Region:Global

Author(s):Geetanshi

Product Code:KRAA1165

Pages:92

Published On:August 2025

By Type:The insecticides market can be segmented into various types, including Synthetic Insecticides, Biological Insecticides, Insect Growth Regulators, Natural Insecticides, and Others. Among these, Synthetic Insecticides are the most widely used due to their effectiveness and rapid action against pests. However, there is a growing trend towards Biological Insecticides as consumers and farmers seek more environmentally friendly options. The demand for Insect Growth Regulators is also increasing as they offer a targeted approach to pest control, minimizing harm to beneficial insects .

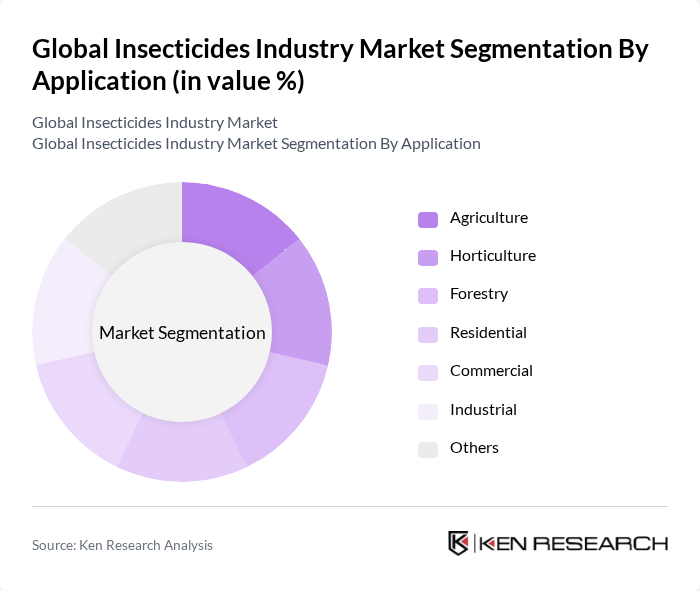

By Application:The applications of insecticides span across various sectors, including Agriculture, Horticulture, Forestry, Residential, Commercial, Industrial, and Others. Agriculture remains the dominant application area, driven by the need to protect crops from pests and diseases. Horticulture is also witnessing significant growth as consumers demand high-quality fruits and vegetables. The Residential and Commercial sectors are increasingly adopting insecticides for pest control, reflecting a growing awareness of hygiene and health .

The Global Insecticides Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayer AG, Syngenta AG, BASF SE, Corteva Agriscience, FMC Corporation, ADAMA Agricultural Solutions Ltd., Sumitomo Chemical Co., Ltd., UPL Limited, Nufarm Limited, Arysta LifeScience Corporation, Marrone Bio Innovations, Inc., Valent BioSciences LLC, Isagro S.p.A., Certis USA LLC, Biobest Group NV contribute to innovation, geographic expansion, and service delivery in this space.

The future of the insecticides market is poised for transformation, driven by technological advancements and a shift towards sustainable agricultural practices. As precision agriculture gains traction, the integration of data analytics and IoT technologies will enhance pest management efficiency. Furthermore, the increasing adoption of integrated pest management strategies will promote the use of biopesticides and organic solutions, aligning with consumer preferences for environmentally friendly products. This evolution will create a dynamic landscape for innovation and collaboration within the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Synthetic Insecticides Biological Insecticides Insect Growth Regulators Natural Insecticides Others |

| By Application | Agriculture Horticulture Forestry Residential Commercial Industrial Others |

| By End-User | Farmers Agricultural Cooperatives Government Agencies Pest Control Operators Others |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Distributors/Dealers Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Packaging Type | Bottles Pouches Bulk Containers Aerosol Cans Others |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Insecticide Usage | 120 | Farmers, Agronomists, Crop Consultants |

| Commercial Pest Control Services | 90 | Pest Control Operators, Service Managers |

| Horticultural Insecticide Applications | 60 | Horticulturists, Landscape Managers |

| Public Health Insecticide Programs | 50 | Public Health Officials, Environmental Health Specialists |

| Research and Development in Insecticides | 40 | R&D Managers, Entomologists, Regulatory Affairs Specialists |

The Global Insecticides Industry Market is valued at approximately USD 20 billion, driven by increasing food security demands, agricultural productivity, and pest control needs across various sectors. This market is expected to grow significantly due to advancements in technology and new formulations.