Global Hypermarket Market Outlook to 2030

Region:Global

Author(s):Sanjana Verma

Product Code:KROD8181

December 2024

95

About the Report

Global Hypermarket Market Overview

- The global hypermarket market is valued at USD 765 billion, driven primarily by the demand for convenience and one-stop shopping experiences. Hypermarkets combine multiple product categories, from groceries to electronics, under one roof, making them a preferred choice for time-sensitive consumers. Increasing urbanization and a growing middle-class population are additional factors contributing to this market's growth. The rising demand for diverse product assortments at competitive prices further fuels market expansion, especially in rapidly developing economies such as India and China.

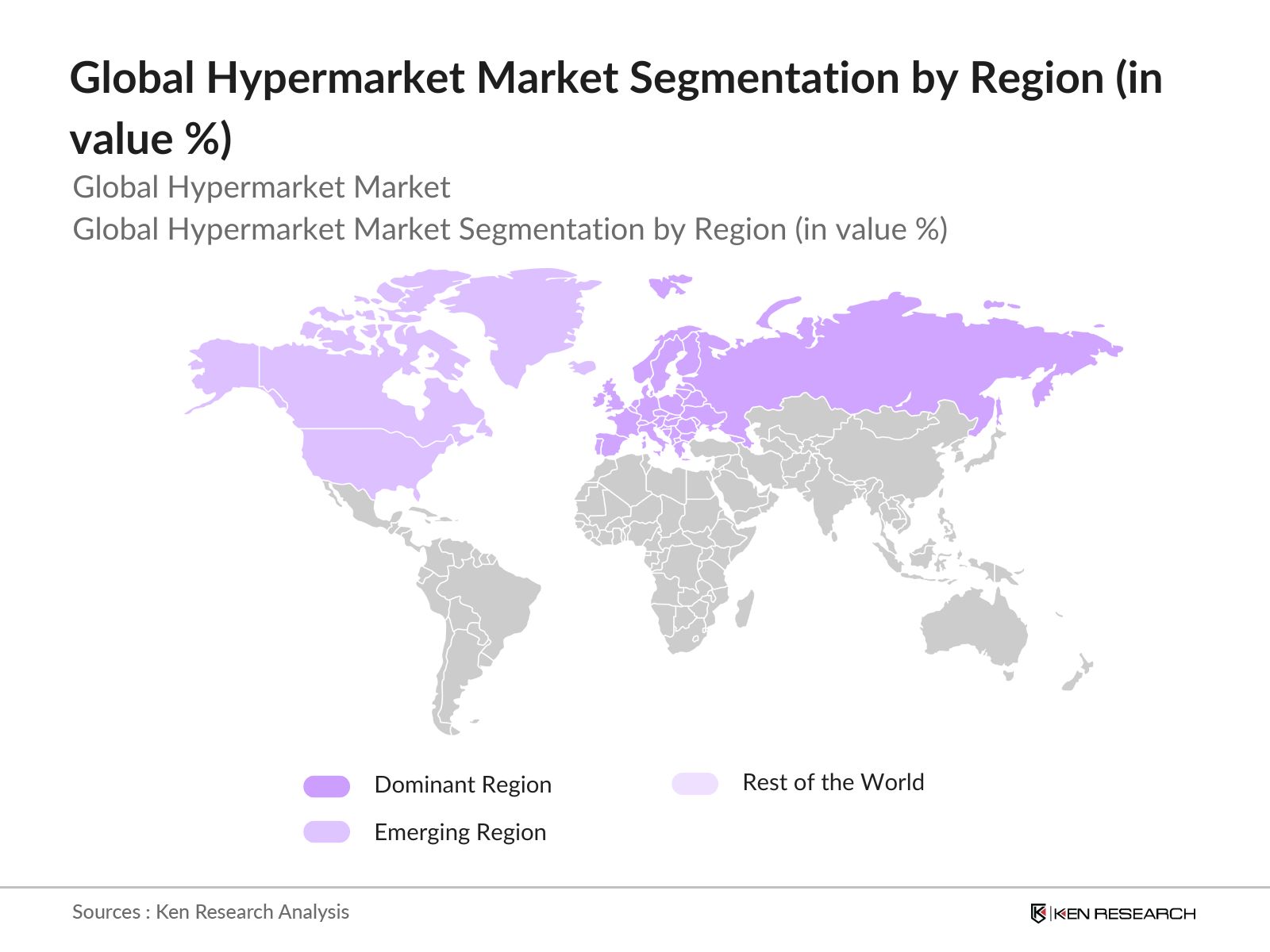

- North America, Europe, and Asia Pacific are dominant regions in the global hypermarket market. Countries like the United States, China, and France lead the market due to their advanced retail infrastructure, high disposable incomes, and a well-established consumer base. These regions house some of the largest hypermarket chains globally, such as Walmart, Carrefour, and Tesco, which benefit from economies of scale, advanced logistics networks, and significant brand loyalty.

- Hypermarkets are subject to stringent retail laws across different markets. In 2023, the European Union enacted that mandate fair competition practices, which have impacted hypermarket operations. These laws ensure that hypermarkets cannot monopolize the retail sector, thereby encouraging competition from smaller retailers. In emerging markets like India, foreign direct investment (FDI) laws have been relaxed, enabling more global hypermarket chains to enter the market.

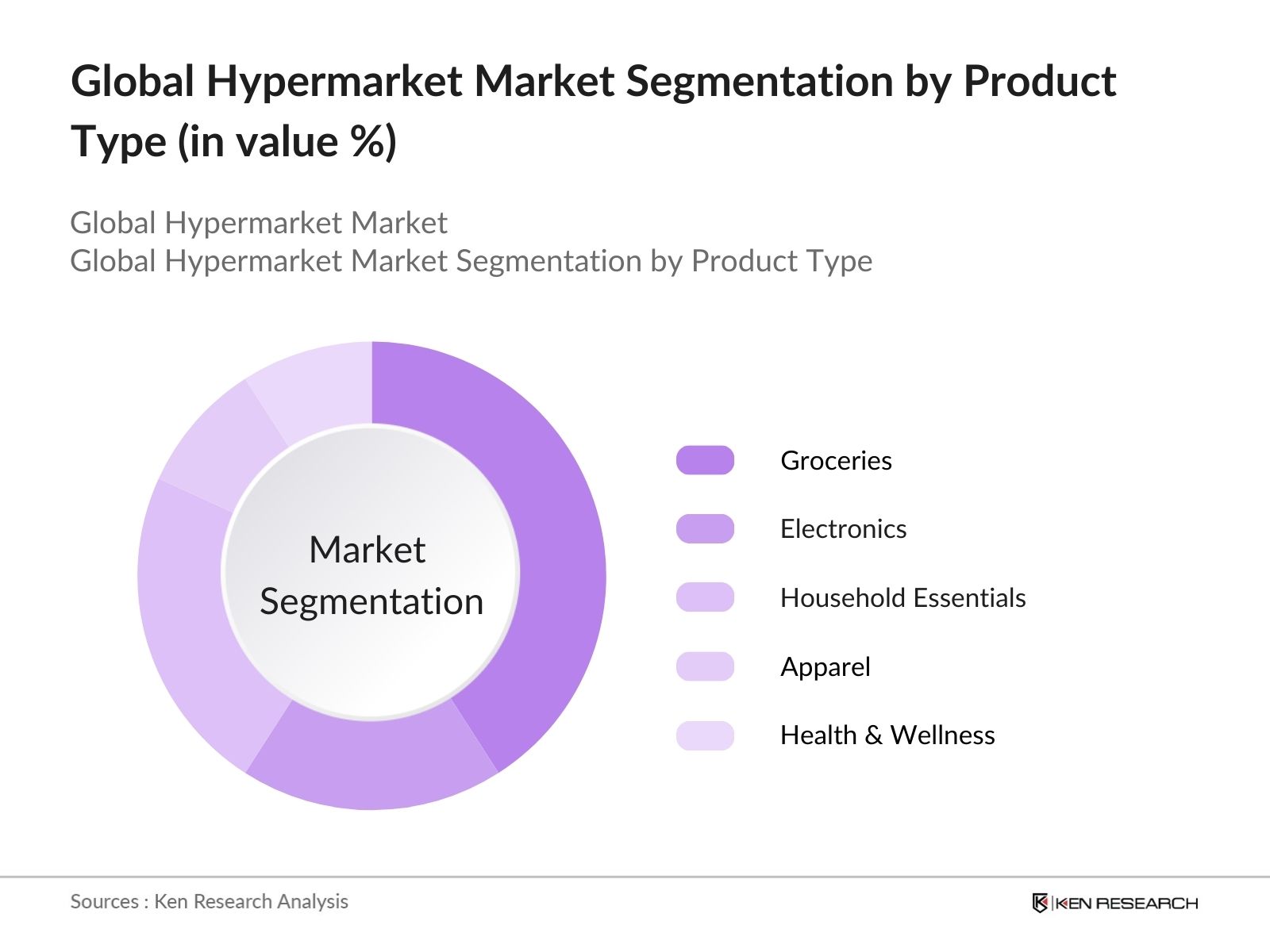

Global Hypermarket Market Segmentation

By Product Type: The global hypermarket market is segmented by product type into groceries, electronics, household essentials, apparel, and health and wellness products. Among these, groceries hold the dominant market share, driven by their consistent demand and necessity. Consumers prefer hypermarkets for grocery shopping due to the availability of fresh produce, variety, and competitive pricing. The rise in consumer preference for organic and locally sourced food products further drives this segment's growth. Established brands like Walmart and Carrefour have also tailored their product offerings to meet the demand for healthier and organic food options.

By Region: Geographically, the global hypermarket market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe dominates the market, particularly in countries like France and Germany, due to the presence of major hypermarket chains such as Carrefour and Metro AG. The region benefits from a well-established retail network and a mature consumer base that values convenience and product variety. Hypermarkets in Europe are also increasingly focusing on sustainability, incorporating eco-friendly practices that attract environmentally-conscious consumers.

By Store Size: The market is segmented by store size into small, medium, and large hypermarkets. Large hypermarkets dominate the global market share due to their capacity to stock a vast range of products and cater to a wide demographic. Their size allows for economies of scale, enabling them to offer lower prices, which attracts cost-conscious shoppers. Large stores also benefit from greater product variety, appealing to consumers looking for diverse shopping experiences under one roof, which small and medium stores may not offer.

Global Hypermarket Market Competitive Landscape

The global hypermarket market is dominated by a few key players, including Walmart, Carrefour, and Tesco, which have strong global presences. These companies benefit from established supply chains, economies of scale, and strong brand loyalty, allowing them to maintain market leadership. Additionally, many players are investing in omnichannel strategies, merging online and offline sales to enhance customer convenience and drive growth. The competitive landscape is characterized by consolidation, with leading players continuously expanding their market reach through mergers, acquisitions, and strategic partnerships.

|

Company |

Establishment Year |

Headquarters |

Number of Stores |

Revenue (2023) |

Market Reach |

Brand Loyalty |

Supply Chain Network |

Omnichannel Strategy |

Sustainability Initiatives |

|

Walmart Inc. |

1962 |

USA |

- |

- |

- |

- |

- |

- |

- |

|

Carrefour S.A. |

1959 |

France |

- |

- |

- |

- |

- |

- |

- |

|

Tesco PLC |

1919 |

UK |

- |

- |

- |

- |

- |

- |

- |

|

Costco Wholesale Corp. |

1983 |

USA |

- |

- |

- |

- |

- |

- |

- |

|

Metro AG |

1964 |

Germany |

- |

- |

- |

- |

- |

- |

- |

Global Hypermarket Market Analysis

Growth Drivers

- Urbanization: The global shift towards urban living continues to drive the growth of hypermarkets. In 2022, the World Bank reported that 56% of the worlds population lived in urban areas, and by 2024, urbanization is expected to further increase, particularly in regions like Asia and Africa. In India, for example, cities like Mumbai and Delhi have seen annual urban population growth of over 1.4 million people, fueling demand for large retail spaces like hypermarkets. As urban centers expand, hypermarkets benefit from higher foot traffic and increased consumer spending, enhancing their market presence.

- E-commerce Adoption: E-commerce has complemented hypermarket operations, with retailers adopting digital solutions for enhancing supply chain efficiency and customer experience. As of 2023, global online retail sales accounted for $6.31 trillion, while hypermarkets are integrating click-and-collect services to meet evolving consumer needs. This adoption drives the development of omnichannel strategies, offering more flexibility for consumers in how they shop. In developed markets like the USA and the EU, hypermarkets are leveraging data analytics to optimize in-store and online offerings, increasing convenience and attracting tech-savvy consumers.

- Consumer Preferences: In 2024, consumers in North America and Europe are spending more on diversified products in single retail locations. The average consumer visit to a hypermarket in the USA includes the purchase of around 20-30 different items, spanning groceries, electronics, and household goods. This consumer behavior favors hypermarkets, as they offer a one-stop shopping experience, addressing the growing need for convenience in busy, urbanized societies.

Challenges

- High Operational Costs: Hypermarkets face high operational costs due to large store footprints, inventory management, and labor expenses. In the USA, labor costs have surged, with average hourly earnings rising to $28.68 in 2023, according to the U.S. Bureau of Labor Statistics. Additionally, utility expenses for large hypermarkets, such as electricity and water, further escalate operational costs, particularly in energy-intensive regions like the Middle East. These overheads challenge hypermarkets in maintaining profitability, especially as they expand into new markets.

- Supply Chain Inefficiencies: Supply chain disruptions continue to impact hypermarkets globally, with the COVID-19 pandemic and geopolitical tensions like the Russia-Ukraine conflict exacerbating delays and costs. The average composite index for container shipping was reported at around$4,079 per 40-foot container, which is significantly higher than pre-pandemic levels but also lower than the peaks seen during the COVID-19 pandemic. Furthermore, inefficient warehousing and logistics management have led to stock shortages and excess inventory in some markets, such as Southeast Asia.

Global Hypermarket Market Future Outlook

Global Hypermarket Market is expected to witness sustained growth, driven by technological advancements, shifting consumer preferences, and the rise of digital retail platforms. Hypermarkets will continue to expand their omnichannel strategies, integrating online and offline experiences to cater to tech-savvy consumers who seek convenience. Additionally, emerging markets in Asia Pacific and Latin America are expected to contribute significantly to market expansion, as urbanization and rising incomes create new opportunities for hypermarket penetration.

Future Market Opportunities

- Digital Transformation: Digital transformation offers significant opportunities for hypermarkets, enhancing operational efficiency and customer engagement. With investments in artificial intelligence (AI), some hypermarkets have optimized their supply chains, reducing restocking times by 40% in 2023. Additionally, mobile apps and loyalty programs have increased customer retention, with data-driven marketing contributing to a 10% rise in average basket size.

- Expansion into Emerging Markets: Emerging markets, particularly in Asia and Africa, present lucrative opportunities for hypermarkets. In 2023, consumer spending in Indias retail sector reached $1.3 trillion, with hypermarkets accounting for a growing share. Countries like Nigeria and Vietnam, where middle-class populations are expanding, offer fertile ground for hypermarket expansion. These markets have untapped potential, with large, young populations seeking greater convenience and product variety.

Scope of the Report

|

By Product Type |

Food & Beverages Household Essentials Electronics Apparel & Accessories Health & Wellness Products |

|

By Store Size |

Small Medium Large |

|

By Operating Model |

Standalone Hypermarkets Hypermarkets within Malls |

|

By Ownership |

Publicly Owned Privately Owned |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Retail Corporations

Hypermarket Chains

FMCG Companies

E-commerce Retailers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., US Federal Trade Commission, European Commission)

Technology Providers (e.g., RFID and supply chain management solutions)

Logistics and Supply Chain Firms

Companies

Players Mentioned in the Report

Walmart Inc.

Carrefour S.A.

Tesco PLC

Costco Wholesale Corporation

Metro AG

Aldi Group

Target Corporation

Auchan Retail International

Schwarz Group (Lidl)

Kroger Co.

Table of Contents

Global Hypermarket Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Global Hypermarket Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

Global Hypermarket Market Analysis

3.1. Growth Drivers

3.1.1. Urbanization

3.1.2. E-commerce Adoption

3.1.3. Consumer Preferences

3.2. Market Challenges

3.2.1. High Operational Costs

3.2.2. Supply Chain Inefficiencies

3.2.3. Intense Competition

3.3. Opportunities

3.3.1. Digital Transformation

3.3.2. Expansion into Emerging Markets

3.3.3. Omnichannel Strategies

3.4. Trends

3.4.1. Integration of Technology

3.4.2. Consumer Experience Enhancements

3.4.3. Sustainability Initiatives

3.5. Government Regulation

3.5.1. Retail Laws

3.5.2. Labor Regulations

3.5.3. Environmental Compliance

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Landscape

Global Hypermarket Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Food & Beverages

4.1.2. Household Essentials

4.1.3. Electronics

4.1.4. Apparel & Accessories

4.1.5. Health & Wellness Products

4.2. By Store Size (In Value %)

4.2.1. Small

4.2.2. Medium

4.2.3. Large

4.3. By Operating Model (In Value %)

4.3.1. Standalone Hypermarkets

4.3.2. Hypermarkets within Malls

4.4. By Ownership (In Value %)

4.4.1. Publicly Owned Hypermarkets

4.4.2. Privately Owned Hypermarkets

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

Global Hypermarket Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Walmart Inc.

5.1.2. Carrefour S.A.

5.1.3. Tesco PLC

5.1.4. Aldi Group

5.1.5. Costco Wholesale Corporation

5.1.6. Auchan Retail International

5.1.7. Target Corporation

5.1.8. Kroger Co.

5.1.9. Schwarz Group (Lidl)

5.1.10. Metro AG

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

Global Hypermarket Market Regulatory Framework

6.1. Retail Regulations

6.2. Consumer Protection Laws

6.3. Environmental Regulations

6.4. Labor Laws and Minimum Wage Policies

Global Hypermarket Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Global Hypermarket Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Store Size (In Value %)

8.3. By Operating Model (In Value %)

8.4. By Ownership (In Value %)

8.5. By Region (In Value %)

Global Hypermarket Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Behavior Analysis

9.3. White Space Opportunity Analysis

9.4. Expansion Strategy Recommendations

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping out the entire hypermarket ecosystem, focusing on key stakeholders, such as retailers, suppliers, logistics partners, and consumers. Extensive desk research was carried out using both secondary data from proprietary databases and public reports to identify critical variables that influence the market dynamics, such as product pricing, consumer behavior, and market entry barriers.

Step 2: Market Analysis and Construction

In this phase, historical data from the global hypermarket market was gathered to assess trends in product penetration, consumer preferences, and store formats. Additionally, data on store expansion and logistics networks was used to evaluate market performance, while revenue generation was analyzed based on store size and regional factors.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed regarding consumer shopping behavior, technological integration, and supply chain efficiency. These were validated through interviews with key industry experts from leading hypermarket chains, including Walmart and Carrefour, providing operational insights and financial perspectives that informed the final analysis.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing the data from various hypermarket stakeholders to deliver a comprehensive view of the market. This phase also included direct engagement with product suppliers and logistics firms to validate findings from the bottom-up analysis and refine the market outlook based on real-world performance data.

Frequently Asked Questions

01. How big is the global hypermarket market?

The global hypermarket market is valued at USD 765 billion, driven by growing consumer demand for convenience and competitive pricing across a wide range of product categories.

02. What are the challenges in the global hypermarket market?

The global hypermarket market faces challenges such as high operational costs, supply chain inefficiencies, and intense competition from both other hypermarkets and emerging e-commerce platforms.

03. Who are the major players in the global hypermarket market?

Key players in the global hypermarket market include Walmart Inc., Carrefour S.A., Tesco PLC, Costco Wholesale Corporation, and Metro AG, each benefiting from economies of scale, advanced supply chains, and strong brand loyalty.

04. What are the growth drivers of the global hypermarket market?

Growth in global hypermarket market is driven by urbanization, rising disposable incomes, the increasing popularity of one-stop shopping experiences, and the integration of digital technologies that enhance the consumer shopping journey.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.