Global Insect Protein Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD7116

November 2024

81

About the Report

Global Insect Protein Market Overview

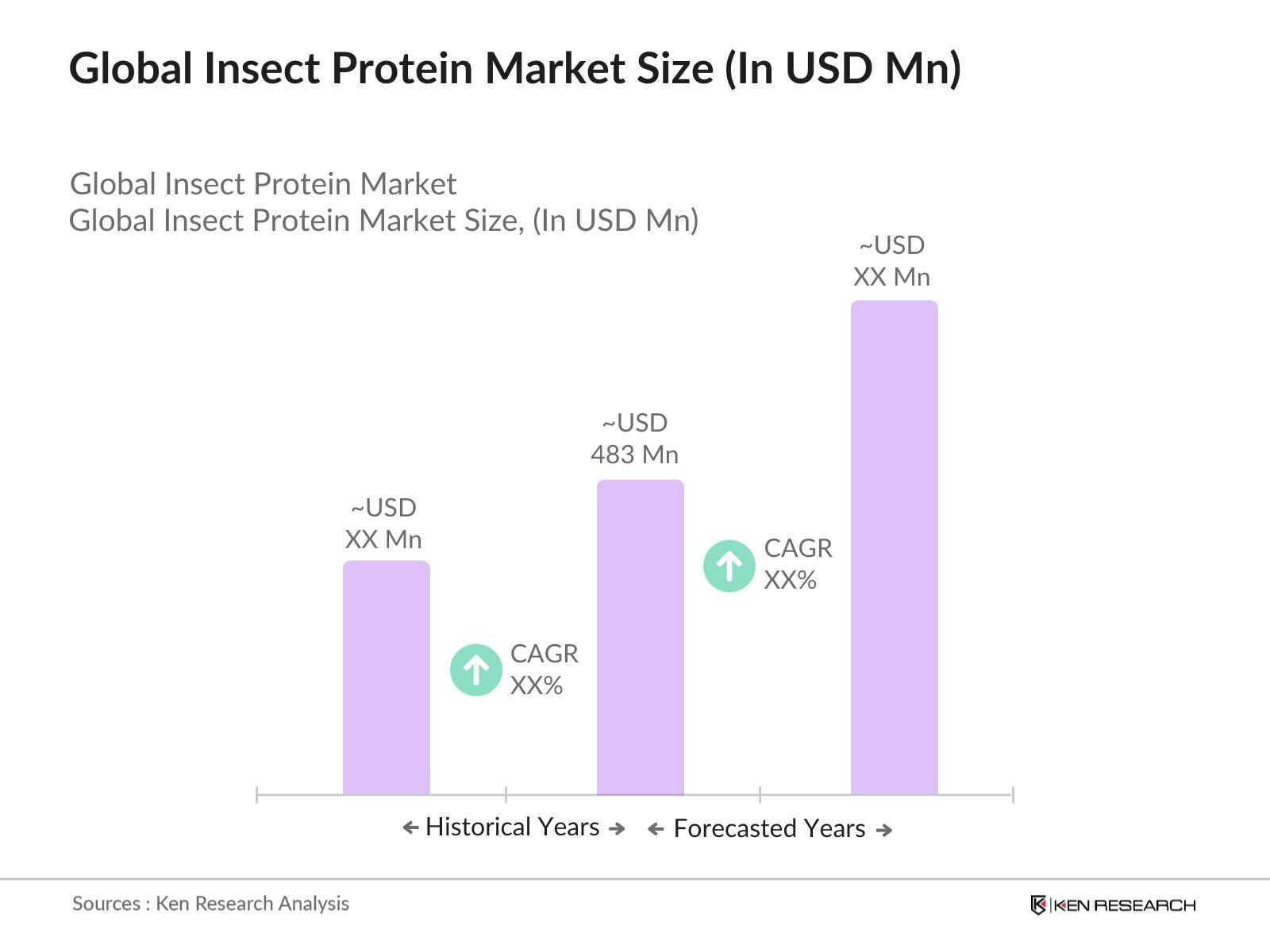

- The Global Insect Protein Market is currently valued at USD 483 million, driven by the increasing demand for alternative protein sources as the world seeks to find sustainable solutions to address food security challenges. This market has seen substantial growth in recent years due to insect protein's high nutritional value and significantly lower environmental impact compared to traditional livestock production. Additionally, consumers growing preference for health-conscious and eco-friendly food choices has further propelled this market's growth.

- Countries in Europe and North America are leading the global insect protein market due to strong government support, advanced regulations, and significant investments in insect farming technologies. In Europe, regulatory approvals for insects as food have created a supportive environment for market expansion. In North America, companies are adopting innovative approaches to incorporate insect protein into pet food, animal feed, and human food products, driving the region's dominance.

- Insect farming is gaining attention as part of broader waste reduction and circular economy initiatives. Countries like the Netherlands and Japan are promoting insect farming to recycle food waste into protein-rich animal feed. According to the United Nations Environment Programme (UNEP), insect farming can process up to 1.3 billion tons of global food waste annually, turning it into valuable protein. These initiatives are aligned with the global push toward sustainable agriculture and circular food systems.

Global Insect Protein Market Segmentation

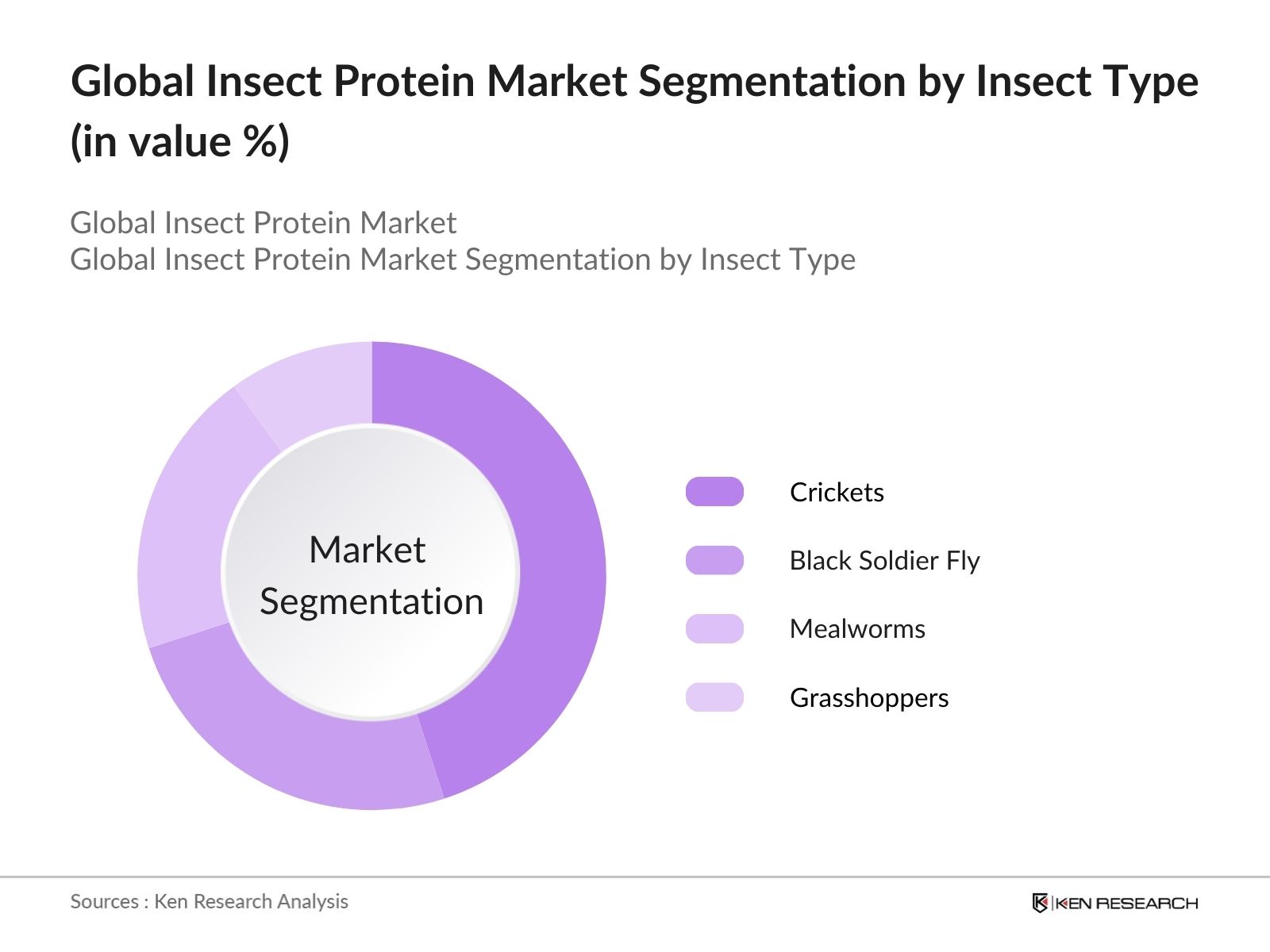

- By Insect Type: The Global Insect Protein Market is segmented by insect type into crickets, black soldier fly, mealworms, grasshoppers, and others. Crickets dominate this segment due to their established presence in various food products such as energy bars, snacks, and protein powders. Crickets offer a balanced nutritional profile with high protein content, making them a popular choice for human consumption. Companies like Entomo Farms have been at the forefront of cricket-based products, which are seeing growing consumer acceptance due to their sustainability benefits.

- By Region: The insect protein market is segmented geographically into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Europe dominates the global market due to favorable regulatory frameworks and the early adoption of insects in the food industry. The European Food Safety Authority (EFSA) has approved several insect species for human consumption, which has significantly boosted the demand in the region. Companies like Protix and Ynsect are investing heavily in scaling up production and expanding their product offerings across the continent.

- By Application: The market is also segmented by application into food and beverage, animal feed, nutraceuticals, cosmetics, and agriculture. The animal feed segment holds the largest market share due to the use of insect protein in aquaculture, poultry, and livestock feed. Black soldier fly larvae are particularly prominent in this segment, as they provide a sustainable and cost-effective source of protein that can replace fishmeal and soy in feed formulations. Increasing investments in insect farming for feed purposes have led to the growth of this segment.

Global Insect Protein Market Competitive Landscape

The Global Insect Protein Market is characterized by a mix of established players and startups that are shaping the future of sustainable protein production. Companies are focusing on technological advancements, scaling production capacities, and forming partnerships to strengthen their market presence. The industry is still fragmented, but consolidation is expected as larger players acquire smaller companies to gain market share.

|

Company |

Established |

Headquarters |

Production Capacity |

Certifications |

R&D Focus |

Partnerships |

Product Line |

Sales Channels |

|

nsect |

2011 |

France |

- |

- |

- |

- |

- |

- |

|

Protix |

2009 |

Netherlands |

- |

- |

- |

- |

- |

- |

|

Aspire Food Group |

2013 |

Canada |

- |

- |

- |

- |

- |

- |

|

AgriProtein |

2008 |

South Africa |

- |

- |

- |

- |

- |

- |

|

Entomo Farms |

2014 |

Canada |

- |

- |

- |

- |

- |

- |

Global Insect Protein Industry Analysis

Growth Drivers

- Rising Demand for Alternative Protein Sources: The global food industry is seeing a shift toward alternative proteins due to rising concerns about the environmental impact of traditional animal farming. Insect protein, rich in essential amino acids, has emerged as a viable solution. According to the Food and Agriculture Organization (FAO), insect farming emits fewer greenhouse gases than livestock, contributing to global sustainability goals. Additionally, the International Monetary Fund (IMF) has noted that food inflation pressures, exacerbated by geopolitical tensions in 2022, are driving the demand for alternative, cost-effective protein sources like insects.

- Increasing Food Security Concerns: Food security concerns have grown amid global population increases and climate change. The World Bank reports that over 820 million people faced food insecurity in 2023, and alternative proteins like insect-based products are part of the solution due to their low environmental impact and scalability. Insects can be farmed using minimal resources such as water and land, making them attractive in regions prone to food shortages. Governments have begun supporting such initiatives to strengthen food security and provide affordable, sustainable protein.

- Government Support and Incentives: Various governments have implemented policies promoting insect farming as a sustainable protein source. The European Food Safety Authority (EFSA) approved mealworms for human consumption in 2022, reflecting a broader trend of regulatory support. Countries like the Netherlands and France have introduced subsidies for insect farms, and the FAO has encouraged nations to include insect protein in national food security policies. Government-backed initiatives in Asia, particularly in Thailand and Vietnam, have further spurred the growth of insect farming by offering tax breaks and research grants.

Market Restraints

- Consumer Acceptance Issues: Despite the benefits, consumer acceptance of insect-based foods remains a challenge, particularly in Western markets. A 2023 report from the European Union's Special Eurobarometer survey highlighted that nearly 70% of EU citizens were reluctant to try insect-based food products. Cultural factors and the perceived ick factor are primary barriers to mainstream adoption. However, market penetration has been more successful in Asia and Africa, where insects have traditionally been part of the local diet.

- Regulatory Barriers (Country-Specific Food Regulations): Regulations governing the use of insects as food vary significantly across countries, hindering market expansion. While the European Union has approved certain insect species for human consumption, the U.S. Food and Drug Administration (FDA) only recently started recognizing insects as food ingredients. Differences in regulatory frameworks create challenges for companies looking to enter multiple markets. For instance, China has strict import restrictions on insect-based foods, complicating global market entry. This patchwork of regulations limits the ability of companies to scale production across borders.

Global Insect Protein Market Future Outlook

Over the next five years, the Global Insect Protein Market is expected to witness substantial growth driven by increased adoption of insect protein across various industries, including animal feed, food and beverages, and pharmaceuticals. Technological advancements in insect farming, including automation and improved breeding techniques, will lower production costs, making insect protein more accessible. Regulatory approval in new regions and growing consumer awareness of the environmental benefits of insect protein will further fuel market expansion.

Market Opportunities

- Expansion into Pet Food and Animal Feed Sectors: The insect protein market is expanding into the pet food and animal feed sectors. The World Bank estimates that global livestock production will increase by 12% by 2025, driving demand for alternative feed sources to reduce environmental impact. Insects like black soldier flies are being increasingly used in animal feed due to their high protein content and sustainability. This shift is supported by government incentives in regions like the European Union, where policies promote sustainable animal feed.

- Development of Novel Food Products: Insect protein is being incorporated into a variety of novel food products, from snack bars to protein powders. According to the FAO, insect protein has already been integrated into functional foods aimed at athletes and health-conscious consumers due to its high amino acid content. Startups in the U.S. and Europe are also developing insect-based energy bars, pasta, and even bread. With increasing consumer interest in sustainable, protein-rich products, these innovations are opening new avenues for growth in the food industry.

Scope of the Report

|

Insect Type |

Crickets Black Soldier Fly Mealworms Grasshoppers Others |

|

Application |

Food and Beverage Animal Feed Nutraceuticals Cosmetics Agriculture |

|

Form |

Whole Insects Insect Powder Insect Oil Paste |

|

End-User |

Human Consumption Livestock Poultry Aquaculture |

|

Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Food Manufacturers

Insect Farming Companies

Animal Feed Producers

Government and Regulatory Bodies (FDA, EFSA)

Pet Food Manufacturers

Nutraceutical Companies

Investor and Venture Capitalist Firms

Agricultural Corporations

Companies

Players Mentioned in the Report:

nsect

Protix

Aspire Food Group

AgriProtein

Entomo Farms

EnviroFlight

Hexafly

Innovafeed

Bugsolutely

Griopro

Jiminis

Cricket Flours

Thailand Unique

Bug Foundation

Exo Protein

Table of Contents

1. Global Insect Protein Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Insect Protein Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Insect Protein Market Analysis

3.1. Growth Drivers

3.1.1 Rising Demand for Alternative Protein Sources

3.1.2 Increasing Food Security Concerns

3.1.3 Government Support and Incentives

3.1.4 Nutritional Benefits of Insect Protein (Protein content %, sustainability metrics, etc.)

3.2. Market Challenges

3.2.1 Consumer Acceptance Issues

3.2.2 Regulatory Barriers (Country-Specific Food Regulations)

3.2.3 High Production Costs and Scaling Challenges

3.3. Opportunities

3.3.1 Expansion into Pet Food and Animal Feed Sectors

3.3.2 Development of Novel Food Products (Functional foods, snack bars, etc.)

3.3.3 Technological Advancements in Insect Farming and Processing

3.4. Trends

3.4.1 Growth in Vegan and Plant-based Food Consumption

3.4.2 Increasing Use of Insect Protein in Nutraceuticals and Supplements

3.4.3 Growing Focus on Sustainable Food Sources

3.5. Government Regulations

3.5.1. Approval of Insect Protein in Human Consumption (FDA, EFSA, etc.)

3.5.2. Subsidies and Incentives for Insect Farming

3.5.3. Waste Reduction and Circular Economy Initiatives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Producers, Retailers, Consumers, Regulatory Bodies)

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Global Insect Protein Market Segmentation

4.1. By Insect Type (In Value %)

4.1.1. Crickets

4.1.2. Black Soldier Fly

4.1.3. Mealworms

4.1.4. Grasshoppers

4.1.5. Others

4.2. By Application (In Value %)

4.2.1. Food and Beverage

4.2.2. Animal Feed

4.2.3. Nutraceuticals

4.2.4. Cosmetics

4.2.5. Agriculture

4.3. By Form (In Value %)

4.3.1. Whole Insects

4.3.2. Insect Powder

4.3.3. Insect Oil

4.3.4. Paste

4.4. By End-User (In Value %)

4.4.1. Human Consumption

4.4.2. Livestock

4.4.3. Poultry

4.4.4. Aquaculture

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Insect Protein Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. nsect

5.1.2. Protix

5.1.3. Aspire Food Group

5.1.4. AgriProtein

5.1.5. Entomo Farms

5.1.6. EnviroFlight

5.1.7. Hexafly

5.1.8. Bugsolutely

5.1.9. Bug Foundation

5.1.10. Exo Protein

5.1.11. Thailand Unique

5.1.12. Griopro

5.1.13. Innovafeed

5.1.14. Cricket Flours

5.1.15. Jiminis

5.2. Cross Comparison Parameters (Production Capacity, No. of Employees, Headquarters, Inception Year, Revenue, Certifications, Supply Chain, Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Insect Protein Market Regulatory Framework

6.1. Safety Standards for Human Consumption

6.2. Animal Feed Regulations

6.3. Labeling and Certification Requirements

6.4. International Trade Regulations

7. Global Insect Protein Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Insect Protein Future Market Segmentation

8.1. By Insect Type (In Value %)

8.2. By Application (In Value %)

8.3. By Form (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Global Insect Protein Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial step focuses on defining critical variables, such as production capacity, supply chain efficiency, and market drivers like sustainability and food security concerns. Secondary research from proprietary databases, industry reports, and governmental statistics supports this phase.

Step 2: Market Analysis and Construction

During this phase, historical data is analyzed, focusing on insect protein consumption across key regions and sectors. This helps establish a growth trajectory and highlight the major players dominating the market in terms of production and consumption.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, market hypotheses are validated through interviews with industry experts and insect protein producers. Their insights help refine projections and validate key trends identified in the desk research phase.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing data from all phases, ensuring accuracy and reliability through cross-verification with industry stakeholders and experts. The outcome is a detailed and validated report with actionable insights.

Frequently Asked Questions

1. How big is the Global Insect Protein Market?

The global insect protein market is valued at USD 483 million, driven by the rising demand for alternative protein sources, sustainability efforts, and government incentives.

2. What are the challenges in the Global Insect Protein Market?

Challenges include consumer acceptance of insect protein, high production costs, and the need for regulatory approvals in various regions, which hinder market penetration.

3. Who are the major players in the Global Insect Protein Market?

Major players include nsect, Protix, Aspire Food Group, AgriProtein, and Entomo Farms. These companies lead the market due to their established production capabilities and strong distribution networks.

4. What are the growth drivers of the Global Insect Protein Market?

Key growth drivers include the increasing awareness of sustainability, the nutritional benefits of insect protein, and regulatory support for using insects in human and animal feed.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.