Global Hot Sauce Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD4472

December 2024

99

About the Report

Global Hot Sauce Market Overview

- The global hot sauce market is valued at USD 2.84 billion, driven by increasing consumer demand for spicy foods, cultural trends, and its use in diverse cuisines. This growth is attributed to the rising popularity of spicy condiments across different demographics, with hot sauce becoming a staple in household kitchens and restaurants. The expanding trend of vegan diets and the health benefits associated with capsaicin, found in chili peppers, also play a significant role in driving the market forward.

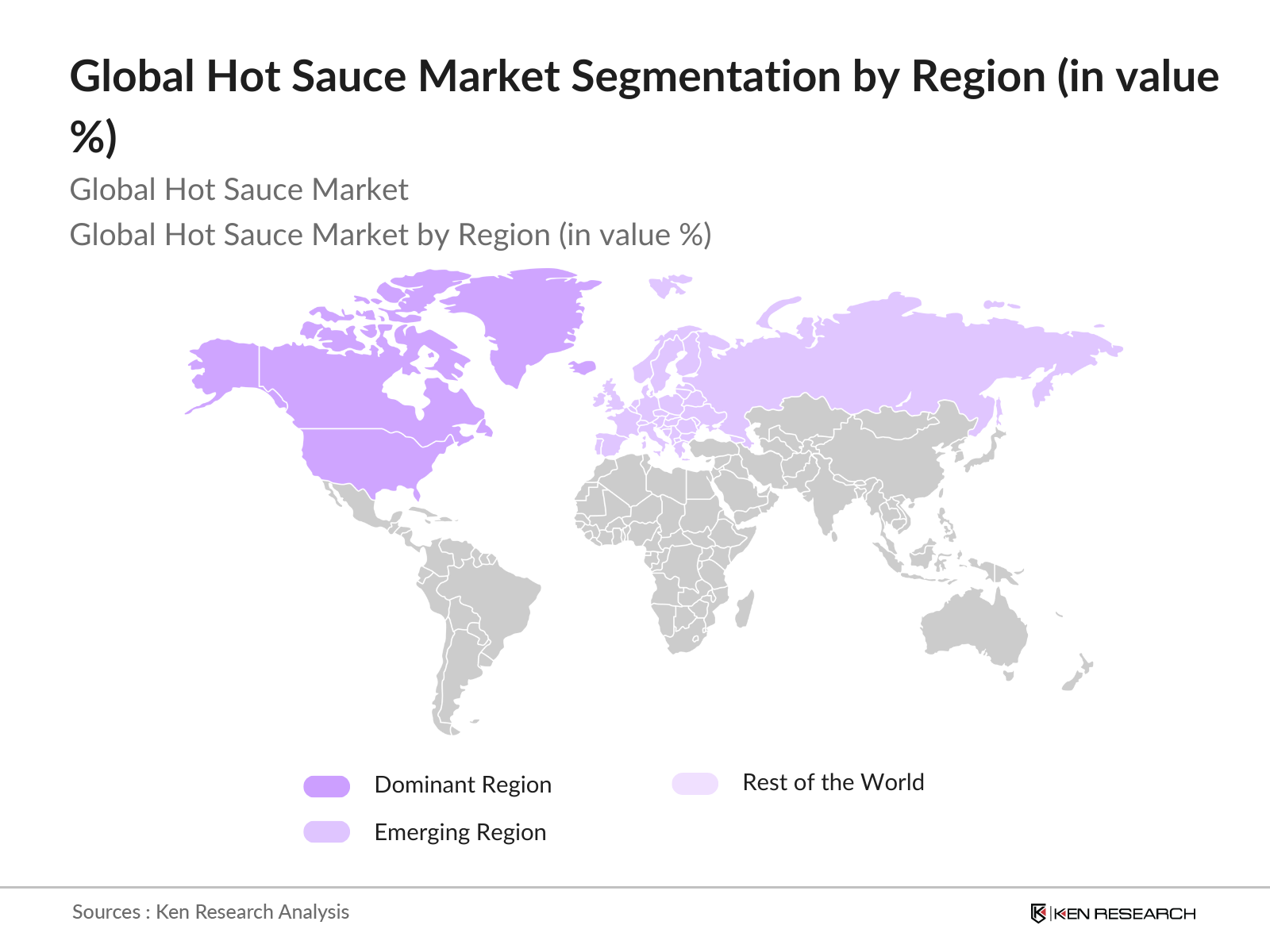

- North America and Latin America are dominant players in the global hot sauce market, with the United States and Mexico being key contributors. This dominance is due to the ingrained cultural preference for spicy foods in these regions, alongside a robust foodservice industry. Additionally, countries like India and Thailand are gaining ground, driven by the rising demand for spicier flavors and the influence of traditional spicy cuisines on global food trends.

- The U.S. FSMA has set new standards for food safety, impacting the production and distribution of hot sauces. Under the FSMA's Preventive Controls for Human Food rule, all hot sauce manufacturers must comply with stringent requirements for safe production processes, including hazard analysis and risk-based preventive controls. The FDA reported that compliance audits in 2023 resulted in the recall of several non-compliant batches of hot sauces, demonstrating the importance of adhering to these regulations.

Global Hot Sauce Market Segmentation

By Sauce: The global hot sauce market is segmented by sauce type into mild, medium, hot, and extra hot. Hot sauces dominate the market share due to their wide appeal across multiple cuisines. Consumers are drawn to the versatility of hot sauces, which can be used in a variety of dishes ranging from fast food to gourmet meals. Popular brands like Tabasco and Frank's RedHot have made significant contributions to the dominance of this segment through strategic marketing and strong brand loyalty.

By Region: The global hot sauce market is also segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America remains the leading region, driven by high consumption rates and well-established brands in the U.S. The region's focus on convenience food and condiments has resulted in significant growth for the hot sauce industry. Latin America's prominence stems from countries like Mexico, where hot sauce is deeply ingrained in the cultural food landscape.

Global Hot Sauce Market Competitive Landscape

The global hot sauce market is dominated by several key players who have cemented their positions through strategic product launches, acquisitions, and marketing initiatives. Major brands such as McIlhenny (Tabasco) and Huy Fong Foods (Sriracha) are examples of long-standing market leaders. These companies continue to innovate by introducing new flavors and packaging to cater to changing consumer preferences.

|

Company |

Establishment Year |

Headquarters |

Product Range |

Revenue (USD Bn) |

Global Presence |

Key Product |

Number of Employees |

Recent Innovations |

Distribution Channels |

|

McIlhenny Company |

1868 |

Avery Island, LA, USA |

|||||||

|

Huy Fong Foods |

1980 |

Irwindale, CA, USA |

|||||||

|

The Kraft Heinz Co. |

2015 (merger) |

Chicago, IL, USA |

|||||||

|

Franks RedHot |

1920 |

Springfield, MO, USA |

|||||||

|

Baumer Foods |

1923 |

Metairie, LA, USA |

Global Hot Sauce Market Analysis

Market Growth Drivers

- Growing Popularity of International Cuisines: The rising appeal of global cuisines, particularly Asian and Latin American foods, has led to increased consumption of hot sauce, especially in countries where spicy flavors were less common. For instance, the United States imported over 34,000 metric tons of chili pepper products in 2022, primarily from Mexico and South America, reflecting the growing demand for spicy foods. This trend is also driven by globalization and cultural exchange, which encourage people to try new flavors, further increasing the consumption of hot sauce globally.

- Health Benefits Associated with Chili Consumption: Capsaicin, the active compound in chili peppers, is linked to several health benefits, including metabolism boosting and pain relief. Studies conducted by the U.S. National Institutes of Health (NIH) in 2023 found that capsaicin consumption helps in reducing obesity by accelerating fat breakdown. Such health benefits contribute to the increasing demand for hot sauces, especially among health-conscious consumers.

- Expanding Vegan and Plant-Based Diet Preferences: The plant-based food sector has seen significant growth, with the global vegan population surpassing 79 million in 2023, according to the Food and Agriculture Organization (FAO). Hot sauce plays a critical role in enhancing the flavors of plant-based meals, making it a staple condiment for vegan and vegetarian consumers. This surge in veganism has positively influenced the hot sauce market, as plant-based eaters seek bold flavors to elevate their meals.

Market Challenges

- Fluctuating Packaging Costs: Packaging costs for hot sauce products have been volatile due to the rising cost of raw materials such as glass and plastic. According to the World Banks 2023 commodity price data, global prices for glass materials increased by 15% from 2022 to 2023, leading to higher production costs for manufacturers. These fluctuations impact profit margins and pricing strategies, particularly for smaller hot sauce producers that rely on premium packaging.

- Regulatory Compliance in International Markets: International markets for hot sauce are subject to stringent regulatory standards, especially concerning food safety and labeling. In 2023, the European Union updated its import requirements for spicy condiments, mandating stricter checks for aflatoxins in peppers. This has created challenges for exporters from regions like Latin America, who need to invest in compliance measures, increasing operational costs.

Global Hot Sauce Market Future Outlook

Over the next several years, the global hot sauce market is poised to grow further, driven by increasing consumer demand for spicy and exotic flavors, along with rising health consciousness. The trend toward clean-label products and the rise of e-commerce as a dominant sales channel will also contribute to the markets expansion. Additionally, brands are expected to innovate with organic, vegan, and gluten-free variants to cater to health-conscious consumers and expand their consumer base.

Market Opportunities:

- Craft and Artisanal Hot Sauce Brands: The demand for artisanal and small-batch hot sauces is on the rise, with consumers gravitating towards unique flavors. According to the USDA, there were over 2,000 registered small-batch condiment producers in the U.S. by 2023, reflecting the growing consumer preference for local and craft products. This trend has spurred innovation, with many artisanal hot sauce brands incorporating exotic peppers and local ingredients

- Hot Sauce in Packaged Meal Kits: Meal kit delivery services have grown in popularity, with the global meal kit market valued at over $15 billion in 2023. These kits often include condiments like hot sauces, providing an additional sales channel for manufacturers. Blue Apron, one of the leading meal kit providers, reported that many of its customers ordered spicy meal kits in 2023, indicating the growing importance of hot sauces in packaged meals.

Scope of the Report

|

By Sauce Type |

Mild Medium Hot Extra Hot |

|

By Ingredient Type |

Peppers Vinegar Spices and Herbs Others (Garlic, Sugar, etc.) |

|

By Distribution Channel |

Supermarkets and Hypermarkets Convenience Stores Online Retailers Food Service Channels |

|

By Packaging Type |

Glass Bottles Plastic Bottles Sachets and Pouches |

|

By Region |

North America Europe Asia Pacific Latin America Middle East and Africa |

Products

Key Target Audience

Hot Sauce Manufacturers

Retailers (Supermarkets, Convenience Stores)

Food Service Providers (Restaurants, Fast Food Chains)

Distributors (Local and International)

Importers and Exporters

Investment and Venture Capital Firms

Government and Regulatory Bodies (FDA, USDA)

E-commerce Platforms

Companies

Players Mention in the Report

McIlhenny Company

Huy Fong Foods

The Kraft Heinz Company

Franks RedHot

Baumer Foods

TW Garner Food Co.

Trappeys Hot Sauce

Texas Pete

B&G Foods

Cholula Food Company

El Yucateco

Daves Gourmet Inc.

Tabasco

Hot Ones Hot Sauce

Secret Aardvark Trading Co.

Table of Contents

1. Global Hot Sauce Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Hot Sauce Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Hot Sauce Market Analysis

3.1. Growth Drivers (Culinary Trends, Cultural Influence, Rising Demand for Spicy Foods)

3.1.1. Growing Popularity of International Cuisines

3.1.2. Rising Trend of Home Cooking

3.1.3. Health Benefits Associated with Chili Consumption

3.1.4. Expanding Vegan and Plant-Based Diet Preferences

3.2. Market Challenges (Supply Chain Disruptions, Price Volatility of Raw Ingredients)

3.2.1. Climate Sensitivity Impacting Pepper Harvests

3.2.2. Fluctuating Packaging Costs

3.2.3. Regulatory Compliance in International Markets

3.3. Opportunities (Innovative Product Development, E-commerce Expansion)

3.3.1. Introduction of Organic and Clean-Label Hot Sauces

3.3.2. Increased Online Direct-to-Consumer Sales

3.3.3. Strategic Collaborations with Food Service Providers

3.4. Trends (Premiumization of Products, Rise of Limited-Edition Flavors)

3.4.1. Craft and Artisanal Hot Sauce Brands

3.4.2. Hot Sauce in Packaged Meal Kits

3.4.3. Growing Popularity of Subscription Boxes

3.5. Government Regulations (Food Safety, Labeling, Export Policies)

3.5.1. Food Safety Modernization Act (FSMA)

3.5.2. Labeling Requirements for Heat Intensity

3.5.3. Tariff Policies on Spices and Condiments

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Raw Material Suppliers, Manufacturers, Distributors, Retailers)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Hot Sauce Market Segmentation

4.1. By Type of Sauce (In Value %)

4.1.1. Mild

4.1.2. Medium

4.1.3. Hot

4.1.4. Extra Hot

4.2. By Ingredient Type (In Value %)

4.2.1. Peppers

4.2.2. Vinegar

4.2.3. Spices and Herbs

4.2.4. Others (Garlic, Sugar, etc.)

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets and Hypermarkets

4.3.2. Convenience Stores

4.3.3. Online Retailers

4.3.4. Food Service Channels

4.4. By Packaging Type (In Value %)

4.4.1. Glass Bottles

4.4.2. Plastic Bottles

4.4.3. Sachets and Pouches

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East and Africa

5. Global Hot Sauce Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. McIlhenny Company

5.1.2. The Kraft Heinz Company

5.1.3. McCormick & Company

5.1.4. Huy Fong Foods

5.1.5. Baumer Foods

5.1.6. TW Garner Food Co.

5.1.7. Daves Gourmet Inc.

5.1.8. Trappeys Hot Sauce

5.1.9. B&G Foods

5.1.10. Louisiana Hot Sauce Co.

5.1.11. El Yucateco

5.1.12. Cholula Food Company

5.1.13. Texas Pete

5.1.14. Tabasco

5.1.15. Frank's RedHot

5.2. Cross Comparison Parameters (Revenue, Headquarters, Employees, Production Capacity, Product Portfolio, Recent Product Launches, Distribution Network, Global Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Hot Sauce Market Regulatory Framework

6.1. Health and Safety Regulations

6.2. Food Labeling Compliance

6.3. Export and Import Policies

7. Global Hot Sauce Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Hot Sauce Future Market Segmentation

8.1. By Type of Sauce (In Value %)

8.2. By Ingredient Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Packaging Type (In Value %)

8.5. By Region (In Value %)

9. Global Hot Sauce Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying key variables influencing the global hot sauce market, such as ingredient pricing, consumer preferences, and regional market penetration. Extensive desk research and proprietary databases are employed to map these factors.

Step 2: Market Analysis and Construction

In this phase, we compile historical data from multiple years, focusing on market penetration, product innovation, and sales trends. We analyze these variables to create a comprehensive picture of the global market.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market growth drivers and challenges are validated through direct interviews and surveys with key industry stakeholders, including hot sauce manufacturers and distributors.

Step 4: Research Synthesis and Final Output

Finally, we consolidate all data gathered through primary and secondary research into a comprehensive report. Cross-referencing with manufacturers and foodservice providers ensures accuracy.

Frequently Asked Questions

01. How big is the Global Hot Sauce Market?

The global hot sauce market, valued at USD 2.84 billion, is driven by consumer demand for spicy flavors, convenience foods, and increased global consumption of ethnic cuisines.

02. What are the challenges in the Global Hot Sauce Market?

Key challenges include fluctuating raw material prices, supply chain disruptions, and regulatory hurdles associated with food safety and labeling compliance in international markets.

03. Who are the major players in the Global Hot Sauce Market?

Major players include McIlhenny Company, Huy Fong Foods, The Kraft Heinz Company, Franks RedHot, and Baumer Foods. These companies dominate due to strong brand loyalty and extensive global distribution networks.

04. What are the growth drivers of the Global Hot Sauce Market?

The market is propelled by the increasing popularity of spicy foods, the expanding global foodservice industry, and the rise in demand for clean-label, organic products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.