Global Liquefied Petroleum Gas Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD10215

November 2024

93

About the Report

Global Liquefied Petroleum Gas Market Overview

- The global Liquefied Petroleum Gas (LPG) market is valued at USD 122 billion. This value reflects the extensive utilization of LPG across various sectors, including residential, commercial, industrial, and automotive. Key factors driving this market size include the increasing demand for clean energy solutions and government incentives promoting the use of LPG as an environmentally friendly alternative to traditional fuels. Additionally, the transition towards cleaner energy sources in urban and rural households has further fueled the growth of the LPG market, as it is a more efficient and lower-emission alternative to other fossil fuels.

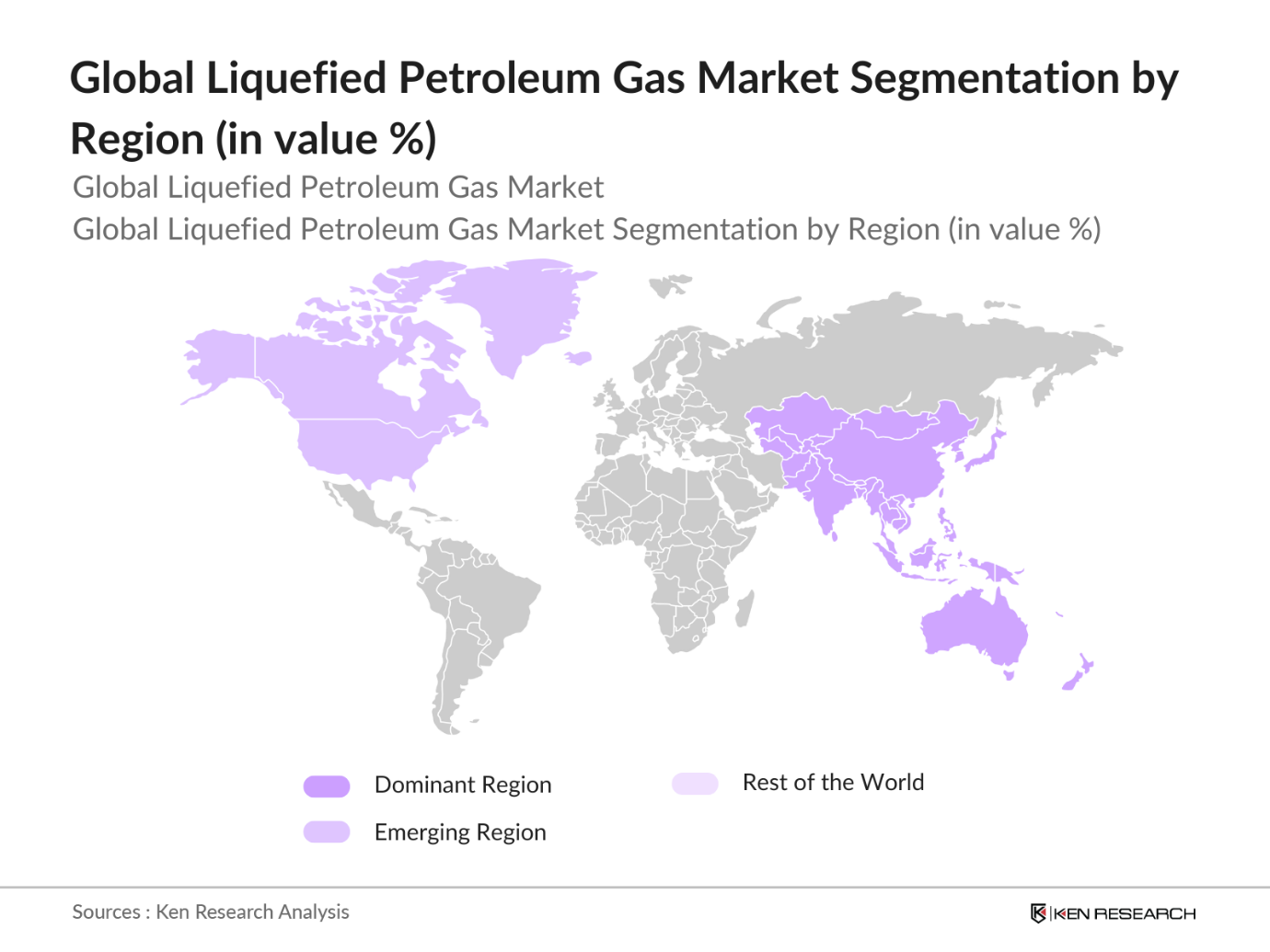

- Countries such as the United States, China, and India dominate the global LPG market due to their large population bases and extensive industrial operations that demand significant energy consumption. The United States leads in LPG production due to its substantial shale gas resources, while China and India are among the largest consumers due to the increasing energy demand from both residential and industrial sectors. Government policies in these countries that promote the adoption of LPG, along with the expansion of LPG infrastructure, have contributed to their dominance in the market.

- LPG subsidy programs have been instrumental in boosting household consumption, especially in emerging economies. Indias Ujjwala scheme, which provides LPG subsidies to rural women, has been highly successful, benefiting over 80 million households by 2023. Similar programs exist in countries like Brazil, where the Bolsa Famlia program includes LPG subsidies

Global Liquefied Petroleum Gas Market Segmentation

- By Source: The global LPG market is segmented by source into Natural Gas Processing and Crude Oil Refining. Natural gas processing accounts for the dominant market share in 2023 due to its more efficient production process and the rise in natural gas exploration projects across the world. The higher yield of LPG during natural gas processing, compared to crude oil refining, has also contributed to its dominance. Additionally, the growth in global shale gas production has further driven the demand for LPG derived from natural gas.

- By Region: The LPG market is segmented by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. Asia-Pacific dominates the market due to the high consumption in countries like China and India, where large populations rely on LPG for cooking and industrial applications. The rapid industrialization and urbanization in these countries have also contributed to their growing demand for LPG. The availability of government subsidies and the expansion of LPG infrastructure are also key factors in this regions dominance.

- By Application: The LPG market is segmented by application into Residential, Commercial, Industrial, Automotive, and Petrochemical. The residential sector leads the market due to its widespread use in cooking and heating, particularly in developing regions where LPG is the primary fuel source for household energy needs. The rise in rural electrification programs has also increased the adoption of LPG in off-grid areas for cooking and heating purposes. The commercial and industrial sectors follow, driven by the need for efficient, clean fuel in heating, drying, and production processes.

Global Liquefied Petroleum Gas Market Competitive Landscape

The LPG market is characterized by the presence of both global and regional players, with large-scale production and distribution networks. The market is dominated by companies that have access to substantial natural gas reserves and refining capacities. Leading players are investing in expanding their LPG storage and transportation infrastructure, as well as enhancing digital solutions for monitoring and distributing LPG.

|

Company |

Establishment Year |

Headquarters |

Operational Capacity |

Market Reach |

Revenue (USD bn) |

Distribution Network |

LPG Product Range |

Technology Integration |

|

Royal Dutch Shell PLC |

1907 |

The Hague, Netherlands |

- |

- |

- |

- |

- |

- |

|

Exxon Mobil Corporation |

1870 |

Irving, Texas, USA |

- |

- |

- |

- |

- |

- |

|

BP PLC |

1909 |

London, UK |

- |

- |

- |

- |

- |

- |

|

Sinopec Corporation |

2000 |

Beijing, China |

- |

- |

- |

- |

- |

- |

|

Reliance Industries Limited |

1973 |

Mumbai, India |

- |

- |

- |

- |

- |

- |

Global Liquefied Petroleum Gas Industry Analysis

Growth Drivers

- Rising Demand from Residential Sector (LPG Consumption by Sector): The residential sector is a major driver of LPG consumption due to its widespread use in cooking and heating. According to the World Bank, over 3 billion people globally still rely on biomass fuels like wood for cooking, highlighting the potential for LPG penetration. In 2022, countries like India saw a demand increase of over 23 million metric tonnes of LPG for household consumption. The World Bank supports initiatives in rural electrification, indirectly fostering LPG adoption in regions without reliable electricity access.

- Increased Use in Automotive and Industrial Applications (Sectoral Contribution): LPGs use in automotive applications, especially as autogas, has been expanding. By 2023, autogas accounted for around 28 million vehicles globally, driven by lower emissions and government incentives. Industrial applications such as fuel for furnaces and heat treatment processes have also increased due to LPG's efficiency and lower emissions compared to other fossil fuels. In 2022, the United States and China consumed approximately 23 million tonnes of LPG for industrial purposes. Governmental push for cleaner industrial fuels further accelerates its demand.

- Government Policies and Subsidies: Government policies play a significant role in boosting LPG adoption, especially through subsidies for lower-income households. For instance, in India, the Pradhan Mantri Ujjwala Yojana (PMUY) provided over 80 million LPG connections to rural households by 2023. Meanwhile, Brazil and Indonesia also have similar LPG subsidy programs benefiting millions. These subsidies reduce the upfront cost of switching to LPG and drive its demand across developing countries.

Market Restraints

- Volatility in LPG Prices (Crude Oil Prices, Geopolitical Factors): LPG prices are linked to crude oil prices, making them volatile due to geopolitical factors and supply-demand dynamics. The average global crude oil price fluctuated between $72 and $95 per barrel from 2022 to 2023, which significantly impacted LPG costs. The Russia-Ukraine conflict in 2022 caused disruptions in the global energy market, driving prices higher and affecting affordability, particularly in developing countries where subsidies arent widespread. This volatility poses a challenge for sustained LPG adoption, especially in low-income regions.

- Supply Chain Disruptions (Logistics, Storage, Distribution): Supply chain disruptions, exacerbated by global events like the COVID-19 pandemic and geopolitical conflicts, have created challenges in LPG distribution. Countries like South Africa and India experienced shortages in 2022 due to delayed shipments and port bottlenecks. The lack of adequate storage facilities in emerging markets further aggravates the situation, leading to inconsistencies in supply. In 2023, countries reliant on LPG imports, such as Bangladesh, faced supply issues due to logistical inefficiencies.

Global Liquefied Petroleum Gas Market Future Outlook

Over the next few years, the global Liquefied Petroleum Gas market is expected to experience robust growth, driven by rising demand for cleaner energy sources, increasing adoption of LPG in rural areas, and government incentives supporting LPG usage. The growing awareness of environmental sustainability and the need for energy efficiency are likely to further fuel the adoption of LPG in industrial and residential sectors. Expansion in the automotive and petrochemical applications of LPG, coupled with technological advancements in distribution and monitoring systems, will provide additional growth opportunities for the market.

Market Opportunities

- Penetration into Rural Markets (Rural Access, Household Penetration): Despite urban LPG saturation, rural areas offer significant growth potential. In sub-Saharan Africa, only 15% of rural households had access to LPG in 2022. This represents a large untapped market, as governments and international agencies aim to reduce dependence on biomass and enhance rural energy access. Programs such as those by the African Development Bank are expected to increase LPG adoption in rural regions by providing financial assistance and infrastructural support.

- Expansion of LPG Infrastructure (Pipeline Expansion, Terminals): Infrastructure development, including LPG terminals and pipelines, presents a major opportunity for market growth. As of 2023, countries like India and China were investing heavily in LPG pipeline expansions, with over 2,000 kilometers of pipelines under construction in India. Similarly, Southeast Asia has expanded its LPG terminal capacity to meet growing demand. These infrastructure projects reduce transportation bottlenecks and help stabilize supply.

Scope of the Report

|

By Source |

Natural Gas Processing Crude Oil Refining |

|

By Application |

Residential Commercial Industrial Automotive Petrochemical |

|

By Distribution Channel |

Bulk Delivery Bottled/Cylinder Distribution Pipeline Distribution |

|

By End-Use Sector |

Cooking and Heating Transportation Power Generation Chemical Feedstock |

|

By Region |

North America Europe Asia-Pacific Middle East & Africa Latin America |

Products

Key Target Audience

LPG Manufacturers

Government and Regulatory Bodies (Environmental Protection Agency, Department of Energy)

Investors and Venture Capitalist Firms

Residential and Commercial LPG Distributors

Petrochemical Companies

Automotive Manufacturers

Industrial Energy Providers

Power Generation Companies

Companies

Players Mentioned in the Report:

Royal Dutch Shell PLC

Exxon Mobil Corporation

BP PLC

Total SE

Chevron Corporation

Sinopec Corporation

Saudi Aramco

Eni SpA

Gazprom PJSC

Reliance Industries Limited

Phillips 66

Bharat Petroleum Corporation Limited

Indian Oil Corporation Limited

Petroleos de Venezuela, S.A. (PDVSA)

Mitsui & Co., Ltd.

Table of Contents

1. Global Liquefied Petroleum Gas Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Liquefied Petroleum Gas Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Liquefied Petroleum Gas Market Analysis

3.1 Growth Drivers

3.1.1 Rising Demand from Residential Sector (LPG Consumption by Sector)

3.1.2 Increased Use in Automotive and Industrial Applications (Sectoral Contribution)

3.1.3 Government Policies and Subsidies (Government Incentives, Subsidies, Tax Relief)

3.1.4 Shift towards Clean and Efficient Fuels (Environmental Benefits, Carbon Emission Reduction)

3.2 Market Challenges

3.2.1 Volatility in LPG Prices (Crude Oil Prices, Geopolitical Factors)

3.2.2 Supply Chain Disruptions (Logistics, Storage, Distribution)

3.2.3 Regulatory Barriers (Environmental Regulations, Tariffs)

3.3 Opportunities

3.3.1 Penetration into Rural Markets (Rural Access, Household Penetration)

3.3.2 Expansion of LPG Infrastructure (Pipeline Expansion, Terminals)

3.3.3 Growing Popularity of LPG in Off-Grid Energy Solutions (Remote Energy Access, Backup Power)

3.4 Trends

3.4.1 Adoption of Autogas (Alternative Fuels Market, Autogas Growth)

3.4.2 Digitalization and Smart LPG Monitoring Systems (IoT Integration, Smart Meters)

3.4.3 Growth in Petrochemical Industry Demand (Feedstock Demand, Propylene and Ethylene Production)

3.5 Government Regulations

3.5.1 LPG Subsidy Programs (Subsidy Schemes, Targeted Distribution)

3.5.2 Environmental Emission Norms (LPG as a Cleaner Fuel)

3.5.3 Safety Standards and Compliance (Storage and Handling Regulations)

3.6 Competitive Landscape

3.6.1 Porters Five Forces Analysis

3.6.2 Market Concentration Ratio (Market Share of Top Players)

3.6.3 Strategic Initiatives by Market Players (Expansions, Partnerships, Product Launches)

3.6.4 SWOT Analysis

4. Global Liquefied Petroleum Gas Market Segmentation

4.1 By Source (In Value %) 4.1.1 Natural Gas Processing

4.1.2 Crude Oil Refining

4.2 By Application (In Value %)

4.2.1 Residential

4.2.2 Commercial

4.2.3 Industrial

4.2.4 Automotive

4.2.5 Petrochemical

4.3 By Distribution Channel (In Value %)

4.3.1 Bulk Delivery

4.3.2 Bottled/Cylinder Distribution

4.3.3 Pipeline Distribution

4.4 By End-Use Sector (In Value %)

4.4.1 Cooking and Heating

4.4.2 Transportation

4.4.3 Power Generation

4.4.4 Chemical Feedstock

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Middle East & Africa

4.5.5 Latin America

5. Global Liquefied Petroleum Gas Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Royal Dutch Shell PLC

5.1.2 Exxon Mobil Corporation

5.1.3 BP PLC

5.1.4 Total SE

5.1.5 Chevron Corporation

5.1.6 Sinopec Corporation

5.1.7 Saudi Aramco

5.1.8 Eni SpA

5.1.9 Gazprom PJSC

5.1.10 Reliance Industries Limited

5.1.11 Phillips 66

5.1.12 Bharat Petroleum Corporation Limited

5.1.13 Indian Oil Corporation Limited

5.1.14 Petroleos de Venezuela, S.A. (PDVSA)

5.1.15 Mitsui & Co., Ltd.

5.2 Cross Comparison Parameters (Market Share, Operational Capacity, Revenue, Distribution Network, End-Use Segments, Regional Presence, Product Diversification, Technology Integration)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Global Liquefied Petroleum Gas Market Regulatory Framework

6.1 Environmental Standards and Compliance

6.2 Certification Processes

6.3 Regional Regulatory Differences

7. Global Liquefied Petroleum Gas Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Liquefied Petroleum Gas Future Market Segmentation

8.1 By Source (In Value %)

8.2 By Application (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By End-Use Sector (In Value %)

8.5 By Region (In Value %)

9. Global Liquefied Petroleum Gas Market Analysts' Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In the first phase, we construct an ecosystem map involving all the major stakeholders within the LPG market. Through desk research and secondary sources, critical variables such as LPG production rates, distribution models, and consumption patterns are identified to form the foundation for further analysis.

Step 2: Market Analysis and Construction

Historical data is collected and analyzed to assess market growth, penetration levels, and sectoral distribution. Special attention is paid to demand fluctuations, price variations, and supply chain disruptions to ensure accurate revenue and market size estimations.

Step 3: Hypothesis Validation and Expert Consultation

We validate market hypotheses through interviews with key industry players. These interviews provide insights into operational efficiencies, technological advancements, and the competitive strategies employed in the LPG market.

Step 4: Research Synthesis and Final Output

Finally, detailed market insights are synthesized, including both qualitative and quantitative data. This phase ensures a comprehensive report backed by extensive primary and secondary research, offering precise and actionable insights.

Frequently Asked Questions

01. How big is the Global Liquefied Petroleum Gas Market?

The global LPG market is valued at USD 122 billion, driven by the growing demand for clean energy solutions in various sectors, including residential, industrial, and automotive applications.

02. What are the challenges in the Global LPG Market?

Key challenges include price volatility linked to crude oil fluctuations, infrastructure limitations in certain regions, and regulatory compliance issues related to safety and environmental standards.

03. Who are the major players in the LPG Market?

The major players in the market include Royal Dutch Shell, Exxon Mobil, BP, Total SE, and Chevron, with each company focusing on expanding their global distribution network and enhancing LPG storage capacities.

04. What are the growth drivers of the LPG Market?

The LPG market is driven by increasing demand for clean energy, government subsidies promoting LPG adoption, and rising consumption in residential and industrial sectors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.