Global Kombucha Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD5341

December 2024

89

About the Report

Global Kombucha Market Overview

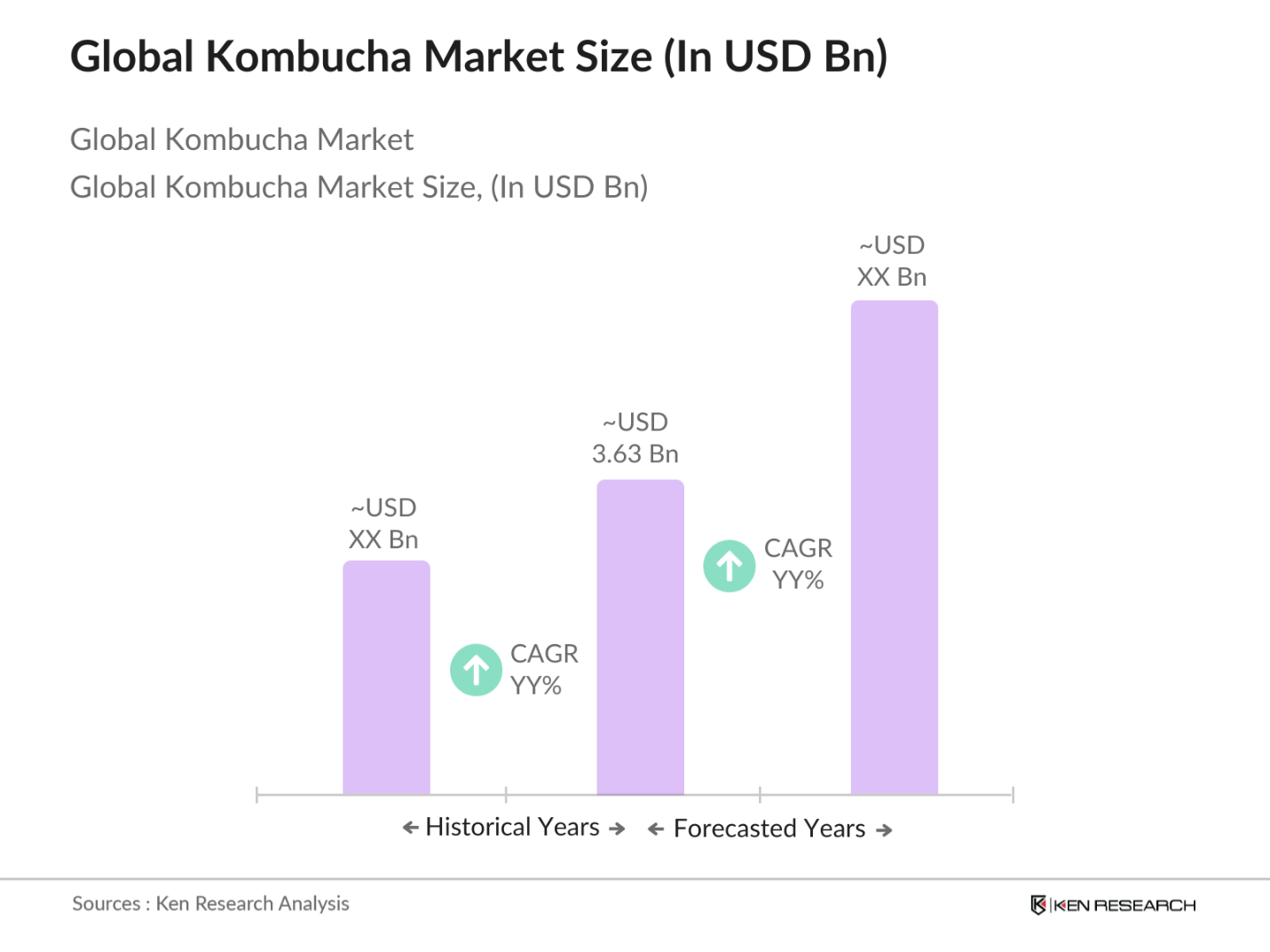

- The global kombucha market is valued at approximately USD 3.63 billion, driven by increasing consumer awareness regarding health and wellness. Kombucha, known for its probiotic content and digestive health benefits, has gained popularity as a healthier alternative to traditional soft drinks. This demand is further boosted by the rise of functional beverages, where consumers seek added health benefits from everyday drinks. The market growth is also propelled by product innovations, including organic, low-sugar, and flavored variants that cater to evolving consumer preferences.

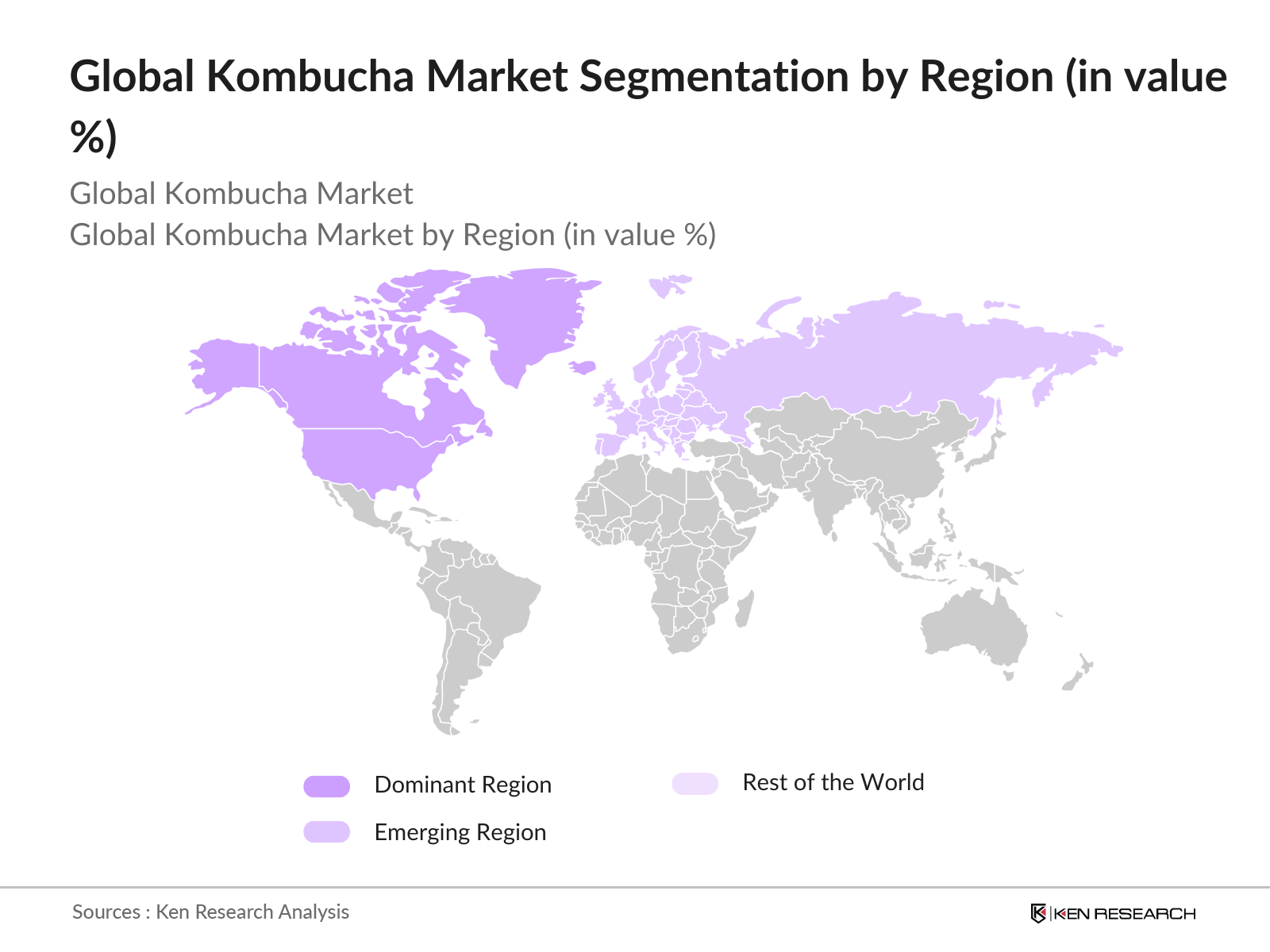

- North America, particularly the U.S., and Western Europe dominate the kombucha market due to their strong health-conscious consumer bases and the presence of key market players. The U.S. is home to major kombucha manufacturers such as GTs Living Foods and Health-Ade Kombucha, which have extensive distribution networks across retail and e-commerce channels. In Europe, Germany and the U.K. lead market consumption due to the growing trend of organic and functional beverages in these countries, supported by high consumer demand for probiotic products.

- Kombucha products marketed as organic must meet stringent certification standards. According to the U.S. Department of Agriculture (USDA), organic certification requires products to be made from ingredients grown without synthetic fertilizers or pesticides. In 2023, organic food and beverage sales in the U.S. exceeded $60 billion, with Kombucha contributing significantly to this figure due to its organic label appeal.

Global Kombucha Market Segmentation

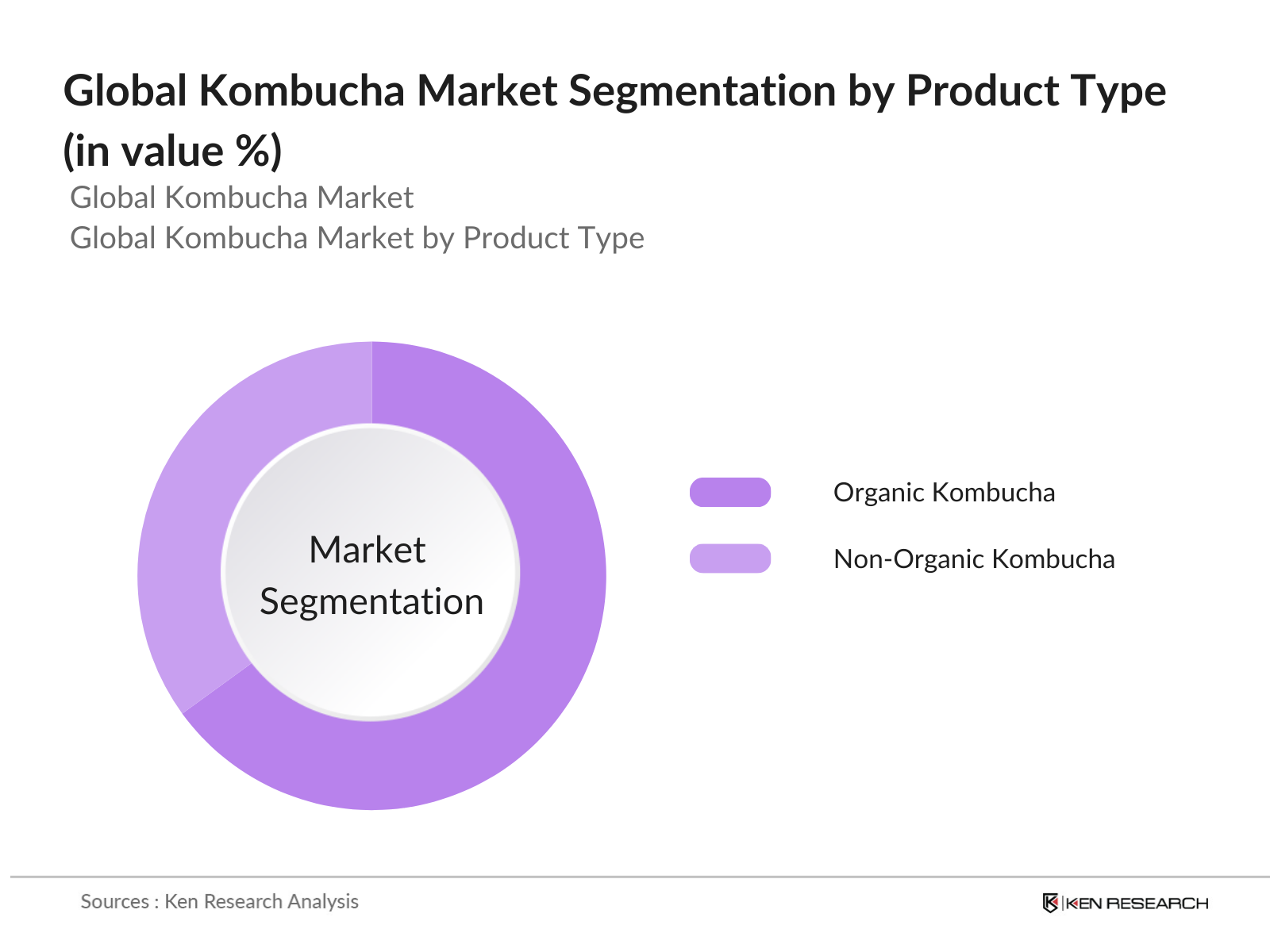

By Product Type: The global kombucha market is segmented by product type into organic kombucha and non-organic kombucha. Organic kombucha holds the dominant market share, attributed to the growing consumer preference for clean-label and organic beverages. As consumers become more conscious of their health and the ingredients in their food and beverages, organic kombucha, made from sustainably sourced ingredients, is seen as a premium option. Furthermore, regulatory certifications for organic products add to the perceived value of these beverages, driving their demand.

By Region: The kombucha market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, driven by the high awareness of health benefits associated with kombucha and a well-established market presence. The U.S. is a significant contributor, with large-scale production facilities and strong distribution channels. Moreover, the increasing trend of clean-label beverages has propelled the market further. Europe follows closely behind, with countries like Germany leading due to rising consumer preference for fermented beverages.

Global Kombucha Market Competitive Landscape

The kombucha market is dominated by a few key players who have established a significant presence through product innovation, marketing strategies, and distribution networks. These players continuously engage in collaborations, acquisitions, and partnerships to strengthen their market positions and expand into new geographies. Additionally, the competitive landscape is shaped by strong brand loyalty among consumers and the introduction of new flavors and functional ingredients.

|

Company Name |

Established |

Headquarters |

Product Range |

Distribution Strategy |

Innovation |

Revenue (2023) |

Market Presence |

No. of Employees |

|

GTs Living Foods |

1995 |

Los Angeles, USA |

- |

- |

- |

- |

- |

- |

|

Health-Ade Kombucha |

2012 |

Los Angeles, USA |

- |

- |

- |

- |

- |

- |

|

Brew Dr. Kombucha |

2008 |

Portland, USA |

- |

- |

- |

- |

- |

- |

|

PepsiCo (KeVita) |

2009 |

Purchase, USA |

- |

- |

- |

- |

- |

- |

|

Remedy Kombucha |

2012 |

Melbourne, Australia |

- |

- |

- |

- |

- |

- |

Global Kombucha Market Analysis

Market Growth Drivers

- Health and Wellness Trends: The global rise in health consciousness has driven the growth of the Kombucha market. According to the World Health Organization (WHO), non-communicable diseases (NCDs), such as heart disease and diabetes, are a leading cause of death globally, urging consumers to prioritize preventive healthcare. As a result, there is increasing demand for functional beverages like Kombucha, which contains probiotics and antioxidants known for their health benefits. In 2023, global healthcare expenditure reached over $8.5 trillion, with wellness and healthy lifestyle choices becoming central to many economies, boosting the demand for Kombucha.

- Rising Demand for Functional Beverages: Functional beverages are increasingly favored by consumers seeking enhanced health benefits from their food and drink. According to a 2024 report by the Food and Agriculture Organization (FAO), global consumption of functional beverages grew to 900 million liters. The Kombucha market benefits from this demand due to its perceived health benefits, including gut health support and detoxification. Consumer expenditure on functional drinks, especially in North America and Europe, is projected to increase, which further drives Kombucha's popularity as a functional drink choice.

- Growing Popularity of Probiotic Drinks: Probiotic beverages, including Kombucha, are becoming mainstream as consumers seek to improve their digestive health. The World Gastroenterology Organization (WGO) estimated that nearly 500 million people globally suffer from digestive issues, driving interest in probiotic consumption. With Kombucha being a natural source of probiotics, demand for probiotic drinks is significantly contributing to the markets growth. The global consumption of probiotic beverages has been steadily increasing, with sales reaching 200 million liters in 2023, according to the WGO.

Market Challenges

- High Costs of Organic Ingredients: The high cost of organic raw materials used in Kombucha production presents a significant challenge to market growth. Organic tea, sugar, and flavorings are considerably more expensive than conventional alternatives. According to the International Federation of Organic Agriculture Movements (IFOAM), the global organic ingredient market was valued at $105 billion in 2023, with prices steadily rising due to increasing demand and limited supply. These escalating costs are often passed on to consumers, making premium-priced Kombucha less accessible to the mass market.

- Regulatory Hurdles and Labeling Standards: Kombucha manufacturers face stringent regulatory challenges, particularly around alcohol content compliance and labeling standards. The Alcohol and Tobacco Tax and Trade Bureau (TTB) mandates that Kombucha must contain less than a specific alcohol threshold to be classified as non-alcoholic. Due to the fermentation process, some Kombucha products may exceed this limit, leading to regulatory issues. In 2023, several Kombucha producers in the U.S. and Europe faced recalls and fines for non-compliance with alcohol content standards, causing disruptions in market supply and consumer trust.

Global Kombucha Market Future Outlook

Over the next five years, the global kombucha market is expected to experience significant growth driven by rising consumer awareness of health and wellness. The expansion of kombucha products into various distribution channels, including supermarkets, specialty stores, and online platforms, will be a key factor. The increasing demand for functional beverages and sustainable packaging will also contribute to market growth, along with new innovations such as sugar-free and low-calorie kombucha offerings. The growing popularity of fermented beverages across global markets is set to fuel this upward trend.

Market Opportunities:

- Kombucha in Ready-to-Drink (RTD) Formats: The rise of convenience-focused consumers has led to an increased demand for Kombucha in ready-to-drink (RTD) formats. According to the Food and Agriculture Organization (FAO), the global RTD beverage market was valued at $100 billion in 2023. Kombucha brands have capitalized on this trend by offering bottled and canned versions, making the product more accessible to on-the-go consumers, particularly in North America and Europe.

- Adoption of Sustainable Packaging Solutions: Sustainability remains a key trend, with consumers increasingly opting for environmentally friendly products. According to the United Nations Environment Programme (UNEP), 80 million metric tons of plastic waste are generated annually. In response, Kombucha brands are shifting towards sustainable packaging, such as glass bottles and biodegradable materials, to reduce their environmental impact. The shift towards eco-friendly packaging is expected to bolster brand loyalty and appeal to environmentally conscious consumers.

Scope of the Report

|

By Product Type |

Organic Kombucha Non-Organic Kombucha |

|

By Flavor Type |

Fruits-Based Herbs and Spices-Based Flowers-Based |

|

By Packaging Type |

Glass Bottles Cans PET Bottles |

|

By Distribution Channel |

Supermarkets/Hypermarket Specialty Stores Online Retail Convenience Stores |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Kombucha Manufacturers

Beverage Distributors and Retailers

Health and Wellness Brands

Functional Beverage Producers

Supermarket Chains

E-commerce Platforms

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. FDA, European Food Safety Authority)

Companies

Players Mention in the Report

GTs Living Foods

Health-Ade Kombucha

Brew Dr. Kombucha

PepsiCo (KeVita)

Remedy Kombucha

Humm Kombucha

Suja Life LLC

Pure Steeps Beverage LLC (Inkombucha)

Revive Kombucha

Kombucha Wonder Drink

Rowdy Mermaid Kombucha

Live Soda Kombucha

Buchi Kombucha

The Hain Celestial Group

Kombrewcha

Table of Contents

01. Global Kombucha Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Global Kombucha Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Global Kombucha Market Analysis

3.1. Growth Drivers

3.1.1. Health and Wellness Trends

3.1.2. Rising Demand for Functional Beverages

3.1.3. Growing Popularity of Probiotic Drinks

3.1.4. Expansion of Organic and Clean Label Trends

3.2. Market Challenges

3.2.1. High Costs of Organic Ingredients

3.2.2. Regulatory Hurdles and Labeling Standards

3.2.3. Limited Consumer Awareness in Emerging Markets

3.3. Opportunities

3.3.1. Product Innovation (e.g., Flavored and Functional Kombucha)

3.3.2. Expansion into Untapped Regions

3.3.3. Growth in E-commerce and Retail Channels

3.4. Trends

3.4.1. Sugar-Free and Low-Calorie Kombucha

3.4.2. Kombucha in Ready-to-Drink (RTD) Formats

3.4.3. Adoption of Sustainable Packaging Solutions

3.5. Government Regulations

3.5.1. Fermentation Standards

3.5.2. Organic Certification Regulations

3.5.3. Alcohol Content Compliance

3.6. SWOT Analysis

3.7. Value Chain Analysis

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

04. Global Kombucha Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Organic Kombucha

4.1.2. Non-Organic Kombucha

4.2. By Flavor Type (In Value %)

4.2.1. Fruits-Based Kombucha

4.2.2. Herbs and Spices-Based Kombucha

4.2.3. Flowers-Based Kombucha

4.3. By Packaging Type (In Value %)

4.3.1. Glass Bottles

4.3.2. Cans

4.3.3. PET Bottles

4.4. By Distribution Channel (In Value %)

4.4.1. Supermarkets/Hypermarkets

4.4.2. Specialty Stores

4.4.3. Online Retail

4.4.4. Convenience Stores

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East and Africa

05. Global Kombucha Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. GTs Living Foods

5.1.2. Health-Ade Kombucha

5.1.3. Brew Dr. Kombucha

5.1.4. The Hain Celestial Group

5.1.5. PepsiCo (KeVita)

5.1.6. Revive Kombucha

5.1.7. Kombucha Wonder Drink

5.1.8. Live Soda Kombucha

5.1.9. Suja Life LLC

5.1.10. Pure Steeps Beverage LLC (Inkombucha)

5.1.11. Buchi Kombucha

5.1.12. Remedy Kombucha

5.1.13. Rowdy Mermaid Kombucha

5.1.14. Humm Kombucha

5.1.15. Kombrewcha

5.2 Cross-Comparison Parameters (No. of Employees, Headquarters, Product Range, Revenue, Regional Presence, Distribution Strategy, Innovation, Market Share)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Mergers and Acquisitions, Partnerships, Collaborations)

5.5 Investment Analysis

5.6 Venture Capital Funding

06. Global Kombucha Market Regulatory Framework

6.1 Fermentation and Alcohol Regulations

6.2 Organic Certification Standards

6.3 Labeling and Health Claims

07. Global Kombucha Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

08. Global Kombucha Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Flavor Type (In Value %)

8.3. By Packaging Type (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

09. Global Kombucha Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying and mapping key stakeholders across the kombucha market. Extensive desk research is conducted, leveraging both secondary and proprietary databases to gather data on product types, consumer trends, and regulatory frameworks. This step focuses on determining the critical factors influencing market growth.

Step 2: Market Analysis and Construction

This phase includes the compilation of historical market data for kombucha, examining production levels, regional demand, and emerging consumer trends. The analysis also includes market penetration rates and the performance of distribution channels, enabling a deeper understanding of how these factors influence revenue.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are constructed around market drivers, challenges, and opportunities. These are then validated through interviews and consultations with industry experts, including manufacturers and distributors, ensuring a robust understanding of the operational landscape and financial health of the kombucha market.

Step 4: Research Synthesis and Final Output

The final step synthesizes all research findings into a comprehensive market analysis. Direct engagement with key kombucha manufacturers is employed to validate projections and market data. The final output ensures that market estimates are grounded in both primary and secondary research, delivering a precise outlook on the kombucha market.

Frequently Asked Questions

01. How big is the global kombucha market?

The global kombucha market is valued at USD 3.63 billion, driven by a growing focus on health and wellness, with increasing consumer preference for probiotic and functional beverages.

02. What are the challenges in the global kombucha market?

The challenges include the high cost of organic ingredients, regulatory barriers related to alcohol content and fermentation standards, and limited consumer awareness in some emerging markets.

03. Who are the major players in the global kombucha market?

Major players include GTs Living Foods, Health-Ade Kombucha, Brew Dr. Kombucha, PepsiCo (KeVita), and Remedy Kombucha, with strong brand recognition and innovative product offerings.

04. What are the growth drivers of the global kombucha market?

The market is driven by rising consumer awareness of the health benefits of kombucha, increasing demand for organic and clean-label beverages, and the expansion of distribution channels, including e-commerce and specialty stores.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.