Global Insurance Market Outlook to 2029

Region:Global

Author(s):Dev

Product Code:KROD-059

June 2025

90

About the Report

Global Insurance Market Overview

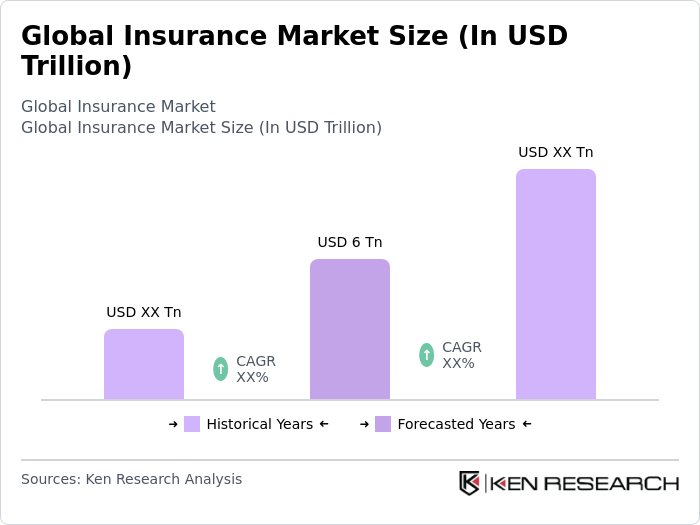

- The Global Insurance Market is valued at USD 6 trillion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer awareness, technological advancements, and the rising demand for insurance products across various sectors, including health, life, and property. The market has seen a significant uptick in digital insurance solutions, which cater to the evolving needs of consumers and businesses alike.

- Key players in this market include the United States, China, and Germany, which dominate due to their robust economies, advanced regulatory frameworks, and high levels of insurance penetration. The presence of major insurance companies and a growing middle class in these regions further contribute to their market leadership, as they offer a wide range of insurance products tailored to diverse consumer needs.

- In 2025, the European Union implemented the Insurance Recovery and Resolution Directive (IRRD), which establishes a harmonized framework for managing failing insurers. It mandates recovery plans, empowers resolution authorities, enhances cross-border cooperation, and protects policyholders while minimizing economic impact and taxpayer costs.

Global Insurance Market Segmentation

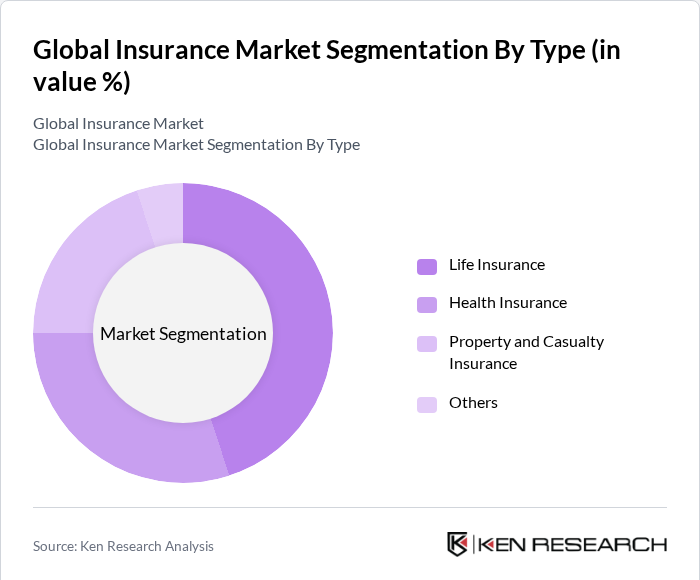

By Type: The insurance market is primarily segmented into life insurance, health insurance, property and casualty insurance, and others. Among these, life insurance is the dominant segment, driven by increasing awareness of financial planning and the need for long-term savings among consumers. The growing aging population and rising disposable incomes have led to a surge in demand for life insurance products, as individuals seek to secure their financial future and provide for their families. Additionally, the integration of technology in policy management and claims processing has made life insurance more accessible and appealing to a broader audience.

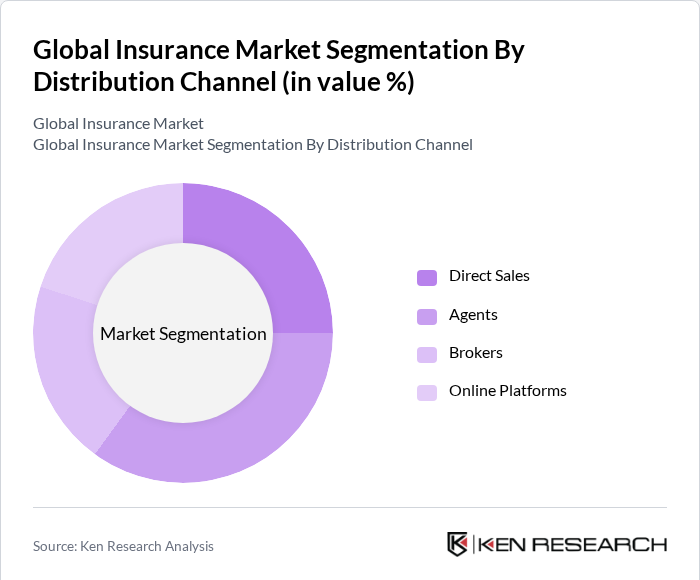

By Distribution Channel: The distribution channels for insurance products include direct sales, agents, brokers, and online platforms. Agents continue to dominate the distribution landscape for insurance products, serving as the most trusted and widely utilized channel, especially for complex and high-value policies. Their ability to offer personalized consultation, build long-term relationships, and provide guidance through intricate insurance terms makes them indispensable to both first-time buyers and experienced policyholders.

Global Insurance Market Competitive Landscape

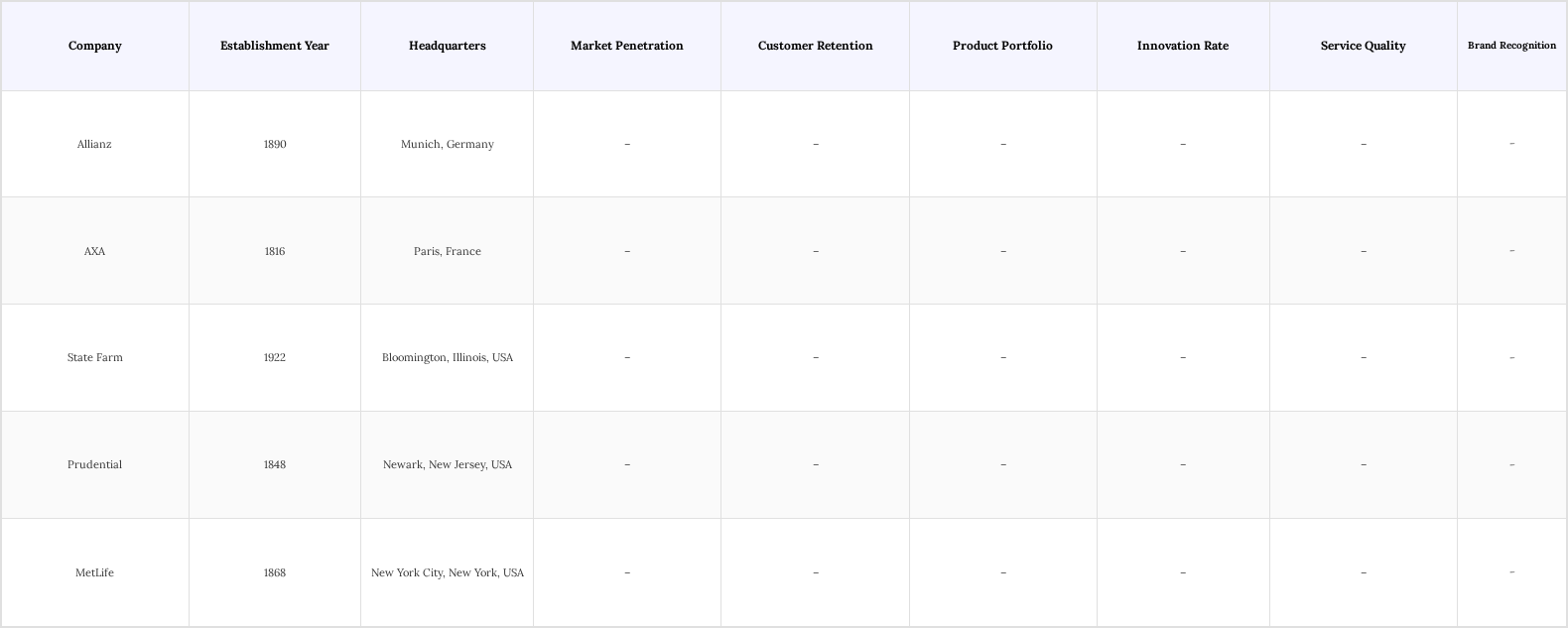

The Global Insurance Market is characterized by intense competition among established players and emerging insurtech companies. Major companies such as Allianz, AXA, and State Farm dominate the landscape, leveraging their extensive distribution networks and diverse product offerings. The market is witnessing a trend towards digital transformation, with companies investing in technology to enhance customer experience and streamline operations.

Global Insurance Market Industry Analysis

Growth Drivers

- Increasing Consumer Awareness of Insurance Products: Rising consumer awareness, fueled by educational initiatives and digital marketing, is driving significant growth in the global insurance market. In 2024, the industry experienced an 8.6% premium growth, reaching a total of USD 7.0 trillion in premiums worldwide. This growth reflects a broader understanding of risk management and financial security, especially in emerging markets, where insurance penetration continues to expand, creating substantial opportunities for insurers to increase policy uptake.

- Technological Advancements in Insurance Services: In 2024, global InsurTech investments totaled approximately $4.2 billion, reflecting a more cautious funding environment compared to previous years but highlighting continued innovation, especially in health insurance which saw a 35% funding increase. Technologies like AI and big data analytics are enhancing personalized product offerings, streamlining claims processing, and improving risk assessment. Despite lower overall funding, early-stage startups and AI-focused companies are attracting significant investment, driving operational efficiency and expanding customer engagement.

- Rising Demand for Customized Insurance Solutions: In 2025, insurers are increasingly offering personalized products such as usage-based and parametric insurance to meet diverse consumer needs. Technologies like AI, IoT, and telematics enable real-time data collection, allowing tailored coverage based on individual behaviors and risk profiles. This shift enhances customer satisfaction and loyalty by providing flexible, transparent policies that align with lifestyles and budgets, while also opening new market segments and improving risk assessment accuracy.

Market Challenges

- Regulatory Compliance and Legal Issues: The insurance industry faces persistent challenges in navigating regulatory compliance and legal complexities. As regulations continue to evolve across jurisdictions, insurers are under constant pressure to align their operations with updated legal standards. This not only strains internal compliance systems but also reduces operational flexibility. Failing to meet regulatory expectations can result in reputational damage and financial penalties, ultimately affecting competitiveness and long-term sustainability in the market.

- Intense Competition Among Insurers: The insurance sector is marked by intense competition, with numerous players competing aggressively for customer attention and market share. This highly saturated environment often leads to pricing pressures and reduced margins. To stay relevant and profitable, insurers must focus on product innovation, customer-centric strategies, and digital transformation. Differentiation through superior service, tailored offerings, and brand trust becomes essential for gaining and retaining clients in a crowded marketplace.

Global Insurance Market Future Outlook

The future of the insurance market appears promising, driven by technological advancements and evolving consumer preferences. Insurers are increasingly adopting digital platforms to enhance customer engagement and streamline operations. Additionally, the focus on sustainability is expected to shape product offerings, with a rise in demand for eco-friendly insurance solutions. As emerging markets continue to develop, opportunities for expansion and innovation will likely drive growth, positioning the insurance sector for a robust future.

Market Opportunities

- Expansion into Emerging Markets: Emerging markets present substantial growth potential, with an estimated over 1 billion individuals currently uninsured. By 2024, insurance penetration in these regions is projected to increase by around 16%, driven by rising incomes, urbanization, and expanding middle classes. Insurers are focusing on developing affordable, accessible products tailored to local needs, supported by growing financial literacy and digital distribution channels.

- Growth of InsurTech Innovations: In 2024, InsurTech investments stabilized around $4.2 billion, reflecting a shift toward profitability and innovation rather than rapid funding growth. Technologies like AI, big data analytics, and blockchain are transforming insurance by enabling faster claims processing, personalized product offerings, and improved risk assessment.

Scope of the Report

| By Product Type |

Life Insurance Health Insurance Property and Casualty Insurance Others |

| By Distribution Channel |

Direct Sales Agents Brokers Online Platforms |

| By Customer Type |

Individual Customers Corporate Customers |

| By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Coverage Type |

Comprehensive Coverage Third-Party Coverage Limited Coverage |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Financial Services Authority, Insurance Regulatory and Development Authority)

Insurance Brokers and Agents

Reinsurers

Insurance Technology (InsurTech) Startups

Claims Management Companies

Underwriters

Actuarial Firms

Companies

Players Mentioned in the Report:

Allianz

AXA

State Farm

Prudential

MetLife

InsureTech Global

SecureLife Insurance

Horizon Coverage Solutions

Apex Risk Management

Unity Assurance Group

Table of Contents

1. Global Insurance Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Insurance Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Insurance Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Consumer Awareness of Insurance Products

3.1.2. Technological Advancements in Insurance Services

3.1.3. Rising Demand for Customized Insurance Solutions

3.2. Market Challenges

3.2.1. Regulatory Compliance and Legal Issues

3.2.2. Intense Competition Among Insurers

3.2.3. Economic Uncertainties Affecting Consumer Spending

3.3. Opportunities

3.3.1. Expansion into Emerging Markets

3.3.2. Growth of InsurTech Innovations

3.3.3. Increasing Demand for Sustainable Insurance Products

3.4. Trends

3.4.1. Shift Towards Digital Insurance Platforms

3.4.2. Growing Popularity of Usage-Based Insurance Models

3.4.3. Enhanced Focus on Customer Experience and Engagement

3.5. Government Regulation

3.5.1. Overview of Regulatory Bodies in the Global Insurance Market

3.5.2. Impact of Regulations on Market Operations

3.5.3. Compliance Challenges Faced by Insurers

3.5.4. Future Regulatory Trends and Implications

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Global Insurance Market Segmentation

4.1. By Product Type

4.1.1. Life Insurance

4.1.2. Health Insurance

4.1.3. Property and Casualty Insurance

4.1.4. Others

4.2. By Distribution Channel

4.2.1. Direct Sales

4.2.2. Agents

4.2.3. Brokers

4.2.4. Online Platforms

4.3. By Customer Type

4.3.1. Individual Customers

4.3.2. Corporate Customers

4.4. By Region

4.4.1. North America

4.4.2. Europe

4.4.3. Asia-Pacific

4.4.4. Latin America

4.4.5. Middle East & Africa

4.5. By Coverage Type

4.5.1. Comprehensive Coverage

4.5.2. Third-Party Coverage

4.5.3. Limited Coverage

5. Global Insurance Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Allianz

5.1.2. AXA

5.1.3. State Farm

5.1.4. Prudential

5.1.5. MetLife

5.1.6. InsureTech Global

5.1.7. SecureLife Insurance

5.1.8. Horizon Coverage Solutions

5.1.9. Apex Risk Management

5.1.10. Unity Assurance Group

5.2. Cross Comparison Parameters

5.2.1. Market Share by Company

5.2.2. Revenue Growth Rate

5.2.3. Customer Satisfaction Ratings

5.2.4. Product Diversification Index

5.2.5. Digital Transformation Score

5.2.6. Claims Settlement Ratio

5.2.7. Average Policy Premiums

5.2.8. Brand Recognition and Reputation

6. Global Insurance Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Insurance Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Insurance Market Future Market Segmentation

8.1. By Product Type

8.1.1. Life Insurance

8.1.2. Health Insurance

8.1.3. Property and Casualty Insurance

8.1.4. Others

8.2. By Distribution Channel

8.2.1. Direct Sales

8.2.2. Agents

8.2.3. Brokers

8.2.4. Online Platforms

8.3. By Customer Type

8.3.1. Individual Customers

8.3.2. Corporate Customers

8.4. By Region

8.4.1. North America

8.4.2. Europe

8.4.3. Asia-Pacific

8.4.4. Latin America

8.4.5. Middle East & Africa

8.5. By Coverage Type

8.5.1. Comprehensive Coverage

8.5.2. Third-Party Coverage

8.5.3. Limited Coverage

9. Global Insurance Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Global Insurance Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Global Insurance Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Global Insurance Market.

Frequently Asked Questions

01. How big is the Global Insurance Market?

The Global Insurance Market is valued at USD 6 trillion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Global Insurance Market?

Key challenges in the Global Insurance Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Global Insurance Market?

Major players in the Global Insurance Market include Allianz, AXA, State Farm, Prudential, MetLife, among others.

04. What are the growth drivers for the Global Insurance Market?

The primary growth drivers for the Global Insurance Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.