Global LED Market Outlook to 2029

Region:Global

Author(s):Dev

Product Code:KROD-058

June 2025

90

About the Report

Global LED Market Overview

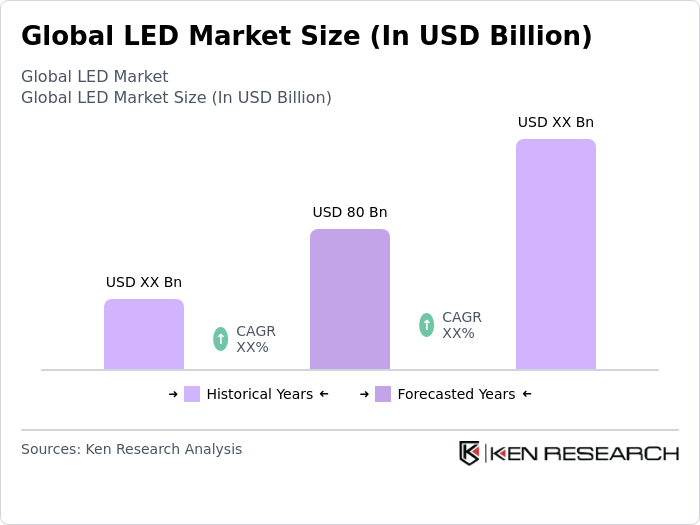

- The Global LED Market was valued at USD 80 billion. This growth is primarily driven by the increasing demand for energy-efficient lighting solutions, technological advancements in LED technology, and the rising awareness of environmental sustainability. The shift from traditional lighting to LED solutions is further propelled by government initiatives promoting energy conservation and the reduction of carbon footprints.

- Key players in this market include the United States, China, and Germany. The United States leads due to its advanced technological infrastructure and significant investments in research and development. China dominates the market owing to its large manufacturing base and cost-effective production capabilities, while Germany is recognized for its innovation in lighting design and energy efficiency standards.

- In 2019, the EU adopted a new consolidated regulation (EU 2019/2020), often called the "Single Lighting Regulation," which replaced earlier fragmented rules starting from September 2021. This regulation sets minimum energy efficiency criteria for all light sources and separate control gears, including integrated luminaires.

Global LED Market Segmentation

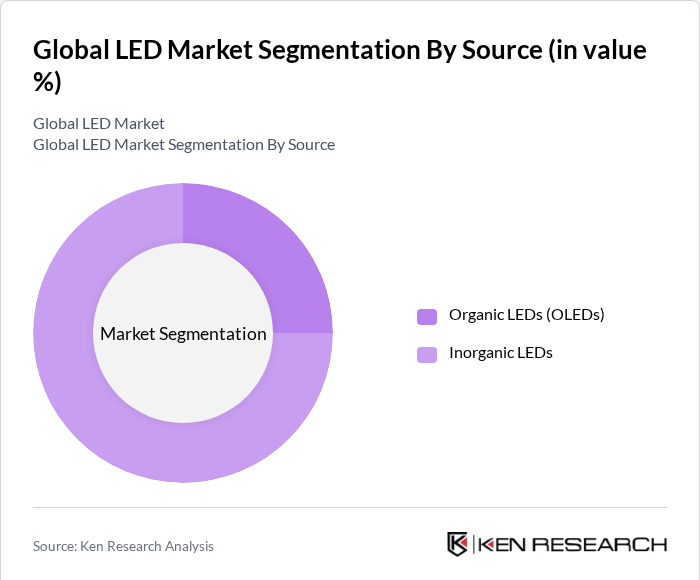

By Source: The LED market can be segmented into two primary sources: organic LEDs (OLEDs) and inorganic LEDs. Among these, inorganic LEDs dominate the market due to their widespread application in various sectors, including residential, commercial, and automotive lighting. The durability, efficiency, and cost-effectiveness of inorganic LEDs make them the preferred choice for consumers and businesses alike. Additionally, the growing trend of smart lighting solutions has further propelled the demand for inorganic LEDs, as they are compatible with advanced technologies such as IoT and automation.

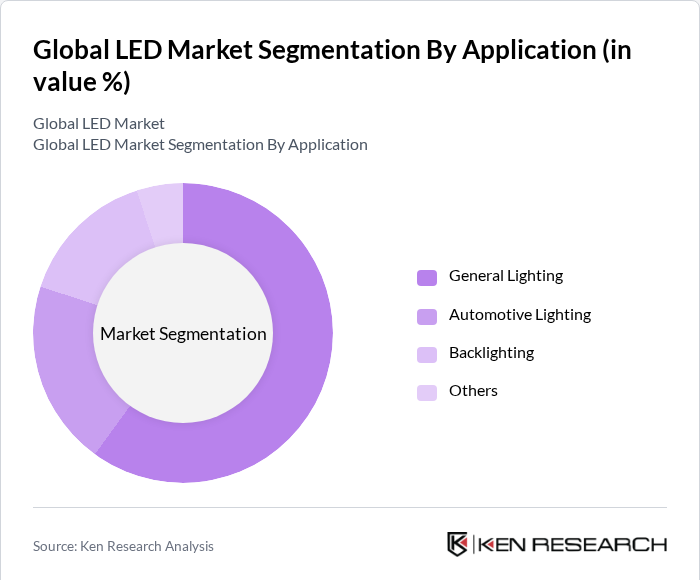

By Application: The LED market is also segmented by application, which includes general lighting, automotive lighting, backlighting, and others. General lighting is the leading application segment, driven by the increasing adoption of LED technology in residential and commercial spaces. The shift towards energy-efficient lighting solutions, coupled with government regulations promoting sustainable practices, has led to a significant rise in the use of LEDs for general lighting purposes. Furthermore, the automotive sector is witnessing a growing trend towards LED headlights and taillights, enhancing vehicle safety and aesthetics.

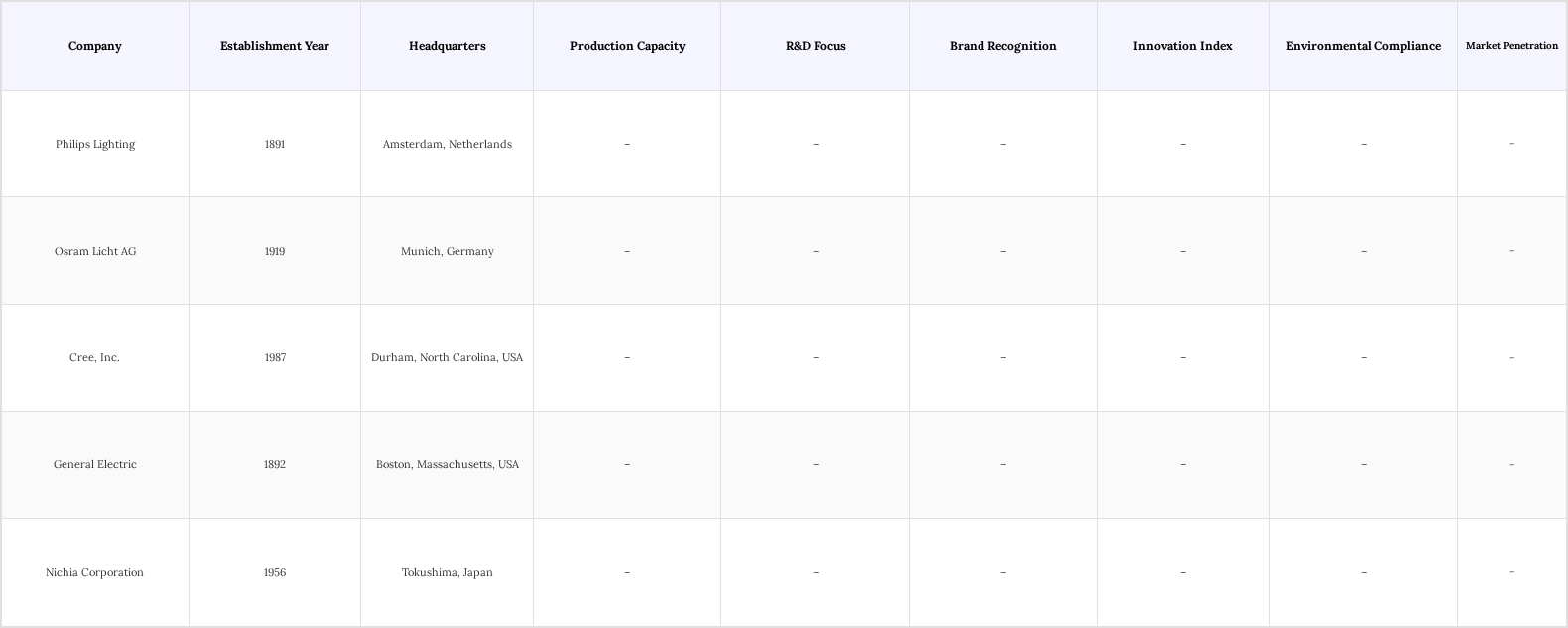

Global LED Market Competitive Landscape

The Global LED Market is characterized by intense competition among key players such as Philips Lighting, Osram Licht AG, Cree, Inc., General Electric, and Nichia Corporation. These companies are focusing on innovation, product development, and strategic partnerships to enhance their market presence. The competitive dynamics are influenced by technological advancements, regulatory frameworks, and the growing demand for energy-efficient lighting solutions.

Global LED Market Industry Analysis

Growth Drivers

- Increasing Demand for Energy-Efficient Solutions: The global shift toward energy efficiency is accelerating LED adoption. LEDs now account for over 50% of global lighting sales, driven by their ability to use up to 75% less energy and last 25 times longer than incandescent bulbs. Rising electricity costs, stricter regulations, and government incentives are prompting consumers and businesses to switch to LEDs, significantly reducing energy consumption and supporting sustainability goals.

- Technological Advancements in LED Technology: Continuous innovations have boosted LED efficacy to approximately 160 lumens per watt in 2024, up from 120 lumens per watt in 2020. Increased R&D investments, reaching $1.5 billion in 2023, have enabled manufacturers to develop more efficient, longer-lasting, and cost-effective LED products. These advancements improve performance and affordability, driving widespread adoption and fueling growth in the LED lighting market.

- Government Initiatives Promoting LED Adoption: Governments worldwide are accelerating LED adoption through policies offering tax rebates, subsidies, and grants totaling around $2 billion in 2024. These incentives lower upfront costs, making energy-efficient lighting accessible for residential and commercial users. Coupled with stringent energy efficiency standards and public sector LED adoption programs, these initiatives are crucial in driving widespread transition from traditional lighting to LEDs, reducing energy consumption and supporting global sustainability goals.

Market Challenges

- High Initial Costs of LED Products: Despite the long-term savings, the upfront costs of LED products remain a significant barrier. In 2024, the average price of LED bulbs is around $10, compared to $2 for traditional incandescent bulbs. This price disparity can deter consumers, particularly in price-sensitive markets, where initial investment costs are a critical consideration for adoption.

- Competition from Alternative Lighting Technologies: The LED market faces stiff competition from alternative technologies, such as compact fluorescent lamps (CFLs) and halogen bulbs. In 2024, CFLs still hold a market share of approximately 25%, primarily due to their lower initial costs. This competition can hinder the growth of the LED market, especially in regions where consumers prioritize upfront affordability over long-term energy savings.

Global LED Market Future Outlook

The future of the LED market appears promising, driven by ongoing technological advancements and increasing consumer awareness of energy efficiency. As smart lighting solutions gain traction, the integration of IoT technologies is expected to enhance user experience and operational efficiency. Additionally, the growing emphasis on sustainability will likely propel demand for eco-friendly LED products, aligning with global efforts to reduce carbon emissions and promote energy conservation in various sectors.

Market Opportunities

- Expansion in Emerging Markets: Emerging markets, particularly in the Asia-Pacific region, are driving significant LED adoption growth, with a projected increase of around 15% in 2024. Rapid urbanization, rising disposable incomes, and supportive government policies in countries like China and India are fueling demand. Infrastructure development and energy efficiency initiatives further boost LED usage, offering manufacturers opportunities to expand their customer base and strengthen market presence in these high-growth regions.

- Growth in Smart Lighting Solutions: The smart lighting segment is rapidly expanding due to increased integration of IoT and energy-efficient technologies in residential and commercial spaces. Features like automated brightness control, occupancy sensors, and AI-driven energy management enhance user convenience and reduce electricity consumption. Growing smart city initiatives and rising awareness of lighting’s impact on health further drive demand, providing manufacturers with ample opportunities to innovate and capture a larger share of this evolving market.

Scope of the Report

| By Source |

Organic LEDs (OLEDs) Inorganic LEDs |

| By Application |

General Lighting Automotive Lighting Backlighting Others |

| By End-User |

Residential Commercial Industrial Architectural |

| By Geography |

North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology |

Conventional LED Smart LED |

| By Form Factor |

Bulbs Strips Modules Panels |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Department of Energy, European Commission)

Manufacturers and Producers

Distributors and Retailers

Lighting Design Firms

Energy Efficiency Organizations

Construction and Real Estate Developers

Utility Companies

Companies

Players Mentioned in the Report:

Philips Lighting

Osram Licht AG

Cree, Inc.

General Electric

Nichia Corporation

Signify

Seoul Semiconductor

Lumileds

Everlight Electronics

Bridgelux

Table of Contents

1. Global LED Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global LED Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global LED Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Energy-Efficient Lighting Solutions

3.1.2. Technological Advancements in LED Technology

3.1.3. Government Initiatives Promoting LED Adoption

3.2. Market Challenges

3.2.1. High Initial Costs of LED Products

3.2.2. Competition from Alternative Lighting Technologies

3.2.3. Market Saturation in Developed Regions

3.3. Opportunities

3.3.1. Expansion in Emerging Markets

3.3.2. Growth in Smart Lighting Solutions

3.3.3. Increasing Applications in Automotive and Backlighting

3.4. Trends

3.4.1. Shift Towards Smart and Connected Lighting Systems

3.4.2. Rising Popularity of Human-Centric Lighting

3.4.3. Focus on Sustainable and Eco-Friendly Products

3.5. Government Regulation

3.5.1. Energy Efficiency Standards and Regulations

3.5.2. Environmental Impact Assessments for LED Products

3.5.3. Incentives for LED Adoption in Public Infrastructure

3.5.4. Compliance with International Safety Standards

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Global LED Market Segmentation

4.1. By Source

4.1.1. Organic LEDs (OLEDs)

4.1.2. Inorganic LEDs

4.2. By Application

4.2.1. General Lighting

4.2.2. Automotive Lighting

4.2.3. Backlighting

4.2.4. Others

4.3. By End-User

4.3.1. Residential

4.3.2. Commercial

4.3.3. Industrial

4.3.4. Architectural

4.4. By Geography

4.4.1. North America

4.4.2. Europe

4.4.3. Asia-Pacific

4.4.4. Latin America

4.4.5. Middle East & Africa

4.5. By Technology

4.5.1. Conventional LED

4.5.2. Smart LED

4.6. By Form Factor

4.6.1. Bulbs

4.6.2. Strips

4.6.3. Modules

4.6.4. Panels

5. Global LED Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Philips Lighting

5.1.2. Osram Licht AG

5.1.3. Cree, Inc.

5.1.4. General Electric

5.1.5. Nichia Corporation

5.1.6. Signify

5.1.7. Seoul Semiconductor

5.1.8. Lumileds

5.1.9. Everlight Electronics

5.1.10. Bridgelux

5.2. Cross Comparison Parameters

5.2.1. Market Share by Company

5.2.2. Product Portfolio Diversity

5.2.3. Geographic Presence

5.2.4. R&D Investment Levels

5.2.5. Customer Satisfaction Ratings

5.2.6. Pricing Strategies

5.2.7. Distribution Channels

5.2.8. Sustainability Initiatives

6. Global LED Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global LED Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global LED Market Future Market Segmentation

8.1. By Source

8.1.1. Organic LEDs (OLEDs)

8.1.2. Inorganic LEDs

8.2. By Application

8.2.1. General Lighting

8.2.2. Automotive Lighting

8.2.3. Backlighting

8.2.4. Others

8.3. By End-User

8.3.1. Residential

8.3.2. Commercial

8.3.3. Industrial

8.3.4. Architectural

8.4. By Geography

8.4.1. North America

8.4.2. Europe

8.4.3. Asia-Pacific

8.4.4. Latin America

8.4.5. Middle East & Africa

8.5. By Technology

8.5.1. Conventional LED

8.5.2. Smart LED

8.6. By Form Factor

8.6.1. Bulbs

8.6.2. Strips

8.6.3. Modules

8.6.4. Panels

9. Global LED Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Global LED Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Global LED Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIS) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Global LED Market.

Frequently Asked Questions

1. How big is the Global LED Market?

The Global LED Market is valued at USD 80 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

2. What are the key challenges in the Global LED Market?

Key challenges in the Global LED Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

3. Who are the major players in the Global LED Market?

Major players in the Global LED Market include Philips Lighting, Osram Licht AG, Cree, Inc., General Electric, Nichia Corporation, among others.

4. What are the growth drivers for the Global LED Market?

The primary growth drivers for the Global LED Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.