Region:Global

Author(s):Rebecca

Product Code:KRAA2191

Pages:95

Published On:August 2025

By Type:The market is segmented into various types of services that cater to the diverse needs of insurance companies. The subsegments include Claims Processing, Policy Administration, Customer Service, Underwriting Support, Risk Management Services, Compliance Services, Finance and Accounting Services, Asset Management Services, Data Entry and Document Management, Marketing Support, and Others. Among these, Claims Processing is the most dominant segment due to the increasing volume of claims and the need for efficient processing to enhance customer satisfaction. Claims Processing accounted for over 30% of total revenue in the latest market analysis, reflecting its critical role in insurance operations .

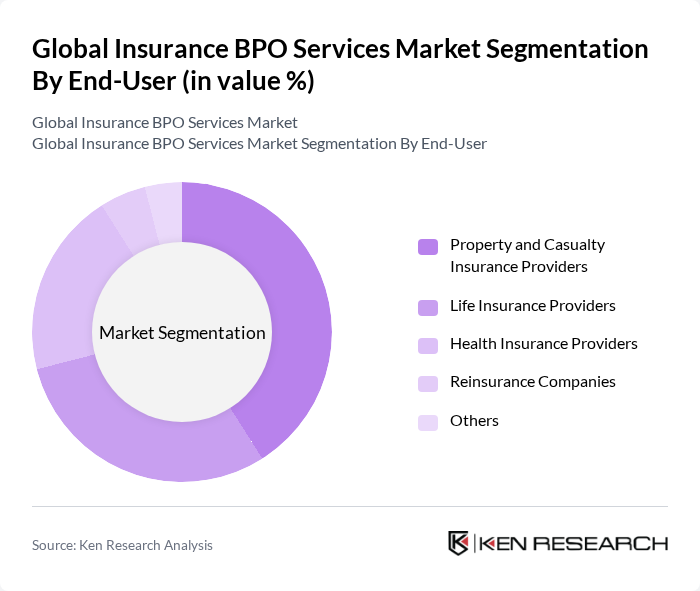

By End-User:The market is segmented based on the end-users, which include Life Insurance Providers, Health Insurance Providers, Property and Casualty Insurance Providers, Reinsurance Companies, and Others. The Property and Casualty Insurance Providers segment currently holds the largest market share, driven by rising demand for digital claims management and automation in policy administration. Life Insurance Providers and Health Insurance Providers also represent significant segments, reflecting the broad adoption of BPO services across insurance types .

The Global Insurance BPO Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Accenture, Cognizant, Genpact, Infosys BPM, Wipro, Tata Consultancy Services (TCS), EXL Service, Capgemini, HCL Technologies, Sitel Group, Teleperformance, Concentrix, Alorica, Sykes Enterprises, Aon plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the insurance BPO services market is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As companies increasingly adopt digital solutions, the demand for BPO services that integrate AI and automation will rise. Additionally, the focus on customer-centric services will lead to innovative offerings that enhance user experience. Strategic partnerships between insurers and BPO providers will also play a crucial role in navigating regulatory challenges and expanding service capabilities, ensuring sustained growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Claims Processing Policy Administration Customer Service Underwriting Support Risk Management Services Compliance Services Finance and Accounting Services Asset Management Services Data Entry and Document Management Marketing Support Others |

| By End-User | Life Insurance Providers Health Insurance Providers Property and Casualty Insurance Providers Reinsurance Companies Others |

| By Service Model | Onshore BPO Services Offshore BPO Services Nearshore BPO Services Hybrid BPO Services |

| By Delivery Channel | Direct Sales Online Platforms Third-Party Distributors Others |

| By Geographic Focus | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Client Size | Large Enterprises Small and Medium Enterprises (SMEs) |

| By Pricing Model | Fixed Pricing Time and Material Pricing Performance-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Claims Processing Services | 60 | Claims Managers, Operations Directors |

| Policy Administration Outsourcing | 45 | Policy Administrators, IT Managers |

| Customer Service BPO in Insurance | 50 | Customer Service Managers, Call Center Supervisors |

| Fraud Detection Services | 40 | Fraud Analysts, Risk Management Officers |

| Regulatory Compliance Outsourcing | 42 | Compliance Officers, Legal Advisors |

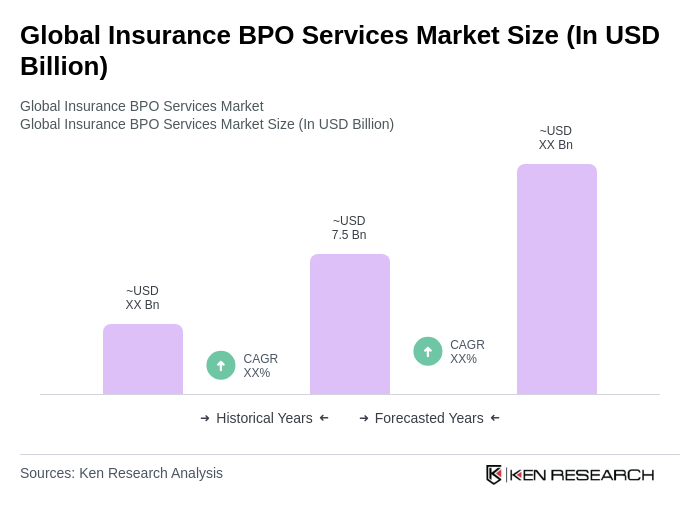

The Global Insurance BPO Services Market is valued at approximately USD 7.5 billion, driven by the demand for cost-effective solutions and enhanced operational efficiency in the insurance sector.