Global Insulin Delivery Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD2599

December 2024

99

About the Report

Global Insulin Delivery Market Overview

- The Global Insulin Delivery market is valued at USD 30 billion, based on a comprehensive five-year analysis. The market is primarily driven by the growing prevalence of diabetes, particularly Type 1 and Type 2 diabetes, as well as the increasing demand for advanced insulin delivery technologies. Additionally, the rise in the geriatric population, who are more susceptible to diabetes, is further pushing the demand for insulin delivery solutions. Significant investments in the development of smart insulin pens, wearable insulin pumps, and automated delivery systems are catalyzing market growth, offering enhanced convenience and precision for patients.

- North America and Europe dominate the Global Insulin Delivery market due to their well-established healthcare infrastructure, high diabetes prevalence rates, and the adoption of technologically advanced medical devices. Countries such as the United States and Germany lead the market due to substantial healthcare spending, strong presence of key insulin delivery manufacturers, and favorable reimbursement policies.

- The FDA has stringent guidelines for insulin delivery devices, particularly regarding safety and efficacy. In 2023, the FDA approved several advanced insulin pumps, but the average approval time remains 9-12 months. These regulations are critical for ensuring patient safety but can delay the introduction of new technologies. Manufacturers must navigate complex regulatory requirements, particularly for devices incorporating new technologies like AI, to bring products to the market.

Global Insulin Delivery Market Segmentation

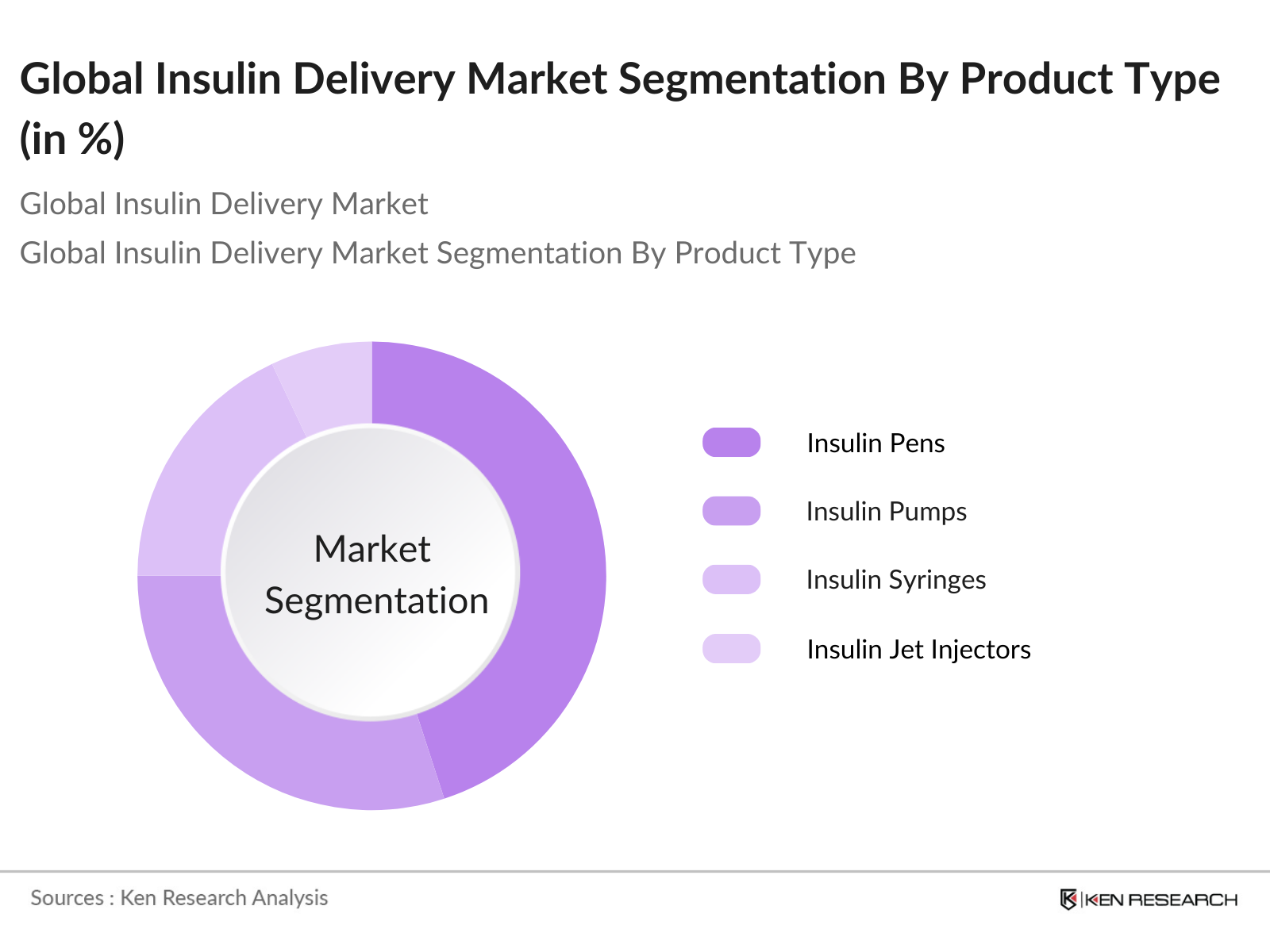

By Product Type: The market is segmented by product type into insulin pens, insulin pumps, insulin syringes, and insulin jet injectors. Among these, insulin pens hold the dominant market share due to their user-friendly design, precise dosage delivery, and rising consumer preference for convenient and painless administration methods.

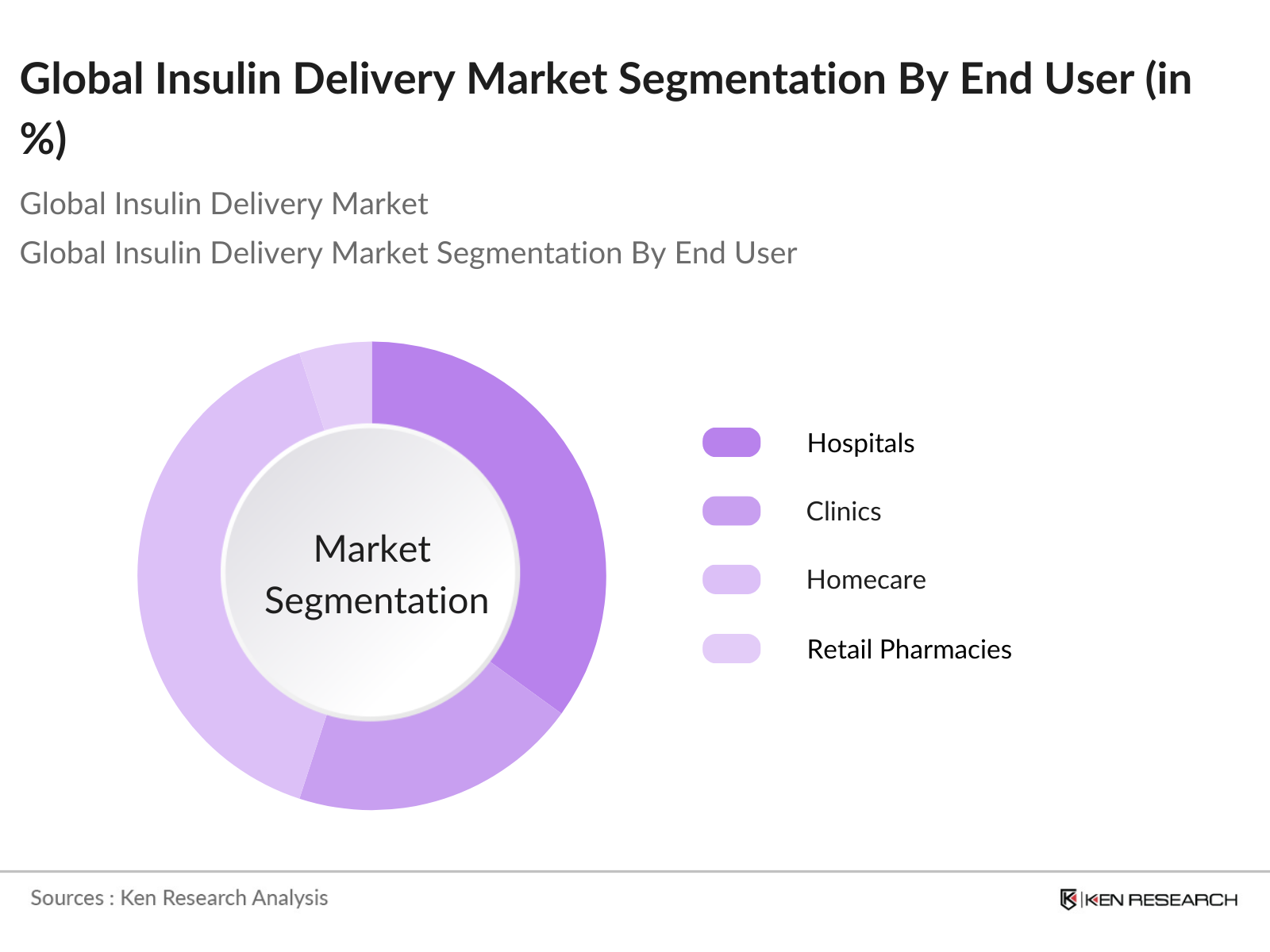

By End User: The market is also segmented by end users into hospitals, clinics, homecare, and retail pharmacies. Homecare dominates the market under this segmentation due to the increasing preference for self-administration of insulin, cost-effectiveness, and the availability of portable and easy-to-use devices.

Global Insulin Delivery Market Competitive Landscape

The Global Insulin Delivery market is characterized by intense competition among key players, each striving to improve device functionality, enhance patient compliance, and expand their global footprint. This consolidation highlights the significant influence of major companies that continually invest in R&D and form strategic partnerships to maintain their market position.

Global Insulin Delivery Market Analysis

Market Growth Drivers

- Increasing Prevalence of Diabetes (Prevalence Rate of Type 1 and Type 2 Diabetes): As of 2023, approximately 537 million adults aged 20 to 79 live with diabetes globally, with type 1 diabetes affecting nearly 8 million people. Additionally, type 2 diabetes accounts for over 90% of cases, particularly prevalent in middle-income countries. According to the International Diabetes Federation, diabetes cases are rising sharply due to factors such as lifestyle changes and rising obesity rates. The World Health Organization (WHO) projects the global burden of diabetes will double in the next two decades, making insulin delivery systems an urgent requirement in healthcare.

- Rising Geriatric Population (Aging Population Growth Rate): By 2024, there are over 771 million people aged 65 and above, with a significant proportion requiring insulin therapy due to age-related susceptibility to type 2 diabetes. The World Bank estimates that the global geriatric population is growing at a rate of 17.5 million per year. In developed countries, about 25% of the elderly population suffers from diabetes, necessitating effective insulin delivery solutions. The growing demand for insulin delivery systems aligns with the increasing aging population across Europe, North America, and parts of Asia.

- Technological Advancements (Painless Insulin Delivery, Smart Insulin Pens): Innovations in insulin delivery devices, such as smart insulin pens and painless delivery systems, have accelerated the adoption of these technologies. For instance, in 2023, the introduction of Bluetooth-enabled insulin pens allowed real-time glucose monitoring and dosage management. These devices are becoming essential in regions like the US and EU, where diabetes management requires patient-centered, data-driven solutions. The market demand is driven by patients seeking improved insulin delivery methods that offer ease of use and reduce the risk of hypoglycemia.

Global Insulin Delivery Market Challenges

- High Cost of Insulin and Delivery Devices (Cost Barrier Analysis): In the US, insulin costs have surged in recent years, with the average annual expenditure on insulin per patient surpassing USD 6,000 by 2023. This high cost presents a barrier to the widespread adoption of advanced insulin delivery devices in both developed and developing regions. Despite government efforts to cap insulin prices, cost remains a critical challenge, particularly in countries without robust healthcare subsidies. As of 2024, the cost disparity between insulin prices in high-income versus low-income countries continues to limit market penetration.

- Lack of Access in Low-Income Countries (Healthcare Accessibility Index): The global disparity in access to insulin delivery systems is stark, with less than 50% of people in low-income countries having access to essential diabetes treatments. According to the World Health Organization, regions like Sub-Saharan Africa and parts of South Asia face significant barriers due to inadequate healthcare infrastructure. As of 2024, low-income countries face a critical shortfall in insulin supply, leading to preventable deaths due to poor diabetes management.

Global Insulin Delivery Market Future Outlook

Over the next five years, the Global Insulin Delivery market is expected to witness significant growth driven by ongoing advancements in insulin delivery technologies, a growing diabetes population, and the increasing availability of wearable and automated devices. The market is set to experience rapid expansion in emerging economies, where rising awareness about diabetes management and government initiatives aimed at improving healthcare access are opening new opportunities. Additionally, the focus on personalized medicine and AI-driven smart insulin delivery systems is expected to revolutionize diabetes care.

Market Opportunities

- Development of Artificial Pancreas Systems (Emerging Technologies): The artificial pancreas system is a promising technology designed to automate insulin delivery and manage blood glucose levels. In 2024, clinical trials for closed-loop systems showed promising results, with over 5,000 patients worldwide benefiting from such systems in early adoption programs. These systems are increasingly used in managing type 1 diabetes, particularly in developed markets like the US and Europe. The market for artificial pancreas systems continues to grow, driven by advancements in AI and real-time glucose monitoring.

- Expansion into Emerging Markets (Market Penetration Strategies in APAC and LATAM): Emerging markets like India and Brazil present lucrative opportunities for insulin delivery device manufacturers. As of 2023, India had over 77 million diabetes patients, while Brazil accounted for 16 million. These large populations, combined with rising healthcare investments in the APAC and LATAM regions, offer significant growth potential for companies seeking to expand. Government initiatives, such as Indias Ayushman Bharat scheme, aim to improve healthcare accessibility, thus facilitating broader insulin delivery adoption.

Scope of the Report

|

Segment |

Sub-Segments |

|

By Product Type |

Insulin Pens |

|

By End User |

Hospitals |

|

By Distribution Channel |

Hospital Pharmacies |

|

By Insulin Type |

Rapid-Acting Insulin |

|

By Region |

North America |

Products

Key Target Audience

Pharmaceutical Companies

Medical Device Manufacturers

Hospitals and Clinics

Homecare Providers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., FDA, EMA)

Health Insurance Companies

Diabetes Care Centers

Companies

Players Mentioned in the Report

Novo Nordisk A/S

Sanofi S.A.

Eli Lilly and Company

Medtronic plc

Insulet Corporation

Ypsomed AG

Tandem Diabetes Care, Inc.

Becton, Dickinson and Company

Animas Corporation (Johnson & Johnson)

Roche Diabetes Care

Table of Contents

1. Global Insulin Delivery Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Insulin Delivery Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Insulin Delivery Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Prevalence of Diabetes (Prevalence Rate of Type 1 and Type 2 Diabetes)

3.1.2. Rising Geriatric Population (Aging Population Growth Rate)

3.1.3. Technological Advancements (Painless Insulin Delivery, Smart Insulin Pens)

3.1.4. Favorable Reimbursement Policies (Government Healthcare Subsidies)

3.2. Market Challenges

3.2.1. High Cost of Insulin and Delivery Devices (Cost Barrier Analysis)

3.2.2. Lack of Access in Low-Income Countries (Healthcare Accessibility Index)

3.2.3. Regulatory Hurdles for Product Approval (FDA and EMA Regulations)

3.3. Opportunities

3.3.1. Development of Artificial Pancreas Systems (Emerging Technologies)

3.3.2. Expansion into Emerging Markets (Market Penetration Strategies in APAC and LATAM)

3.3.3. Growing Adoption of Wearable Insulin Delivery Devices (Growth Rate of Wearable Technology)

3.4. Trends

3.4.1. Increasing Use of Smart Insulin Pens (IoT-Enabled Devices)

3.4.2. Shift Toward Closed-Loop Systems (Automated Insulin Delivery Systems)

3.4.3. Focus on Patient-Centric Solutions (Personalized Medicine in Diabetes Care)

3.5. Government Regulation

3.5.1. FDA Guidelines for Insulin Delivery Devices

3.5.2. CE Mark Regulations in Europe

3.5.3. Health Insurance Policies Across Regions

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Pharmaceutical Companies, Medical Device Manufacturers, Hospitals, and Clinics)

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. Global Insulin Delivery Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Insulin Pens

4.1.2. Insulin Pumps

4.1.3. Insulin Syringes

4.1.4. Insulin Jet Injectors

4.2. By End User (In Value %)

4.2.1. Hospitals

4.2.2. Clinics

4.2.3. Homecare

4.2.4. Retail Pharmacies

4.3. By Distribution Channel (In Value %)

4.3.1. Hospital Pharmacies

4.3.2. Retail Pharmacies

4.3.3. Online Pharmacies

4.4. By Insulin Type (In Value %)

4.4.1. Rapid-Acting Insulin

4.4.2. Short-Acting Insulin

4.4.3. Intermediate-Acting Insulin

4.4.4. Long-Acting Insulin

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Insulin Delivery Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Novo Nordisk A/S

5.1.2. Sanofi S.A.

5.1.3. Eli Lilly and Company

5.1.4. Medtronic plc

5.1.5. Insulet Corporation

5.1.6. Ypsomed AG

5.1.7. Tandem Diabetes Care, Inc.

5.1.8. Becton, Dickinson and Company

5.1.9. Animas Corporation (Johnson & Johnson)

5.1.10. Roche Diabetes Care

5.1.11. Biocon Ltd.

5.1.12. Wockhardt Limited

5.1.13. MannKind Corporation

5.1.14. Beta Bionics

5.1.15. Senseonics Holdings, Inc.

5.2. Cross Comparison Parameters (Revenue, Headquarters, Product Portfolio, Insulin Delivery Product Innovation, Global Market Share, R&D Investment, Key Partnerships, Manufacturing Facilities)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Insulin Delivery Market Regulatory Framework

6.1. FDA Approval Processes

6.2. Compliance Requirements in Key Regions (US, Europe, APAC)

6.3. CE Mark Certification for Insulin Devices

7. Global Insulin Delivery Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Insulin Delivery Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By End User (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Insulin Type (In Value %)

8.5. By Region (In Value %)

9. Global Insulin Delivery Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first phase focuses on creating a detailed ecosystem map of stakeholders within the Global Insulin Delivery market. Comprehensive desk research is conducted using both secondary and proprietary databases to gather essential industry information. Key variables, including product type, market drivers, and regional analysis, are identified to understand market dynamics.

Step 2: Market Analysis and Construction

This step involves compiling historical data on insulin delivery devices, analyzing sales volumes, and evaluating revenue streams. A comparative analysis of device adoption rates across various regions is conducted, providing insight into market penetration. Additionally, service quality metrics are evaluated to ensure the accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses about market trends and growth patterns are validated through expert consultations with industry leaders. These insights are collected through structured interviews and online surveys, offering a deeper understanding of market operations and potential growth areas.

Step 4: Research Synthesis and Final Output

In the final phase, direct engagement with insulin delivery device manufacturers is conducted to validate statistical models and market forecasts. This bottom-up approach ensures that the report provides a comprehensive and accurate analysis of the global insulin delivery market.

Frequently Asked Questions

01. How big is the Global Insulin Delivery Market?

The Global Insulin Delivery market, valued at USD 30 billion, is driven by the increasing global prevalence of diabetes and advancements in insulin delivery technologies, such as smart insulin pens and wearable pumps.

02. What are the challenges in the Global Insulin Delivery Market?

The challenges include the high cost of insulin and insulin delivery devices, limited access in low-income countries, and stringent regulatory requirements for product approval and safety compliance.

03. Who are the major players in the Global Insulin Delivery Market?

Key players in the Global Insulin Delivery market include Novo Nordisk A/S, Sanofi S.A., Eli Lilly and Company, Medtronic plc, and Insulet Corporation. These companies dominate due to their large-scale production capabilities, R&D investments, and strategic partnerships.

04. What are the growth drivers of the Global Insulin Delivery Market?

The Global Insulin Delivery market is primarily driven by the rising global prevalence of diabetes, technological advancements in insulin delivery systems, and increasing healthcare expenditure across developed and emerging markets.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.