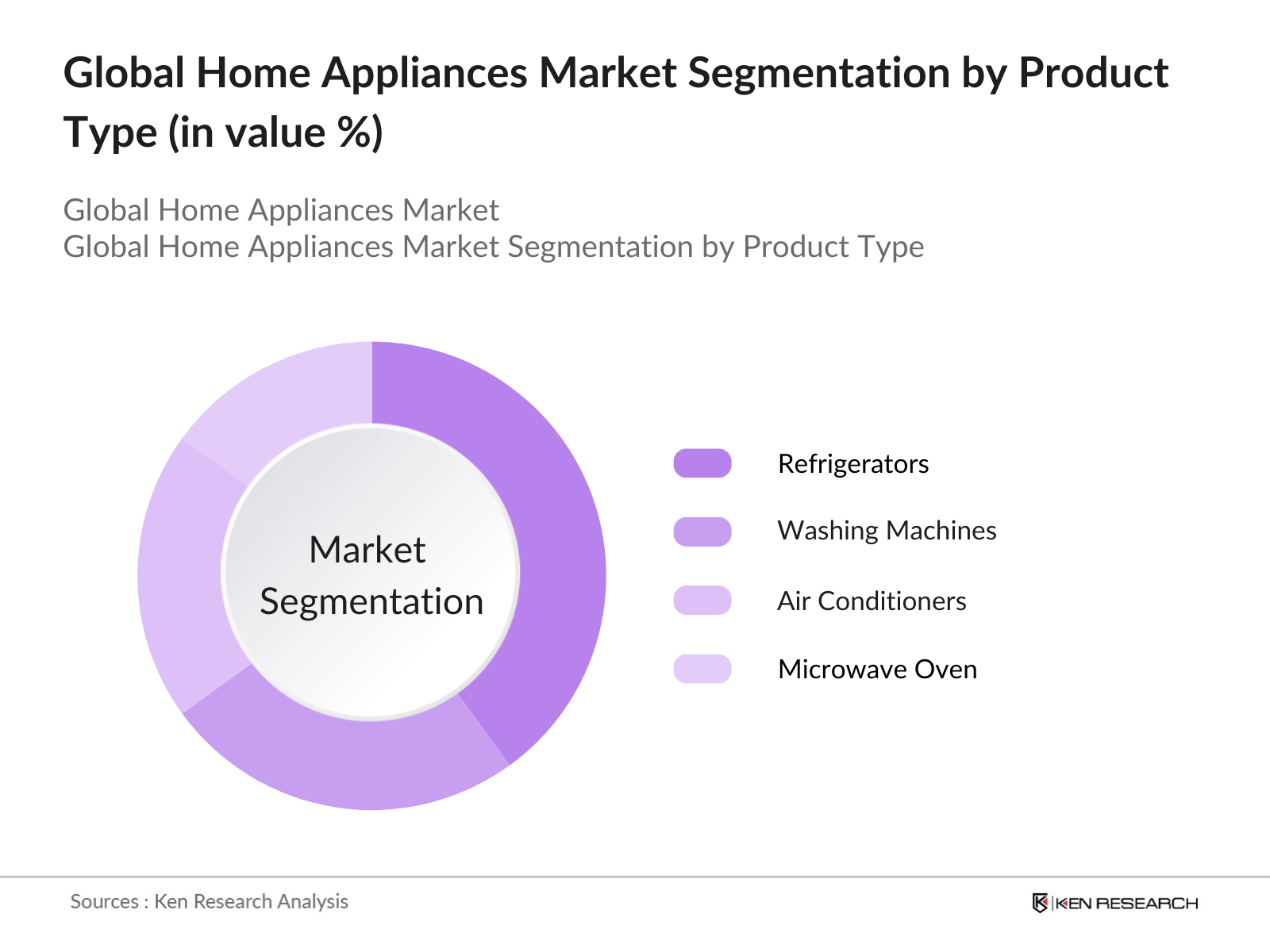

- By Product Type: The global home appliances market is segmented by product type into refrigerators, washing machines, air conditioners, microwave ovens, and vacuum cleaners. Recently, refrigerators have a dominant market share within this segmentation. This is due to increasing consumer demand for smart and energy-efficient models, coupled with government regulations promoting energy conservation. Additionally, technological advancements such as IoT-enabled refrigerators with smart features like temperature control and food management systems have gained popularity, particularly among tech-savvy consumers in developed economies.

- By Region: Geographically, the home appliances market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Asia-Pacific holds the largest market share, with countries like China and India leading the region due to their vast populations, increasing disposable incomes, and growing urbanization. The demand for affordable and energy-efficient appliances in these countries is a significant growth driver. North America follows, with a high adoption rate of premium and smart appliances, driven by tech-savvy consumers and higher spending power.

- By Application: The home appliances market can also be segmented by application into residential and commercial uses. Residential applications dominate the market due to the rising consumer focus on home automation, smart living, and energy efficiency. This growth is largely driven by the middle and upper-class segments that are increasingly adopting smart appliances. Commercial applications, while smaller, are also experiencing growth, particularly in sectors like hospitality and healthcare where high-capacity appliances are in demand for efficiency and bulk usage.

Global Home Appliances Market Competitive Landscape

The global home appliances market is dominated by a few major players with a strong international presence. These companies have established their dominance through a combination of technological innovation, large-scale manufacturing, and extensive distribution networks. Key market players continue to invest heavily in R&D to develop energy-efficient and smart appliances that meet the evolving demands of consumers.

Global Home Appliances Industry Analysis

Growth Drivers

- Increasing Disposable Income: As of 2024, global disposable income levels have seen a noticeable increase, particularly in developing regions. The IMF reports that household disposable income in India, for example, reached over USD 2,200 per capita in 2023, up from USD 1,950 in 2022. This rise has driven demand for home appliances like refrigerators, washing machines, and air conditioners. A similar trend is observed in Brazil, where disposable income reached USD 10,000 per capita in 2024, encouraging consumer spending on mid-to-high-end home appliances. This shift supports the market's expansion across both emerging and developed markets.

- Rising Urbanization: The global urban population continues to grow, with the World Bank reporting that over 56% of the worlds population now resides in urban areas. In countries such as China, urbanization has reached 65.2% as of 2024, fueling demand for more efficient and compact home appliances. Urban households tend to invest in smaller, multifunctional devices to suit apartment living. The growth in urban infrastructure has supported a 12 million unit rise in home appliance sales in metropolitan cities worldwide, reflecting consumer lifestyle shifts linked to rapid urbanization.

- Technological Advancements: Technological innovation in the home appliances market has surged, with over 50 million smart home devices sold in 2024, according to global customs data. Advanced AI-driven appliances such as self-cleaning ovens and voice-controlled washing machines have entered mainstream markets. For example, South Korea has recorded a 27% increase in smart appliance production, reflecting a trend where manufacturers capitalize on AI and IoT integration to enhance energy efficiency and user convenience. This demand is particularly evident in the United States, where smart appliance penetration now exceeds 40% of households.

Market Restraints

- Energy Efficiency Regulations: Government regulations on energy efficiency have become stricter in 2024, with over 45 countries now enforcing mandatory energy consumption limits on household appliances. The European Union, for instance, has introduced regulations that require all washing machines sold after 2023 to consume no more than 50 liters of water per cycle, significantly impacting manufacturers production lines. Compliance costs in the industry are estimated to have risen by USD 4 billion globally in 2024, adding complexity to the manufacturing process and pushing manufacturers to invest in more sustainable technologies.

- Fluctuating Raw Material Prices: The cost of raw materials such as steel, copper, and aluminum, essential for home appliance production, has fluctuated sharply. Data from the World Bank reveals that the global price of steel reached USD 680 per metric ton in mid-2024, driven by supply chain disruptions and increased demand in construction. Similarly, copper prices hit USD 9,250 per ton, reflecting its extensive use in wiring and appliance components. These price variations have strained profit margins for appliance manufacturers, especially in regions where imports play a significant role in raw material supply.

Global Home Appliances Market Future Outlook

Over the next five years, the global home appliances market is expected to show significant growth, driven by technological advancements, increased adoption of smart home technologies, and rising demand for energy-efficient products. The push for sustainability, with stricter government regulations and incentives for energy-efficient appliances, will likely propel the development of green technologies in the sector. Additionally, growing consumer awareness about environmental impact and the benefits of smart homes will continue to drive market expansion.

Market Opportunities

- Growth in E-Commerce: E-commerce continues to expand as a key sales channel for home appliances, with online platforms facilitating USD 350 billion in global appliance sales in 2024. China remains a leader in this space, accounting for nearly 45% of global online home appliance sales. The pandemic-driven surge in online shopping has led to significant investment in logistics infrastructure by retailers, increasing the availability of appliances in rural and semi-urban areas. Companies that optimize their e-commerce platforms are poised to capture a growing share of the market.

- Increased Demand in Emerging Markets: Emerging markets such as India, Brazil, and South Africa are witnessing significant growth in home appliance demand, driven by rising incomes and increased electrification. The Indian governments rural electrification program added over 30 million new households to the grid between 2022 and 2024, facilitating access to basic home appliances like refrigerators and microwaves. Brazil, too, saw a rise in appliance sales, with a 9 million unit increase in 2024 alone, supported by favorable government policies and improved infrastructure. These markets present substantial growth potential.

Scope of the Report

|

Product Type |

Refrigerators, Washing Machines, Air Conditioners, Microwave Ovens, Vacuum Cleaners |

|

Application |

Residential, Commercial |

|

Technology |

Conventional Appliances, Smart Appliances |

|

Energy Efficiency Rating |

A+++ to A+ Rated, B Rated, C Rated |

|

Region |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Products

Key Target Audience

Home Appliance Manufacturers

Suppliers and Distributors of Home Appliances

Consumer Electronics Retailers

Government and Regulatory Bodies (e.g., U.S. Environmental Protection Agency, European Commission)

Investor and Venture Capitalist Firms

Smart Home Technology Providers

Energy Efficiency Certification Agencies (e.g., Energy Star, Ecolabel)

Consumer Advocacy Groups

Companies

Players Mentioned in the Report:

Whirlpool Corporation

LG Electronics Inc.

Samsung Electronics Co. Ltd.

Haier Group Corporation

Electrolux AB

Panasonic Corporation

Bosch Home Appliances

Midea Group

Hitachi Appliances Inc.

Gree Electric Appliances

Arcelik A.S.

GE Appliances

Sharp Corporation

Daikin Industries Ltd.

Godrej Group

Table of Contents

1. Global Home Appliances Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Home Appliances Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Home Appliances Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Disposable Income

3.1.2. Rising Urbanization

3.1.3. Technological Advancements

3.1.4. Shift Towards Smart Home Solutions

3.2. Market Challenges

3.2.1. Energy Efficiency Regulations

3.2.2. Fluctuating Raw Material Prices

3.2.3. High Initial Investment in Smart Appliances

3.3. Opportunities

3.3.1. Growth in E-Commerce

3.3.2. Increased Demand in Emerging Markets

3.3.3. Government Incentives for Energy-Efficient Appliances

3.4. Trends

3.4.1. Adoption of IoT and Smart Devices

3.4.2. Shift to Energy-Efficient Products

3.4.3. Rise of Subscription Models for Home Appliances

3.5. Government Regulation

3.5.1. Energy Efficiency Standards

3.5.2. Import and Export Regulations

3.5.3. Product Safety Standards

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Distributors, Retailers, Consumers)

3.8. Porters Five Forces

3.9. Competitive Landscape Overview

4. Global Home Appliances Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Refrigerators

4.1.2. Washing Machines

4.1.3. Air Conditioners

4.1.4. Microwave Ovens

4.1.5. Vacuum Cleaners

4.2. By Application (In Value %)

4.2.1. Residential

4.2.2. Commercial

4.3. By Technology (In Value %)

4.3.1. Conventional Appliances

4.3.2. Smart Appliances

4.4. By Energy Efficiency Rating (In Value %)

4.4.1. A+++ to A+ Rated

4.4.2. B Rated

4.4.3. C Rated

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Home Appliances Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Whirlpool Corporation

5.1.2. LG Electronics Inc.

5.1.3. Samsung Electronics Co. Ltd.

5.1.4. Electrolux AB

5.1.5. Haier Group Corporation

5.1.6. Panasonic Corporation

5.1.7. Midea Group

5.1.8. Bosch Home Appliances

5.1.9. GE Appliances

5.1.10. Hitachi Appliances Inc.

5.1.11. Sharp Corporation

5.1.12. Gree Electric Appliances

5.1.13. Arcelik A.S.

5.1.14. Daikin Industries Ltd.

5.1.15. Godrej Group

5.2. Cross Comparison Parameters

Revenue

Product Portfolio

R&D Investment

Geographic Presence

Technological Innovation

Sustainability Initiatives

Energy Efficiency Solutions

Customer Satisfaction Index

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Home Appliances Market Regulatory Framework

6.1. Energy Efficiency Standards

6.2. Product Certification

6.3. Trade Regulations and Tariffs

6.4. Environmental Regulations

7. Global Home Appliances Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Home Appliances Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Energy Efficiency Rating (In Value %)

8.5. By Region (In Value %)

9. Global Home Appliances Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involved identifying the key variables impacting the global home appliances market, including technological advancements, energy efficiency regulations, and consumer behavior. A thorough review of secondary sources, including government reports and industry databases, was conducted to map the market ecosystem.

Step 2: Market Analysis and Construction

In this step, historical market data was compiled to analyze the market penetration of different home appliance categories. The focus was on evaluating the revenue generation of smart appliances versus conventional models, and the influence of energy efficiency standards.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed based on the data and subsequently validated through interviews with industry experts from leading home appliance manufacturers. These consultations provided insights into operational strategies and emerging trends in the sector.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing the research findings and validating the market data through direct engagement with key manufacturers. This ensured a comprehensive and accurate analysis of the global home appliances market.

Frequently Asked Questions

01. How big is the global home appliances market?

The global home appliances market is valued at USD 708 billion, driven by rising consumer demand for energy-efficient products, increased disposable incomes, and the growing popularity of smart home appliances.

02. What are the challenges in the global home appliances market?

Challenges in the market include fluctuating raw material prices, stringent energy efficiency regulations, and the high cost of smart appliances, which can deter price-sensitive consumers in emerging markets.

03. Who are the major players in the global home appliances market?

Key players in the market include Whirlpool Corporation, LG Electronics Inc., Samsung Electronics Co. Ltd., Haier Group Corporation, and Electrolux AB. These companies dominate due to their extensive product portfolios and strong global distribution networks.

04. What are the growth drivers of the global home appliances market?

Growth drivers include the increasing adoption of smart home technologies, rising disposable incomes, and government incentives promoting energy-efficient appliances. Consumer demand for convenience and technological innovation further fuels market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.