Global Lighting Contactor Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD8599

November 2024

92

About the Report

Global Lighting Contactor Market Overview

- The global lighting contactor market is valued at USD 2.3 billion, according to recent studies. This market is driven by the increasing focus on energy efficiency and the widespread adoption of automation systems in various industries. As energy-saving initiatives gain momentum, the demand for lighting control systems continues to rise. Furthermore, the growing interest in smart lighting solutions, particularly in urban areas and commercial sectors, has significantly contributed to the expansion of the market.

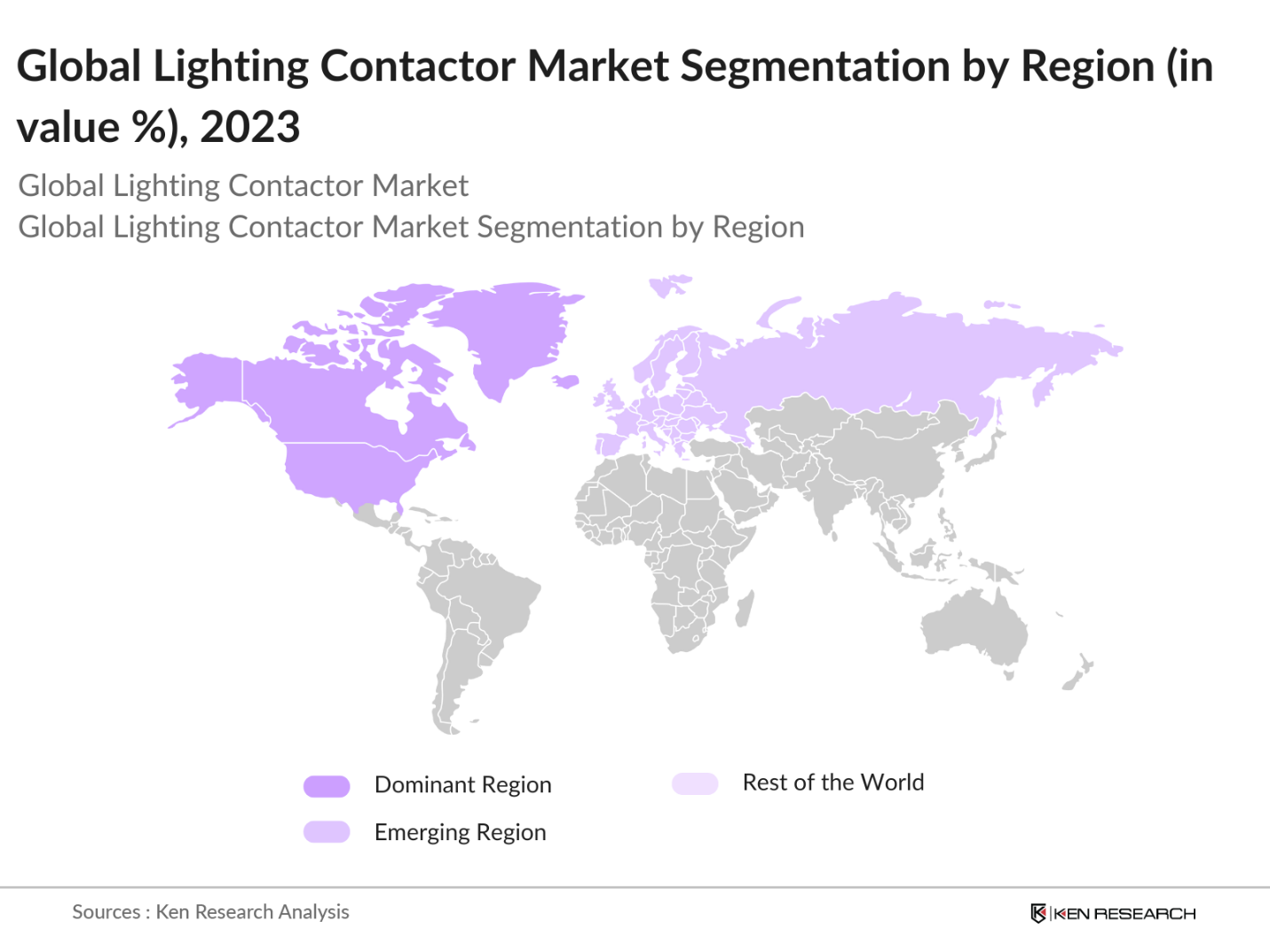

- Key regions that dominate the lighting contactor market include North America, Europe, and Asia-Pacific. North Americas dominance can be attributed to the rapid growth of smart cities and stringent energy regulations across the U.S. and Canada. Meanwhile, Europe follows closely due to its strong sustainability initiatives, especially in countries like Germany and France. Asia-Pacific, led by China and Japan, is becoming a significant market player due to expanding infrastructure projects and government incentives aimed at reducing energy consumption.

- Wireless lighting control systems, which enable more flexible and scalable installations, are becoming popular in commercial buildings. By the end of 2023, over 40% of new lighting installations in commercial buildings across North America utilized wireless controls, reducing installation costs and increasing the adaptability of lighting systems.

Global Lighting Contactor Market Segmentation

By Product Type: The global lighting contactor market is segmented by product type into electrically held contactors and mechanically held contactors. Electrically held contactors currently dominate the market due to their widespread application in industrial and commercial sectors. These contactors are favored for their simplicity, durability, and reliability in energy-efficient lighting systems. Additionally, their ability to control high-voltage circuits through low-voltage signals makes them ideal for large-scale applications in manufacturing plants and warehouses.

By Region: Regionally, the lighting contactor market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America, specifically the United States, holds the largest market share due to its highly developed infrastructure, government energy-saving initiatives, and the extensive use of smart building technologies. Europe, with its stringent energy policies, follows closely. Asia-Pacific is experiencing rapid growth, driven by urbanization, infrastructure development, and government investments in energy-efficient solutions.

By End-Use Industry: The global lighting contactor market is further segmented by end-use industry into commercial, residential, industrial, and public infrastructure. The commercial sector holds the largest market share due to the rapid urbanization and the development of smart buildings that integrate automated lighting systems. The need for energy-efficient lighting solutions in offices, shopping malls, and airports has led to increased adoption of lighting contactors. Furthermore, smart lighting systems are increasingly being deployed to reduce energy consumption, which further fuels the growth of this segment.

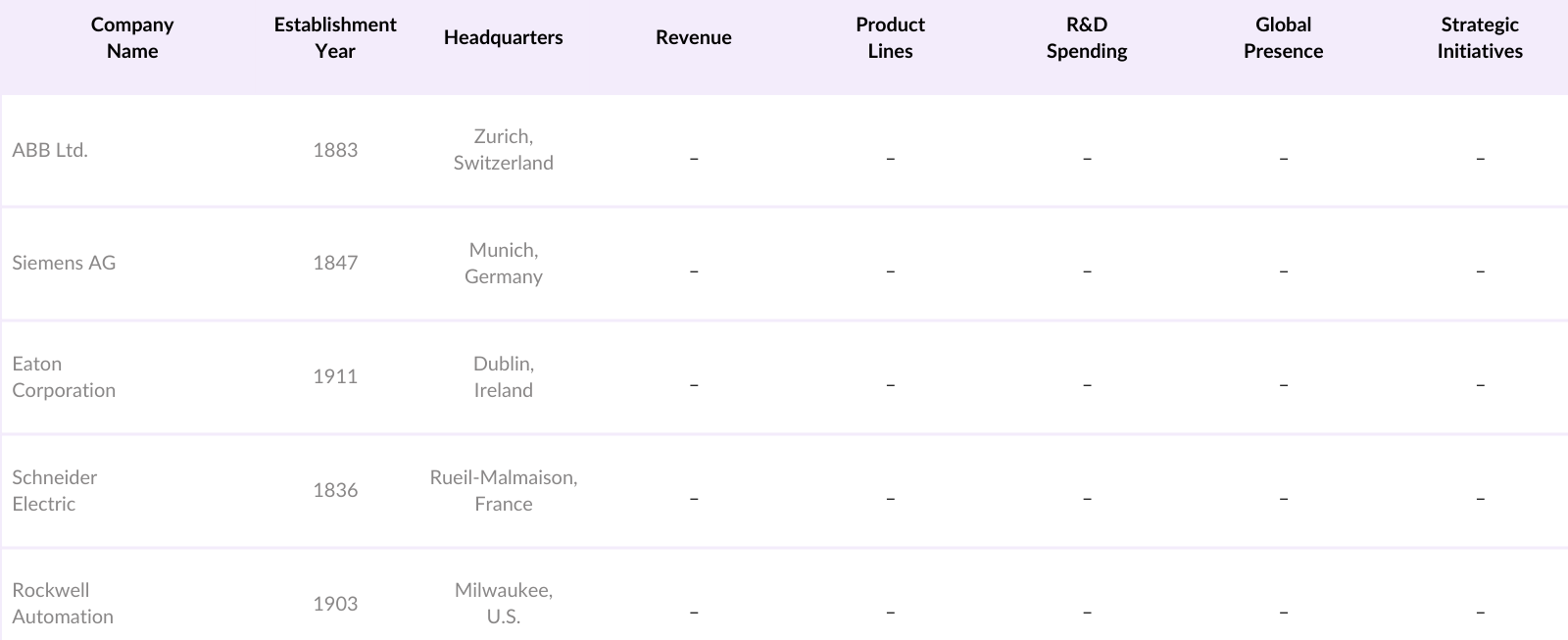

Global Lighting Contactor Market Competitive Landscape

The global lighting contactor market is highly consolidated with the presence of key players that have established themselves over the years. This includes both multinational corporations and regional companies, with major market players driving innovation and expanding their product portfolios. The competitive landscape is shaped by factors such as product differentiation, technological advancements, and strategic collaborations. Companies are investing heavily in R&D to offer energy-efficient, smart lighting solutions. For example, ABB Ltd. and Siemens AG have introduced contactors integrated with IoT-based control systems for better energy management.

Global Lighting Contactor Industry Analysis

Growth Drivers

- Energy Efficiency Initiatives: Governments globally are increasingly prioritizing energy efficiency measures to reduce energy consumption and emissions. As of 2024, the global energy demand is expected to increase by 6.5% according to the International Energy Agency (IEA). Lighting contactors, crucial in smart grids and energy-efficient building systems, are gaining prominence, particularly in regions like Europe, which leads energy-saving projects. Green building codes and the drive for energy-efficient infrastructure are accelerating adoption, particularly in commercial sectors where lighting accounts for 20-30% of energy usage.

- Rise in Smart Lighting Systems: The adoption of smart lighting systems has seen a sharp rise due to their integration with building automation, contributing to the overall efficiency of large-scale infrastructure. In 2023, over 700 million smart buildings were being developed, with a significant portion incorporating automated lighting solutions. These systems rely heavily on lighting contactors to manage the load and efficiency of large lighting networks.

- Government Energy Conservation Mandates: Governments worldwide are implementing stringent mandates that compel commercial and industrial buildings to adopt energy-saving measures. For instance, the European Union has set a target to reduce greenhouse gas emissions by 40% by 2030, leading to heightened demand for energy-efficient solutions such as lighting contactors. Such mandates drive large-scale upgrades in municipal and industrial lighting, enhancing the market's growth.

Market Challenges

- High Initial Capital Costs: Although lighting contactors offer long-term energy savings, the initial investment remains high, especially for small and medium enterprises. According to market data from 2023, average installation costs for smart lighting systems, including contactors, have ranged from USD 2,000 to USD 10,000 for mid-sized commercial buildings, deterring smaller firms from adopting these technologies.

- Compatibility Issues with Existing Systems

Legacy systems pose significant compatibility challenges when upgrading to smart lighting systems with modern contactors. In 2022, about 65% of industrial buildings still used outdated lighting systems, making integration costly and complex. Retrofits can require rewiring and additional hardware, contributing to higher costs and delays.

Global Lighting Contactor Market Future Outlook

Over the next five years, the global lighting contactor market is expected to show significant growth driven by the increased focus on smart city development, advancements in IoT-based lighting systems, and growing government mandates for energy efficiency. The integration of wireless lighting control systems, coupled with increased investments in energy-efficient infrastructure, is set to fuel the demand for lighting contactors across multiple sectors. As companies continue to focus on sustainability and reducing operational costs, lighting contactors will play an essential role in achieving energy management goals.

Opportunities

- IoT Integration and Smart Cities Expansion: The global expansion of smart cities is one of the most promising opportunities for the lighting contactor market. Cities like Dubai and Singapore have already implemented IoT-based lighting systems, which rely heavily on advanced lighting contactors. The smart city initiatives underway in over 90 countries will create demand for sophisticated lighting solutions.

- Rising Adoption of LED and Low-Power Systems: The transition to LED lighting, which consumes 75% less energy than incandescent bulbs, has driven the need for advanced lighting control systems. In 2024, LEDs are expected to dominate 75% of all new lighting installations globally. This trend requires efficient lighting contactors to handle the lower power loads while optimizing performance and energy savings.

Scope of the Report

|

By Type |

Electrically Held Contactors Mechanically Held Contactors |

|

By End-Use Industry |

Commercial (Office Buildings, Malls, Airports) Residential Industrial (Manufacturing Plants, Warehouses) Public Infrastructure (Streets, Parks) |

|

By Application |

Indoor Lighting Outdoor Lighting |

|

By Control Method |

Automatic Control Manual Control Remote Control |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Lighting System Manufacturing Companies

Building Automation System Provider Companies

Energy Service Companies

Real Estate Development Industries

Government and Regulatory Bodies (e.g., U.S. Department of Energy, European Commission)

Investors and Venture Capital Firms

Facility Management Companies

Companies

Players Mentioned in the Report

ABB Ltd.

Siemens AG

Eaton Corporation

Schneider Electric

Rockwell Automation

General Electric

Legrand Group

Hubbell Incorporated

Acuity Brands Lighting

Johnson Controls International

Table of Contents

1. Global Lighting Contactor Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Lighting Contactor Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Lighting Contactor Market Analysis

3.1. Growth Drivers

3.1.1. Energy Efficiency Initiatives

3.1.2. Rise in Smart Lighting Systems (Integration with Building Automation)

3.1.3. Government Energy Conservation Mandates

3.1.4. Growth in Green Building Projects

3.2. Market Challenges

3.2.1. High Initial Capital Costs

3.2.2. Compatibility Issues with Existing Systems

3.2.3. Technological Complexity in Retrofit Installations

3.2.4. Lack of Standardization (Regulatory Gaps)

3.3. Opportunities

3.3.1. IoT Integration and Smart Cities Expansion

3.3.2. Rising Adoption of LED and Low-Power Systems

3.3.3. Growing Demand for Automated Energy Management Systems (EMS)

3.3.4. Expansion of Market in Developing Economies

3.4. Trends

3.4.1. Emergence of Wireless Lighting Control Systems

3.4.2. Increased Adoption of Cloud-Based Lighting Management

3.4.3. Rise of Artificial Intelligence in Lighting Systems

3.4.4. Preference for Modular and Scalable Contactors

3.5. Government Regulations

3.5.1. Energy Star Standards

3.5.2. International Energy Conservation Code (IECC) Compliance

3.5.3. Green Building Codes and LEED Certifications

3.5.4. Public-Private Partnerships for Sustainable Energy Projects

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Distributors, Suppliers, Installers)

3.8. Porters Five Forces Analysis (Competitive Intensity, Supplier Bargaining Power, Buyer Influence)

3.9. Competitive Ecosystem

4. Global Lighting Contactor Market Segmentation

4.1. By Type (In Value %)

4.1.1. Electrically Held Contactors

4.1.2. Mechanically Held Contactors

4.2. By End-Use Industry (In Value %)

4.2.1. Commercial (Office Buildings, Malls, Airports)

4.2.2. Residential

4.2.3. Industrial (Manufacturing Plants, Warehouses)

4.2.4. Public Infrastructure (Streets, Parks)

4.3. By Application (In Value %)

4.3.1. Indoor Lighting

4.3.2. Outdoor Lighting

4.4. By Control Method (In Value %)

4.4.1. Automatic Control

4.4.2. Manual Control

4.4.3. Remote Control

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Lighting Contactor Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. ABB Ltd.

5.1.2. Siemens AG

5.1.3. Eaton Corporation

5.1.4. Schneider Electric

5.1.5. Rockwell Automation

5.1.6. General Electric

5.1.7. Legrand Group

5.1.8. Hubbell Incorporated

5.1.9. Acuity Brands Lighting

5.1.10. Johnson Controls International

5.1.11. Leviton Manufacturing Co., Inc.

5.1.12. NSI Industries

5.1.13. Panasonic Corporation

5.1.14. Lutron Electronics

5.1.15. Intermatic Inc.

5.2. Cross Comparison Parameters

5.2.1. Market Share

5.2.2. Revenue

5.2.3. Geographical Presence

5.2.4. Product Portfolio

5.2.5. R&D Investments

5.2.6. Strategic Collaborations

5.2.7. Expansion Initiatives

5.2.8. Distribution Channels

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Lighting Contactor Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements (e.g., UL Certification, CE Marking)

6.3. Certification Processes

7. Global Lighting Contactor Market Future Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Lighting Contactor Market Future Segmentation

8.1. By Type (In Value %)

8.2. By End-Use Industry (In Value %)

8.3. By Application (In Value %)

8.4. By Control Method (In Value %)

8.5. By Region (In Value %)

9. Global Lighting Contactor Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves the identification of all key stakeholders in the global lighting contactor market. Secondary research through industry databases is used to map the market landscape and identify critical variables, including technological advancements, market regulations, and consumer preferences.

Step 2: Market Analysis and Construction

In this step, historical data of the lighting contactor market is compiled to assess market growth patterns. Various metrics, such as sales volumes, revenue streams, and regional penetration, are analyzed to understand market dynamics. Additionally, the role of industry regulations in shaping the market is thoroughly evaluated.

Step 3: Hypothesis Validation and Expert Consultation

To validate market hypotheses, in-depth interviews are conducted with industry experts from leading lighting contactor manufacturers and distributors. These consultations provide firsthand insights into industry trends, challenges, and future market opportunities.

Step 4: Research Synthesis and Final Output

In the final phase, the results from the bottom-up approach are cross-verified with top-down market analysis, ensuring accuracy. Direct interactions with manufacturers help refine market estimates and forecasts, providing a well-rounded market report.

Frequently Asked Questions

01. How big is the global lighting contactor market?

The global lighting contactor market is valued at USD 2.3 billion, driven by increasing demand for energy-efficient lighting systems and advancements in smart building technologies.

02. What are the major challenges in the global lighting contactor market?

Key challenges include high initial investment costs, compatibility issues with existing lighting systems, and the lack of standardization in various regions, which hampers seamless implementation.

03. Who are the major players in the global lighting contactor market?

Major players in the market include ABB Ltd., Siemens AG, Eaton Corporation, Schneider Electric, and Rockwell Automation, among others, with strong global presence and diversified product portfolios.

04. What drives the growth of the global lighting contactor market?

The market is driven by the increasing adoption of energy-efficient lighting systems, rising investments in smart city projects, and growing government mandates for reducing energy consumption.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.