Global IoT Medical Devices Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD2768

December 2024

89

About the Report

Global IoT Medical Devices Market Overview

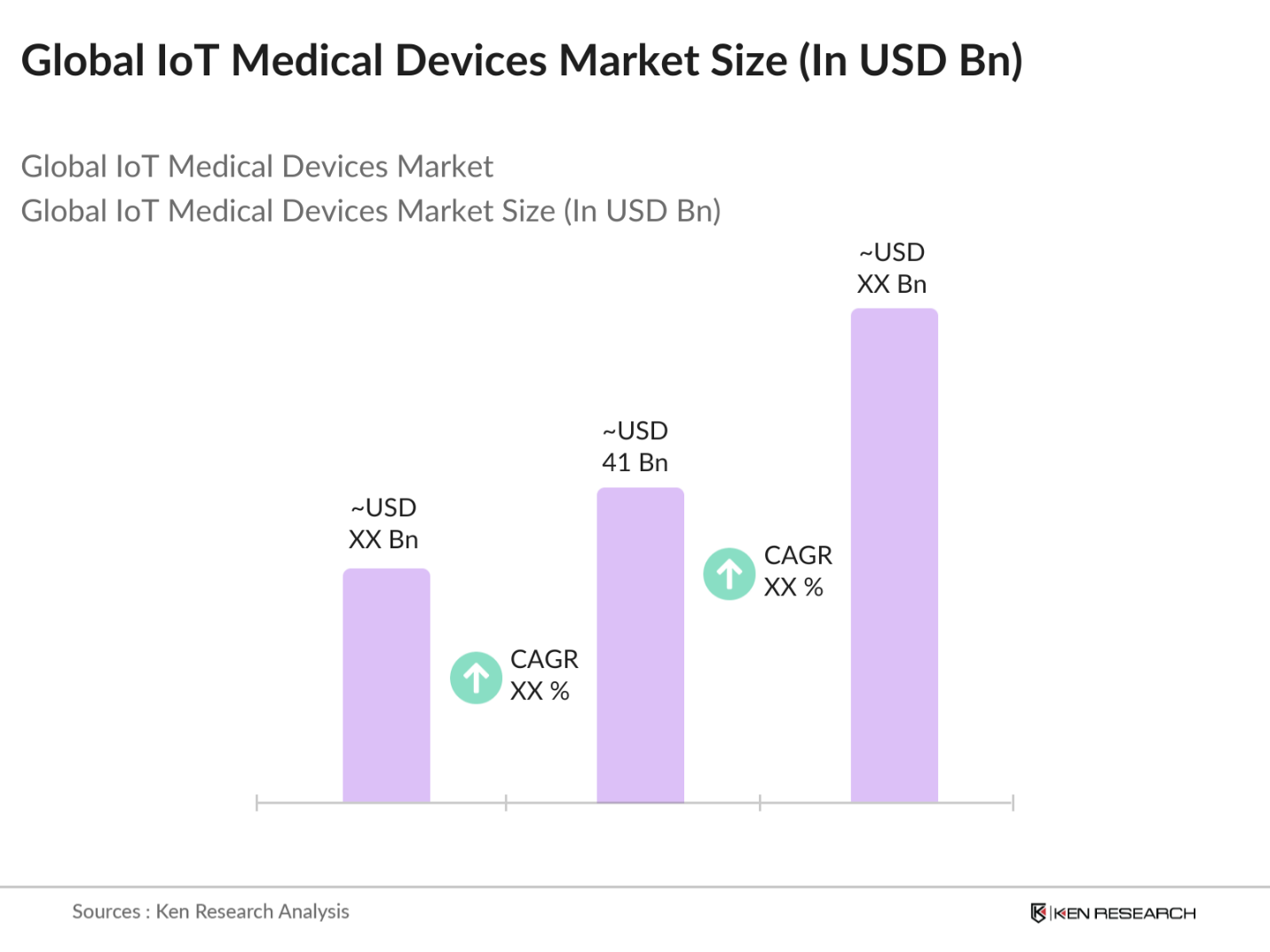

- The Global IoT Medical Devices market is valued at USD 41 billion, based on a comprehensive five-year analysis. The market is primarily driven by increasing demand for connected healthcare systems, which provide real-time monitoring, early diagnosis, and patient-centric care. IoT devices, such as wearable sensors and implantable devices, enable continuous data transmission, enhancing the efficiency of healthcare providers while improving patient outcomes. Significant investments in AI-enabled healthcare technologies and the rise of telemedicine services are further fueling market growth, allowing for more personalized and effective treatment options.

- North America and Europe dominate the Global IoT Medical Devices market, owing to their well-established healthcare systems, high adoption rates of IoT technologies, and supportive government initiatives. The United States leads in this sector due to substantial healthcare investments, an aging population with increasing chronic disease burdens, and favorable regulations that promote innovation in medical devices. Additionally, Europe is driven by a rising focus on digital health technologies and the integration of AI in healthcare services, particularly in countries like Germany and the UK.

- In 2023, regulatory bodies such as the FDA and the European Medicines Agency (EMA) established stringent guidelines for IoT medical devices, ensuring that safety and data security standards are met. These guidelines emphasize the importance of secure data transmission, compliance with patient privacy laws (e.g., HIPAA), and the need for rigorous testing before market entry. This regulatory framework, while promoting innovation, also adds a layer of complexity for manufacturers seeking to introduce IoT devices that integrate advanced technologies such as AI and 5G connectivity.

Global IoT Medical Devices Market Segmentation

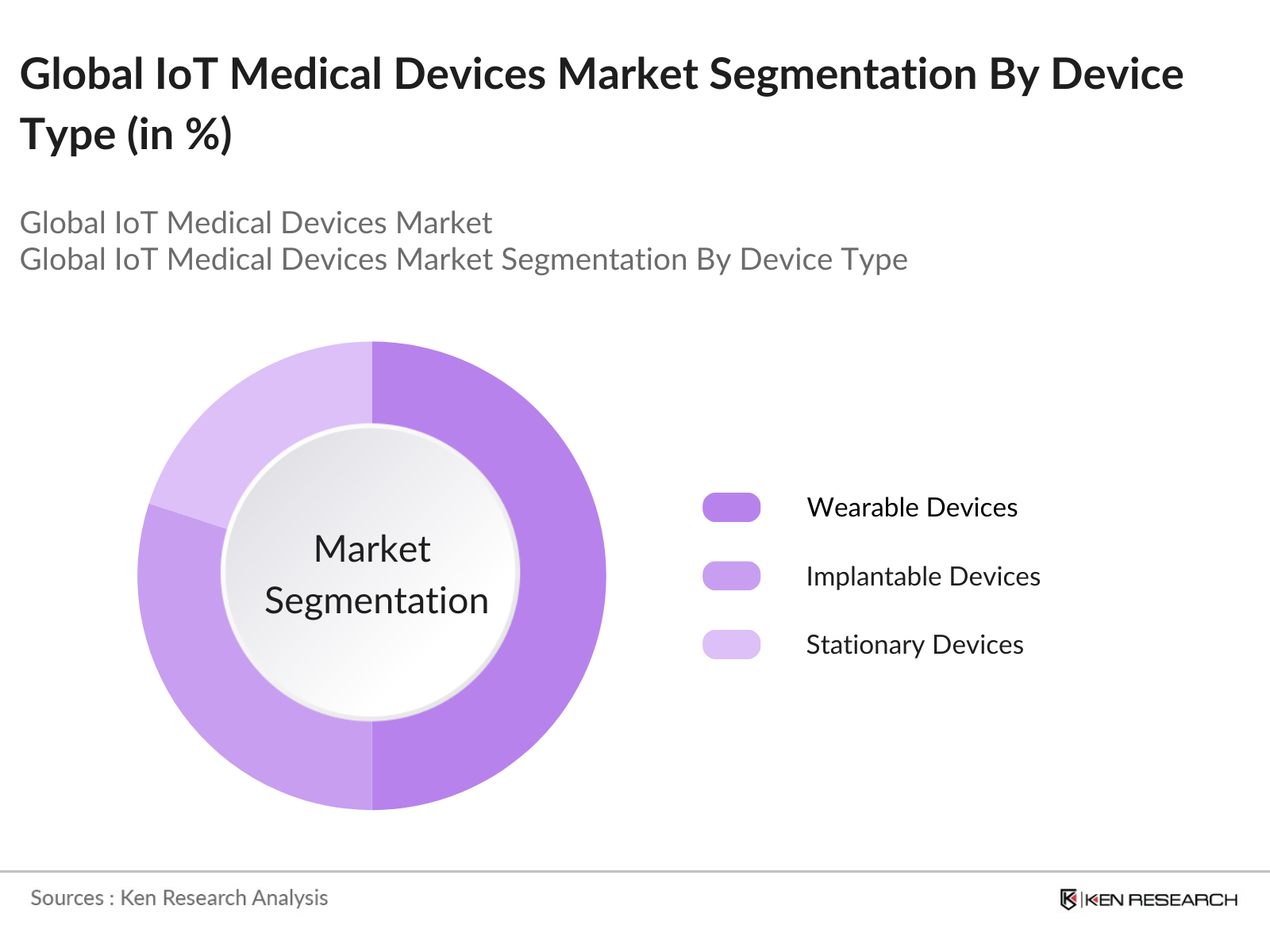

By Device Type: The market is segmented by device type into wearable devices, implantable devices, and stationary devices. Wearable devices hold the dominant market share due to their widespread use in monitoring chronic diseases like diabetes and heart disease. Wearable IoT devices, such as smartwatches, fitness trackers, and glucose monitors, have become popular for their convenience and real-time data tracking, helping patients manage their conditions effectively.

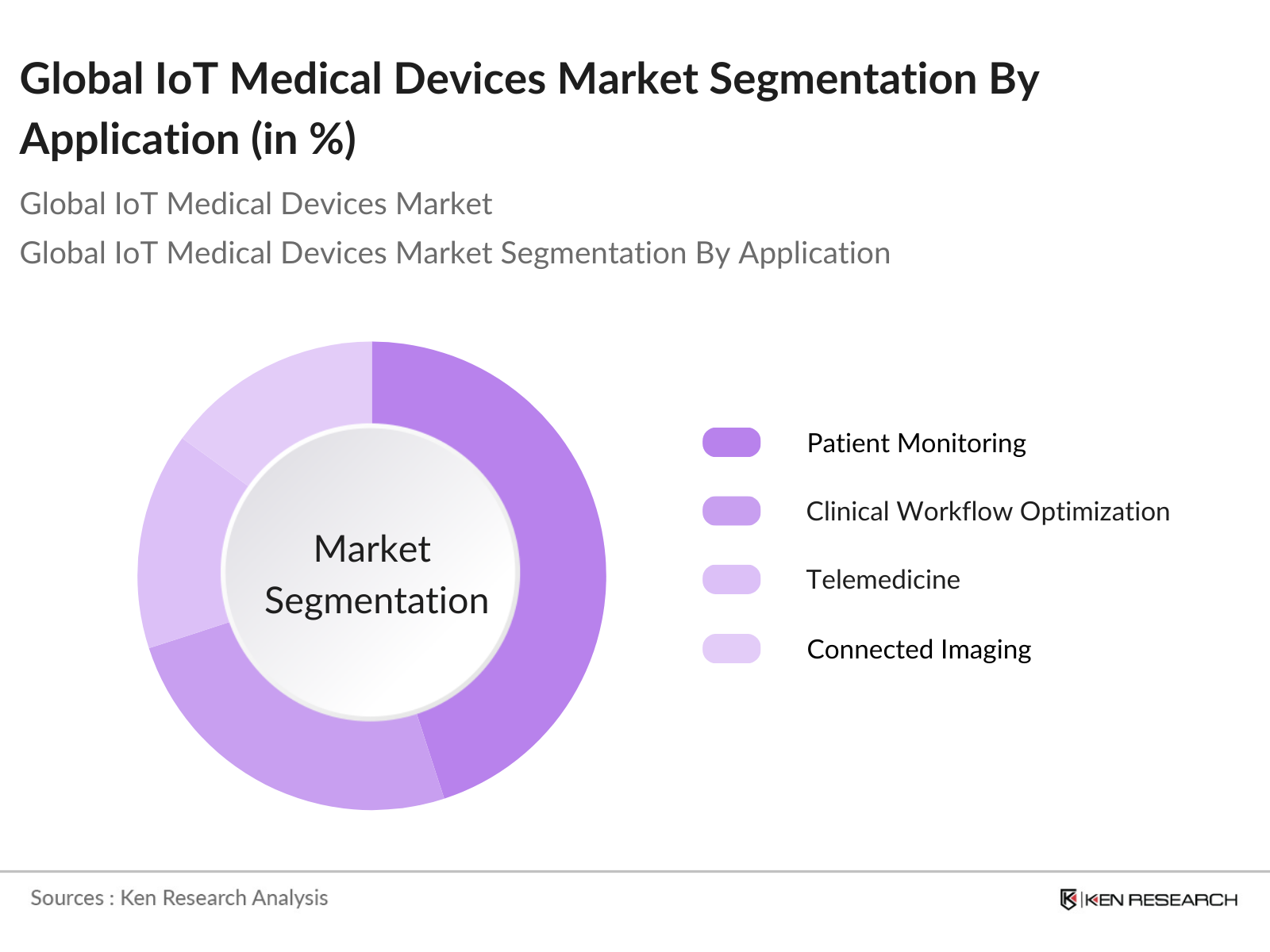

By Application: The market is segmented by application into patient monitoring, clinical workflow optimization, telemedicine, and connected imaging. Patient monitoring holds the largest share, driven by the need for continuous and remote monitoring of patients with chronic conditions such as diabetes, hypertension, and cardiovascular diseases. IoT-enabled patient monitoring devices have been instrumental in improving patient outcomes, reducing hospital readmissions, and enabling healthcare professionals to make data-driven decisions in real-time.

Global IoT Medical Devices Market Competitive Landscape

The Global IoT Medical Devices market is highly competitive, with major players focusing on product innovation, strategic partnerships, and expanding their global presence. Companies such as Medtronic, Philips Healthcare, and Abbott are leading the market by developing advanced IoT solutions that integrate artificial intelligence, data analytics, and cloud-based platforms. These companies are investing heavily in R&D to enhance device functionality, improve patient compliance, and address emerging healthcare needs.

Global IoT Medical Devices Industry Analysis

Growth Drivers

- Advancements in Telehealth (IoT Applications): Telehealth, driven by IoT technologies, has witnessed significant growth as it bridges gaps in healthcare access, particularly in rural areas. In 2024, the global healthcare access gap is estimated to affect nearly 3 billion people, many of whom benefit from telehealth solutions leveraging IoT for real-time consultations. Government initiatives, like the WHOs eHealth Strategy, focus on deploying IoT-enabled telemedicine tools, particularly in underserved regions.

- Integration with Wearable Devices (Remote Monitoring Capabilities): IoT-integrated wearable devices have revolutionized remote patient monitoring, enabling continuous tracking of vital signs like heart rate and blood glucose levels. In 2024, over 320 million wearable health devices are in use globally, providing key insights for chronic disease management. As per the World Health Organization, chronic diseases contribute to 41 million deaths annually, and IoT wearables help manage these conditions by offering real-time health data to healthcare providers, reducing the burden on hospitals. The surge in wearable devices allows the continuous care of more than 1.2 billion chronic patients worldwide.

- Increasing Prevalence of Chronic Diseases (IoT Solutions for Continuous Care): The rise in chronic diseases, particularly in aging populations, has intensified the need for IoT medical devices to manage conditions like diabetes and cardiovascular diseases. With approximately 500 million people suffering from diabetes in 2023, IoT solutions such as glucose monitoring devices play a pivotal role in continuous care. In the U.S. alone, healthcare costs related to chronic diseases exceed $4 trillion annually.

Market Challenges

- Data Privacy and Cybersecurity Concerns: The growing adoption of IoT in healthcare has raised concerns over data privacy and cybersecurity. As of 2024, the World Economic Forum reports that healthcare organizations face an average of 300 cyberattacks weekly, with IoT devices often being the weakest link in cybersecurity systems. This is particularly alarming considering that, in 2023, the healthcare sector stored over 2,500 exabytes of data globally, much of which is sensitive patient information.

- Regulatory Compliance (Device Safety and Data Standards): Regulatory requirements surrounding IoT medical devices are stringent, making it difficult for manufacturers to ensure compliance across different regions. According to the European Medicines Agency, approximately 70% of medical device manufacturers had to revise their IoT products in 2023 to meet new safety and data standards. Compliance with regulations like the FDA's 21 CFR Part 11 in the U.S. or CE certification in the EU has become mandatory for IoT devices, which can delay market entry.

Global IoT Medical Devices Market Future Outlook

Over the next five years, the Global IoT Medical Devices market is expected to witness significant growth driven by advancements in IoT technology, increasing demand for remote healthcare solutions, and the expansion of healthcare infrastructure in emerging markets. The growing adoption of AI-driven healthcare solutions and 5G technology will revolutionize patient care by enabling real-time monitoring, predictive analytics, and personalized treatment plans.

Market Opportunities

- Expansion of AI-Powered Diagnostic Tools (AI and IoT Integration): AI integration with IoT devices has led to the development of advanced diagnostic tools that assist in real-time disease detection. In 2024, over 40 million IoT-connected medical devices are leveraging AI for predictive analytics, particularly in imaging and diagnostics. According to the World Bank, the integration of AI can reduce diagnostic errors by nearly 20%, making healthcare more efficient and reliable.

- Rise of 5G Networks Enabling Real-time Data Transfer: The deployment of 5G networks is revolutionizing IoT applications in healthcare by enabling real-time data transfer, a critical requirement for telemedicine and remote surgery. In 2024, over 85 countries have rolled out 5G networks, and healthcare providers in these regions have begun leveraging the technology to enable faster and more reliable IoT device performance. The latency of 5G, less than one millisecond, significantly improves the functionality of IoT devices, facilitating real-time monitoring and immediate data analysis, crucial for critical care situations.

Scope of the Report

|

Device Type |

Wearable Medical Devices Implantable Medical Devices Stationary Medical Devices |

|

Application |

Patient Monitoring Clinical Operations Connected Imaging Telemedicine Others |

|

Connectivity Technology |

Wi-Fi Bluetooth Cellular Networks NFC |

|

End-User |

Hospitals & Clinics Ambulatory Surgical Centers Home Healthcare Diagnostic Labs |

|

Region |

North America Europe Asia-Pacific Middle East & Africa Latin America |

Products

Key Target Audience

Healthcare Providers (Hospitals, Clinics, Ambulatory Surgical Centers)

Medical Device Manufacturers

Government and Regulatory Bodies (FDA, EMA)

Telemedicine Providers

Home Healthcare Providers

Investments and Venture Capitalist Firms

Health Insurance Companies

Research and Development Firms

Companies

Players Mentioned in the Report

Medtronic Plc

Philips Healthcare

GE Healthcare

Abbott Laboratories

Siemens Healthineers

Boston Scientific

Dexcom Inc.

Johnson & Johnson (Biosense Webster)

Masimo Corporation

Biotronik

Table of Contents

1. Global IoT Medical Devices Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global IoT Medical Devices Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global IoT Medical Devices Market Analysis

3.1. Growth Drivers

3.1.1. Advancements in Telehealth (IoT Applications)

3.1.2. Integration with Wearable Devices (Remote Monitoring Capabilities)

3.1.3. Increasing Prevalence of Chronic Diseases (IoT Solutions for Continuous Care)

3.1.4. Growing Adoption of Cloud-based Healthcare Platforms

3.2. Market Challenges

3.2.1. Data Privacy and Cybersecurity Concerns

3.2.2. High Initial Setup Costs for IoT Infrastructure

3.2.3. Regulatory Compliance (Device Safety and Data Standards)

3.2.4. Interoperability Issues between Devices

3.3. Opportunities

3.3.1. Expansion of AI-Powered Diagnostic Tools (AI and IoT Integration)

3.3.2. IoT in Geriatric Care (Home-based Health Monitoring)

3.3.3. Rise of 5G Networks Enabling Real-time Data Transfer

3.3.4. Personalized Healthcare Solutions through IoT Devices

3.4. Trends

3.4.1. Miniaturization of Medical Devices (Wearable IoT Devices)

3.4.2. Increasing Use of Edge Computing in Healthcare

3.4.3. Integration of IoT with Robotic Surgery

3.4.4. Use of Blockchain for Data Security in IoT Devices

3.5. Government Regulations and Policies

3.5.1. IoT Device Certification Standards (FDA, CE)

3.5.2. Compliance with HIPAA and GDPR (Data Protection in Healthcare)

3.5.3. Regulations around Medical Data Transmission and Storage

3.5.4. Telehealth and IoT Device Approval Guidelines

3.6. SWOT Analysis

3.7. IoT Medical Devices Stake Ecosystem (Manufacturers, Healthcare Providers, Patients, Payers, Regulators)

3.8. Porters Five Forces (Supplier Power, Buyer Power, Threat of Substitutes, Industry Rivalry, Barriers to Entry)

3.9. Competition Ecosystem

4. Global IoT Medical Devices Market Segmentation

4.1. By Device Type (In Value %)

4.1.1. Wearable Medical Devices

4.1.2. Implantable Medical Devices

4.1.3. Stationary Medical Devices

4.2. By Application (In Value %)

4.2.1. Patient Monitoring

4.2.2. Clinical Operations & Workflow Optimization

4.2.3. Connected Imaging

4.2.4. Telemedicine

4.2.5. Others (Chronic Disease Management, Emergency Care)

4.3. By Connectivity Technology (In Value %)

4.3.1. Wi-Fi

4.3.2. Bluetooth

4.3.3. Cellular Networks

4.3.4. Near Field Communication (NFC)

4.4. By End-User (In Value %)

4.4.1. Hospitals & Clinics

4.4.2. Ambulatory Surgical Centers

4.4.3. Home Healthcare

4.4.4. Diagnostic Laboratories

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

5. Global IoT Medical Devices Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Medtronic Plc

5.1.2. Philips Healthcare

5.1.3. GE Healthcare

5.1.4. Abbott Laboratories

5.1.5. Siemens Healthineers

5.1.6. Boston Scientific

5.1.7. Dexcom Inc.

5.1.8. Johnson & Johnson (Biosense Webster)

5.1.9. Masimo Corporation

5.1.10. Biotronik

5.1.11. Honeywell Life Care Solutions

5.1.12. Omron Healthcare

5.1.13. AliveCor Inc.

5.1.14. ResMed

5.1.15. Stryker Corporation

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Market Share, Revenue, IoT Device Portfolio, R&D Expenditure, Strategic Collaborations, Digital Healthcare Innovations)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Partnerships with Healthcare Providers

5.9. Private Equity Investments

6. Global IoT Medical Devices Market Regulatory Framework

6.1. Regulatory Approval Processes

6.2. International Data Transfer Compliance (IoT in Healthcare)

6.3. Certification Processes for IoT Devices

6.4. Data Encryption and Privacy Guidelines

7. Global IoT Medical Devices Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global IoT Medical Devices Future Market Segmentation

8.1. By Device Type (In Value %)

8.2. By Application (In Value %)

8.3. By Connectivity Technology (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Global IoT Medical Devices Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. IoT Device Adoption Strategies for Healthcare Providers

9.3. Potential for Market Disruptors and Innovations

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves creating an ecosystem map encompassing all major stakeholders within the Global IoT Medical Devices Market. This process utilizes extensive desk research and proprietary databases to define critical variables, such as device usage patterns, market penetration, and key drivers influencing market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data on market growth, device adoption rates, and healthcare expenditure is compiled and analyzed. The analysis includes evaluating market saturation, competition intensity, and technological advancements to ensure reliable revenue estimates for the market.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through consultations with industry experts, including healthcare providers, IoT device manufacturers, and regulatory authorities. These interviews help refine the market data and offer operational insights, ensuring accurate and validated market analysis.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing the research findings with insights from IoT device manufacturers to verify sales performance, consumer demand, and emerging market trends. This ensures a comprehensive and validated market report ready for publication.

Frequently Asked Questions

1. How big is the Global IoT Medical Devices Market?

The global IoT Medical Devices market is valued at USD 41 billion and is primarily driven by the rising demand for remote healthcare monitoring systems and connected medical devices that improve patient outcomes.

2. What are the challenges in the Global IoT Medical Devices Market?

Key challenges include data privacy concerns, regulatory hurdles, high initial investment costs for implementing IoT infrastructure, and interoperability issues between different IoT medical devices.

3. Who are the major players in the Global IoT Medical Devices Market?

Major players in the market include Medtronic Plc, Philips Healthcare, GE Healthcare, Abbott Laboratories, and Siemens Healthineers, all of which dominate due to their innovative product portfolios and significant R&D investments.

4. What drives the growth of the Global IoT Medical Devices Market?

The growth of the IoT medical devices market is fueled by advancements in telemedicine, the rise of connected wearable devices, and the increasing adoption of cloud-based healthcare systems that enable real-time health monitoring.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.