Global Iron and Steel Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD1787

December 2024

83

About the Report

Global Iron and Steel Market Overview

- The global iron and steel market reached a valuation of USD 1700 billion in 2023, driven by strong demand across multiple industries, including construction, automotive, and manufacturing. The market's growth is fueled by rapid urbanization in emerging economies, which has significantly increased the need for infrastructure development.

- Major players in the global iron and steel market include ArcelorMittal, Nippon Steel Corporation, China Baowu Steel Group, POSCO, and Tata Steel. These companies have cemented their market leadership through continuous investments in advanced technologies, strategic mergers, and acquisitions, and a focus on expanding their production capacities. Their ability to innovate, particularly in sustainable steel production, has allowed them to maintain a competitive edge globally.

- In 2023, China Baowu Steel Group announced the development of a new hydrogen-based steelmaking plant in Xinjiang, with an estimated annual capacity of 5 million tons. This plant is a key part of Baowu's strategy to meet the growing demand for green steel and aligns with China's broader goals of reducing carbon emissions. Similarly, ArcelorMittal expanded its operations in Europe by investing in advanced recycling technologies aimed at increasing the use of scrap steel in production.

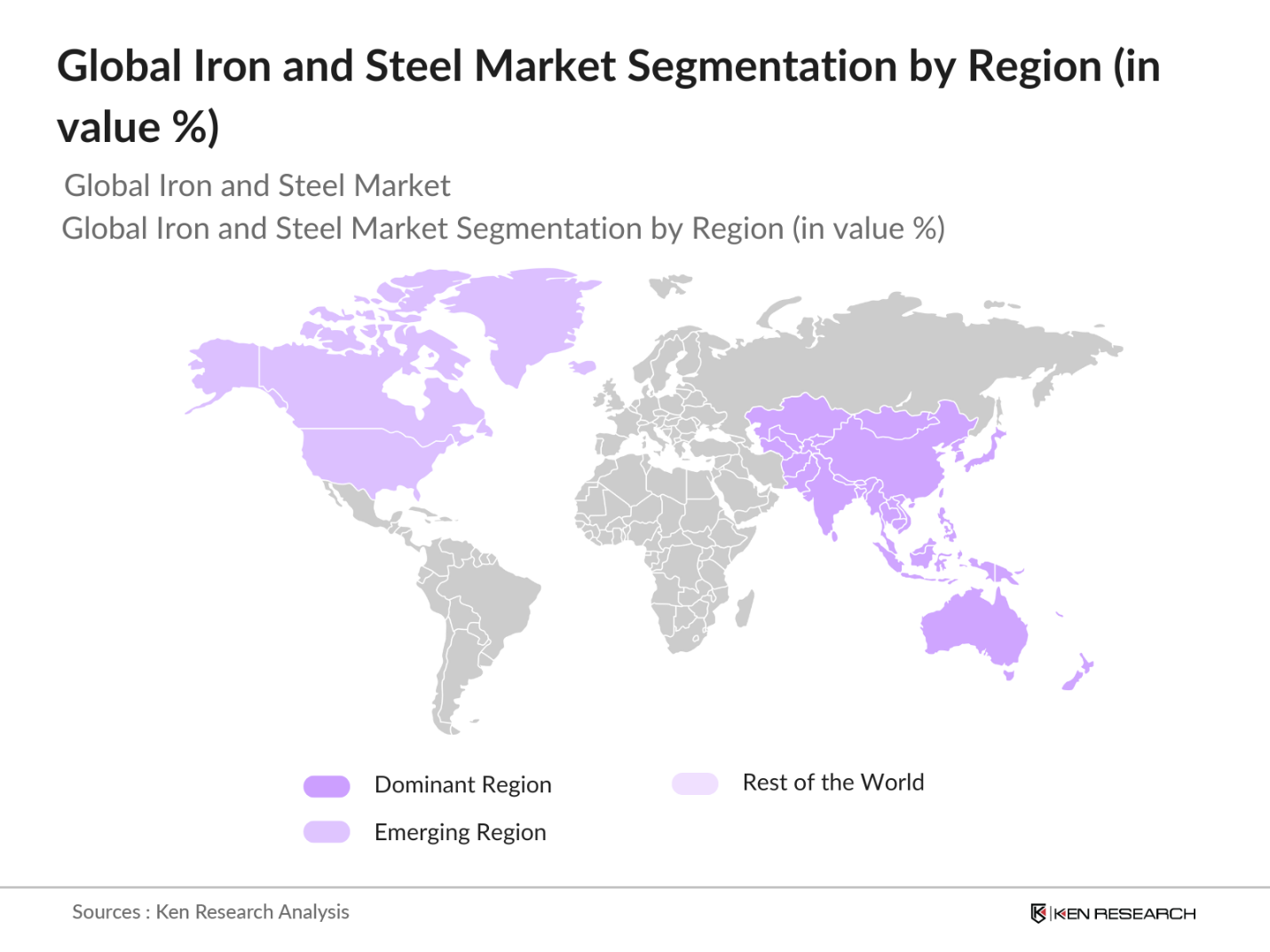

- Asia-Pacific dominates the global iron and steel market, primarily due to the significant industrial base in countries like China and India. These countries are the largest producers and consumers of steel, driven by massive infrastructure projects and a growing automotive sector. Government initiatives such as Chinas Belt and Road Initiative, which involves infrastructure development across multiple countries, are also contributing to the region's leadership position in the global market.

Global Iron and Steel Market Segmentation

By Product Type: The global iron and steel market is segmented by product type into flat steel, long steel, and tubular steel. In 2023, flat steel held the dominant market share, largely due to its widespread application in the automotive and construction sectors. The demand for flat steel is particularly strong in automotive manufacturing, where it is used extensively in vehicle bodies and components, driving its significant share in the market.

By Application: The market is further segmented by application into construction, automotive, and machinery. The construction sector accounted for the largest market share in 2023, driven by the global demand for infrastructure development. The use of steel in building roads, bridges, and commercial buildings is critical, particularly in developing countries where rapid urbanization is ongoing, ensuring the dominance of this segment.

By Region: The market is segmented into North America, Europe, Asia-Pacific, Latin America, and MEA. Asia-Pacific dominated the market in 2023, driven by China and India, which are the leading producers and consumers of steel globally. The region's strong industrial base, coupled with large-scale infrastructure projects, supports its dominant market position.

Global Iron and Steel Market Competitive Landscape

|

Company Name |

Headquarters |

Establishment Year |

|

ArcelorMittal |

Luxembourg City, Luxembourg |

1976 |

|

Nippon Steel Corporation |

Tokyo, Japan |

1950 |

|

China Baowu Steel Group |

Shanghai, China |

2016 |

|

POSCO |

Pohang, South Korea |

1968 |

|

Tata Steel |

Mumbai, India |

1907 |

- Nippon Steel Corporation: In 2024, Nippon Steel Corporation announced its partnership with Mitsubishi Heavy Industries to develop carbon capture and utilization technology for steel production. This collaboration aims to capture 1 million tons of CO2 annually by 2026, reinforcing the companys commitment to sustainability and reducing its carbon footprint.

- Tata Steel: In 2024, Tata Steel invested $1 billion in expanding its Kalinganagar plant in India to increase its production capacity by 5 million tons annually. This expansion is part of Tata Steel's strategy to meet the rising domestic demand for steel in infrastructure and automotive sectors.

Global Iron and Steel Market Analysis

Market Growth Drivers

- Infrastructure Development in Emerging Economies: The global push for infrastructure development, particularly in emerging economies such as India and China, is a major growth driver. Indias government has allocated $130 billion towards infrastructure projects in 2024, with a focus on roads, railways, and urban development. These projects significantly increase the demand for steel, propelling market growth.

- Automotive Industry Expansion: The increasing production of vehicles, including electric vehicles (EVs), is another key growth driver. In 2024, the global automotive industry is expected to produce over 80 million vehicles, with a significant portion of this demand driven by the growing EV market. Steel remains a crucial material in vehicle manufacturing, particularly in the production of vehicle bodies and components.

- Renewable Energy Projects: The expansion of renewable energy projects, particularly wind and solar power, is driving the demand for steel. In 2024, Europe is set to add 7 GW of offshore wind capacity, requiring significant steel inputs for turbines and infrastructure. This trend is expected to continue, with renewable energy projects playing a key role in market growth.

Global Iron and Steel Market Challenges

- High Raw Material Costs: The rising cost of raw materials such as iron ore and coking coal poses a significant challenge. In 2024, the price of iron ore reached $120 per ton, driven by supply chain disruptions and increased demand. This increase in costs affects profit margins and creates challenges for steel producers in maintaining competitive pricing.

- Environmental Regulations: Stringent environmental regulations, such as the European Unions Carbon Border Adjustment Mechanism (CBAM), are another challenge for the industry. The CBAM imposes tariffs on carbon-intensive imports, increasing operational costs for companies that rely on traditional steel production methods. Compliance with these regulations requires substantial investments in green technologies.

Global Iron and Steel Market Government Initiatives

- Indias National Steel Policy 2024: Indias National Steel Policy aims to boost the countrys steel production capacity to 300 million tons by 2030. The policy includes incentives for modernizing existing plants, promoting domestic production, and reducing import dependency. This initiative is expected to attract significant investments in the Indian steel sector.

- United States Infrastructure Investment and Jobs Act: The U.S. Infrastructure Investment and Jobs Act, which came into effect in 2023, continues to impact the steel industry by driving demand for steel in large-scale infrastructure projects. The Act provides $1.2 trillion for infrastructure development, including roads, bridges, and railways, significantly boosting domestic steel production.

Global Iron and Steel Market Future Market Outlook

The global iron and steel market is poised for substantial growth by 2028, driven by advancements in sustainable steel production, increased digitalization, and the growing demand in emerging markets.

Future Market Trends

- Adoption of Green Steel Technologies: By 2028, the global iron and steel market will see significant adoption of green steel technologies, driven by environmental regulations and corporate sustainability goals. Hydrogen-based steelmaking and carbon capture technologies are expected to become mainstream, reducing the carbon footprint of steel production. Companies like ArcelorMittal and Tata Steel are leading the way, with plans to produce millions of tons of green steel annually by 2028.

- Expansion in Emerging Markets: The market is set to expand significantly in emerging regions such as Asia-Pacific and Latin America. The industrial growth and urbanization in these regions will drive the demand for steel, particularly in infrastructure and automotive sectors. By 2028, Asia-Pacific is expected to maintain its dominance, with significant contributions from India and China, where steel consumption will continue to rise.

Scope of the Report

|

By Product |

Flat Steel Long Steel Tubular Steel |

|

By Production Process |

Basic Oxygen Furnace (BOF) Electric Arc Furnace (EAF) Direct Reduced Iron (DRI) |

|

By Region |

North America Europe APAC Latin America MEA |

|

By Application |

Construction Automotive Machinery |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Steel Manufacturers

Automotive Manufacturers

Construction Companies

Industrial Machinery Manufacturers

Government and Regulatory Bodies (e.g., U.S. EPA, European Commission)

Investment and Venture Capitalist Firms

Renewable Energy Companies

Infrastructure Development Agencies

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report

ArcelorMittal

Nippon Steel Corporation

China Baowu Steel Group

POSCO

Tata Steel

JFE Steel Corporation

Hyundai Steel

United States Steel Corporation

Severstal

Nucor Corporation

Table of Contents

1. Global Iron and Steel Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Iron and Steel Market Size (in USD Trillion), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Iron and Steel Market Analysis

3.1. Growth Drivers

3.1.1. Infrastructure Development in Emerging Economies

3.1.2. Automotive Industry Expansion

3.1.3. Renewable Energy Projects

3.2. Restraints

3.2.1. High Raw Material Costs

3.2.2. Stringent Environmental Regulations

3.2.3. Labor Shortages

3.3. Opportunities

3.3.1. Adoption of Green Steel Technologies

3.3.2. Increased Digitalization and Automation

3.3.3. Expansion in Emerging Markets

3.4. Trends

3.4.1. Adoption of Hydrogen-Based Steelmaking

3.4.2. Growing Use of Scrap-Based Steel Production

3.4.3. Integration of AI and IoT in Steel Manufacturing

3.5. Government Regulations

3.5.1. Indias National Steel Policy 2024

3.5.2. European Unions Green Steel Initiative

3.5.3. U.S. Infrastructure Investment and Jobs Act

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. Global Iron and Steel Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Flat Steel

4.1.2. Long Steel

4.1.3. Tubular Steel

4.2. By Application (in Value %)

4.2.1. Construction

4.2.2. Automotive

4.2.3. Machinery

4.3. By Production Process (in Value %)

4.3.1. Basic Oxygen Furnace (BOF)

4.3.2. Electric Arc Furnace (EAF)

4.3.3. Direct Reduced Iron (DRI)

4.4. By Region (in Value %)

4.4.1. Asia-Pacific

4.4.2. North America

4.4.3. Europe

4.4.4. Latin America

4.4.5. MEA

5. Global Iron and Steel Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. ArcelorMittal

5.1.2. Nippon Steel Corporation

5.1.3. China Baowu Steel Group

5.1.4. POSCO

5.1.5. Tata Steel

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global Iron and Steel Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global Iron and Steel Market Regulatory Framework

7.1. Environmental and Sustainability Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Global Iron and Steel Market Future Market Size (in USD Trillion), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global Iron and Steel Market Future Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Application (in Value %)

9.3. By Production Process (in Value %)

9.4. By Region (in Value %)

10. Global Iron and Steel Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables

Creating an ecosystem framework for all major entities within the Global Iron and Steel Market. This step involves desk research using a combination of secondary and proprietary databases to gather comprehensive industry-level information, identify market trends, and understand the competitive landscape.

Step 2: Market Building

Gathering and analyzing statistics on the Global Iron and Steel Market over the years, including production capacities, market shares, and sales data. This data is used to accurately compute the revenue generated within the market. Rigorous quality checks are conducted to ensure the reliability of data points shared.

Step 3: Validating and Finalizing

Developing market hypotheses and conducting interviews with industry experts and stakeholders from leading companies in the iron and steel market. These interviews validate the collected data, refine market forecasts, and provide operational and financial insights directly from industry representatives.

Step 4: Research Output

Engaging with multiple key players in the iron and steel industry to understand product segments, customer needs, sales patterns, and market challenges. A bottom-up approach is used to validate the data, ensuring that the final statistics and insights accurately reflect market conditions and support strategic decision-making.

Frequently Asked Questions

1. How big is the global iron and steel market?

The global iron and steel market reached a valuation of USD 1700 billion in 2023, driven by strong demand across multiple industries, including construction, automotive, and manufacturing.

2. What are the challenges in the global iron and steel market?

Challenges in the global iron and steel market include rising raw material costs, stringent environmental regulations, and labor shortages. These factors contribute to increased operational expenses and put pressure on profit margins for industry players.

3. Who are the major players in the global iron and steel market?

Key players in the global iron and steel market include ArcelorMittal, Nippon Steel Corporation, China Baowu Steel Group, POSCO, and Tata Steel. These companies lead the market due to their extensive production capacities, technological advancements, and strategic global presence.

4. What are the growth drivers of the global iron and steel market?

The global iron and steel market is driven by infrastructure development in emerging economies, the expansion of the automotive industry, and the increasing investment in renewable energy projects, all of which demand large volumes of steel.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.