Global Hydraulic Components Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD8294

December 2024

80

About the Report

Global Hydraulic Components Market Overview

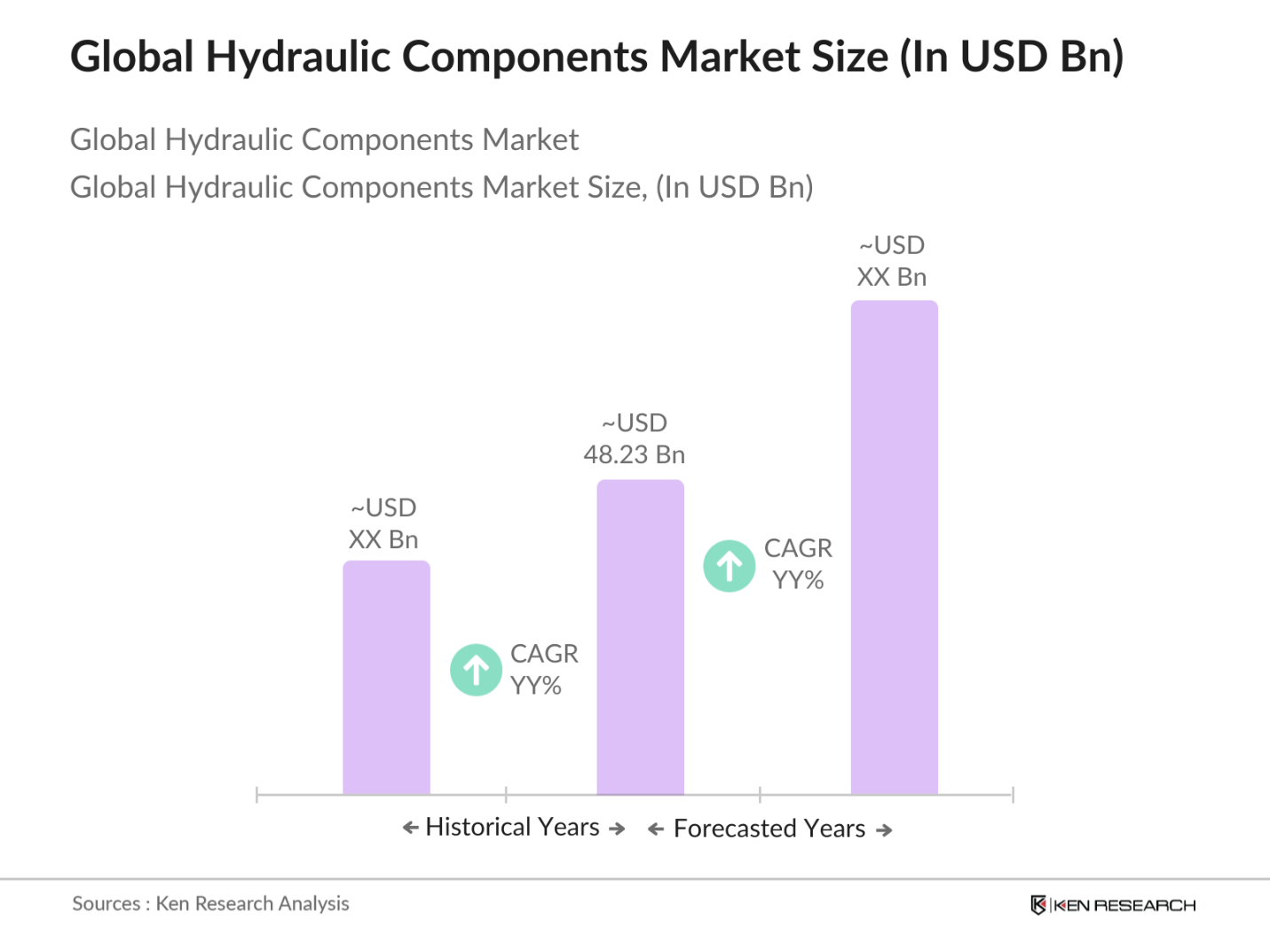

- The global hydraulic components market reached a valuation of USD 48.23 billion, largely driven by expanding infrastructure and construction projects globally, as well as the increasing use of hydraulic systems in industries such as aerospace, automotive, and marine. Hydraulic systems play a crucial role in modern industrial processes due to their efficiency in power transmission using pressurized fluids. Key factors propelling market growth include the adoption of automation and the integration of hydraulic components into advanced machinery across sectors.

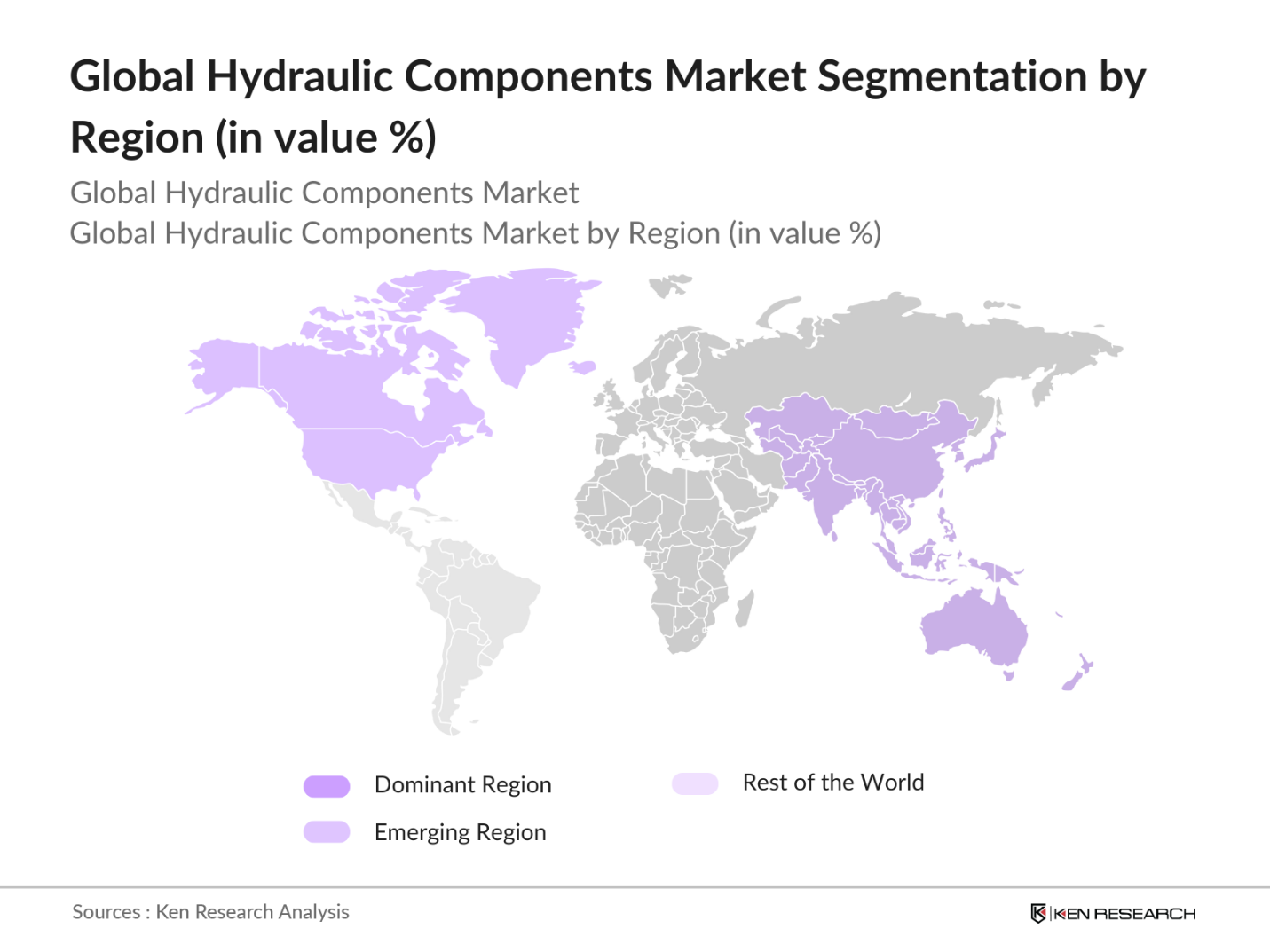

- Asia-Pacific dominates the hydraulic components market, with China, India, and Japan leading due to their rapidly industrializing economies and investments in infrastructure development. These countries are seeing heightened demand for hydraulic systems in manufacturing and construction, with significant government initiatives supporting industrial growth. North America and Europe also contribute strongly, with countries like the United States and Germany focusing on technological innovations in hydraulic equipment to improve efficiency and sustainability.

- The U.S. Bipartisan Infrastructure Law, allocates $1.2 trillion for infrastructure improvements, covering areas such as transportation, power grids, and clean energy. A significant portion of this funding is directed toward upgrading roads, bridges, and water systems, where hydraulic machinery is essential. The law is expected to stimulate the hydraulic components market by increasing demand for hydraulic-powered construction and maintenance equipment across various industries.

Global Hydraulic Components Market Segmentation

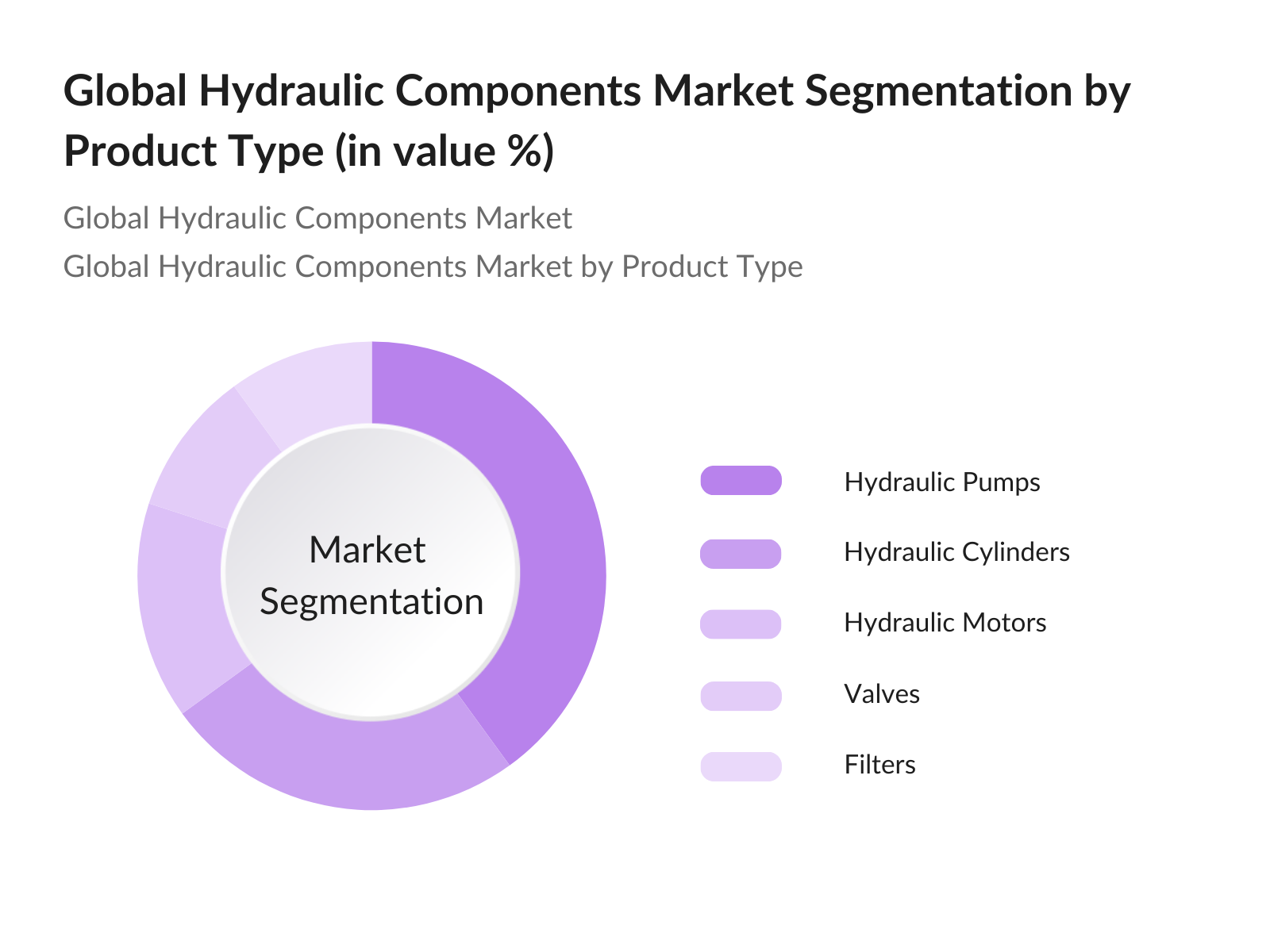

By Product Type: The hydraulic components market is segmented by product type into Hydraulic Pumps, Hydraulic Cylinders, Hydraulic Motors, Valves, and Filters. Hydraulic pumps hold the dominant market share due to their widespread applications across industries like automotive and construction. The ability of hydraulic pumps to convert mechanical energy into fluid power, crucial for lifting heavy equipment, contributes to their prominence, particularly in sectors requiring robust power sources.

By Region: The market is divided into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. Asia-Pacific holds the largest market share, driven by the region's rapid industrialization, especially in China and India, where infrastructure development is booming. The region's focus on manufacturing and automotive industries also plays a critical role in its market dominance.

Global Hydraulic Components Market Competitive Landscape

The global hydraulic components market is consolidated with a few major players dominating the landscape. The market leaders are known for their strong product portfolios and global distribution networks. Companies like Bosch Rexroth and Eaton are leveraging their technological expertise to cater to diverse industries, while Caterpillar and Parker Hannifin continue to expand through strategic acquisitions and innovation?.

|

Company |

Established Year |

Headquarters |

Product Portfolio |

Technological Innovations |

Global Reach |

R&D Investments |

Market Share |

Recent Acquisitions |

|

Bosch Rexroth AG |

1886 |

Germany |

Hydraulic Systems |

|||||

|

Eaton Corporation |

1911 |

United States |

Power Management |

|||||

|

Parker Hannifin |

1917 |

United States |

Filtration & Fluid Systems |

|||||

|

Caterpillar Inc. |

1925 |

United States |

Heavy Machinery |

|||||

|

Wipro Enterprises |

1945 |

India |

Industrial Equipment |

Global Hydraulic Components Market Analysis

Market Growth Drivers

- Industrial Automation Demand: The increasing demand for automation across industries such as manufacturing, logistics, and automotive is driving the hydraulic components market. According to the World Bank, the global industrial output in 2023 was valued at over $12 trillion, with automation being a key driver of efficiency. Countries like Germany, Japan, and the United States are leading the shift toward automated production systems, heavily relying on hydraulics for precision and performance in assembly lines, robotics, and material handling. Hydraulic components play a crucial role in these applications due to their power density and durability.

- Rising Investments in Construction Sector: Governments are investing heavily in infrastructure projects to support economic growth, which is fueling the demand for hydraulic components in construction machinery. In 2023, the global construction sector received $11 trillion in investment, with a significant portion allocated to road, rail, and energy infrastructure. Hydraulic systems are essential for operating heavy machinery like excavators, cranes, and loaders. For instance, India’s infrastructure budget in 2023 is projected to exceed $100 billion, significantly boosting demand for hydraulic-driven equipment.

- Industrial Fluid Power Requirements: Hydraulics are a key source of fluid power in industries such as oil & gas, aerospace, and manufacturing. These sectors rely on hydraulic components for high-force applications in drilling, aircraft control systems, and factory automation. According to a report by the World Bank, global oil production in 2023 was 94 million barrels per day, with hydraulic systems playing a critical role in extraction and transportation. As fluid power remains essential in these industries, the demand for hydraulic components continues to grow.

Market Challenges:

- High Initial Costs and Maintenance Challenges: The initial costs of hydraulic systems, coupled with maintenance challenges, act as significant barriers to market growth. According to a report by the U.S. Department of Energy, industrial maintenance costs due to hydraulic system failures accounted for $1.2 billion in 2023 alone. These costs are exacerbated by complex repairs, oil contamination, and wear and tear, which require regular upkeep and skilled technicians. This issue is particularly prevalent in small and medium-sized enterprises, which may find the upfront costs prohibitive.

- Environmental Concerns: Hydraulic systems face scrutiny due to their environmental impact, particularly concerning leaks and oil spills, which contribute to pollution. In 2023, approximately 15 million gallons of hydraulic oil were lost in industrial leaks globally, according to the U.S. Environmental Protection Agency (EPA). Additionally, stringent regulations concerning emissions and the use of eco-friendly fluids have been imposed by governments across Europe and North America. These regulations push for the adoption of biodegradable hydraulic fluids, but the transition poses significant cost and compatibility challenges.

Global Hydraulic Components Market Future Outlook

Over the next five years, the global hydraulic components market is expected to witness significant growth, driven by advancements in hydraulic technology and the rising demand for automation across industries. Increased infrastructure development, particularly in Asia-Pacific, along with the adoption of energy-efficient hydraulic systems in developed economies, will fuel this growth. The integration of digital control systems and predictive maintenance solutions will further enhance the performance and reliability of hydraulic equipment?.

Market Opportunities:

- Increased Usage in Mining and Agriculture: Hydraulic components are increasingly used in mining and agriculture for machinery such as tractors, harvesters, and mining trucks. In 2023, global agricultural production stood at over 8 billion metric tons, highlighting the crucial role of hydraulic machinery in powering farm equipment and enabling efficient production processes. Similarly, the mining industry, valued at $2 trillion globally, is seeing a rise in the adoption of hydraulic systems to boost operational efficiency in heavy-duty machines for ore extraction and processing. These sectors present significant growth opportunities for the hydraulic components market, especially in emerging economies.

- Use of Alternative Hydraulic Fluids: The adoption of alternative hydraulic fluids, such as biodegradable and fire-resistant fluids, is increasing due to environmental regulations. In 2023, the European Union implemented regulations mandating the use of eco-friendly fluids in certain industries, leading to a 20% increase in demand for biodegradable hydraulic oils. Additionally, industries such as marine and offshore drilling are transitioning to fire-resistant fluids to enhance safety measures. These trends are pushing manufacturers to develop more sustainable hydraulic fluid alternatives.

Scope of the Report

|

By Component Type |

Hydraulic Pumps Hydraulic Cylinders Hydraulic Motors Valves Filters |

|

By Application |

Construction Aerospace & Defense Automotive Agriculture Industrial |

|

By Technology |

Electro-Hydraulic Standard Hydraulic Hybrid Hydraulic |

|

By End-User Industry |

Manufacturing |

|

By Region |

North America |

Products

Key Target Audience

Hydraulic Components Manufacturers

Construction Equipment Companies

Automotive OEMs

Aerospace and Defense Contractors

Mining and Agricultural Equipment Manufacturers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Environmental Protection Agencies, Industry Standards Bodies)

Research and Development Institutions (Hydraulic Systems Labs)

Companies

Players Mention in the Report

Bosch Rexroth AG

Eaton Corporation

Parker Hannifin

Caterpillar Inc.

Pacoma GmbH

Hydratech Industries

Komatsu Ltd.

Wipro Enterprises

KYB Corporation

Hengli Hydraulic

Ligon Industries

Enerpac Tool Group

DY Power

Suvera Fluid Power

Texas Hydraulics Inc.

Table of Contents

01. Global Hydraulic Components Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Structure Overview

1.4 Growth Potential Analysis (Market Penetration, Growth Factors)

02. Global Hydraulic Components Market Size (USD Billion)

2.1 Historical Market Size

2.2 Market Growth Drivers (e.g., Infrastructure Development, Electrification)

2.3 Key Market Milestones and Technological Innovations

03. Global Hydraulic Components Market Dynamics

3.1 Growth Drivers

3.1.1 Industrial Automation Demand

3.1.2 Rising Investments in Construction Sector

3.1.3 Industrial Fluid Power Requirements

3.2 Market Restraints

3.2.1 High Initial Costs and Maintenance Challenges

3.2.2 Environmental Concerns (Eco-friendly Fluids, Emission Regulations)

3.2.3 Skilled Labor Shortage in Automation Systems

3.3 Opportunities

3.3.1 Increased Usage in Mining and Agriculture

3.3.2 IoT-Integrated Hydraulic Systems

3.4 Industry Trends

3.4.1 Miniaturization and Compact Systems

3.4.2 Use of Alternative Hydraulic Fluids (Biodegradable Fluids)

3.5 Competitive Landscape (Porters Five Forces Analysis)

04. Global Hydraulic Components Market Segmentation

4.1 By Component Type (in Value %):

4.1.1 Hydraulic Pumps

4.1.2 Hydraulic Cylinders

4.1.3 Hydraulic Motors

4.1.4 Valves

4.1.5 Filters

4.2 By Application (in Value %):

4.2.1 Construction

4.2.2 Aerospace and Defense

4.2.3 Automotive

4.2.4 Agriculture and Forestry

4.2.5 Industrial Equipment

4.3 By Technology (in Value %):

4.3.1 Electro-Hydraulic Systems

4.3.2 Standard Hydraulic Systems

4.3.3 Hybrid Hydraulic Systems

4.4 By End-User Industry (in Value %):

4.4.1 Manufacturing

4.4.2 Oil & Gas

4.4.3 Marine and Ports

4.5 By Region (in Value %):

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Middle East & Africa

4.5.5 Latin America

05. Global Hydraulic Components Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Bosch Rexroth AG

5.1.2 Eaton Corporation

5.1.3 Parker Hannifin Corporation

5.1.4 Caterpillar Inc.

5.1.5 Pacoma GmbH

5.1.6 Hydratech Industries

5.1.7 Komatsu Ltd.

5.1.8 Wipro Enterprises

5.1.9 KYB Corporation

5.1.10 Hengli Hydraulic

5.1.11 Ligon Industries

5.1.12 Enerpac Tool Group

5.1.13 DY Power

5.1.14 Suvera Fluid Power

5.1.15 Texas Hydraulics Inc.

5.2 Cross Comparison Parameters:

Revenue, Product Portfolio, Technological Innovations, Global Reach, Market Share, R&D Investments, Manufacturing Footprint, Service Networks

5.3 Strategic Initiatives and Innovations

5.4 Mergers and Acquisitions

5.5 Investment and Funding Analysis

06. Global Hydraulic Components Market Regulatory Framework

6.1 Environmental and Safety Standards

6.2 Industry Certifications and Compliance

6.3 Regional Regulations Impacting the Market

07. Global Hydraulic Components Future Market Size

7.1 Future Market Projections (in USD Billion)

7.2 Key Factors Driving Future Growth

08. Global Hydraulic Components Future Market Segmentation

8.1 By Product Type (in Value %)

8.2 By Application (in Value %)

8.3 By Technology (in Value %)

8.4 By End-User Industry (in Value %)

8.5 By Region (in Value %)

09. Global Hydraulic Components Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Market Entry Strategies

9.3 Expansion Opportunities

Research Methodology

Step 1: Identification of Key Variables

The initial stage involves mapping the entire hydraulic components market ecosystem, identifying key players, and studying trends through extensive desk research. Primary and proprietary databases were used to define critical market variables, such as product innovation and consumer demand.

Step 2: Market Analysis and Construction

Historical data related to hydraulic components was compiled to assess the market dynamics and revenue generation patterns. We examined the relationship between market demand and supplier capabilities to provide accurate market forecasts.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses were validated through consultations with industry experts, including senior executives from leading hydraulic equipment manufacturers. These interviews provided real-time insights into production capacities and emerging market trends.

Step 4: Research Synthesis and Final Output

We conducted direct engagement with manufacturers and industry associations to validate the data. The final output includes segmented insights and predictions based on a bottom-up analysis of production and market trends.

Frequently Asked Questions

01. How big is the Global Hydraulic Components Market?

The global hydraulic components market was valued at USD 48.23 billion, driven by robust demand from construction, automotive, and aerospace industries.

02. What are the challenges in the Global Hydraulic Components Market?

Key challenges include high initial investment costs, the scarcity of skilled labor for automation systems, and increasing regulatory pressure to adopt eco-friendly hydraulic fluids.

03. Who are the major players in the Global Hydraulic Components Market?

Major players include Bosch Rexroth AG, Eaton Corporation, Parker Hannifin, Caterpillar Inc., and Wipro Enterprises. These companies dominate due to their technological innovations and global reach.

04. What are the growth drivers of the Global Hydraulic Components Market?

The market is primarily driven by infrastructure development projects, the rise of automation in industrial processes, and advancements in hydraulic system efficiency.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.