Global Lab Grown Diamond Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD1431

December 2024

84

About the Report

Global Lab Grown Diamond Market Overview

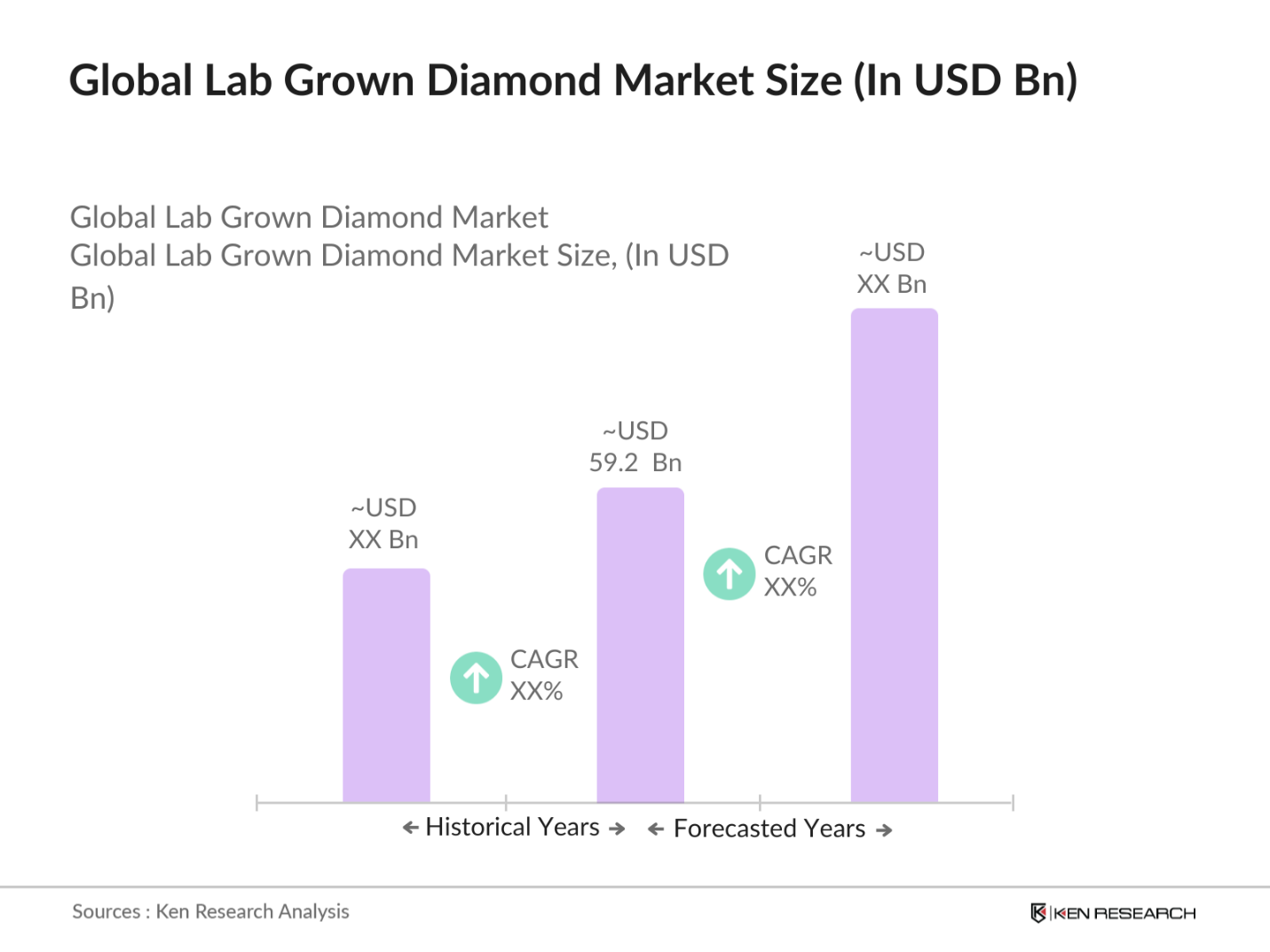

- The global lab-grown diamond market is valued at USD 59.2 billion, driven by increasing consumer demand for ethically sourced diamonds and technological advancements in diamond manufacturing processes. Over the past five years, technological breakthroughs in chemical vapor deposition (CVD) and high-pressure high-temperature (HPHT) methods have contributed significantly to production efficiency, leading to a broader acceptance of lab-grown diamonds. These factors have expanded the market, with sustained growth driven by their affordability compared to natural diamonds and rising interest in sustainable luxury.

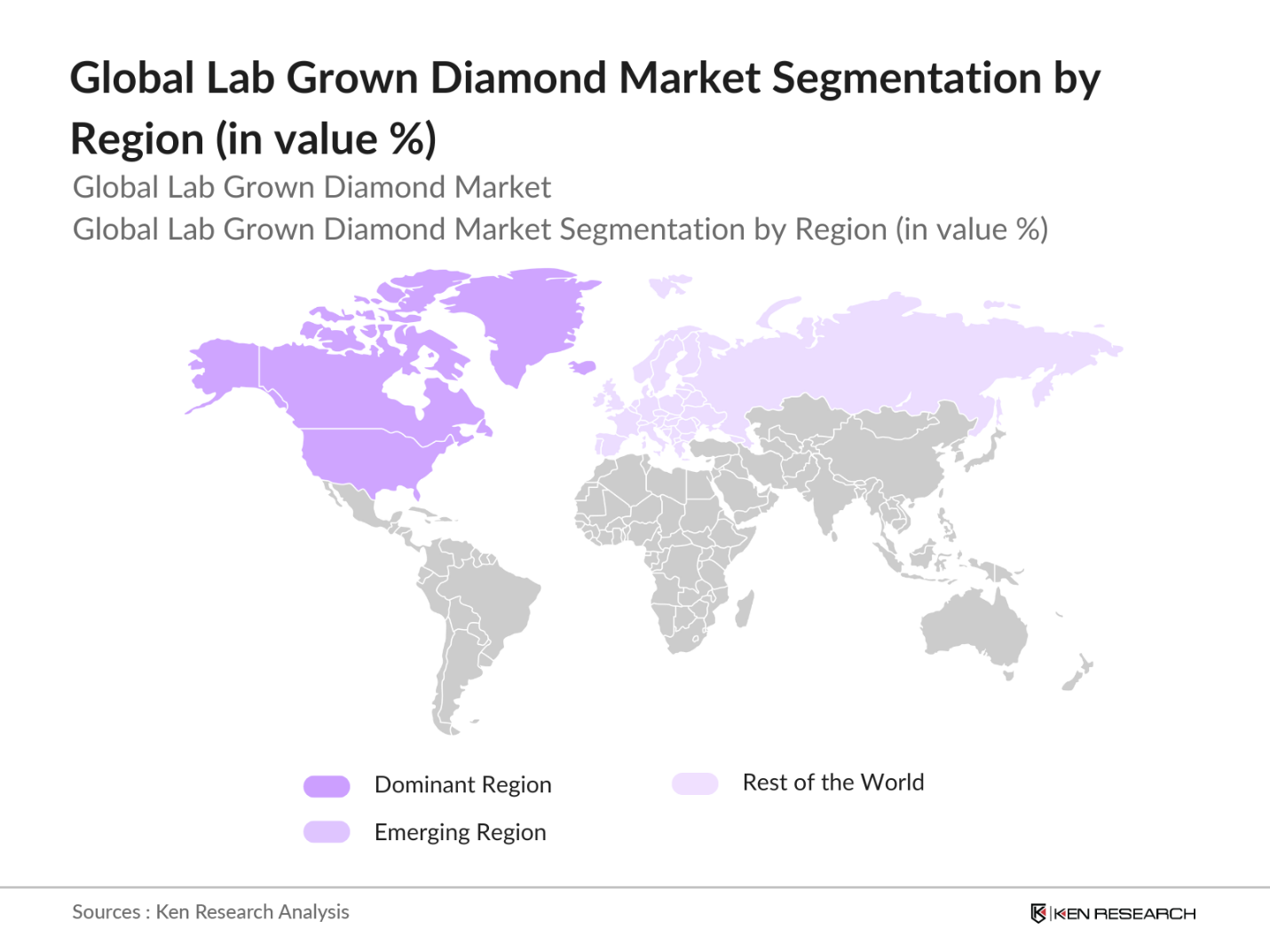

- Countries like the United States, China, and India dominate the lab-grown diamond market, driven by high consumer demand and robust production capabilities. The U.S. leads due to consumer preference for eco-friendly luxury, while China and India dominate manufacturing due to lower production costs and advanced technology. These regions continue to attract investment, bolstering their positions in the global market.

- Governments are increasingly supporting lab-grown diamond industries through policy reforms. In 2023, Indias Ministry of Commerce and Industry allocated $30 million to the development of diamond production technology as part of its National Lab-Grown Diamond Mission. The initiative aims to make India a global hub for lab-grown diamond manufacturing. Similarly, the U.S. Department of Energy announced a $10 million grant to improve energy efficiency in lab-grown diamond production, aligning with sustainability goals.

Global Lab Grown Diamond Market Segmentation

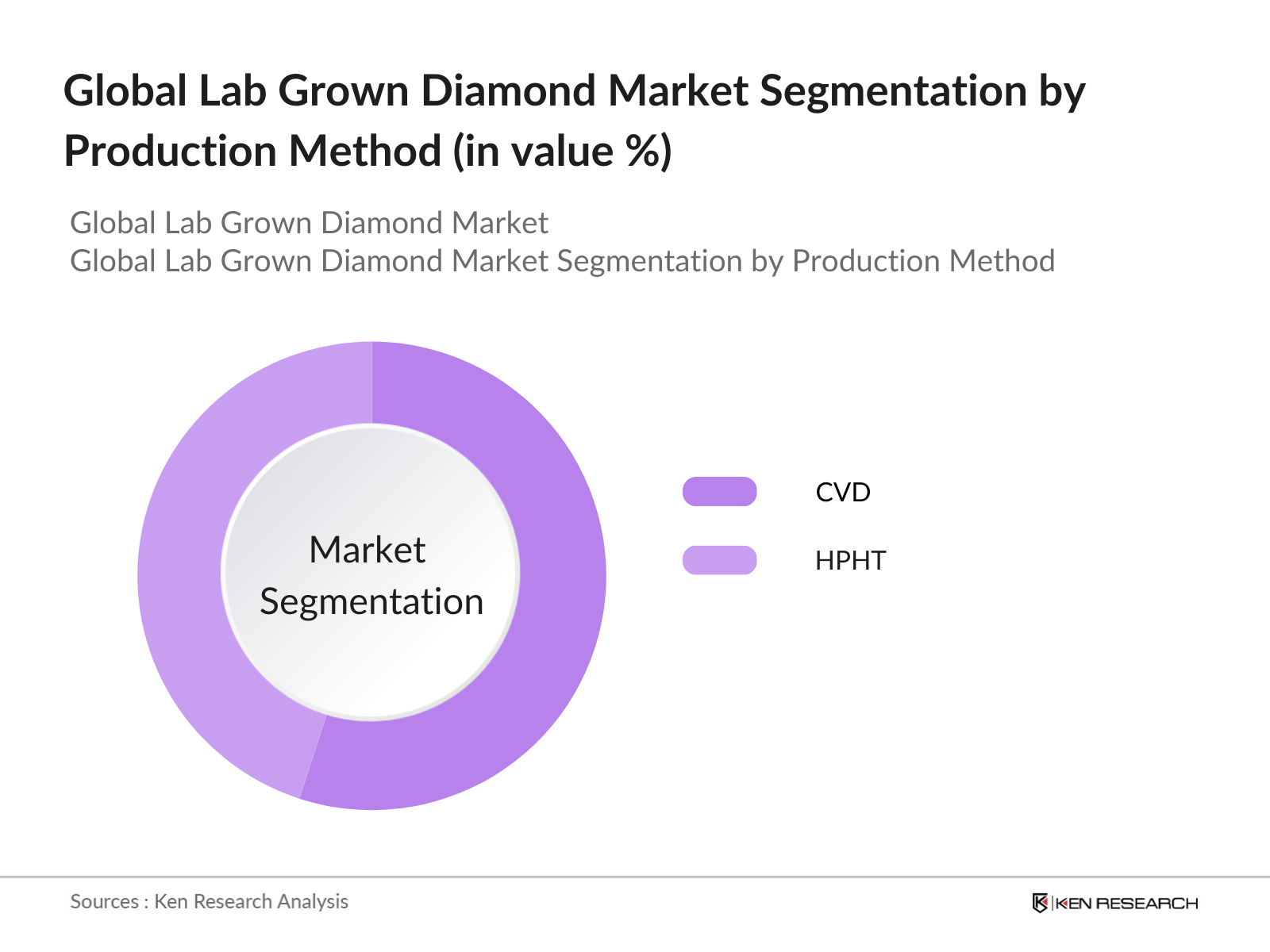

By Production Method: The lab-grown diamond market is segmented by production method into HPHT and CVD processes. CVD has been gaining dominance due to its lower cost and ability to produce high-quality diamonds. With brands opting for CVD to meet consumer preferences for sustainability and affordability, this sub-segment is expected to continue leading the market.

By Region: The lab-grown diamond market is segmented regionally into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. North America continues to hold the largest market share, driven by strong consumer demand for luxury and sustainable goods, particularly in the U.S. The region's robust retail network and high disposable incomes contribute to the dominance of lab-grown diamonds in jewelry, especially engagement and wedding rings.

Global Lab Grown Diamond Market Competitive Landscape

The global lab-grown diamond market is highly competitive, with a few key players dominating the industry. Companies are investing in research and development to enhance diamond quality, reduce production costs, and improve sustainability. The market is driven by brands that prioritize innovation, ethical sourcing, and technological advancements.

|

Company |

Established |

Headquarters |

Production Method |

Sustainability Initiatives |

Revenue (2023) |

Market Focus |

Retail Partnerships |

|

De Beers (Lightbox) |

1888 |

London, UK |

- |

- |

- |

- |

- |

|

Diamond Foundry |

2012 |

San Francisco, USA |

- |

- |

- |

- |

- |

|

Altr Created Diamonds |

2006 |

New York, USA |

- |

- |

- |

- |

- |

|

Pure Grown Diamonds |

2012 |

New Jersey, USA |

- |

- |

- |

- |

- |

|

Scio Diamond Technology |

2004 |

Greenville, USA |

- |

- |

- |

- |

- |

Global Lab Grown Diamond Market Analysis

Global Lab Grown Diamond Market Growth Drivers

- Sustainability Trends in Jewelry: The shift towards sustainability is increasingly influencing the lab-grown diamond market, millennial and Gen Z consumers considering ethical sourcing important in their purchasing decisions, according to the World Bank. Lab-grown diamonds have lower carbon footprints, using 250 million gallons less water annually compared to natural diamond mining. As environmental concerns rise, countries like the USA and Canada are regulating carbon emissions in the diamond production industry, contributing to the demand for lab-grown alternatives. This eco-friendly shift is strengthening the market in 2024, positioning it for long-term growth.

- Growing Adoption in Industrial Applications: Lab-grown diamonds are gaining traction in industrial applications, especially in cutting and drilling technologies. The US Geological Survey (USGS) reports that approximately 110 million carats of synthetic diamonds are used annually in industrial sectors like mining, construction, and electronics. Their high thermal conductivity and hardness make them superior to natural diamonds in specific uses. Major players in industrialized nations like the United States and China are increasingly investing in lab-grown diamonds for technological applications, pushing demand higher in 2023.

- Rising Consumer Awareness and Ethical Demand: Consumers are increasingly choosing lab-grown diamonds due to their ethical production. A survey conducted by the International Trade Centre (ITC) indicates that of global consumers are willing to pay a premium for ethically produced goods, including diamonds. The ethical appeal of lab-grown diamonds, especially in regions like North America and Europe, has contributed significantly to market growth. This awareness, combined with the transparency of sourcing, is expected to further strengthen market dynamics throughout 2024.

Global Lab Grown Diamond Market Challenges

- Competition from Natural Diamonds: Despite the growing demand for lab-grown diamonds, natural diamonds remain a strong competitor. In 2023, the natural diamond industry generated close to 125 million carats globally, as reported by the Kimberley Process Certification Scheme (KPCS). The emotional and historical value attached to natural diamonds presents a challenge for lab-grown alternatives, particularly in regions like India, where traditional values still dominate.

- Regulatory and Certification Issues: The lack of uniform regulations and certifications across different countries poses a challenge for lab-grown diamonds. The World Trade Organization (WTO) reported that international trade agreements on synthetic diamonds are not harmonized, making it difficult for manufacturers to achieve standardized certification, especially when exporting to different regions. This results in inconsistencies in how lab-grown diamonds are perceived in markets like Europe, Asia, and North America.

Global Lab Grown Diamond Market Future Outlook

Over the next five years, the global lab-grown diamond market is poised to experience significant growth, driven by advancements in production technology, rising consumer demand for ethical diamonds, and increasing applications in the industrial sector. Continuous investments in sustainable production methods and expanding consumer awareness of lab-grown diamonds are expected to drive market growth further.

Market Opportunities:

- Increased Investment in Eco-friendly Production: Governments and companies are increasingly investing in eco-friendly production methods for lab-grown diamonds. The International Finance Corporation (IFC) reported a 50% increase in investment into sustainable diamond manufacturing facilities globally in 2023. Countries like Canada and the United States are leading the shift toward cleaner energy usage in diamond production, aiming to further reduce the environmental footprint of lab-grown diamonds, aligning with the global sustainability agenda.

- Customization of Diamonds for Niche Markets: Lab-grown diamonds are increasingly customized to cater to niche markets, such as the tech sector, where diamonds are used in high-precision tools and electronics. The World Trade Organization reported that specialized diamonds accounted for nearly 40 million carats in 2023, specifically for technological applications. Customization in terms of size, purity, and specific properties enables manufacturers to target niche markets, driving new revenue streams.

Scope of the Report

|

By Production Method |

HPHT CVD |

|

By Application |

Jewelry Industrial Research |

|

By Diamond Type |

White Lab-Grown Diamonds Colored Lab-Grown Diamonds |

|

By Carat Siz |

Below 1 Carat 1-2 Carats Above 2 Carats |

|

By Region |

North America Europe Asia Pacific Middle East & Africa Latin America |

Products

Key Target Audience

Jewelry Manufacturers

Industrial Diamond Suppliers

Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Federal Trade Commission, European Gemological Laboratories)

Retailers and E-commerce Platforms

Ethical Luxury Brands

Technology Innovators in Diamond Production

Investment Firms

Companies

Players Mention in the Report

De Beers (Lightbox)

Diamond Foundry

Altr Created Diamonds

Pure Grown Diamonds

Scio Diamond Technology

MiaDonna

Vrai

1215 Diamonds

Fenix Diamonds

Washington Diamonds Corp

Brilliant Earth

Great Heights

Helzberg Diamonds

New Diamond Technology

Clean Origin

Table of Contents

01. Global Lab Grown Diamond Market Overview

1.1. Definition and Scope

1.2. Market Valuation and Historical Analysis

1.3. Key Market Developments and Milestones

02. Global Lab Grown Diamond Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Major Trends Impacting Market Growth

03. Global Lab Grown Diamond Market Analysis

3.1. Growth Drivers

3.1.1. Sustainability Trends in Jewelry

3.1.2. Growing Adoption in Industrial Applications

3.1.3. Rising Consumer Awareness and Ethical Demand

3.2. Market Challenges

3.2.1. Competition from Natural Diamonds

3.2.2. Regulatory and Certification Issues

3.3. Market Opportunities

3.3.1. Increased Investment in Eco-friendly Production

3.3.2. Customization of Diamonds for Niche Markets

3.4. Future Trends

3.4.1. Advancements in Production Technology

3.4.2. Expansion into New Applications

04. Global Lab Grown Diamond Market Segmentation

4.1. By Production Method (In Value %)

4.1.1. HPHT

4.1.2. CVD

4.2. By Application (In Value %)

4.2.1. Jewelry

4.2.2. Industrial

4.2.3. Research

4.3. By Diamond Type (In Value %)

4.3.1. White Lab-Grown Diamonds

4.3.2. Colored Lab-Grown Diamonds

4.4. By Carat Size (In Value %)

4.4.1. Below 1 Carat

4.4.2. 1-2 Carats

4.4.3. Above 2 Carats

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

05. Global Lab Grown Diamond Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. De Beers (Lightbox)

5.1.2. Diamond Foundry

5.1.3. Altr Created Diamonds

5.1.4. Pure Grown Diamonds

5.1.5. Scio Diamond Technology

5.1.6. MiaDonna

5.1.7. Vrai

5.1.8. 1215 Diamonds

5.1.9. Fenix Diamonds

5.1.10. Washington Diamonds Corp

5.1.11. Brilliant Earth

5.1.12. Great Heights

5.1.13. Helzberg Diamonds

5.1.14. New Diamond Technology

5.1.15. Clean Origin

5.2. Cross Comparison Parameters (Production Method, Sustainability Initiatives, Market Focus)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

06. Global Lab Grown Diamond Market Regulatory Framework

6.1. Compliance Standards and Industry Regulations

6.2. Environmental Impact Guidelines

07. Global Lab Grown Diamond Market Future Outlook

7.1. Future Market Size Projections (In USD Billion)

7.2. Key Factors Driving Future Market Growth

08. Global Lab Grown Diamond Market Future Segmentation

8.1. By Production Method (In Value %)

8.2. By Application (In Value %)

8.3. By Diamond Type (In Value %)

8.4. By Carat Size (In Value %)

8.5. By Region (In Value %)

09. Global Lab Grown Diamond Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Market Entry Strategies

9.3. Key Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying major stakeholders within the global lab-grown diamond market, focusing on jewelry, industrial applications, and technological innovations. Extensive desk research, complemented by secondary and proprietary databases, is used to gather relevant industry data.

Step 2: Market Analysis and Construction

The second phase consists of analyzing historical data from the lab-grown diamond market to assess its penetration and growth trajectory. Data collection involves evaluating the key application areasjewelry and industrial sectorsto understand revenue generation and market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

The third step involves formulating market hypotheses and validating them through consultations with experts, including major lab-grown diamond producers and retailers. Computer-assisted interviews (CATIs) help in refining the data and confirming market estimates.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the research findings and validating them through discussions with key industry players. The results are then consolidated into a comprehensive market report to provide actionable insights into market opportunities, challenges, and future trends.

Frequently Asked Questions

01. How big is the global lab-grown diamond market?

The global lab-grown diamond market is valued at USD 59.2 billion, driven by increasing demand for ethical and sustainable luxury products, with growth observed across major regions.

02. What are the challenges in the lab-grown diamond market?

Challenges include competition from natural diamonds, the high cost of large stone production, and regulatory hurdles, particularly in terms of certification and market acceptance.

03. Who are the major players in the global lab-grown diamond market?

Major players include De Beers (Lightbox), Diamond Foundry, Altr Created Diamonds, Pure Grown Diamonds, and Scio Diamond Technology, all known for their technological innovations and sustainability focus.

04. What are the growth drivers of the lab-grown diamond market?

Growth is driven by advancements in CVD and HPHT technologies, increasing consumer awareness of ethical diamonds, and rising demand in the industrial sector for lab-grown diamonds.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.