Global HR Analytics Market Outlook to 2030

Region:Global

Author(s):Sanjeev

Product Code:KROD1856

November 2024

96

About the Report

Market Overview

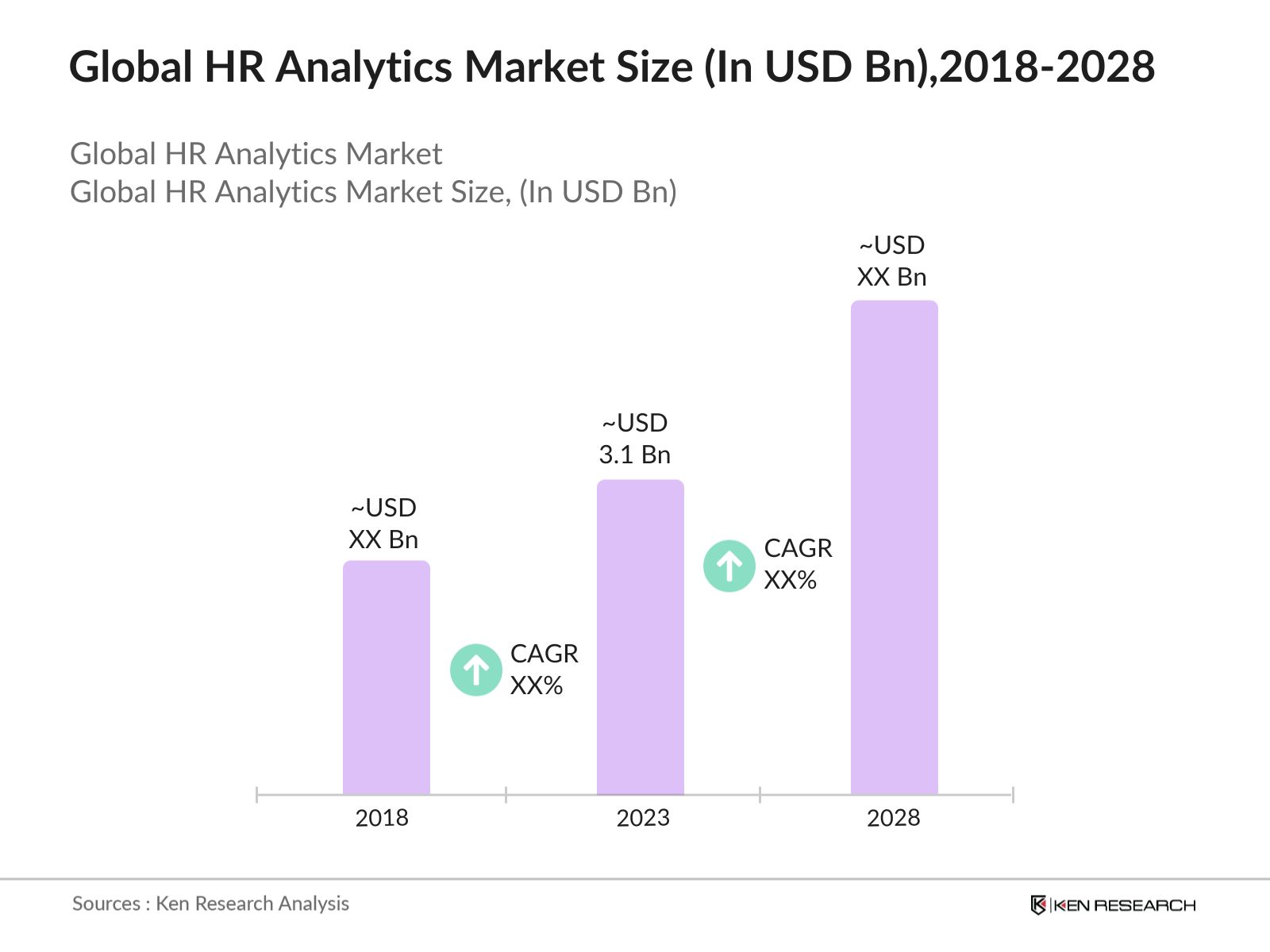

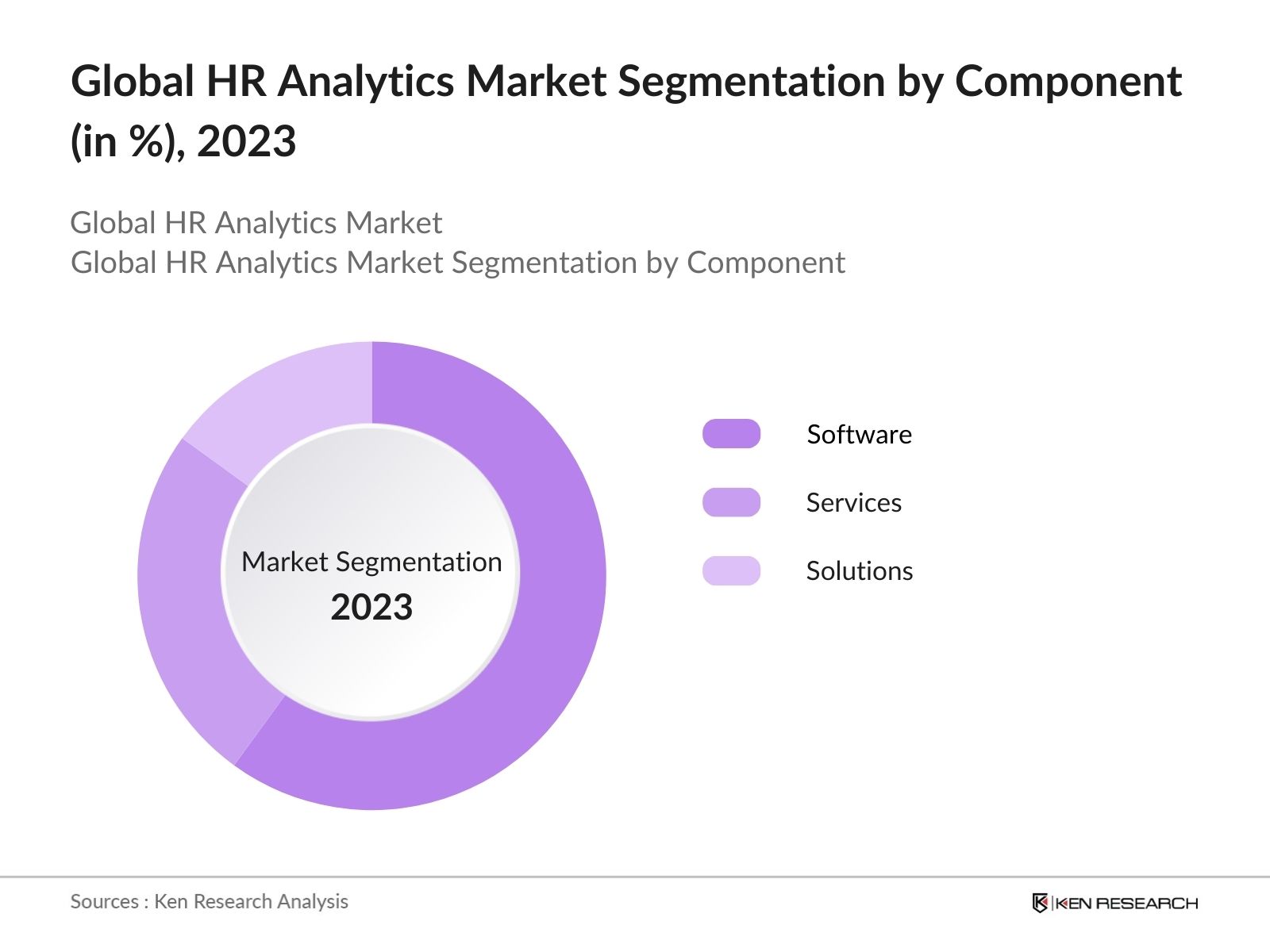

- In 2023, the Global HR Analytics Market was valued at USD 3.1 billion, driven by increasing adoption of data-driven decision-making in human resources, the growing need for workforce optimization, and the rising importance of employee engagement and retention strategies. The market is segmented into software, services, and solutions, with software being the most dominant due to its ability to provide actionable insights and automate HR processes.

- Key players in the Global HR Analytics Market include Oracle Corporation, SAP SE, IBM Corporation, ADP, LLC, and Workday, Inc. These companies are recognized for their comprehensive HR analytics platforms that offer advanced features such as predictive analytics, AI integration, and real-time data analysis. Oracle Corporation leads the market with its cloud-based HR analytics solutions known for their scalability and customization.

- In North America, the United States and Canada are prominent markets, driven by high adoption rates of advanced HR technologies and a strong focus on optimizing HR operations. These countries are characterized by a mature HR analytics market with investments in digital transformation and employee experience enhancement.

- In 2023, SAP SE launched a new line of AI-powered HR analytics tools under its SuccessFactors brand, aimed at automating recruitment and employee performance analysis. This innovation underscores the ongoing shift towards intelligent analytics solutions that can predict employee behavior and optimize workforce management.

Global HR Analytics Market Segmentation

The Global HR Analytics Market can be segmented by component, deployment mode, organization size, and region:

- By Component: The market is segmented into software, services, and solutions. In 2023, software remains the most dominant component due to its capability to integrate with existing HR systems and provide a comprehensive view of workforce data. However, services are gaining popularity for their role in helping organizations implement and optimize HR analytics tools.

- By Region: The global market is segmented regionally into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. In 2023, North America leads the market due to a high concentration of tech-savvy businesses and a strong focus on HR innovation. Asia-Pacific is also a significant market, driven by the increasing adoption of HR technologies in countries like India and China.

- By Deployment Mode: The market is segmented by deployment mode into on-premise and cloud-based. In 2023, cloud-based solutions dominate the market due to their scalability, flexibility, and lower upfront costs. On-premise solutions, while still significant, are preferred by organizations with stringent data security requirements.

Global HR Analytics Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Oracle Corporation |

1977 |

Austin, USA |

|

SAP SE |

1972 |

Walldorf, Germany |

|

IBM Corporation |

1911 |

Armonk, USA |

|

ADP, LLC |

1949 |

Roseland, USA |

|

Workday, Inc. |

2005 |

Pleasanton, USA |

- Oracle Corporation: In 2023, Oracle Corporation introduced a new suite of HR analytics tools within its Oracle Fusion HCM platform, focusing on predictive analytics for employee retention and talent acquisition. This launch is aimed at strengthening the company's position in the HR analytics market by offering solutions that cater to the growing demand for data-driven decision-making in HR.

- SAP SE: In 2024, SAP SE expanded its product line with the launch of SuccessFactors People Analytics, designed to meet the rising demand for real-time, AI-powered insights into employee performance and engagement. This expansion reflects SAP's commitment to enhancing its HR analytics offerings and capturing a share of the growing analytics market.

Global HR Analytics Market Analysis

Market Growth Drivers:

- Increased Demand for HR Specialists: Human resources specialists earn a median annual wage of USD 67,650 and are projected to see a 6% job growth from 2022 to 2032, which is faster than average. Annually, about 78,700 openings will arise, primarily due to workforce transitions and retirements.

- Growing Adoption of Data-Driven Decision Making: The growing emphasis on data-driven decision-making in HR functions is boosting the demand for HR analytics. Organizations are leveraging analytics to gain insights into employee behavior, predict future trends, and improve talent management strategies.

- Advancements in AI and Machine Learning: Continuous advancements in AI and machine learning are enhancing the capabilities of HR analytics tools, making them more accurate and efficient. IBM's Watson Analytics for HR offers predictive capabilities that can help organizations identify potential employee turnover risks.

Market Challenges:

- Data Quality and Integration Issues: One of the challenges in the HR analytics sector is ensuring data quality and seamless integration across various HR systems. Organizations often struggle with inconsistent or incomplete data, which can lead to inaccurate analytics outcomes. Integrating HR analytics tools with existing HR information systems (HRIS) and other enterprise software can also be complex and time-consuming, requiring substantial IT support and resources.

- Lack of Skilled Personnel: The successful implementation and utilization of HR analytics require a workforce skilled in data science, analytics, and HR processes. However, there is a shortage of professionals with the necessary expertise to manage and interpret complex data sets within the HR domain. This skills gap can hinder organizations' ability to fully leverage the capabilities of HR analytics tools, resulting in underutilized investments and suboptimal decision-making.

Government Initiatives:

- European Union's General Data Protection Regulation (GDPR): The GDPR, enforced by the European Union in May 2018, aims to protect the personal data and privacy of EU citizens. The regulation includes provisions for significant fines for non-compliance, up to 4% of global annual turnover or EUR 20 million, whichever is higher. Since its enforcement, over 150,000 cases have been reported to data protection authorities across the EU, with fines totaling more than EUR 1.6 billion. This initiative has driven organizations across Europe to adopt more robust data governance frameworks and invest in secure HR analytics solutions to ensure compliance and safeguard employee data.

- Japan's Act on the Protection of Personal Information (APPI): Japan revised its Act on the Protection of Personal Information (APPI) in 2020 to align more closely with international standards like the GDPR. The amendments include stricter regulations on the transfer of personal data to third parties and increased penalties for non-compliance, up to JPY 100 million. This revision has prompted Japanese companies to enhance their HR analytics capabilities to ensure compliance with the new regulations, with over 800 companies upgrading their data protection frameworks since the amendments were announced.

Global HR Analytics Market Future Market Outlook

The Global HR Analytics Market is expected to continue its robust growth, driven by the increasing focus on data-driven HR practices, advancements in AI and machine learning, and the growing importance of employee engagement and retention.

Future Market Trends:

- Growth of Predictive Analytics: Predictive analytics in HR is expected to grow in popularity as organizations seek to proactively address workforce challenges. This trend will drive the development of more sophisticated analytics tools that can predict employee behavior and optimize HR strategies.

- Increased Focus on Employee Experience: There will likely be a growing emphasis on using HR analytics to enhance employee experience. Organizations are expected to invest in tools that provide insights into employee satisfaction, engagement, and well-being, contributing to higher retention rates and improved productivity.

Scope of the Report

|

By Region |

West East North South |

|

By Deployment Mode |

On-premise Cloud-based |

|

By Organization Size |

Small and Medium-Sized Enterprises (SMEs) Large Enterprises |

|

By Component |

Dry Cat Food Wet Cat Food Cat Treats |

|

By Application |

Talent Acquisition and Recruitment Employee Engagement and Retention Workforce Planning and Optimization Performance Management Compensation and Benefits Management Compliance and Risk Management |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

HR Professionals and Managers

Human Resource Consultants

HR Technology Startups

Business Intelligence (BI) Software Vendors

Cloud Service Providers

Corporate Training Providers

Data Analytics Firms

Technology Providers

HR Software Vendors

System Integrators

Government and Regulatory Bodies (FRA, OAIC, PDPC, CHRC)

Academic and Research Institutions

Investors and Venture Capitalists

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Oracle Corporation

SAP SE

IBM Corporation

ADP, LLC

Workday, Inc.

Ultimate Software

Kronos Incorporated

Ceridian HCM, Inc.

Sage Group plc

Infor

Zoho Corporation

Tableau Software

Visier, Inc.

BambooHR

Cornerstone OnDemand, Inc.

Table of Contents

1. Global HR Analytics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global HR Analytics Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global HR Analytics Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Focus on Workforce Optimization

3.1.2. Growing Adoption of Data-Driven Decision Making

3.1.3. Advancements in AI and Machine Learning

3.2. Restraints

3.2.1. Data Quality and Integration Issues

3.2.2. High Costs of Advanced Analytics Solutions

3.2.3. Lack of Skilled Personnel

3.3. Opportunities

3.3.1. Technological Advancements

3.3.2. Expansion into New Markets

3.3.3. Growing Demand for Predictive Analytics

3.4. Trends

3.4.1. Growth of Predictive Analytics

3.4.2. Increased Focus on Employee Experience

3.4.3. Integration of AI and Machine Learning

3.5. Government Regulation

3.5.1. European Union's General Data Protection Regulation (GDPR)

3.5.2. Japan's Act on the Protection of Personal Information (APPI)

3.5.3. United Kingdom's Data Ethics Framework

3.5.4. South Korea's Personal Information Protection Act (PIPA)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. Global HR Analytics Market Segmentation, 2023

4.1. By Component (in Value %)

4.1.1. Software

4.1.2. Services

4.1.3. Solutions

4.2. By Deployment Mode (in Value %)

4.2.1. On-premise

4.2.2. Cloud-based

4.3. By Organization Size (in Value %)

4.3.1. Small and Medium-Sized Enterprises (SMEs)

4.3.2. Large Enterprises

4.4. By Application (in Value %)

4.4.1. Talent Acquisition and Recruitment

4.4.2. Employee Engagement and Retention

4.4.3. Workforce Planning and Optimization

4.4.4. Performance Management

4.4.5. Compensation and Benefits Management

4.4.6. Compliance and Risk Management

4.5. By Region (in Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global HR Analytics Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. Oracle Corporation

5.1.2. SAP SE

5.1.3. IBM Corporation

5.1.4. ADP, LLC

5.1.5. Workday, Inc.

5.1.6. Ultimate Software

5.1.7. Kronos Incorporated

5.1.8. Ceridian HCM, Inc.

5.1.9. Sage Group plc

5.1.10. Infor

5.1.11. Zoho Corporation

5.1.12. Tableau Software

5.1.13. Visier, Inc.

5.1.14. BambooHR

5.1.15. Cornerstone OnDemand, Inc.

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global HR Analytics Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global HR Analytics Market Regulatory Framework

7.1. Data Privacy Regulations

7.2. Compliance Requirements

7.3. Certification Processes

8. Global HR Analytics Market Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global HR Analytics Market Future Market Segmentation, 2028

9.1. By Component (in Value %)

9.2. By Deployment Mode (in Value %)

9.3. By Organization Size (in Value %)

9.4. By Application (in Value %)

9.5. By Region (in Value %)

10. Global HR Analytics Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables

We begin by referencing multiple secondary and proprietary databases to conduct desk research. This includes gathering industry-level information on market drivers, challenges, key players, and emerging technologies. We also assess regulatory impacts and market dynamics specific to the global HR analytics market.

Step 2: Market Building

We collect historical data on market size, growth rates, component segmentation (software, services, and solutions), and deployment modes (on-premise and cloud-based). We also analyze market share and revenue generated by leading vendors, emerging trends in HR technology, and customer preferences to ensure accuracy and reliability in the data presented.

Step 3: Validating and Finalizing

We perform Computer-Assisted Telephone Interviews (CATIs) with industry experts, including representatives from leading HR analytics providers, system integrators, and end-users. These interviews validate the statistics collected and provide insights into operational and financial aspects, such as pricing strategies, solution customization, and customer adoption patterns.

Step 4: Research Output

Our team interacts with HR technology providers, HR managers, market analysts, and technology consultants to understand the dynamics of market segments, evolving customer preferences, and sales trends. This process helps validate the derived statistics using a bottom-to-top approach, ensuring that the final data accurately reflects the actual market conditions.

Frequently Asked Questions

1. How large is the Global HR Analytics Market?

In 2023, the Global HR Analytics Market was valued at USD 3.1 billion. The market's growth is driven by the increasing adoption of data-driven decision-making in HR, advancements in AI and machine learning, and the rising importance of employee engagement strategies.

2. What are the challenges in the Global HR Analytics Market?

Challenges in the Global HR Analytics Market include data privacy and security concerns, high implementation costs, and integration issues with existing HR systems. Additionally, compliance with various data protection regulations poses significant challenges.

3. Who are the major players in the Global HR Analytics Market?

Major players in the Global HR Analytics Market include Oracle Corporation, SAP SE, IBM Corporation, ADP, LLC, and Workday, Inc. These companies lead the market with comprehensive HR analytics platforms that offer advanced features and functionalities.

4. What are the growth drivers of the Global HR Analytics Market?

Key growth drivers include the increasing focus on workforce optimization, growing adoption of data-driven decision-making in HR, and advancements in AI and machine learning. The expanding scope of HR analytics to cover various HR functions also contributes to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.