Global Linear Alkyl Benzene (LAB) Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD11382

December 2024

99

About the Report

Global Linear Alkyl Benzene (LAB) Market Overview

- The global linear alkyl benzene market is valued at USD 8.51 billion, driven by the widespread demand for LAB in the production of detergents and surfactants. Increased consumer spending on premium household and industrial cleaning products has bolstered demand for LAB, especially as it is a cost-effective, biodegradable intermediate. The industry also witnesses substantial growth from bio-based LAB, motivated by environmental sustainability concerns and the expanding global preference for eco-friendly cleaning solutions.

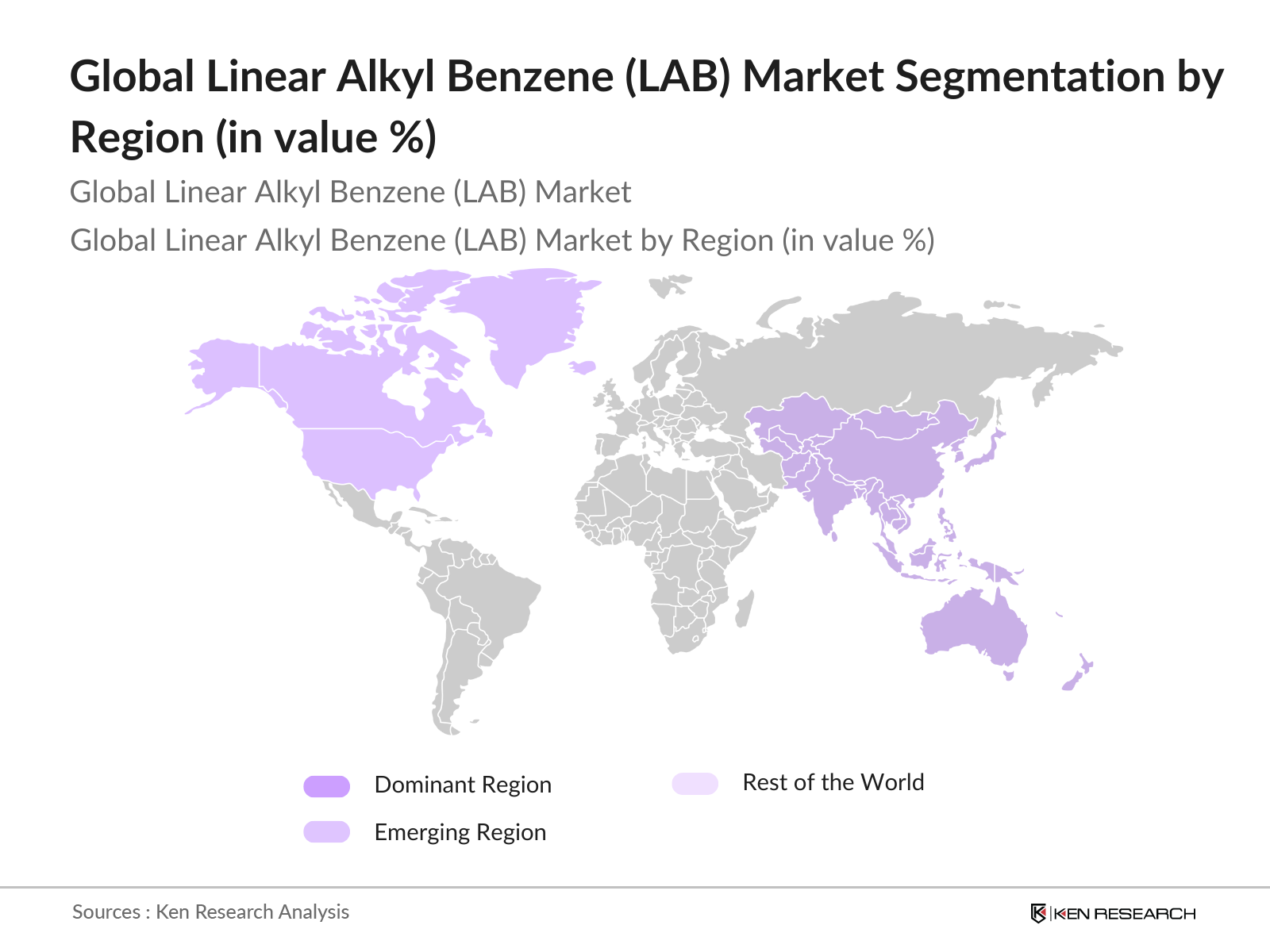

- Asia-Pacific holds a dominant position in the LAB market due to the high production capabilities in countries like China and India, which benefit from low-cost feedstock and labor advantages. The Middle East also plays a critical role with its resource-rich base, contributing significantly to the LAB supply chain, making it a central export hub for high-demand regions like North America and Europe.

- The European Unions Green Deal, launched to make Europe the first climate-neutral continent, is pushing industries toward sustainable practices. Through regulations like REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals), the EU mandates compliance with strict environmental standards for chemical manufacturers. This regulation impacts LAB producers, who must meet criteria to minimize emissions and adopt eco-friendly processes. By promoting bio-based alternatives in detergent ingredients, the EU Green Deal incentivizes manufacturers to transition toward LAB and renewable-based feedstocks, supporting a more sustainable industry.

Global Linear Alkyl Benzene (LAB) Market Segmentation

By Application: The LAB market segments include Linear Alkylbenzene Sulfonate (LAS), which is utilized across heavy-duty laundry liquids, laundry powders, light-duty dishwashing liquids, industrial cleaners, and household cleaners. LAS dominates this segment due to its wide-ranging use in cleaning applications and its suitability for both industrial and household purposes. LAS products are favored for their superior cleaning properties and compatibility with enzymes, leading to sustained demand in laundry and dishwashing sectors.

By Region: The global LAB market is divided across Asia-Pacific, North America, Europe, Central and South America, and Middle East & Africa. The Asia-Pacific region leads the market share due to its expansive production capabilities and resource accessibility. Key countries in the region, such as China and India, benefit from strong industrial infrastructures, enabling high-volume, cost-effective LAB production, supporting both local and export markets.

Global Linear Alkyl Benzene (LAB) Market Competitive Landscape

The LAB market comprises several major players, including both global and regional manufacturers. This consolidation highlights the influence of a few dominant companies that maintain substantial control over LAB production and supply chains globally.

|

Company |

Establishment Year |

Headquarters |

Production Capacity |

Revenue (USD) |

Innovation in Bio-based LAB |

Key Regions Served |

Sustainability Certification |

Major Product Types |

|

CEPSA |

1929 |

Spain |

High |

- |

- |

- |

- |

- |

|

ISU Chemical |

1969 |

South Korea |

Medium |

- |

- |

- |

- |

- |

|

Huntsman Corporation |

1970 |

USA |

High |

- |

- |

- |

- |

- |

|

Reliance Aromatics |

1966 |

India |

Very High |

- |

- |

- |

- |

- |

|

Chevron Phillips Chemical |

2000 |

USA |

High |

- |

- |

- |

- |

- |

Global Linear Alkyl Benzene (LAB) Market Analysis

Market Growth Drivers

- Rising Demand for Liquid Detergents (Consumer Preferences): With urbanization accelerating globally, the demand for liquid detergents has been driven by convenience, ease of use, and effectiveness. In 2023, the World Bank reported that urban areas hosted a significant portion of the global population, with continued growth anticipated in regions like Asia and Africa, where detergent usage is rapidly rising. In Southeast Asia, liquid detergent consumption has increased alongside higher household spending, with an average expenditure of $2,800 on cleaning and personal care products per household in 2023.

- Expansion of Bio-based LAB Solutions (Sustainability): The drive toward bio-based alternatives in detergent manufacturing has been strengthened by global sustainability goals and consumer demand for eco-friendly products. The International Energy Agency noted that in 2023, a portion of global chemical feedstocks was derived from renewable resources, a trend significantly influenced by the European Union's stringent environmental policies. Bio-based LAB solutions, which lower carbon emissions in detergent production, are increasingly adopted, particularly in Europe, where over 7 million tons of bio-based feedstock were utilized in consumer goods manufacturing in 2023.

- Cost-Efficiency of LAB in Detergent Manufacturing: LAB's cost efficiency as a raw material, combined with its high cleaning performance, makes it a preferred ingredient in large-scale detergent production. World Bank data indicates that manufacturing costs in developing economies remained comparatively lower than in developed regions, making LAB an ideal choice for cost-sensitive markets. In India, for example, the cost of detergent manufacturing was notably lower than in North America in 2022 due to reduced energy and labor costs, highlighting LAB's advantage in such economies. This competitive edge in production costs reinforces LAB's role in the detergent industry.

Market Challenges:

- Regulatory and Environmental Compliance (Emission Norms): Environmental regulations are impacting the LAB market as authorities enforce strict emission standards to reduce pollution. In 2023, the United Nations reported that global industrial emissions reached over 5 billion metric tons annually, prompting stringent controls in industrial processes. For example, in the EU, compliance with REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) mandates has required LAB manufacturers to adopt cleaner production techniques, which incurs additional costs. Similarly, emission controls in the U.S. have led to the increased adoption of eco-friendly processes, creating challenges for manufacturers needing to upgrade facilities.

- Volatile Raw Material Costs (Feedstock Availability): The LAB market faces instability in raw material costs, influenced by fluctuations in crude oil prices, as LAB is derived from petrochemical feedstocks. According to the International Energy Agency, crude oil prices varied between $70 to $90 per barrel in 2023, affecting feedstock costs and creating pricing uncertainty for LAB producers. In regions like the Middle East, raw material availability is heavily influenced by geopolitical factors that impact oil production. These fluctuations lead to inconsistent pricing for LAB, creating a challenging environment for detergent manufacturers reliant on stable material costs.

Global Linear Alkyl Benzene (LAB) Market Future Outlook

Over the next five years, the LAB market is projected to experience robust growth driven by a continuous shift toward bio-based LAB, growing demand in the Asia-Pacific region, and new technological advancements in LAB production. The market is also expected to witness enhanced investments in sustainable production practices, driven by rising consumer and regulatory demand for eco-friendly cleaning solutions.

Market Opportunities:

- Increasing Penetration in Emerging Markets (Asia Pacific, MEA): Emerging economies in the Asia-Pacific and Middle East & Africa regions represent a significant opportunity for LAB adoption due to rising detergent usage and consumer population growth. The World Bank reported a population growth of approximately 10 million in Sub-Saharan Africa alone in 2023, and with increasing disposable incomes, demand for consumer goods is growing. In Southeast Asia, household expenditure rose by $150 on average in 2023, boosting detergent consumption. These regions are experiencing increasing penetration of LAB-based detergents as they fulfill demand for affordable, effective cleaning solutions.

- Shift Towards Biodegradable and Bio-based Products: The shift towards bio-based and biodegradable products has been pronounced, driven by consumer demand for sustainable goods and stricter environmental regulations. According to a 2024 United Nations report, the global biodegradable product market grew substantially, with 500 million households now reportedly opting for eco-friendly cleaning products. LAB-based products that adhere to biodegradability standards are increasingly popular as they offer minimal environmental impact. This trend aligns with governmental goals, such as the European Green Deal, which aims to reduce chemical waste across industries.

Scope of the Report

|

By Product Type |

Linear Alkylbenzene Sulfonate (LAS) Other Applications (e.g., solvents, agricultural herbicides, ink solvents, emulsifying agents) |

|

By End-Use Industry |

Household Cleaning Products Industrial Cleaners Specialty Applications (e.g., lubricants, anti-hygroscopic additives, cable oil) |

|

By Product Type |

Heavy-duty Liquids Laundry Powders Light-duty Dishwashing Liquids |

|

By Distribution Channel |

Direct Sales Retail Distribution (B2B and B2C channels) E-commerce Platforms |

|

By Region |

North America Europe Asia Pacific Central and South America Middle East and Africa |

Products

Key Target Audience

Investments and Venture Capitalist Firms

Household and Industrial Detergent Manufacturers

Sustainability and Environmental Agencies (e.g., International Sustainability and Carbon Certification)

Research and Development Labs for Chemical Innovation

LAB Suppliers and Raw Material Providers

Government and Regulatory Bodies (e.g., Environmental Protection Agency, European Chemicals Agency)

Distributors and Wholesalers of Chemical Products

Petrochemical and Bio-based Industry Investors

Companies

Players Mention in the Report

CEPSA Quimica S.A.

ISU Chemical

Jintung Petrochemical Corp. Ltd

Sasol

Reliance Aromatics and Petrochemicals Pvt. Ltd.

Huntsman Corporation

Chevron Phillips Chemical

Honeywell International Inc.

Fushun Petrochemical

Unggul Indah Cahaya

Indorama Ventures

Clariant

Egyptian Petrochemicals Holding (ECHEM)

Deten Quimica

PT Unggul Indah Cahaya Tbk

Table of Contents

01. Global LAB Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Industry Growth Rate and Dynamics

02. Global LAB Market Size (in USD Million and Kilotons)

2.1 Historical Market Size

2.2 Year-On-Year Market Analysis

2.3 Market Evolution and Key Developments

03. Global LAB Market Dynamics

3.1 Growth Drivers

3.1.1 Rising Demand for Liquid Detergents (Consumer Preferences)

3.1.2 Expansion of Bio-based LAB Solutions (Sustainability)

3.1.3 Cost-Efficiency of LAB in Detergent Manufacturing

3.2 Market Challenges

3.2.1 Regulatory and Environmental Compliance (Emission Norms)

3.2.2 Volatile Raw Material Costs (Feedstock Availability)

3.3 Opportunities

3.3.1 Technological Innovations in Production Processes

3.3.2 Increasing Penetration in Emerging Markets (Asia Pacific, MEA)

3.4 Trends

3.4.1 Shift Towards Biodegradable and Bio-based Products

3.4.2 Adoption in Niche Industrial Applications

04. Global LAB Market Segmentation

4.1 By Application (in Value and Volume %)

4.1.1 Linear Alkylbenzene Sulfonate (LAS)

Heavy-duty Laundry Liquids

Light-duty Dishwashing Liquids

Industrial Cleaners

Household Cleaners

4.1.2 Other Applications

Agricultural Herbicides

Ink Solvent

Emulsifying Agents

Electric Cable Oil

4.2 By Region (Market Share and Consumption)

4.2.1 North America

4.2.2 Europe

4.2.3 Asia Pacific

4.2.4 Central and South America

4.2.5 Middle East and Africa

05. Global LAB Market Competitive Landscape

5.1 Company Profiles of Major Competitors

CEPSA Quimica S.A.

ISU Chemical

Jintung Petrochemical Corp. Ltd

Sasol

Reliance Aromatics and Petrochemicals

Huntsman Corporation

Chevron Phillips Chemical

Honeywell International Inc.

Fushun Petrochemical

Unggul Indah Cahaya

Indorama Ventures

Clariant

Egyptian Petrochemicals Holding (ECHEM)

Deten Quimica

PT Unggul Indah Cahaya Tbk

5.2 Cross Comparison Parameters (Production Capacity, Revenue, Global Reach, Product Portfolio, Technology Adoption, Sustainability Initiatives, Mergers & Acquisitions, Strategic Collaborations)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Sustainability, Bio-based Innovations)

5.5 Recent Mergers, Acquisitions, and Joint Ventures

06. Global LAB Market Regulatory and Environmental Compliance

6.1 Overview of Regulatory Landscape

6.2 Certification Requirements and Emission Standards

6.3 Environmental Impact and Sustainability Standards

07. Global LAB Market Future Market Size Projections (in USD and Kilotons)

7.1 Key Growth Drivers and Constraints for Future Market Expansion

08. Global LAB Market Analysts Recommendations

8.1 Opportunity Analysis for Bio-based LAB

8.2 Strategy Recommendations for Emerging Markets

8.3 Innovations in Supply Chain Optimization

Research Methodology

Step 1: Identification of Key Variables

A detailed ecosystem map was created, encompassing all relevant stakeholders in the LAB market. The primary objective was to identify critical variables influencing market dynamics, relying on a combination of primary and proprietary databases.

Step 2: Market Analysis and Construction

Historical data related to market penetration, revenue streams, and service provider ratios were gathered to evaluate market performance and validate revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through direct interviews with industry experts and practitioners, providing operational insights critical for accurate market data.

Step 4: Research Synthesis and Final Output

Direct engagement with LAB manufacturers provided additional insights into product segments, production performance, and consumer trends. This data was synthesized to produce a comprehensive analysis of the global LAB market.

Frequently Asked Questions

01. How big is the global linear alkyl benzene (LAB) market?

The global LAB market is valued at USD 8.51 billion, driven primarily by its demand in household and industrial cleaning applications, as well as the shift towards bio-based products.

02. What challenges does the LAB market face?

Challenges include regulatory compliance requirements, raw material cost volatility, and the environmental impact of petrochemical-derived LAB, prompting the markets shift towards bio-based alternatives.

03. Who are the major players in the LAB market?

Leading players include CEPSA, ISU Chemical, Jintung Petrochemical, Sasol, and Reliance Aromatics, dominating due to their strong production capabilities and presence in key markets.

04. What factors are driving growth in the LAB market?

Growth drivers include the rising demand for household and industrial cleaning products, advancements in bio-based LAB production, and significant industrial applications beyond cleaning products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.