Global Image Guided Therapy Market Outlook to 2030

Region:Global

Author(s):Shambhavi

Product Code:KROD5708

December 2024

94

About the Report

Global Image Guided Therapy Market Overview

- The global image-guided therapy market is valued at USD 1.5 billion, based on a five-year historical analysis. The market is primarily driven by technological advancements in imaging modalities such as MRI, CT, and ultrasound, which have enhanced the precision and efficiency of medical interventions. The rising prevalence of chronic diseases such as cancer and cardiovascular conditions has increased demand for minimally invasive surgeries, further driving the adoption of image-guided therapy systems. These technologies reduce surgical risks and recovery times, contributing to their widespread use in hospitals and surgical centers.

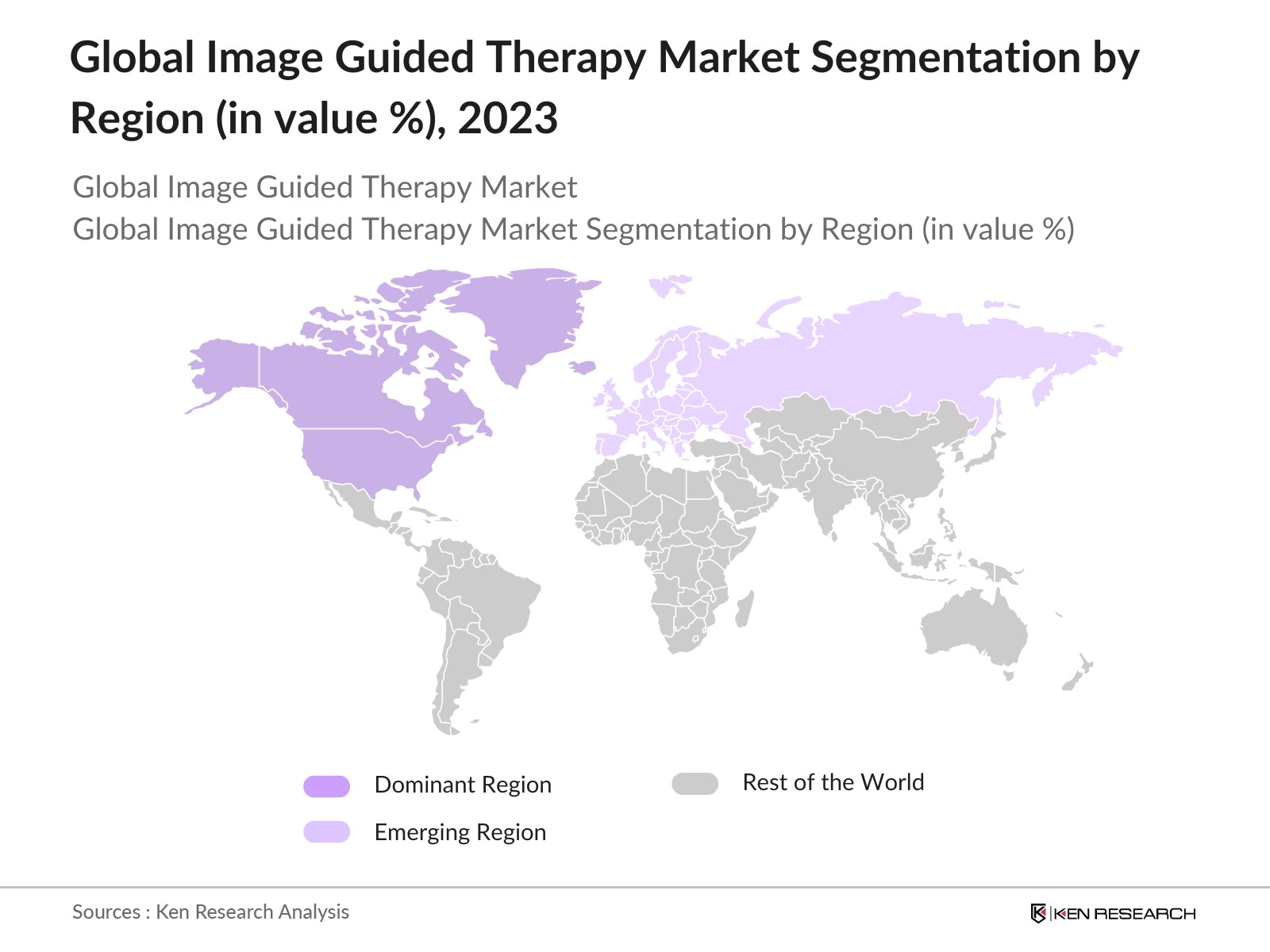

- The market is dominated by regions such as North America and Europe, primarily due to the presence of advanced healthcare infrastructures and higher adoption rates of cutting-edge technologies. The dominance of these regions is also attributed to the availability of highly skilled healthcare professionals and favorable government policies supporting technological innovations in medical imaging. Additionally, the growing number of specialized clinics and hospitals in these regions has created a conducive environment for the growth of the image-guided therapy market.

- The regulatory landscape for medical imaging devices is governed by agencies such as the FDA and the European CE marking system. In 2024, over 300 medical imaging devices received FDA approval for clinical use, ensuring safety and efficacy standards. These regulatory bodies are critical in maintaining the quality and performance of imaging technologies used in therapies, which directly impacts patient outcomes.

Global Image Guided Therapy Market Segmentation

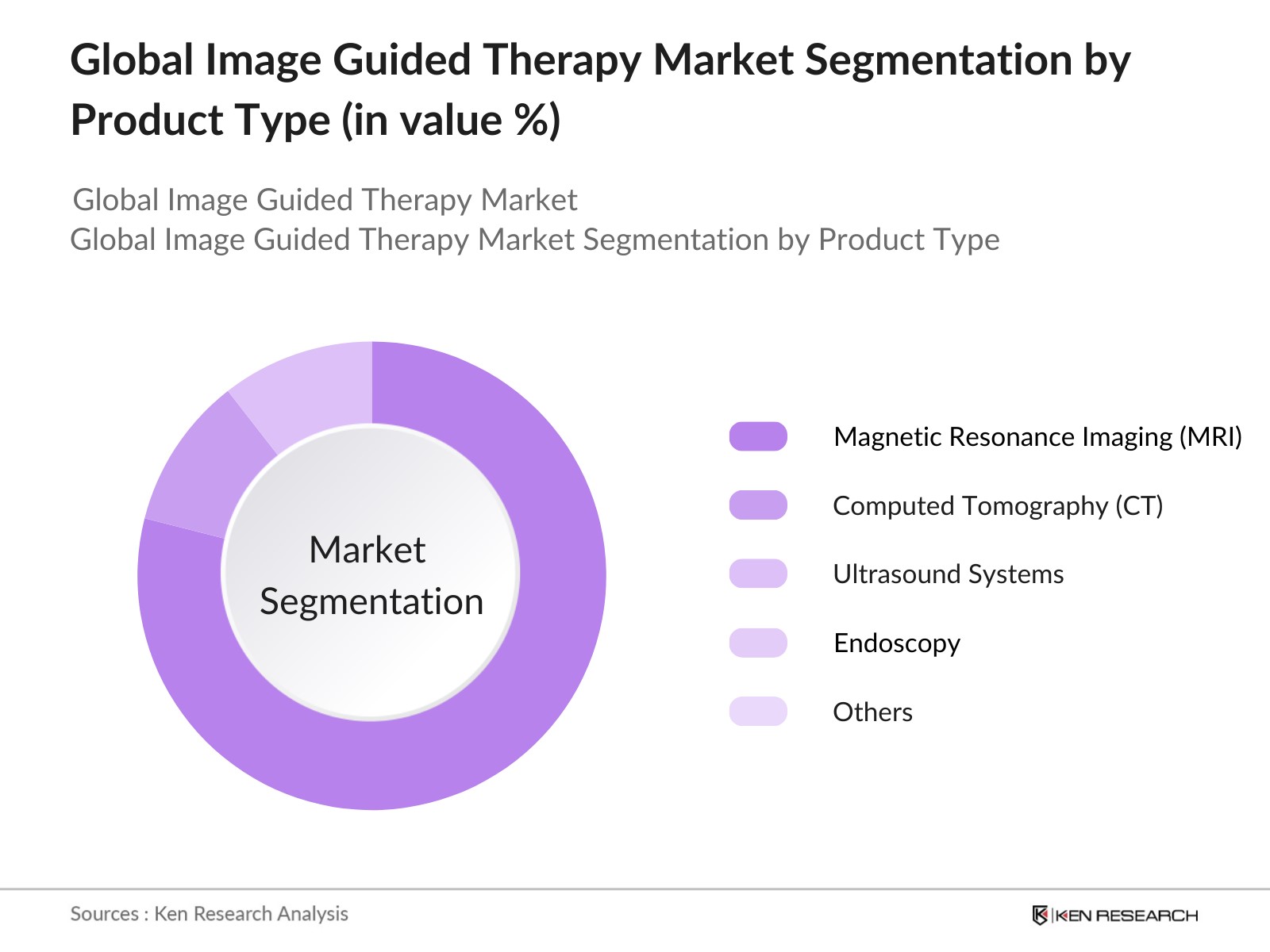

By Product Type: The global image-guided therapy market is segmented by product type into computed tomography (CT), magnetic resonance imaging (MRI), ultrasound systems, endoscopy, and others such as fluoroscopy and X-rays. Among these, MRI systems have a dominant market share in 2023, due to their superior soft tissue imaging capabilities, which make them crucial in diagnosing complex conditions such as brain and spinal cord disorders. MRIs ability to produce detailed images without ionizing radiation makes it a preferred choice in both diagnostic and therapeutic procedures. The non-invasive nature of MRI further boosts its demand across a wide range of medical applications.

By Application: The global image-guided therapy market is segmented by application into oncology, neurology, orthopedic surgery, cardiovascular diseases, and gastroenterology. Oncology holds the largest market share in 2023, primarily due to the increasing use of image-guided therapies in the diagnosis and treatment of cancers. Advanced imaging technologies enable precise tumor localization, which helps in planning and executing minimally invasive procedures. Image-guided radiation therapy (IGRT) is particularly significant in oncology, where the precision of tumor targeting plays a critical role in improving patient outcomes and minimizing damage to surrounding healthy tissues.

By Region: Geographically, the global image-guided therapy market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America dominates the market share in 2023, driven by the regions advanced healthcare systems, significant investment in healthcare infrastructure, and a higher rate of adoption of innovative technologies. The strong presence of leading medical device companies in the U.S. and Canada, coupled with favorable reimbursement policies, further cements North Americas leadership in this market. Asia-Pacific is also emerging as a high-growth region due to rising healthcare expenditure and increasing demand for advanced medical technologies in countries like China and India.

Global Image Guided Therapy Market Competitive Landscape

The global image-guided therapy market is highly competitive, with key players focusing on product innovation, strategic partnerships, and geographic expansion. The market is dominated by a few multinational corporations with extensive product portfolios in medical imaging and surgical technologies. These companies are investing heavily in R&D to enhance the precision and capabilities of their imaging devices, thus maintaining a competitive edge.

Global Image Guided Therapy Market Analysis

Growth Drivers

- Technological Advancements in Imaging Modalities: The integration of advanced imaging technologies such as MRI, CT scans, and ultrasound has significantly enhanced the precision of image-guided therapies. These modalities are increasingly utilized in minimally invasive surgeries, allowing real-time visualization. For instance, MRI usage in healthcare has grown steadily, with over 41 million MRI procedures performed in the U.S. in 2022, according to the World Bank. Similarly, global CT scan adoption has increased due to its diagnostic accuracy, particularly in detecting tumors. The expansion of imaging modalities improves the effectiveness of therapies, thus driving the market.

- Increasing Prevalence of Chronic Diseases: The rising prevalence of chronic diseases such as cancer, cardiovascular issues, and neurological disorders is a major driver for the Image Guided Therapy market. According to the World Health Organization (WHO), in 2023, cancer accounted for 10 million deaths globally. Similarly, cardiovascular diseases were responsible for 17.9 million deaths, representing a quarter of global deaths. With the global burden of chronic diseases growing, particularly in developing regions, the need for precise diagnostic and therapeutic interventions using image-guided modalities is critical to improve outcomes.

- Rise in Minimally Invasive Surgeries: Minimally invasive surgeries have been gaining traction worldwide due to faster recovery times, reduced hospital stays, and fewer post-operative complications. In 2024, over 18 million minimally invasive procedures were performed in hospitals worldwide, according to World Bank data. These surgeries increasingly utilize image-guided technologies to navigate complex anatomical structures, improving surgical precision and reducing risks associated with traditional surgery. This rising adoption of minimally invasive procedures is expected to continue bolstering the Image Guided Therapy market.

Market Challenges

- High Initial Costs of Equipment: One of the primary challenges in the Image Guided Therapy market is the high initial costs associated with procuring advanced imaging equipment like MRI and CT machines. According to data from the International Monetary Fund (IMF), the average cost of acquiring an MRI machine is around $1.2 million in 2024, making it inaccessible for many healthcare providers, especially in developing countries. This cost barrier limits the widespread adoption of advanced imaging technologies, restricting the growth of the market in price-sensitive regions.

- Regulatory Hurdles in Different Regions: The regulatory environment for medical devices and imaging equipment differs widely across regions, creating challenges for manufacturers and healthcare providers. The U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have stringent requirements for approval, which can delay the commercialization of new image-guided devices. In 2023, the FDA approved only 42 new medical imaging devices, a relatively low number compared to other sectors, highlighting the regulatory complexities in this market.

Global Image Guided Therapy Market Future Outlook

Over the next few years, the global image-guided therapy market is expected to show significant growth, driven by advancements in imaging technologies, the increasing demand for minimally invasive procedures, and the integration of robotics and AI in surgical procedures. The market's expansion will also be supported by growing healthcare investments in emerging economies and the rising prevalence of chronic diseases that require precision-based interventions. Moreover, government policies that encourage technological innovation and healthcare digitization are expected to play a crucial role in shaping the future of the image-guided therapy market.

Market Opportunities

- Expansion in Emerging Market: Emerging markets in regions like Asia-Pacific, Latin America, and the Middle East & Africa present significant opportunities for the Image Guided Therapy market. Countries such as India, China, and Brazil have been investing heavily in healthcare infrastructure, with a combined healthcare expenditure of over $400 billion in 2023, as per World Bank reports. The growing healthcare investments, coupled with increasing patient demand for advanced treatments, make these regions attractive for market expansion.

- Development of Portable and Wearable Image Guided Devices: Technological innovations in developing portable and wearable image-guided devices represent a key growth opportunity. These devices are increasingly being used in remote areas and by mobile healthcare units to provide real-time imaging solutions. In 2024, more than 500,000 portable ultrasound machines were in use globally, especially in resource-constrained regions, as reported by the World Health Organization (WHO). This trend indicates a growing demand for portable solutions that cater to underserved markets.

Products

Key Target Audience

Hospital Chains

Surgical Centers

Government and Regulatory Bodies (FDA, CE Authorities)

Healthcare Equipment Distributors

Medical Imaging Manufacturers

Investor and Venture Capitalist Firms

Health Insurance Providers

Research Institutes

Companies

Players Mentioned in the Report

Siemens Healthineers

GE Healthcare

Philips Healthcare

Medtronic

Brainlab

Canon Medical Systems

Varian Medical Systems

Intuitive Surgical

Stryker Corporation

Karl Storz GmbH

Shimadzu Corporation

Elekta AB

Esaote SpA

Hitachi Medical Systems

Zimmer Biomet

Table of Contents

1. Global Image Guided Therapy Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Image Guided Therapy Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Image Guided Therapy Market Analysis

3.1 Growth Drivers

3.1.1 Technological Advancements in Imaging Modalities (MRI, CT, Ultrasound)

3.1.2 Increasing Prevalence of Chronic Diseases (Cancer, Cardiovascular, Neurological)

3.1.3 Rise in Minimally Invasive Surgeries

3.1.4 Integration with Robotics and AI

3.2 Market Challenges

3.2.1 High Initial Costs of Equipment

3.2.2 Regulatory Hurdles in Different Regions

3.2.3 Skilled Workforce Shortage

3.3 Opportunities

3.3.1 Expansion in Emerging Markets (APAC, LATAM, MEA)

3.3.2 Development of Portable and Wearable Image Guided Devices

3.3.3 Strategic Collaborations and Partnerships

3.4 Trends

3.4.1 Real-Time Imaging and 3D Visualization

3.4.2 Adoption of Cloud-based Solutions for Image Storage and Processing

3.4.3 Integration of Image-Guided Therapy with Telemedicine Platforms

3.5 Government Regulation

3.5.1 FDA and CE Marking for Medical Imaging Devices

3.5.2 Data Protection Laws for Imaging Systems (HIPAA, GDPR)

3.5.3 Standardization of Protocols for Imaging Procedures

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Global Image Guided Therapy Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Computed Tomography (CT)

4.1.2 Magnetic Resonance Imaging (MRI)

4.1.3 Ultrasound Systems

4.1.4 Endoscopy

4.1.5 Others (Fluoroscopy, X-rays)

4.2 By Application (In Value %)

4.2.1 Oncology

4.2.2 Neurology

4.2.3 Orthopedic Surgery

4.2.4 Cardiovascular Diseases

4.2.5 Gastroenterology

4.3 By Technology (In Value %)

4.3.1 2D Imaging

4.3.2 3D Imaging

4.3.3 4D Imaging

4.4 By End User (In Value %)

4.4.1 Hospitals

4.4.2 Ambulatory Surgical Centers

4.4.3 Research Institutes

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Global Image Guided Therapy Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Siemens Healthineers

5.1.2 GE Healthcare

5.1.3 Philips Healthcare

5.1.4 Medtronic

5.1.5 Canon Medical Systems

5.1.6 Brainlab

5.1.7 Intuitive Surgical

5.1.8 Stryker Corporation

5.1.9 Karl Storz GmbH & Co. KG

5.1.10 Zimmer Biomet

5.1.11 Shimadzu Corporation

5.1.12 Elekta AB

5.1.13 Hitachi Medical Systems

5.1.14 Varian Medical Systems

5.1.15 Esaote SpA

5.2 Cross Comparison Parameters (Revenue, Product Portfolio, Market Share, Technological Innovations, R&D Expenditure, Geographical Presence, Key Partnerships, Market Position)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Government Grants

5.8 Private Equity Investments

6. Global Image Guided Therapy Market Regulatory Framework

6.1 Device Approval Requirements (FDA, CE Mark)

6.2 Compliance Requirements (Data Protection, Medical Device Regulation)

6.3 Certification Processes (ISO 13485, IEC 60601)

7. Global Image Guided Therapy Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Image Guided Therapy Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Technology (In Value %)

8.4 By End User (In Value %)

8.5 By Region (In Value %)

9. Global Image Guided Therapy Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 White Space Opportunity Analysis

9.3 Strategic Marketing Initiatives

Disclaimer Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that includes all major stakeholders within the global image-guided therapy market. This step is underpinned by extensive desk research using secondary and proprietary databases to gather comprehensive industry-level information, aiming to identify and define the key variables that impact market dynamics.

Step 2: Market Analysis and Construction

This phase involves compiling and analyzing historical data related to the global image-guided therapy market. The analysis focuses on market penetration, the ratio of marketplaces to service providers, and revenue generation. Additionally, service quality statistics are evaluated to ensure the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through consultations with industry experts. These consultations provide operational and financial insights from various companies, which are essential in refining and corroborating market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with healthcare providers to gather detailed insights into product segments, sales performance, and consumer preferences. These interactions validate the statistics derived from the bottom-up approach, ensuring comprehensive, accurate, and validated analysis.

Frequently Asked Questions

01. How big is the Global Image Guided Therapy Market?

The global image-guided therapy market is valued at approximately USD 4.7 billion, driven by advancements in medical imaging technologies and the rising demand for minimally invasive surgical procedures.

02. What are the challenges in the Global Image Guided Therapy Market?

Challenges include high equipment costs, stringent regulatory requirements, and the need for highly skilled personnel to operate advanced imaging technologies effectively.

03. Who are the major players in the Global Image Guided Therapy Market?

Key players include Siemens Healthineers, GE Healthcare, Philips Healthcare, Medtronic, and Brainlab, all of which dominate due to their technological innovations and extensive product portfolios.

04. What are the growth drivers of the Global Image Guided Therapy Market?

The market is driven by factors such as technological advancements in imaging modalities, the increasing prevalence of chronic diseases, and the rise in demand for precision-based surgeries that minimize risks and recovery times.

05. What are the opportunities in the Global Image Guided Therapy Market?

Opportunities include the expansion into emerging markets, the development of portable and wearable imaging devices, and the integration of AI and robotics into image-guided procedures.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.