Global Knitted Fabric Market Outlook to 2030

Region:Global

Author(s):Naman Rohilla

Product Code:KROD7193

December 2024

100

About the Report

Global Knitted Fabric Market Overview

- The global knitted fabric market is valued at USD 28 billion based on a five-year historical analysis. The market is driven by the increasing demand for knitted fabrics in diverse applications such as apparel, home textiles, industrial textiles, and technical textiles. The introduction of advanced knitting technologies and the growing preference for sustainable and comfortable clothing options further fuel the growth of this market. Major global brands are incorporating knitted fabrics in their product lines, thereby enhancing the markets prominence.

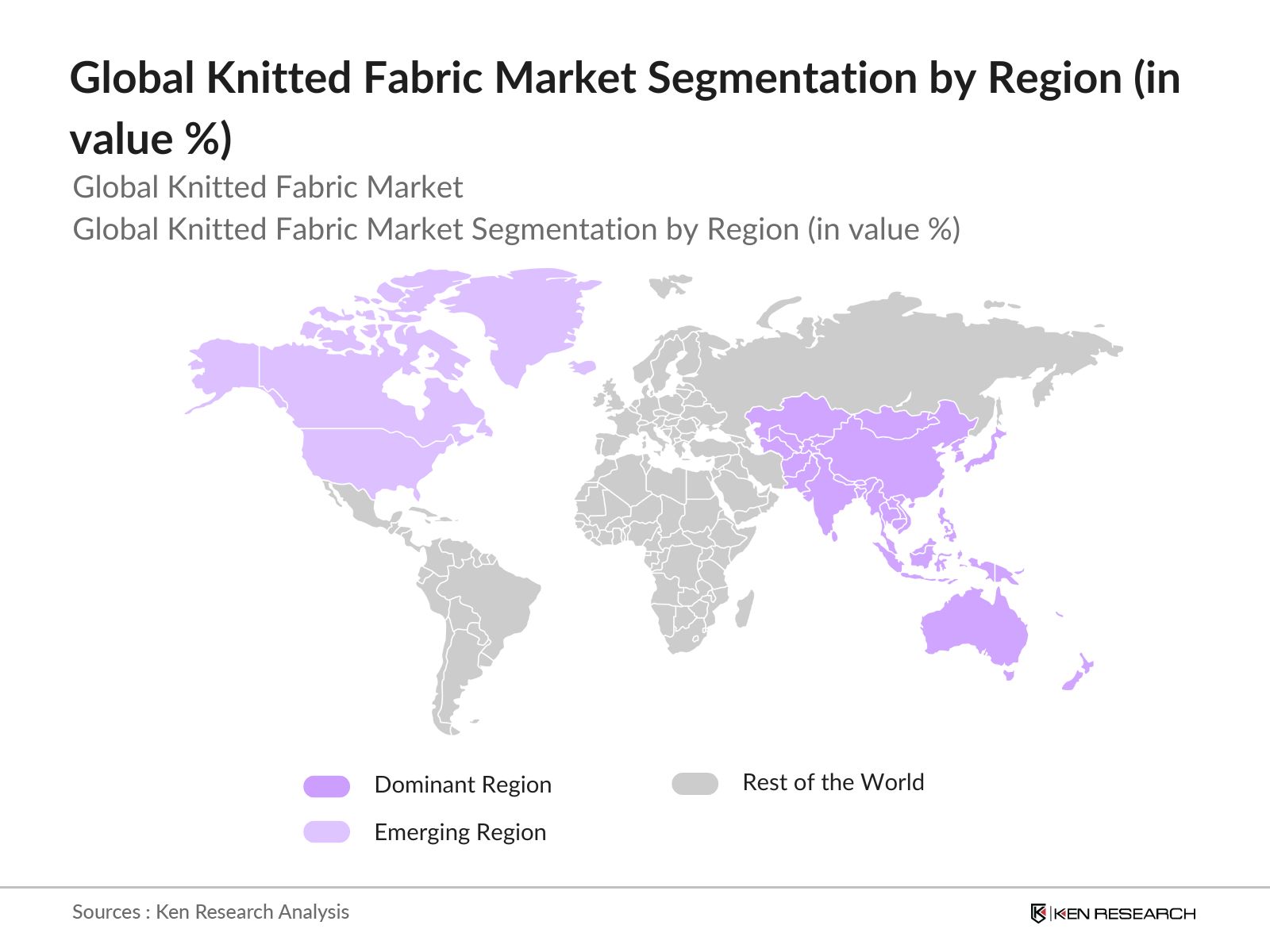

- Countries like China, India, and Bangladesh dominate the knitted fabric market due to their well-established textile manufacturing industries, availability of raw materials, and cost-effective labor. China, in particular, benefits from government support and large-scale investments in textile technology. These countries also have strong supply chain networks, which contribute to their dominance in the global market. Additionally, the growing trend of "Made in China" and "Made in India" textiles is reinforcing the position of these countries.

- Government regulations related to textile standards and certifications have a major impact on the knitted fabric market. In 2023, more than 60% of the textile products in the European Union had to comply with stringent standards like OEKO-TEX and GOTS, ensuring that fabrics are free from harmful substances and meet specific environmental criteria. These certifications help manufacturers meet the growing consumer demand for eco-friendly and ethically produced fabrics, especially in developed markets such as Europe and North America.

Global Knitted Fabric Market Segmentation

- By Application: The market is segmented by application into apparel, home textiles, industrial textiles, medical textiles, and sportswear. Apparel dominates the application segment due to the increasing demand for comfortable and stretchable fabrics. The fashion industry's evolving needs, along with the rise in demand for activewear and athleisure, drive the growth of this sub-segment. Sportswear and medical textiles are also gaining traction due to their specialized applications in high-performance and technical environments.

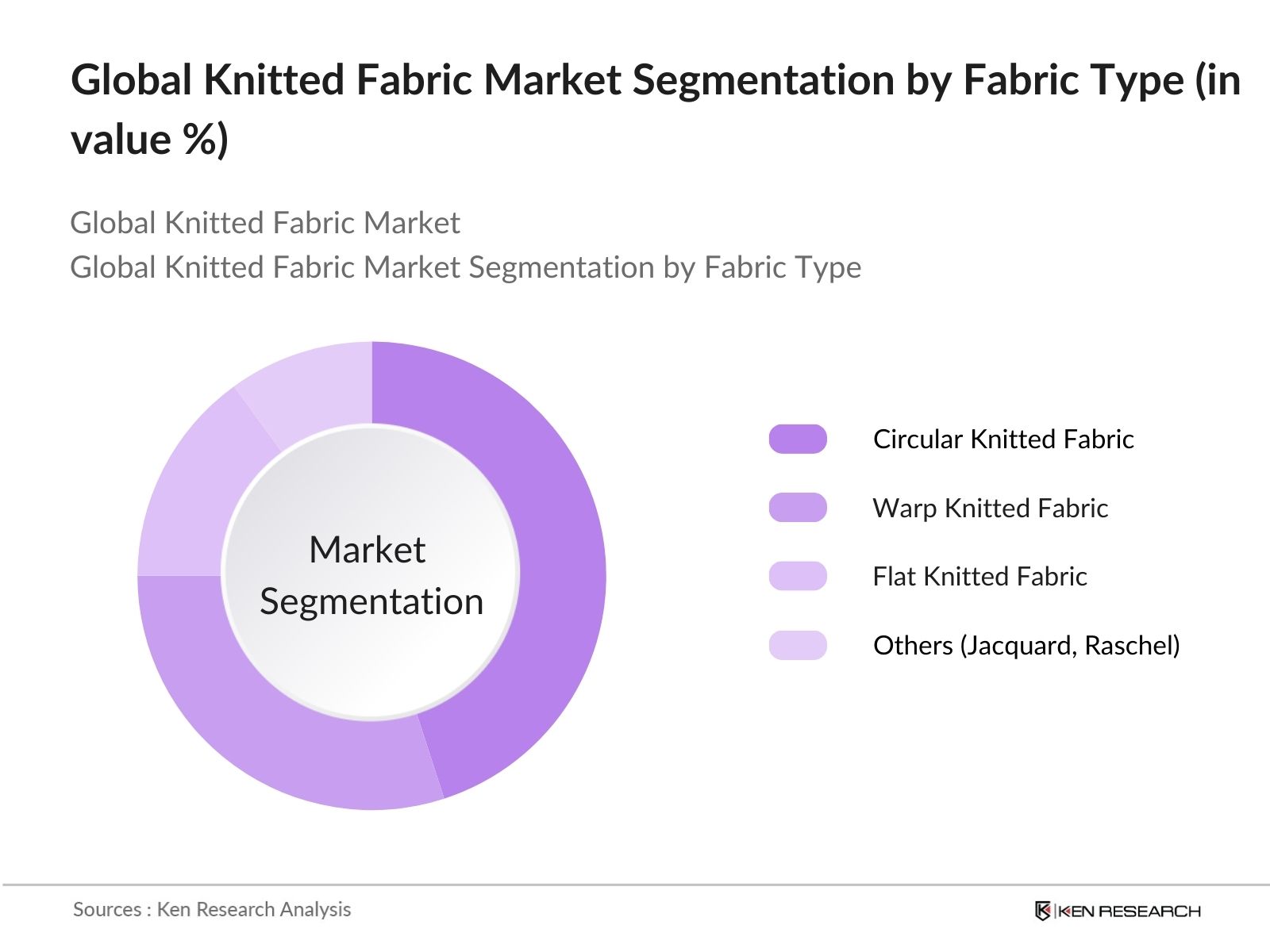

- By Fabric Type: The global knitted fabric market is segmented by fabric type into circular knitted fabric, warp knitted fabric, flat knitted fabric, and others (such as Jacquard and Raschel fabrics). Circular knitted fabric holds the largest market share due to its widespread application in the apparel and fashion industries. The versatility of circular knitted fabrics in creating seamless garments and its high production efficiency makes it the dominant segment in terms of fabric type.

- By Region: The global knitted fabric market is geographically segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Asia Pacific dominates the regional segment, primarily due to China and India's large-scale production capacities and advanced textile manufacturing processes. The region benefits from lower production costs and strong export-oriented industries, which contribute to its leading market share. Additionally, the growing domestic demand for high-quality textiles in these countries reinforces their dominance in the global market.

Global Knitted Fabric Market Competitive Landscape

The global knitted fabric market is dominated by several major players, both from established markets like China and emerging ones such as India and Bangladesh. These companies operate with large-scale production capabilities, strong supply chain networks, and innovation-driven manufacturing practices.

|

Company Name |

Established Year |

Headquarters |

Product Portfolio |

R&D Investment |

Market Presence |

Global Reach |

Manufacturing Facilities |

Sustainability Initiatives |

Strategic Partnerships |

|

Toray Industries |

1926 |

Japan |

- |

- |

- |

- |

- |

- |

- |

|

Shandong RuYi Technology |

1972 |

China |

- |

- |

- |

- |

- |

- |

- |

|

Fulgar SPA |

1978 |

Italy |

- |

- |

- |

- |

- |

- |

- |

|

Apex Mills Corporation |

1943 |

USA |

- |

- |

- |

- |

- |

- |

- |

|

Eclat Textile Co. Ltd. |

1977 |

Taiwan |

- |

- |

- |

- |

- |

- |

- |

Global Knitted Fabric Market Analysis

Global Knitted Fabric Market Growth Drivers

- Demand from Apparel Industry: The apparel industry continues to drive the demand for knitted fabrics due to increasing consumer spending on clothing worldwide. The demand for comfortable and flexible garments, particularly activewear and casualwear, has escalated due to changing lifestyle trends. For example, the U.S. consumer expenditure on apparel amounted to $230 billion in 2023, indicating a consistent rise in demand for high-quality knitted fabrics in the textile sector.

- Rising Preference for Comfort in Textiles: Consumer preferences are shifting towards more comfortable and versatile fabrics, with knitted textiles offering breathability, stretch, and softness. A survey by the International Textile Manufacturers Federation in 2023 revealed that 65% of respondents preferred knitted fabrics for casual and sportswear due to their superior comfort. Furthermore, the demand for these fabrics has spurred growth in emerging markets, especially in China and India, where apparel manufacturers are investing heavily in knitting technologies to meet the growing consumer demand for comfort-based clothing.

- Sustainability Initiatives and Recyclable Fabrics: The global shift towards sustainability is encouraging the adoption of eco-friendly materials in knitted fabric production. Initiatives like the European Union's Green Deal, aimed at reducing textile waste, are pushing manufacturers to focus on recyclable and biodegradable fabrics. In 2023, nearly 20% of textiles produced in the EU contained recycled materials, showing an increase from 15% in 2022. These developments align with global environmental policies, making knitted fabrics a key player in the circular economy.

Global Knitted Fabric Market Challenges

Volatile Raw Material Prices: The knitted fabric market faces challenges due to fluctuating raw material prices, particularly cotton and synthetic fibers. According to the World Bank, cotton prices fluctuated between $1.25 and $1.35 per kilogram in 2023, largely driven by supply chain disruptions in major cotton-producing countries like India and the U.S. The unpredictability in raw material prices impacts manufacturers' profit margins, particularly for small and medium-sized enterprises (SMEs), who rely heavily on consistent supply and stable prices to maintain production efficiency.

High Production Costs: The cost of production in the knitted fabric industry remains high, primarily due to the rising energy costs and wages in textile-manufacturing hubs like China and Bangladesh. In 2023, labor costs in China rose by 8%, while energy costs for textile factories increased by 10% in Bangladesh, according to the International Labor Organization (ILO). These increased operational costs reduce profitability for manufacturers, especially for those that do not have access to advanced automation technologies.

Global Knitted Fabric Market Future Outlook

Over the next five years, the global knitted fabric market is expected to witness growth, driven by increasing demand for sustainable and comfortable fabrics, advancements in knitting technology, and the rising popularity of technical textiles. Key industry players are expected to focus on innovation, eco-friendly production processes, and expanding their footprint in emerging markets to capitalize on the growing demand for knitted fabrics across various applications.

Global Knitted Fabric Market Opportunities

- Growth in E-commerce and Fast Fashion: The rise of e-commerce platforms has boosted the demand for knitted fabrics, particularly in fast fashion, where quick turnaround times are crucial. Global online apparel sales reached $700 billion in 2023, driven by increased internet penetration and mobile shopping. This shift has encouraged manufacturers to focus on fast production techniques using knitted fabrics to meet the dynamic demands of the fashion industry. The growing e-commerce industry in emerging economies, especially in Southeast Asia and Latin America, presents a lucrative opportunity for knitted fabric producers.

- Expansion into Emerging Markets: Emerging markets, such as Vietnam, Indonesia, and Ethiopia, are becoming key players in the global textile industry due to favorable government policies and lower production costs. In 2023, Vietnams textile exports grew by 9%, reaching $40 billion, with knitted fabrics accounting for a substantial portion of this growth. These markets offer competitive labor costs and are attracting foreign investment from textile giants in Europe and the U.S. Expanding production into these regions allows knitted fabric manufacturers to reduce costs while meeting global demand.

|

Fabric Type |

Circular Knitted Fabric Warp Knitted Fabric Flat Knitted Fabric Others (Jacquard, Raschel) |

|

Application |

Apparel Home Textiles Industrial Medical Sportswear |

|

Technology |

Weft Knitting Warp Knitting |

|

Material |

Cotton Polyester Nylon Wool Blended Materials |

|

Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Textile Manufacturers

Apparel Brands

Home Textile Companies

Industrial Textile Users

Banks and Financial Institutions

Medical Textile Providers

Sportswear Manufacturers

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Ministries of Textiles, Environmental Compliance Agencies)

Companies

Players Mentioned in the Report

Toray Industries

Shandong RuYi Technology Group

China Textile Co.

Hyosung TNC

Weiqiao Textile Company Limited

Fulgar SPA

Texhong Textile Group

Huafu Top Dyed Melange Yarn Co. Ltd.

Apex Mills Corporation

Eclat Textile Co. Ltd.

Table of Contents

1. Global Knitted Fabric Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Knitted Fabric Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Knitted Fabric Market Analysis

3.1. Growth Drivers

3.1.1. Demand from Apparel Industry

3.1.2. Technological Advancements in Knitting Machines

3.1.3. Rising Preference for Comfort in Textiles

3.1.4. Sustainability Initiatives and Recyclable Fabrics

3.2. Market Challenges

3.2.1. Volatile Raw Material Prices

3.2.2. High Production Costs

3.2.3. Market Fragmentation

3.3. Opportunities

3.3.1. Growth in E-commerce and Fast Fashion

3.3.2. Expansion into Emerging Markets

3.3.3. Technological Integration (AI and IoT) in Knitting

3.4. Trends

3.4.1. Increasing Demand for Functional and Technical Fabrics

3.4.2. Customization and Personalization Trends in Fabric Production

3.4.3. Sustainable Knitting Technologies

3.5. Government Regulation

3.5.1. Textile Standards and Certifications

3.5.2. Environmental Compliance for Manufacturers

3.5.3. Import and Export Regulations

3.6. SWOT Analysis

3.7. Value Chain Analysis (Raw Material Suppliers, Manufacturers, Retailers)

3.8. Porters Five Forces

3.8.1. Bargaining Power of Suppliers

3.8.2. Bargaining Power of Buyers

3.8.3. Threat of New Entrants

3.8.4. Threat of Substitutes

3.8.5. Intensity of Competitive Rivalry

3.9. Competition Ecosystem

4. Global Knitted Fabric Market Segmentation

4.1. By Fabric Type (In Value %)

4.1.1. Circular Knitted Fabric

4.1.2. Warp Knitted Fabric

4.1.3. Flat Knitted Fabric

4.1.4. Others (Jacquard, Raschel)

4.2. By Application (In Value %)

4.2.1. Apparel

4.2.2. Home Textiles

4.2.3. Industrial

4.2.4. Medical

4.2.5. Sportswear

4.3. By Technology (In Value %)

4.3.1. Weft Knitting

4.3.2. Warp Knitting

4.4. By Material (In Value %)

4.4.1. Cotton

4.4.2. Polyester

4.4.3. Nylon

4.4.4. Wool

4.4.5. Blended Materials

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Knitted Fabric Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Toray Industries

5.1.2. Shandong RuYi Technology Group

5.1.3. China Textile Co.

5.1.4. Hyosung TNC

5.1.5. Weiqiao Textile Company Limited

5.1.6. Fulgar SPA

5.1.7. Texhong Textile Group

5.1.8. Huafu Top Dyed Melange Yarn Co. Ltd.

5.1.9. Apex Mills Corporation

5.1.10. Eclat Textile Co. Ltd.

5.1.11. Santana Textiles

5.1.12. South Asia Textiles Ltd.

5.1.13. Zhejiang Jinda Holding Group

5.1.14. Luthai Textile Co. Ltd.

5.1.15. Nishat Mills Ltd.

5.2. Cross Comparison Parameters (Product Portfolio, Market Presence, Revenue, Number of Employees, Manufacturing Facilities, R&D Investments, Sustainability Practices, Global Reach)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Collaborations, Joint Ventures)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Private Equity and Venture Capital Involvement)

5.7. Government Incentives

6. Global Knitted Fabric Market Regulatory Framework

6.1. Compliance Standards

6.2. Certifications Required (OEKO-TEX, Global Organic Textile Standard, etc.)

6.3. Environmental Regulations for Textile Manufacturers

7. Global Knitted Fabric Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Knitted Fabric Future Market Segmentation

8.1. By Fabric Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Material (In Value %)

8.5. By Region (In Value %)

9. Global Knitted Fabric Market Analyst's Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Innovation and Product Development Opportunities

9.3. Market Entry Strategies

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, an ecosystem map of the knitted fabric market was developed. This involved identifying major stakeholders such as fabric manufacturers, raw material suppliers, and textile designers. Extensive secondary research was conducted to outline critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

Historical data was compiled and analyzed to evaluate market penetration, product adoption, and sales figures. This step also involved the collection of data on revenue generation, supply chain efficiency, and customer preferences.

Step 3: Hypothesis Validation and Expert Consultation

Interviews were conducted with key industry experts and professionals from leading companies in the knitted fabric industry. These consultations helped validate the market hypotheses, refining the accuracy of the data collected and gaining operational insights.

Step 4: Research Synthesis and Final Output

Final insights were synthesized through direct engagement with manufacturers. Key data points on product segmentation, market trends, and consumer behavior were analyzed, providing a comprehensive view of the knitted fabric market's future trajectory.

Frequently Asked Questions

01. How big is the global knitted fabric market?

The global knitted fabric market is valued at USD 28 billion, driven by the increasing demand for comfortable and sustainable textiles across various applications.

02. What are the challenges in the knitted fabric market?

Challenges in the global knitted fabric market include fluctuating raw material prices, high production costs, and the need for technological innovation to meet increasing demand for functional textiles.

03. Who are the major players in the global knitted fabric market?

Major players in the global knitted fabric market include Toray Industries, Shandong RuYi Technology Group, Hyosung TNC, Weiqiao Textile Company, and Fulgar SPA, among others.

04. What are the growth drivers of the knitted fabric market?

The growth of the global knitted fabric market is driven by rising demand for comfortable fabrics, advancements in knitting technology, and increasing interest in sustainable textile production.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.