Global Industrial Salt Market Outlook to 2030

Region:Global

Author(s):Shambhavi

Product Code:KROD3715

December 2024

91

About the Report

Global Industrial Salt Market Overview

- The global industrial salt market is valued at USD 13 billion, driven by its extensive applications in sectors like chemical manufacturing, de-icing, water treatment, and food processing. The demand for industrial salt is heavily influenced by its crucial role in chemical processes, particularly in the production of chlorine, caustic soda, and soda ash. These chemicals are foundational to various industries, thus ensuring a consistent demand for industrial salt. Additionally, increasing urbanization and growing infrastructure in emerging economies have further boosted the requirement for de-icing salt and water treatment solutions.

- Countries like China, the United States, and India dominate the industrial salt market due to their significant chemical manufacturing industries and large salt reserves. China, the largest consumer of industrial salt, benefits from its massive chemical sector and the availability of large salt deposits. Meanwhile, the United States has a strong presence in the de-icing segment due to its cold climate in several regions, driving demand for salt during winter months. Similarly, Indias industrial salt production is bolstered by its vast coastline, supporting solar salt production.

- Governments are increasingly implementing sustainability standards for salt mining to reduce environmental harm. The European Union and the U.S. have introduced stricter regulations in 2023 to limit the ecological damage caused by salt extraction. These frameworks emphasize sustainable production methods, pushing producers to adopt more eco-friendly practices. Compliance with these regulations not only ensures environmental protection but also enables producers to maintain market access in regions with stringent environmental standards.

Global Industrial Salt Market Segmentation

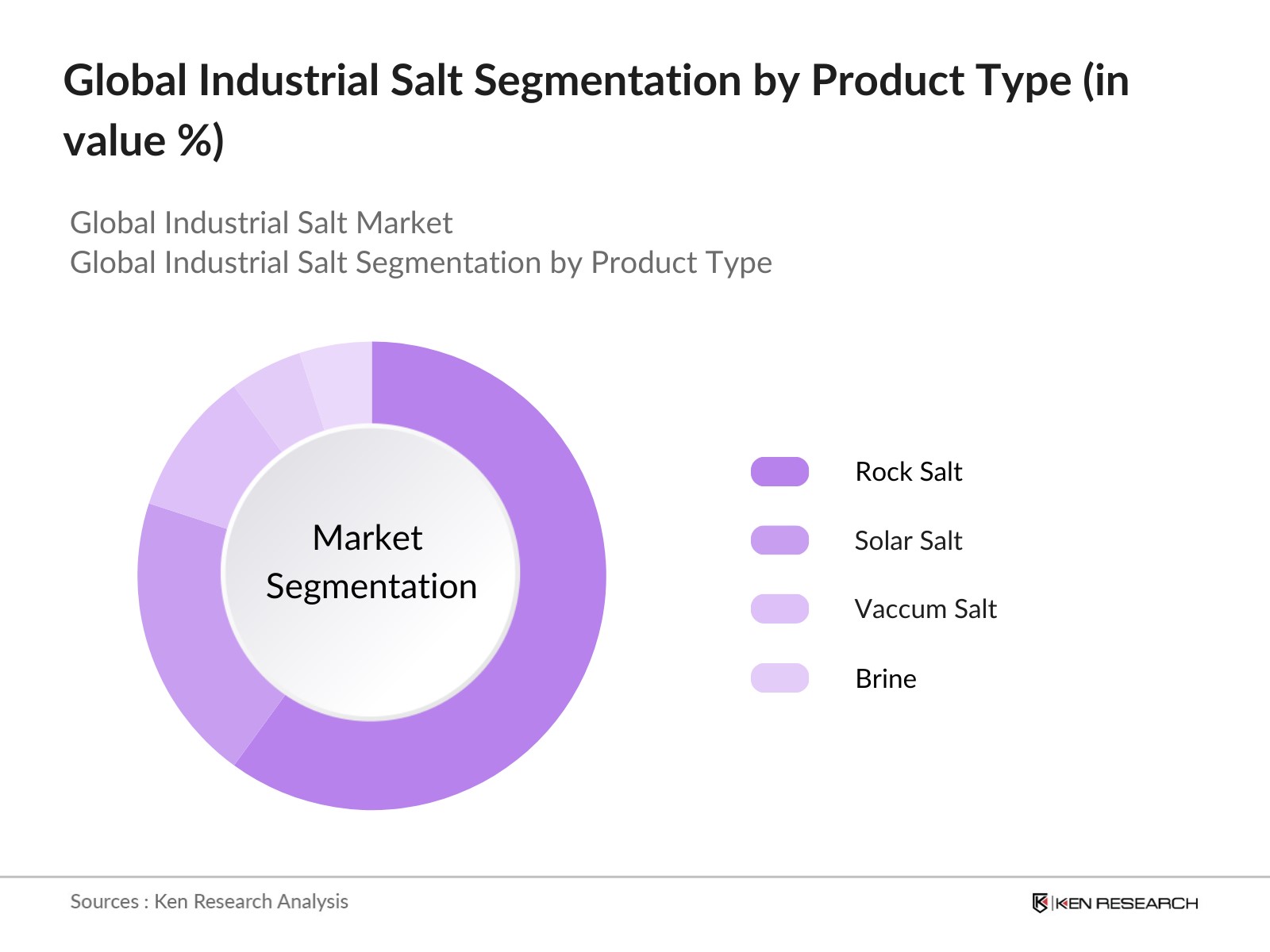

By Product Type:

The global industrial salt market is segmented by product type into rock salt, solar salt, vacuum salt, and brine. Recently, rock salt holds a dominant market share, as it is the most abundant and cost-effective form of salt used for industrial purposes, particularly in chemical processing and de-icing applications. Rock salts robust demand in countries like the U.S. and Canada, where it is extensively used for de-icing during harsh winters, significantly boosts its consumption. Furthermore, the ease of mining and availability of large reserves contribute to its market leadership.

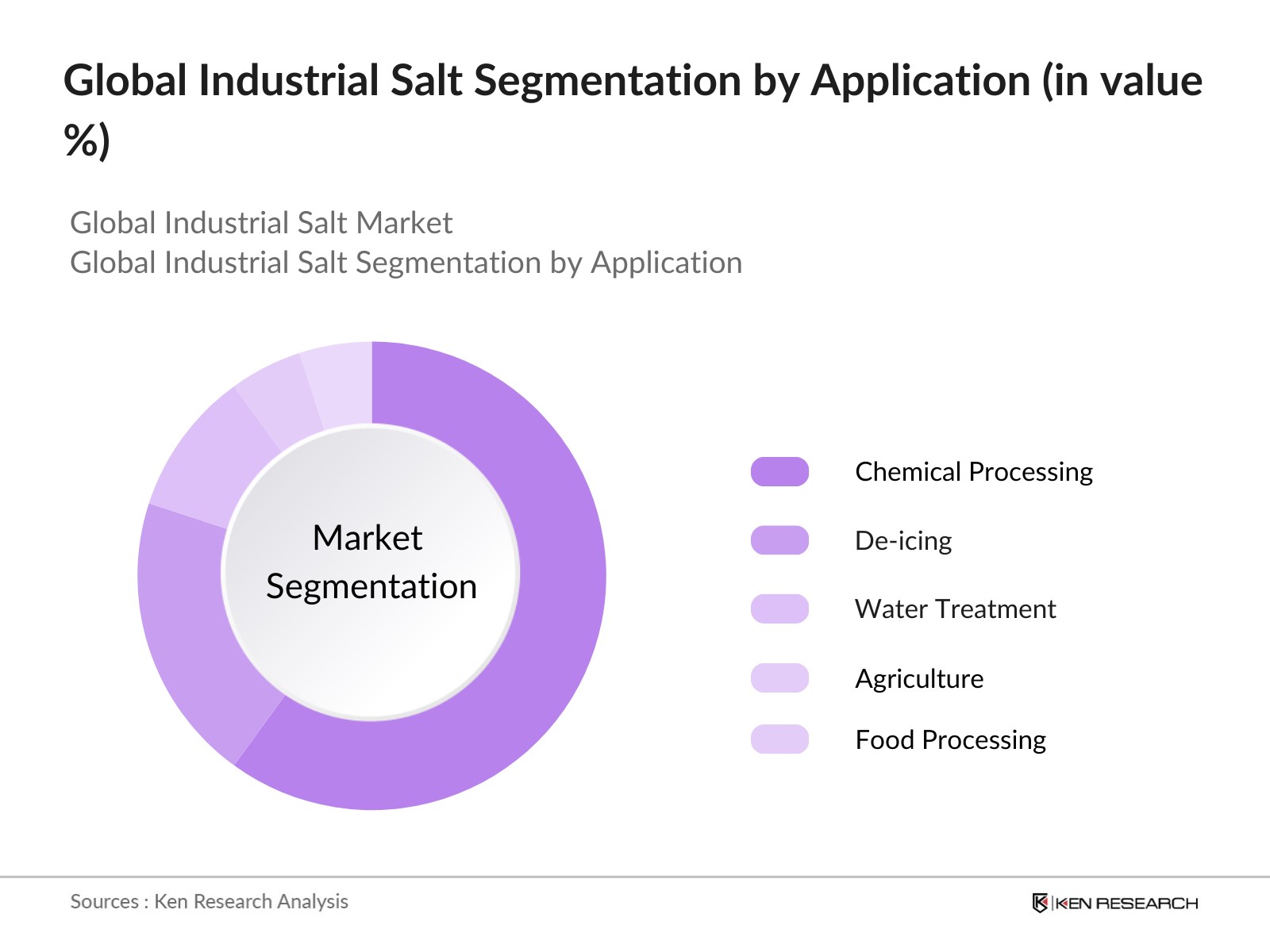

By Application:

The industrial salt market is segmented by application into chemical processing, de-icing, water treatment, agriculture, and food processing. Chemical processing holds the largest market share due to its significant use of salt in the production of chlorine, caustic soda, and soda ash. These chemicals are essential for various industries, including paper, plastics, and textiles. The steady growth of these end-use industries, coupled with industrialization in developing countries, reinforces the dominance of chemical processing as the largest application of industrial salt.

Global Industrial Salt Market Competitive Landscape

The global industrial salt market is dominated by several major players, each with unique strengths in areas such as production capacity, global distribution networks, and technological innovation in salt processing. These companies maintain a strong presence through strategic partnerships, acquisitions, and investments in R&D. The market features well-established players such as Cargill, K+S AG, and Compass Minerals International, who dominate due to their extensive salt production capacities and global distribution channels. Companies from China and India are also making inroads due to increasing domestic demand and the availability of vast salt reserves.

|

Company |

Establishment Year |

Headquarters |

Production Capacity (MT/Year) |

Global Reach (Countries) |

Revenue (USD Bn) |

Key Product |

R&D Investment (USD Mn) |

Strategic Initiatives |

|

Cargill, Inc. |

1865 |

U.S. |

- |

- |

- |

- |

- |

- |

|

K+S AG |

1889 |

Germany |

- |

- |

- |

- |

- |

- |

|

Compass Minerals International |

1844 |

U.S. |

- |

- |

- |

- |

- |

- |

|

Tata Chemicals Ltd. |

1939 |

India |

- |

- |

- |

- |

- |

- |

|

Mitsui & Co., Ltd. |

1947 |

Japan |

- |

- |

- |

- |

- |

- |

Global Industrial salt Market Analysis

Growth Drivers

- Increasing Demand in Chemical Processing: The global industrial salt market is significantly driven by its critical role in chemical processing. Industrial salt is vital for producing caustic soda and soda ash, which are used in manufacturing glass, detergents, and paper. In 2023, the global production of soda ash reached over 60 million metric tons, with large salt-consuming regions including the U.S. and China. The chemical industry, valued at over $5 trillion in 2022, continues to expand, driving salt demand in these applications. Reliable supply chains for industrial salt support the growth of this sector, which underpins multiple industries.

- Expanding Applications in De-icing and Water Treatment: Industrial salts demand is also fueled by its widespread use in de-icing roads and water treatment. In North America alone, over 20 million tons of salt are used annually for de-icing purposes, especially in regions prone to heavy snowfalls. Simultaneously, global urbanization and the need for clean water drive demand for salt in water treatment facilities, with nearly 2 billion people lacking access to safe drinking water in 2023. This need for efficient water purification further enhances the industrial salt market's stability and growth.

- Rising Use in Food Processing: The food industry accounts for a significant portion of industrial salt consumption. Salt is essential in food preservation and flavor enhancement, with approximately 240 million metric tons of salt produced globally in 2022, a notable share of which is utilized in food processing. The food processing sector, valued at $8 trillion in 2023, heavily relies on purified salt for consistency and safety. Countries like India and the U.S. are leading producers and consumers of industrial salt in food applications, ensuring a steady demand across this market.

Market Challenges

- Impact of Environmental Regulations: Stringent environmental regulations affect industrial salt mining and production. Governments globally are imposing stricter sustainability requirements to mitigate the ecological impact of salt extraction, especially in coastal areas. For example, in 2023, the European Union tightened its environmental policies, directly affecting salt mining operations. The enforcement of these regulations leads to increased production costs and potential supply constraints, as producers must invest in environmentally friendly technologies and processes to comply with regulations.

- Volatility in Raw Material Supply Chain: The industrial salt market faces supply chain volatility due to fluctuating salt reserves and extraction challenges. Some of the world's largest producers, like China and the U.S., reported supply chain disruptions in 2023 due to extreme weather conditions impacting mining operations. Furthermore, the reliance on natural salt reserves, particularly in regions vulnerable to resource depletion, adds uncertainty to consistent supply. These factors contribute to periodic price fluctuations and logistical hurdles in ensuring a steady salt supply to key industries.

Global Industrial Salt Market Future Outlook

Over the next five years, the global industrial salt market is expected to witness moderate growth, driven by steady demand from the chemical industry and increasing applications in emerging sectors such as renewable energy. The use of salt in new technologies, such as salt-based energy storage systems in solar power plants, will also play a key role in shaping the future demand. Additionally, the growing focus on sustainable and eco-friendly production processes will lead to innovations in salt extraction and processing. As industrialization and urbanization continue to rise, particularly in developing regions such as Asia-Pacific, the market is likely to experience a significant increase in demand for industrial salt, particularly for chemical processing, de-icing, and water treatment applications.

Market Opportunities

- Expansion in Renewable Energy Sector: The rise of renewable energy technologies presents an opportunity for industrial salt, particularly in thermal energy storage for concentrated solar power (CSP) plants. Molten salt is used to store heat efficiently, which is then converted into electricity. In 2022, CSP capacity worldwide reached over 6.5 gigawatts, with countries like Spain and the U.S. leading in solar salt adoption. As global investments in renewable energy exceed $500 billion in 2023, the demand for industrial salt in this sector is expected to remain strong.

- Increasing Demand for Purified and Specialty Salts: Purified and specialty salts are gaining prominence in pharmaceuticals and food-grade applications. The pharmaceutical industry, valued at over $1.4 trillion in 2023, requires high-purity salts for various formulations and manufacturing processes. Similarly, the food industry increasingly demands high-quality, purified salts to meet stringent safety standards, including those set by regulatory bodies such as the FDA. This shift toward specialty salts creates new growth avenues for industrial salt producers who can meet the rising purity standards.

Products

Key Target Audience

Chemical Manufacturing Companies

Water Treatment Companies

Food & Beverage Producers

Oil & Gas Companies

Pharmaceutical Manufacturers

Municipalities & De-icing Service Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Environmental Protection Agency, European Chemicals Agency)

Companies

Major Players Mentioned in the Global Industrial Salt Market

Cargill, Inc.

K+S AG

Compass Minerals International, Inc.

Tata Chemicals Ltd.

Mitsui & Co., Ltd.

Rio Tinto PLC

Akzo Nobel N.V.

China National Salt Industry Corporation (CNSIC)

INEOS Group Holdings S.A.

ICL Group

Morton Salt, Inc.

Exportadora de Sal S.A.

Dampier Salt Limited

Salins Group

Dominion Salt Ltd.

Table of Contents

1. Global Industrial Salt Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy (By Type, Application, End-User Industry)

1.3 Market Growth Rate (CAGR, Volume, Value)

1.4 Market Segmentation Overview

2. Global Industrial Salt Market Size (In USD Mn)

2.1 Historical Market Size (Global and Regional Levels)

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Industrial Salt Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Demand in Chemical Processing (Caustic Soda, Soda Ash Production)

3.1.2 Expanding Applications in De-icing and Water Treatment

3.1.3 Rising Use in Food Processing

3.1.4 Growth in Oil & Gas Industry (Drilling Fluids)

3.2 Market Challenges

3.2.1 Impact of Environmental Regulations (Salt Mining and Production)

3.2.2 Volatility in Raw Material Supply Chain (Salt Reserves, Extraction Techniques)

3.2.3 Impact of Weather and Climate Changes (De-icing Demand Fluctuations)

3.3 Opportunities

3.3.1 Expansion in Renewable Energy Sector (Salt for Solar Power Generation)

3.3.2 Increasing Demand for Purified and Specialty Salts (Pharmaceuticals, Food Grade)

3.3.3 Technological Advancements in Extraction and Processing Techniques

3.4 Trends

3.4.1 Growing Use of Salt in Battery Manufacturing (Lithium-Ion Batteries)

3.4.2 Development of Eco-Friendly De-icing Solutions

3.4.3 Automation in Salt Mining and Processing Plants

3.5 Government Regulation

3.5.1 Regulatory Framework for Environmental Impact (Sustainability Standards)

3.5.2 Compliance with Food Safety Standards (Codex Alimentarius, FDA, EU)

3.5.3 Global Trade Regulations (Tariffs, Import/Export Quotas)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Producers, Distributors, End-Users, Regulators)

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Global Industrial Salt Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Rock Salt

4.1.2 Solar Salt

4.1.3 Vacuum Salt

4.1.4 Brine

4.2 By Application (In Value %)

4.2.1 Chemical Processing (Soda Ash, Chlor-Alkali)

4.2.2 De-icing

4.2.3 Water Treatment

4.2.4 Agriculture

4.2.5 Food Processing

4.3 By End-User Industry (In Value %)

4.3.1 Chemical Industry

4.3.2 Municipalities (De-icing, Water Softening)

4.3.3 Oil & Gas

4.3.4 Food & Beverage

4.3.5 Pharmaceuticals

4.4 By Source (In Value %)

4.4.1 Seawater

4.4.2 Rock Salt Deposits

4.4.3 Salt Lakes

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Middle East & Africa

4.5.5 Latin America

5. Global Industrial Salt Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Cargill, Incorporated

5.1.2 K+S AG

5.1.3 Compass Minerals International, Inc.

5.1.4 Tata Chemicals Ltd.

5.1.5 Mitsui & Co., Ltd.

5.1.6 Rio Tinto PLC

5.1.7 Akzo Nobel N.V.

5.1.8 Dampier Salt Limited

5.1.9 China National Salt Industry Corporation (CNSIC)

5.1.10 ICL Group

5.1.11 INEOS Group Holdings S.A.

5.1.12 Dominion Salt Ltd.

5.1.13 Exportadora de Sal S.A.

5.1.14 Salins Group

5.1.15 Morton Salt, Inc.

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Production Capacity, Revenue, Market Share, Key Products, Global Reach, Strategic Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives (New Product Launches, Expansion Plans, Collaborations)

5.5 Mergers and Acquisitions

5.6 Investment Analysis (Private Equity, Government Grants, Corporate Investments)

5.7 Venture Capital Funding

6. Global Industrial Salt Market Regulatory Framework

6.1 Environmental Standards (Pollution Control, Resource Management)

6.2 Compliance Requirements (Food Safety, Mining Regulations)

6.3 Certification Processes (ISO, HACCP, GMP)

7. Global Industrial Salt Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth (Technological Innovations, Shifts in End-Use Demand)

8. Global Industrial Salt Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By End-User Industry (In Value %)

8.4 By Source (In Value %)

8.5 By Region (In Value %)

9. Global Industrial Salt Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives (Brand Positioning, Advertising)

9.4 White Space Opportunity Analysis

Disclaimer Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involves creating an ecosystem map that covers major stakeholders, including producers, suppliers, and end-users of industrial salt. Extensive desk research is conducted using secondary and proprietary databases to gather comprehensive industry-level information, focusing on production capacity, global trade flows, and consumption trends.

Step 2: Market Analysis and Construction

Historical data is compiled and analyzed to assess the global industrial salt market. This includes examining production and consumption rates, price trends, and trade statistics across different regions. The analysis also includes evaluating the quality of service delivery by suppliers and distributors.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through consultations with industry experts. Structured interviews and questionnaires are conducted with key personnel from major industrial salt producers, chemical manufacturers, and regulatory agencies to gain insights into market dynamics and emerging trends.

Step 4: Research Synthesis and Final Output

The final phase synthesizes the collected data and insights into a comprehensive market report. The synthesis involves direct engagement with manufacturers and distributors to cross-verify data obtained from the bottom-up analysis. This ensures a well-rounded, accurate depiction of the market.

Frequently Asked Questions

How big is the global industrial salt market?

The global industrial salt market is valued at USD 17 billion, driven by its applications across chemical manufacturing, de-icing, and food processing sectors.

What are the challenges in the global industrial salt market?

Key challenges include the environmental impact of salt extraction and production, fluctuating raw material costs, and the introduction of stringent environmental regulations.

Who are the major players in the global industrial salt market?

Major players include Cargill, K+S AG, Compass Minerals International, Tata Chemicals, and Mitsui & Co., Ltd., all of which maintain significant global reach and production capacities.

What are the growth drivers of the global industrial salt market?

Growth drivers include the rising demand for chlorine and caustic soda in chemical industries, increasing de-icing applications, and the expansion of water treatment facilities across urban areas.

Which regions dominate the global industrial salt market?

Countries like China, the U.S., and India dominate due to their large salt reserves, significant industrial base, and robust infrastructure for salt extraction and distribution.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.