Global Industrial AI Market Outlook to 2030

Region:Global

Author(s):Paribhasha Tiwari

Product Code:KROD10337

November 2024

92

About the Report

Global Industrial AI Market Overview

- The Global Industrial AI market is valued at USD 2.1 billion, driven by increasing integration of artificial intelligence across industries such as manufacturing, automotive, and energy sectors. The rising demand for automation and predictive analytics is significantly propelling market growth. Innovations in machine learning algorithms and the expansion of AI-enabled robotics are contributing to higher productivity and reduced operational costs in industries. AIs ability to improve decision-making processes and enhance efficiency is accelerating its adoption across industrial sectors.

- The United States, China, and Germany are leading in the adoption of Industrial AI solutions. The dominance of these countries can be attributed to their well-established industrial sectors and large-scale investments in AI research and development. The U.S. leads due to its advanced technological infrastructure, while Chinas government-backed initiatives in AI and Germanys focus on Industry 4.0 have cemented their positions as top players in the global market. These countries also benefit from a skilled workforce, fostering innovation and accelerating the development of AI applications.

- The USA continues to support industrial AI development through the National AI Initiative Act, which, as of 2024, has allocated 10 billion USD in funding for AI research and implementation in key industries such as manufacturing and logistics. This government initiative aims to strengthen the country's competitiveness in the global AI race, particularly in sectors where AI can enhance productivity and automation.

Global Industrial AI Market Segmentation

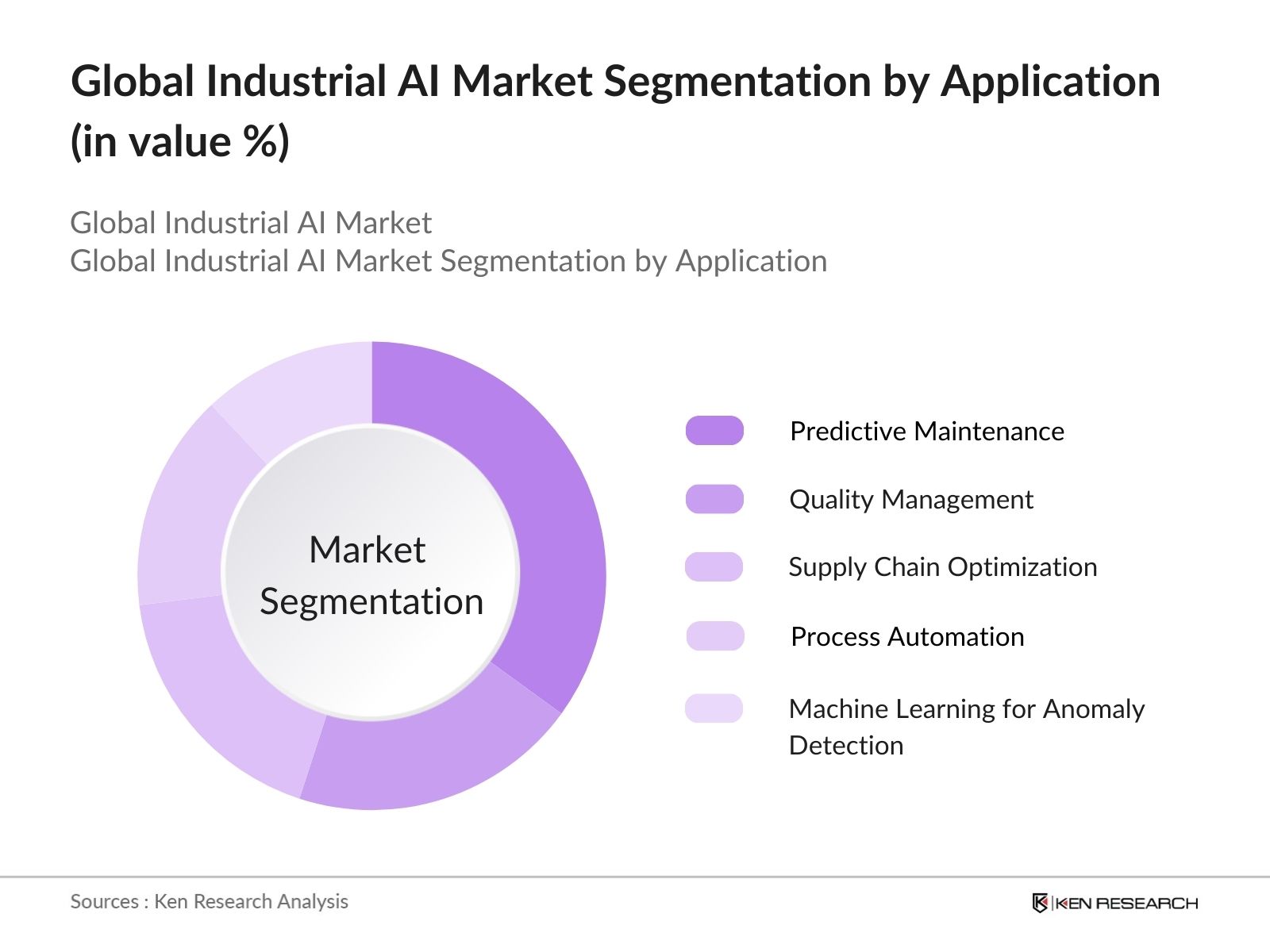

By Application The Global Industrial AI market is segmented by application into predictive maintenance, quality management, supply chain optimization, process automation, and machine learning for anomaly detection. Among these, predictive maintenance has emerged as a dominant sub-segment in 2023. Its growth is driven by the increasing need for reducing machine downtime and optimizing operational efficiency. AI-driven predictive maintenance solutions are widely used in sectors such as manufacturing and energy, where equipment failure can lead to significant financial losses.

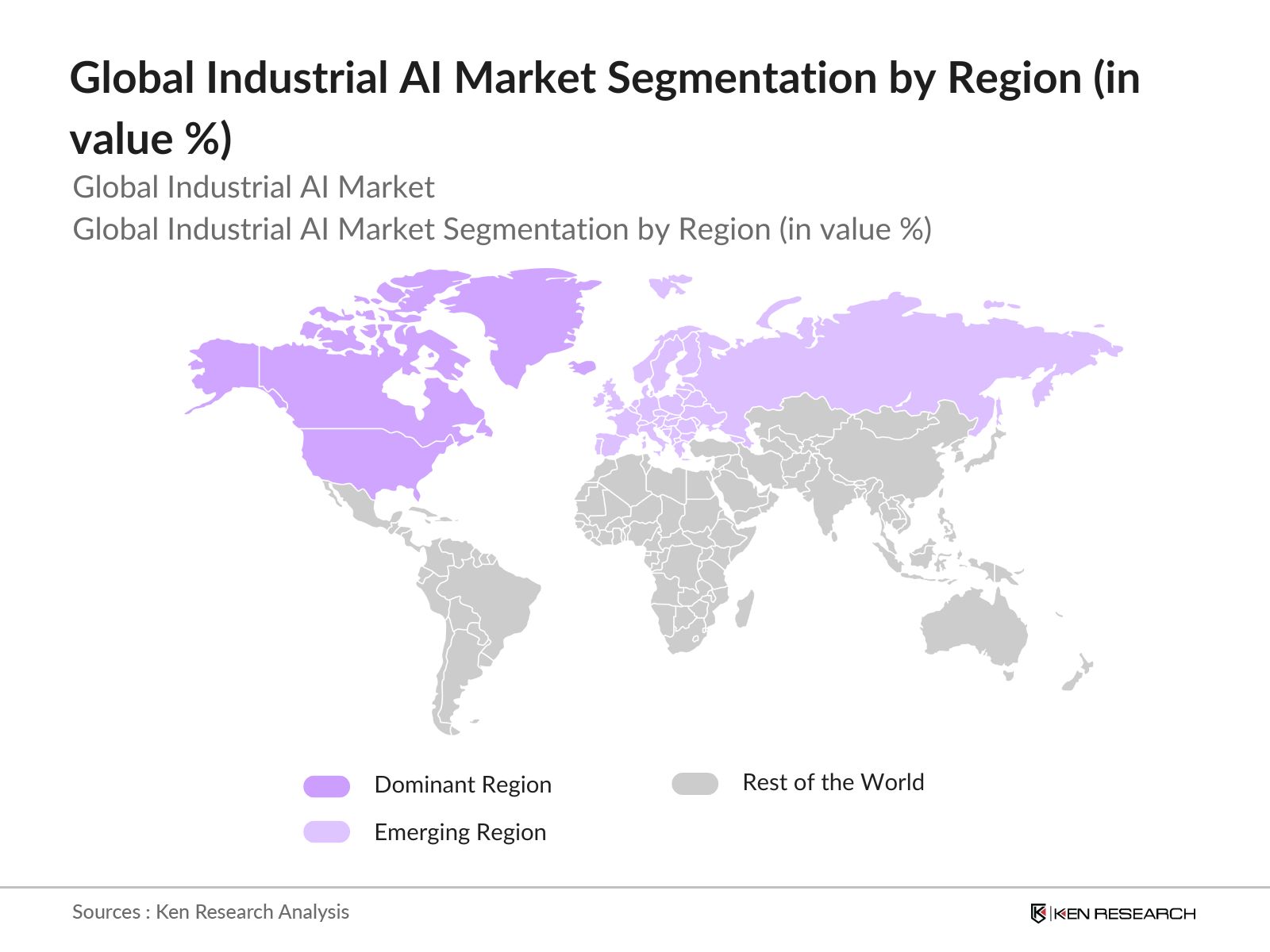

By Region The Global Industrial AI market is segmented by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. North America leads the regional segment, largely due to the United States heavy investments in AI technologies and its strong presence of key AI solution providers. The region's well-developed industrial infrastructure and ongoing AI research and development activities are also contributing to its market dominance.

By Technology By technology, the Global Industrial AI market is segmented into machine learning (ML), natural language processing (NLP), computer vision, robotics process automation (RPA), and deep learning. Machine learning dominates this segment, accounting for a major market share. The widespread use of ML algorithms in automating repetitive tasks, analyzing large data sets, and making predictive insights has led to its dominance. MLs application in real-time decision-making and anomaly detection is particularly impactful in industries like energy and manufacturing.

Global Industrial AI Market Competitive Landscape

The Global Industrial AI market is dominated by several key players with a strong focus on AI-driven technologies, extensive R&D investments, and partnerships to enhance their market presence. These players are leveraging AI technologies for predictive analytics, automation, and AI-based robotics in industrial settings.

Global Industrial AI Market Analysis

Growth Drivers:

- Increasing Adoption of AI in Process Automation: The adoption of AI in industrial process automation is rapidly accelerating, with industries increasingly utilizing AI-powered systems for quality control, defect detection, and process optimization. According to macroeconomic data from 2024, the manufacturing sector has invested over 100 billion USD globally in AI-based automation technologies. This surge is fueled by the desire to streamline operations and reduce human error in complex production environments, especially in large-scale manufacturing hubs like the USA and Germany.

- Expansion of Smart Factories and Industry 4.0 Initiatives: Industry 4.0 initiatives are reshaping global manufacturing, integrating AI systems with IoT devices to create smart factories that enhance real-time decision-making. By 2024, over 60,000 smart factories are operational globally, generating significant demand for AI solutions that drive efficiencies in production lines. These factories, which are prominent in Asia and Europe, are expected to enhance industrial output by incorporating predictive analytics and autonomous systems.

- Cost Reduction in AI-Enabled Robotics: The cost of AI-enabled robotics has seen a significant reduction due to advancements in semiconductor technologies and economies of scale in hardware production. In 2024, the cost of AI-powered industrial robots has dropped to an average of 15,000 USD per unit, making them accessible to small and medium enterprises (SMEs). This reduction in cost is enabling widespread adoption in sectors like automotive and consumer electronics, where robotics is critical for maintaining production standards.

Market Challenges:

- Data Security and Privacy Concerns: The proliferation of AI in industrial settings has raised significant data security concerns. In 2024, global industries have faced a total of 5,000 data breaches related to AI systems, amounting to over 10 billion USD in potential losses. The challenge is exacerbated by the interconnectedness of AI and IoT devices, making sensitive industrial data more vulnerable to cyberattacks.

- High Initial Investment in AI Systems: Despite the long-term cost benefits, the upfront investment in AI-powered systems remains a major barrier. In 2024, the average cost for deploying AI solutions in industrial settings ranges from 1 to 5 million USD, which is unaffordable for many smaller companies, particularly in emerging markets like Southeast Asia. This financial barrier is slowing AI adoption in certain industries that require significant upfront capital.

Global Industrial AI Market Future Outlook

The Global Industrial AI market is expected to experience robust growth over the next five years. The increasing implementation of AI in manufacturing, energy, and automotive industries, coupled with advancements in machine learning, will continue to drive the market. Furthermore, government initiatives supporting AI innovation and the rise of Industry 4.0 will play a significant role in shaping the future of industrial AI. This growth is expected to lead to widespread AI adoption across multiple sectors, enhancing productivity, reducing costs, and improving operational efficiency.

Market Opportunities:

-

Integration of AI with Industrial IoT Platforms: The convergence of AI with Industrial Internet of Things (IIoT) platforms presents significant growth opportunities. In 2024, over 80 million industrial IoT devices are expected to be connected globally, with AI providing real-time analytics and automation capabilities. This integration is particularly beneficial in sectors like energy and logistics, where AI can optimize operational efficiencies through real-time monitoring and adaptive decision-making.

- Growing Use of AI in Logistics and Supply Chain: AI is increasingly being deployed in logistics and supply chain management to streamline operations and reduce delivery times. As of 2024, the logistics sector globally has adopted AI-based systems in over 150,000 facilities to manage inventory, optimize routes, and predict demand. This trend is enhancing supply chain resilience, particularly in regions such as North America and Europe, where just-in-time delivery models are gaining prominence.

Scope of the Report

|

By Application |

Predictive Maintenance Quality Management Supply Chain Optimization Process Automation Anomaly Detection |

|

By Technology |

Machine Learning Natural Language Processing Computer Vision Robotics Process Automation Deep Learning |

|

By Industry Vertical |

Manufacturing Energy & Utilities Healthcare Automotive Logistics & Transportation |

|

By Deployment Model |

On-Premise Cloud-Based Hybrid Model |

|

By Region |

North America Europe Asia-Pacific Middle East & Africa Latin America |

Products

Key Target Audience

Industrial Automation Companies

AI Solution Providers

AI Research Institutes

Government and Regulatory Bodies (e.g., U.S. Department of Energy)

Industrial Equipment Manufacturers

Investors and Venture Capitalist Firms

Energy and Utilities Providers

Automotive Manufacturers

Companies

Players Mentioned in the Report:

IBM Corporation

Siemens AG

Microsoft Corporation

General Electric

Rockwell Automation, Inc.

ABB Group

FANUC Corporation

SAP SE

NVIDIA Corporation

Oracle Corporation

Table of Contents

1. Global Industrial AI Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Industrial AI Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Industrial AI Market Analysis

3.1 Growth Drivers (Technological Innovation, AI Adoption in Manufacturing, Robotics Integration, Efficiency Improvement)

3.1.1 Increasing Adoption of AI in Process Automation

3.1.2 Expansion of Smart Factories and Industry 4.0 Initiatives

3.1.3 Cost Reduction in AI-Enabled Robotics

3.1.4 Advancements in AI Algorithms for Predictive Maintenance

3.2 Market Challenges (Data Privacy, High Costs, Talent Shortage, Regulatory Barriers)

3.2.1 Data Security and Privacy Concerns

3.2.2 High Initial Investment in AI Systems

3.2.3 Shortage of Skilled AI Workforce

3.2.4 Regulatory and Ethical Challenges in AI Deployment

3.3 Opportunities (Industrial IoT Expansion, Cross-Industry AI Adoption, Custom AI Solutions, AI-as-a-Service)

3.3.1 Integration of AI with Industrial IoT Platforms

3.3.2 Growing Use of AI in Logistics and Supply Chain

3.3.3 Development of Tailored AI Solutions for SMEs

3.3.4 Expansion of AI-as-a-Service in Manufacturing

3.4 Trends (Edge AI, Digital Twins, Collaborative Robots, Self-Optimizing Systems)

3.4.1 Rise of Edge AI in Industrial Applications

3.4.2 Growth of Digital Twin Technology in Manufacturing

3.4.3 Increased Use of Collaborative AI-Driven Robots (Cobots)

3.4.4 Self-Optimizing AI Systems for Enhanced Productivity

3.5 Government Regulation (AI Ethics, Data Policies, Industry Standards, Compliance)

3.5.1 AI Ethics and Governance Frameworks

3.5.2 Global Data Governance and Privacy Regulations

3.5.3 Industry-Specific AI Standards and Protocols

3.5.4 Compliance and Certification Requirements for AI Systems

3.6 SWOT Analysis (Specific to Industrial AI)

3.7 Stakeholder Ecosystem (AI Solution Providers, Manufacturers, Technology Enablers, Integrators)

3.8 Porters Five Forces (Bargaining Power of Suppliers, Bargaining Power of Buyers, Industry Rivalry, Threat of New Entrants, Threat of Substitutes)

3.9 Competition Ecosystem (AI Vendors, Robotics Manufacturers, Industrial Automation Firms, Software Companies)

4. Global Industrial AI Market Segmentation

4.1 By Application (In Value %)

4.1.1 Predictive Maintenance

4.1.2 Quality Management

4.1.3 Supply Chain Optimization

4.1.4 Process Automation

4.1.5 Machine Learning for Anomaly Detection

4.2 By Technology (In Value %)

4.2.1 Machine Learning (ML)

4.2.2 Natural Language Processing (NLP)

4.2.3 Computer Vision

4.2.4 Robotics Process Automation (RPA)

4.2.5 Deep Learning

4.3 By Industry Vertical (In Value %)

4.3.1 Manufacturing

4.3.2 Energy and Utilities

4.3.3 Healthcare

4.3.4 Automotive

4.3.5 Logistics and Transportation

4.4 By Deployment Model (In Value %)

4.4.1 On-Premise

4.4.2 Cloud-Based

4.4.3 Hybrid Model

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Middle East & Africa

4.5.5 Latin America

5. Global Industrial AI Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 IBM Corporation

5.1.2 Siemens AG

5.1.3 Microsoft Corporation

5.1.4 General Electric

5.1.5 Rockwell Automation, Inc.

5.1.6 ABB Group

5.1.7 FANUC Corporation

5.1.8 SAP SE

5.1.9 NVIDIA Corporation

5.1.10 Oracle Corporation

5.1.11 Honeywell International Inc.

5.1.12 Bosch Rexroth AG

5.1.13 Intel Corporation

5.1.14 Amazon Web Services (AWS)

5.1.15 Schneider Electric SE

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, AI Integration, AI R&D Investments, Product Portfolio, Market Share)

5.3 Market Share Analysis

5.4 Strategic Initiatives (AI Collaborations, Mergers & Acquisitions, Partnerships)

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding in AI

5.8 Government Grants for AI R&D

5.9 Private Equity Investments

6. Global Industrial AI Market Regulatory Framework

6.1 AI Ethical Standards

6.2 Data Governance and Compliance

6.3 Certification Processes for AI Deployment

7. Global Industrial AI Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Industrial AI Future Market Segmentation

8.1 By Application (In Value %)

8.2 By Technology (In Value %)

8.3 By Industry Vertical (In Value %)

8.4 By Deployment Model (In Value %)

8.5 By Region (In Value %)

9. Global Industrial AI Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involves an in-depth analysis of key stakeholders within the Global Industrial AI Market. A thorough desk research was conducted using secondary and proprietary databases to identify the critical variables influencing market growth, including technological advancements, AI investments, and industry-specific applications.

Step 2: Market Analysis and Construction

Historical data was analyzed to understand the penetration of AI in industrial sectors. The analysis focused on revenue generation, industry adoption rates, and technological integration. Service quality statistics were also considered to assess the impact of AI solutions on operational efficiency.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed based on initial findings and validated through interviews with industry experts. These consultations provided key insights into operational strategies, AI deployment challenges, and investment trends within the market.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing the data gathered from industry consultations, resulting in a comprehensive market analysis. Insights from key AI players were incorporated to ensure an accurate representation of the Global Industrial AI market dynamics.

Frequently Asked Questions

01. How big is the Global Industrial AI Market?

The Global Industrial AI market was valued at USD 2.1 billion, driven by increasing adoption of AI in manufacturing, energy, and automotive sectors.

02. What are the challenges in the Global Industrial AI Market?

Key challenges in the Global Industrial AI market include high initial investments in AI systems, data security concerns, and a shortage of skilled AI professionals to meet growing industry demands.

03. Who are the major players in the Global Industrial AI Market?

Major players in the Global Industrial AI market include IBM Corporation, Siemens AG, Microsoft Corporation, General Electric, and Rockwell Automation, Inc., who are key innovators in AI technology for industrial applications.

04. What are the growth drivers of the Global Industrial AI Market?

Growth drivers in the Global Industrial AI market include the expansion of AI-enabled robotics, advancements in machine learning algorithms, and the rise of Industry 4.0, which is boosting demand for AI-powered solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.