Global Kids Apparel Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD10980

December 2024

90

About the Report

Global Kids Apparel Market Overview

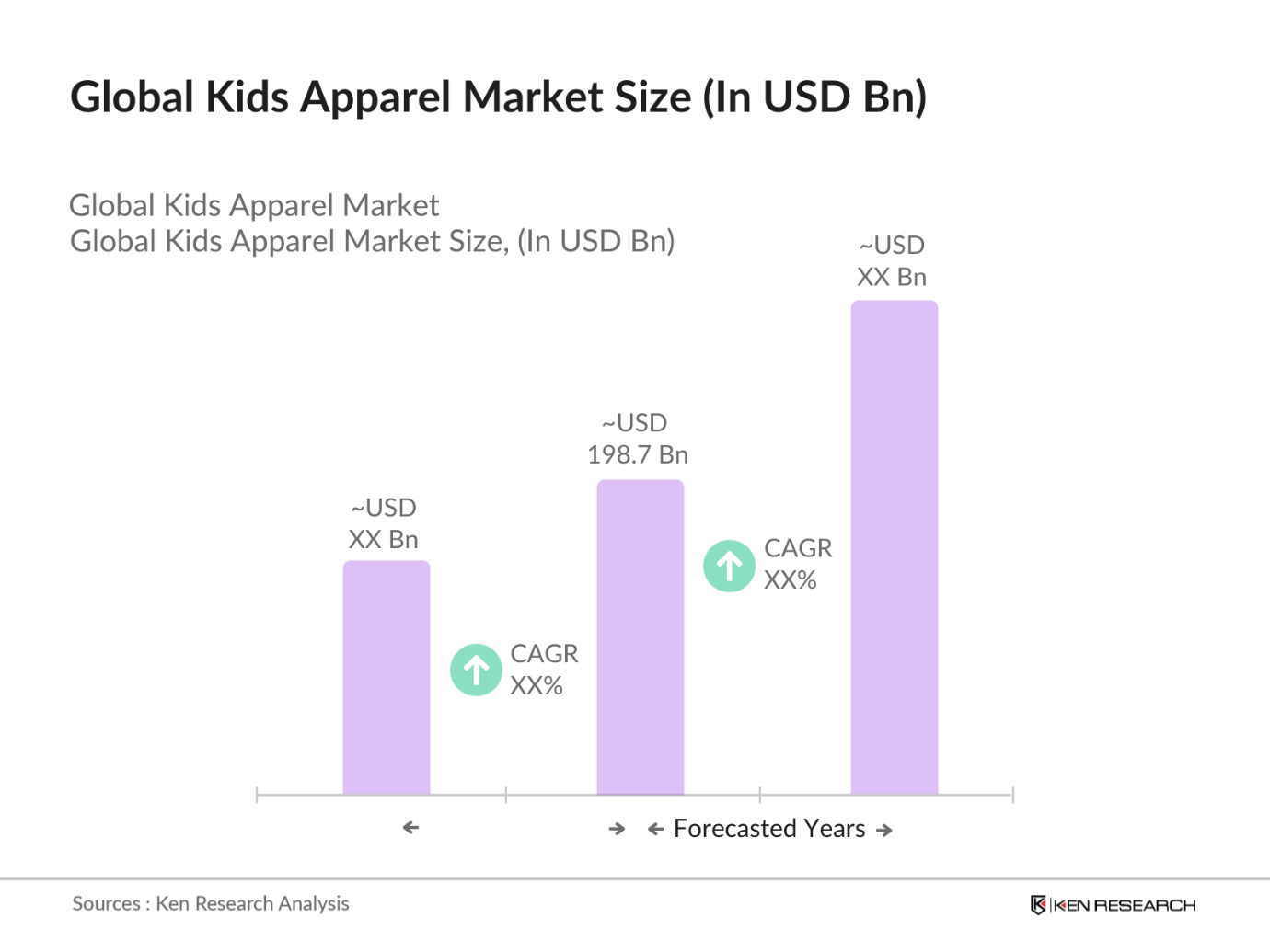

- The global kids apparel market is valued at USD 198.7 billion, driven by key factors such as the rise in disposable income among parents, increased spending on childrens clothing, and the growing awareness of fashion trends for kids. Additionally, the growing influence of social media and the increasing prevalence of online shopping have played a significant role in driving market growth. Brands are also focusing on offering eco-friendly and sustainable clothing, which is increasingly popular among conscious consumers. According to credible sources like Statista and Euromonitor, this market is highly competitive with a surge in demand for fashionable, comfortable, and practical clothing options for children.

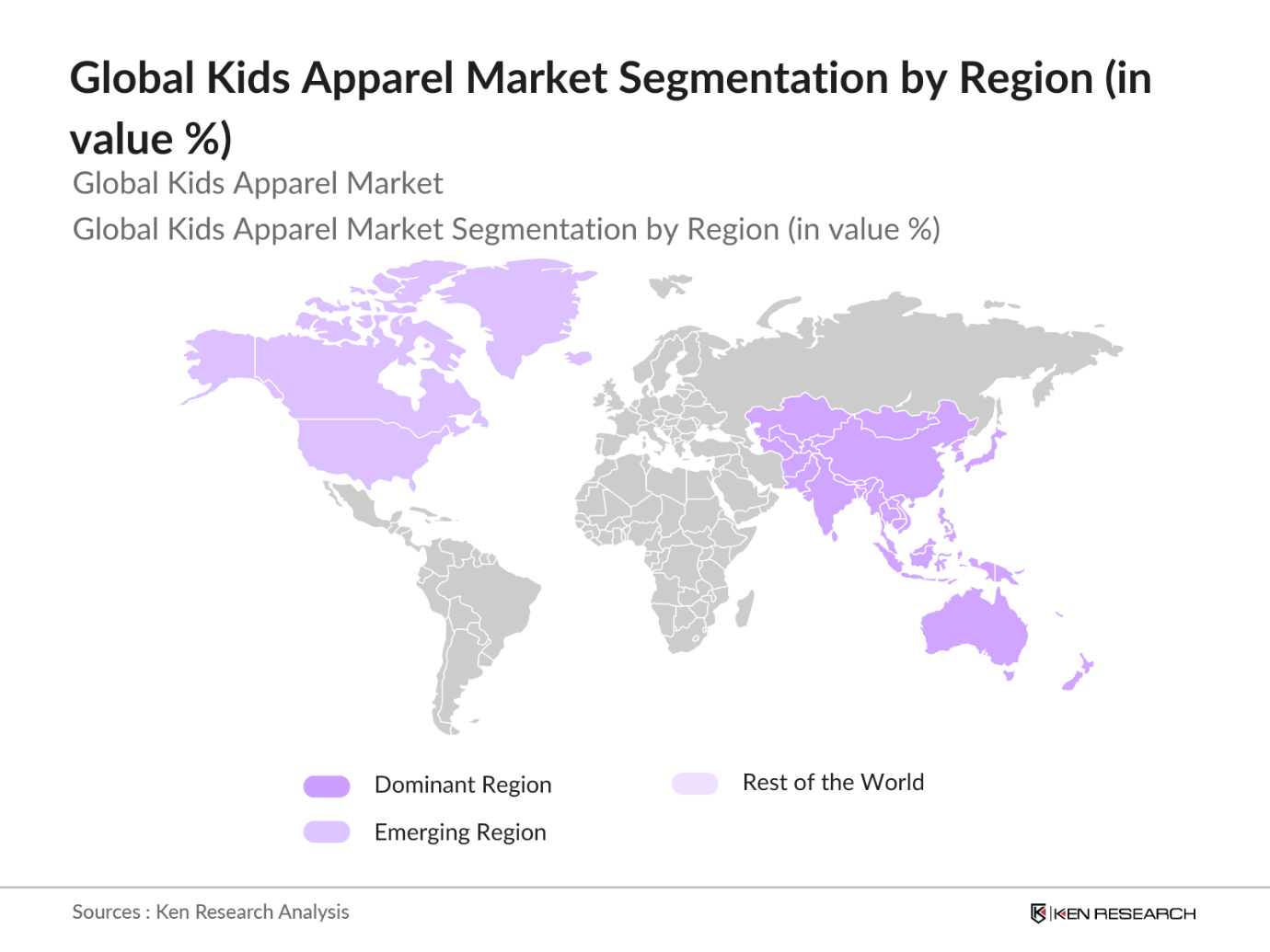

- Countries like the United States, China, and India dominate the kids apparel market due to their large population base, high birth rates, and rapid urbanization. In the United States, the dominance stems from the strong presence of leading global kids apparel brands and the widespread popularity of fast fashion. Chinas dominance is largely due to its massive consumer base, combined with the increasing trend of mini-me fashion, where parents and children wear matching outfits. Indias growing middle-class population and increased demand for western-style childrens clothing make it another significant player in this market. These countries also benefit from extensive retail distribution networks and evolving consumer preferences toward branded apparel.

- Governments around the world continue to enforce stringent safety standards for children's apparel. In 2023, the European Union introduced new regulations under the General Product Safety Directive (GPSD) that mandated stricter guidelines on flammability and choking hazards in kids' clothing. Similarly, the U.S. Consumer Product Safety Commission enforced regulations in 2024 requiring manufacturers to ensure all garments for children under five are free from toxic dyes and chemicals. These regulatory changes have necessitated rigorous compliance efforts by apparel manufacturers globally

Global Kids Apparel Market Segmentation

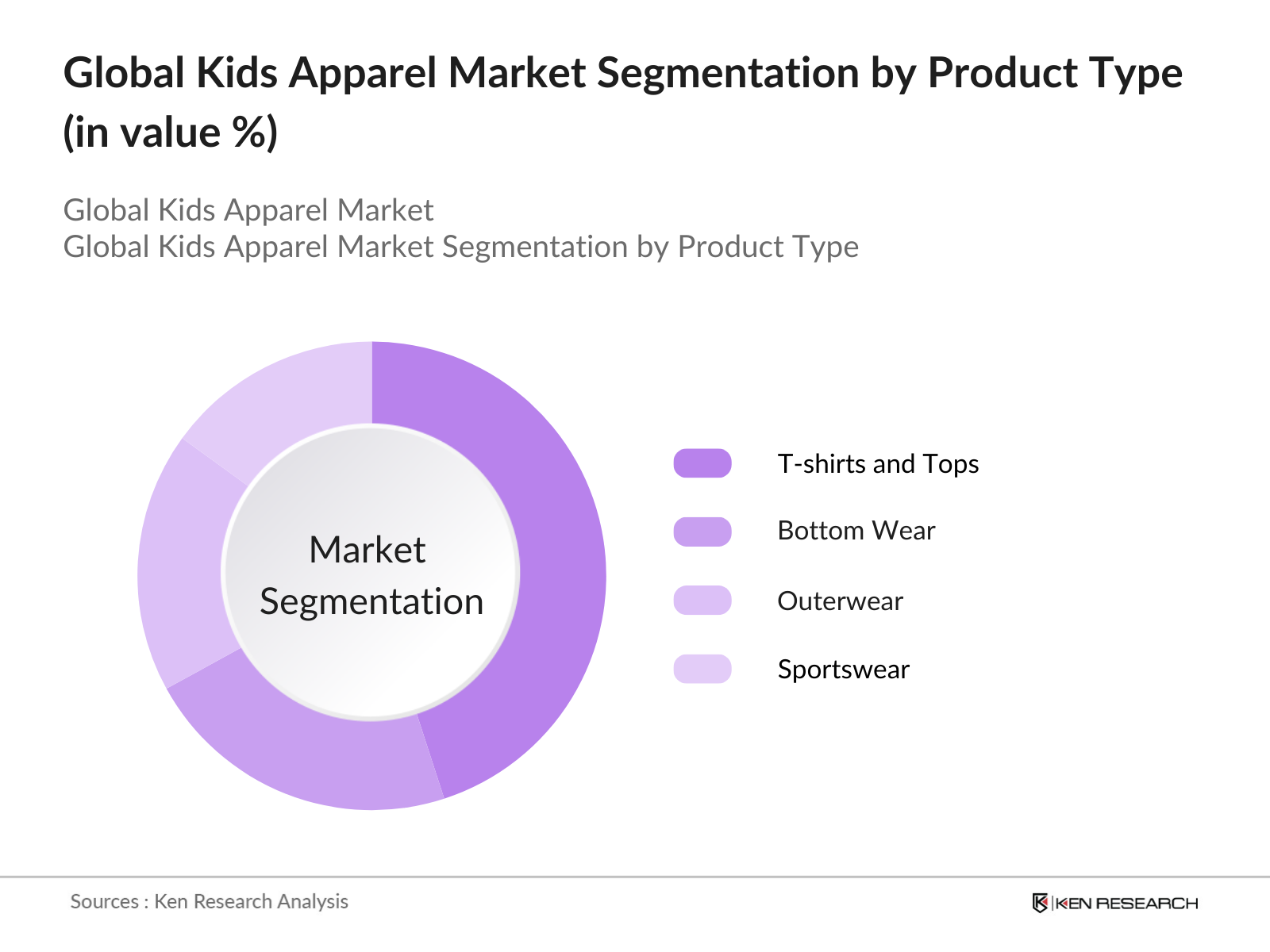

- By Product Type: The global kids apparel market is segmented by product type into t-shirts and tops, bottom wear (pants, skirts, shorts), outerwear (jackets, coats), sportswear, and sleepwear/loungewear. T-shirts and tops dominate the market due to their versatile nature and high demand for casual and comfortable wear, especially for younger children. This dominance is further driven by the affordability and high availability of this category across both online and offline retail channels. Brands like Carters and H&M capitalize on the growing demand for trendy and affordable t-shirts and tops, making this segment a key contributor to market growth.

- By Region: The global kids apparel market is segmented by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. Asia-Pacific leads the market due to its large child population and increasing disposable incomes in countries such as China and India. Furthermore, the region's growing demand for western-style clothing, coupled with the rapid expansion of online shopping platforms, has significantly contributed to its market dominance. Asia-Pacific also benefits from cost-effective manufacturing and increasing brand awareness, driving the overall growth of the kids apparel market in this region.

- By Distribution Channel: The kids apparel market is segmented by distribution channel into online retail, offline retail (department stores, supermarkets), specialty stores, and brand outlets. Online retail is currently leading the market due to the increasing penetration of e-commerce and convenience it offers to consumers. With the rise in smartphone usage and internet accessibility, parents prefer online shopping platforms like Amazon, Zara, and H&M for a wide range of choices, competitive pricing, and ease of shopping. The ability to compare prices, access exclusive online collections, and frequent promotional deals further enhance the dominance of online retail in the kids apparel market.

Global Kids Apparel Market Competitive Landscape

The global kids apparel market is characterized by the presence of both global and regional players. Brands such as Carters, Gap, H&M, and Zara are market leaders due to their wide distribution networks, strong brand presence, and ability to cater to changing consumer preferences. Additionally, smaller local brands are making their mark by focusing on sustainable clothing and ethical manufacturing practices.

Global Kids Apparel Industry Analysis

Growth Drivers

- Rising Disposable Income (Purchasing Power): The global rise in disposable income, especially in developing economies, has directly influenced consumer spending on kids' apparel. In India, for instance, the per capita income increased to $2,388 in 2024, up from $1,944 in 2022, according to the Ministry of Statistics and Programme Implementation. This surge in income has expanded the ability of middle-class families to spend more on premium children's apparel. The growth in household consumption expenditure, which increased by $75 billion globally from 2022 to 2024, reflects this trend, driving demand for higher-quality kids' fashion.

- Increase in Birth Rates in Developing Economies (Demographic Changes): Birth rates in developing regions continue to rise, contributing to heightened demand for kids' apparel. In Nigeria, the birth rate in 2023 was 36 births per 1,000 people, which has remained consistently high, reinforcing the expanding market for childrens clothing. Similarly, India saw 22 million births in 2023, supporting the demand for childrens apparel. As these countries represent significant populations, such demographic shifts fuel the need for affordable and durable childrens clothing.

- Shift Toward Sustainable Materials (Eco-conscious Consumer Demand): The growing trend toward sustainability is shaping consumer preferences in the kids' apparel sector. In 2024, a report from the UN Environment Programme highlighted that over 8.7 million tons of textile waste were generated globally in 2022, prompting shifts towards organic and recycled materials. Consumers increasingly prioritize eco-friendly products, with over 35% of global consumers seeking sustainably produced clothing for their children. This shift is visible in developed economies like the U.S. and Europe, where imports of organic cotton-based kids' apparel rose by 120,000 metric tons between 2022 and 2024.

Market Restraints

- Supply Chain Disruptions (Global Sourcing Challenges): Global supply chains for textiles, including kids' apparel, have faced significant disruptions in recent years. The COVID-19 pandemic and geopolitical conflicts in regions like Eastern Europe have strained logistics, with container freight rates from Asia to Europe peaking at $8,000 per 40-foot container in 2023, a 200% increase from pre-pandemic levels. This has delayed shipments and increased costs for manufacturers reliant on global supply chains, affecting product availability and pricing in several key markets.

- Fast Fashion Impact (Ethical and Environmental Issues): The proliferation of fast fashion has led to both ethical concerns and environmental degradation within the kids' apparel industry. In 2022, the fashion industry contributed 10% of global carbon emissions, according to the World Bank, exacerbated by the rapid production and disposal cycle of fast fashion. This environmental toll has triggered a consumer backlash, with parents increasingly opting for sustainable brands. The pressure on the industry to adopt more ethical production methods has grown, but many brands face difficulties balancing affordability with sustainability.

Global Kids Apparel Market Future Outlook

Over the next five years, the global kids apparel market is expected to see significant growth, driven by the increasing influence of fashion trends, rising disposable incomes, and a growing focus on sustainability. The demand for premium kids clothing, especially from eco-conscious parents, will continue to fuel the growth of the market. Additionally, the penetration of e-commerce, combined with technological advancements such as smart textiles and wearable technology, is expected to further boost market expansion.

Market Opportunities

- Expansion into Emerging Markets (Regional Growth Potential): Emerging markets present a significant growth opportunity for the kids' apparel industry. Countries like Vietnam and Indonesia have experienced rapid urbanization and rising middle-class populations, with Vietnam's urban population growing by 2 million people from 2022 to 2024, according to the UN. This urban expansion, coupled with increased disposable income, is driving demand for diverse kids' clothing styles. Moreover, governments in these regions are supporting domestic textile production, further stimulating market opportunities for international and local brands.

- E-commerce Penetration (Digital Sales Channels): The rise of e-commerce has reshaped how consumers purchase kids' apparel, with online retail channels expanding rapidly. In 2023, e-commerce sales for kids' clothing reached $12 billion globally, fueled by increased internet penetration and mobile device usage, especially in regions like Southeast Asia. Indonesia, for example, saw its online retail sales for apparel grow by 18% from 2022 to 2023, as smartphone usage in the country crossed 75% of the population. These digital platforms offer brands greater reach and convenience for consumers, propelling future sales growth.

Scope of the Report

|

By Product Type |

T-shirts and Tops Bottom Wear Outerwear Sportswear Sleepwear |

|

By Material Type |

Cotton Organic Cotton Polyester Wool Blended Fabrics |

|

By Distribution Channel |

Online Retail Offline Retail Specialty Stores Hypermarkets Direct Sales |

|

By Age Group |

Newborn Toddler Young Kids Pre-Teens |

|

By Region |

North America Europe, Asia-Pacific Middle East & Africa Latin America |

Products

Key Target Audience

Retail Chains and Distributors

Apparel Manufacturers

E-commerce Platforms

Sustainability Advocates

Fashion Designers

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Consumer Product Safety Commission)

Apparel Sourcing Agencies

Companies

Players Mentioned in the Report:

Carters

Gap Inc.

H&M

Zara

Adidas Kids

Nike Kids

Puma Kids

Ralph Lauren Kids

Burberry Children

Mothercare

Benetton Group

Gymboree

OshKosh Bgosh

Tommy Hilfiger Kids

The Childrens Place

Table of Contents

1. Global Kids Apparel Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Kids Apparel Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Kids Apparel Market Analysis

3.1. Growth Drivers

3.1.1. Rising Disposable Income (Purchasing Power)

3.1.2. Increase in Birth Rates in Developing Economies (Demographic Changes)

3.1.3. Shift Toward Sustainable Materials (Eco-conscious Consumer Demand)

3.1.4. Influence of Celebrity and Social Media Trends (Cultural Drivers)

3.2. Market Challenges

3.2.1. High Manufacturing Costs (Operational Constraints)

3.2.2. Supply Chain Disruptions (Global Sourcing Challenges)

3.2.3. Fast Fashion Impact (Ethical and Environmental Issues)

3.3. Opportunities

3.3.1. Expansion into Emerging Markets (Regional Growth Potential)

3.3.2. E-commerce Penetration (Digital Sales Channels)

3.3.3. Customization and Personalization (Product Innovation)

3.3.4. Partnerships with Retailers (Strategic Alliances)

3.4. Trends

3.4.1. Gender-neutral Apparel (Shifting Consumer Preferences)

3.4.2. Use of Organic and Recycled Fabrics (Sustainability Focus)

3.4.3. Mini-Me Fashion Trends (Parent-Child Matching Outfits)

3.4.4. Integration of Wearable Technology (Innovative Fabrics)

3.5. Government Regulation

3.5.1. Child Safety Regulations (Compliance Standards)

3.5.2. Labor Laws and Ethical Sourcing (Regulatory Framework)

3.5.3. Environmental Regulations on Apparel Manufacturing (Sustainability Compliance)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. Global Kids Apparel Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. T-shirts and Tops

4.1.2. Bottom Wear (Pants, Shorts, Skirts)

4.1.3. Outerwear (Jackets, Coats)

4.1.4. Sportswear and Activewear

4.1.5. Sleepwear and Loungewear

4.2. By Material Type (In Value %)

4.2.1. Cotton

4.2.2. Organic Cotton

4.2.3. Polyester

4.2.4. Wool and Fleece

4.2.5. Blended Fabrics

4.3. By Distribution Channel (In Value %)

4.3.1. Online Retail

4.3.2. Offline Retail (Department Stores, Supermarkets)

4.3.3. Specialty Stores

4.3.4. Hypermarkets and Discount Stores

4.3.5. Direct Sales/Brand Outlets

4.4. By Age Group (In Value %)

4.4.1. Newborn (0-12 Months)

4.4.2. Toddler (1-3 Years)

4.4.3. Young Kids (4-8 Years)

4.4.4. Pre-Teens (9-12 Years)

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

5. Global Kids Apparel Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Carters Inc.

5.1.2. Gap Inc. (Baby Gap, Old Navy)

5.1.3. H&M Group

5.1.4. The Childrens Place

5.1.5. Zara Kids

5.1.6. Adidas Kids

5.1.7. Nike Kids

5.1.8. Puma Kids

5.1.9. Ralph Lauren Kids

5.1.10. Mothercare

5.1.11. Benetton Group

5.1.12. Gymboree

5.1.13. OshKosh Bgosh

5.1.14. Tommy Hilfiger Kids

5.1.15. Burberry Children

5.2. Cross Comparison Parameters (Revenue, Global Footprint, Sustainability Practices, Ethical Sourcing, Product Range, Digital Presence, Customization Options, Marketing Strategies)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Private Equity Funding

5.8. Government Incentives

6. Global Kids Apparel Market Regulatory Framework

6.1. Consumer Product Safety Requirements (Child Apparel)

6.2. Environmental Compliance in Apparel Manufacturing

6.3. Trade Tariffs and Import Duties

7. Global Kids Apparel Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Kids Apparel Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Material Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Age Group (In Value %)

8.5. By Region (In Value %)

9. Global Kids Apparel Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Behavior Insights

9.3. Brand Positioning Strategies

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This phase involved constructing a comprehensive stakeholder ecosystem map within the global kids apparel market. Extensive desk research, combined with the use of proprietary databases, helped identify the primary variables influencing the market, including consumer behavior and emerging trends.

Step 2: Market Analysis and Construction

In this step, historical data was collected and analyzed to assess market penetration and distribution channels. The collected data was further cross-verified through proprietary research and market studies to ensure accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through expert interviews with industry leaders and key decision-makers. These insights were instrumental in refining the market estimates and projections.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing the collected data with insights from manufacturers and distributors to provide a holistic market outlook. This validated approach ensured the reliability of the market projections and identified key growth opportunities in the global kids apparel market.

Frequently Asked Questions

01. How big is the global kids apparel market?

The global kids apparel market was valued at USD 198.7 billion, driven by increased consumer spending on childrens clothing and the growing influence of fashion trends.

02. What are the challenges in the global kids apparel market?

Challenges include high manufacturing costs, supply chain disruptions, and the increasing emphasis on ethical and sustainable sourcing, which can drive up production costs.

03. Who are the major players in the global kids apparel market?

Key players in the market include Carters, Gap Inc., H&M, Zara, and The Childrens Place, which dominate due to their extensive distribution networks and strong brand presence.

04. What are the growth drivers of the global kids apparel market?

The market is propelled by rising disposable incomes, increased birth rates in developing economies, and the growing trend of sustainable and eco-friendly kids clothing.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.