Global Hydration Supplement Market Outlook to 2030

Region:Global

Author(s):Yogita Sahu

Product Code:KROD10803

November 2024

84

About the Report

Global Hydration Supplement Market Overview

- The Global Hydration Supplement Market is valued at USD 34.2 billion, with its growth fueled by rising health awareness, especially among fitness-conscious individuals, and increased participation in outdoor sports. Consumer preferences for functional beverages that support endurance and recovery have further accelerated demand. This trend is driven by greater accessibility through online retail channels and innovations in ingredient formulations, creating wider adoption in various consumer groups globally.

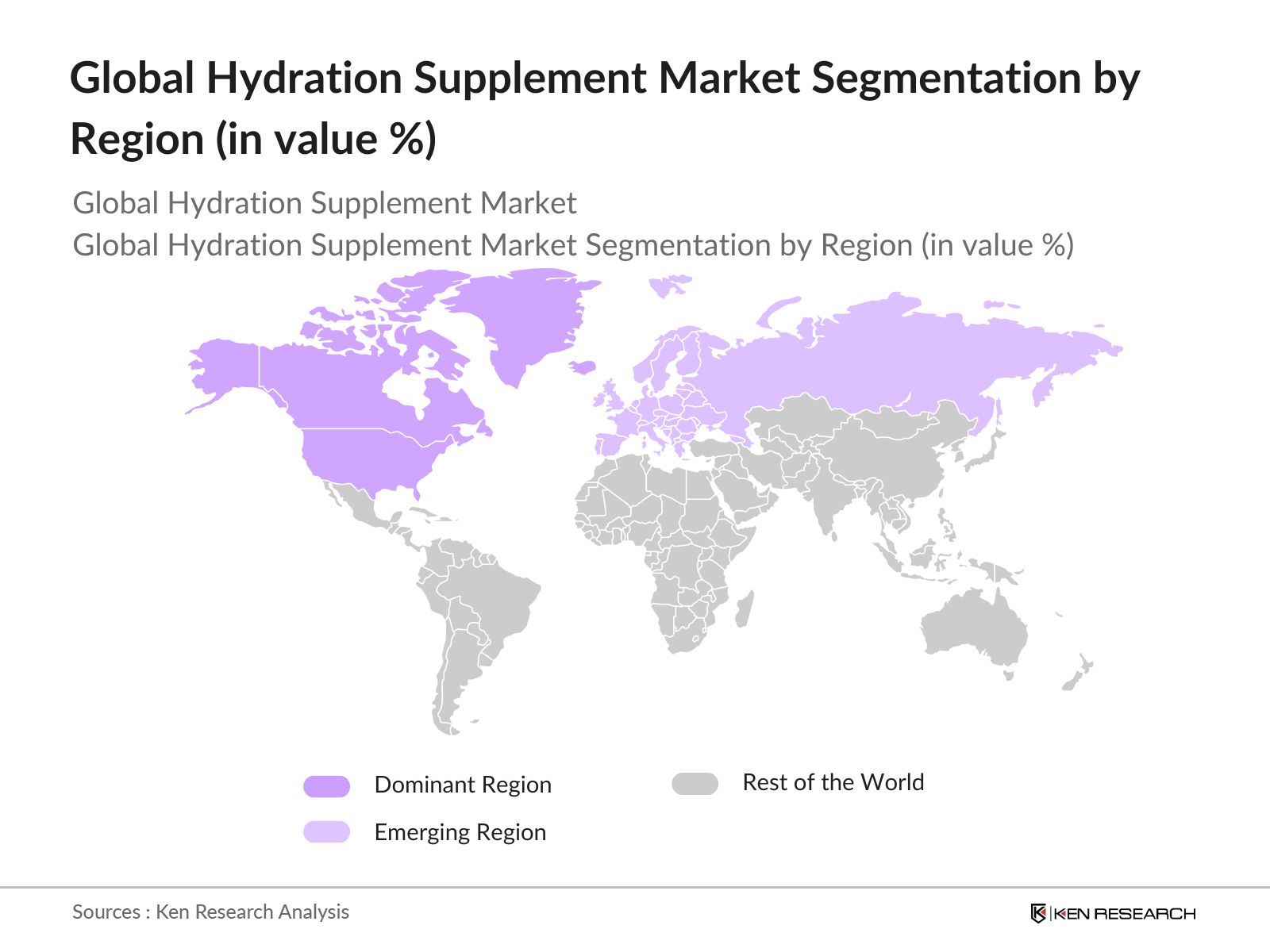

- The market is notably dominated by North America and Europe, attributed to well-established fitness and wellness industries and a high consumer inclination towards health-focused products. The dominance of these regions stems from a blend of purchasing power, high penetration of hydration supplements in sports and recreational activities, and a robust distribution network across fitness centers and online platforms.

- The U.S. government allocated approximately $1 billion in funding in 2024 toward health and wellness initiatives, supporting research into dietary supplements, including hydration products, for better public health. This has spurred product innovations and encouraged new market entrants focusing on hydration-based wellness solutions, contributing to the sectors steady growth.

Global Hydration Supplement Market Segmentation

By Product Type: The market is segmented by product type into electrolyte tablets, electrolyte powders, hydration drink mixes, and hydration gummies. Electrolyte powders have a dominant market share due to their versatility in application, easy accessibility, and preference among athletes and fitness enthusiasts for customizable hydration. Brands like Liquid I.V. and Pedialyte are popular in this sub-segment, as they offer multiple flavors and variants targeting hydration and recovery.

By Distribution Channel: The distribution channels in the market include e-commerce, health & wellness retailers, sports nutrition stores, and pharmacies. E-commerce holds a substantial market share, driven by convenience, promotional discounts, and subscription models offered by online platforms. This distribution channel has also benefited from the widespread reach and tailored consumer experiences facilitated by digital marketing strategies.

By Region: The market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America leads this segment due to its high consumption of fitness supplements and established brands. The presence of major players, coupled with a strong distribution infrastructure, positions this region as the largest market.

Global Hydration Supplement Market Competitive Landscape

The competitive landscape of the market is characterized by the presence of established brands and new entrants focusing on innovative formulations and marketing strategies. Key players dominate through their vast distribution networks and strong brand recognition, with significant investments in R&D to introduce unique flavors and natural ingredients.

Global Hydration Supplement Market Analysis

Market Growth Drivers

- Rise in Health Awareness and Demand for Hydration Supplements: The global demand for hydration supplements is driven by the increasing number of health-conscious consumers actively seeking products to enhance their well-being. As of 2024, 2 billion people worldwide are estimated to regularly use dietary supplements, with hydration products becoming essential, particularly in regions experiencing high temperatures.

- Expansion of the Fitness and Sports Industry: The fitness industrys expansion has directly boosted the hydration supplement market, with the industry expected to support over 1.2 billion gym-goers globally by 2025. A growing base of professional athletes and fitness enthusiasts has led to a substantial increase in hydration products to support optimal athletic performance.

- Increased Consumer Spending on Health and Wellness Products: The health and wellness sector has seen a considerable increase in consumer spending, with the global market expected to reach a valuation exceeding $1 trillion in 2024. In this landscape, hydration supplements have garnered substantial attention, with consumers in markets like North America spending an average of $450 annually on wellness-related products.

Market Challenges

- Regulatory Compliance and Quality Standards: The hydration supplement market is highly regulated, with stringent quality checks in place. Meeting global regulatory standards, such as FDA compliance in the U.S. and EFSA regulations in Europe, has increased the operational costs for manufacturers. In 2024, over 15,000 cases of non-compliance in the supplement market were recorded globally, leading to significant fines and recalls.

- Supply Chain and Raw Material Sourcing Issues: Due to reliance on specific minerals like sodium, potassium, and calcium, hydration supplement manufacturers face challenges in sourcing quality ingredients. In 2024, it is estimated that disruptions in raw material supply chains caused by geopolitical tensions and economic instability impacted over $12 billion worth of raw goods across the dietary supplement industry.

Global Hydration Supplement Market Future Outlook

The Global Hydration Supplement industry is expected to experience steady growth driven by evolving consumer health priorities, a rise in sports and outdoor activities, and product innovation. Expanding consumer knowledge around the benefits of hydration supplements for physical performance and overall wellness will play a key role in market growth.

Future Market Opportunities

- Rise of Electrolyte-Enriched Functional Beverages: In the next five years, functional beverages enhanced with electrolytes are expected to dominate the hydration market, driven by growing consumer interest in multifunctional products. This segment is anticipated to generate more than $10 billion annually by 2028, supported by consumer demand for convenient hydration solutions that offer additional health benefits.

- Increased Use of Plant-Based Electrolytes in Formulations: A growing shift towards plant-based electrolytes is expected, with over 30% of new hydration products anticipated to incorporate plant-derived minerals by 2028. This trend aligns with rising consumer preferences for natural ingredients and is forecasted to drive substantial R&D investments to develop cost-effective plant-based electrolyte formulations.

Scope of the Report

|

By Product Type |

Electrolyte Tablets Electrolyte Powders Hydration Drink Mixes Hydration Gummies |

|

By Distribution Channel |

E-Commerce Health & Wellness Retailers Sports Nutrition Stores Pharmacies |

|

By Consumer Group |

Athletes General Consumers Military Personnel Pediatric |

|

By Flavor Profile |

Citrus-based Berry-based Tropical and Mixed Flavors Plain/Unflavored |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Hydration Supplement Manufacturers

Health and Wellness Retail Chains

Sports and Fitness Centers

Online Retail Platforms

Government and Regulatory Bodies (FDA, European Food Safety Authority)

Investor and Venture Capitalist Firms

Product Development and R&D Teams

Companies

Nuun Hydration

Liquid I.V.

DripDrop

Pedialyte

SOS Hydration

Ultima Replenisher

Science in Sport (SiS)

LMNT

NOOMA

Vega Sport

Table of Contents

1. Global Hydration Supplement Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Hydration Supplement Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Hydration Supplement Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Health Awareness

3.1.2. Rising Demand for Fitness Supplements

3.1.3. Product Innovation (Electrolyte Composition, Flavor Diversity)

3.1.4. Expansion in E-Commerce Distribution Channels

3.2. Market Challenges

3.2.1. High Competition from Alternative Beverages

3.2.2. Regulatory and Quality Control Barriers

3.2.3. Ingredient Sourcing Limitations

3.3. Opportunities

3.3.1. Growth in Functional Foods Sector

3.3.2. Rise in Endurance Sports and Recreational Fitness

3.3.3. Potential in Untapped Emerging Markets

3.4. Trends

3.4.1. Development of Clean Label Supplements

3.4.2. Inclusion of Adaptogens and Botanicals

3.4.3. Enhanced Focus on Personalized Nutrition

3.5. Regulatory Landscape

3.5.1. FDA Compliance Requirements

3.5.2. Nutritional Labeling Standards

3.5.3. Certification Processes (NSF, GMP)

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. Global Hydration Supplement Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Electrolyte Tablets

4.1.2. Electrolyte Powders

4.1.3. Hydration Drink Mixes

4.1.4. Hydration Gummies

4.2. By Distribution Channel (In Value %)

4.2.1. E-Commerce

4.2.2. Health & Wellness Retailers

4.2.3. Sports Nutrition Stores

4.2.4. Pharmacies

4.3. By Consumer Group (In Value %)

4.3.1. Athletes

4.3.2. General Consumers

4.3.3. Military Personnel

4.3.4. Pediatric

4.4. By Flavor Profile (In Value %)

4.4.1. Citrus-based

4.4.2. Berry-based

4.4.3. Tropical and Mixed Flavors

4.4.4. Plain/Unflavored

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Hydration Supplement Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Nuun Hydration

5.1.2. Pedialyte

5.1.3. Ultima Replenisher

5.1.4. Liquid I.V.

5.1.5. Gatorade

5.1.6. DripDrop

5.1.7. Hydralyte

5.1.8. SOS Hydration

5.1.9. Science in Sport (SiS)

5.1.10. H.V.M.N.

5.1.11. LMNT

5.1.12. NOOMA

5.1.13. Vega Sport

5.1.14. Klean Athlete

5.1.15. Cure Hydration

5.2 Cross Comparison Parameters (Revenue, Product Range, Market Share, R&D Investment, Distribution Network, Consumer Ratings, Innovation Score, and Brand Equity)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Global Hydration Supplement Market Regulatory Framework

6.1 Nutritional Standards

6.2 Ingredient Safety Regulations

6.3 Advertising and Labeling Compliance

7. Global Hydration Supplement Future Market Size (In USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Hydration Supplement Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Consumer Group (In Value %)

8.4 By Flavor Profile (In Value %)

8.5 By Region (In Value %)

9. Global Hydration Supplement Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Consumer Behavior Insights

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This initial phase involves mapping key stakeholders within the hydration supplement market. Extensive desk research and secondary data collection form the foundation of this phase, where core market dynamics, including consumer preferences, regulatory frameworks, and product innovation trends, are identified.

Step 2: Market Analysis and Construction

In this phase, a detailed historical analysis of the market is performed, assessing revenue generation, distribution channel efficacy, and consumer trends. This step ensures comprehensive insights into demand patterns and the dominance of specific segments within the market.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated and validated through discussions with industry experts across companies specializing in hydration supplements. These consultations, conducted through CATIs (Computer-Assisted Telephone Interviews), provide financial and operational insights to strengthen market estimates.

Step 4: Research Synthesis and Final Output

This stage synthesizes the data collected, incorporating direct feedback from manufacturers regarding product categories, consumer demand, and distribution channels. The outcome is a thorough, verified market analysis, aligning with the dynamics of the hydration supplement industry.

Frequently Asked Questions

01. How big is the Global Hydration Supplement Market?

The global hydration supplement market is valued at USD 34.2 billion, primarily driven by increased awareness of health benefits and a rise in fitness-related activities.

02. What are the key growth drivers in the Global Hydration Supplement Market?

The global hydration supplement market growth is supported by consumer demand for endurance products, the influence of e-commerce, and innovative product formulations catering to different health and fitness needs.

03. Who are the major players in the Global Hydration Supplement Market?

Leading players in the global hydration supplement market include Nuun Hydration, Liquid I.V., DripDrop, Pedialyte, and SOS Hydration, known for their expansive product portfolios and strong market presence.

04. What challenges are faced by the Global Hydration Supplement Market?

Challenges in the global hydration supplement market include intense competition from alternative beverages, high regulatory standards for ingredient safety, and the need for consistent quality assurance.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.