Region:Global

Author(s):Geetanshi

Product Code:KRAA0022

Pages:95

Published On:August 2025

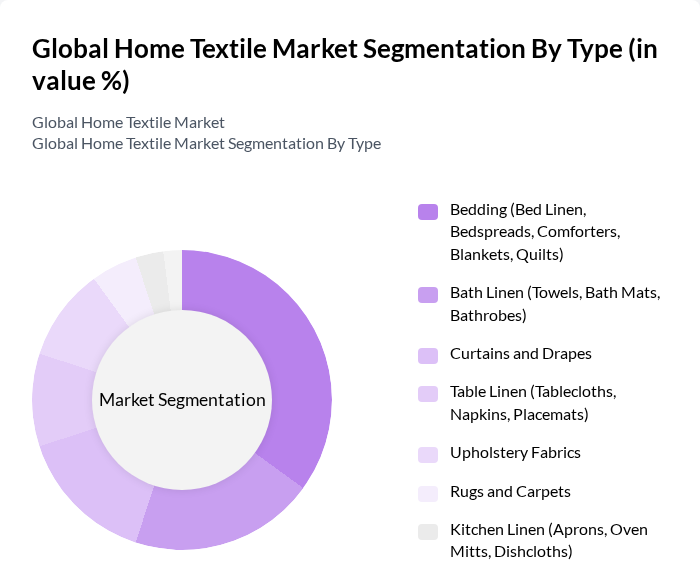

By Type:The market is segmented into various types of home textiles, including bedding, bath linen, curtains, table linen, upholstery fabrics, rugs, kitchen linen, and others. Among these, bedding products—which encompass bed linen, bedspreads, comforters, blankets, and quilts—dominate the market due to their essential role in home comfort and aesthetics. The increasing trend of personalized, luxury, and sustainable bedding options, as well as the adoption of smart textiles and digital printing technologies, has further fueled this segment's growth .

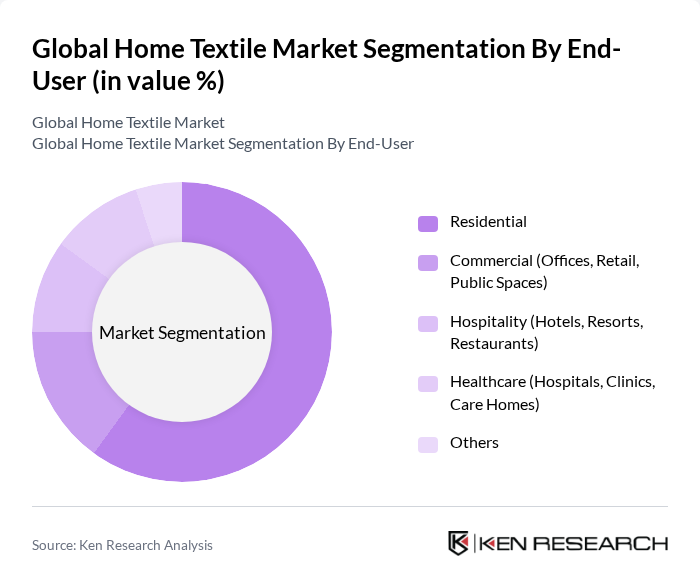

By End-User:The home textile market is also segmented by end-user categories, including residential, commercial, hospitality, healthcare, and others. The residential segment holds the largest share, driven by the increasing trend of home decoration, renovation, and the influence of digital platforms on consumer purchasing behavior. Consumers are investing more in home textiles to enhance their living spaces, with a growing preference for sustainable and customizable products .

The Global Home Textile Market is characterized by a dynamic mix of regional and international players. Leading participants such as Welspun India Ltd., Trident Group, Bombay Dyeing, Inter IKEA Holding BV (IKEA), Springs Global, Ralph Lauren Home, Target Corporation, Bed Bath & Beyond Inc., Mohawk Industries, Shahi Exports, Culp, Inc., Loftex China, S. Kumars Nationwide Ltd., American Textile Company, Sunvim Group, Williams-Sonoma, Inc., Steinhoff International Holdings NV, The Home Depot Inc., Macy's Inc., Amazon.com Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the home textile market in None appears promising, driven by increasing consumer awareness of sustainability and the growing trend of online shopping. As disposable incomes rise, consumers are likely to invest more in quality home textiles, particularly those that are eco-friendly. Additionally, technological advancements in textile production are expected to enhance product offerings, making them more appealing to a broader audience. The integration of smart textiles will further revolutionize the market landscape, creating new opportunities for growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Bedding (Bed Linen, Bedspreads, Comforters, Blankets, Quilts) Bath Linen (Towels, Bath Mats, Bathrobes) Curtains and Drapes Table Linen (Tablecloths, Napkins, Placemats) Upholstery Fabrics Rugs and Carpets Kitchen Linen (Aprons, Oven Mitts, Dishcloths) Others |

| By End-User | Residential Commercial (Offices, Retail, Public Spaces) Hospitality (Hotels, Resorts, Restaurants) Healthcare (Hospitals, Clinics, Care Homes) Others |

| By Distribution Channel | Online Retail (E-commerce, Direct-to-Consumer) Offline Retail (Department Stores, Specialty Stores) Direct Sales Wholesale Others |

| By Material | Cotton Polyester Linen Silk Wool Blends (Poly-cotton, Cotton-linen, etc.) Specialty & Recycled Fibers Others |

| By Design | Printed Embroidered Solid Textured Jacquard & Woven Patterns Others |

| By Price Range | Budget Mid-range Premium Luxury Others |

| By Region | North America (US, Canada, Mexico) Europe (UK, Germany, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Australia, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Bedding Products | 100 | Product Managers, Retail Buyers |

| Upholstery Fabrics | 60 | Interior Designers, Fabric Suppliers |

| Window Treatments | 50 | Home Decor Retailers, Purchasing Agents |

| Textile Sustainability Initiatives | 40 | Sustainability Managers, Corporate Social Responsibility Officers |

| Consumer Preferences in Home Textiles | 80 | End Consumers, Homeowners |

The Global Home Textile Market is valued at approximately USD 140 billion, driven by factors such as increasing consumer spending on home decor, rising disposable incomes, and a growing trend towards home improvement and renovation.