Global Ice Hockey Equipment Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD7083

November 2024

83

About the Report

Global Ice Hockey Equipment Market Overview

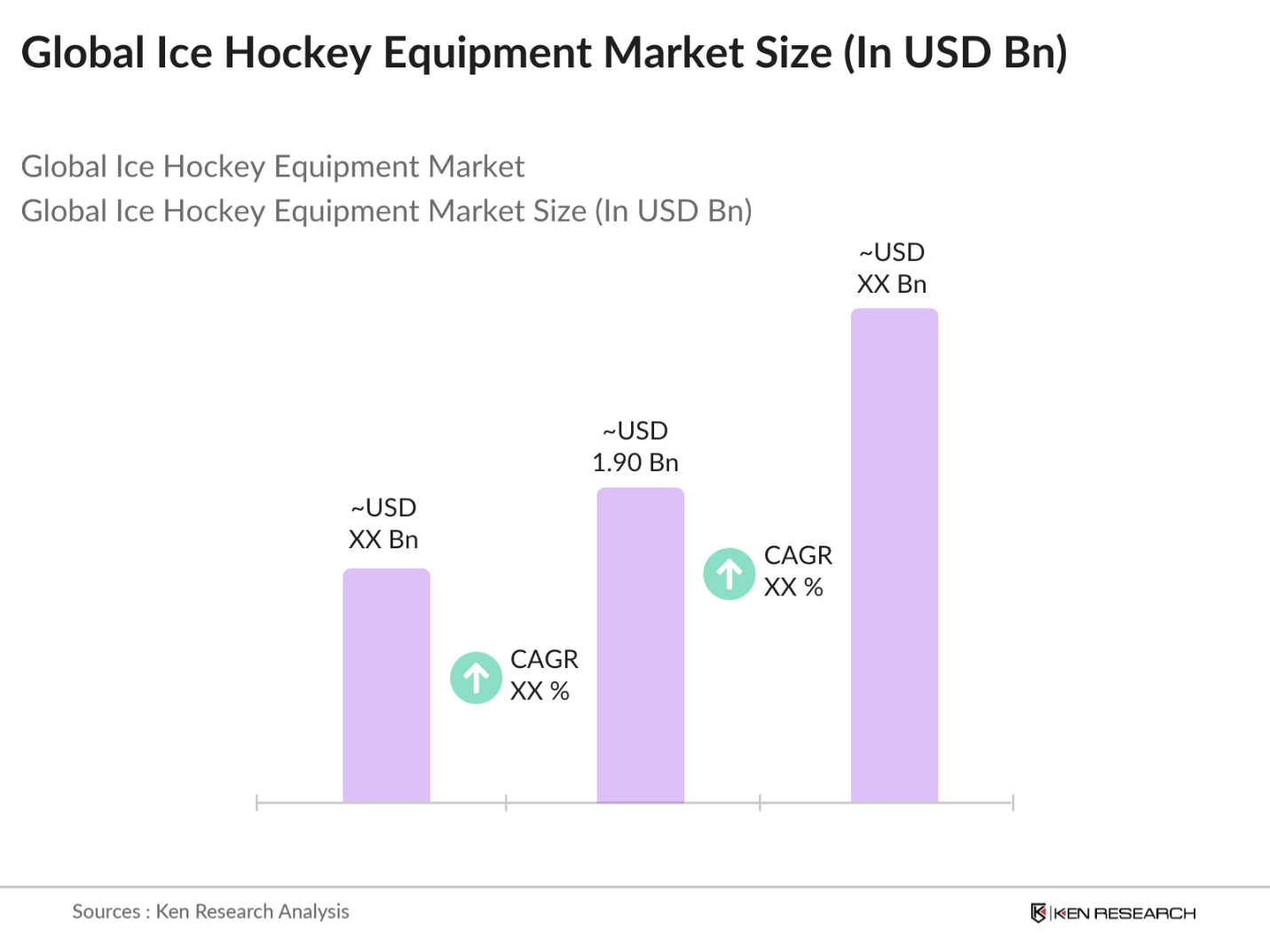

- The global ice hockey equipment market is valued at USD 1.90 billion, based on a five-year historical analysis. This market is primarily driven by rising participation in ice hockey across North America and Europe, along with continuous innovations in equipment design, particularly in protective gear and skates. As ice hockey remains a highly popular sport in regions with established leagues and youth development programs, the demand for advanced, performance-enhancing equipment is expected to sustain market growth, especially in professional and amateur leagues.

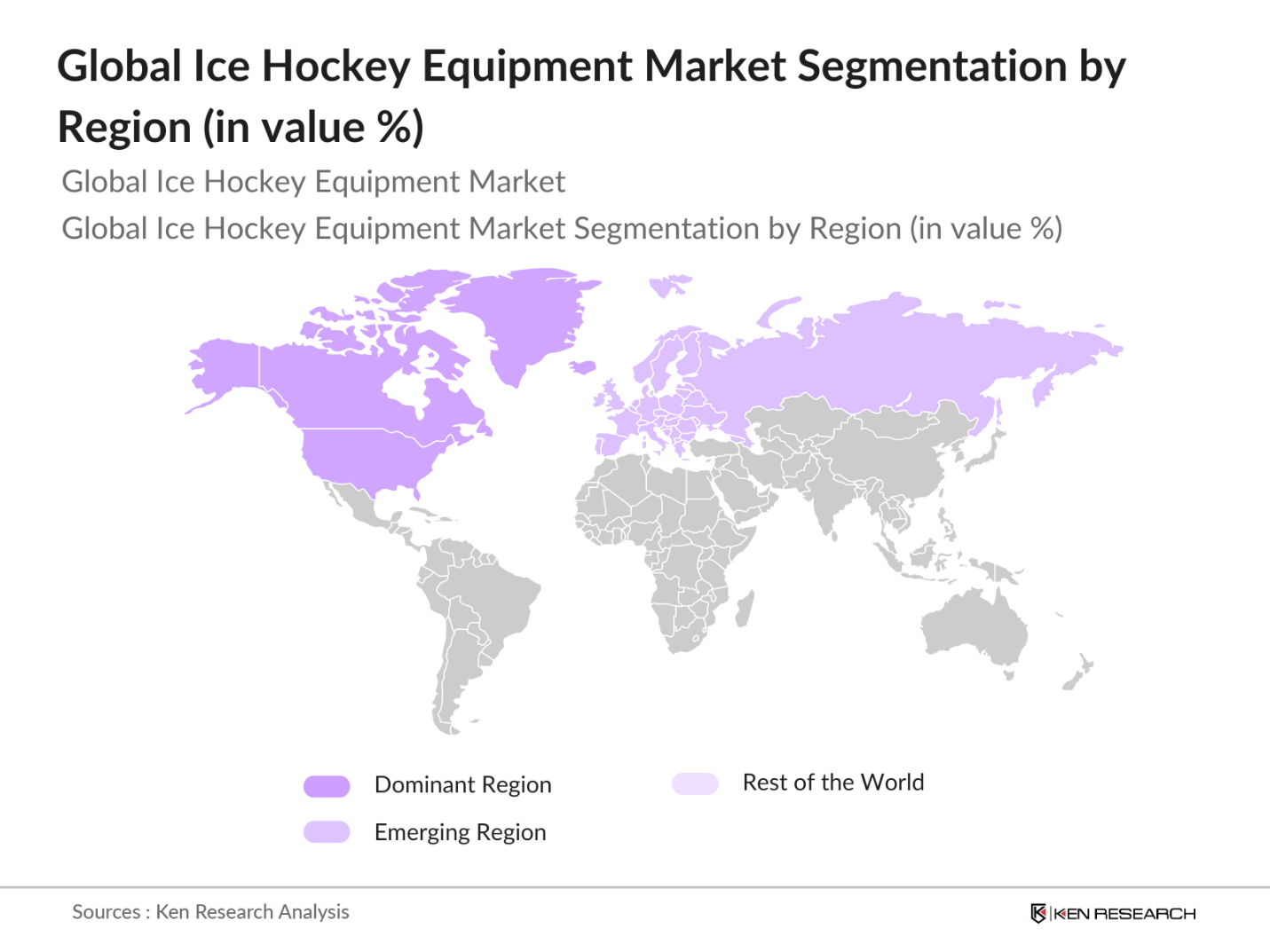

- North America, particularly Canada and the United States, dominate the global ice hockey equipment market due to their long-established ice hockey cultures and large player bases. These countries have a robust infrastructure for the sport, with extensive leagues, professional tournaments, and youth programs that consistently drive the demand for new and improved equipment. In Europe, countries like Sweden, Finland, and Russia play key roles due to their strong hockey traditions and participation in international tournaments, which further stimulates market growth.

- In 2023, global governments tightened safety standards for ice hockey gear, with the European Union updating CE certification for helmets and pads, requiring enhanced impact resistance and durability. The U.S. Consumer Product Safety Commission also introduced stricter regulations, imposing fines up to $500,000 for non-compliance. These regulations enhance player safety and encourage innovation in protective equipment technologies.

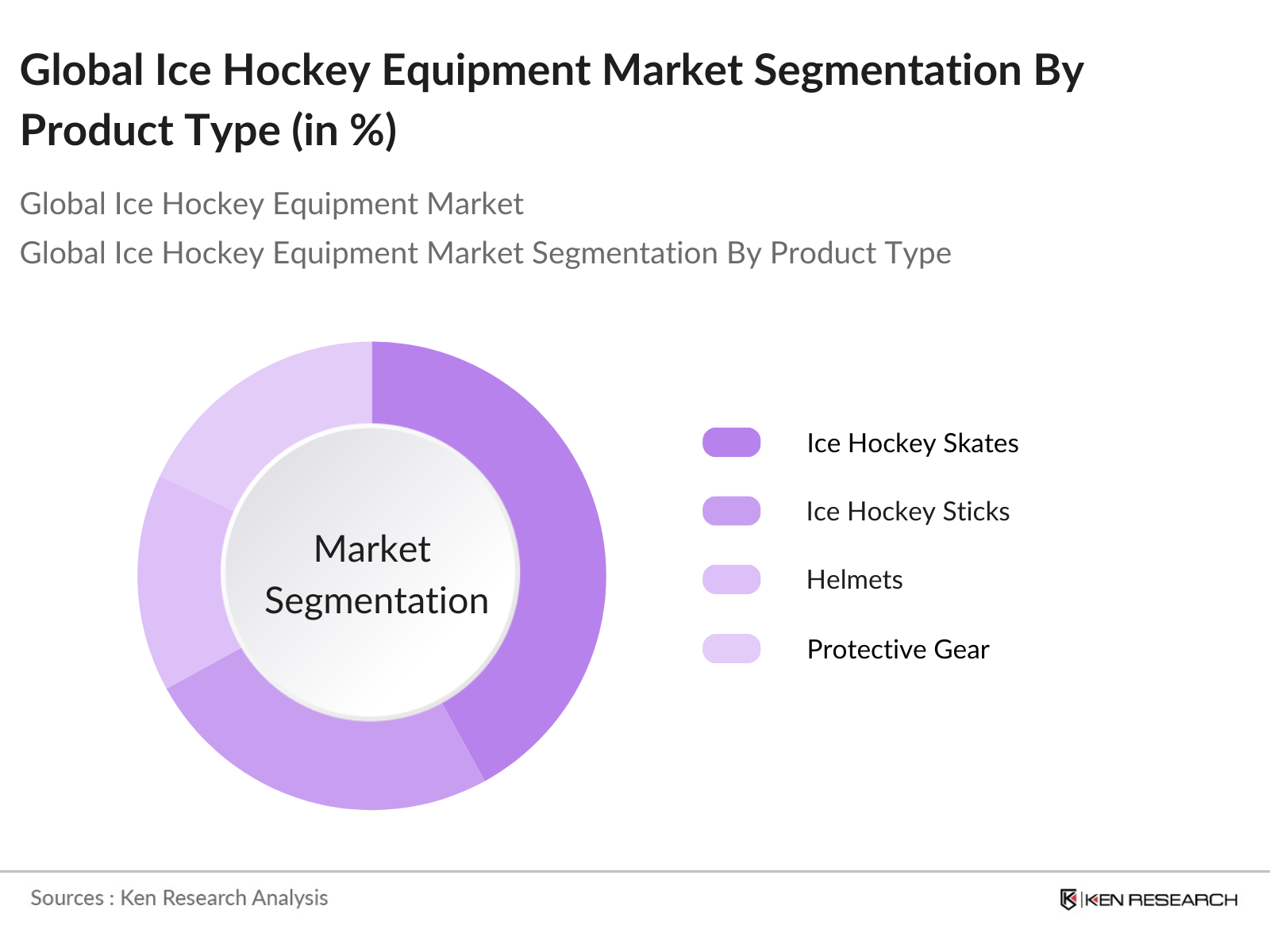

Global Ice Hockey Equipment Market Segmentation

By Product Type: The global ice hockey equipment market is segmented by product type into ice hockey sticks, ice hockey skates, helmets, protective gear, and apparel. Among these, ice hockey skates hold the largest market share, accounting for 34% of the total market in 2023. This dominance is attributed to the critical role that skates play in player performance and the continuous innovations in skate design, such as better blade technology and enhanced ankle support, which attract both professional and amateur players.

By Application: The market is also segmented by application into professional players, amateur players, and youth players. Professional players dominate the application segment, holding 40% of the market share in 2023. This is driven by the higher frequency of equipment replacement among professional athletes, who prioritize performance and safety, as well as sponsorship deals with leading equipment manufacturers. Additionally, the visibility of professional players encourages amateur and youth players to purchase similar, high-quality gear.

By Region: Regionally, the market is segmented into North America, Europe, Asia Pacific, and the Rest of the World. North America leads the market with a 55% share in 2023, thanks to the well-established hockey leagues like the NHL and a strong presence of key manufacturers. Europe holds a significant 30% share, with countries like Sweden and Finland being strong contributors. Asia Pacific is emerging as a potential growth region, though it currently holds a smaller share due to lower levels of participation compared to North America and Europe.

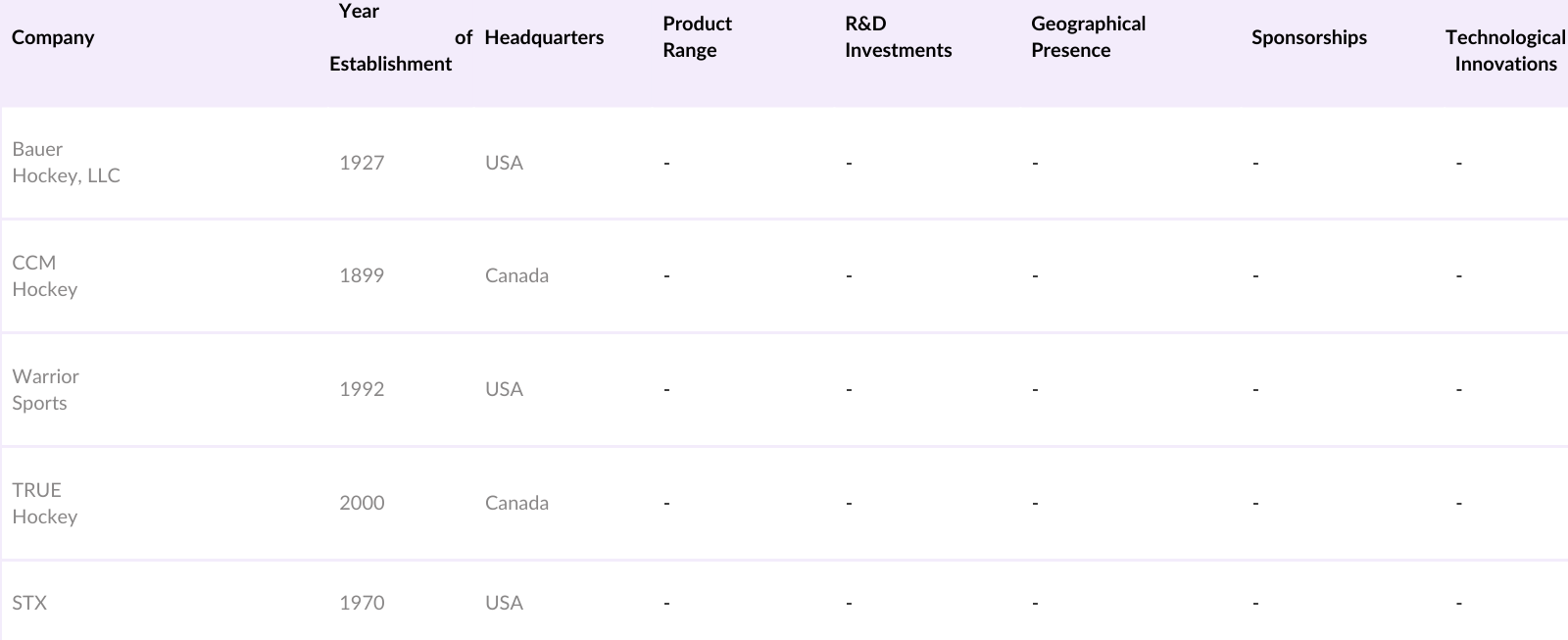

Global Ice Hockey Equipment Market Competitive Landscape

The global ice hockey equipment market is highly consolidated, with a few major players dominating the landscape. Companies such as Bauer Hockey, CCM, and Warrior Sports lead the market due to their extensive product offerings and strong brand presence. These companies invest heavily in R&D to develop innovative products that cater to the needs of professional players, as well as sponsorship deals with high-profile leagues like the NHL, which strengthens their market dominance.

Global Ice Hockey Equipment Industry Analysis

Growth Drivers

- Rising Popularity of Ice Hockey (Participation Rates): The growing participation in ice hockey, particularly in North America and Europe, has driven the demand for high-quality equipment. In the USA alone, over 450,000 people were registered with USA Hockey as players in 2023, which indicates a steady rise in the sport's popularity. Ice hockey has also gained traction in non-traditional markets like China, where government-backed initiatives promote winter sports development ahead of international tournaments like the Winter Olympics.

- Technological Advancements in Equipment (Material Innovation): Technological innovations, especially in protective gear materials, have revolutionized ice hockey equipment. Lightweight, durable composites and impact-resistant foams are now standard in helmets and padding. In 2023, manufacturers introduced carbon-fiber sticks and advanced padding materials, improving performance and safety. This technological shift aligns with global trends in material science, supported by government R&D programs.

- Increased Global Sports Events (Tournament Participation): Global sports events such as the IIHF World Championship and Winter Olympics have amplified the global visibility of ice hockey, resulting in higher equipment sales. For instance, in 2023, the IIHF World Championship recorded over 600,000 spectators, significantly boosting market exposure. These events also encourage participation across regions, with non-traditional ice hockey countries like Korea and Japan increasing their involvement in international competitions. Government and sports federations in these countries are providing grants worth $5 million annually to promote ice hockey participation.

Market Challenges

- High Cost of Equipment: The cost of high-quality ice hockey gear remains a significant barrier for many potential players, especially at the youth level. A full set of protective gear, including a helmet, shoulder pads, and skates, can easily exceed $1,000, making it unaffordable for many families. This issue is compounded by inflationary pressures in 2024, where the cost of materials like carbon fiber has risen by 15%, further driving up the price of equipment.

- Seasonal Nature of Ice Hockey (Limited Playing Regions): Ice hockey remains largely seasonal, limiting market expansion to colder climates. In regions like North America and Europe, the sport thrives, but in warmer regions, participation is limited due to infrastructure challenges. In 2023, only 32% of countries globally had the facilities to host ice hockey games, restricting the potential for year-round market growth. Although artificial rinks are being developed, their high installation and maintenance costs limit their widespread adoption, particularly in emerging markets.

Global Ice Hockey Equipment Market Future Outlook

Over the next five years, the global ice hockey equipment market is expected to see robust growth, driven by the continuous development of advanced protective gear, expanding participation in emerging markets, and growing interest in youth and womens hockey. Major players are expected to invest in innovative technologies that enhance player performance and safety, further pushing market demand.

Market Opportunities

- Expansion into Emerging Markets (Geographic Expansion): The ice hockey market has significant potential for expansion into emerging markets, particularly in Asia and Eastern Europe. Countries like China and India are investing in winter sports infrastructure, with China building over 300 new ice rinks in 2022 to support the growing demand for winter sports. This infrastructural development is backed by government funding, with the Chinese government investing $145 million in winter sports development, including ice hockey.

- Growth of Womens Ice Hockey (Gender-Specific Equipment Demand): Women's ice hockey is experiencing significant growth, particularly in North America and Europe. The 2023 Women's World Hockey Championship drew record audiences, with over 200,000 spectators. This surge in popularity has led to increased demand for gender-specific equipment, including lighter, more tailored protective gear. National governments like Finland and Sweden have allocated $10 million each to support women's sports, including ice hockey, which will likely spur further growth in this segment.

Scope of the Report

|

By Product Type |

Ice Hockey Sticks Ice Hockey Skates Helmets Protective Gear Apparel |

|

By Application |

Professional Players Amateur Players Youth Players |

|

By Distribution Channel |

Specialty Stores E-commerce Platforms Sporting Goods Retailers |

|

By End-User |

Male Players Female Players Junior Players |

|

By Region |

North America Europe Asia Pacific Rest of the World |

Products

Key Target Audience

Ice Hockey Equipment Manufacturers

Sporting Goods Retailers

E-commerce Platforms

Sports Federations (e.g., International Ice Hockey Federation, NHL)

Professional Ice Hockey Teams

Amateur and Youth Hockey Leagues

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Consumer Product Safety Commission, European Commission)

Companies

Players Mentioned in the Report

Bauer Hockey, LLC

CCM Hockey

Warrior Sports

TRUE Hockey

STX

Sherwood Hockey

Easton Hockey

Franklin Sports

Grit Inc.

Reebok-CCM

Table of Contents

1. Global Ice Hockey Equipment Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Ice Hockey Equipment Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Ice Hockey Equipment Market Analysis

3.1. Growth Drivers

3.1.1. Rising Popularity of Ice Hockey (Participation Rates)

3.1.2. Technological Advancements in Equipment (Material Innovation)

3.1.3. Increased Global Sports Events (Tournament Participation)

3.1.4. Government and Federation Support (Funding and Sponsorship)

3.2. Market Challenges

3.2.1. High Cost of Equipment

3.2.2. Seasonal Nature of Ice Hockey (Limited Playing Regions)

3.2.3. Competitive Market Saturation

3.3. Opportunities

3.3.1. Expansion into Emerging Markets (Geographic Expansion)

3.3.2. Growth of Womens Ice Hockey (Gender-Specific Equipment Demand)

3.3.3. Customization and Personalization Trends in Equipment

3.4. Trends

3.4.1. Rise in Eco-Friendly Equipment Materials

3.4.2. Advanced Safety Gear (Concussion Prevention Technologies)

3.4.3. E-commerce and Direct-to-Consumer Sales Channels

3.5. Government Regulations

3.5.1. Safety Standards for Protective Gear (Regulatory Compliance)

3.5.2. Import/Export Tariffs on Ice Hockey Equipment

3.5.3. Subsidies and Grants for Sports Development

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Distributors, Retailers, Associations)

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem (Market Share by Key Players)

4. Global Ice Hockey Equipment Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Ice Hockey Sticks

4.1.2. Ice Hockey Skates

4.1.3. Ice Hockey Helmets

4.1.4. Protective Gear (Shoulder Pads, Elbow Pads, Gloves, Shin Guards)

4.1.5. Ice Hockey Apparel

4.2. By Application (In Value %)

4.2.1. Professional Players

4.2.2. Amateur Players

4.2.3. Youth Players

4.3. By Distribution Channel (In Value %)

4.3.1. Specialty Stores

4.3.2. E-commerce Platforms

4.3.3. Sporting Goods Retailers

4.4. By End-User (In Value %)

4.4.1. Male Players

4.4.2. Female Players

4.4.3. Junior Players

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Rest of the World

5. Global Ice Hockey Equipment Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Bauer Hockey, LLC

5.1.2. CCM Hockey

5.1.3. Warrior Sports

5.1.4. TRUE Hockey

5.1.5. STX

5.1.6. Sherwood Hockey

5.1.7. Easton Hockey

5.1.8. Franklin Sports

5.1.9. Grit Inc.

5.1.10. Reebok-CCM

5.1.11. Vaughn Custom Sports

5.1.12. Graf Skates AG

5.1.13. Mission Hockey

5.1.14. Tackla Pro

5.1.15. Koho

5.2. Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Geographical Presence, R&D Investments, Strategic Partnerships, Number of Employees, Product Innovation)

5.3. Market Share Analysis

5.4. Strategic Initiatives (New Product Launches, Collaborations, Mergers & Acquisitions)

5.5. Investment Analysis (Venture Capital, Private Equity)

5.6. Government Grants and Subsidies

5.7. Key Patents and Intellectual Property Rights

6. Global Ice Hockey Equipment Market Regulatory Framework

6.1. Product Certification Standards (Material Composition, Safety Requirements)

6.2. Environmental Regulations (Eco-Friendly Materials and Sustainability)

6.3. Trade Regulations (Import and Export Policies)

7. Global Ice Hockey Equipment Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Ice Hockey Equipment Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Global Ice Hockey Equipment Market Analyst's Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Strategies for Player-Specific Equipment

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step in the research process involved identifying the key variables impacting the global ice hockey equipment market. Through desk research, secondary sources such as industry reports, and proprietary databases, we created an ecosystem map of the market and its stakeholders.

Step 2: Market Analysis and Construction

We gathered historical data on market penetration and sales from previous years, assessing factors such as player participation rates and demand for specific product types. Revenue estimates were cross-verified using multiple sources, ensuring the accuracy of the projections.

Step 3: Hypothesis Validation and Expert Consultation

Through interviews with industry experts, we validated our market hypotheses, gaining insights into player preferences, equipment innovations, and market challenges. These interviews provided valuable feedback, which was used to refine the overall market analysis.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing the research and producing a comprehensive analysis of the market, which was verified by consulting directly with equipment manufacturers and other key stakeholders. This ensured that the report was comprehensive, reliable, and actionable.

Frequently Asked Questions

01. How big is the Global Ice Hockey Equipment Market?

The global ice hockey equipment market is valued at USD 1.90 billion, based on a five-year historical analysis. This market is primarily driven by rising participation in ice hockey across North America and Europe, along with continuous innovations in equipment design, particularly in protective gear and skates.

02. What are the challenges in the Global Ice Hockey Equipment Market?

Challenges in the market include high equipment costs, competitive market saturation, and limited geographic scope for ice hockey, which restricts growth opportunities in certain regions.

03. Who are the major players in the Global Ice Hockey Equipment Market?

Key players include Bauer Hockey, CCM, Warrior Sports, TRUE Hockey, and STX, who dominate the market through strong brand presence, innovation, and strategic partnerships with professional leagues.

04. What are the growth drivers of the Global Ice Hockey Equipment Market?

The market is propelled by increased demand for lightweight and advanced protective gear, rising player participation rates, and the expansion of youth and womens hockey leagues globally.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.