Region:Global

Author(s):Shubham

Product Code:KRAC0868

Pages:93

Published On:August 2025

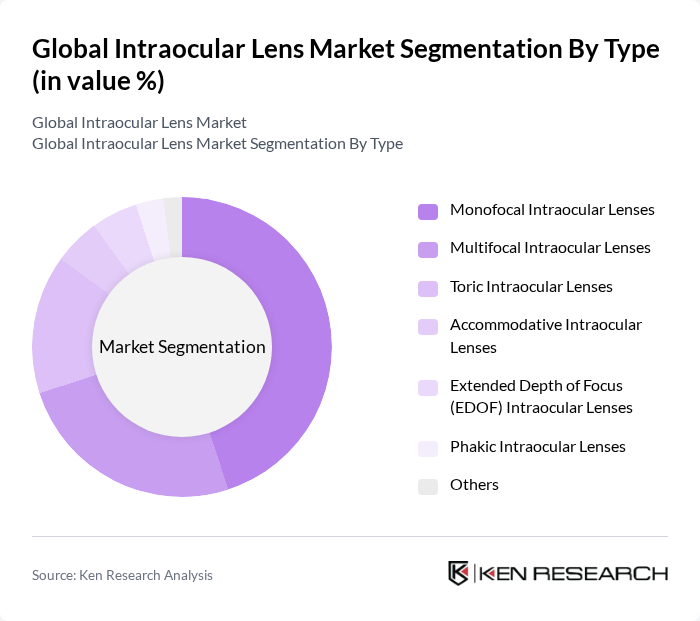

By Type:The market is segmented into various types of intraocular lenses, including Monofocal Intraocular Lenses, Multifocal Intraocular Lenses, Toric Intraocular Lenses, Accommodative Intraocular Lenses, Extended Depth of Focus (EDOF) Intraocular Lenses, Phakic Intraocular Lenses, and Others. Among these, Monofocal Intraocular Lenses dominate the market due to their widespread use in cataract surgeries, offering patients clear vision at a single distance. The simplicity and effectiveness of monofocal lenses make them a preferred choice for both surgeons and patients. Premium lens segments, such as multifocal and toric lenses, are experiencing faster growth due to increasing patient awareness and demand for spectacle independence .

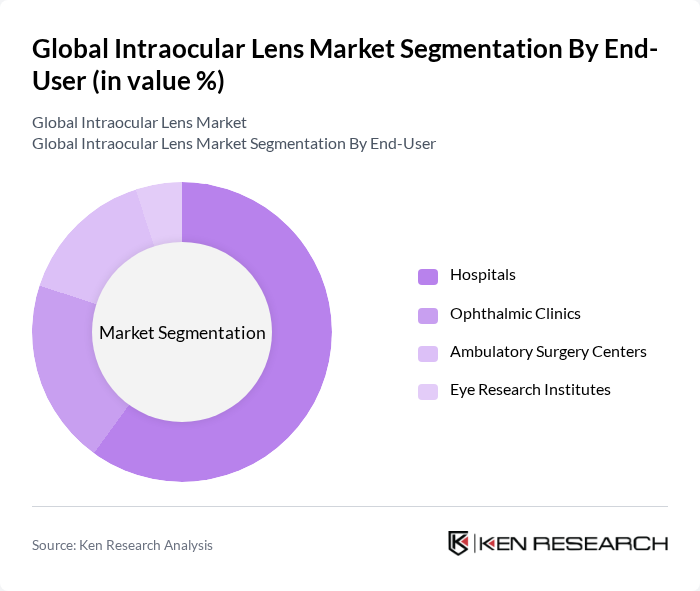

By End-User:The market is segmented by end-users, including Hospitals, Ophthalmic Clinics, Ambulatory Surgery Centers, and Eye Research Institutes. Hospitals are the leading end-user segment, primarily due to their capacity to perform complex surgeries and provide comprehensive patient care. The increasing number of cataract surgeries performed in hospitals, coupled with the availability of advanced surgical equipment, drives this segment's growth. Ambulatory Surgery Centers are also gaining traction due to their cost-effectiveness and shorter patient turnaround times .

The Global Intraocular Lens Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alcon Inc., Johnson & Johnson Vision, Bausch + Lomb, Carl Zeiss Meditec AG, HOYA Corporation, Rayner Intraocular Lenses Limited, STAAR Surgical Company, PhysIOL S.A. (part of BVI Medical), HumanOptics AG, Lenstec, Inc., Aurolab, SIFI S.p.A., Hanita Lenses, Omni Lens Pvt Ltd, MORCHER GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the intraocular lens market appears promising, driven by technological advancements and demographic shifts. As the geriatric population continues to grow, the demand for cataract surgeries will likely increase, further propelling the market. Additionally, the integration of digital technologies in eye care, such as telemedicine and AI-driven diagnostics, is expected to enhance patient outcomes and streamline surgical processes. Companies that invest in research and development will be well-positioned to capitalize on these trends and meet evolving patient needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Monofocal Intraocular Lenses Multifocal Intraocular Lenses Toric Intraocular Lenses Accommodative Intraocular Lenses Extended Depth of Focus (EDOF) Intraocular Lenses Phakic Intraocular Lenses Others |

| By End-User | Hospitals Ophthalmic Clinics Ambulatory Surgery Centers Eye Research Institutes |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Material | Hydrophobic Acrylic Hydrophilic Acrylic Silicone PMMA (Polymethyl Methacrylate) Others |

| By Region | North America Western Europe Eastern Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Application | Cataract Surgery Refractive Surgery Presbyopia Correction Corneal Disorders Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ophthalmic Surgeons | 120 | Surgeons specializing in cataract and refractive surgery |

| Hospital Procurement Managers | 80 | Managers responsible for purchasing medical devices and implants |

| Optometrists | 60 | Practitioners providing pre- and post-operative care |

| Clinical Researchers | 50 | Researchers involved in ophthalmic device studies and trials |

| Patient Advocacy Groups | 40 | Representatives from organizations focused on eye health |

The Global Intraocular Lens Market is valued at approximately USD 6.2 billion, driven by factors such as the increasing prevalence of cataracts, advancements in lens technology, and a growing geriatric population requiring cataract surgeries.