Global Label Printers Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD6895

December 2024

86

About the Report

Global Label Printers Market Overview

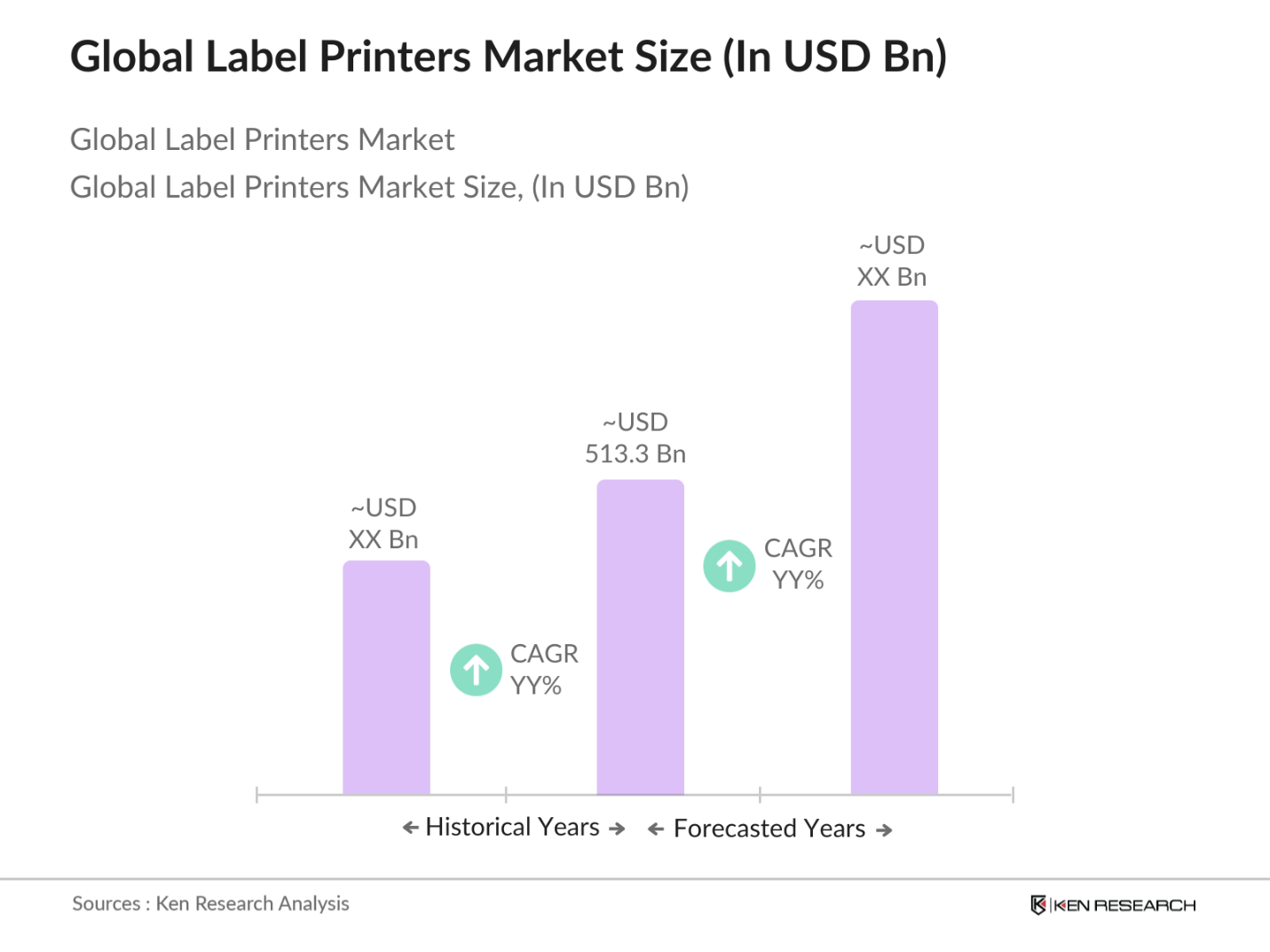

- The global label printers market is valued at USD 513.3 billion, reflecting steady growth driven by the expansion of e-commerce, logistics, and manufacturing sectors. The demand for automated labeling solutions in warehouses and supply chain processes has significantly contributed to this market size. Additionally, the rise in the adoption of smart labels embedded with RFID technology, along with the push for sustainable labeling solutions, is further propelling market growth.

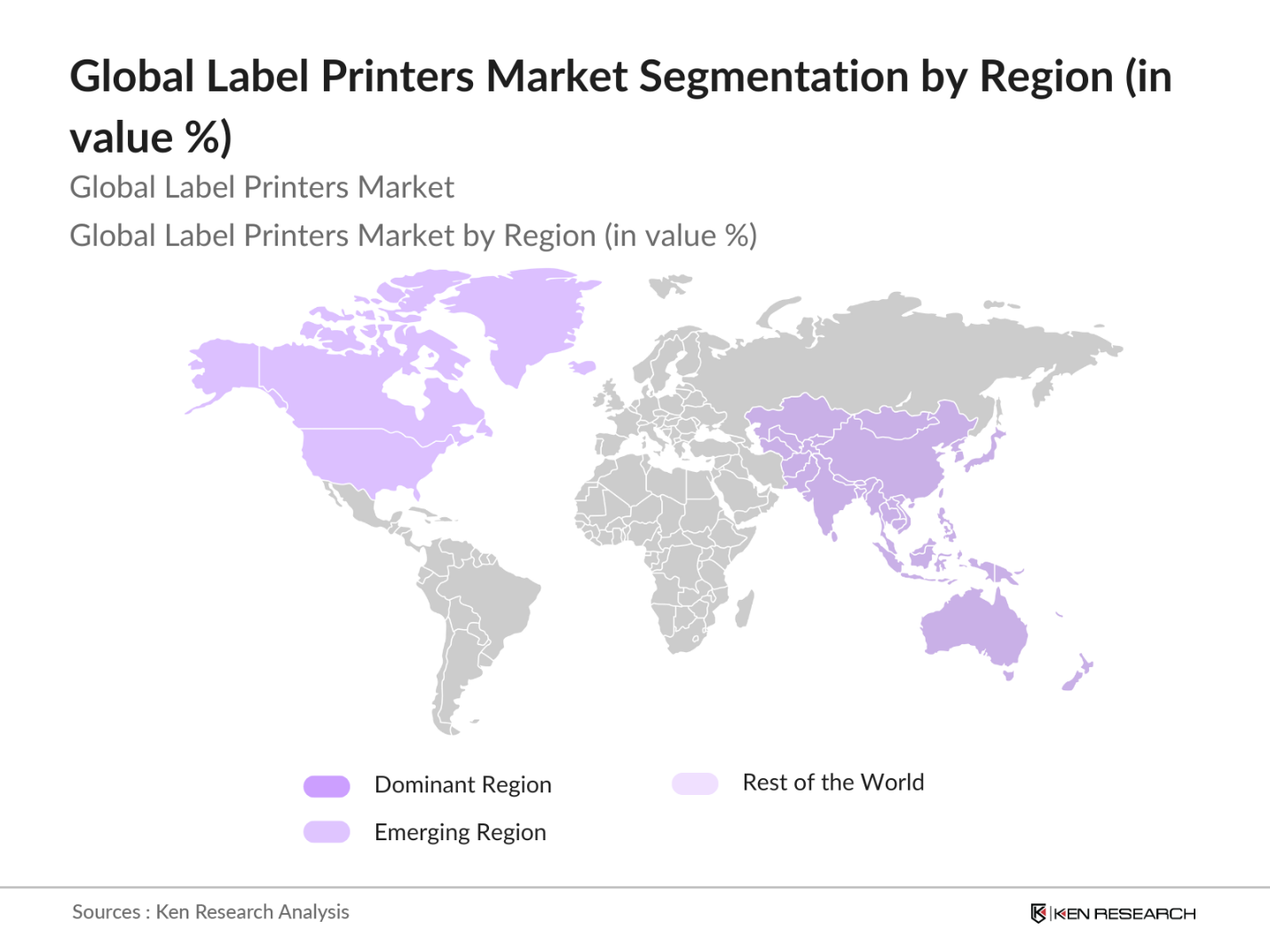

- Key markets dominating the label printers industry include the United States, Germany, and China. The dominance of the U.S. stems from the presence of large-scale manufacturing facilities and strong demand from the retail and logistics sectors. Germany leads in Europe due to its advanced manufacturing industry and technological innovations in the printing sector. Chinas dominance is attributed to its massive e-commerce sector and cost-effective manufacturing capabilities, which drive demand for label printing solutions.

- Government regulations on labeling have become more stringent, particularly in industries such as food, pharmaceuticals, and consumer goods. In 2023, countries like the U.S., through the FDA, have reinforced compliance regulations requiring clear and accurate labeling to protect consumers. The European Union has also strengthened labeling directives under its food safety and consumer protection laws. These regulations are driving businesses to invest in high-precision label printers to ensure compliance, particularly in sectors where mislabeling can lead to severe penalties.

Global Label Printers Market Segmentation

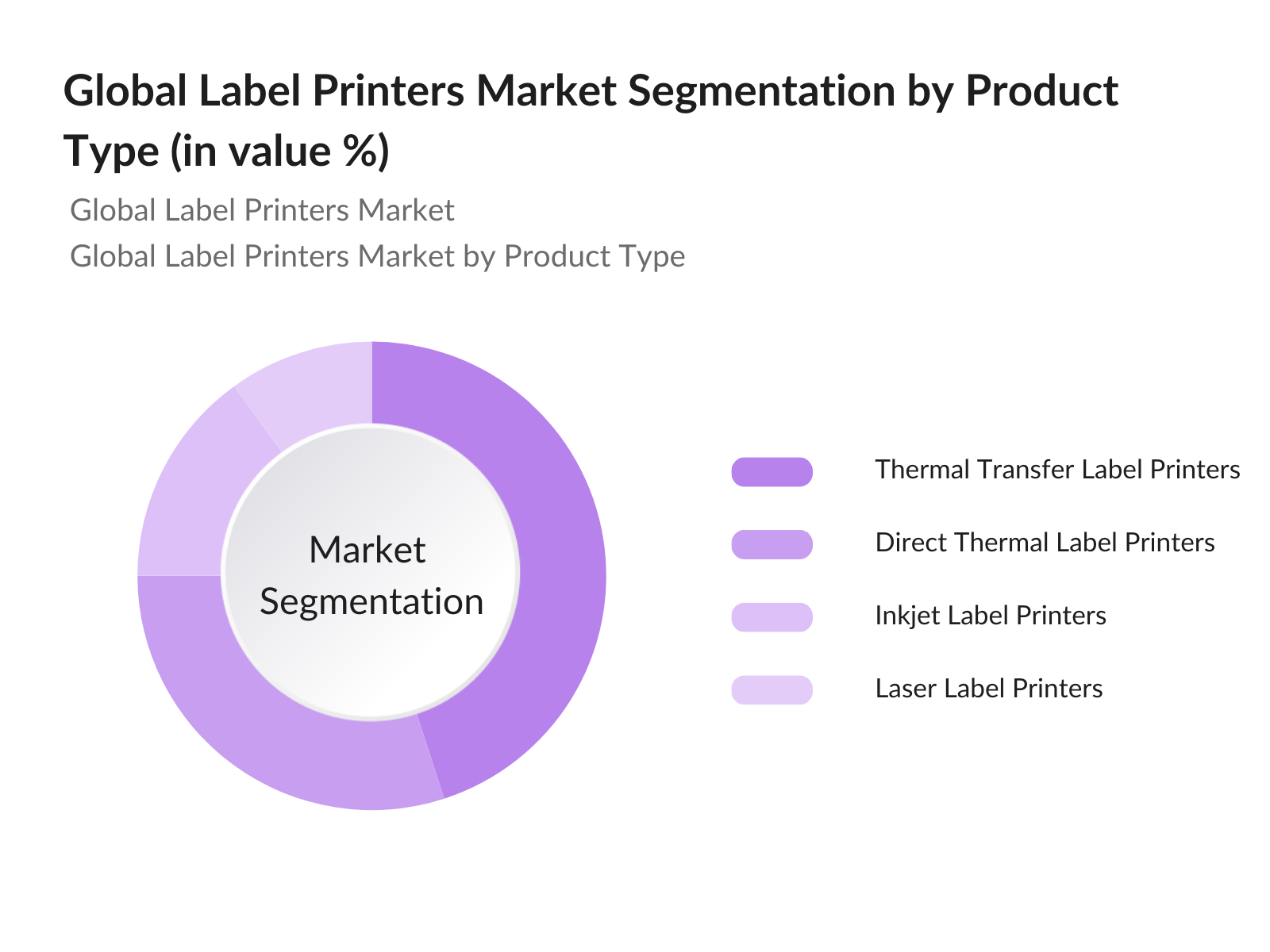

By Product Type: The global label printers market is segmented by product type into thermal transfer label printers, direct thermal label printers, inkjet label printers, and laser label printers. Recently, thermal transfer label printers have been dominant due to their ability to produce durable, high-quality labels that withstand harsh environments, making them ideal for industrial use. The preference for this sub-segment is especially seen in sectors like logistics and manufacturing, where long-lasting labeling solutions are essential for tracking goods throughout the supply chain.

By Region: The global label printers market is divided into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Asia-Pacific dominates the global label printers market, primarily due to the rapid growth of its e-commerce and manufacturing sectors, particularly in China, Japan, and India. This region is also home to many key players in the label printer manufacturing industry. The rise in industrial automation, coupled with increasing logistics operations across the region, further drives demand for label printing solutions.

Global Label Printers Market Competitive Landscape

The global label printers market is highly competitive, with a mix of established global players and emerging companies focusing on innovation and regional expansion. Major players dominate due to their strong R&D capabilities, wide product portfolios, and strategic partnerships across the supply chain.

|

Company |

Establishment Year |

Headquarters |

Product Portfolio |

R&D Investments |

Production Capacity |

Global Reach |

Sustainability Initiatives |

Key Customers |

Innovation Strategy |

|

Zebra Technologies |

1969 |

Illinois, USA |

Broad |

||||||

|

SATO Holdings |

1940 |

Tokyo, Japan |

Specialized |

||||||

|

Honeywell International |

1906 |

North Carolina, USA |

Extensive |

||||||

|

Brother Industries |

1908 |

Nagoya, Japan |

Broad |

||||||

|

Avery Dennison Corporation |

1935 |

California, USA |

Extensive |

Global Label Printers Market Analysis

Market Growth Drivers

- Expansion of eCommerce and Logistics Sectors: The rapid growth of eCommerce and logistics sectors globally is driving the demand for label printers. In 2023, global eCommerce retail sales are expected to exceed $7.3 trillion, reflecting the increasing need for efficient labeling solutions to streamline operations in warehouses and fulfillment centers. Logistics activities, such as packaging and inventory management, are also heavily reliant on labeling systems. Countries like the U.S., China, and India are witnessing substantial growth in eCommerce logistics, which is leading to greater demand for label printers that support high-volume production and fast delivery cycles.

- Increasing Demand for Automated Labeling Solutions: Automation is becoming a key focus area for industries seeking to reduce human error and enhance productivity in labeling processes. By 2024, industrial automation is expected to influence nearly 40% of global manufacturing sectors, with countries like Germany, Japan, and South Korea leading the way in automating production lines. Automated labeling systems are now integral to sectors such as food and beverage, pharmaceuticals, and retail, reducing costs and speeding up processes. This has led to a sharp increase in demand for high-performance label printers compatible with automation systems.

- Adoption of RFID Technology: RFID technology adoption is significantly boosting the label printer market, especially in sectors like retail, logistics, and healthcare, where tracking products in real-time is crucial. In 2023, the global RFID market is valued at over $20 billion, with a substantial portion allocated to RFID label printers. The integration of RFID technology allows companies to enhance their inventory tracking systems and supply chain efficiency, increasing the use of advanced label printers that support RFID encoding. North America and Europe are leading regions in RFID adoption.

Market Challenges:

- High Initial Setup Costs: One of the main challenges in the label printer market is the high initial investment required for modern and automated labeling solutions. Setting up an industrial-grade label printing system with RFID and AI integrations can cost upwards of $50,000. This poses a significant entry barrier for small and medium-sized businesses, especially in emerging economies like Brazil and Indonesia. These high costs include not only the hardware but also software and maintenance expenses, which can restrict market expansion in cost-sensitive markets.

- Technical Limitations in Printing Speed and Resolution: Despite advancements, many label printers still face technical limitations in printing speed and resolution, particularly when handling complex designs or large print volumes. Industries such as pharmaceuticals and retail, where precision is critical, face challenges in achieving high-quality output at speed. Average printing speeds for thermal label printers range between 6 to 12 inches per second, which can be a bottleneck in high-demand settings. Enhancing speed without compromising quality remains a challenge for manufacturers.

Global Label Printers Market Future Outlook

Over the next five years, the global label printers market is expected to witness significant growth. This growth will be driven by increasing automation in industrial processes, the adoption of sustainable labeling solutions, and advancements in digital printing technologies. Additionally, rising demand for RFID labels and smart labels in sectors such as retail, logistics, and healthcare is anticipated to fuel market expansion. Government regulations mandating product transparency and safety labeling will also play a pivotal role in market growth.

Market Opportunities:

- Cloud-based Label Printing Solutions: Cloud-based label printing is gaining traction, allowing businesses to manage and monitor their printing operations remotely. This trend aligns with the broader adoption of cloud technologies in industries such as retail, logistics, and healthcare, which are increasingly seeking scalable and flexible labeling solutions. In 2023, cloud services are projected to account for over $1 trillion in global business revenues, highlighting the growing dependence on cloud platforms. Cloud-based label printing reduces operational costs and provides real-time data analytics, making it an attractive option for businesses globally.

- Energy-Efficient Printing Technologies: Energy efficiency is becoming a key focus in the label printing industry, as companies strive to meet sustainability goals and reduce operational costs. Label printers with lower energy requirements, such as thermal and digital models, are gaining popularity, especially in regions with strict environmental regulations like Europe. These printers help companies reduce their carbon footprint while maintaining high production volumes, providing a sustainable and cost-effective solution for various industries, including logistics, food, and pharmaceuticals. The emphasis on eco-friendly printing practices is expected to grow as businesses seek to align with global environmental standards.

Scope of the Report

|

By Product Type |

Thermal Transfer Label Printers Direct Thermal Label Printers Inkjet Label Printers Laser Label Printers |

|

By Connectivity |

Wired Label Printers Wireless Label Printers |

|

By Application |

Retail Manufacturing Healthcare Transportation and Logistics |

|

By Printing Speed |

Below 100 mm/s 100300 mm/s Above 300 mm/s |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Label Printer Manufacturers

Logistics and Transportation Companies

E-commerce Businesses

Retail Chains

Healthcare Providers

Packaging and Labeling Solution Providers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. Food and Drug Administration, European Commission)

Companies

Players Mention in the Report

Zebra Technologies

SATO Holdings

Honeywell International

Brother Industries

Avery Dennison Corporation

TSC Auto ID Technology Co., Ltd.

Brady Corporation

Epson America, Inc.

Seiko Instruments

Citizen Systems Japan Co., Ltd.

Bixolon Co., Ltd.

Wasp Barcode Technologies

Toshiba Tec Corporation

Printronix Auto ID

Cab Produkttechnik GmbH

Table of Contents

01. Global Label Printers Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Global Label Printers Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Global Label Printers Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of eCommerce and Logistics Sectors

3.1.2. Increasing Demand for Automated Labeling Solutions

3.1.3. Adoption of RFID Technology

3.1.4. Growing Need for Sustainability in Labeling

3.2. Market Challenges

3.2.1. High Initial Setup Costs

3.2.2. Technical Limitations in Printing Speed and Resolution

3.2.3. Lack of Standardization

3.3. Opportunities

3.3.1. Integration with AI for Smart Labeling

3.3.2. Rising Demand for Label Printers in Emerging Markets

3.3.3. Growing Adoption of Digital Label Printers

3.4. Trends

3.4.1. Cloud-based Label Printing Solutions

3.4.2. Increased Customization Capabilities

3.4.3. Energy-Efficient Printing Technologies

3.5. Government Regulation

3.5.1. Labeling Compliance Requirements

3.5.2. Industry-Specific Labeling Standards

3.5.3. Green Label Initiatives

04. Global Label Printers Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Thermal Transfer Label Printers

4.1.2. Direct Thermal Label Printers

4.1.3. Inkjet Label Printers

4.1.4. Laser Label Printers

4.2. By Connectivity (In Value %)

4.2.1. Wired Label Printers

4.2.2. Wireless Label Printers

4.3. By Application (In Value %)

4.3.1. Retail

4.3.2. Manufacturing

4.3.3. Healthcare

4.3.4. Transportation and Logistics

4.4. By Printing Speed (In Value %)

4.4.1. Below 100 mm/s

4.4.2. 100300 mm/s

4.4.3. Above 300 mm/s

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

05. Global Label Printers Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Zebra Technologies

5.1.2. SATO Holdings

5.1.3. Honeywell International

5.1.4. Brother Industries

5.1.5. Avery Dennison Corporation

5.1.6. TSC Auto ID Technology Co., Ltd.

5.1.7. Brady Corporation

5.1.8. Epson America, Inc.

5.1.9. Seiko Instruments

5.1.10. Citizen Systems Japan Co., Ltd.

5.1.11. Bixolon Co., Ltd.

5.1.12. Wasp Barcode Technologies

5.1.13. Toshiba Tec Corporation

5.1.14. Printronix Auto ID

5.1.15. Cab Produkttechnik GmbH

5.2. Cross Comparison Parameters (Revenue, Production Capacity, Product Portfolio, R&D Investments, Number of Patents, Global Reach, Sustainability Initiatives, Customer Base)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

06. Global Label Printers Market Regulatory Framework

6.1. Industry Standards

6.2. Labeling Compliance Regulations

6.3. Environmental and Safety Standards

6.4. Certification Processes

07. Global Label Printers Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08. Global Label Printers Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Connectivity (In Value %)

8.3. By Application (In Value %)

8.4. By Printing Speed (In Value %)

8.5. By Region (In Value %)

09. Global Label Printers Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial step involved mapping the entire ecosystem of the global label printers market, including manufacturers, suppliers, and end-users. Desk research was conducted using proprietary databases and secondary sources to identify key variables affecting market growth, such as technological advancements and industry trends.

Step 2: Market Analysis and Construction

Historical market data was compiled and analyzed to understand the penetration of label printers across various industries. Market dynamics, such as demand shifts due to the rise of e-commerce and logistics, were also assessed to provide an accurate forecast of future trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through expert consultations and interviews with stakeholders across the supply chain. These interviews provided insights into operational challenges, market drivers, and technological innovations, ensuring the accuracy of the market data.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing data from all phases to provide a comprehensive analysis of the global label printers market. Industry insights from key players, combined with bottom-up data analysis, ensured that the report offers actionable recommendations for stakeholders.

Frequently Asked Questions

01. How big is the global label printers market?

The global label printers market is valued at USD 513.3 billion, driven by the expansion of e-commerce, logistics, and demand for automated labeling solutions.

02. What are the challenges in the global label printers market?

Challenges include high initial setup costs, the need for technical expertise, and the lack of standardization in labeling solutions across different industries.

03. Who are the major players in the global label printers market?

Major players include Zebra Technologies, Honeywell International, Brother Industries, SATO Holdings, and Avery Dennison Corporation, who dominate due to their extensive product portfolios and global reach.

04. What are the growth drivers of the global label printers market?

The market is driven by the rise of e-commerce, increasing demand for smart and RFID labels, and technological advancements in digital printing and sustainability initiatives.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.