Region:Global

Author(s):Geetanshi

Product Code:KRAA0026

Pages:99

Published On:August 2025

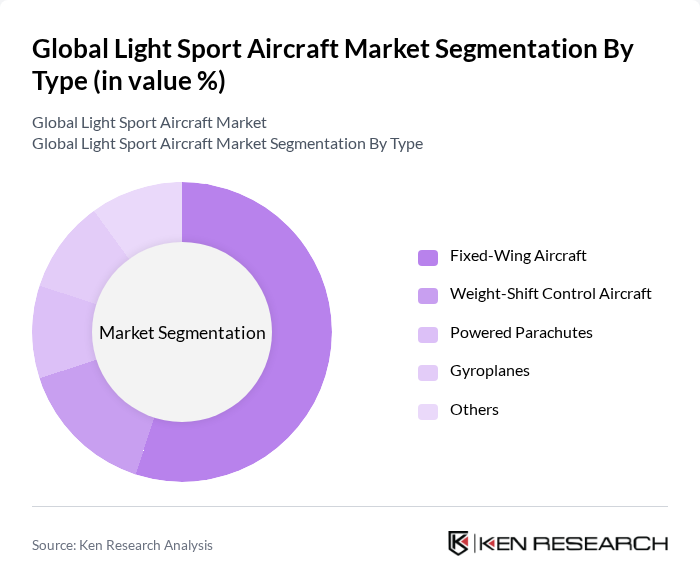

By Type:The light sport aircraft market is segmented into various types, including Fixed-Wing Aircraft, Weight-Shift Control Aircraft, Powered Parachutes, Gyroplanes, and Others. Among these, Fixed-Wing Aircraft dominate the market due to their versatility, ease of use, and widespread acceptance among private owners and flight schools. The growing interest in recreational flying and flight training has led to an increased demand for these aircraft, making them the preferred choice for many consumers.

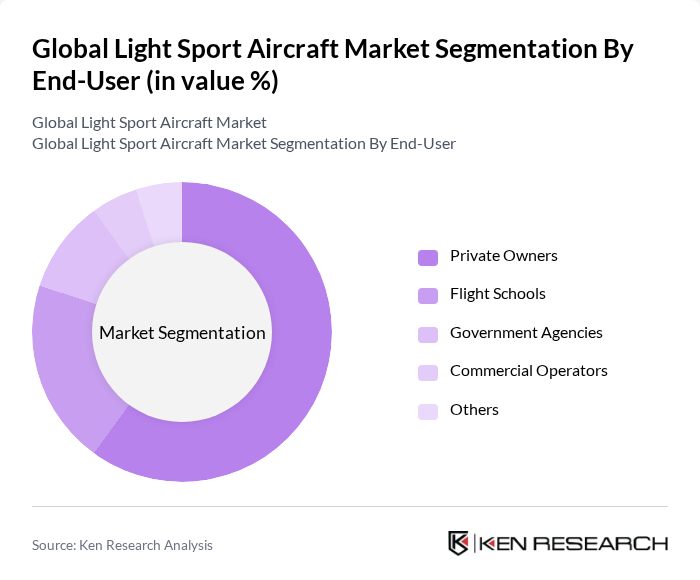

By End-User:The market is further segmented by end-user, including Private Owners, Flight Schools, Government Agencies, Commercial Operators, and Others. Private Owners represent the largest segment, driven by the increasing number of individuals seeking personal aircraft for leisure and recreational purposes. The trend towards personal aviation, coupled with the affordability and ease of operation of light sport aircraft, has made this segment particularly robust in recent years. Flight schools also represent a significant share due to the rising demand for pilot training.

The Global Light Sport Aircraft Market is characterized by a dynamic mix of regional and international players. Leading participants such as Flight Design GmbH, Pipistrel Aircraft, Aeropro, Tecnam, CubCrafters, American Legend Aircraft Company, Cessna (Textron Aviation), Evektor, Zenith Aircraft Company, Just Aircraft, Remos Aircraft, Aerotrek Aircraft, BRM Aero, Vashon Aircraft, TL-Ultralight contribute to innovation, geographic expansion, and service delivery in this space.

The future of the light sport aircraft market appears promising, driven by increasing consumer interest in sustainable aviation solutions and technological innovations. As environmental concerns grow, manufacturers are likely to focus on developing electric light sport aircraft, which could revolutionize the market. Additionally, the rise of community-based flying clubs is expected to foster a supportive environment for new pilots, enhancing participation in recreational flying and training programs, ultimately expanding the market's reach.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed-Wing Aircraft Weight-Shift Control Aircraft Powered Parachutes Gyroplanes Others |

| By End-User | Private Owners Flight Schools Government Agencies Commercial Operators Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Engine Type | Piston Engines Electric Engines Turboprop Engines Others |

| By Usage | Recreational Flying Flight Training Aerial Photography Agricultural Applications Others |

| By Certification Type | S-LSA (Special Light-Sport Aircraft) E-LSA (Experimental Light-Sport Aircraft) Others |

| By Price Range | Below $50,000 $50,000 - $100,000 $100,000 - $200,000 Above $200,000 Others |

| By Design | Single-Engine Multi-Engine Tandem Side-by-Side |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Light Sport Aircraft Manufacturers | 60 | Product Managers, R&D Directors |

| Flight Schools Utilizing Light Sport Aircraft | 50 | Chief Instructors, Operations Managers |

| Aviation Regulatory Bodies | 40 | Regulatory Officers, Policy Makers |

| Aftermarket Service Providers | 45 | Service Managers, Parts Distributors |

| Light Sport Aircraft Enthusiasts and Pilots | 55 | Pilot Instructors, Aviation Hobbyists |

The Global Light Sport Aircraft Market is valued at approximately USD 1.3 billion, reflecting a growing interest in recreational flying and advancements in aircraft technology, including lightweight materials and digital cockpit systems.