Global Industrial Automation Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD3829

December 2024

99

About the Report

Global Industrial Automation Market Overview

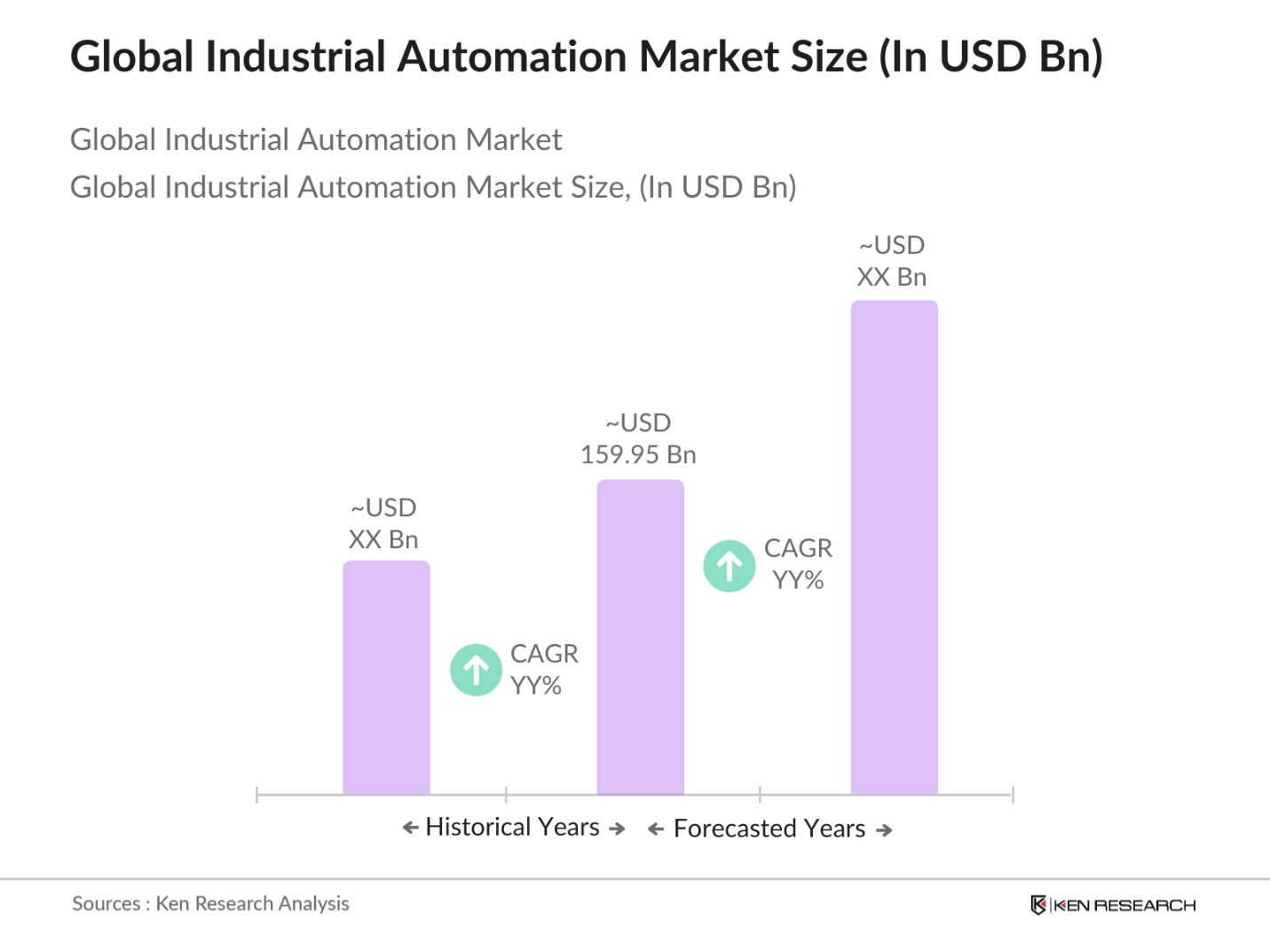

- The global industrial automation market is valued at USD 159.95 billion, reflecting robust growth driven by the rising demand for automation across industries such as manufacturing, automotive, and healthcare. The markets upward trajectory is fueled by factors such as the increasing implementation of robotics, artificial intelligence (AI), and Internet of Things (IoT) technologies. These advanced technologies allow for higher operational efficiency, reduced human intervention, and real-time data processing, making automation systems indispensable in modern industrial operations.

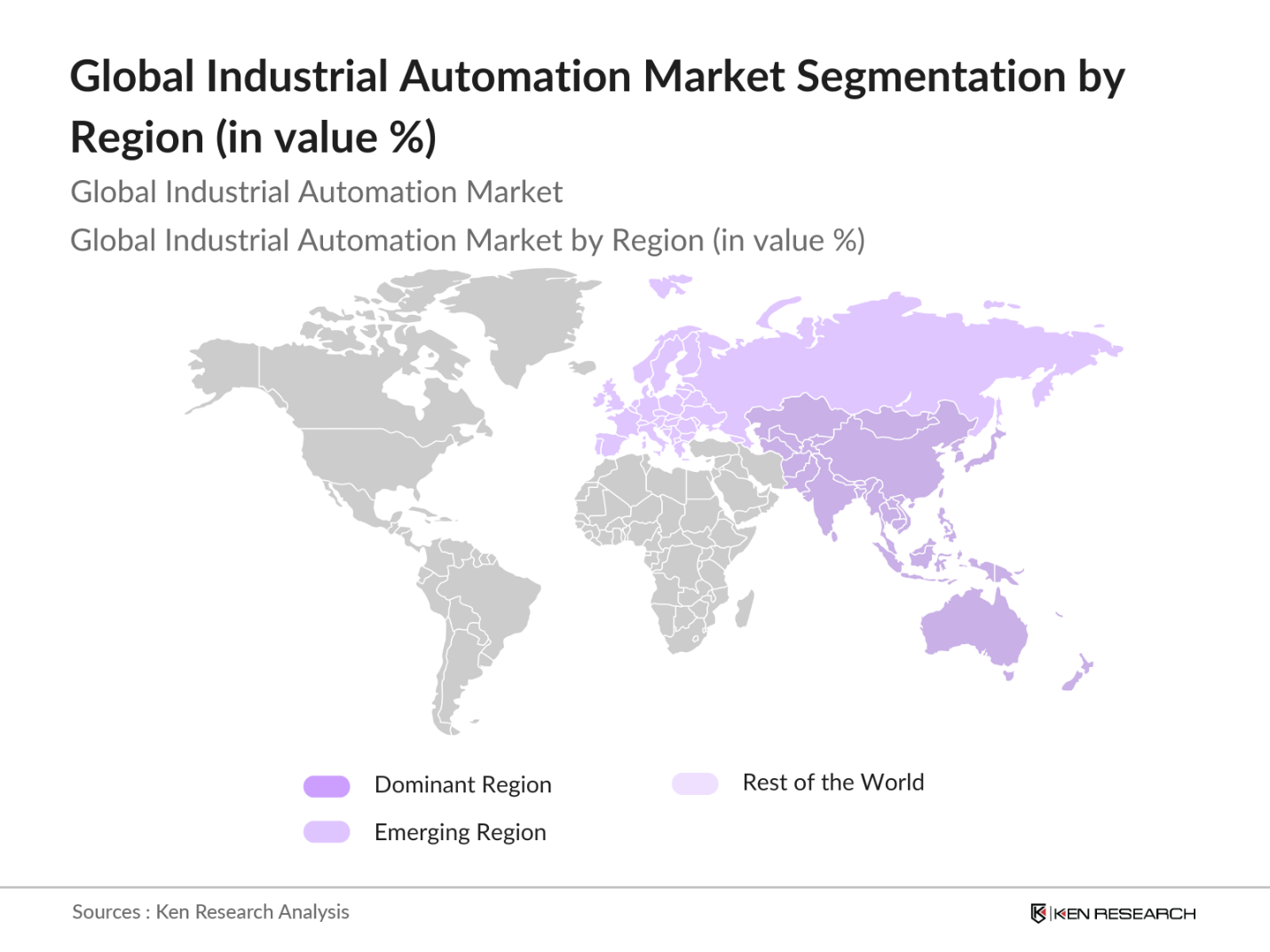

- The Asia-Pacific region, particularly countries like China, Japan, and India, dominates the industrial automation market. This dominance is largely due to their strong manufacturing bases, significant investments in smart factory projects, and government support for automation technologies. China, for example, leads the region in producing automation components like sensors and actuators, further cementing its role in the global industrial automation landscape.

- Governments are increasingly imposing regulations to promote energy efficiency in industrial automation, particularly in sectors like energy and manufacturing. In 2023, the European Union introduced stricter energy efficiency standards for automated factories, focusing on reducing energy consumption in manufacturing facilities. This push for greener automation practices aligns with global efforts to reduce industrial emissions and improve sustainability. Compliance with these regulations is particularly crucial for heavy industries, which account for a significant portion of global energy consumption, according to the International Energy Agency (IEA).

Global Industrial Automation Market Segmentation

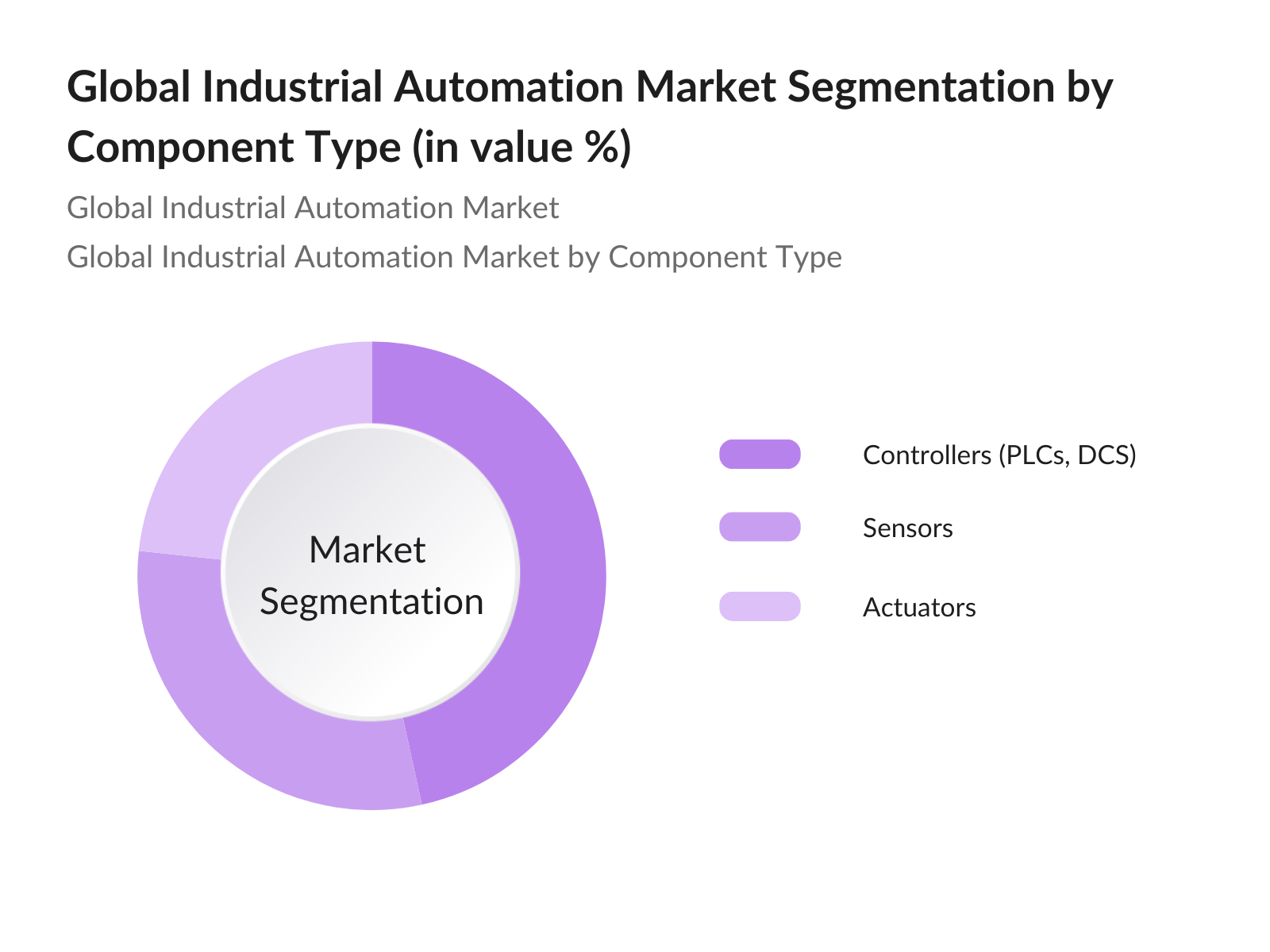

By Component Type: The global industrial automation market is segmented by component type into sensors, controllers, and actuators. controllers such as Programmable Logic Controllers (PLCs) hold the dominant market share. This is because PLCs are vital in automation systems, managing various automated processes in industries such as manufacturing and oil & gas. The rising integration of AI and IoT into controllers, enabling them to process real-time data, further contributes to their dominance in this segment.

By Region: Asia-Pacific leads the market in terms of regional segmentation, owing to its strong manufacturing industry and high investments in automation technologies. Countries like China, India, and Japan have seen a significant rise in the adoption of industrial automation solutions, particularly in manufacturing and healthcare sectors. The region is also seeing increased investment in smart factories, further driving the dominance of this market.

Global Industrial Automation Market Competitive Landscape

The global industrial automation market is characterized by the presence of major players who drive innovation and market consolidation through mergers, acquisitions, and partnerships. The market is led by companies such as ABB, Siemens, and Rockwell Automation, which invest heavily in R&D and expanding automation capabilities. These companies focus on introducing advanced automation solutions, such as AI-integrated controllers and IoT-enabled devices, enhancing their market position.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (USD Bn) |

R&D Investment |

Key Product Line |

Global Reach |

Partnerships |

|

ABB Ltd. |

1883 |

Zurich, Switzerland |

105,000 |

- |

- |

- |

- |

- |

|

Siemens AG |

1847 |

Munich, Germany |

295,000 |

- |

- |

- |

- |

- |

|

Rockwell Automation, Inc. |

1903 |

Milwaukee, USA |

24,500 |

- |

- |

- |

- |

- |

|

Mitsubishi Electric Corp. |

1921 |

Tokyo, Japan |

145,000 |

- |

- |

- |

- |

- |

|

Honeywell International |

1906 |

Charlotte, USA |

99,000 |

- |

- |

- |

- |

- |

Global Industrial Automation Market Analysis

Market Growth Drivers

- Robotics Integration in Manufacturing: Robotics has played a crucial role in enhancing productivity and efficiency in industrial automation. In 2023, over 4.5 million robots were operating in factories globally, driven by automation in automotive, electronics, and metalworking industries. South Korea, Japan, and Germany lead in robot density, with South Korea having over 800 robots per 10,000 manufacturing employees, according to the International Federation of Robotics. This trend is backed by the increasing demand for precision and high-quality manufacturing output, supporting the global shift towards automated industrial ecosystems.

- Adoption of AI in Automation: Artificial intelligence has significantly influenced the automation industry, particularly in predictive analytics, production efficiency, and real-time data processing. By 2024, global investments in AI are expected to surpass $110 billion, with a major share directed toward industrial applications like automation, according to the World Economic Forum. AIs integration into automation enhances process control, reduces human intervention, and improves overall decision-making processes, particularly in sectors like oil & gas, pharmaceuticals, and energy, which require real-time analytics for optimal operation.

- Increasing Adoption of IoT Technologies: Industrial Internet of Things (IIoT) is transforming manufacturing by enabling machine-to-machine communication, predictive maintenance, and supply chain optimization. As of 2024, there are over 30 billion IoT-connected devices globally, used extensively in industrial sectors, according to IoT Analytics. IoT applications in industrial automation, such as remote monitoring, energy management, and real-time data analytics, enhance operational efficiency and reduce downtime. Manufacturing industries in the US and China lead this adoption, significantly improving plant productivity and reducing operational costs through better data-driven decisions and predictive maintenance strategies.

Market Challenges:

- Integration Challenges with Legacy Systems: The industrial automation sector faces significant hurdles when integrating advanced automation technologies with existing legacy systems. A 2023 report by the World Economic Forum revealed that many factories globally still operate using outdated control systems, making seamless integration a challenge. These legacy systems often lack compatibility with modern automated machinery, leading to inefficiencies and higher operational costs. This integration complexity is especially prevalent in regions like Southeast Asia and Eastern Europe, where older manufacturing infrastructure persists, creating further delays in adopting cutting-edge automation technologies.

- High Costs of Automation Implementation: The high upfront costs of industrial automation remain a critical barrier for small and medium-sized enterprises (SMEs), especially in developing economies. A 2024 study by the World Bank highlighted that initial setup costs for fully automated systems could reach as high as $10 million per manufacturing plant. These costs include robotic systems, advanced AI software, and IoT device integration, which many SMEs struggle to afford. This financial constraint limits automation adoption rates in emerging economies like Africa and Latin America, despite long-term cost-saving benefits.

Global Industrial Automation Market Future Outlook

Over the next five years, the global industrial automation market is poised for significant growth, driven by advancements in AI, IoT, and the deployment of 5G technologies. These innovations will not only enhance operational efficiency but also enable real-time monitoring and predictive maintenance, which are key factors propelling the adoption of industrial automation across various sectors. The growing demand for smart factories and digitalized supply chains is expected to further fuel the expansion of this market, particularly in regions such as Asia-Pacific and North America.

Market Opportunities:

- Expansion of Smart Manufacturing Facilities: Smart factories are rapidly expanding, driven by advancements in AI, robotics, and IoT. In 2023, over 75,000 smart factories were operational globally, with the highest concentration in the US, China, and Germany, as reported by the United Nations Industrial Development Organization (UNIDO). These facilities offer enhanced flexibility, cost efficiency, and reduced human error by integrating fully automated workflows and real-time analytics. The increasing demand for high-tech products and efficiency in automotive, aerospace, and electronics sectors will further drive smart factory adoption.

- Utilization of Machine Learning for Process Optimization: Machine learning (ML) is playing a pivotal role in optimizing industrial processes by analyzing vast datasets to identify patterns, predict outcomes, and enhance decision-making. As of 2024, global manufacturers are increasingly utilizing ML algorithms for process control and optimization, as reported by the World Economic Forum. In particular, industries such as pharmaceuticals, food processing, and automotive are using ML to reduce production errors, optimize energy consumption, and improve product quality. This integration of ML has contributed to significant cost reductions and enhanced operational efficiency in these sectors.

Scope of the Report

|

By Component Type |

Sensors Controllers Actuators HMI |

|

By Industry |

Discrete Automation Process Automation |

|

By Solution |

AI-Driven Automation Cloud-Based Automation Solutions |

|

By End-User |

Automotive Manufacturing Healthcare Energy |

|

By Region |

North America Europe Asia-Pacific MEA |

Products

Key Target Audience

Automation Equipment Manufacturers

Automotive Manufacturers

Oil & Gas Companies

Smart Factory Operators

Government & Regulatory Bodies (e.g., International Electrotechnical Commission)

Venture Capital and Investment Firms

Healthcare Equipment Manufacturers

Electrical & Electronics Manufacturers

Companies

Players Mention in the Report

ABB Ltd.

Siemens AG

Rockwell Automation, Inc.

Mitsubishi Electric Corporation

Honeywell International Inc.

Emerson Electric Co.

Schneider Electric SE

OMRON Corporation

Yokogawa Electric Corporation

Bosch Rexroth AG

Fanuc Corporation

General Electric

Fuji Electric

Toshiba Corporation

Hitachi, Ltd.

Table of Contents

1. Global Industrial Automation Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Industrial Automation Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Industrial Automation Market Analysis

3.1. Growth Drivers (Robotics, AI, 5G, IoT)

3.1.1. Robotics Integration in Manufacturing

3.1.2. Adoption of AI in Automation

3.1.3. Emergence of 5G in Industrial Automation

3.1.4. Increasing Adoption of IoT Technologies

3.2. Market Challenges (Cybersecurity, High Initial Costs)

3.2.1. Integration Challenges with Legacy Systems

3.2.2. High Costs of Automation Implementation

3.3. Opportunities (Smart Factories, Predictive Maintenance)

3.3.1. Expansion of Smart Manufacturing Facilities

3.3.2. Predictive Maintenance Using IoT Sensors

3.4. Trends (Edge Computing, Machine Learning)

3.4.1. Increased Deployment of Edge Computing in Automation

3.4.2. Utilization of Machine Learning for Process Optimization

3.5. Government Regulation (Energy Efficiency, Environmental Compliance)

3.5.1. Industry Regulations on Automation in the Energy Sector

3.5.2. Environmental Compliance for Automated Factories

3.6. Porters Five Forces Analysis

3.7. Industry Stakeholders Ecosystem

3.8. SWOT Analysis of the Market

4. Global Industrial Automation Market Segmentation

4.1. By Component Type (In Value %)

4.1.1. Sensors (Temperature, Humidity, Torque Sensors)

4.1.2. Controllers (PLC, DCS, SCADA)

4.1.3. Actuators (Motors, Drives)

4.1.4. Human-Machine Interface (HMI)

4.2. By Industry (In Value %)

4.2.1. Discrete Automation (Automotive, Electronics, Packaging)

4.2.2. Process Automation (Oil & Gas, Chemicals, Water & Wastewater)

4.3. By Solution (In Value %)

4.3.1. AI-Driven Automation

4.3.2. Cloud-Based Automation Solutions

4.4. By Region (In Value %)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia-Pacific

4.4.4. Middle East & Africa

4.5. By End-User (In Value %)

4.5.1. Automotive

4.5.2. Manufacturing

4.5.3. Healthcare

4.5.4. Energy & Utilities

5. Global Industrial Automation Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. ABB Ltd.

5.1.2. Emerson Electric Co.

5.1.3. Honeywell International Inc.

5.1.4. Mitsubishi Electric Corporation

5.1.5. Rockwell Automation, Inc.

5.1.6. Schneider Electric

5.1.7. Siemens AG

5.1.8. Yokogawa Electric

5.1.9. OMRON Corporation

5.1.10. Fanuc Corporation

5.1.11. Bosch Rexroth

5.1.12. General Electric Company

5.1.13. Fuji Electric

5.1.14. Toshiba Corporation

5.1.15. Hitachi, Ltd.

5.2 Cross-Comparison Parameters (Revenue, Market Share, Product Innovations, Geographical Presence, Inception Year, No. of Employees, Strategic Initiatives, Major Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Private Equity & Venture Capital Involvement

6. Global Industrial Automation Market Regulatory Framework

6.1. Industrial Standards (ISO, IEC)

6.2. Regulatory Compliance for Automation Systems

6.3. Certification Processes for Automated Systems

7. Global Industrial Automation Future Market Size (In USD Mn)

7.1. Projected Market Size

7.2. Key Factors Driving Future Market Growth

8. Global Industrial Automation Future Market Segmentation

8.1. By Component Type

8.2. By Industry

8.3. By Solution

8.4. By Region

9. Global Industrial Automation Market Analyst Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Innovation and Investment Opportunities

9.3. Market Entry Strategies for Emerging Regions

9.4. Competitive Advantage Recommendations

Research Methodology

Step 1: Identification of Key Variables

In the first stage, the research team identifies key variables such as automation product segments and their applications across industries. This is achieved through extensive desk research, tapping into secondary and proprietary databases to compile relevant data on the global industrial automation market.

Step 2: Market Analysis and Construction

Historical data from industrial automation reports is analyzed to assess growth trends. Market penetration, service provider analysis, and product adoption rates are considered to develop accurate market projections and revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses generated from data analysis are validated through interviews with industry experts, using CATI techniques. These interviews help refine the data and add qualitative insights into market drivers and challenges.

Step 4: Research Synthesis and Final Output

In the final stage, synthesized insights from primary and secondary research are used to create a comprehensive market report. This includes reviewing automation trends, market opportunities, and segment-specific forecasts, ensuring a holistic and accurate representation of the industrial automation market.

Frequently Asked Questions

01. How big is the global industrial automation market?

The global industrial automation market is valued at USD 159.95 billion, driven by advancements in robotics, AI, and IoT, as well as increasing demand from sectors like automotive and healthcare.

02. What are the key drivers of the industrial automation market?

Key drivers include technological advancements such as the deployment of AI and 5G, the growing demand for smart factories, and the need for improved operational efficiency in industries like manufacturing and energy.

03. Which regions dominate the industrial automation market?

The Asia-Pacific region leads the market due to its strong manufacturing sector and government support for automation. Countries like China, Japan, and India are major contributors to this dominance.

04. What are the major challenges in the industrial automation market?

Challenges include high initial costs, integration complexities with legacy systems, and concerns over data security, especially with the increased adoption of connected devices and IoT solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.