Global Iced Tea Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD11377

December 2024

87

About the Report

Global Iced Tea Market Overview

- The global iced tea market is valued at USD 52.02 billion, driven by a growing preference for ready-to-drink beverages. Health-conscious consumers are increasingly shifting away from sugary carbonated drinks, opting for iced tea due to its refreshing qualities and perceived health benefits. The market has been supported by innovations in flavor, packaging, and the rising popularity of low-sugar and organic variants. Increasing disposable incomes and the expansion of distribution channels such as e-commerce have further propelled this market forward, ensuring its sustained growth.

- The United States and China dominate the global iced tea market. The U.S. has a longstanding culture of iced tea consumption, especially in Southern states where it is a staple, while in China, the shift toward bottled and ready-to-drink tea products has fueled market growth. Additionally, major urban centers in Europe, like London and Paris, have witnessed growing demand for healthier alternatives to traditional soft drinks. The dominance of these regions is also attributed to the strong presence of leading global brands, a high level of urbanization, and consumer preference for convenience.

- Government bodies worldwide have implemented strict health and safety standards for beverage production. According to the World Health Organization, over 120 countries now have specific guidelines on sugar content, preservative use, and artificial additives in beverages, including iced tea. In 2023, the European Union introduced stricter food safety regulations, requiring manufacturers to clearly label ingredients and allergen information on all beverage products. This has increased compliance costs for companies but ensures consumer safety.

Global Iced Tea Market Segmentation

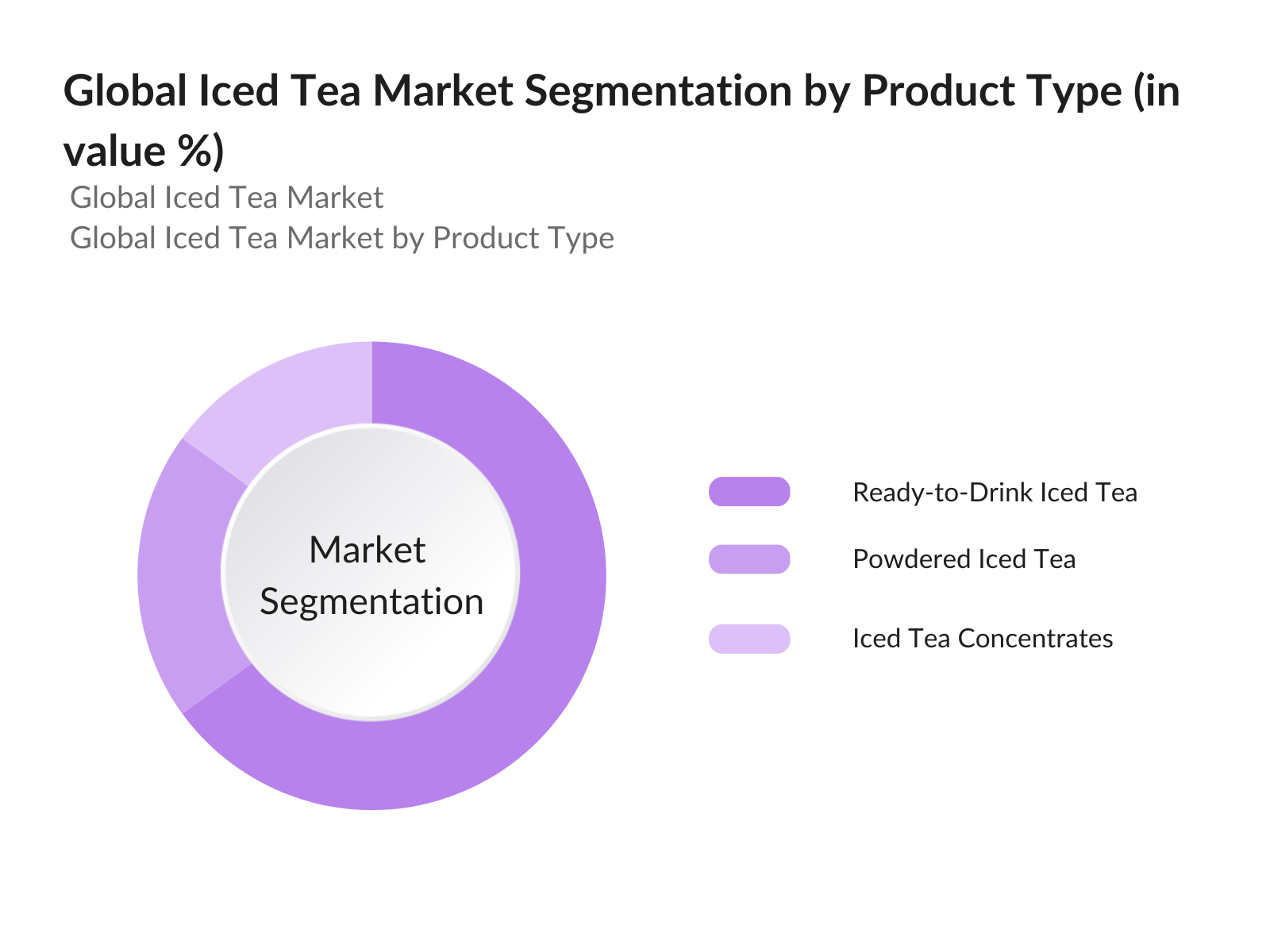

By Product Type: The global iced tea market is segmented by product type into ready-to-drink iced tea, powdered iced tea, and iced tea concentrates. Recently, ready-to-drink iced tea holds the dominant market share due to its convenience and widespread availability across retail stores and online platforms. Major brands like Lipton and Arizona Beverage have a strong foothold in this segment, leveraging consumer demand for healthy, on-the-go beverages. The popularity of these products is also boosted by the continuous introduction of new flavors and low-calorie variants.

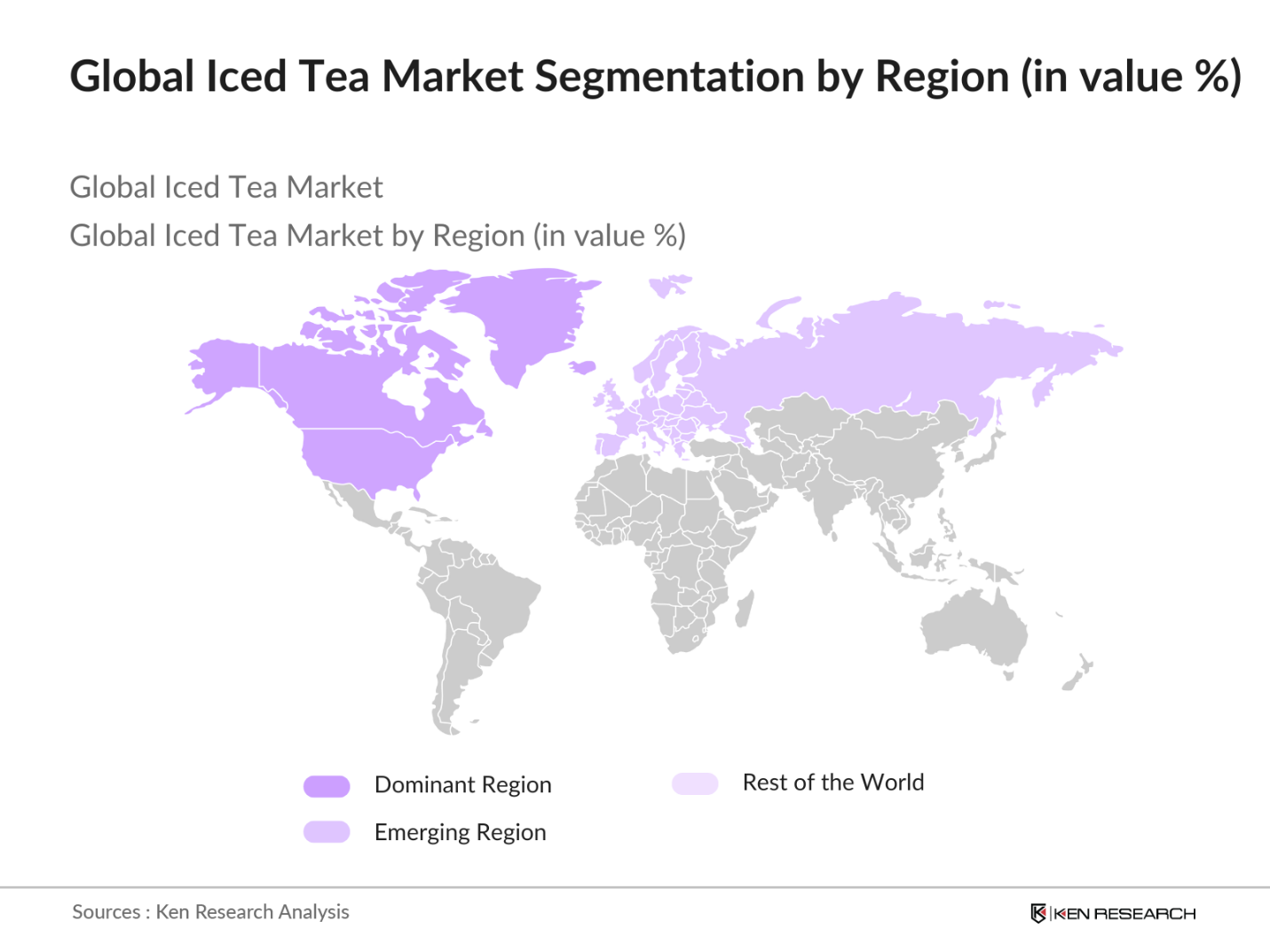

By Region: The iced tea market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America continues to dominate the iced tea market due to the high consumption rates in the United States. The U.S. has a deep-rooted tradition of iced tea consumption, particularly in southern states, where sweet iced tea is a cultural staple. Moreover, the rise of healthier alternatives and growing awareness of the detrimental effects of sugary soft drinks have driven more consumers toward iced tea options.

Global Iced Tea Market Competitive Landscape

The global iced tea market is highly competitive and dominated by key players that have established strong brand presence, distribution networks, and innovative product lines. The competitive landscape is characterized by the dominance of major companies that are increasingly focusing on product innovation and sustainability to capture market share.

|

Company Name |

Established Year |

Headquarters |

Product Portfolio |

Innovation Focus |

Global Presence |

Marketing Strategies |

Recent Acquisitions |

Sustainability Initiatives |

Market Reach |

|

Nestl S.A. |

1867 |

Vevey, Switzerland |

Ready-to-Drink, Tea |

- |

- |

- |

- |

- |

- |

|

The Coca-Cola Company |

1892 |

Atlanta, USA |

Bottled Iced Tea |

- |

- |

- |

- |

- |

- |

|

PepsiCo Inc. |

1965 |

New York, USA |

Lipton Iced Tea |

- |

- |

- |

- |

- |

- |

|

Unilever PLC |

1930 |

London, UK |

Pure Leaf, Lipton |

- |

- |

- |

- |

- |

- |

|

AriZona Beverages |

1992 |

New York, USA |

Bottled Iced Tea |

- |

- |

- |

- |

- |

- |

Global Iced Tea Market Analysis

Market Growth Drivers

- Increasing Health Consciousness: The rise in health consciousness among consumers has significantly driven demand for iced tea, as people seek healthier alternatives to sugary soft drinks. In 2023, according to the World Health Organization (WHO), global obesity levels continue to climb, particularly in high-income countries, with over 1.9 billion adults categorized as overweight. As a response, iced tea is increasingly favored for its lower sugar content and antioxidant properties, especially in developed regions like the U.S. and Europe. This shift towards healthier beverages is expected to accelerate demand for iced tea in countries that prioritize wellness.

- Innovation in Flavors and Ingredients: The market for iced tea has experienced a surge in product innovations, particularly in terms of flavors and ingredients. In 2023, over 50 new variants were introduced in the U.S. and European markets, including flavors like hibiscus, matcha, and turmeric, according to government food authorities. These innovations cater to a growing consumer base that demands variety and functional health benefits from their beverages. The rise of plant-based ingredients, reported by the USDA, shows a 12% increase in demand for botanical teas, further driving the growth of the iced tea market

- Rising Popularity of Functional Beverages: Functional beverages, which offer health benefits beyond basic nutrition, have been a key driver for the iced tea market. According to data from the United Nations Food and Agricultural Organization (FAO), functional drinks grew by 9% in 2023. This includes iced teas infused with probiotics, vitamins, and minerals. In particular, countries like the U.S., China, and Germany are seeing a sharp rise in the consumption of functional iced tea drinks that promote digestion and immune system health.

Market Challenges:

- High Competition from Soft Drinks: Soft drinks, especially carbonated beverages, continue to be a significant competitor to iced tea. As of 2024, the global soft drink market is projected to maintain its dominance in the beverage sector, with over 400 billion liters consumed annually, according to the Food and Beverage Administration. Iced tea, though growing, still faces intense competition from well-established carbonated soft drink brands. This competition is particularly fierce in developing markets like Brazil and India, where soft drinks are deeply entrenched in consumer preferences.

- Fluctuations in Raw Material Prices: The volatility in the prices of raw materials, such as tea leaves and sweeteners, poses a significant challenge to the iced tea market. Changes in climatic conditions and supply chain disruptions in key tea-producing countries like China, India, and Kenya directly affect the availability and cost of these essential ingredients. Additionally, global supply chains face disruptions due to various geopolitical and environmental factors, further impacting the cost structure for iced tea manufacturers. The fluctuating prices of sugar and other sweeteners also contribute to the challenges in maintaining consistent production costs in the market.

Global Iced Tea Market Future Outlook

Over the next five years, the global iced tea market is expected to witness significant growth driven by increasing consumer preference for healthy beverages, continuous innovation in flavor profiles, and the rising trend of premium and organic iced tea products. The growing popularity of ready-to-drink beverages and the expansion of e-commerce platforms will further drive market expansion. Additionally, manufacturers focusing on sustainability and eco-friendly packaging will play a crucial role in shaping the future of the iced tea industry.

Market Opportunities:

- Premiumization of Iced Tea Products: The trend of premiumization has reached the iced tea market, with consumers willing to pay a higher price for quality ingredients and exclusive flavors. In 2023, the premium beverage segment saw a 6% increase in sales in markets like France, Japan, and the United States, according to government beverage industry reports. Brands that offer premium iced tea options, such as those infused with organic herbs or exotic flavors, are benefiting from this trend

- Increasing Demand for Low-Sugar and Diet Iced Tea: Health-conscious consumers are driving the demand for low-sugar and diet iced tea variants. According to the World Health Organization (WHO), sugar consumption limits set by health authorities are becoming more stringent, with over 50 countries introducing sugar taxes in 2023. This regulatory pressure, combined with increasing consumer awareness of the adverse effects of sugar, has led to a 12% increase in demand for low-sugar iced tea in markets like Canada, Australia, and the U.K.

Scope of the Report

|

By Product Type |

Ready-to-Drink Iced Tea Powdered Iced Tea Concentrates |

|

By Flavor Type |

Lemon Peach Green Tea Herbal |

|

By Packaging Type |

Bottles Cans Cartons |

|

By Distribution Channel |

Supermarkets & Hypermarkets Convenience Stores Online Channels Specialty Stores |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Beverage Manufacturers

Retail Chains (Supermarkets & Hypermarkets)

Foodservice Operators (Restaurants & Cafs)

Health and Wellness Brands

Packaging Industry Stakeholders

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, EFSA)

Distributors and Wholesalers

Companies

Players Mention in the Report

Nestl S.A.

The Coca-Cola Company

PepsiCo Inc.

Unilever PLC

AriZona Beverage Company LLC

Starbucks Corporation

Fuze Beverage

Tata Global Beverages

Suntory Beverage & Food Limited

Snapple Beverage Corp.

The J.M. Smucker Company

King Fu Tea

Purity Organic LLC

Honest Tea Inc.

B.W. Coopers Iced Tea Company

Table of Contents

01. Global Iced Tea Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Global Iced Tea Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Global Iced Tea Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Health Consciousness

3.1.2. Growth in Ready-to-Drink Beverages Demand

3.1.3. Innovation in Flavors and Ingredients

3.1.4. Rising Popularity of Functional Beverages

3.2. Market Challenges

3.2.1. High Competition from Soft Drinks

3.2.2. Fluctuations in Raw Material Prices

3.2.3. Limited Shelf Life of Natural Products

3.3. Opportunities

3.3.1. Expansion in Emerging Markets

3.3.2. Adoption of Organic and Natural Iced Tea

3.3.3. Innovation in Packaging and Sustainable Solutions

3.4. Trends

3.4.1. Growth of E-commerce Channels

3.4.2. Premiumization of Iced Tea Products

3.4.3. Increasing Demand for Low-Sugar and Diet Iced Tea

3.5. Government Regulations

3.5.1. Health and Safety Standards

3.5.2. Import and Export Regulations

3.5.3. Packaging and Labeling Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

04. Global Iced Tea Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Ready-to-Drink Iced Tea

4.1.2. Powdered Iced Tea

4.1.3. Concentrates

4.2. By Flavor Type (In Value %)

4.2.1. Lemon

4.2.2. Peach

4.2.3. Green Tea

4.2.4. Herbal

4.3. By Packaging Type (In Value %)

4.3.1. Bottles

4.3.2. Cans

4.3.3. Cartons

4.4. By Distribution Channel (In Value %)

4.4.1. Supermarkets & Hypermarkets

4.4.2. Convenience Stores

4.4.3. Online Channels

4.4.4. Specialty Stores

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

05. Global Iced Tea Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Nestle S.A.

5.1.2. The Coca-Cola Company

5.1.3. PepsiCo Inc.

5.1.4. Unilever PLC

5.1.5. AriZona Beverage Company LLC

5.1.6. Starbucks Corporation

5.1.7. Fuze Beverage

5.1.8. Tata Global Beverages

5.1.9. Suntory Beverage & Food Limited

5.1.10. Snapple Beverage Corp.

5.1.11. The J.M. Smucker Company

5.1.12. King Fu Tea

5.1.13. Purity Organic LLC

5.1.14. Honest Tea Inc.

5.1.15. B.W. Coopers Iced Tea Company

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Geographical Presence, Market Strategy, R&D Investments)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

06. Global Iced Tea Market Regulatory Framework

6.1. Health and Safety Standards

6.2. Compliance Requirements

6.3. Certification Processes

07. Global Iced Tea Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08. Global Iced Tea Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Flavor Type (In Value %)

8.3. By Packaging Type (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

09. Global Iced Tea Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping out the global iced tea ecosystem, identifying key players, product categories, and distribution channels. This process is carried out through comprehensive desk research, leveraging proprietary databases and secondary sources to gather the relevant market data.

Step 2: Market Analysis and Construction

In this step, historical data is analyzed to understand market trends and growth patterns. This includes analyzing consumer preferences, sales volumes, and product availability across different regions. We also evaluate the market penetration rate of different iced tea categories.

Step 3: Hypothesis Validation and Expert Consultation

We then develop initial market hypotheses which are validated through direct consultations with industry experts, including beverage manufacturers, distributors, and marketing professionals. Their insights help us refine our market estimates and understand emerging trends.

Step 4: Research Synthesis and Final Output

In the final step, we consolidate all the data, insights, and expert feedback into a structured market report. This includes detailed analysis of product segments, regional markets, and key competitors, ensuring that the data is accurate and actionable for business decision-making.

Frequently Asked Questions

01. How big is the global iced tea market?

The global iced tea market is valued at USD 52.02 billion, driven by rising consumer interest in healthy, refreshing beverages and the expansion of ready-to-drink tea options.

02. What are the major challenges in the global iced tea market?

Challenges include high competition from other ready-to-drink beverages, fluctuations in raw material prices, and the short shelf life of natural and organic products.

03. Who are the key players in the global iced tea market?

Key players in the market include Nestl S.A., The Coca-Cola Company, PepsiCo Inc., Unilever PLC, and AriZona Beverage Company LLC. These companies have a strong global presence and continue to innovate in flavor and packaging.

04. What factors are driving growth in the iced tea market?

Growth is driven by increasing health awareness, consumer demand for convenient and refreshing beverages, and innovations in low-sugar, organic, and flavored iced tea options.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.