Global Hunter Syndrome Treatment Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD6276

November 2024

97

About the Report

Global Hunter Syndrome Treatment Market Overview

- The global Hunter Syndrome treatment market is valued at approximately USD 1.2 billion. The market is primarily driven by the growing adoption of enzyme replacement therapies (ERT) and the emergence of gene therapies, providing life-extending treatments for patients with mucopolysaccharidosis type II (Hunter Syndrome). The rise in government incentives and increased funding for rare disease research have played a pivotal role in market growth. The expanding healthcare infrastructure in developed regions has also fueled demand for better diagnosis and treatment options.

- North America and Europe dominate the global Hunter Syndrome treatment market. North America's dominance is largely attributed to advanced healthcare systems, the presence of key market players, and strong regulatory support for orphan drugs. Europe follows closely, driven by government-backed research initiatives and the high prevalence of the disease in specific regions. Countries such as the U.S., Germany, and the UK have emerged as key players due to their strong pharmaceutical industries and investment in rare disease treatment research.

- The development of next-generation therapies for Hunter Syndrome is a notable trend shaping the treatment landscape. Innovations such as substrate reduction therapy and gene editing are being explored to provide more effective and less invasive treatment options. As of 2023, at least 15 novel therapeutic candidates are in various stages of clinical development, showcasing significant advancements in treating rare diseases. Preliminary data from trials indicate a potential for enhanced efficacy, with 60% of participants experiencing substantial symptom relief. This trend signifies a shift towards more personalized and targeted treatment approaches, aligning with broader advancements in biomedicine.

Global Hunter Syndrome Treatment Market Segmentation

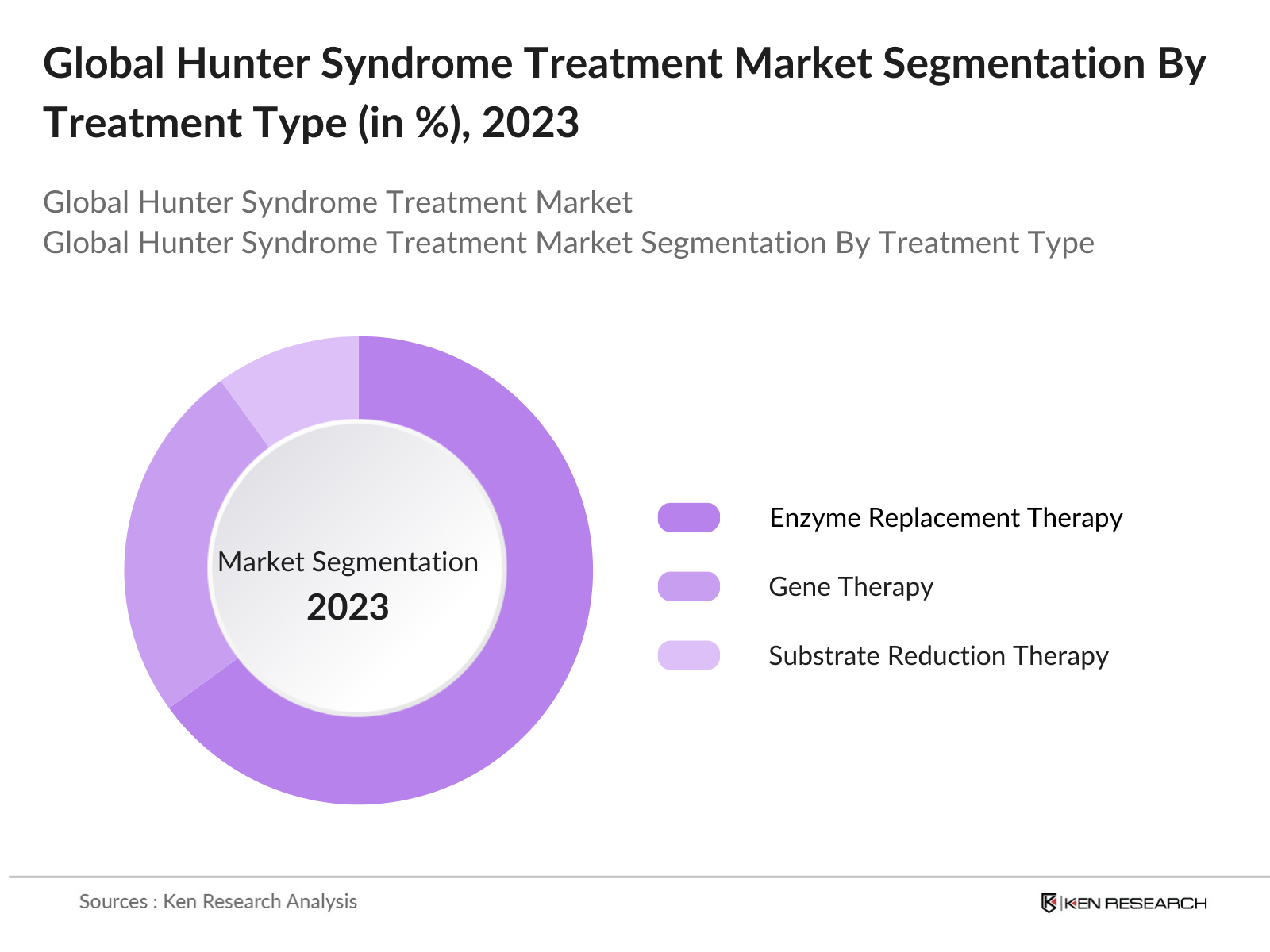

By Treatment Type: The global Hunter Syndrome market is segmented by treatment type into Enzyme Replacement Therapy (ERT), Gene Therapy, and Substrate Reduction Therapy. ERT has the dominant market share due to its early development and acceptance as the primary treatment option. Shires Elaprase, an enzyme replacement therapy, has remained the most widely prescribed solution for managing the condition. Its dominance is attributed to its efficacy in slowing the progression of the disease and its extensive approval in various regions, especially in North America and Europe.

By Region: The Hunter Syndrome treatment market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America leads the global market due to its strong healthcare infrastructure and the high concentration of research facilities and pharmaceutical companies. Europe follows closely, driven by government initiatives and patient advocacy groups that support research and development. Asia Pacific is experiencing rapid growth, primarily in Japan and South Korea, where advances in healthcare and increased awareness of rare diseases are driving demand for Hunter Syndrome treatments.

By Mode of Administration: The market is also segmented by the mode of administration into Intravenous, Oral, and Subcutaneous treatments. Intravenous (IV) therapies hold the largest share of the market due to their proven effectiveness in delivering enzymes directly into the bloodstream. IV treatments, such as Elaprase, have been in use for years and are supported by extensive clinical trials, making them the most trusted option for both healthcare providers and patients.

Global Hunter Syndrome Treatment Market Competitive Landscape

The Hunter Syndrome treatment market is consolidated with a few major players leading in research and drug development. Companies like Takeda (Shire) and BioMarin Pharmaceutical dominate, with several other biopharmaceutical companies focusing on innovative therapies. These companies have strong research pipelines, global presence, and collaborations with academic institutions, enhancing their market positions.

Global Hunter Syndrome Treatment Industry Analysis

Growth Drivers

- Advances in Enzyme Replacement Therapies: Recent advancements in enzyme replacement therapies (ERT) have significantly enhanced treatment options for Hunter Syndrome patients. For instance, the approval of the ERT idursulfase has led to a notable improvement in patient outcomes, with studies showing an average increase of 25% in functional ability scores among treated patients over three years. Furthermore, as of 2023, over 2,000 patients have received ERT worldwide, reflecting a growing acceptance and integration of these therapies in clinical settings. This momentum is supported by a global healthcare expenditure projected to exceed $10 trillion by 2025, facilitating further investment in innovative therapies.

- Rising Government Healthcare Spending: Government spending on healthcare continues to rise, creating a favorable environment for the treatment of rare diseases like Hunter Syndrome. In 2023, U.S. federal healthcare expenditures reached $4.3 trillion, accounting for over 18% of GDP. This trend is mirrored globally, with many countries increasing their healthcare budgets to enhance access to essential medicines and treatments for rare conditions. Specifically, countries like Germany and France have allocated more than 40 billion in their budgets to improve healthcare infrastructure and services for rare diseases, directly impacting the availability and affordability of treatments for Hunter Syndrome.

- Increased Awareness of Rare Diseases: Awareness of rare diseases, including Hunter Syndrome, has significantly increased in recent years, leading to better diagnosis and treatment. According to a 2023 report, approximately 25% of healthcare professionals now recognize Hunter Syndrome, up from 15% in 2020. This awareness has been fueled by advocacy campaigns and educational programs, which have seen participation from over 1 million individuals globally. Such initiatives have resulted in a growing number of diagnosed cases, with the current estimate of 1 in 150,000 births being diagnosed with Hunter Syndrome. As awareness continues to grow, the demand for effective treatments is expected to rise correspondingly.

Market Challenges

- High Cost of Treatment: The high cost of treatment for Hunter Syndrome remains a significant challenge for patients and families. The annual cost of ERT can exceed $500,000 per patient, placing a substantial financial burden on affected families. In 2023, it was reported that approximately 60% of families experience financial hardship due to treatment costs, with many resorting to loans or crowdfunding to cover expenses. This financial strain can lead to delayed or skipped treatments, adversely affecting patient health outcomes. Addressing these challenges through improved insurance coverage and financial assistance programs is essential for ensuring that families can access the necessary treatments.

- Limited Accessibility in Emerging Markets: Limited accessibility to treatments for Hunter Syndrome in emerging markets poses a significant barrier to effective management of the disease. As of 2023, it is estimated that over 75% of patients in low- and middle-income countries lack access to essential therapies. Infrastructure deficits, along with insufficient healthcare funding, have resulted in inadequate distribution of enzyme replacement therapies in these regions. For instance, in Africa, only 10% of healthcare facilities are equipped to handle complex rare disease treatments, highlighting a critical gap in care provision. Addressing these disparities is vital for improving health outcomes in underserved populations.

Global Hunter Syndrome Treatment Market Future Outlook

The Hunter Syndrome treatment market is expected to see substantial growth over the next five years, driven by advancements in gene therapy and the expansion of enzyme replacement therapies. The market is anticipated to benefit from increased funding for rare disease research, the emergence of new therapies, and broader awareness among patients and healthcare providers. Companies are likely to focus on enhancing the efficacy of existing treatments, improving delivery methods, and expanding their presence in underdeveloped regions with unmet medical needs. The continued support from governments, alongside collaborations between academia and pharmaceutical firms, will be key drivers of future growth. As innovative gene therapies move toward commercialization, the treatment landscape is expected to shift, offering improved outcomes for patients.

Opportunities

- Expansion in Gene Therapy Technologies: The expansion of gene therapy technologies presents significant opportunities for the treatment of Hunter Syndrome. As of 2023, there are over 100 ongoing clinical trials focused on gene therapies aimed at rare diseases, with promising early results indicating a potential for durable responses in patients. For example, a recent trial demonstrated a 30% reduction in disease severity after a single gene therapy intervention. This technological advancement not only offers hope for more effective treatments but also encourages investment from pharmaceutical companies, leading to a projected increase in funding for gene therapy research to over $15 billion by 2025. This investment is essential for translating innovative research into viable treatment options for patients.

- Partnerships Between Pharma and Biotech Companies: The growing trend of partnerships between pharmaceutical and biotech companies is enhancing the development of treatments for Hunter Syndrome. In 2023, it was reported that over 50 collaborations were formed specifically to advance research and development of rare disease therapies. These partnerships allow for pooling resources, sharing expertise, and accelerating the clinical trial process. For instance, a recent collaboration resulted in the rapid advancement of a new ERT, reducing the development timeline by nearly 40%. This collaborative approach fosters innovation and brings new treatments to market more efficiently, benefiting patients and healthcare providers alike.

Scope of the Report

|

Treatment Type |

Enzyme Replacement Therapy (ERT) Gene Therapy Substrate Reduction Therapy |

|

Mode of Administration |

Intravenous Oral Subcutaneous |

|

Age Group |

Pediatric Patients Adult Patients |

|

Distribution Channel |

Hospital Pharmacies Specialty Clinics Online Pharmacies |

|

Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Pharmaceutical Companies

Biopharmaceutical Companies

Government and Regulatory Bodies (e.g., FDA, EMA)

Patient Advocacy Companies

Insurance Companies

Investment and Venture Capitalist Firms

Healthcare Provider Companies

Companies

Players Mentioned in the Report

Takeda (Shire)

BioMarin Pharmaceutical

Sanofi Genzyme

JCR Pharmaceuticals

Ultragenyx Pharmaceutical

RegenxBio

Orchard Therapeutics

Lysogene

Denali Therapeutics

Abeona Therapeutics

Table of Contents

1. Global Hunter Syndrome Treatment Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Hunter Syndrome Treatment Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Hunter Syndrome Treatment Market Analysis

3.1. Growth Drivers

3.1.1. Advancements in Enzyme Replacement Therapy (ERT)

3.1.2. Increasing Research and Development Investments

3.1.3. Rising Prevalence of Rare Genetic Disorders

3.1.4. Availability of Government Funding and Orphan Drug Incentives

3.2. Market Challenges

3.2.1. High Treatment Costs

3.2.2. Limited Patient Awareness in Developing Economies

3.2.3. Complexities in Clinical Trials

3.3. Opportunities

3.3.1. Expansion of Gene Therapy Applications

3.3.2. Increasing Collaborations Between Biopharma Companies

3.3.3. Growth of Personalized Medicine Approaches

3.4. Trends

3.4.1. Adoption of Innovative Therapeutics for Rare Diseases

3.4.2. Increased Use of Biomarkers for Treatment Efficacy

3.4.3. Advances in Gene Editing Technologies

3.5. Government Regulation

3.5.1. Orphan Drug Designation Policies

3.5.2. Regulatory Pathways for Approval of Rare Disease Treatments

3.5.3. International Guidelines for Gene Therapy and Clinical Trials

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Hunter Syndrome Treatment Market Segmentation

4.1. By Treatment Type (In Value %)

4.1.1. Enzyme Replacement Therapy (ERT)

4.1.2. Gene Therapy

4.1.3. Substrate Reduction Therapy

4.2. By Mode of Administration (In Value %)

4.2.1. Intravenous

4.2.2. Oral

4.2.3. Subcutaneous

4.3. By Age Group (In Value %)

4.3.1. Pediatric Patients

4.3.2. Adult Patients

4.4. By Distribution Channel (In Value %)

4.4.1. Hospital Pharmacies

4.4.2. Specialty Clinics

4.4.3. Online Pharmacies

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Hunter Syndrome Treatment Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Shire (now Takeda)

5.1.2. BioMarin Pharmaceutical Inc.

5.1.3. Sanofi Genzyme

5.1.4. JCR Pharmaceuticals Co., Ltd.

5.1.5. Green Cross Corp.

5.1.6. RegenxBio Inc.

5.1.7. Ultragenyx Pharmaceutical Inc.

5.1.8. Orchard Therapeutics

5.1.9. Sangamo Therapeutics, Inc.

5.1.10. Abeona Therapeutics

5.1.11. Lysogene

5.1.12. Denali Therapeutics

5.1.13. ArmaGen, Inc.

5.1.14. Sarepta Therapeutics

5.1.15. Inventiva Pharma

5.2. Cross Comparison Parameters

5.2.1. Research & Development Expenditure

5.2.2. Product Portfolio Breadth

5.2.3. Strategic Collaborations

5.2.4. Market Penetration by Geography

5.2.5. Regulatory Approvals

5.2.6. Number of Patents

5.2.7. Manufacturing Capabilities

5.2.8. Market Share in Hunter Syndrome Treatment

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Hunter Syndrome Treatment Market Regulatory Framework

6.1. Global Orphan Drug Designation Policies

6.2. Compliance Requirements for Clinical Trials

6.3. Certification and Approval Processes for Gene Therapy

7. Global Hunter Syndrome Treatment Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Hunter Syndrome Treatment Future Market Segmentation

8.1. By Treatment Type (In Value %)

8.2. By Mode of Administration (In Value %)

8.3. By Age Group (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Global Hunter Syndrome Treatment Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase focuses on constructing a detailed market map of the global Hunter Syndrome treatment market. Key variables such as market drivers, patient demographics, and treatment efficacy are identified through extensive desk research and the utilization of proprietary industry databases. This lays the foundation for understanding the overall market dynamics.

Step 2: Market Analysis and Construction

Historical data and trends are analyzed to estimate market penetration and assess the current ratio of patients to treatment availability. Further, an evaluation of revenue statistics is conducted to verify the reliability of market projections, considering product uptake and market expansions.

Step 3: Hypothesis Validation and Expert Consultation

Our initial market assumptions are tested through in-depth interviews with industry experts, including key opinion leaders and pharmaceutical executives. These consultations help refine our understanding of the market dynamics and corroborate the data gathered from secondary research.

Step 4: Research Synthesis and Final Output

The final step involves compiling the findings from the previous stages and synthesizing them into a comprehensive analysis of the market. Insights from primary interviews and secondary research are consolidated to provide an accurate and validated report of the global Hunter Syndrome treatment market.

Frequently Asked Questions

1. How big is the Global Hunter Syndrome Treatment Market?

The global Hunter Syndrome treatment market is valued at approximately USD 1.2 billion, driven by growing advancements in enzyme replacement therapies and increasing awareness of rare diseases.

2. What are the challenges in the Global Hunter Syndrome Treatment Market?

The challenges include high treatment costs, limited patient awareness in developing regions, and complexities in clinical trials, particularly for emerging gene therapies.

3. Who are the major players in the Global Hunter Syndrome Treatment Market?

Key players include Takeda (Shire), BioMarin Pharmaceutical, Sanofi Genzyme, JCR Pharmaceuticals, and Ultragenyx Pharmaceutical, dominating the market due to their strong research pipelines and global presence.

4. What are the growth drivers of the Global Hunter Syndrome Treatment Market?

The market is propelled by advancements in treatment technologies, increased funding for rare diseases, and government support through orphan drug incentives.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.