Global Lithium Iron Phosphate (LFP) Batteries Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD7236

November 2024

97

About the Report

Global Lithium Iron Phosphate (LFP) Batteries Market Overview

- The global lithium iron phosphate (LFP) batteries market is valued at USD 17 billion, based on a five-year historical analysis. The market is primarily driven by the increasing adoption of electric vehicles (EVs) and energy storage systems (ESS), owing to LFP batteries' superior safety, thermal stability, and cost advantages over competing chemistries like nickel-cobalt-manganese (NMC). As industries such as automotive, renewable energy, and consumer electronics integrate LFP batteries into their product offerings, the market is expected to grow significantly.

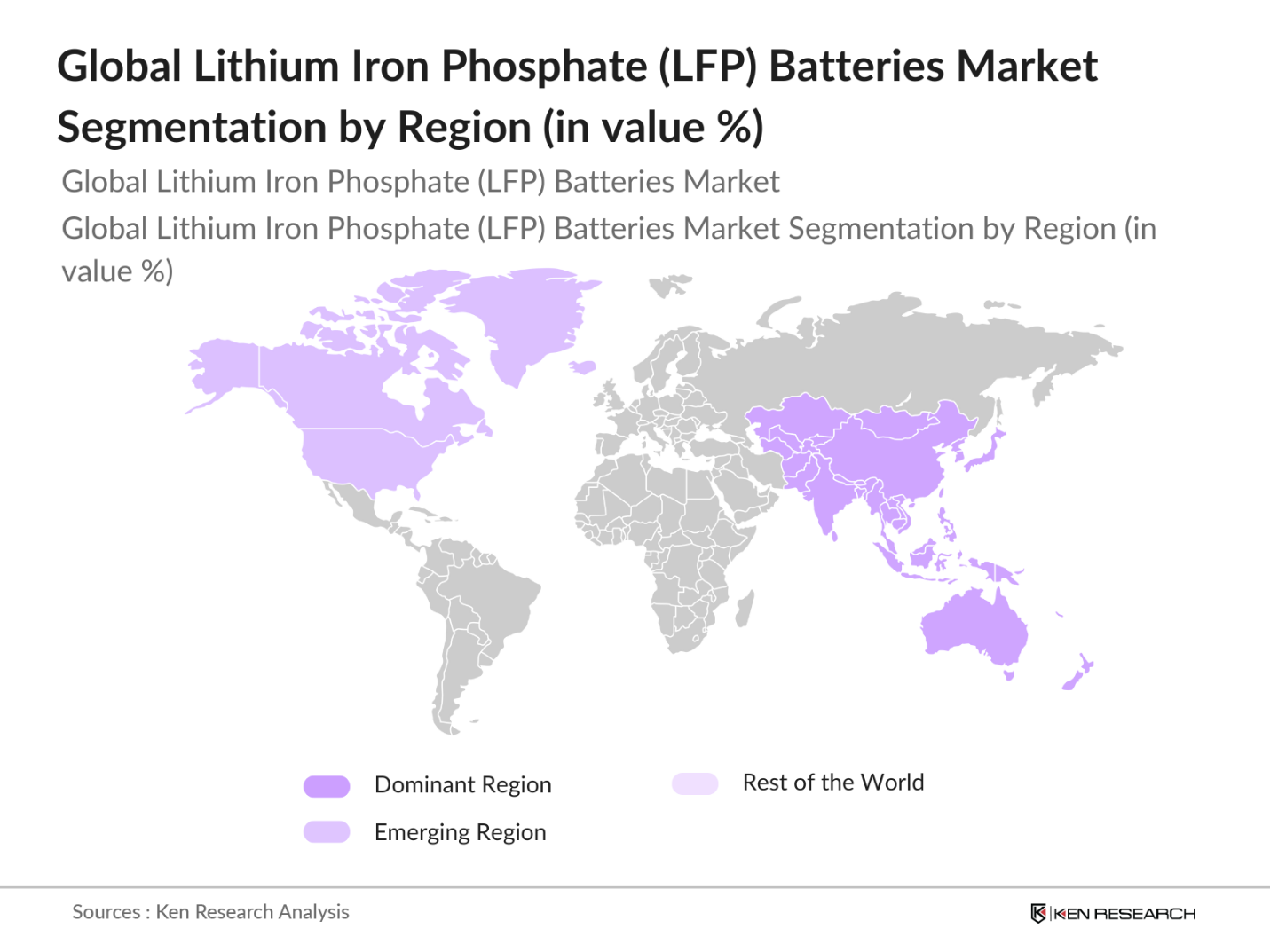

- The Asia-Pacific (APAC) region dominates the global lithium iron phosphate (LFP) batteries market, driven largely by Chinas leadership in electric vehicle (EV) production and battery manufacturing. APAC's dominance is further supported by strong government incentives promoting clean energy technologies and sustainable transportation solutions. North America follows, with significant contributions from the United States, where advancements in battery technology and rising EV adoption are key factors.

- Global emission reduction targets are driving the demand for LFP batteries, especially in regions like Europe where the European Green Deal mandates carbon neutrality by introduced stricter CO2 emissions limits for vehicles, pushing automakers to adopt LFP batteries in their electric models. This regulatory environment has encouraged battery manufacturers to scale LFP production, with Europe planning to add over 20 GWh of battery production capacity by 2025.

Global Lithium Iron Phosphate (LFP) Batteries Market Segmentation

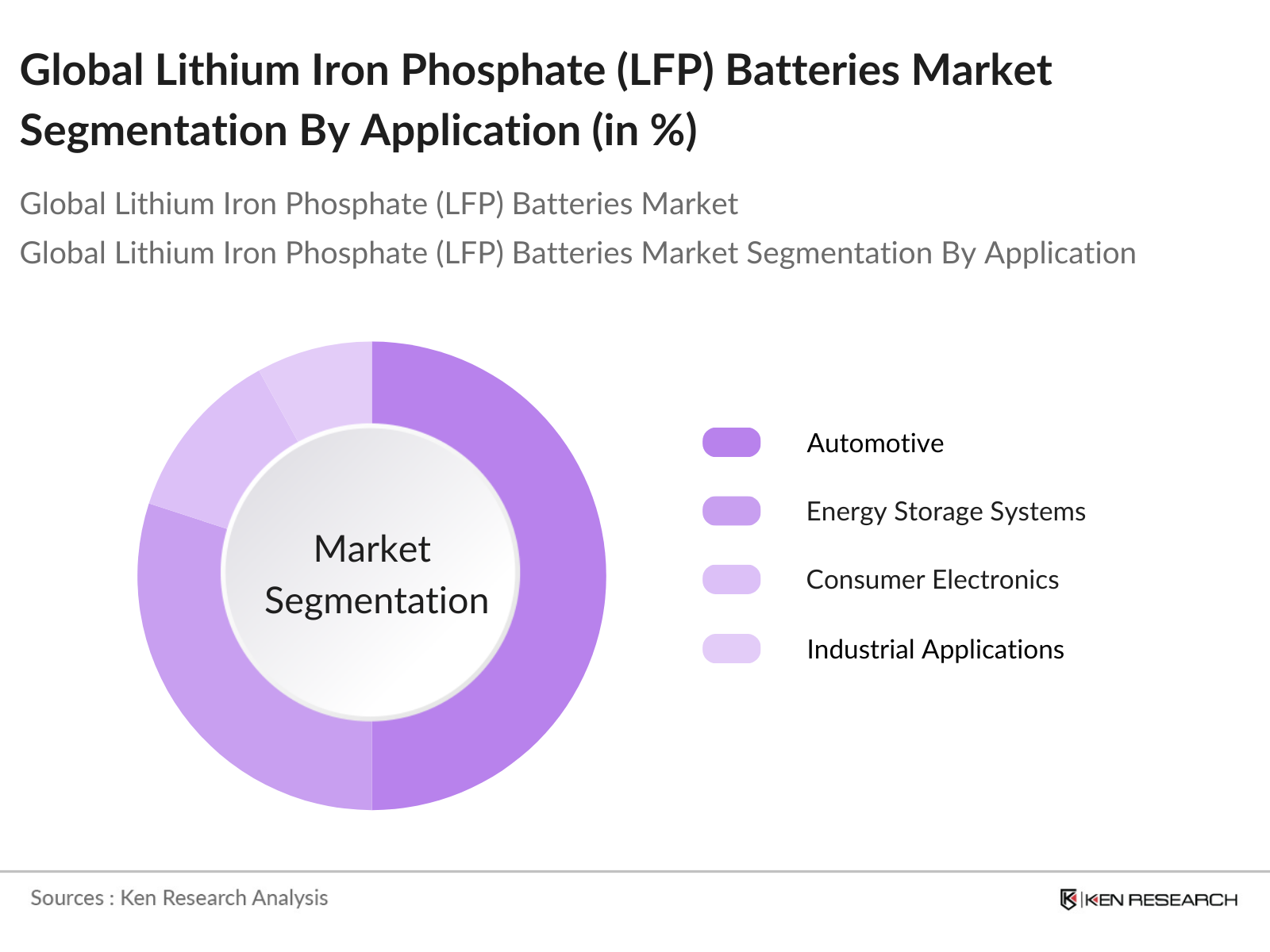

By Application: The LFP battery market is segmented by application into automotive, energy storage systems, consumer electronics, industrial applications, and aerospace & defense. The automotive sector dominates this segmentation due to the growing adoption of electric vehicles globally. Companies like Tesla and BYD utilize LFP batteries due to their long cycle life and enhanced safety.

By Power Capacity: The market is segmented by power capacity into up to 20 kWh, 20-50 kWh, 50-100 kWh, and above 100 kWh. The 20-50 kWh segment holds the largest market share, as this range is widely used in electric vehicles (EVs) and energy storage systems (ESS), offering an optimal balance between performance, weight, and cost. This segment benefits from advancements in EV production and the rapid deployment of renewable energy systems.

By Region: The LFP battery market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Asia-Pacific dominates the regional market share, driven primarily by China's leadership in EV production and battery manufacturing. With substantial government investments and favorable policies, China has become a hub for LFP battery innovation, making the region a critical player in the global market.

Global Lithium Iron Phosphate (LFP) Batteries Market Competitive Landscape

The global lithium iron phosphate (LFP) batteries market is dominated by a few key players, including large-scale manufacturers and integrators of battery solutions for the automotive and energy storage sectors. The competitive landscape is defined by these major companies, their innovations in battery technology, and their ability to scale production to meet growing demand. Substantial investments in research and development, partnerships with automotive OEMs, and vertical integration strategies further consolidate their market presence.

Global Lithium Iron Phosphate (LFP) Batteries Industry Analysis

Growth Drivers

- Growing Demand for Electric Vehicles (EV Adoption Impact on LFP): The global push towards electrification is driving demand for electric vehicles (EVs), a sector where lithium iron phosphate (LFP) batteries play a crucial role. According to data from the International Energy Agency (IEA), over 10 million EVs were sold in 2022, with demand expected to grow due to stricter emission regulations in regions like Europe and China. LFP batteries are preferred for EVs because of their superior safety and lower costs.

- Cost-fety Advantages (Comparative Advantages in Safety and Cost-Reduction): LFP batteries are gaining market share due to their cost-efficiency and enhanced safety profile compared to other lithium-ion chemistries, such as lithium nickel cobalt manganese (NCM) batteries. According to the U.S. Department of Energy, LFP batteries are less prone to thermal runaway, making them safer for large-scale deployments. They also use abundant raw materials like iron and phosphate, reducing costs by up to 25% compared to NCM batteries.

- Regulatory Push for Susnment Policies Encouraging LFP Battery Use): Governments worldwide are implementing stricter policies to promote sustainable energy, boosting demand for LFP batteries. In 2023, the European Union allocated over 800 million in subsidies for renewable energy projects that rely heavily on LFP battery storage. The U.S. government, through the Inflation Reduction Act, incentivized domestic battery production, including LFP chemistries, with tax credits and grants exceeding $400 million in 2023.

Market Challenges

- Limited Energy Der Batteries: Despite its advantages, one significant challenge for LFP batteries is their lower energy density compared to NCM or nickel-cobalt-aluminum (NCA) batteries. For example, the energy density of LFP batteries averages 160-190 Wh/kg, while NCM batteries can reach up to 250 Wh/kg. This discrepancy affects applications requiring compact, lightweight solutions, such as consumer electronics and high-performance EVs. The lower energy density means LFP batteries require more space, posing challenges for industries where size and weight constraints are critical.

- Recycling and Environmental Concerns (End-of-life Management): life disposal of LFP batteries is a growing environmental concern. While LFP batteries do not contain toxic cobalt, the lack of widespread recycling infrastructure remains a challenge. A report by the U.S. Environmental Protection Agency in 2023 noted that only 5% of LFP batteries were recycled globally. Additionally, developing efficient recycling techniques for LFP chemistries remains difficult due to their relatively stable structure, increasing the potential for landfill waste unless new regulations or technologies emerge to address this issue.

Global Lithium Iron Phosphate (LFP) Batteries Market Future Outlook

Over the next five years, the global LFP battery market is expected to experience significant growth, driven by continuous advancements in battery technology, the expansion of electric vehicle production, and the rising demand for renewable energy storage. Government regulations promoting clean energy, along with growing investments in battery recycling and sustainability, will likely contribute to the market's future development.

Market Opportunities

- Growing Stationary Energy Storage Demand (Utility-Scale and Residential): Thenewable energy installations has significantly boosted demand for LFP batteries in stationary energy storage. In 2022, China added over 6 GW of new energy storage capacity, with LFP batteries accounting for nearly 80% of this growth. Similarly, the U.S. energy storage market added over 10 GW in 2023, largely driven by LFP technology due to its safety and long cycle life. The trend towards grid-scale storage for renewable integration creates substantial growth opportunities for LFP battery manufacturers.

- Emerging Markets and Regions (LFP Demand in Developing Economies): Developing economies are rapidly adopting LFP batteryVs and energy storage solutions. India, for example, saw a 200% increase in EV sales in 2023, with over 70% of electric buses equipped with LFP batteries. Similarly, in Southeast Asia, government initiatives supporting renewable energy projects are fueling the adoption of LFP-based ESS systems. In 2022, Vietnam and Thailand together deployed over 1 GW of solar energy, much of which relied on LFP battery storage, demonstrating growing demand in emerging markets.

Scope of the Report

|

By Application |

Automotive Energy Storage Systems Consumer Electronics Industrial Applications Aerospace & Defense |

|

By Power Capacity |

Up to 20 kWh 20-50 kWh 50-100 kWh Above 100 kWh |

|

By Type |

Cylindrical Prismatic Pouch |

|

By End User |

Automotive Renewable Energy Storage Industrial Electronics Aerospace & Defense |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Automotive OEMs

Energy Storage Providers

Consumer Electronics Manufacturers

Aerospace & Defense Contractors

Government and Regulatory Bodies (e.g., U.S. Department of Energy, Chinas Ministry of Industry and Information Technology)

Battery Recycling Companies

Investments and Venture Capitalist Firms

Electric Vehicle Charging Infrastructure Developers

Companies

Players Mentioned in the Report

BYD Company Ltd.

Contemporary Amperex Technology Co. Ltd. (CATL)

A123 Systems LLC

Valence Technology, Inc.

Panasonic Corporation

Lithium Werks

Shenzhen OptimumNano Energy Co., Ltd.

BAK Power Battery

Saft Groupe S.A.

RELiON Battery LLC

Table of Contents

1. Global Lithium Iron Phosphate Batteries Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (LFP Battery Growth Trajectories)

1.4 Market Segmentation Overview (Battery Chemistry, Applications, End-user Industry, Geography, Capacity)

2. Global Lithium Iron Phosphate Batteries Market Size (In USD Bn)

2.1 Historical Market Size (LFP Batteries Global Revenues)

2.2 Year-On-Year Growth Analysis (Annual Growth in LFP Battery Adoption)

2.3 Key Market Developments and Milestones (Key Developments in Battery Technology, Market Expansion)

3. Global Lithium Iron Phosphate Batteries Market Analysis

3.1 Growth Drivers

3.1.1 Growing Demand for Electric Vehicles (EV Adoption Impact on LFP)

3.1.2 Increased Use in Energy Storage Systems (ESS Deployment and LFP Role)

3.1.3 Cost-Effectiveness and Safety Advantages (Comparative Advantages in Safety and Cost-Reduction)

3.1.4 Regulatory Push for Sustainable Energy (Government Policies Encouraging LFP Battery Use)

3.2 Market Challenges

3.2.1 Limited Energy Density Compared to Other Batteries

3.2.2 Recycling and Environmental Concerns (End-of-life Management)

3.2.3 High Competition from Lithium Nickel Cobalt Manganese Oxide (NCM) Batteries

3.3 Opportunities

3.3.1 Growing Stationary Energy Storage Demand (Utility-Scale and Residential)

3.3.2 Emerging Markets and Regions (LFP Demand in Developing Economies)

3.3.3 Advances in Manufacturing Technologies (Cost-Efficiency in Production)

3.4 Trends

3.4.1 Use of LFP in Electric Commercial Fleets (Fleet Electrification)

3.4.2 Adoption in Grid-Scale Storage (Role in Renewable Energy Integration)

3.4.3 Development of Solid-State LFP Batteries

3.5 Government Regulation

3.5.1 Regulatory Support for EVs (Incentives and Subsidies Driving LFP Battery Use)

3.5.2 Emission Reduction Targets (Impact of Climate Goals on LFP Adoption)

3.5.3 Recycling and Waste Management Regulations (LFP Battery End-of-life Regulations)

3.6 SWOT Analysis

3.7 Value Chain Ecosystem

3.8 Porters Five Forces

3.9 Competitive Ecosystem

4. Global Lithium Iron Phosphate Batteries Market Segmentation

4.1 By Battery Chemistry (In Value %)

4.1.1. Lithium Iron Phosphate (LFP)

4.1.2. Lithium Nickel Manganese Cobalt Oxide (NMC)

4.1.3. Lithium Cobalt Oxide (LCO)

4.2 By Application (In Value %)

4.2.1. Automotive (EVs, E-bikes, Buses)

4.2.2. Energy Storage Systems (Grid, Residential, Commercial)

4.2.3. Consumer Electronics (Wearable Devices, Laptops)

4.2.4. Industrial (Robotics, Forklifts, Marine)

4.3 By End-user Industry (In Value %)

4.3.1. Automotive

4.3.2. Power Generation and Utilities

4.3.3. Consumer Electronics

4.3.4. Industrial and Manufacturing

4.4 By Capacity (In Value %)

4.4.1. Up to 16,000 mAh

4.4.2. 16,00030,000 mAh

4.4.3. Above 30,000 mAh

4.5 By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Lithium Iron Phosphate Batteries Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. CATL

5.1.2. BYD Company Ltd.

5.1.3. Panasonic Corporation

5.1.4. Toshiba Corporation

5.1.5. LG Energy Solution

5.1.6. A123 Systems LLC

5.1.7. K2 Energy

5.1.8. Samsung SDI Co., Ltd.

5.1.9. Lithium Werks B.V.

5.1.10. Saft Groupe S.A.

5.1.11. RELiON Battery

5.1.12. BAK Power Battery Co., Ltd.

5.1.13. OptimumNano Energy Co., Ltd.

5.1.14. Pylon Technologies Co., Ltd.

5.1.15. Farasis Energy

5.2 Cross Comparison Parameters (Market Share, Revenue, Production Capacity, Battery Cell Chemistry, Manufacturing Locations, Key R&D Projects, Strategic Partnerships, Expansion Plans)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Partnerships, Collaborations, Licensing Agreements)

5.5 Mergers and Acquisitions

5.6 Investment Analysis (Private Equity, Venture Capital, Government Investments)

5.7 New Product Developments and Innovations

5.8 Market Positioning Analysis

6. Global Lithium Iron Phosphate Batteries Market Regulatory Framework

6.1. Regulatory Standards for Battery Safety

6.2. Compliance with Emission Norms

6.3. Certification Processes for Automotive Batteries

6.4. Environmental Regulations and Disposal Norms

7. Global Lithium Iron Phosphate Batteries Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Renewable Integration, EV Growth)

8. Global Lithium Iron Phosphate Batteries Future Market Segmentation

8.1. By Battery Chemistry (In Value %)

8.2. By Application (In Value %)

8.3. By End-user Industry (In Value %)

8.4. By Capacity (In Value %)

8.5. By Region (In Value %)

9. Global Lithium Iron Phosphate Batteries Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Supply Chain Optimization Strategies

9.3. White Space Opportunity Analysis

9.4. Mergers and Acquisitions Prospects

Research Methodology

Step 1: Identification of Key Variables

In the first step, we build a comprehensive ecosystem map encompassing all significant stakeholders in the global LFP battery market. This involves thorough desk research using a mix of secondary and proprietary databases to gather comprehensive industry-level data. The goal is to identify and define the key variables driving market dynamics, including technological trends, manufacturing capacity, and government regulations.

Step 2: Market Analysis and Construction

In this phase, we collect and analyze historical data on LFP battery production, demand in various application sectors, and revenue generation trends. This step includes assessing manufacturing processes and the adoption of LFP technology by electric vehicle and energy storage companies to ensure accurate market estimates.

Step 3: Hypothesis Validation and Expert Consultation

We develop market hypotheses based on the collected data, which are then validated through expert consultations with industry insiders. These consultations provide valuable insights into production trends, supply chain challenges, and future market directions, ensuring our estimates are reliable and accurate.

Step 4: Research Synthesis and Final Output

In the final phase, we engage directly with battery manufacturers and EV producers to gather detailed data on product segments, market trends, and consumer preferences. This process helps in cross-verifying our findings through a bottom-up approach, ensuring a holistic and validated market analysis.

Frequently Asked Questions

1. How big is the Global Lithium Iron Phosphate Batteries Market?

The global lithium iron phosphate (LFP) batteries market is valued at USD 17 billion, based on a five-year historical analysis.

2. What are the challenges in the Global LFP Batteries Market?

The major challenges include competition from other battery chemistries like nickel-cobalt-manganese (NMC), energy density limitations, and battery recycling regulations.

3. Who are the major players in the Global LFP Batteries Market?

Key players include BYD Company Ltd., Contemporary Amperex Technology Co. Ltd. (CATL), A123 Systems LLC, Panasonic Corporation, and Valence Technology, Inc.

4. What are the growth drivers for the Global LFP Batteries Market?

The market is propelled by the rising demand for electric vehicles, renewable energy storage solutions, and advancements in battery safety and cost-effectiveness.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.