Global Interior Door Supplier Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD2018

December 2024

88

About the Report

Global Interior Door Supplier Market Overview

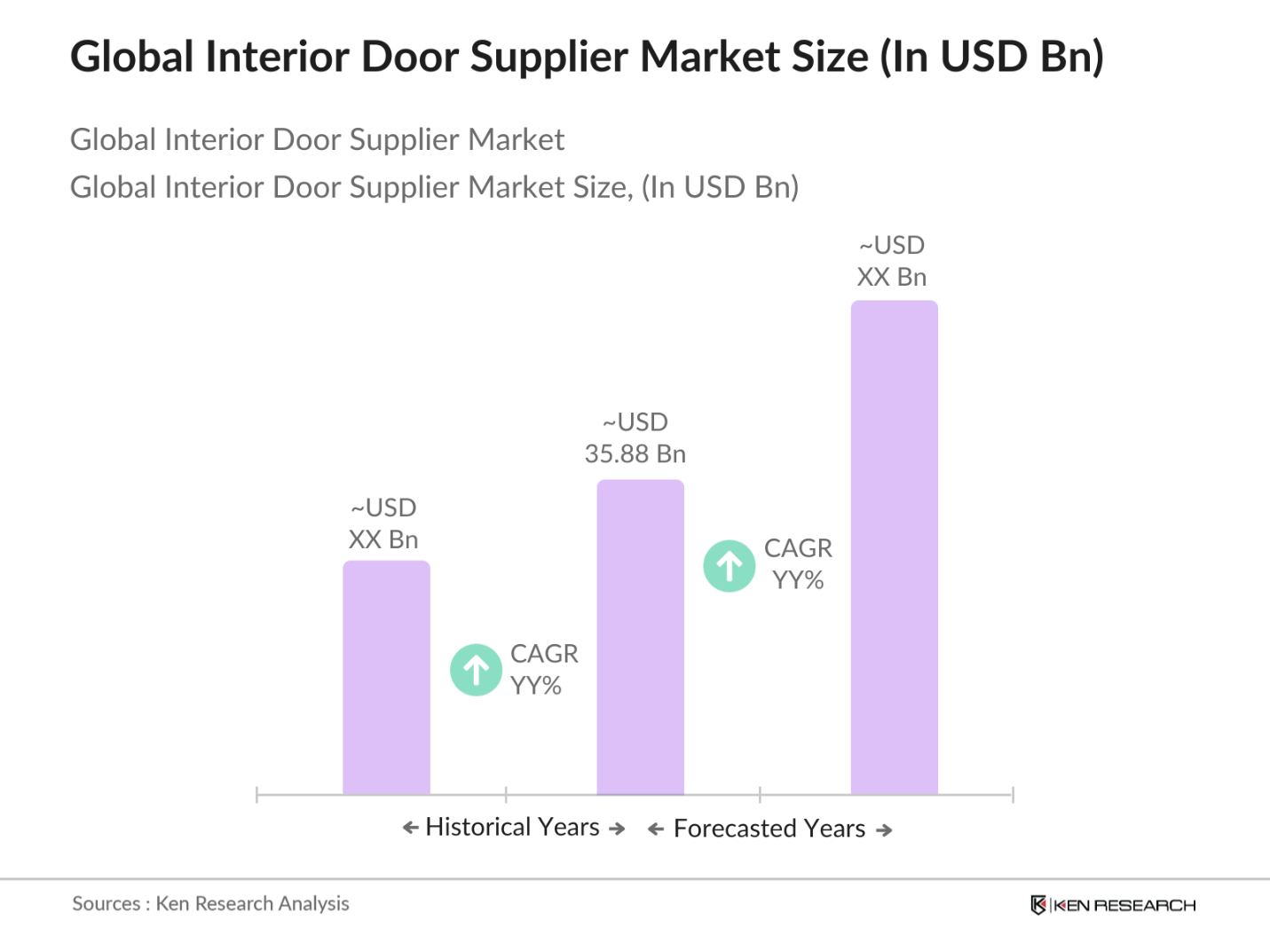

- The global interior door supplier market is valued at USD 35.88 billion, driven by the expanding residential and commercial construction sectors. The demand for aesthetically appealing, durable, and energy-efficient doors has grown significantly due to rising consumer preferences and architectural trends. Urbanization, coupled with government policies encouraging infrastructure development, has further bolstered this demand, particularly in key developing regions. The introduction of smart and energy-efficient door solutions is also playing a crucial role in the market's growth.

- The market is dominated by countries like the United States, China, and Germany due to their advanced construction sectors and high demand for interior solutions. The dominance of the U.S. stems from its large-scale housing projects and high disposable income levels, while China's expanding urbanization and Germany's focus on energy-efficient solutions make them significant players. In these regions, strong manufacturing bases and technological innovations further cement their leadership in the market.

- Government regulations regarding building codes and safety standards play a crucial role in shaping the interior door market. In the U.S., building codes mandated by the International Code Council (ICC) ensure that all doors meet safety and performance criteria. As of 2022, compliance with these regulations is mandatory for all new constructions and significant renovations, influencing the types of doors manufactured and sold. These regulations promote the use of fire-rated and secure doors, thereby driving demand for compliant products within the industry.

Global Interior Door Supplier Market Segmentation

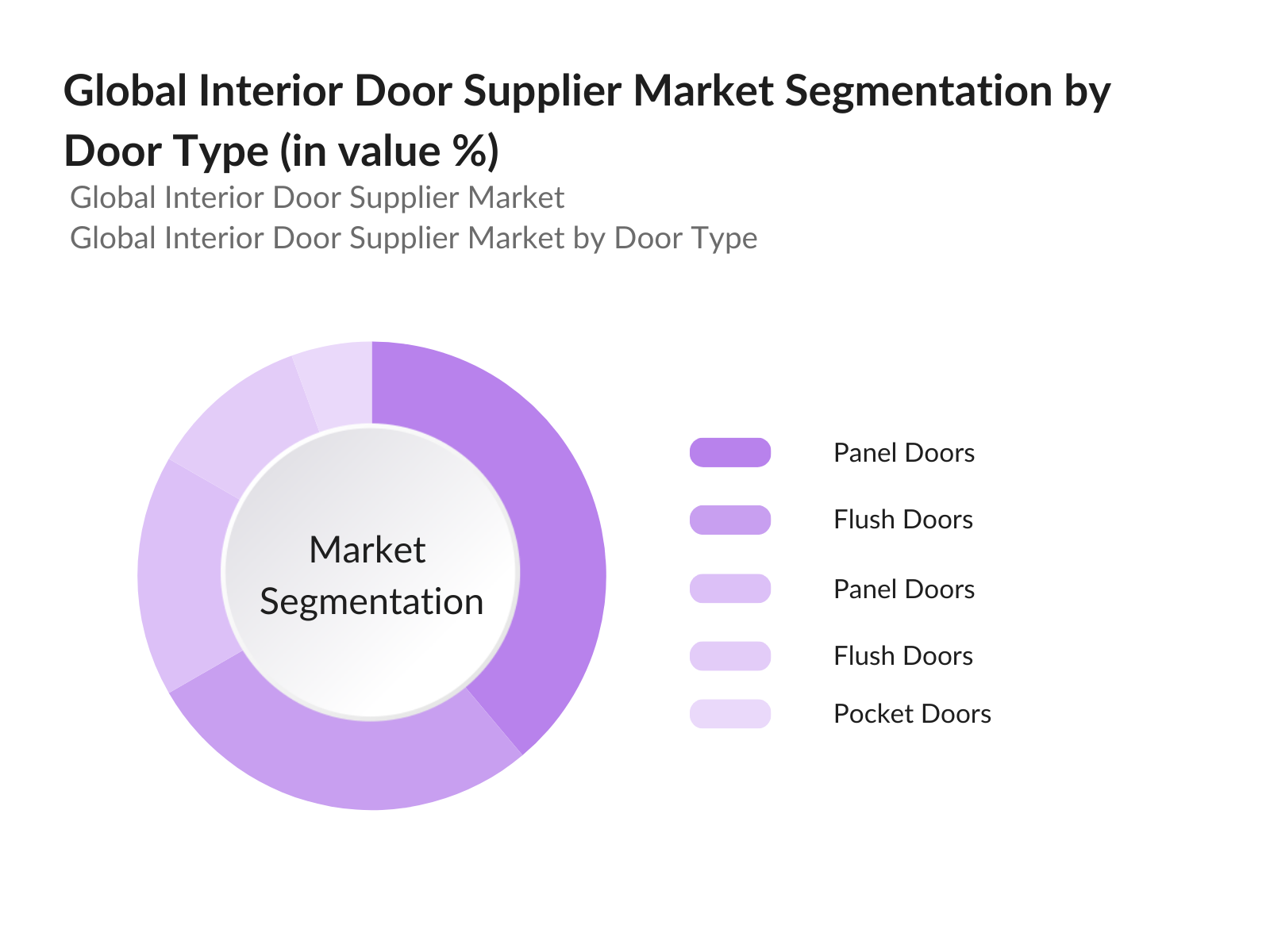

By Door Type: The global interior door supplier market is segmented by door type into panel doors, flush doors, French doors, sliding doors, and pocket doors. Panel doors are the dominant sub-segment, attributed to their popularity in both residential and commercial sectors. Their sturdy construction, availability in various materials, and ability to blend with diverse architectural styles make them a preferred choice. Brands offer customizable options in terms of design and finish, further boosting the appeal of panel doors in modern construction.

By Region: The global interior door supplier market is divided into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads the market due to robust demand from the residential construction sector. The U.S., in particular, has a high rate of home renovations and new constructions, driving the demand for interior doors. Additionally, the focus on energy-efficient solutions has amplified the demand for insulated doors in this region.

Global Interior Door Supplier Market Competitive Landscape

The global interior door supplier market is moderately consolidated, with several key players holding a significant share due to their extensive product portfolios and strong brand recognition. Companies like Masonite International and Jeld-Wen are among the top manufacturers, offering a wide range of doors catering to both residential and commercial sectors. These companies also invest heavily in innovation, ensuring energy efficiency, sustainability, and smart technology integration in their products.

|

Company Name |

Establishment Year |

Headquarters |

Market Parameters |

|

Jeld-Wen Holding Inc. |

1960 |

Charlotte, USA |

- |

|

Masonite International Corp |

1925 |

Tampa, USA |

- |

|

Pella Corporation |

1925 |

Pella, USA |

- |

|

ASSA ABLOY Group |

1994 |

Stockholm, Sweden |

- |

|

Simpson Door Company |

1912 |

McCleary, USA |

- |

Global Interior Door Supplier Market Analysis

Market Growth Drivers

- Urbanization and Housing Demand: The growing urban population is significantly driving the demand for interior doors. In 2022, approximately 4.6 billion people lived in urban areas globally, with projections indicating this figure will rise in the coming years (United Nations). This surge in urbanization translates into heightened housing demand, as cities require more residential units. In the United States alone, there were over 1.55 million housing starts in 2022, showcasing a robust construction environment. This trend toward urban living is set to bolster the demand for high-quality interior doors in new housing developments.

- Increase in Residential Construction: The residential construction market is expanding due to increased investments in housing. In 2022, residential construction spending in the U.S. was estimated at approximately USD 870 billion (U.S. Census Bureau). This significant investment indicates a strong market for suppliers of interior doors, as new homes require various door types for functionality and aesthetics. Additionally, renovations and upgrades in existing homes are contributing to growth in this sector, further enhancing the demand for diverse interior door designs and materials.

- Rise in Commercial Construction: The commercial construction sector is experiencing robust growth, which is positively impacting the interior door market. The U.S. non-residential construction spending reached around USD 1.02 trillion in 2022 (U.S. Census Bureau), highlighting a substantial investment in commercial spaces such as offices, retail, and hospitality. As businesses continue to expand, the need for high-quality interior doors becomes crucial for functionality, security, and design. This trend is echoed globally, with numerous countries increasing their investments in commercial infrastructure, thereby driving demand for interior doors.

Market Challenges:

- Competitive Pressure from Local Suppliers: Local suppliers pose a competitive challenge in the interior door market, particularly in developing regions. These suppliers often have lower operational costs, enabling them to offer competitive pricing. For example, in markets like Southeast Asia, where labor and material costs are lower, local manufacturers can undercut prices of established brands from developed nations. This competitive pressure may result in reduced market shares for larger companies, forcing them to innovate or adjust pricing strategies to maintain their position.

- Fluctuating Raw Material Costs: One of the key challenges facing the interior door supplier market is the volatility in raw material prices. In 2022, the price of softwood lumber reached an average of USD 600 per 1,000 board feet (U.S. Department of Agriculture). These fluctuations create uncertainty for manufacturers regarding production costs and profit margins. Such instability can lead to increased prices for consumers and may inhibit growth within the industry if costs become prohibitive.

Global Interior Door Supplier Market Future Outlook

The global interior door supplier market is expected to experience steady growth over the next five years. Factors contributing to this growth include increasing residential and commercial construction activities, growing awareness of energy-efficient building solutions, and the rising adoption of smart home technology. Technological advancements, particularly in door insulation and automated locking systems, will further drive demand. Additionally, emerging economies with large-scale infrastructure development projects present significant growth opportunities for manufacturers.

Market Opportunities:

- Increasing Use of Digital Design Solutions: The integration of digital design solutions is transforming the interior door industry. In 2023, a significant number of designers reported using software tools for designing customized doors (National Kitchen & Bath Association). This trend allows for greater customization and precision in manufacturing, enabling suppliers to meet specific customer needs more effectively. As digital technologies continue to evolve, they will likely enhance collaboration between designers and manufacturers, streamlining the production process and reducing lead times.

- Customization in Door Aesthetics: Customization is becoming a significant trend in the interior door market, as consumers increasingly seek unique designs that reflect their personal style. In 2022, a considerable portion of homeowners expressed interest in personalized home features, including doors (Home Innovation Research Labs). This trend is driving manufacturers to offer a wider range of customizable options, such as finishes, colors, and hardware, catering to the diverse tastes of consumers and enhancing market growth potential.

Scope of the Report

|

By Door Type |

Panel Doors Flush Doors French Doors Sliding Doors Pocket Doors |

|

By Material |

Wood Glass Metal Fiberglass Composite |

|

By Application |

Residential Commercial Industrial |

|

By End-User |

New Construction Renovation & Remodeling |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Interior Door Manufacturers

Residential Construction Companies

Commercial Construction Firms

Interior Designers and Architects

Door Component Suppliers

Government and Regulatory Bodies (Building Codes and Standards Authorities)

Investment and Venture Capital Firms

Smart Home Solution Providers

Companies

Players Mention in the Report

Jeld-Wen Holding Inc.

Masonite International Corporation

Pella Corporation

Simpson Door Company

ASSA ABLOY Group

Therma-Tru Doors

TruStile Doors

Marvin Doors

ETO Doors

Lynden Door

Steves & Sons, Inc.

Plastpro Inc.

Hrmann Group

VPI Quality Windows

Andersen Corporation

Table of Contents

1. Global Interior Door Supplier Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Interior Door Supplier Market Size (in USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Interior Door Supplier Market Analysis

3.1. Growth Drivers

- Urbanization and Housing Demand

- Increase in Residential Construction

- Rise in Commercial Construction

- Government Policies Favoring Infrastructure Development

3.2. Market Challenges

- Fluctuating Raw Material Costs

- High Installation Costs

- Competitive Pressure from Local Suppliers

- Environmental Regulations (Sustainability Standards)

3.3. Opportunities

- Growth in Smart Home Market

- Demand for Energy-Efficient Doors

- Technological Advancements in Manufacturing

- Expansion into Developing Markets

3.4. Trends

- Rising Adoption of Eco-Friendly Materials

- Increasing Use of Digital Design Solutions

- Customization in Door Aesthetics

- Integration of Smart Locking Systems

3.5. Government Regulations

- Building Codes and Safety Regulations

- Import/Export Duties

- Certifications for Fire-Rated Doors

- Energy-Efficiency Standards

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. Global Interior Door Supplier Market Segmentation

4.1. By Door Type (in Value %)

- Panel Doors

- Flush Doors

- French Doors

- Sliding Doors

- Pocket Doors

4.2. By Material (in Value %)

- Wood

- Glass

- Metal

- Fiberglass

- Composite

4.3. By Application (in Value %)

- Residential

- Commercial

- Industrial

4.4. By End-User (in Value %)

- New Construction

- Renovation & Remodeling

4.5. By Region (in Value %)

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

5. Global Interior Door Supplier Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Jeld-Wen Holding Inc.

5.1.2. Masonite International Corporation

5.1.3. ASSA ABLOY Group

5.1.4. Pella Corporation

5.1.5. Simpson Door Company

5.1.6. Andersen Corporation

5.1.7. Therma-Tru Doors

5.1.8. TruStile Doors

5.1.9. Marvin Doors

5.1.10. ETO Doors

5.1.11. Lynden Door

5.1.12. Steves & Sons, Inc.

5.1.13. Plastpro Inc.

5.1.14. Hrmann Group

5.1.15. VPI Quality Windows

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Product Range, Revenue, Market Share, Regional Presence, Manufacturing Facilities, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Interior Door Supplier Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Interior Door Supplier Future Market Size (in USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Interior Door Supplier Future Market Segmentation

8.1. By Door Type (in Value %)

8.2. By Material (in Value %)

8.3. By Application (in Value %)

8.4. By End-User (in Value %)

8.5. By Region (in Value %)

9. Global Interior Door Supplier Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying the critical factors influencing the global interior door supplier market. This step is conducted through extensive desk research, utilizing secondary data from industry reports, government publications, and proprietary databases to define market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data is analyzed to assess trends in the interior door market, focusing on consumer demand, technological developments, and shifts in design preferences. This includes a thorough examination of the supply chain and product segmentation.

Step 3: Hypothesis Validation and Expert Consultation

We develop hypotheses based on market trends and validate them through consultations with industry experts. These consultations offer insights into current market conditions, product innovations, and future growth opportunities.

Step 4: Research Synthesis and Final Output

The final stage of research involves synthesizing the findings from expert consultations and secondary data to deliver comprehensive insights. This ensures that all information presented is accurate, relevant, and up-to-date, forming the basis of this detailed market analysis.

Frequently Asked Questions

01. How big is the Global Interior Door Supplier Market?

The global interior door supplier market is valued at USD 35.88 billion, driven by rising demand for durable and energy-efficient door solutions in residential and commercial construction sectors.

02. What are the challenges in the Global Interior Door Supplier Market?

Key challenges include fluctuating raw material prices, high manufacturing and installation costs, and increasing competition from local suppliers in emerging markets.

03. Who are the major players in the Global Interior Door Supplier Market?

Major players include Jeld-Wen Holding Inc., Masonite International Corporation, Pella Corporation, Simpson Door Company, and ASSA ABLOY Group, all of which have extensive product offerings and global reach.

04. What factors are driving the growth of the Global Interior Door Supplier Market?

Growth is driven by urbanization, increasing residential and commercial construction projects, and the demand for energy-efficient and smart door solutions. The push for sustainability and eco-friendly materials is also a key driver.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.