Global Infrared Search and Track Market Outlook to 2030

Region:Global

Author(s):Shubham Kashyap

Product Code:KROD5335

December 2024

81

About the Report

Global IRST Market Overview

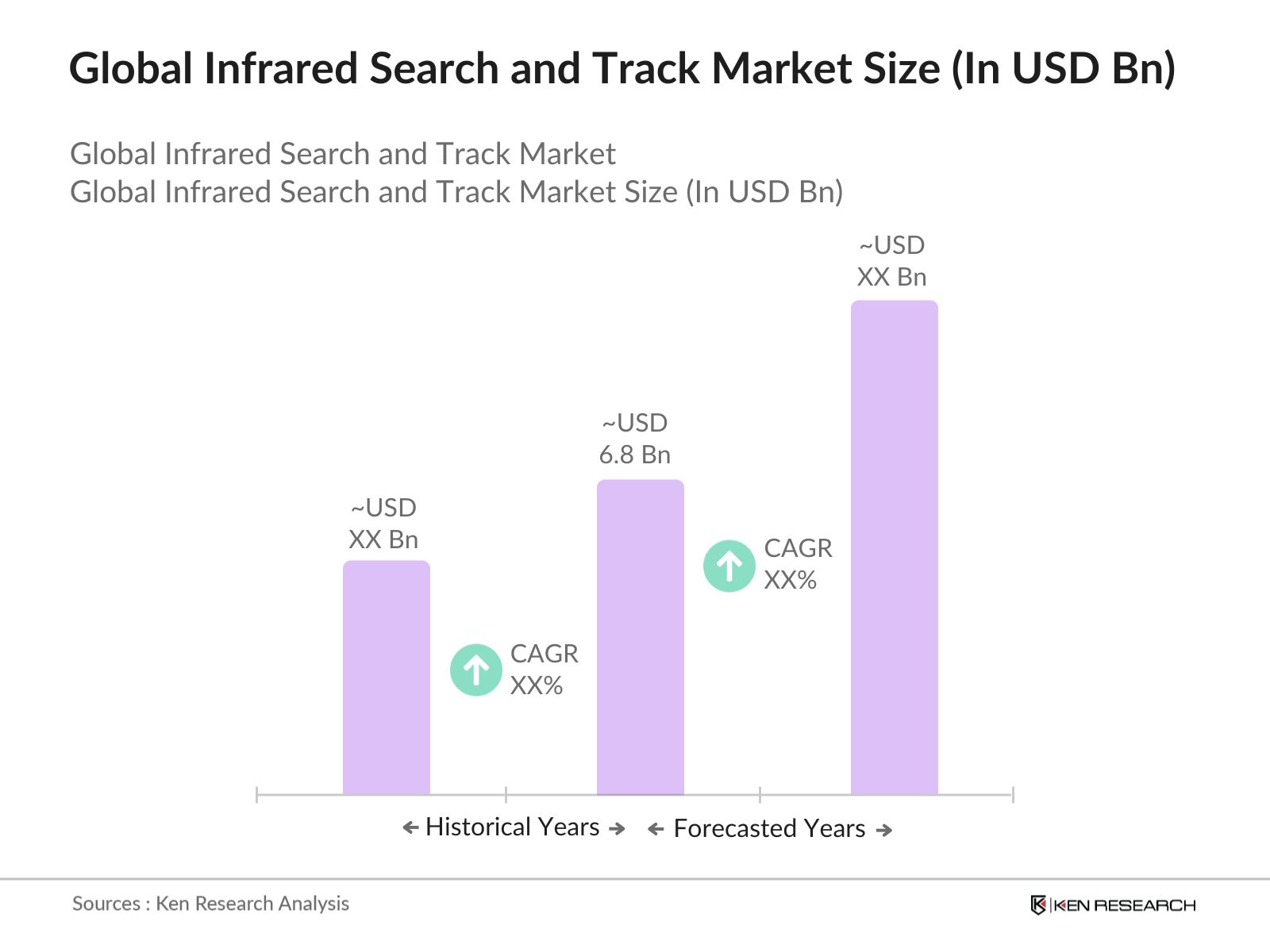

- The global Infrared Search and Track (IRST) market is projected to witness significant growth, currently valued at USD 6.8 billion, driven by increasing demand for advanced defense technologies and the growing focus on stealth detection capabilities. IRST systems play a critical role in modern warfare, providing passive detection of enemy aircraft and missiles, even those designed with stealth capabilities. The increasing integration of these systems in defense platforms, including aircraft, naval vessels, and ground-based systems, further fuels market demand. Additionally, rising military expenditures, particularly in North America and Europe, are contributing to market growth, as governments continue to prioritize defense modernization programs.

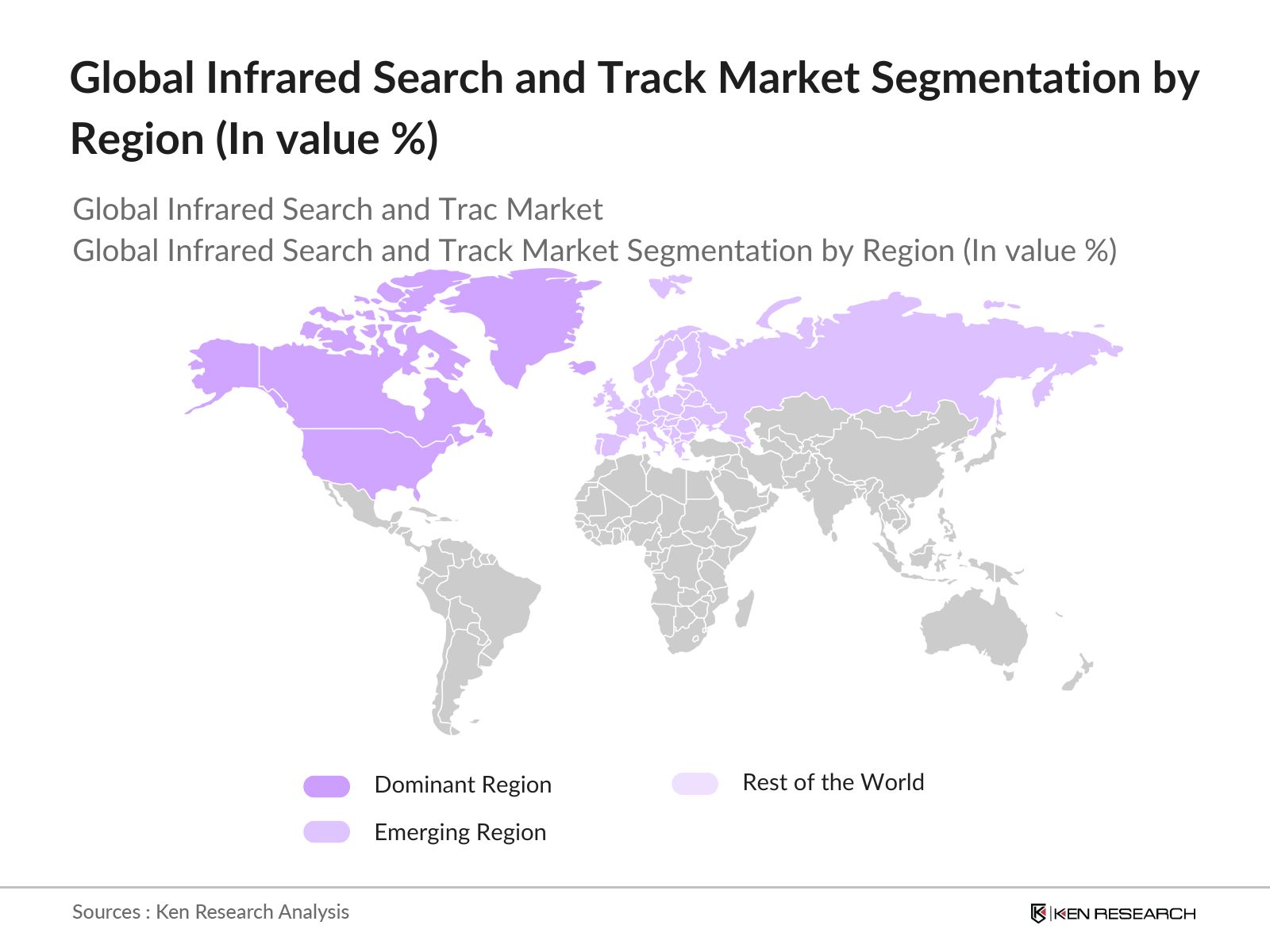

- Key regions driving growth in the IRST market include North America, Europe, and Asia Pacific. The North American market is benefiting from large defense budgets, increased adoption of advanced military technologies, and the presence of key defense contractors. In Europe, rising geopolitical tensions and the focus on upgrading military capabilities are major drivers. Meanwhile, the Asia Pacific region, led by China and India, is experiencing growth due to increasing defense investments and a focus on countering advanced threats such as stealth aircraft. The growing use of unmanned aerial vehicles (UAVs) and autonomous systems in these regions also contributes to the markets expansion.

- Military surveillance systems, including IRST, must adhere to stringent standards set by international organizations such as NATO. In 2023, NATO updated its standards for defense systems, requiring member countries to meet new specifications for detection accuracy and operational reliability . Compliance with these standards is critical for IRST manufacturers looking to supply systems to NATO members. These evolving standards also drive innovation in the market, as manufacturers must continually improve their products to meet the latest military requirements.

Global IRST Market Segmentation

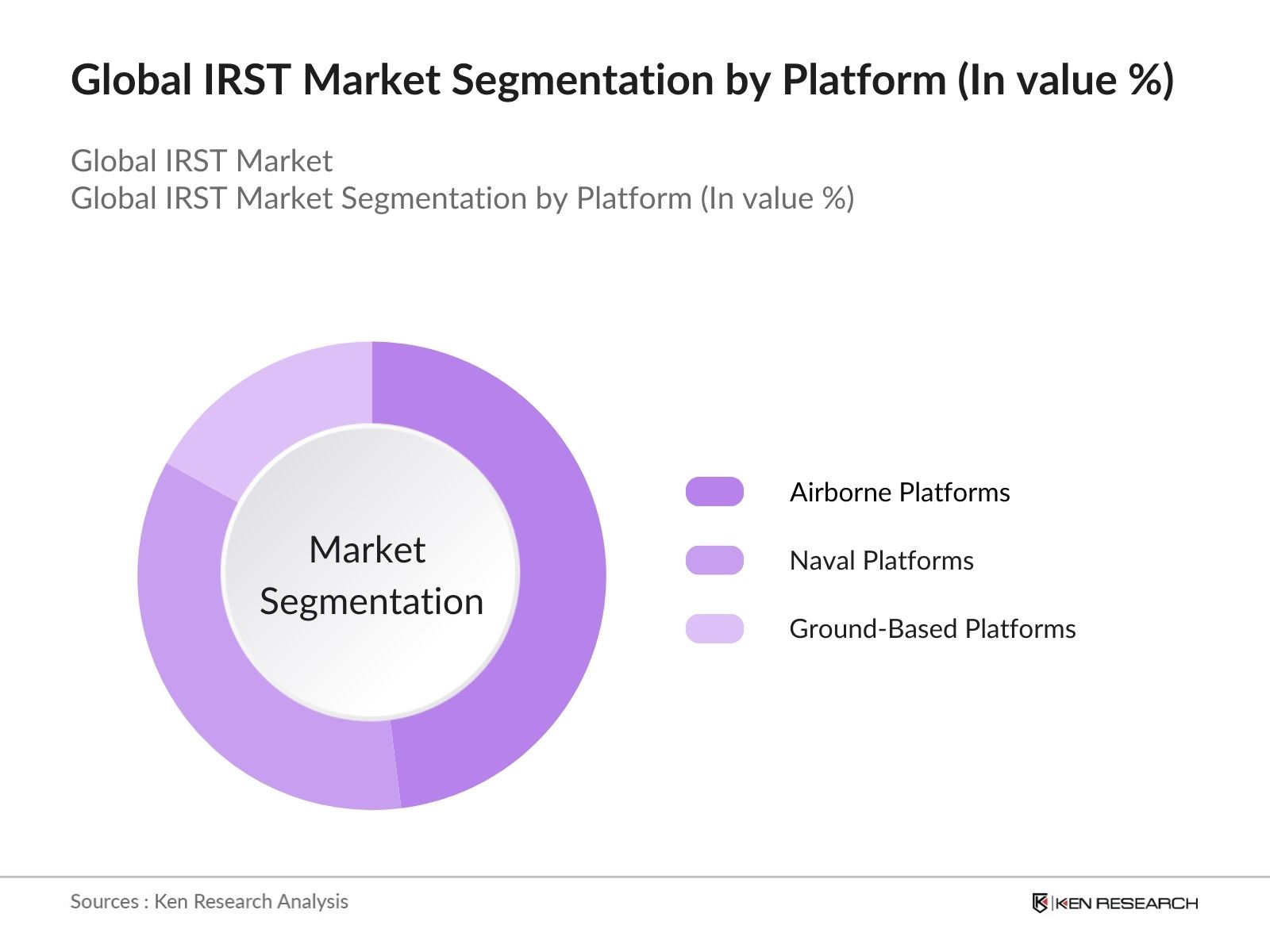

- By Platform Type: The market is segmented by platform type into airborne platforms, naval platforms, and ground-based platforms. Airborne platforms currently hold the dominant market share due to their crucial role in detecting stealth aircraft and missiles, which are increasingly common in modern warfare. Fighter jets and unmanned aerial vehicles (UAVs) rely heavily on IRST systems to enhance their situational awareness and improve engagement capabilities in contested environments where traditional radar systems may be ineffective. As militaries prioritize aerial superiority, the demand for IRST systems in this segment continues to grow.

- By Component: The market is also segmented by component, including scanners, optics and sensors, processing units, and display systems. Optics and sensors dominate this segment due to their critical role in detecting infrared signatures. The continuous advancements in sensor technology, particularly in enhancing detection range, accuracy, and resolution, have made optics and sensors the most vital component in IRST systems. With growing defense budgets and the increasing complexity of modern combat scenarios, optics and sensors are expected to continue leading the market in the near future.

- By Region: The market is segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America leads the market, driven by the U.S., which is a key player in defense spending and technological innovation. The U.S. government has been actively investing in DEW systems, such as high-energy lasers (HEL) and high-power microwave (HPM) weapons, to enhance national security against modern aerial and missile threats. The Department of Defense (DoD) has initiated modernization programs focused on integrating advanced DEW systems into military applications.

Global IRST Market Competitive Landscape

The global IRST market is dominated by a few major players who focus on technological innovation and securing large defense contracts. Key companies such as Lockheed Martin, Northrop Grumman, and Saab AB are at the forefront of developing next-generation IRST systems. These companies are investing heavily in research and development to enhance the capabilities of their IRST offerings, particularly in terms of range, accuracy, and stealth detection. The market is characterized by long-term contracts with defense departments, which further consolidates the competitive landscape.

Global IRST Market Analysis

Growth Drivers

- Increasing Demand for Enhanced Surveillance Systems: The global military sector is seeing increasing investment in surveillance systems, with governments enhancing capabilities to meet modern security demands. The United States defense budget for 2024 allocated over USD 842 billion, with a significant portion directed toward the procurement of surveillance technologies like IRST (Infrared Search and Track) system sanding usage of these systems in defense strategies reflects their crucial role in enhancing situational awareness, particularly for long-range target detection in stealth and low-visibility environments. These drive demand for more advanced and efficient IRST systems globally.

- Technological Advancements in Sensor Technology: Ongoing innovations in sensor technology are transforming the capabilities of IRST systems. Advanced infrared sensors now allow detection at ranges exceeding 100 kilometers under various weather conditions . Governments, sue in Europe, are investing heavily in upgrading defense technology to meet these new capabilities. Germany's defense budget has earmarked over 51 billion for military advancements in 2024, prioritizing improvements in surveillance systems like IRST . These investments drive cal advancements that make IRST systems indispensable for defense, particularly for stealth detection and long-range engagement.

- Expanding Defense Budgets Globally: Defense budgets are growing across the globe, reflecting increased geopolitical tensions and modernization efforts. In 2024, total global military spending is projected to surpass USD 2.2 trillion . Countries like India and China are expanding their defense allocations, with Indias budget crossing USD 73 billion, partly allocated to modernizing its naval and air forces, including the adoption of advanced IRST systems. This trend of expanding defense budgets is driving demand for cutting-edge surveillance and detection technologies, including IRST, particularly for monitoring stealth aircraft and improving situational awareness.

Challenges

- High Initial Investments and Maintenance Costs: The deployment of IRST systems involves significant initial costs due to advanced technology integration. The installation of these systems on military platforms like fighter aircraft requires advanced components and specialized expertise, leading to high upfront expenses. Additionally, ongoing maintenance, including recalibration of sensors and periodic software updates, adds to the overall cost. These expenses create financial challenges for defense forces, particularly in emerging economies where defense budgets may not support extensive spending on advanced surveillance systems, limiting the broader adoption of IRST technology.

- Technological Integration Challenges with Existing Systems: Integrating IRST systems with older, legacy defense platforms poses significant technological challenges. Many older military systems lack the infrastructure to seamlessly accommodate modern IRST technology, requiring extensive retrofitting. This process can be complex and time-consuming, often involving hardware modifications and software updates to ensure compatibility. These challenges are particularly prominent in fleets operated by developing nations, where older technology is still in use. As a result, the adoption of IRST systems can be slowed down, impacting the overall growth of the market in regions reliant on outdated military infrastructure.

Global IRST Market Future Outlook

The global IRST market is expected to experience steady growth, driven by rising military expenditures, technological advancements, and the growing use of stealth technologies in warfare. As countries continue to modernize their defense capabilities, the demand for advanced surveillance systems, including IRST, is projected to rise. Additionally, the integration of AI and machine learning into IRST systems will enhance their operational capabilities, further fueling market growth.

Future Market Opportunities

- Emerging Markets with Growing Defense Sectors: Emerging markets such as India, Brazil, and South Africa are seeing rapid expansion in defense spending. India's defense budget for 2024 reached over USD 73 billion, with a portion earmarked for enhancing its air and naval surveillance capabilities . These countries are investing in modernizing their fleets, making them potential growth markets for IRST systems. As these nations focus on upgrading their military capabilities, the adoption of advanced surveillance systems, including IRST, is expected to rise, presenting substantial opportunities for manufacturers.

- Development of AI-based IRST Systems: The integration of artificial intelligence (AI) in IRST systems is an emerging trend. AI-powered IRST can autonomously detect, track, and classify targets without human intervention, significantly enhancing efficiency. The global defense sector spent a substantial amount on AI research and development in 2023, much of it directed toward improving autonomous systems . Countries like the U.S. and China are at the forefront of adopting AI-driven surveillance technologies, offering opportunities for innovation and market expansion in this sector.

Scope of the Report

|

Platform Type |

Airborne Naval Ground-Based |

|

Component |

Scanners Processing Units Optics & Sensors Display Systems |

|

Range |

Long-Range Medium-Range Short-Range |

|

End-User |

Military & Defense Civil Aviation Maritime Security Border Security & Law Enforcement |

|

Region |

North America Europe Asia-Pacific Middle East & Africa Latin America |

Products

Key Target Audience

Military and Defense Organizations

Government and Regulatory Bodies (U.S. Department of Defense, NATO, European Defense Agency)

Infrared Sensor Manufacturers

Defense Contractors and Integrators

Research and Development Firms in Defense Technology

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Military Technology Innovators

Companies

Major Players Mentioned in the Report

Lockheed Martin Corporation

Northrop Grumman Corporation

Leonardo DRS

Saab AB

Thales Group

Rheinmetall AG

BAE Systems

Raytheon Technologies

Hensoldt AG

L3Harris Technologies

Textron Inc.

Safran Electronics & Defense

Aselsan A.S.

Mitsubishi Electric Corporation

FLIR Systems

Table of Contents

01 Global IRST Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

02 Global IRST Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones (e.g., product launches, tech advancements)

03 Global IRST Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Demand for Enhanced Surveillance Systems (military, defense)

3.1.2 Technological Advancements in Sensor Technology (long-range detection)

3.1.3 Rising Adoption of Stealth Aircraft and Naval Vessels

3.1.4 Expanding Defense Budgets Globally

3.2 Market Challenges

3.2.1 High Initial Investments and Maintenance Costs

3.2.2 Technological Integration Challenges with Existing Systems

3.2.3 Stringent Government Regulations on Defense Technology Export

3.3 Opportunities

3.3.1 Emerging Markets with Growing Defense Sectors

3.3.2 Development of AI-based IRST Systems (autonomous capabilities)

3.3.3 Expanding Use in Civil Aviation and Maritime Security

3.4 Trends

3.4.1 Miniaturization of IRST Systems for UAV Integration

3.4.2 Increased Collaboration between Defense Contractors and Tech Companies

3.4.3 Enhanced Performance through AI and Data Analytics Integration

3.5 Government Regulations (Defense Export Control, Procurement Policies, Military Standards)

3.5.1 National Defense Procurement Policies (country-specific)

3.5.2 Export Control and Licensing Regulations

3.5.3 Standards for Military Surveillance Systems (NATO, etc.)

3.5.4 Public-Private Partnerships in R&D (collaborations between governments and companies)

3.6 SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7 Stakeholder Ecosystem (Manufacturers, Suppliers, End-Users, R&D Bodies)

3.8 Porters Five Forces (Competitive Intensity, Threat of New Entrants, etc.)

3.9 Competition Ecosystem (Analysis of Key Competitors and Market Share)

04 Global IRST Market Segmentation

4.1 By Platform Type (In Value %)

4.1.1 Airborne Platforms (fighter jets, UAVs)

4.1.2 Naval Platforms (submarines, warships)

4.1.3 Ground-Based Platforms (vehicles, stationary units)

4.2 By Component (In Value %)

4.2.1 Scanners

4.2.2 Processing Units

4.2.3 Optics and Sensors

4.2.4 Display Systems

4.3 By Range (In Value %)

4.3.1 Long-Range Detection

4.3.2 Medium-Range Detection

4.3.3 Short-Range Detection

4.4 By End-User (In Value %)

4.4.1 Military and Defense

4.4.2 Civil Aviation

4.4.3 Maritime Security

4.4.4 Border Security and Law Enforcement

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Middle East & Africa

4.5.5 Latin America

05 Global IRST Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Lockheed Martin Corporation

5.1.2 Northrop Grumman Corporation

5.1.3 Leonardo DRS

5.1.4 Saab AB

5.1.5 Thales Group

5.1.6 Rheinmetall AG

5.1.7 BAE Systems

5.1.8 Raytheon Technologies

5.1.9 Hensoldt AG

5.1.10 L3Harris Technologies

5.1.11 Textron Inc.

5.1.12 Safran Electronics & Defense

5.1.13 Aselsan A.S.

5.1.14 Mitsubishi Electric Corporation

5.1.15 FLIR Systems

5.2 Cross Comparison Parameters (Market Share, Revenue, Key Contracts, Global Presence, No. of Employees, R&D Spend, Technological Capabilities, Recent Mergers/Acquisitions)

5.3 Market Share Analysis (based on platforms, components)

5.4 Strategic Initiatives (technology upgrades, partnerships, joint ventures)

5.5 Mergers and Acquisitions (notable deals, impact on market landscape)

5.6 Investment Analysis (funding rounds, defense budget allocations)

5.7 Government Contracts (procurement and supply contracts)

5.8 Private Equity and Venture Capital Funding (impact on new market entrants)

06 Global IRST Market Regulatory Framework

6.1 Defense Standards and Certifications (ISO certifications, military standards)

6.2 Export Controls and Compliance (Wassenaar Arrangement, ITAR regulations)

6.3 Procurement Laws and Bidding Processes (government contracts, defense tenders)

07 Global IRST Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

08 Global IRST Future Market Segmentation

8.1 By Platform Type (In Value %)

8.2 By Component (In Value %)

8.3 By Range (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

09 Global IRST Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Competitive Strategy Recommendations

9.3 White Space Opportunity Analysis (innovation potential)

9.4 Go-to-Market Strategies (regional and global perspectives)

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involves identifying the key variables influencing the IRST market, including defense spending, technological advancements, and the deployment of stealth aircraft. This process is supported by extensive desk research and data collection from secondary sources such as industry reports, government publications, and proprietary databases.

Step 2: Market Analysis and Construction

In this step, historical data on the IRST market is analyzed to understand platform penetration, revenue generation, and the adoption of IRST systems in different defense sectors. The analysis also considers the technological advancements driving market demand and the operational challenges faced by defense contractors.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through consultations with industry experts, including defense contractors, IRST manufacturers, and military organizations. These insights help refine the market analysis and ensure that the report provides accurate and actionable intelligence.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing the data collected from desk research and expert consultations to provide a comprehensive outlook on the IRST market. The report offers detailed insights into market trends, growth drivers, challenges, and future opportunities.

Frequently Asked Questions

01. How big is the Global IRST Market?

The global IRST market is currently valued at USD 6.8 billion, driven by rising military expenditures and advancements in infrared sensor technology.

02. What are the challenges in the Global IRST Market?

Challenges in the IRST market include high development costs, integration issues with existing military systems, and stringent export regulations for defense technologies.

03. Who are the major players in the Global IRST Market?

Major players in the IRST market include Lockheed Martin Corporation, Northrop Grumman Corporation, Leonardo DRS, Saab AB, and Thales Group. These companies lead the market due to their strong government contracts and technological innovations.

04. What are the growth drivers of the Global IRST Market?

The IRST market is driven by increasing military budgets, growing threats from stealth aircraft, and advancements in infrared sensor technology. The need for enhanced situational awareness in defense operations is also a significant factor.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.