Global Hydraulics Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD9337

October 2024

92

About the Report

Global Hydraulics Market Overview

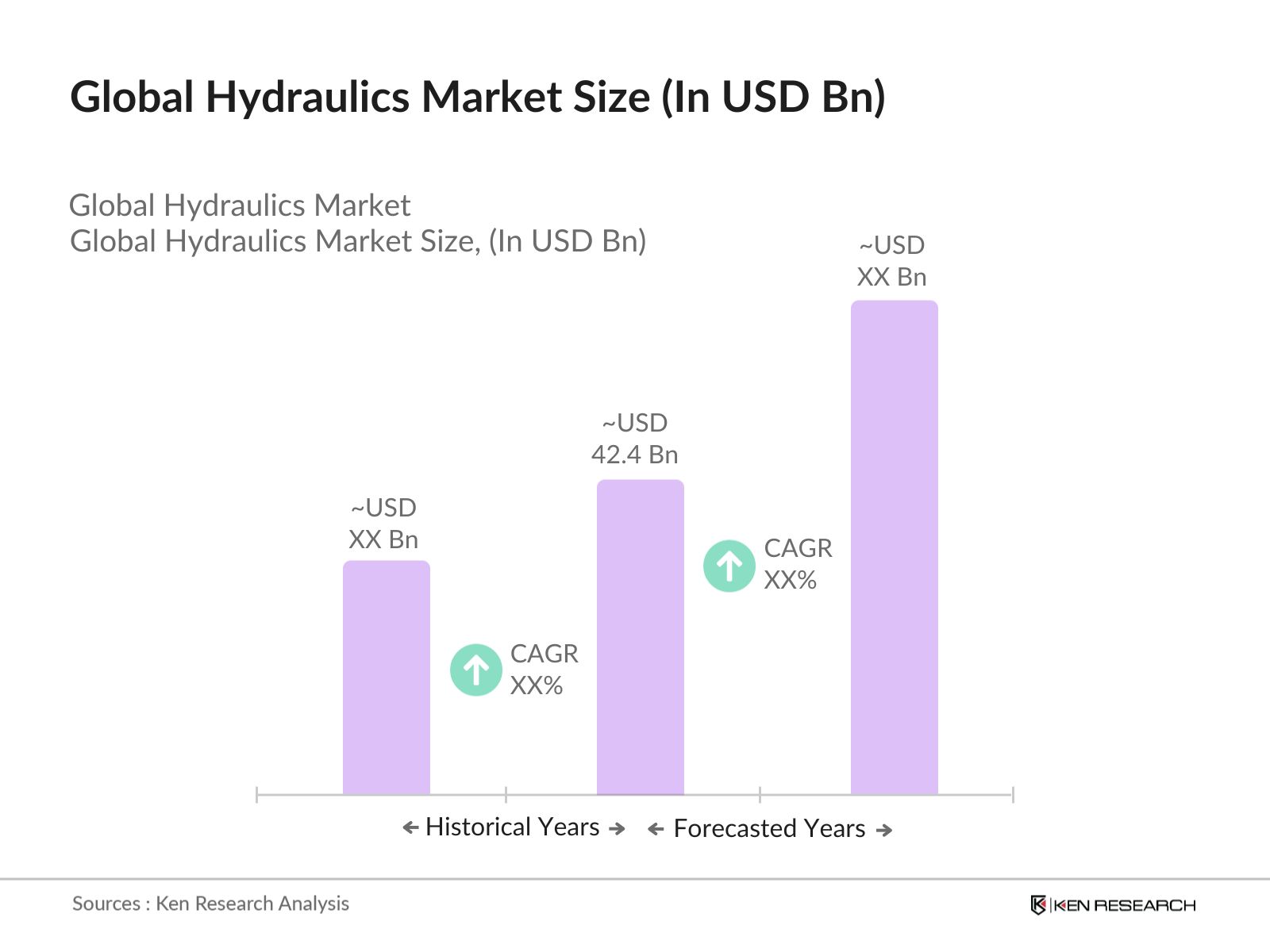

- The global hydraulics market is valued at USD 42.4 billion based on a thorough analysis of historical data and current market conditions. The market is driven primarily by the increasing demand in construction, manufacturing, and material handling sectors. These industries rely on hydraulic systems for efficient power transmission, energy conservation, and enhanced productivity. Additionally, the demand for advanced hydraulic equipment, especially in energy-efficient systems, is shaping the market's growth trajectory, propelled by governmental emphasis on sustainability.

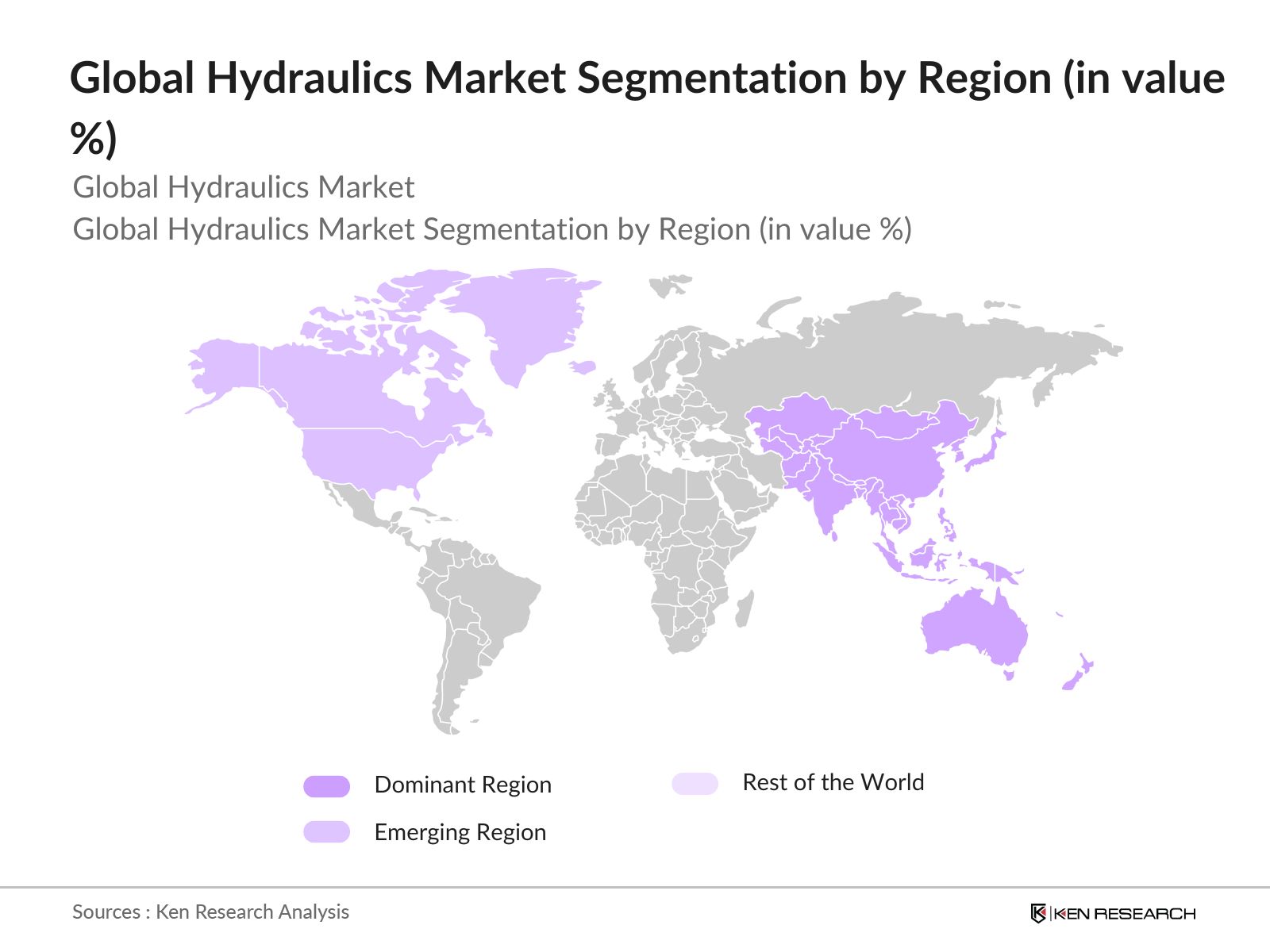

- Countries like China, the United States, and Germany dominate the global hydraulics market due to their well-established industrial and construction sectors. China's expansive manufacturing capabilities, combined with rapid urbanization and infrastructure projects, make it a key market leader. The U.S. and Germany benefit from technological advancements in hydraulics, along with a focus on automation and energy-efficient machinery, giving them a competitive edge in global hydraulic equipment production and consumption.

- Energy efficiency standards are increasingly being enforced globally, impacting the hydraulics market. In 2023, China introduced new energy efficiency regulations, requiring hydraulic systems used in industrial machinery to reduce energy consumption by 15%. Similarly, the U.S. Department of Energy introduced efficiency standards for hydraulic pumps and motors, which are expected to save the industry approximately 1.2 terawatt-hours of energy annually by 2025. These regulations are driving manufacturers to adopt more energy-efficient technologies in hydraulic machinery.

Global Hydraulics Market Segmentation

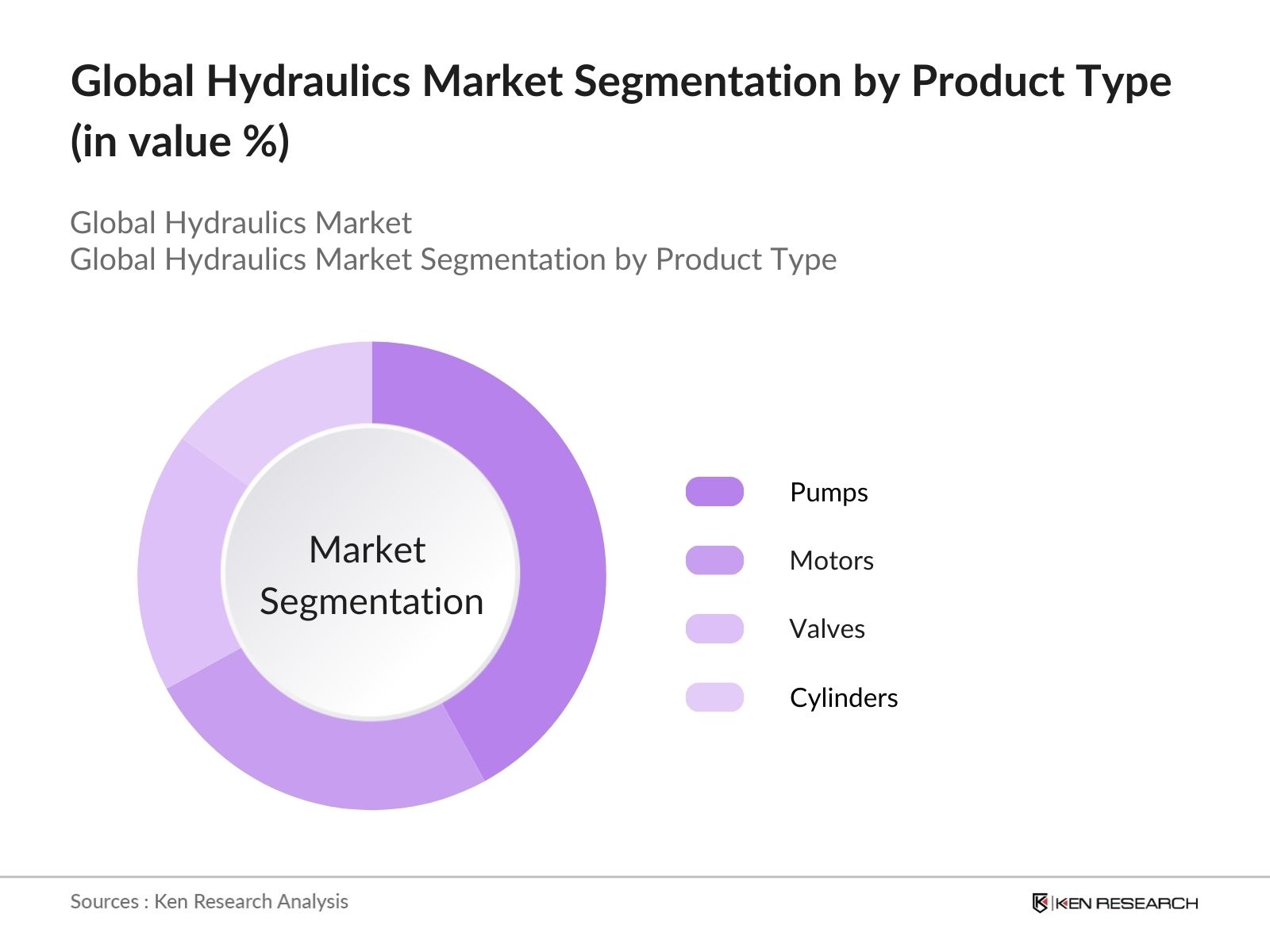

- By Product Type: The global hydraulics market is segmented by product type into pumps, motors, valves, cylinders, and accumulators. Among these, pumps have a dominant market share due to their widespread application across various industries, including construction, oil & gas, and manufacturing. The reliability of hydraulic pumps in heavy-duty applications, coupled with advancements in energy-efficient pump technologies, has bolstered their demand globally. Pumps account for 32% of the total market in 2023.

- By Region: Regionally, the hydraulics market is divided into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. Asia-Pacific leads the market due to rapid industrialization, urbanization, and construction activities, especially in China and India. Government initiatives to develop infrastructure and increased investments in renewable energy projects are also fueling demand for hydraulic systems. Asia-Pacific holds 45% of the market in 2023.

- By Application: The global hydraulics market is also segmented by application into mobile equipment, industrial equipment, and aerospace & defense. Mobile equipment, which includes construction and agricultural machinery, holds the largest market share. The growing demand for efficient hydraulic systems in heavy-duty vehicles and the need for precise control in construction operations has contributed to the dominance of this segment. In 2023, mobile equipment accounts for 40% of the market.

Global Hydraulics Market Competitive Landscape

The global hydraulics market is characterized by the presence of several major players, with competition focused on technological advancements, product innovation, and market expansion. The market is dominated by key players like Bosch Rexroth AG, Parker Hannifin Corporation, and Eaton Corporation. These companies have established strong brand equity and continue to invest in research and development, ensuring their products meet evolving customer demands for more energy-efficient and smarter hydraulic systems.

|

Company |

Establishment Year |

Headquarters |

Global Presence |

R&D Investment |

Product Range |

Technology Partnerships |

No. of Patents |

Customer Segments |

Manufacturing Facilities |

|

Bosch Rexroth AG |

1795 |

Lohr am Main, Germany |

|||||||

|

Parker Hannifin Corp |

1917 |

Cleveland, USA |

|||||||

|

Eaton Corporation |

1911 |

Dublin, Ireland |

|||||||

|

Danfoss A/S |

1933 |

Nordborg, Denmark |

|||||||

|

Kawasaki Heavy Industries |

1896 |

Tokyo, Japan |

Global Hydraulics Industry Analysis

Growth Drivers

- Industrial Automation (Automation & Efficiency Needs): Industrial automation is a significant growth driver in the hydraulics market, particularly with the increased adoption of automated systems across industries. In 2024, the global manufacturing sector is projected to grow by 4% (excluding China), which is driving the demand for hydraulic solutions to enhance efficiency. Hydraulic systems are widely used for automation in sectors like mining, construction, and material handling. For example, in the U.S., the manufacturing output for durable goods, which heavily relies on hydraulic systems, reached $4.45 trillion in 2023. This demand is fueled by the need for automation, productivity enhancement, and operational cost savings.

- Infrastructure Development (Infrastructure Expansion Impact): Infrastructure development is driving demand for hydraulics globally, with significant investments in large-scale projects. In 2023, the global infrastructure development market saw a notable $9 trillion investment, driven by both developed and emerging economies. Hydraulic systems play a crucial role in the construction sector due to their efficiency in handling heavy loads and complex operations. For instance, the Indian government allocated $1.7 trillion for infrastructure projects in 2023, including roads, bridges, and urban development, significantly boosting the hydraulics market.

- Energy Efficiency Regulations (Hydraulic Energy Solutions): Energy efficiency regulations are prompting the adoption of more efficient hydraulic systems in industries. The European Unions energy efficiency directive, which mandates a 30% reduction in industrial energy consumption by 2025, has spurred innovation in hydraulic machinery. Modern hydraulic systems now focus on reducing energy loss through advanced components and better integration with electric systems. Additionally, in Japan, government regulations have promoted the use of energy-efficient hydraulic machinery, contributing to reduced energy consumption by 12% in industrial applications between 2020 and 2023.

Market Restraints

- High Initial Costs (Hydraulic System Investment Costs): Hydraulic systems, while efficient and durable, require significant initial capital investment. The average cost of industrial hydraulic systems ranges between $20,000 and $150,000, depending on the complexity and size of the equipment. This cost includes components like pumps, motors, and actuators, which are priced higher due to their heavy-duty usage in industries like mining and construction. Small to mid-sized companies often struggle to absorb these costs, especially in developing economies where funding for such equipment remains limited.

- Maintenance Complexity (Hydraulic Equipment Maintenance): Hydraulic systems, although reliable, require extensive maintenance to ensure optimal performance. In 2023, global industrial maintenance costs reached $60 billion, with a significant portion attributed to hydraulic machinery. The complexity of hydraulic systems, particularly in industries like aviation and manufacturing, often leads to longer downtimes for repairs and servicing, resulting in productivity losses. For instance, in the U.S. aerospace industry, 35% of equipment downtime in 2023 was attributed to hydraulic system maintenance.

Global Hydraulics Market Future Outlook

The global hydraulics market is poised for steady growth over the next five years, driven by increasing industrial automation, energy efficiency trends, and innovations in hydraulic technologies. As industries continue to adopt hydraulic systems in emerging applications such as renewable energy and electric vehicle manufacturing, the demand for advanced, energy-efficient, and compact hydraulic systems is expected to rise. Additionally, government regulations focused on reducing carbon emissions and improving energy efficiency will play a crucial role in shaping the future of the hydraulics market.

Market Opportunities

- Technological Advancements (Smart Hydraulics, IoT Integration): Advancements in technology, particularly smart hydraulics and IoT integration, are creating new opportunities in the market. In 2023, over 500,000 hydraulic systems were integrated with IoT for real-time monitoring and predictive maintenance, reducing downtime and increasing efficiency. The U.S. Department of Energy estimates that IoT-enabled hydraulic systems can improve efficiency by 15% in industrial applications. Smart hydraulics, which include sensors and control systems, are also expected to drive demand in industries like automotive and aerospace, where precision and reliability are critical.

- Emerging Economies (Hydraulics Market Penetration): Emerging economies are witnessing a surge in demand for hydraulic systems, driven by industrialization and infrastructure development. In 2023, countries like Brazil and Indonesia recorded a 7% and 6% growth in hydraulic machinery imports, respectively. These nations are investing heavily in construction, mining, and agriculture sectors, where hydraulics are essential. For instance, Brazils construction sector, valued at $150 billion in 2023, has become a key market for hydraulic system manufacturers, offering immense growth potential for the future.

Scope of the Report

|

By Product Type |

Pumps, Motors, Valves, Cylinders, Accumulators |

|

By Application |

Mobile Equipment, Industrial Equipment, Aerospace |

|

By End-User |

Construction, Automotive, Oil & Gas, Marine |

|

By Technology |

Hydraulic Transmission Systems, Electro-Hydraulic |

|

By Region |

North America, Europe, Asia-Pacific, Middle East & Africa, Latin America |

Products

Key Target Audience

Hydraulic Equipment Manufacturers

Industrial Machinery Manufacturers

Government & Regulatory Bodies (e.g., U.S. Environmental Protection Agency)

Construction and Infrastructure Companies

Energy and Renewable Energy Companies

Aerospace and Defense Organizations

Investors and Venture Capitalist Firms

Oil & Gas Industry Stakeholders

Companies

Players Mentioned in the Report:

Bosch Rexroth AG

Parker Hannifin Corporation

Eaton Corporation

Danfoss A/S

Kawasaki Heavy Industries Ltd.

Hydac International GmbH

Moog Inc.

HAWE Hydraulik SE

Bailey International LLC

Daikin Industries Ltd.

Bucher Hydraulics

Linde Hydraulics

Casappa S.p.A.

Yuken Kogyo Co., Ltd.

HYDAC Technology GmbH

Table of Contents

1. Global Hydraulics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Hydraulics Sector Growth)

1.4. Market Segmentation Overview (Hydraulic Applications, Products)

2. Global Hydraulics Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (OEM Sales, Aftermarket Sales)

2.3. Key Market Developments and Milestones

3. Global Hydraulics Market Analysis

3.1. Growth Drivers

3.1.1. Industrial Automation (Automation & Efficiency Needs)

3.1.2. Infrastructure Development (Infrastructure Expansion Impact)

3.1.3. Energy Efficiency Regulations (Hydraulic Energy Solutions)

3.1.4. Rising Demand for Construction Equipment

3.2. Market Challenges

3.2.1. High Initial Costs (Hydraulic System Investment Costs)

3.2.2. Maintenance Complexity (Hydraulic Equipment Maintenance)

3.2.3. Substitutes (Electric Drives and Pneumatics)

3.3. Opportunities

3.3.1. Technological Advancements (Smart Hydraulics, IoT Integration)

3.3.2. Emerging Economies (Hydraulics Market Penetration)

3.3.3. Renewable Energy Sector Adoption

3.4. Trends

3.4.1. Electrohydraulics Growth (Combining Electric and Hydraulic Systems)

3.4.2. Compact Hydraulic Systems (Smaller, Energy-Efficient Systems)

3.4.3. Increased Use of Hydraulic Fluids with Low Environmental Impact

3.5. Government Regulation

3.5.1. Environmental Regulations on Hydraulic Fluids

3.5.2. Energy Efficiency Standards for Hydraulic Machinery

3.5.3. Certification Standards (ISO, IEC)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Hydraulics Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Pumps

4.1.2. Motors

4.1.3. Valves

4.1.4. Cylinders

4.1.5. Accumulators

4.2. By Application (In Value %)

4.2.1. Mobile Equipment (Agricultural, Construction, Mining)

4.2.2. Industrial Equipment (Manufacturing, Automation)

4.2.3. Aerospace & Defense

4.3. By End-User Industry (In Value %)

4.3.1. Construction

4.3.2. Automotive

4.3.3. Oil & Gas

4.3.4. Marine

4.4. By Technology (In Value %)

4.4.1. Hydraulic Transmission Systems

4.4.2. Electro-Hydraulic Systems

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

5. Global Hydraulics Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Bosch Rexroth AG

5.1.2. Parker Hannifin Corporation

5.1.3. Eaton Corporation

5.1.4. Danfoss A/S

5.1.5. Hydac International GmbH

5.1.6. Kawasaki Heavy Industries Ltd.

5.1.7. Moog Inc.

5.1.8. HAWE Hydraulik SE

5.1.9. Bailey International LLC

5.1.10. Daikin Industries Ltd.

5.1.11. Bucher Hydraulics

5.1.12. Linde Hydraulics

5.1.13. Casappa S.p.A.

5.1.14. Yuken Kogyo Co., Ltd.

5.1.15. HYDAC Technology GmbH

5.2. Cross Comparison Parameters (Revenue, Product Offerings, R&D Investments, No. of Patents, Global Presence, Customer Segments, Technology Partnerships, Operational Facilities)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Hydraulics Market Regulatory Framework

6.1. Environmental Standards for Hydraulic Fluids

6.2. Compliance with Machinery Directive

6.3. Certification and Testing Standards for Hydraulics

7. Global Hydraulics Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Digital Hydraulics, Energy-Efficient Equipment)

8. Global Hydraulics Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By End-User Industry (In Value %)

8.5. By Region (In Value %)

9. Global Hydraulics Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis (Total Addressable Market, Serviceable Available Market, Serviceable Obtainable Market)

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives (Product Promotion Strategies)

9.4. White Space Opportunity Analysis (Unserved Market Segments)

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the global hydraulics market. This step includes a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

This phase compiles and analyzes historical data on the global hydraulics market, assessing market penetration, product segmentation, and revenue generation. Further evaluation of service quality statistics ensures reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through interviews with industry experts representing diverse companies. These consultations provide valuable insights, refining the market data through a combination of expert opinions and industry practices.

Step 4: Research Synthesis and Final Output

In the final phase, we engage directly with multiple hydraulics equipment manufacturers to acquire detailed insights into product segments, sales performance, and industry trends. This interaction serves to verify and complement the findings derived from the bottom-up approach.

Frequently Asked Questions

01. How big is the Global Hydraulics Market?

The global hydraulics market is valued at USD 42.4 billion, driven by significant demand across industrial, construction, and agricultural sectors. The increased focus on energy-efficient machinery is propelling growth further.

02. What are the challenges in the Global Hydraulics Market?

Challenges include the high cost of initial setup, maintenance complexity, and competition from electric and pneumatic alternatives. Additionally, evolving regulatory standards around energy efficiency are also adding pressure on market players.

03. Who are the major players in the Global Hydraulics Market?

Key players in the market include Bosch Rexroth AG, Parker Hannifin Corporation, Eaton Corporation, Danfoss A/S, and Kawasaki Heavy Industries Ltd. These companies dominate the market due to their advanced technologies, extensive product portfolios, and global reach.

04. What are the growth drivers of the Global Hydraulics Market?

Growth is driven by rapid industrialization, increased demand in the construction sector, and advancements in hydraulic technologies. The need for energy-efficient solutions and increased automation in industrial processes are also key factors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.