Global Insurtech Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD7143

November 2024

97

About the Report

Global Insurtech Market Overview

- The Global Insurtech Market is valued at USD 5.72 billion, based on a five-year historical analysis. This market has grown rapidly due to increasing digitization in the insurance industry, driven by customer demand for personalized insurance products and enhanced user experiences. The proliferation of technologies such as artificial intelligence, machine learning, blockchain, and cloud computing has further contributed to this expansion, enabling insurance companies to automate claims processing and underwriting, leading to significant operational efficiencies.

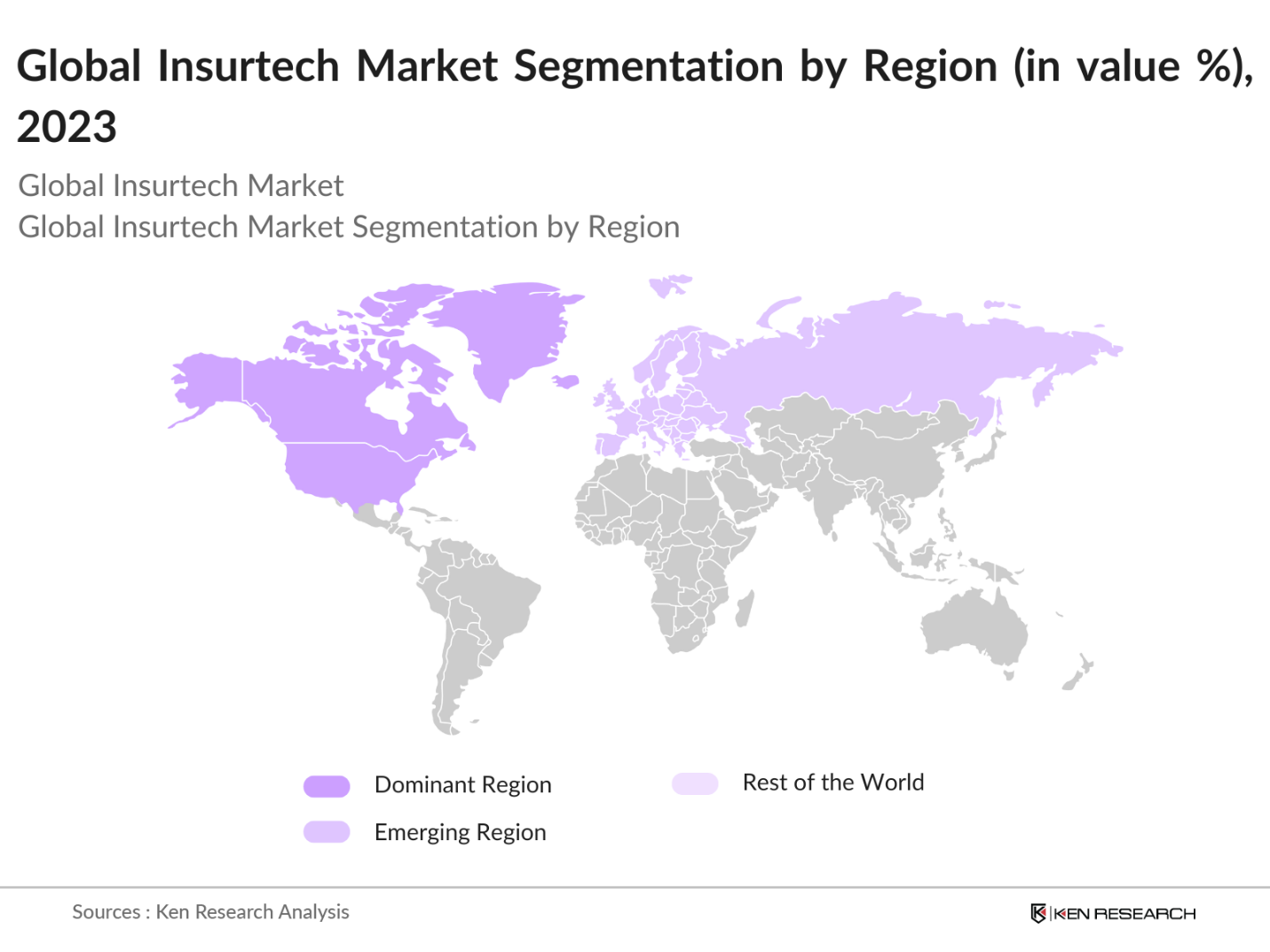

- Countries like the United States, the United Kingdom, and China dominate the Insurtech market. In the U.S. and U.K., this dominance is attributed to the presence of well-established insurance markets, mature regulatory frameworks that encourage technological innovation, and significant venture capital investments in insurtech startups. Meanwhile, China leads due to its rapid digital transformation and the extensive integration of mobile platforms for insurance services, driven by the high penetration of mobile internet and fintech innovations.

- Regulatory sandboxes have become essential for fostering innovation in the insurtech sector. As of 2023, over 70 regulatory sandboxes were in operation globally, with notable programs in markets like the U.K., Singapore, and the UAE. These sandboxes allow startups to test innovative products under relaxed regulations while ensuring consumer protection. The IMF notes that over 200 insurtech firms have participated in these sandboxes, leading to increased regulatory clarity and a smoother path to market for new insurance technologies.

Global Insurtech Market Segmentation

By Region: The market is geographically segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America dominates the Insurtech market due to its mature insurance industry, strong regulatory support for digital transformation, and a high number of Insurtech startups. The region's leadership is supported by continuous innovation in customer-centric insurance models and the high adoption rate of technologies like AI and cloud computing.

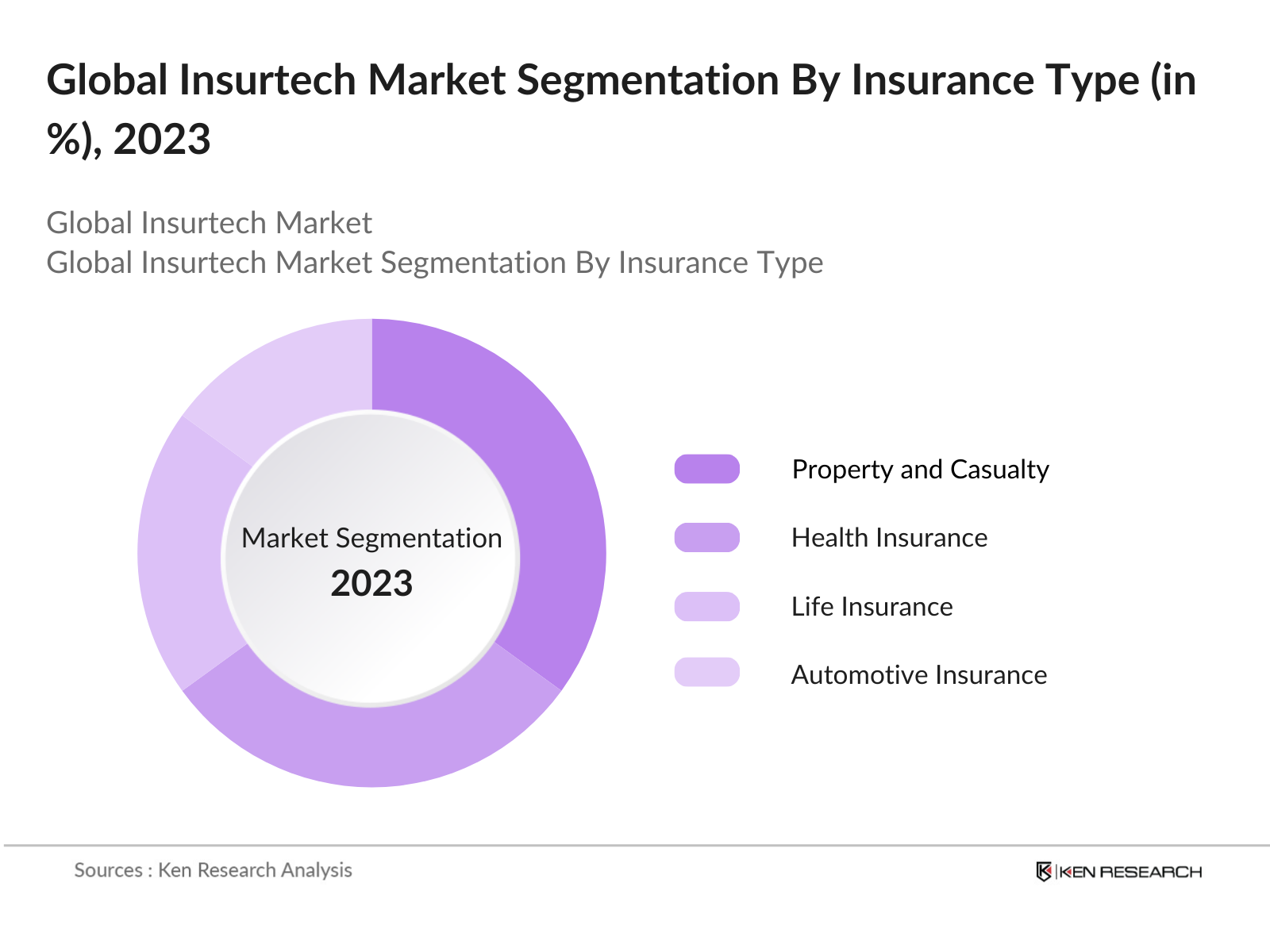

By Insurance Type: The Global Insurtech market is segmented by insurance type into life insurance, health insurance, property and casualty insurance, automotive insurance, and reinsurance. Property and casualty insurance hold the dominant market share under this segmentation, largely due to the increasing demand for digital platforms that streamline the claims process. Major insurance companies are leveraging Insurtech solutions to offer faster claim settlements, better customer experiences, and more efficient risk management systems, especially in regions prone to natural disasters and high-risk industries.

Global Insurtech Market Competitive Landscape

The Global Insurtech Market is dominated by both emerging startups and established insurance companies incorporating digital transformation strategies. Insurtech companies like Lemonade and Metromile are driving innovation in the industry through digital-first models, while traditional players such as Allianz and AXA are embracing Insurtech to enhance customer engagement and streamline operations.

|

Company Name |

Establishment Year |

Headquarters |

Technology Focus |

Valuation |

Geographic Presence |

Customer Base |

Revenue |

Key Partners |

|

Lemonade |

2015 |

New York, USA |

_ |

_ |

_ |

_ |

_ |

_ |

|

Metromile |

2011 |

San Francisco, USA |

_ |

_ |

_ |

_ |

_ |

_ |

|

ZhongAn Online P&C |

2013 |

Shanghai, China |

_ |

_ |

_ |

_ |

_ |

_ |

|

Clover Health |

2013 |

New Jersey, USA |

_ |

_ |

_ |

_ |

_ |

_ |

|

PolicyBazaar |

2008 |

Gurgaon, India |

_ |

_ |

_ |

_ |

_ |

_ |

Global Insurtech Industry Analysis

Growth Drivers

- Increasing Digitization of Financial Services: The rising digitization of financial services, including AI and blockchain, is propelling the insurtech market. AI applications, like predictive analytics and chatbots, have revolutionized customer service and claims processing. As of 2023, global spending on AI in financial services is expected to exceed $135 billion, showing significant traction in insurtech. Blockchain, too, is playing a crucial role by ensuring transparency and security in policy management. According to the World Bank, over 75% of insurers in developed countries are adopting some form of AI to streamline operations.

- Regulatory Support for Fintech Adoption: Governments are providing regulatory support to facilitate fintech growth, indirectly benefiting the insurtech market. Regulatory sandboxes established in over 50 countries, including the U.S., U.K., and Singapore, offer a controlled environment for insurtech startups to innovate. According to the International Monetary Fund (IMF), fintech regulations in key markets such as the U.S. and EU have enabled over 2,000 insurtech firms to operate under regulatory sandbox regimes, ensuring consumer protection while driving innovation. These regulatory frameworks support global fintech adoption, leading to a stronger insurtech ecosystem.

- Surge in Usage of Mobile Insurance Platforms: Mobile platforms have become a key driver of insurtech adoption, with over 60% of insurance transactions conducted via mobile apps as of 2023. In emerging markets such as India and China, the penetration of mobile insurance is increasing due to higher smartphone usage. According to the World Bank, smartphone penetration in India reached 75% in 2022, which has boosted the adoption of mobile-based insurance products in both urban and rural areas, revolutionizing customer engagement and product personalization in the insurtech space.

Market Challenges

- Data Privacy and Security Concerns: The increasing digitization of insurance services has also raised concerns over data privacy and security. A significant rise in cyberattacks targeting financial institutions, including insurers, has been reported in recent years. In 2023, financial institutions were subject to over 2,500 reported cyberattacks globally, impacting operations across all digital insurance platforms. The European Union's General Data Protection Regulation (GDPR) imposes stringent requirements on insurtech companies, with penalties exceeding 200 million for non-compliance in 2023 alone.

- Integration of Legacy Systems: One of the biggest challenges faced by traditional insurers and insurtech companies is integrating modern digital solutions with legacy systems. According to the IMF, over 70% of insurers still operate on legacy systems, making it difficult to incorporate advanced technologies like AI and blockchain. The need to overhaul these systems to integrate new digital solutions can delay innovation, costing insurance companies approximately $1 billion annually in operational inefficiencies across major markets like the U.S. and the U.K.

Global Insurtech Market Future Outlook

Over the next five years, the Global Insurtech Market is expected to grow significantly due to increasing demand for digital insurance products, the rise of smart contracts via blockchain technology, and AI-powered claims processing systems. Insurtechs role in reshaping the insurance industry will be driven by advancements in IoT for real-time monitoring of risks, allowing insurers to offer personalized premiums and better customer experiences.

Opportunities

- AI and Machine Learning for Fraud Detection: The integration of AI and machine learning into fraud detection offers significant opportunities in the insurtech market. Insurers reported over $80 billion in fraud claims annually as of 2023, with machine learning algorithms helping reduce detection time by 50%. In 2024, the IMF highlighted the use of AI in fraud detection as a major growth area for insurers, helping save millions in fraudulent claims. This technology-driven approach is enabling faster, more accurate detection and prevention of fraudulent activities.

- Growth in Emerging Markets: Emerging markets like Asia-Pacific (APAC) and Latin America (LATAM) present vast opportunities for insurtech growth. With insurance penetration below 10% in many LATAM countries, according to the World Bank, these regions offer untapped potential. In APAC, insurance adoption is rising rapidly, with Indias insurance sector alone growing to include over 1.5 billion policies by 2023. These emerging economies are increasingly adopting digital solutions to overcome gaps in traditional insurance infrastructure, creating an expanding market for insurtech solutions.

Scope of the Report

|

Insurance Type |

Life Insurance Health Insurance Property and Casualty Insurance Automotive Insurance Reinsurance |

|

Technology |

Artificial Intelligence Blockchain IoT and Telematics Cloud Computing Big Data Analytics |

|

Deployment Mode |

On-Premises Cloud-Based |

|

End-User |

Insurance Companies Third-Party Administrators Reinsurers Brokers/Agents Policyholders |

|

Region |

North America Europe Asia Pacific Latin America Middle East and Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Insurance Companies

Reinsurers Companies

Technology Companies

Venture Capital and Investment Firms

Government and Regulatory Bodies (e.g., Insurance Regulatory and Development Authority, Financial Conduct Authority)

Brokers and Agents Industry

Companies

Players Mentioned in the Report:

Lemonade

Clover Health

PolicyBazaar

Oscar Health

ZhongAn Online P&C Insurance

Trov

Shift Technology

Metromile

Next Insurance

Bright Health

Root Insurance

Cover Genius

Bima Insurance

Slice Labs

Hippo Insurance

Table of Contents

1. Global Insurtech Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Insurtech Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Insurtech Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Digitization of Financial Services (e.g., AI, Blockchain)

3.1.2 Regulatory Support for Fintech Adoption

3.1.3 Surge in Usage of Mobile Insurance Platforms (market-specific)

3.1.4 Demand for Personalized Insurance Products

3.2 Market Challenges

3.2.1 Data Privacy and Security Concerns

3.2.2 Integration of Legacy Systems

3.2.3 Regulatory Complexity Across Geographies (Insurtech-specific compliance challenges)

3.3 Opportunities

3.3.1 AI and Machine Learning for Fraud Detection (emerging technologies)

3.3.2 Growth in Emerging Markets (APAC, LATAM)

3.3.3 Partnership Opportunities with Traditional Insurance Players

3.4 Trends

3.4.1 Adoption of Blockchain for Claims Processing

3.4.2 Rise of Peer-to-Peer Insurance Models

3.4.3 Usage-Based Insurance Models Driven by IoT (telematics)

3.5 Government Regulation

3.5.1 Regulatory Sandboxes for Insurtech Startups

3.5.2 GDPR and Data Compliance in the Insurance Sector

3.5.3 Insurtech Licensing Requirements in Key Markets

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (regulators, technology providers, insurers, consumers)

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Global Insurtech Market Segmentation

4.1 By Insurance Type (In Value %)

4.1.1 Life Insurance

4.1.2 Health Insurance

4.1.3 Property and Casualty Insurance

4.1.4 Automotive Insurance

4.1.5 Reinsurance

4.2 By Technology (In Value %)

4.2.1 Artificial Intelligence

4.2.2 Blockchain

4.2.3 IoT and Telematics

4.2.4 Cloud Computing

4.2.5 Big Data Analytics

4.3 By Deployment Mode (In Value %)

4.3.1 On-Premises

4.3.2 Cloud-Based

4.4 By End-User (In Value %)

4.4.1 Insurance Companies

4.4.2 Third-Party Administrators

4.4.3 Reinsurers

4.4.4 Brokers/Agents

4.4.5 Policyholders

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia Pacific

4.5.4 Latin America

4.5.5 Middle East and Africa

5. Global Insurtech Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Lemonade

5.1.2 Clover Health

5.1.3 PolicyBazaar

5.1.4 Oscar Health

5.1.5 ZhongAn Online P&C Insurance

5.1.6 Trov

5.1.7 Shift Technology

5.1.8 Metromile

5.1.9 Next Insurance

5.1.10 Bright Health

5.1.11 Root Insurance

5.1.12 Cover Genius

5.1.13 Bima Insurance

5.1.14 Slice Labs

5.1.15 Hippo Insurance

5.2 Cross Comparison Parameters (Valuation, No. of Employees, Headquarters, Geographical Presence, Technology Focus, Customer Base, Revenue, Product Portfolio)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Global Insurtech Market Regulatory Framework

6.1 Regulatory Environment (Data Protection Laws, Financial Conduct Authority, Insurance Regulatory and Development Authority)

6.2 Licensing Processes for Insurtech Firms

6.3 Certification Processes for AI-based Solutions

7. Global Insurtech Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Insurtech Future Market Segmentation

8.1 By Insurance Type (In Value %)

8.2 By Technology (In Value %)

8.3 By Deployment Mode (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

9. Global Insurtech Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this step, we created a detailed ecosystem map of all major stakeholders in the Global Insurtech Market, utilizing proprietary and secondary data sources. The goal was to identify key drivers and challenges impacting market dynamics.

Step 2: Market Analysis and Construction

Here, we analyzed historical data related to the Insurtech market, including adoption rates of AI and blockchain technologies. We also reviewed service quality metrics to ensure the accuracy of the revenue estimates provided in the report.

Step 3: Hypothesis Validation and Expert Consultation

Industry-specific hypotheses were formed and validated through interviews with experts in insurance and technology, providing firsthand operational insights that supported the final market findings.

Step 4: Research Synthesis and Final Output

In the last step, we synthesized our findings by directly engaging with Insurtech companies to collect detailed data on market segments, consumer preferences, and sales performance to deliver an accurate, final market assessment.

Frequently Asked Questions

01. How big is the Global Insurtech Market?

The Global Insurtech Market is valued at USD 5.72 billion, driven by the rapid adoption of AI, blockchain, and cloud computing in the insurance sector.

02. What are the challenges in the Global Insurtech Market?

Challenges include regulatory complexities across different geographies, data privacy concerns, and the integration of Insurtech solutions with legacy insurance systems.

03. Who are the major players in the Global Insurtech Market?

Key players in the market include Lemonade, Clover Health, ZhongAn Online P&C, Metromile, and PolicyBazaar, all of which lead due to their technological innovations and customer-centric solutions.

04. What are the growth drivers of the Global Insurtech Market?

The market is driven by the digitization of insurance services, increasing demand for personalized insurance products, and AI-powered fraud detection solutions.

05. Which regions dominate the Global Insurtech Market?

North America, Europe, and China dominate the market due to a combination of regulatory support, strong venture capital investments, and high mobile internet penetration.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.